It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

0

share:

reply to post by rstregooski

MAN I wish I would have been smart enough to buy big into both just before 9/11!

2nd line.

MAN I wish I would have been smart enough to buy big into both just before 9/11!

2nd line.

With 'hindsight' we would all change the world.... so don't beat yourself up over it !!!

According to the 'Kieser report', a TV show on RT channel with Max Keiser (a financial jouno)... he is suggesting Silver still has some way to go......

The idea being that a bank, Morgan Stanley or the other load of crooks have 'exposed' themselves on significant Shorts on silver and because the price of Silver is increasing then that means MEGA losses for that bank...... It was rumoured that a Russian Billionaire has bought more SIGNIFICANT amounts of silver so as to push the price up further and HURT these banks whom has already HURT US......

I think there is a little battle behind the scenes going on which US mortals don't know much about............

Have a look for the Keiser programme, it was linked to on another thread on ATS....makes interesting reading / viewing.....

Regards

PDUK

According to the 'Kieser report', a TV show on RT channel with Max Keiser (a financial jouno)... he is suggesting Silver still has some way to go......

The idea being that a bank, Morgan Stanley or the other load of crooks have 'exposed' themselves on significant Shorts on silver and because the price of Silver is increasing then that means MEGA losses for that bank...... It was rumoured that a Russian Billionaire has bought more SIGNIFICANT amounts of silver so as to push the price up further and HURT these banks whom has already HURT US......

I think there is a little battle behind the scenes going on which US mortals don't know much about............

Have a look for the Keiser programme, it was linked to on another thread on ATS....makes interesting reading / viewing.....

Regards

PDUK

reply to post by PurpleDog UK

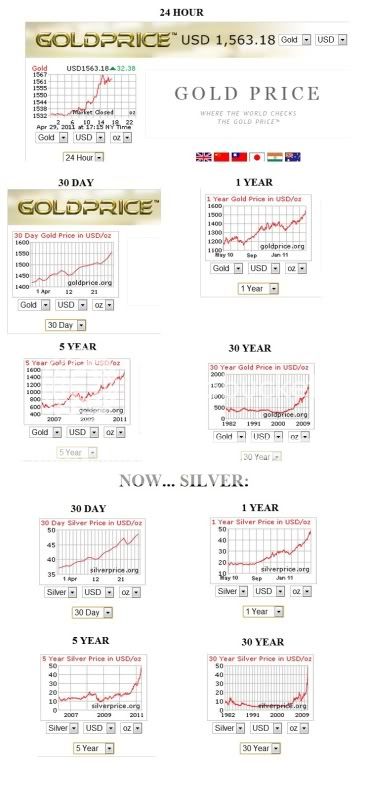

Yea, I've seen a few Kieser reports.. Interesting look at the 30-year silver graph versus gold...

Yea, I've seen a few Kieser reports.. Interesting look at the 30-year silver graph versus gold...

reply to post by PurpleDog UK

Thank PDUK - yeah, I've seen interesting prediction of silver up to as much as $150 in the next few months, and apparently with all the tungsten parading around in the gold markets (plated), the true value of gold based on volume should be anywhere up to like $115k/oz. - ridiculous, eh?

Anyone with market insight have any input on that last bit? I remember headlines from some time back talking about the plated tungsten bars they were coming across.

Thank PDUK - yeah, I've seen interesting prediction of silver up to as much as $150 in the next few months, and apparently with all the tungsten parading around in the gold markets (plated), the true value of gold based on volume should be anywhere up to like $115k/oz. - ridiculous, eh?

Anyone with market insight have any input on that last bit? I remember headlines from some time back talking about the plated tungsten bars they were coming across.

Yeah..... the 30 year graph is already at a peak and yet Max Keiser is Completely Adamant that it will go higher............ Like I said before there

appears to be some behind the scenes shananigins going on..

The question is .... Do we, as mere mortals who can't really afford to lose our money get invloved in the 'game' or not ??

Regards

PDUK

The question is .... Do we, as mere mortals who can't really afford to lose our money get invloved in the 'game' or not ??

Regards

PDUK

edit on 30-4-2011 by PurpleDog UK because: Really pathetic gramma !!! d'oh

reply to post by rstregooski

I think part of what you're seeing is gold prices pushing investors into silver as a more affordable commodity.

Small investors recently entered into the markets can't justify the entry price in gold - speculators would rather play in more-but-less-costly futures contracts and are primarily responsible for the volatility in ALL markets IMO.

