It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

IMF Prepares for Financial Meltdown

GAB & NAB INFO

I know this is an OP-ED from Huffington Post(sorry) but the issue is of global importance. Are we, as brothers and sisters of this planet, to allow the Global Banking Cartel to manage the mess they've created? This system of imagined wealth seems to be reaching a moment of truth. It is clear from so many signs the system's viability depends on financial policy-makers' ability to make drastic and effective changes. And with what would we be left? A modified system in which the new boss is the same as the old.

The future of public debt-BIS

ATS Thread related to BIS Report

The IMF has been making a lot of noise recently, but their biggest move almost managed to slip through completely unnoticed.

The Executive Board of the International Monetary Fund (IMF) today approved a ten-fold expansion of the Fund's New Arrangements to Borrow (NAB, and transfer the Fund's premier standing credit arrangement into a more flexible and effective tool of crisis management. The NAB will be increased by SDR 333.5 billion (about US$500 billion) to SDR 367.5 billion (about US$550 billion), representing a major increase in the resources available for the Fund's lending to its members.

This IMF program didn't even exist until a year ago, when the IMF began issuing SDRs for the first time since the 1970's. The IMF has only sold SDRs in times of global financial stress.

It makes a person wonder "Why now?" Why is the IMF suddenly tripling its lending facilities? What do they know that we don't?

GAB & NAB INFO

I know this is an OP-ED from Huffington Post(sorry) but the issue is of global importance. Are we, as brothers and sisters of this planet, to allow the Global Banking Cartel to manage the mess they've created? This system of imagined wealth seems to be reaching a moment of truth. It is clear from so many signs the system's viability depends on financial policy-makers' ability to make drastic and effective changes. And with what would we be left? A modified system in which the new boss is the same as the old.

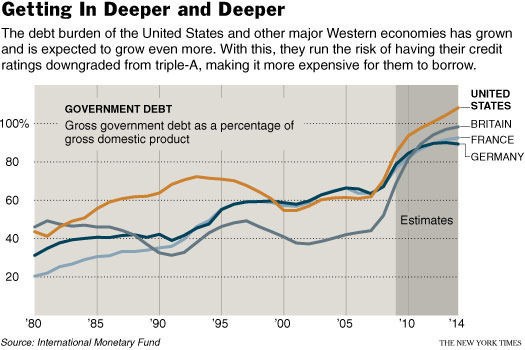

A few days ago Dominique Strauss-Kahn warned about public debt levels. However, that wasn't the announcement that needed attention. The really scary report came from the Bank of International Settlements a week ago.

"The aftermath of the financial crisis is poised to bring a simmering fiscal problem in industrial economies to the boiling point", said the Swiss-based bank for central bankers -- the oldest and most venerable of the world's financial watchdogs. Drastic austerity measures will be needed to head off a compound interest spiral, if it is not already too late for some.

Official debt figures in the West are "very misleading" since they fail to take in account the contingent liabilities and pension debts that have mushroomed over recent years. "Rapidly ageing populations present a number of countries with the prospect of enormous future costs that are not wholly recognised in current budget projections. The size of these future obligations is anybody's guess," said the report. The BIS lamented the lack of any systematic data on the scale of unfunded IOUs that care-free politicians have handed out like confetti.

Britain emerges in the BIS paper as an arch-sinner. The country may have entered the crisis with a low public debt but this shock absorber has already been used up, exposing the underlying rot in the UK's public accounts.

Of course Britain's "shock absorber" was used up bailing out its banks, not by spending it on public pensions and health care. The reports never seem to mention things like that.

The future of public debt-BIS

ATS Thread related to BIS Report

The United States debt to GDP ratio is about 89.6% . It has been going up literally about .05% of GDP a day since I started watching it and at this

rate we will be in the same economic/financial crisis as Greece within a year. You can check out the U.S. debt by the numbers

here. The debt to GDP ratio is in the top right corner.

Bernanke made an announcement a few days ago that we might hit a 100% debt to GDP ratio before 2012.

Bernanke made an announcement a few days ago that we might hit a 100% debt to GDP ratio before 2012.

Originally posted by time91100% debt to GDP ratio before 2012.

I'm doing the math on my fingers and that don't add up to a functioning economy.

