It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Many of us, have started threads regarding information about Gold and Precious Metals. I have many times wished, we had one good informative thread

about Gold, Silver and Precious Metals, where those that are interested could come, to read and post about those Metals.

So, I thought I would begin one, where people could come to learn more and discuss what is happening with those commodities.

Live Metals Chart from Kitco.com

Gold and Silver have been talked about by many economist and analyst.

I have found the "real" ones, say buy gold, compared to the MSM media people saying "sell" it, and put your money in treasuries etc.

When I have heard that, I have wanted to reach in to the T.V. and wring their necks, for miss leading people, which will ultimately cause them harm in the long run (in my opinion).

Anyway, for those that are interested in Gold, Silver and Metals for investment purposes etc........ we can now come to one thread and inform each other - what the current information is on them.

So, what do you think?

I know I go to many sites every day to read the latest about Gold and Silver.

I also know that silver is actually more "rare" than gold.......

Almost every single analyst say.... Silver will eventually "out shine" gold.

[edit on 26-2-2009 by questioningall]

So, I thought I would begin one, where people could come to learn more and discuss what is happening with those commodities.

Live Metals Chart from Kitco.com

Gold and Silver have been talked about by many economist and analyst.

I have found the "real" ones, say buy gold, compared to the MSM media people saying "sell" it, and put your money in treasuries etc.

When I have heard that, I have wanted to reach in to the T.V. and wring their necks, for miss leading people, which will ultimately cause them harm in the long run (in my opinion).

Anyway, for those that are interested in Gold, Silver and Metals for investment purposes etc........ we can now come to one thread and inform each other - what the current information is on them.

So, what do you think?

I know I go to many sites every day to read the latest about Gold and Silver.

I also know that silver is actually more "rare" than gold.......

Almost every single analyst say.... Silver will eventually "out shine" gold.

[edit on 26-2-2009 by questioningall]

I go to Stevenquayle.com everyday to check up on the latest. I love the Mugambo and his brilliant insights and hilarious wit.

I would love to see it here on the forum, we could ahve a Kitco chart that changes right?

I would love to see it here on the forum, we could ahve a Kitco chart that changes right?

silver will never trade above gold unless it is a temporary aberration caused by a futures short squeeze as gold is a superior substitute for any

electronic/industrial application that silver is used for. gold is too soft for flatware (altho it can be alloyed w copper and nickel) but there isnt

too much demand now for sterling flatware anyway (except to melt it).

I like researching and reading up on things over at gold is money. Good shizzle.

goldismoney.info...

goldismoney.info...

reply to post by antar

OH, that would be great, they have something you can insert into a site.

I need to ask a mod if that is ok, it would be from kitco. They are the only ones with one that I know of.

OH, that would be great, they have something you can insert into a site.

I need to ask a mod if that is ok, it would be from kitco. They are the only ones with one that I know of.

A while back I thought of a way to make Gold more accessible to the public. I wanted to sell Gold Bullion in Gram and fractional Gram Forms. A gm is

about $32 USD now. 100 mg would be about $3. Sell them as a foil in a plastic carrier. The Carrier could be replaced with a special tool if it wore

out. The "foil" would be shaped in such a way so that a simple inertial test would tell if it had been tampered with. The idea would be to make it

moderately secure from tampering and forgery so that the value

is secure.

I would call it Bullion because I wouldn't want to get into the coin business...no siree! _javascript:icon('')

Even had a name for my company;

is secure.

I would call it Bullion because I wouldn't want to get into the coin business...no siree! _javascript:icon('')

Even had a name for my company;

Liquid Bullion

Chart is finally up and running, it is a live chart - so we will see the prices on real time!

I got the OK for it.

I got the OK for it.

Excellent on the Kitco Chart! Ats is really getting so great its like going on vaction but never having to leave the farm...

Anyway found something worth taking a look at:

seekingalpha.com...

