It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

4

share:

if the "sources" are not credible enough please seek your own. this aint blues clues

For starters:

Coupled with:

e.g.

(for demonstrative purposes)

Current Mortgage: $1200

Current Electric: $160

Caps Off & Mort. Reset...

Mortgage: $1600-$1800+/-

Electric: $200-$300 +/-

It would seem the coming months are going to prove Quite interesting.

Enjoy the ride... :shk:

[edit on 21-1-2010 by 12m8keall2c]

For starters:

energy.cas.psu.edu...

The bottom line is that consumers have experienced no more than nominal annual price increases in electricity (5 percent or less) since 1996. These small increases have been occurring at the same time that prices for oil, natural gas, propane, coal, and even firewood have skyrocketed.

No one knows for sure what will happen when the rate caps expire. Price increases are anticipated. In neighboring states of Maryland and Delaware, prices for electricity rose by about 70 percent and 50 percent, respectively, when their rate caps expired. In Maine, the increase was about 100 percent.

Coupled with:

dailyreckoning.com...

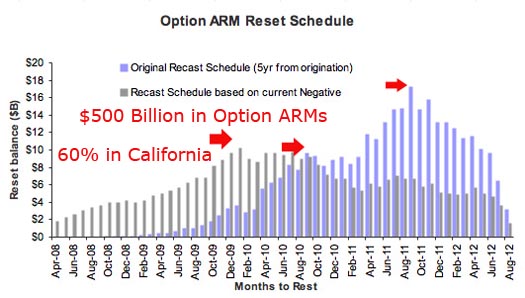

Unfortunately, no one is talking about the second wave of ARM resets and foreclosures…

You see, this second wave will come crashing even harder than the first. It’s made up of a type of mortgage called “Option ARMs.” These give borrowers the option of how much they want to pay during the first five or 10 years of repayment:

1) The full amortized rate, including interest and principal.

2) Interest only, or…

3) A token payment, well below the amount needed to cover the interest on the loan.

This third option causes the mortgage balance to INCREASE instead of decrease. And usually, the borrower can continue to make minimum payments until the mortgage balance increases to 125% of the original amount. That’s when the trouble begins…especially if the interest rate increases at the same time.

This is the exact situation in which many homeowners now find themselves.

Obviously, these option ARMs were supposed to be reserved for customers with better credit than those who took out subprime mortgages. But apparently, they were handed out to almost anyone who wanted them.

e.g.

(for demonstrative purposes)

Current Mortgage: $1200

Current Electric: $160

Caps Off & Mort. Reset...

Mortgage: $1600-$1800+/-

Electric: $200-$300 +/-

It would seem the coming months are going to prove Quite interesting.

Enjoy the ride... :shk:

[edit on 21-1-2010 by 12m8keall2c]

Originally posted by 12m8keall2c

It would seem the coming months are going to prove Quite interesting.

[atsimg]http://files.abovetopsecret.com/images/member/a349c9543351.jpg[/atsimg]

[edit on 21-1-2010 by In nothing we trust]

Interesting to say the least. We do seem to have survived one stock market 'correction' (translation: limited crash) created by a collapse in the

housing market. Now it would appear another similar situation is on the way. The difference is that this time, we do not have a vibrant economy; we

have a struggling economy.

The last time, we bailed out the banks who caused the problem, in order to try and stave off the problem. We went into extreme debt to do so, against the will of the vast majority of the public. This time, we are already deeper in debt than we have ever been.

All this coupled with the double whammy of adding in rate increases for electricity mean that the public will be hurting worse than any of us can remember. And throw in our present severe reliance on electricity to survive. Many places will condemn homes that go for too long without electricity. Some places will remove children from homes for the same reason. What happens when the choice is between losing one's home to foreclosure and losing it to governmental action?

12m8keall2c, great find and your interpretation is right on the money. If optimistic...

TheRedneck

The last time, we bailed out the banks who caused the problem, in order to try and stave off the problem. We went into extreme debt to do so, against the will of the vast majority of the public. This time, we are already deeper in debt than we have ever been.

All this coupled with the double whammy of adding in rate increases for electricity mean that the public will be hurting worse than any of us can remember. And throw in our present severe reliance on electricity to survive. Many places will condemn homes that go for too long without electricity. Some places will remove children from homes for the same reason. What happens when the choice is between losing one's home to foreclosure and losing it to governmental action?

12m8keall2c, great find and your interpretation is right on the money. If optimistic...

TheRedneck

Whats even more terrifying is that *if* this occurs, the Gov/Fed has ZERO ways to fight it. Interest rates are at zero and bonds are WAY out of

control. When these horrors start to reset, game over.

Originally posted by TruthWithin

Whats even more terrifying is that *if* this occurs, the Gov/Fed has ZERO ways to fight it. Interest rates are at zero and bonds are WAY out of control. When these horrors start to reset, game over.

