It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

LINK to story

Quote:

Wonder what effect this will have on things....

[edit on 19-2-2009 by shrike071]

Quote:

The Labor Department said Thursday that wholesale prices increased by 0.8 percent last month, the biggest gain since last July and well above the 0.2 percent increase that economists had expected.

Wonder what effect this will have on things....

[edit on 19-2-2009 by shrike071]

Yes, but we by God have to fight even rumors of deflation right now! Ignore the facts, clearly they aren't news worthy because Ben Bernanke and the

other pirates on the Fed's ship have told us that inflation isn't an issue, but deflation is swimming the water like a school of sharks after a

blood trail.

At what point will the majority of Americans become so sick and tired of being blatently lied to that we start seeing rotten produce being thrown at these theives like Bernanke everytime they appear publically?

At what point will the majority of Americans become so sick and tired of being blatently lied to that we start seeing rotten produce being thrown at these theives like Bernanke everytime they appear publically?

Most of the increase is from a supply and demand issue, not an "inflation" issue. Our currency (USD) is strong right now, getting even stronger

today.

When the credit markets froze up tight, import shipping pretty much came to a halt. In fact in most ports there is still a lot of containers that have yet to be moved out to their final destinations.

When you don't have the supplies, but you have the demand, the price rises.

When the credit markets froze up tight, import shipping pretty much came to a halt. In fact in most ports there is still a lot of containers that have yet to be moved out to their final destinations.

When you don't have the supplies, but you have the demand, the price rises.

Originally posted by redhatty

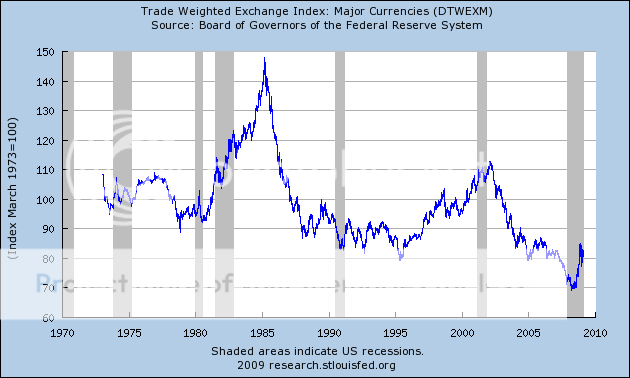

Most of the increase is from a supply and demand issue, not an "inflation" issue. Our currency (USD) is strong right now, getting even stronger today.

Supply and demand is an essential component of the 'inflation' dynamic.

Currency 'strength' is relative. The US dollar is only 'strong' in it's relationship to a basket of other rapidly weakening currencies.

The last time we experienced double digit inflation was during the 1974/75 recession - cpi peaked around 14% - the dollar @ 109+...much 'stronger' than today's 87+.

IOW, US dollar performance relative to other major currencies should not be considered a metric for gauging inflation.

*DTWEXM is equivalent to the NYBOT USDX.

When you don't have the supplies, but you have the demand, the price rises.

Exactly...it's called price inflation. With declining profits, limited access to new credit, and the inability to roll-over existing loans...supply destruction is the inevitable result of producer cut-backs...suppliers going out of business. Those that believe an inflation scenario is the ultimate end game, will point out that cutbacks in base metals & energy production, are soon to be joined by serious shortages from the drought stricken wheat producing nations.

GL

Edit add: Protectionist measures to curb exports in order to satisfy domestic demand, will only fuel the fire of global shortages.

[edit on 19-2-2009 by OBE1]

new topics

-

This is our Story

General Entertainment: 5 minutes ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 2 hours ago -

Ode to Artemis

General Chit Chat: 3 hours ago -

Ditching physical money

History: 6 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 7 hours ago -

VirginOfGrand says hello

Introductions: 7 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 8 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 16 hours ago, 20 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 11 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 13 hours ago, 9 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 2 hours ago, 8 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 14 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 8 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 7 hours ago, 4 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago, 4 flags -

God lived as a Devil Dog.

Short Stories: 12 hours ago, 3 flags -

Ditching physical money

History: 6 hours ago, 3 flags

2