I was just thinking about this the other night. If you have silver right now, hang on to it and dont let go. Know what your sellout price would be and if you must, dont sell more than half, hang on this is not going to be a pretty sight in the next 18 months, people are going to sell when silver reaches 30usd, but if you will wait until the next lift off its gonna be outstanding. IMHO.

Anyway found something worth taking a look at:

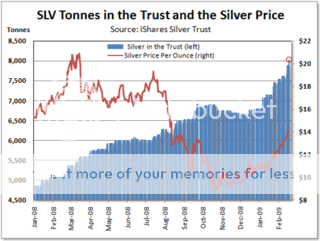

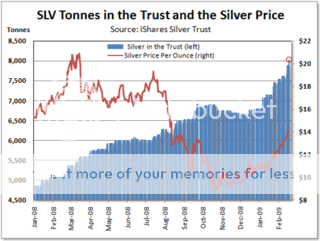

The folks over at the iShares Silver Trust (NYSE:SLV) were quite busy last week, adding a total of 420 tonnes of silver to their stash, pushing the inventory at the world's most popular silver ETF above the 8,000 tonne level for the first time ever.

seekingalpha.com...

Since the first of the year, they've added 1,234 tonnes to the trust, an increase of about 18 percent. During that time, the price of silver has risen almost 30 percent, the best performing commodity so far in 2009 by a wide margin.

I was just thinking about this the other night. If you have silver right now, hang on to it and dont let go. Know what your sellout price would be and if you must, dont sell more than half, hang on this is not going to be a pretty sight in the next 18 months, people are going to sell when silver reaches 30usd, but if you will wait until the next lift off its gonna be outstanding. IMHO.

reply to post by Anonymous ATS

No, when analyst say "shine brighter than gold" they mean will increase at a much bigger rate than gold, thus people will make more money in the long run, by owning silver.

No, when analyst say "shine brighter than gold" they mean will increase at a much bigger rate than gold, thus people will make more money in the long run, by owning silver.

This link says there is a gold coin shortage:

www.ft.com...

Gold has been going down the last few days, but due to what many analyst have said, I knew it was going to go down.

Because Lehman Bros and many institutions associated with the govt. have been putting many shorts on the price, which are around $900. So they are forcing the price down. The govt. wants to keep the price of gold down, because otherwise people on a whole will start worrying about the dollar, and they definitely don't want that.

another article: www.bloomberg.com...

www.ft.com...

“There is demand for double or triple what the US mint is able to produce,” said Michael Kramer, president of MTB in New York, one of the four US gold dealers authorised to purchase bullion coins directly from the government’s mint.

The US Mint has sold 193,500 ounces of its popular American Eagle gold coin in the first seven weeks of this year, the same amount it shipped during the whole of 2007 and about the same as in the first six months of last year.

“The demand is extraordinary. All the coins we got on Monday are gone today [Tuesday] and we will not be able to take any order until the following week,” Mr Kramer said. “It is the same with other mints.”

Gold has been going down the last few days, but due to what many analyst have said, I knew it was going to go down.

Because Lehman Bros and many institutions associated with the govt. have been putting many shorts on the price, which are around $900. So they are forcing the price down. The govt. wants to keep the price of gold down, because otherwise people on a whole will start worrying about the dollar, and they definitely don't want that.

another article: www.bloomberg.com...

Gold is the most favored investment this year ahead of investment-grade bonds and other assets, according to a survey of investment advisers, the producer-funded World Gold Council said.

About 60 percent of the 31 advisers surveyed in Europe expect investors to take fewer risks this year compared with 2008, while about 30 percent expect investors to be less risk averse, the London-based council said today in a report. Almost 60 percent expect better market conditions this year.

The following is a table of preference for 10 investments. A figure of 1 is most favored and 10 is least favored.

Asset Average Ranking

Gold 3.97

Investment Grade Credit 4.13

Commodity Basket 4.71

Cash 4.74

Alternatives 5.39

Equities 5.42

Oil 5.65

Gilts 6.32

Non-investment Grade Credit 6.45

Property 6.84

Regarding the govt.

link: www.kitco.com...