It's wag the dog economics where the casino gamblers betting on the future availability of largely non-existent commodities are in control of the price to the market - typical economic principles like supply and demand don't really enter into the equation any more in determining the economic outlook.

ganjoa

I think part of what you're seeing is gold prices pushing investors into silver as a more affordable commodity.

Small investors recently entered into the markets can't justify the entry price in gold - speculators would rather play in more-but-less-costly futures contracts and are primarily responsible for the volatility in ALL markets IMO.

It's wag the dog economics where the casino gamblers betting on the future availability of largely non-existent commodities are in control of the price to the market - typical economic principles like supply and demand don't really enter into the equation any more in determining the economic outlook.

ganjoa

Does the 30 year graph take into consideration inflation? So if Gold was worth, just for the sake of example, $300 an an ounce in 1982, by today's

standards, that may be close to $1000 - or whatever inflationary effects would have it.

reply to post by surrealist

I don't have the exact figures on hand, but if my memory isn't failing me, the inflation adjusted prices right now would be Silver $140/oz, Gold $2400/oz.

There may or may not be truth to the JP Morgan short rumor, but I don't think anyone disagrees that the market itself is totally manipulated. The paper gold and silver futures market (which determines the spot prices) is a derivative scheme just like the mortgage backed securities scheme. It's going to blow up at some point when people find out that their paper silver and gold is worthless. But even if JP Morgan was short, they will manipulate the price of silver as needed to allow them to go long and eventually bet against the positon their bank is holding. This is what all the banks did with their mortgage securities, I have no doubt they will do it again with Gold and Silver - IF it appears that the dollar cannot be saved.

That's why people like Keiser say it will still go up - once the paper market is exposed, the valuations will adjust and who knows how high Silver/Gold could go then. Alternatively, inflation fears will force the paper market up and up. And if inflation ever turns into hyperinflation, at least part of your wealth is protected by holding physical.

Never underestimate your opponent, however, especially when that opponent is an insanely rich criminal bankster syndicate with control of the Fed, SEC and the White House. I hold both metals, but I'm holding them until I die or a new monetary system is implemented. If you're looking to "make profit" then you're investing in the physical for the wrong reason, IMO.

I don't have the exact figures on hand, but if my memory isn't failing me, the inflation adjusted prices right now would be Silver $140/oz, Gold $2400/oz.

There may or may not be truth to the JP Morgan short rumor, but I don't think anyone disagrees that the market itself is totally manipulated. The paper gold and silver futures market (which determines the spot prices) is a derivative scheme just like the mortgage backed securities scheme. It's going to blow up at some point when people find out that their paper silver and gold is worthless. But even if JP Morgan was short, they will manipulate the price of silver as needed to allow them to go long and eventually bet against the positon their bank is holding. This is what all the banks did with their mortgage securities, I have no doubt they will do it again with Gold and Silver - IF it appears that the dollar cannot be saved.

That's why people like Keiser say it will still go up - once the paper market is exposed, the valuations will adjust and who knows how high Silver/Gold could go then. Alternatively, inflation fears will force the paper market up and up. And if inflation ever turns into hyperinflation, at least part of your wealth is protected by holding physical.

Never underestimate your opponent, however, especially when that opponent is an insanely rich criminal bankster syndicate with control of the Fed, SEC and the White House. I hold both metals, but I'm holding them until I die or a new monetary system is implemented. If you're looking to "make profit" then you're investing in the physical for the wrong reason, IMO.

new topics

-

Supreme Court Oral Arguments Today 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 5 minutes ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 14 minutes ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 41 minutes ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 9 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 13 hours ago, 10 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 17 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 14 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 14 hours ago, 5 flags -

Electrical tricks for saving money

Education and Media: 12 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 16 hours ago, 3 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 14 minutes ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 41 minutes ago, 0 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 33 • : FlyersFan -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 62 • : Consvoli -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 281 • : marg6043 -

I Guess Cloud Seeding Works

Fragile Earth • 42 • : WaESN -

Supreme Court Oral Arguments Today 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 0 • : WeMustCare -

D.C. Court of Appeals made a horrible ruling against Trump

US Political Madness • 320 • : WeMustCare -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest • 1 • : FlyersFan -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 58 • : Ophiuchus1 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 63 • : andy06shake -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 3 • : ImagoDei

0