It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

2

share:

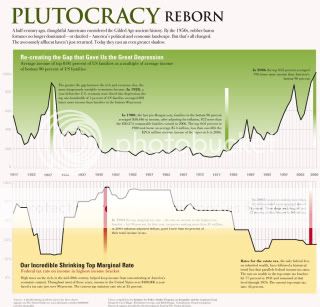

I came across this article which makes the case for a tax increase on the wealthy as promised by candidate Obama! So let's go back in history to FDR

and see what happened when he raised taxes during the Great Depression.

Democratic Underground

and this graph...

[edit on 26-11-2008 by Leo Strauss]

Democratic Underground

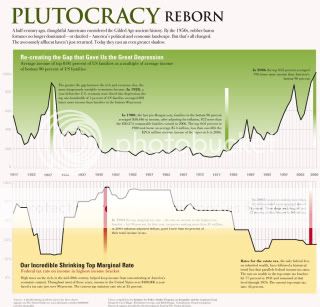

From listening to today’s right wing conservatives and the blathering talking heads of our corporate news media you’d expect catastrophic consequences to our economy from any attempt to increase taxes on the wealthy, even to the relatively moderate levels that existed just prior to the Bush II presidency. From these warnings you would think that the extremely high rates of taxation on the wealthy beginning with FDR’s presidency and lasting for half a century would have ruined our economy for many years to come...

...In any event, the high top marginal tax rates continued for several decades after FDR died, at 70% or more (far higher than what Obama is proposing increasing it to), until the Reagan Presidency starting in 1981. This chart shows median family income levels, beginning in 1947. With the top marginal tax rate approaching 90% at this time, median family income rose steadily (in 2005 dollars) from $22,499 in 1947 to more than double that, $47,173, in 1980. Then, for the next 25 years, except for some moderate growth during the Clinton years, there was almost no growth in median income at all, which rose only to $56,194 by 2005 (85% of that growth accounted for during the Clinton years).

and this graph...

[edit on 26-11-2008 by Leo Strauss]

reply to post by Leo Strauss

Too much policy and facts in this post. Not enough mudslinging and dirt. Won't get much a response from people.

I happen to agree, by the way. Good post!

Too much policy and facts in this post. Not enough mudslinging and dirt. Won't get much a response from people.

I happen to agree, by the way. Good post!

Don't you need to tax the wealthy before you can raise there taxes??

my house flooded last January in the major flooding in Indiana .No I do not live near any water.I filed a form to have my property tax adjusted as per flood .My property tax has been raised about $180 a year since then.Two years ago I got a tax break on my property.Then they reassessed it and raised it more than my tax was to begin. $180 doesn't sound like much but thats on top of $1600 per year on a house thats been flooded.

(edit to avoid one line post)

[edit on 26-11-2008 by deadcatsrule]

my house flooded last January in the major flooding in Indiana .No I do not live near any water.I filed a form to have my property tax adjusted as per flood .My property tax has been raised about $180 a year since then.Two years ago I got a tax break on my property.Then they reassessed it and raised it more than my tax was to begin. $180 doesn't sound like much but thats on top of $1600 per year on a house thats been flooded.

(edit to avoid one line post)

[edit on 26-11-2008 by deadcatsrule]

There is certainly historical precedent for it... and one of the reasons FDR was called a traitor to his class.

Indeed between 1932 and 1960 the taxes on the wealthy went up roughly 70% and were their highest under Eisenhower (R). The first significant tax cuts went into effect under Democrat JFK.

It was these taxes on the wealthy in those 32 years that helped us spend our way out of the great depression, fight WW2 and build the infrastructure (interstates and all) that are decaying today and in those jobs helped give rise to the middle class.

So yes. Its been done and it worked.

Indeed between 1932 and 1960 the taxes on the wealthy went up roughly 70% and were their highest under Eisenhower (R). The first significant tax cuts went into effect under Democrat JFK.

It was these taxes on the wealthy in those 32 years that helped us spend our way out of the great depression, fight WW2 and build the infrastructure (interstates and all) that are decaying today and in those jobs helped give rise to the middle class.

So yes. Its been done and it worked.

You have two options here. You can dramatically shrink government and end the 16th Amendment for all or you can jack up taxes on the rich. One way

or another we have to get our budget in check and lower taxes without smaller government aka Reaganomics does not work.

What does medium income have to do with the consequences of taxing the wealthy?

I expect nothing less from the Democrat(ic) Underground.

I don't need a source for anything I am about to say...It is all common sense.

Higher taxes on the wealthy leads to the wealthy taking money out of the economy. If you are going to get socked at an 70% tax rate on a certain amount of money...how hard are you going to work to go over that amount? How hard are you going to look for loopholes in the tax code to protect your hard earned money? If you are a successful businessman, how many people are you going to lay off to offset the tax increases? How much are you going to invest in the stock market if the capital gains tax is so high that it is not worth it to invest? The rich are not stupid...that is why they are rich. You hurt the rich...everyone is going to end up hurting.

Remember the luxury tax? The rich simply stopped buying luxury items, putting many hard working people out of work. It was repealed after no time. Great example of Reaganomics working right there.

I expect nothing less from the Democrat(ic) Underground.

I don't need a source for anything I am about to say...It is all common sense.

Higher taxes on the wealthy leads to the wealthy taking money out of the economy. If you are going to get socked at an 70% tax rate on a certain amount of money...how hard are you going to work to go over that amount? How hard are you going to look for loopholes in the tax code to protect your hard earned money? If you are a successful businessman, how many people are you going to lay off to offset the tax increases? How much are you going to invest in the stock market if the capital gains tax is so high that it is not worth it to invest? The rich are not stupid...that is why they are rich. You hurt the rich...everyone is going to end up hurting.

Remember the luxury tax? The rich simply stopped buying luxury items, putting many hard working people out of work. It was repealed after no time. Great example of Reaganomics working right there.

Originally posted by mybigunit

You have two options here. You can dramatically shrink government and end the 16th Amendment for all or you can jack up taxes on the rich. One way or another we have to get our budget in check and lower taxes without smaller government aka Reaganomics does not work.

Thanks to all who posted!

MBU I appreciate that coming from you! I understand and appreciate your libertarian philosophy. I have not seen it practiced successfully in modern times on a scale that the USA would require. If you know of an example please point it out. I want to say I love the ideal of a small to non existent federal gov which has nearly zero per cent role in my life. Including: no foreign wars, no troops stationed abroad, only enough defense spending to secure our borders, no goverment laws regarding personal preferences. I hear you.

But it is not going to happen...at least not yet ...maybe after a long period of socialism can we have enlightened anarchy.

In the meantime here we are! I am constantly amazed how so called conservative can support these RINO's. The progressives are much more concerned with individual liberties than these contemporary "conservatives".

Originally posted by RRconservative

Higher taxes on the wealthy leads to the wealthy taking money out of the economy.

Nonsense. Go back and reread my post... under Eisenhower the tax rate on the top brackets was approaching 80% and the 50's were a boom economy.

Why shouldn't those who benefit most pay the most?

Trickle down economy is a baldfaced lie.

[edit on 26-11-2008 by grover]

Originally posted by grover

Originally posted by RRconservative

Higher taxes on the wealthy leads to the wealthy taking money out of the economy.

Why shouldn't those who benefit most pay the most?

Trickle down economy is a baldfaced lie.

Let's go back to the luxury tax....how got hurt more from the luxury tax...the rich, who just didn't buy as many luxury items.....or the hard working people who got laid off, because luxury items wasn't selling?

Here is a very recent example of Reaganomics....

durangoherald.com...

DENVER - This ski season is shaping up to be the worst in years, said a Canadian ski-resort company that has announced it has laid off workers across a dozen resorts, including three in Colorado.

Colorado's Steamboat Ski & Resort, for example, is more than three hours by car from Denver. Because of that, most visitors fly in and stay several days, while smaller resorts closer to big cities have an easier time surviving a poor economy.

"They're not as dependent on out-of- state and international visitors," Dave Belin, director at Boulder-based research firm RRC Associates, told the Rocky Mountain News.

WOW! Rich people cut back on going to resorts, and WHO suffers? The rich? NO, how about the people that work there?

If that is not an example of trickle down economics....what is?

[edit on 26-11-2008 by RRconservative]

In a new world order where bankers hold up the citizens, I'm not sure ???

Originally posted by Leo Strauss

Thanks to all who posted!

MBU I appreciate that coming from you! I understand and appreciate your libertarian philosophy. I have not seen it practiced successfully in modern times on a scale that the USA would require. If you know of an example please point it out. I want to say I love the ideal of a small to non existent federal gov which has nearly zero per cent role in my life. Including: no foreign wars, no troops stationed abroad, only enough defense spending to secure our borders, no goverment laws regarding personal preferences. I hear you.

But it is not going to happen...at least not yet ...maybe after a long period of socialism can we have enlightened anarchy.

In the meantime here we are! I am constantly amazed how so called conservative can support these RINO's. The progressives are much more concerned with individual liberties than these contemporary "conservatives".

Sure just because you get rid of the individual income tax doesnt mean the government has not income. There is the corporate tax. excise taxes, and certain tariffs. The government will have income. I happen to believe the federal government really has one duty and that is the defense of this country and upholding contracts and maintaining freedom. Any of the education, infrastructure, and other government programs should be done through the states. I would do it by a consumption tax of some sort. This promotes saving. This will never happen because of our monetary system. Because its based on debt saving is not a good thing for the system. We need to kick the fiat fractional reserve system and go to a production based currency instead of a debt based like we have now.

When in modern times has it worked? Well it worked for America pretty well till 1913 when the 16th Amendment was passed along with the federal reserve act and FBI. Coincidence?

reply to post by mybigunit

HAHAHA really huh?

So your saying if you get rid of the massive Federal Bureaucracy that we will somehow magically save money.. That by allocating expenses and projects to localities based on the average income of the region is more responsible? .. That getting rid of hundreds of Alphabet organizations we are going to be better off???

I just won't believe it!!

PS. Someone point out one thing in life that is not taxed by the Federal Government. Waiting. Waiting. Whats that? Standing still? LOITERING FINE!!!

Government has money. It makes it up anyways.

HAHAHA really huh?

So your saying if you get rid of the massive Federal Bureaucracy that we will somehow magically save money.. That by allocating expenses and projects to localities based on the average income of the region is more responsible? .. That getting rid of hundreds of Alphabet organizations we are going to be better off???

I just won't believe it!!

PS. Someone point out one thing in life that is not taxed by the Federal Government. Waiting. Waiting. Whats that? Standing still? LOITERING FINE!!!

Government has money. It makes it up anyways.

The tax system is designed for the 'wealth creators,' which presumes that a CEO is a wealth creator, but by definition (s)he is a political creature

and wealth creation is second on his agenda. There are real wealth creators, but they take bonuses. Maybe the basic wage is a better measure of the

gravy sage.... Most 'wealth creators' are in the gravy train, and are part of boris aristo drink the blood of the poor, dream of knights and

cruelty. C#nt.

Originally posted by Rockpuck

reply to post by mybigunit

HAHAHA really huh?

So your saying if you get rid of the massive Federal Bureaucracy that we will somehow magically save money.. That by allocating expenses and projects to localities based on the average income of the region is more responsible? .. That getting rid of hundreds of Alphabet organizations we are going to be better off???

I just won't believe it!!

PS. Someone point out one thing in life that is not taxed by the Federal Government. Waiting. Waiting. Whats that? Standing still? LOITERING FINE!!!

Government has money. It makes it up anyways.

Yea Im saying if you shrink government that would save us money. Kind of weird to think of that huh? Small government = less taxes. I do feel it should be state based. Example why should someone in Montana pay big taxes to FEMA to pay to bail out people in Florida? Not really fair. I feel if there is to be taxes it should be a consumption. Why tax people on their hard work? If there has to be a tax that is how it should be. Agreed you get taxed on everything. Even taxed to pee and taxed to even die. Sad huh?

reply to post by RRconservative

Very poor logic RR not that I expected more.... and just how does that relate to a luxury tax? It doesn't. Its about a poor economy. Besides that a luxury tax is levied on high end puchases like yacht's... airplanes... high end motor cars like Rolls Royce's etc. Not on a ski trip.

[edit on 26-11-2008 by grover]

Very poor logic RR not that I expected more.... and just how does that relate to a luxury tax? It doesn't. Its about a poor economy. Besides that a luxury tax is levied on high end puchases like yacht's... airplanes... high end motor cars like Rolls Royce's etc. Not on a ski trip.

[edit on 26-11-2008 by grover]

Oh I quite agree!!!

But honestly though, the people of California won't like it when the 49 other states stop paying their bills......

Regional and personal responsibility is so 1776.

But honestly though, the people of California won't like it when the 49 other states stop paying their bills......

Regional and personal responsibility is so 1776.

Originally posted by Rockpuck

Oh I quite agree!!!

But honestly though, the people of California won't like it when the 49 other states stop paying their bills......

Regional and personal responsibility is so 1776.

LOL yup I guess Im old school like that. Now Ill put on a white wig and "carry on" with the rest of them

reply to post by RRconservative

The examples you gave simply show that when business is down, workers are laid off. That's not Reaganomics, that's just business. Business is not generated by the rich only, but by people of all income groups. Look at the profits of Wal-Mart, which don't depend on the purchases of the rich but rather from the trade of the average buyer. Makers of high-end products may suffer a little from higher taxes on the rich, but it's unlikely the rich will stop buying them altogether. If the middle class stops buying products, you have a depression.

Reaganomics is the philosophy that if the rich get richer their wealth will "trickle down" to the little guy. It's also about deregulating everything. There's also a philosophy of smaller government, though that has never happened.

It's Reaganomics, from Ronald Reagan through the current administration, that has got us into this current economic mess.

I'm willing to go back to the solution of Roosevelt, Truman and Eisenhower. Let the rich pay their fair share of the taxes and instead promote the welfare of the middle class.

[edit on 26-11-2008 by Sestias]

The examples you gave simply show that when business is down, workers are laid off. That's not Reaganomics, that's just business. Business is not generated by the rich only, but by people of all income groups. Look at the profits of Wal-Mart, which don't depend on the purchases of the rich but rather from the trade of the average buyer. Makers of high-end products may suffer a little from higher taxes on the rich, but it's unlikely the rich will stop buying them altogether. If the middle class stops buying products, you have a depression.

Reaganomics is the philosophy that if the rich get richer their wealth will "trickle down" to the little guy. It's also about deregulating everything. There's also a philosophy of smaller government, though that has never happened.

It's Reaganomics, from Ronald Reagan through the current administration, that has got us into this current economic mess.

I'm willing to go back to the solution of Roosevelt, Truman and Eisenhower. Let the rich pay their fair share of the taxes and instead promote the welfare of the middle class.

[edit on 26-11-2008 by Sestias]

reply to post by Sestias

why are the republicans so against taxing the rich? in the meantime, my friends daughter who is mentally handicapped had their monthly check from the state cut by $14 a month. Money taken from people who can afford it the least, and can't stand up for themselves.

just corrected spelling error

why are the republicans so against taxing the rich? in the meantime, my friends daughter who is mentally handicapped had their monthly check from the state cut by $14 a month. Money taken from people who can afford it the least, and can't stand up for themselves.

edit on 2-7-2011 by

research100 because: (no reason given)

just corrected spelling error

edit on 2-7-2011 by research100 because: (no reason given)

new topics

-

Electrical tricks for saving money

Education and Media: 2 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 3 hours ago -

Sunak spinning the sickness figures

Other Current Events: 4 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 4 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 6 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 7 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 9 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 11 hours ago

top topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 7 hours ago, 8 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 14 hours ago, 8 flags -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 3 hours ago, 8 flags -

Former Labour minister Frank Field dies aged 81

People: 16 hours ago, 4 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 11 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 4 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 4 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 14 hours ago, 3 flags -

Electrical tricks for saving money

Education and Media: 2 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 6 hours ago, 2 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 129 • : ImagoDei -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 18 • : Xtrozero -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 29 • : WeMustCare -

VirginOfGrand says hello

Introductions • 6 • : TheMichiganSwampBuck -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 31 • : rickymouse -

Electrical tricks for saving money

Education and Media • 1 • : BeyondKnowledge3 -

Why to avoid TikTok

Education and Media • 18 • : burritocat -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 654 • : 777Vader -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 138 • : Xtrozero -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 44 • : BrotherKinsMan

2