Gold Anti - Trust Action : www.gata.org...

Here is an ad, they ran in the Wall St. Journal on Jan 31, 2009

link: www.gata.org...

[edit on 26-2-2009 by questioningall]

link: www.kitco.com...

Government interventions can cause gold and silver to trade at prices lower than they would in a free-market, as has been so thoroughly and carefully documented in the mountain of research compiled by the Gold Anti-Trust Action Committee, now celebrating its tenth anniversary (www.gata.org). But in the long-run, these market interventions cannot prevent gold and silver from rising when national currencies are being debased, as is evident by the fact that gold has risen against the dollar for eight years in a row.

Interventions into the free-market process inevitably become clear as greater numbers of people come to understand that governments and central banks do not determine the value of gold or silver anymore than they could set and then control at their desired level the value of a Picasso, a condo in Miami or a pound of sirloin steak. We participants in the market process determine the value of all goods and services, and money is a good – but a special one because without it, the market could not operate. And sound money is the best money of all.

Gold Anti - Trust Action : www.gata.org...

Here is an ad, they ran in the Wall St. Journal on Jan 31, 2009

link: www.gata.org...

[edit on 26-2-2009 by questioningall]

Originally posted by UMayBRite!

A while back I thought of a way to make Gold more accessible to the public. I wanted to sell Gold Bullion in Gram and fractional Gram Forms. A gm is about $32 USD now. 100 mg would be about $3. Sell them as a foil in a plastic carrier. The Carrier could be replaced with a special tool if it wore out. The "foil" would be shaped in such a way so that a simple inertial test would tell if it had been tampered with. The idea would be to make it moderately secure from tampering and forgery so that the value

is secure.

I would call it Bullion because I wouldn't want to get into the coin business...no siree! _javascript:icon('')

Even had a name for my company;

Liquid Bullion

Pretty Cool!

Wow silver went down considerably since last night. It would be nice to see it bottom out just one more time before the price goes sky high for us

people that cannot afford gold.

I have actually looked into the gold coins but found that if I did that by the time I had an ounce it would not be worth the price I paid.

It is just too expensive to come up with a thousand dollars and walk away with a little gold ounce.

One thing you can do which is a smart move is to buy gold and silver necklaces, this way during troubled times you can always take off a link or two to sell. Thing is you need to have a good scale or better yet get a link weighed now before things get rough that way your not giving away publically what you have once the bottom drops out.

I dont know what do you think?

I have actually looked into the gold coins but found that if I did that by the time I had an ounce it would not be worth the price I paid.

It is just too expensive to come up with a thousand dollars and walk away with a little gold ounce.

One thing you can do which is a smart move is to buy gold and silver necklaces, this way during troubled times you can always take off a link or two to sell. Thing is you need to have a good scale or better yet get a link weighed now before things get rough that way your not giving away publically what you have once the bottom drops out.

I dont know what do you think?

reply to post by tenhearttkc

If you are talking about melting gold, is that illegal? and dangerous to your health? Just asking I really do not know but have thought about it.

And just how would you do it? And why ?

If you are talking about melting gold, is that illegal? and dangerous to your health? Just asking I really do not know but have thought about it.

And just how would you do it? And why ?

reply to post by antar

Melting gold is perfectly legal. Also selling bulk gold is legal as well. What is illegal is the hoarding of gold. For some strange reason the government doesn't want people to buy up gold bricks and stack them in their homes.

Melting gold is perfectly legal. Also selling bulk gold is legal as well. What is illegal is the hoarding of gold. For some strange reason the government doesn't want people to buy up gold bricks and stack them in their homes.

link to article:

www.marketoracle.co.uk...

All I can say, is I hope more people take the physical gold from Comex and they can at SOME POINT get BUSTED and the manipulation will finally END!!

www.marketoracle.co.uk...

Investors are also flocking to gold coins. At the U.S. Mint, a total of 147,500 ounces of American Eagle gold bullion coins were sold in the first two months this year, a surge of 176% from the same period last year.

