It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

4

share:

There are so many reasons why the government should not raise taxes or otherwise collect more revenue; even if only from “the rich”. The first

reason is moral. Taxation is robbery. There cannot be a good nor a just tax. Every tax rests its case on force. It is sad that most self-styled

lovers of humanity embrace a money-raising system grounded in the threat of physical force against people who themselves have not used force. How is

this morally justifiable? If I stick a gun in your face and take your money, I am guilty of a violent crime. If I get the government to do it for me,

many(especially socialist liberals) applaud the action as "just" and "right".

The argument against taxes holds even in our current corporatist economy, where money is made through the political, as opposed to the economic, means. The way to end illicit gains through government intervention is to abolish the privileges. It makes no sense to continue the privileges and then tax away some of the proceeds. That merely compounds the power of government. The government gains power by choosing winners and losers via it's tax policies.

This argument also holds if the new revenues are to come from ending tax deductions and credits rather than raising or imposing new taxes. A plain flat tax system is bad enough; one that gives rulers the power to reward and punish the economic activities of their choice is infinitely worse. Selectively ending exemptions while leaving others in place is not true reform. Would-be revenue raisers pretend they want to clean up the tax code by getting rid of “loopholes” but we know that’s not true. If they were serious, they’d be targeting all such exemptions not just those that make for popular sound bites. Corporate welfare of any sort is wrong. Targeted exemptions favor those who line the politician's pockets, and all we do is complain that GE paid no tax.

Even if you think the government should have new revenues to deal with the debt, new taxes are not the way. , Politicians can’t be trusted to use the new taxes the way they say they will. They are much more likely to find new ways to spend the money. It’s happened many times before because that’s the nature of the system.

Here’s another reason: There aren’t enough rich people to make a big difference. Obama has often expressed his wish to raises taxes on couples making more than $250,000. But as Kevin D. Williamson of National Review points out, there’s not enough money in that group to fix the budget.

There is a message buried in all this. A big-spending government will have to stick it to the middle class. That’s where the money is. But it won’t fix the deficit.

So the only way back away from the brink is to cut spending — by eliminating missions wholesale. But politicians don’t really want to cut spending. Hence, the problem.

The argument against taxes holds even in our current corporatist economy, where money is made through the political, as opposed to the economic, means. The way to end illicit gains through government intervention is to abolish the privileges. It makes no sense to continue the privileges and then tax away some of the proceeds. That merely compounds the power of government. The government gains power by choosing winners and losers via it's tax policies.

This argument also holds if the new revenues are to come from ending tax deductions and credits rather than raising or imposing new taxes. A plain flat tax system is bad enough; one that gives rulers the power to reward and punish the economic activities of their choice is infinitely worse. Selectively ending exemptions while leaving others in place is not true reform. Would-be revenue raisers pretend they want to clean up the tax code by getting rid of “loopholes” but we know that’s not true. If they were serious, they’d be targeting all such exemptions not just those that make for popular sound bites. Corporate welfare of any sort is wrong. Targeted exemptions favor those who line the politician's pockets, and all we do is complain that GE paid no tax.

Even if you think the government should have new revenues to deal with the debt, new taxes are not the way. , Politicians can’t be trusted to use the new taxes the way they say they will. They are much more likely to find new ways to spend the money. It’s happened many times before because that’s the nature of the system.

Here’s another reason: There aren’t enough rich people to make a big difference. Obama has often expressed his wish to raises taxes on couples making more than $250,000. But as Kevin D. Williamson of National Review points out, there’s not enough money in that group to fix the budget.

The 2012 deficit is forecast to hit $1.1 trillion under Obama’s budget. (Thanks, Mr. President!) Spread that deficit over all the households in Club 250K and you have to jack up their taxes by an average of $500,000. Which you simply can’t do, since a lot of them don’t have $500,000 in income to seize: Most of them are making $250,000 to $450,000 and paying about half in taxes already.

There is a message buried in all this. A big-spending government will have to stick it to the middle class. That’s where the money is. But it won’t fix the deficit.

The Bush “tax cuts for the rich” cost the Treasury about $800 billion in forgone revenue; the Bush tax cuts for the middle class cost trillions — 2.2 of them, to be precise.

Repealing all of those Bush tax cuts, for rich and middle class alike, gets you about $3 trillion — over ten years. The deficit is running from a third to almost half that every year.

So the only way back away from the brink is to cut spending — by eliminating missions wholesale. But politicians don’t really want to cut spending. Hence, the problem.

The government needs to drastically reduce spending. Enough with the squeezing of the American people.

I'm no supporter of the mega corporations and the Oligarchy which control the United States, but it was no coincidence that the same Senator, Aldrich, forced through both the Federal Reserve Act and simultaneously created the IRS via the very controversial sixteenth amendment.

This group of bankers knew that the individual states would never allow themselves to be taxed to fund deficit spending by the federal government so they had to enact legislation on the federal level.

Our government is the most wasteful entity on Earth. They destroy every program they have ever touched from Social Security to welfare. How can someone reasonably think that we should give them MORE of our money?

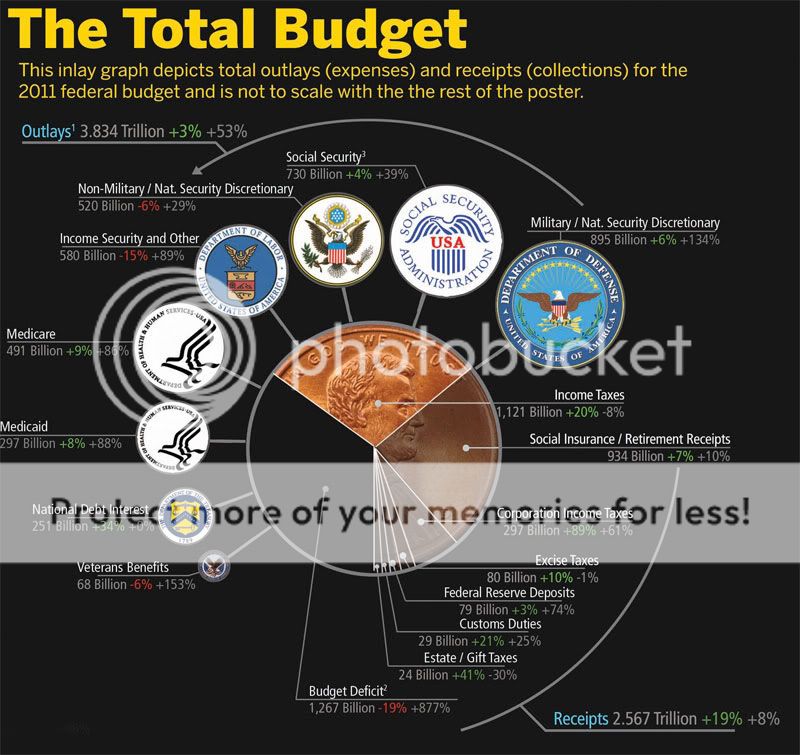

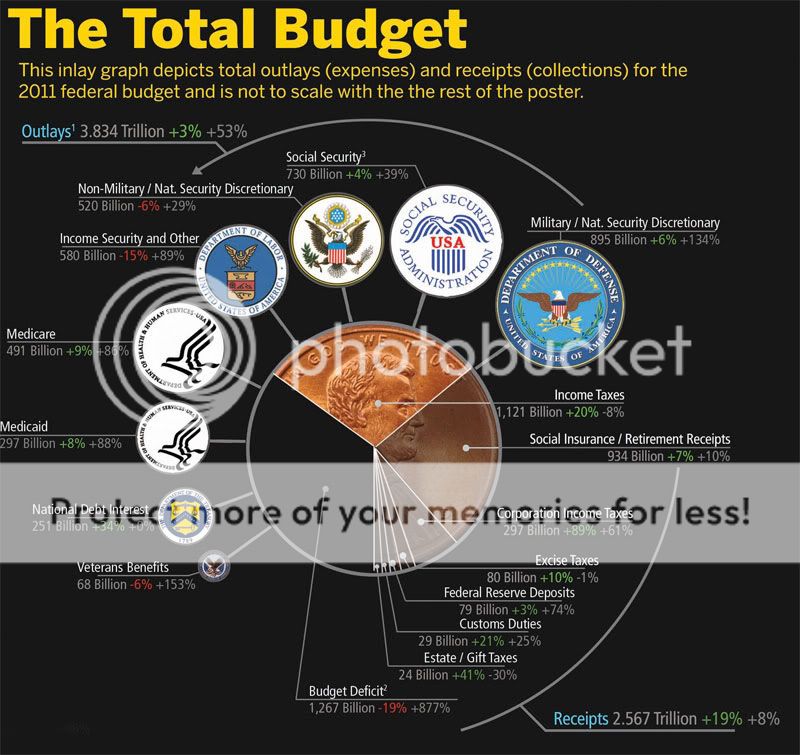

Most people done even realize that income taxes account for less than HALF of total income generated by our government. If these maniacs would just reduce spending to 1996 levels, we could eliminate income taxes altogether. Bye bye IRS.

I'm no supporter of the mega corporations and the Oligarchy which control the United States, but it was no coincidence that the same Senator, Aldrich, forced through both the Federal Reserve Act and simultaneously created the IRS via the very controversial sixteenth amendment.

This group of bankers knew that the individual states would never allow themselves to be taxed to fund deficit spending by the federal government so they had to enact legislation on the federal level.

Our government is the most wasteful entity on Earth. They destroy every program they have ever touched from Social Security to welfare. How can someone reasonably think that we should give them MORE of our money?

Most people done even realize that income taxes account for less than HALF of total income generated by our government. If these maniacs would just reduce spending to 1996 levels, we could eliminate income taxes altogether. Bye bye IRS.

I absolutely agree. Thanks for that chart. I don't see how our liberal friends can ignore it and the important information there.

new topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 3 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 5 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 5 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 6 hours ago

4