.

stars and flags

economist are saying that Japan could be the next one to fall and we could lose our AAA credit rating.

economist are saying that Japan could be the next one to fall and we could lose our AAA credit rating.

I'm sure someone could explain my little question.

Why don't the numbers on the debt clock (or the revenue clock for that matter) ever stop? For example, today is Sunday, it is neither a business or banking day so why are the numbers moving?

Are these figures estimates or actual ?

Why don't the numbers on the debt clock (or the revenue clock for that matter) ever stop? For example, today is Sunday, it is neither a business or banking day so why are the numbers moving?

Are these figures estimates or actual ?

reply to post by Moonsouljah

Yeah, when you hit an equal debt to GDP it makes it near impossible to pay it(debt) off unless you are sure it is short term (like if we were in the middle of a world war). However we are not and there is nothing magic that will pull us out of our bad economy. In Greece their debt to GDP is a little over 125% and not too long ago their interest rate went from 4% to 15%, which in layman's terms means the s*** has hit the fan. This year in America literally 1/8th of federal taxes went to service interest on the debt. In the coming years it will rise very quickly and we will have to put in very unpopular measures(speculating here), just like Greece, that will add to social unrest like it did in Greece.

Yeah, when you hit an equal debt to GDP it makes it near impossible to pay it(debt) off unless you are sure it is short term (like if we were in the middle of a world war). However we are not and there is nothing magic that will pull us out of our bad economy. In Greece their debt to GDP is a little over 125% and not too long ago their interest rate went from 4% to 15%, which in layman's terms means the s*** has hit the fan. This year in America literally 1/8th of federal taxes went to service interest on the debt. In the coming years it will rise very quickly and we will have to put in very unpopular measures(speculating here), just like Greece, that will add to social unrest like it did in Greece.

And this is just the money -- just wait till we run out of water in 20 years, not to mention the oil crisis hitting in a few years.

Ah civilization -- looks like this is it!

Ah civilization -- looks like this is it!

reply to post by searching4truth

I'm not 100% sure, but it says that they get their 'real time' numbers using formulas. But then they verify the numbers by looking at the numbers available from the treasury and other places. If you hover over the ones at the top it will say where they got them.

I'm not 100% sure, but it says that they get their 'real time' numbers using formulas. But then they verify the numbers by looking at the numbers available from the treasury and other places. If you hover over the ones at the top it will say where they got them.

Isn't the world always at war? I mean seriously, when have we not been at war? How big of a military budget does each person have let alone a

country?

Originally posted by Moonsouljah

Originally posted by time91100% debt to GDP ratio before 2012.

I'm doing the math on my fingers and that don't add up to a functioning economy.

.

so what happens to our soldiers on the foreign battlefield

when the gov can no longer pay them for their services???

Massive desertions?? Military Coups within

Military Coups?? It is frightening !!!

reply to post by time91

I've been watching the debt clock too. In the last couple of months, it's rose 1% about every 18 days. By my calculations, we'll be at 100% debt/gdp way before 2012. More like the end of October, this year !!

I've been watching the debt clock too. In the last couple of months, it's rose 1% about every 18 days. By my calculations, we'll be at 100% debt/gdp way before 2012. More like the end of October, this year !!

Originally posted by drew hempel

And this is just the money -- just wait till we run out of water in 20 years, not to mention the oil crisis hitting in a few years.

Ah civilization -- looks like this is it!

mmmm. i disagree. there is 2.5 TRILLION barrels of oil in the u.s., enough for a 10,000 year supply running america 100%. the only oil crisis is that we aren't tapping that. and water? there's plenty of water everywhere

reply to post by Bob Sholtz

Please stop the nonsense! There are not 2.5trillion barrels of oil. The article which started this bs has been proven to be a lie. Most of the large oil reserves is shale, and it's not easily recoverable. Even if it were, it wouldn't last us 10,000 years.

Don't you realize how much oil the U.S. goes through each day! It's 22million barrels, which comes out to 8.03 billion barrels a year, giving the 2.5 trillion phony barrels a supply capacity for 311 years. Once again, the oil found isn't all recoverable, what is recoverable is somewhat inefficient (takes oil to extract and process the oil) , and some of it really shouldn't be touched due to enivironmental conditions.

