It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by burdman30ott6

Lol...when i first read it I didn't notice it was 2009 until later. Nothing gets by ATSers

I should have linked and quoted to the actual site the graph originated from. I goofed..my bad.

Someone needs to let that guy last week who claimed to have discovered who John Titor really is that he may want to check out the David1979 guy before he makes any announcements.

Lol...when i first read it I didn't notice it was 2009 until later. Nothing gets by ATSers

I should have linked and quoted to the actual site the graph originated from. I goofed..my bad.

Nice the Op replies to off topis stuff but does not reply to anything that threatens his original premise. Typical ATS behavior.

Either say the last few posts are right or if you don't agree tell us why.

Either say the last few posts are right or if you don't agree tell us why.

I really don't know what is right. It's overly complicated. I don't think we can continue to print money like we are and not expect some type of

consequences that are going to be hurtful.

Is it possible if they see that inflation is getting out of hand that they could start destroying some of the cash that has been printed? Would that help stop the inflation?

Is it possible if they see that inflation is getting out of hand that they could start destroying some of the cash that has been printed? Would that help stop the inflation?

reply to post by redhatty

You seem to think that inflation and wages go hand in hand. That may have been true at one point but that is no longer the case.

Inflation takes place in the money supply. Everything else is a side effect of that increase. Now we can keep this under control with current rules by keeping interest rates at record lows. This is called "Manipulation".

But when that foreign investment starts to leave the FED will have NO CHOICE but to raise those interest rates.

If you want to look at CPI consider that price deflation as reported by the manipulated CPI only includes big ticket items like cars. Soft commodities are currently increasing in price(But are not factored in). Those are the things you and I buy. With the rules that the FED plays with, the way the government allows monopolies to corner markets(which stifle wages, and hurt competition), the FED can independently create inflation by printing money and omitting certain indicators that may give one a clue that something is up. You can get hyperinflation in this environment DESPITE stifled and stagnant wages. If we define inflation as a decrease in buying power.

Now in this environment the only saving grace would be foreign investment and cheap dollars. But we have massive outstanding debts in the tens of trillions. That foreign money will leave soon. When that happens the Fed will raise rates on the existing money supply. Then you get inflation. But as I said before even if it is just 70's style inflation our economy will crumble.

You seem to think that inflation and wages go hand in hand. That may have been true at one point but that is no longer the case.

Inflation takes place in the money supply. Everything else is a side effect of that increase. Now we can keep this under control with current rules by keeping interest rates at record lows. This is called "Manipulation".

But when that foreign investment starts to leave the FED will have NO CHOICE but to raise those interest rates.

If you want to look at CPI consider that price deflation as reported by the manipulated CPI only includes big ticket items like cars. Soft commodities are currently increasing in price(But are not factored in). Those are the things you and I buy. With the rules that the FED plays with, the way the government allows monopolies to corner markets(which stifle wages, and hurt competition), the FED can independently create inflation by printing money and omitting certain indicators that may give one a clue that something is up. You can get hyperinflation in this environment DESPITE stifled and stagnant wages. If we define inflation as a decrease in buying power.

Now in this environment the only saving grace would be foreign investment and cheap dollars. But we have massive outstanding debts in the tens of trillions. That foreign money will leave soon. When that happens the Fed will raise rates on the existing money supply. Then you get inflation. But as I said before even if it is just 70's style inflation our economy will crumble.

reply to post by projectvxn

In your opinion, how much inflation would it take to see a drastic effect on the economy and the dollar?

What is considered the divide between inflation and hyperinflation?

In your opinion, how much inflation would it take to see a drastic effect on the economy and the dollar?

What is considered the divide between inflation and hyperinflation?

reply to post by David9176

Well 1970's inflation was at a pervasive ten percent for almost the whole decade. And that was bad enough. Our only saving grace at that moment was to include China, Japan and the Middle East investments into our economy. That helped soften the blow. But we had trade surpluses then even if we had a budget deficit, but that was small in comparison to our deficits now..

When you wake up one day and there's breaking news on CNN that the dollar has lost ten percent in ONE DAY then you will see what is the beginning of hyperinflation.

[edit on 28-1-2009 by projectvxn]

Well 1970's inflation was at a pervasive ten percent for almost the whole decade. And that was bad enough. Our only saving grace at that moment was to include China, Japan and the Middle East investments into our economy. That helped soften the blow. But we had trade surpluses then even if we had a budget deficit, but that was small in comparison to our deficits now..

When you wake up one day and there's breaking news on CNN that the dollar has lost ten percent in ONE DAY then you will see what is the beginning of hyperinflation.

[edit on 28-1-2009 by projectvxn]

reply to post by projectvxn

Do you think it can be stopped, or is this all inevitable? The figures, when you look at them all, are mindblowing. I don't see how we can keep doing what we are doing and somehow come out of this without severly damaging the economy.

I'm far from being an economist, i'm just a regular guy trying to understand it all. Now if I see that something may be wrong, why aren't the world class economist seeing this?

Do they know something that everyone else doesn't?

I keep hearing that we'll pull out of this recession soon, and then I hear others say the opposite.

Who is right?

Do you think it can be stopped, or is this all inevitable? The figures, when you look at them all, are mindblowing. I don't see how we can keep doing what we are doing and somehow come out of this without severly damaging the economy.

I'm far from being an economist, i'm just a regular guy trying to understand it all. Now if I see that something may be wrong, why aren't the world class economist seeing this?

Do they know something that everyone else doesn't?

I keep hearing that we'll pull out of this recession soon, and then I hear others say the opposite.

Who is right?

reply to post by David9176

This is inevitable one way or the other. It is either hyper or just rampant. We avoided in in the early '90s because Japan opened up a huge bourse of investment in the United States. But we have been skating by on manipulated figures and lending that is nothing short of a ponzi scheme ever since. We are in for it now.

The way to FIX the economy is to become capitalists again.

I have written this down before but I think it's worth mentioning again:

[edit on 28-1-2009 by projectvxn]

This is inevitable one way or the other. It is either hyper or just rampant. We avoided in in the early '90s because Japan opened up a huge bourse of investment in the United States. But we have been skating by on manipulated figures and lending that is nothing short of a ponzi scheme ever since. We are in for it now.

The way to FIX the economy is to become capitalists again.

I have written this down before but I think it's worth mentioning again:

1. Tariff the hell out of imported goods and the good produced by American companies overseas. This will give the government the money they need to pay for reinvestment programs without taxing US taxpayers into oblivion. Do this to the point that it becomes cheaper to produce in the US. 2. Return to a sound monetary policy backed by hard valued assets instead of speculated value. 3. ENFORCE MONOPOLY laws. Our anti-trust laws are there for a reason. We cannot allow large conglomerates to corner markets to the point that they drive competition into the ground. 4. Allow failed enterprises to fail instead of giving them a handout that they will just steal from us and never pay back anyway. 5. Foster good employee protections and make sure that production keeps up with wages and vice versa. If we don't do this we will always have to deal with costs out-pacing wages and creating default crises like the one we are seeing now. 6. Eliminate free-trade agreements. Cheap foreign products does not translate into American prosperity, it only eliminates business here in the US that would otherwise be hiring workers to make their products. 7. After all of this get as much foreign investment as possible to finance further growth. The foreign investors will get consistent and REAL returns based on our consistent and REAL production, and every body wins. 8.Shrink government spending and get rid of agencies and departments that do nothing more than drain the people wealth and pass it on to the top of an already imbalanced pyramid. Other domestic policy: Eliminate the Fed and the IRS, review and reform FEMA, abolish DHS, and abolish the DEA. I would reform the CIA, and the FBI and make them play by the constitution. Period. I would increase funding for the important things, like education, R & D in medicine, consumer energy technology, and refrain from trying to legislate morality. I would retrain all US police forces with the permission of the states to teach them procedures that follow the constitution to the letter. I would abolish gun laws and guns bans that punish law abiding citizens. And no AWB would EVER be enacted or enforced by me, the justice department, or anyone else. At that level the ATF would be abolished. I would reform CPS. And I would reform our immigration policy ONLY with respect to illegals and not punish or make worse the situation of LEGAL aliens. On foreign policy. I would refrain from invading countries and propping up dictators. I would cease all aid to countries that violate international laws like Israel, Saudi Arabia, and China. I would scale back the nuclear arsenal to a manageable size that can be justified as a needed expense rather than a monumental waste. This would give me the trump card needed to ease the worries of countries like Iran, North Korea, and Russia. I would stop the antagonizing of all 3, and find a common ground by which we could build a peaceful world.

[edit on 28-1-2009 by projectvxn]

Originally posted by disgustedbyhumanity

How about the world stock markets being down 40% +? The majority of people's retirement and personal savings is in the stock markets.

The total amount of money in the system has totally dried up.

Portfolio value dropping by 40% represents an unrealized loss. No loss is realized until the shares are actually sold.

A winner for every loser

The stock market is a Zero Sum system . Every loss represents someone else' gain...and vice versa. The "money" isn't destroyed...or vaporized. It simply changes hands.

When money is not coming back into the market (buying), it is determined to be "sidelined"...usually hiding-out in MM funds, bank deposits, savings accounts, CD' etc.

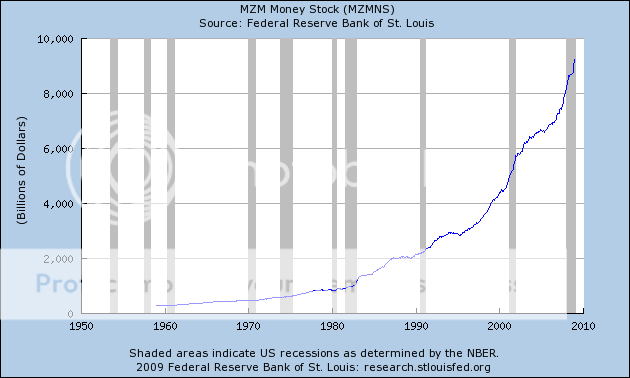

This pool of "sidelined cash" will show-up in the broadest measure of liquid money: MZM...the majority being held by households. Imo, probably households in the top 10%.

Yep...looks like there's some hoarding going on.

*Zero Sum: One could make the argument for Non Zero [negative] citing brokers commissions...but commissions represent a minuscule amount of any transaction, and besides the money still exists in the "system".

**Credit Isn't Money

reply to post by OBE1

Ok, I realize now what you are stating. Money that used to be in the market isn't actually gone, it's in hiding basically. This is why we are able to print so much money without inflation happening directly after.

How harsh is this going to be when this money comes back into play?

Originally posted by disgustedbyhumanity How about the world stock markets being down 40% +? The majority of people's retirement and personal savings is in the stock markets. The total amount of money in the system has totally dried up. Portfolio value dropping by 40% represents an unrealized loss. No loss is realized until the shares are actually sold.

Ok, I realize now what you are stating. Money that used to be in the market isn't actually gone, it's in hiding basically. This is why we are able to print so much money without inflation happening directly after.

How harsh is this going to be when this money comes back into play?

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 1 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 2 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 3 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 4 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 4 hours ago -

Weinstein's conviction overturned

Mainstream News: 5 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 7 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 7 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 7 hours ago, 9 flags -

Weinstein's conviction overturned

Mainstream News: 5 hours ago, 6 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 10 hours ago, 6 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 7 hours ago, 5 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 4 hours ago, 4 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 4 hours ago, 4 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 12 hours ago, 2 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 2 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago, 1 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 68 • : YourFaceAgain -

Weinstein's conviction overturned

Mainstream News • 20 • : Xtrozero -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 22 • : NoviceStoic4 -

Sunak spinning the sickness figures

Other Current Events • 22 • : angelchemuel -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest • 10 • : Cre8chaos79 -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 93 • : Xtrozero -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 194 • : Irishhaf -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 88 • : Xtrozero -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues • 20 • : Justsomeboreddude3 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 141 • : Consvoli