Maybe the corporate owned US government shouldn't have pissed off the American people?

Don't know, just throwing that out there.

What's your harvard / yale / CFR focus group say about that?

Stupid rich people.

Who owns you?

[atsimg]http://files.abovetopsecret.com/images/member/3df5bc48992e.jpg[/atsimg]

Submit

[edit on 22-1-2010 by In nothing we trust]

It’s not just the rich folk.

I own a small cabinet shop. We do custom wood working and build in cabinetry. It takes a good amount of electric to run my equipment. It's my bigest expence. Now do you think I’m going to take a pay cut when this happens? If you went to work one day and your boss said your doing a grate job around here but we have to cut your salary because of electric deregulation would you say OK or say hell NO.

I and all my competitors will have to increase the price of are goods and services. If that dose not work, than we will have to reduce are cost, that unfortunately translates into laying off the low men on the to-tam pole.

Ether way this is going to have a negative affect on the economy right when we need things in our live to cost less.

Peace All

I own a small cabinet shop. We do custom wood working and build in cabinetry. It takes a good amount of electric to run my equipment. It's my bigest expence. Now do you think I’m going to take a pay cut when this happens? If you went to work one day and your boss said your doing a grate job around here but we have to cut your salary because of electric deregulation would you say OK or say hell NO.

I and all my competitors will have to increase the price of are goods and services. If that dose not work, than we will have to reduce are cost, that unfortunately translates into laying off the low men on the to-tam pole.

Ether way this is going to have a negative affect on the economy right when we need things in our live to cost less.

Peace All

Originally posted by TheRedneck

All this coupled with the double whammy of adding in rate increases for electricity mean that the public will be hurting worse than any of us can remember.

Exactly.

Some of those households and individuals might be able to handle or absorb one or the other, increased mortgage/increased energy costs, but to be hit with both at or around the same time is going to greatly increase the numbers who simply cannot find the means to do so.

Also there are a significant percentage of those with option a.r.m.s. who fall into the group known as the NINJA loans (no income. no job. no assets)

Folks who should have Never received mortgage loans in the first place.

When you take all the above into consideration, it sure doesn't seem a matter of If but more a matter of When and How many will result in foreclosures and defaults.

Given the state of the economy and sheer number of those due to reset over the coming year or so, it's going to be one helluva rough ride all around ... most likely Far worse than the first go 'round of sub prime defaults.

reply to post by 12m8keall2c

murfdog makes an excellent point as well. This will affect more than just power costs from the utilities; the cost of everything will rise except wages. The minimum cost of any product is the cost to bring it to the shelves plus profit, and higher energy costs can do nothing less than drive up prices.

That means that amongst the already impossible situation, prices of food, clothing, medicine, etc. will also climb.

Now, what I am wondering at this point is: how will this affect national stability? The theory of bread and circuses has been brought up many times in other threads on the economy, and I believe it is accurate: people will succumb to almost any tyranny as long as they have food and entertainment. I see these two things being taken away. Will we see riots in the streets this time?

There is a breaking point. I just wish I knew where that breaking point was.

TheRedneck

murfdog makes an excellent point as well. This will affect more than just power costs from the utilities; the cost of everything will rise except wages. The minimum cost of any product is the cost to bring it to the shelves plus profit, and higher energy costs can do nothing less than drive up prices.

That means that amongst the already impossible situation, prices of food, clothing, medicine, etc. will also climb.

Now, what I am wondering at this point is: how will this affect national stability? The theory of bread and circuses has been brought up many times in other threads on the economy, and I believe it is accurate: people will succumb to almost any tyranny as long as they have food and entertainment. I see these two things being taken away. Will we see riots in the streets this time?

There is a breaking point. I just wish I knew where that breaking point was.

TheRedneck

new topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 2 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 5 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 5 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 6 hours ago -

George Knapp AMA on DI

Area 51 and other Facilities: 11 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 11 hours ago, 25 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 6 hours ago, 14 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 14 hours ago, 7 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 17 hours ago, 6 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 5 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 12 hours ago, 5 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 5 hours ago, 4 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 15 hours ago, 3 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 2 hours ago, 3 flags

active topics

-

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 23 • : andy06shake -

Mandela Effect - It Happened to Me!

The Gray Area • 109 • : ArMaP -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 1 • : stosh64 -

Mood Music Part VI

Music • 3058 • : Hellmutt -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 60 • : whereislogic -

Scarface does Tiny Desk Concert

Music • 7 • : sitrose -

The Acronym Game .. Pt.3

General Chit Chat • 7727 • : F2d5thCavv2 -

Russia Ukraine Update Thread - part 3

World War Three • 5697 • : F2d5thCavv2 -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 22 • : SchrodingersRat -

Iran launches Retalliation Strike 4.18.24

World War Three • 15 • : semperfortis

4