[edit on 18-4-2010 by unityemissions]

Please stop the nonsense! There are not 2.5trillion barrels of oil. The article which started this bs has been proven to be a lie. Most of the large oil reserves is shale, and it's not easily recoverable. Even if it were, it wouldn't last us 10,000 years.

Don't you realize how much oil the U.S. goes through each day! It's 22million barrels, which comes out to 8.03 billion barrels a year, giving the 2.5 trillion phony barrels a supply capacity for 311 years. Once again, the oil found isn't all recoverable, what is recoverable is somewhat inefficient (takes oil to extract and process the oil) , and some of it really shouldn't be touched due to enivironmental conditions.

[edit on 18-4-2010 by unityemissions]

reply to post by unityemissions

sometimes i wonder about the so called "lack of oil". a very good friend of mine was interviewing at an oil company a while ago and they had asked her one of the most important things she's looking for in a career and she replied "job security". so the interviewer told her not to worry, because they have more than enough oil for generations still...it was a really crazy interview...they kept trying to learn her political ideals throughout the whole thing and trying to see if she was one of those people who "does what it takes to succeed" like...trampling all over others...thats apparently the type of employee they wanted.

sometimes i wonder about the so called "lack of oil". a very good friend of mine was interviewing at an oil company a while ago and they had asked her one of the most important things she's looking for in a career and she replied "job security". so the interviewer told her not to worry, because they have more than enough oil for generations still...it was a really crazy interview...they kept trying to learn her political ideals throughout the whole thing and trying to see if she was one of those people who "does what it takes to succeed" like...trampling all over others...thats apparently the type of employee they wanted.

reply to post by Moonsouljah

The BIS (Bank for International Settlements) has also reported a meltdown warning. See:

blog.civilchallenger.com...

Mostly its just very similar data but from the BIS instead of the IMF. I guess these people are well aware of basic math, basic accounting, and can use calculators.

A *worldwide* meltdown will be set into stone if the spending sprees in major countries continue another one or two years. Clearly this would be a dangerous time and leave opportunity for a Hitler-like world power to take over just like in the 1930's.

The BIS (Bank for International Settlements) has also reported a meltdown warning. See:

blog.civilchallenger.com...

Mostly its just very similar data but from the BIS instead of the IMF. I guess these people are well aware of basic math, basic accounting, and can use calculators.

A *worldwide* meltdown will be set into stone if the spending sprees in major countries continue another one or two years. Clearly this would be a dangerous time and leave opportunity for a Hitler-like world power to take over just like in the 1930's.

reply to post by devilishlyangelic23

So...why would you trust this information when you can see the interviewer is amoral?!

So...why would you trust this information when you can see the interviewer is amoral?!

reply to post by truthquest

Agreed, though if there are any emergency alarms of significance it is the BIS and IMF. They represent the premier analysis on global economics and for them to paint such a grim picture is a bit distressing.

Agreed, though if there are any emergency alarms of significance it is the BIS and IMF. They represent the premier analysis on global economics and for them to paint such a grim picture is a bit distressing.

If everyone truly knew what the IMF folks know, we would all be hiding in our closets. Their biggest problem is trying to keep secret that the entire

world monetary systems are all screwed. Sooner or later, the cat will come out of the bag. When that happens, everything will come tumbling down

rather quickly. We will all be surprised at how fast our little world comes crashing down.

all plans have been set in motion, and can't be stopped. Just enjoy the show, and remember, this time, it's all real.

all plans have been set in motion, and can't be stopped. Just enjoy the show, and remember, this time, it's all real.

new topics

-

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 4 hours ago -

Bobiverse

Fantasy & Science Fiction: 6 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago -

Former Labour minister Frank Field dies aged 81

People: 9 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 15 hours ago, 18 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 9 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 16 hours ago, 3 flags -

This is our Story

General Entertainment: 13 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 6 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 4 hours ago, 1 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 80 • : Consvoli -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology • 2 • : Springbok -

Bobiverse

Fantasy & Science Fiction • 2 • : Springbok -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 18 • : watchitburn -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 13 • : Consvoli -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 137 • : Annee -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 54 • : Asher47 -

LaBTop is back at last.

Introductions • 15 • : LaBTopOld -

Russia Ukraine Update Thread - part 3

World War Three • 5727 • : YourFaceAgain -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 259 • : SourGrapes

8