Demand is rising at the Comex, the metals division of the New York Mercantile Exchange, where investors increasingly are choosing to take physical delivery of gold, rather than cash, once their futures contacts expire.

Rising delivery orders have kept Brink's Inc., a major carrier for the Comex, busy. The Richmond, Va., company said it saw a large spike in clients shipping gold and silver from the exchange over the past few months.

In December, 4.5% of gold contracts ended in delivery, compared with 3.4% a year earlier, according to the exchange. Investors also are taking delivery of silver, with contracts ending in delivery rising to 7.3% from 4.7%. December is typically a big month for deliveries, and in

January, deliveries remained higher than the year before.

Investors typically buy gold on exchanges using futures contracts. Since each contract represents 100 ounces of gold, an investor would have to pay $96,910 per contract, based on Tuesday's close, in order to take delivery. By contrast, investors need to put down only $3,999 up front to trade such a futures contract.

"It is an expensive proposition," says Jeff Christian, managing director at CPM Group, a New York precious-metal research firm.

Also, the logistics of buying a big lump of metal might be daunting for smaller players. Investors who decide to take delivery of gold contracts face high storage and insurance costs. And if buyers actually want the gold or other precious metals in their possession, they must

arrange for delivery by armored truck. In a recent delivery of 100,000 ounces of silver, Mr. Coleman paid $3,000 to transport the metal from New York to Idaho.

All I can say, is I hope more people take the physical gold from Comex and they can at SOME POINT get BUSTED and the manipulation will finally END!!

I've been following jim sinclair for years. He's been very accurate in predicting the problems in the world economy. OTOH - his forecasts on the

price of gold have been pretty poor. In spring of 2006 and 2008 he predicted gold was going to the moon and both times it entered a 30% bear market.

www.marketwatch.com...

t=bigcharts&

With the breaking news of the recession deepening this morning and the dollar has weakened, I would think gold will keep going up.

Also Dow futures down 80 right now.

NEW YORK (MarketWatch) -- Gold futures rose Friday for the first session in five, climbing above $950 an ounce as losses in the previous four sessions attracted buyers. Gold for April delivery rose $12, or 1.3%, to $954.60 an ounce in early North American electronic trading. It had tumbled $60 from its last Friday's high above $1,000. "Gold was supported by bargain hunter demand," said James Moore, an analyst at TheBullionDesk.com

With the breaking news of the recession deepening this morning and the dollar has weakened, I would think gold will keep going up.

Also Dow futures down 80 right now.

i wonder when people will realize that gold with one day be used not to trade but in space flight, as lifters an wiring for propulsion..some day..

www.marketwatch.com...

charts&

Gold looks to be totally decoupled from the U.S dollar now!

It started being decoupled in Jan. now it is consitently staying decoupled.

The dollar has gained 9.5% against the euro this year, and the dollar index ($DXY:US Dollar Index Future - Spot Price

a broader gauge measuring the value of the greenback against other major currencies, has climbed 8%. Gold has made nearly the same gain, with front-month futures rising 10%.

In past periods -- most notably the second half of last year -- the dollar and gold often took off in opposite directions. Analysts often cite the strong performance of the dollar as a reason behind past drops in dollar-denominated gold prices. But the metal has withstood the dollar's rally this year, topping $1,000 an ounce on Feb. 20 for the first time in 11 months.

Gold looks to be totally decoupled from the U.S dollar now!

It started being decoupled in Jan. now it is consitently staying decoupled.

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 4 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 5 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 6 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 9 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 9 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 9 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 12 hours ago, 6 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 6 hours ago, 5 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 4 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 6 hours ago, 5 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 3 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 4 hours ago, 2 flags

active topics

-

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 684 • : daskakik -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 10 • : Caver78 -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 200 • : cherokeetroy -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 21 • : WhitewaterSquirrel -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 12 • : Boomer1947 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 78 • : chr0naut -

The Acronym Game .. Pt.3

General Chit Chat • 7750 • : bally001 -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 7 • : rickymouse -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong