It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by DaytonaBeach

I am watching very closely to see what the outcome of the latest US generosity is going to do to the overall world economies, I guess the super powers are starting run dry on the available economies to exploit and they need new blood.

I am watching very closely to see what the outcome of the latest US generosity is going to do to the overall world economies, I guess the super powers are starting run dry on the available economies to exploit and they need new blood.

could not find a really precise thread for this FYI

hey listen ti these 3 different guys""

for a 25:00 minute video on the FU way we are going..

heres' the segmented web address... put it together in an unbroken line

http://

beforeitsnews.com/economics-and-politics/2014/01/this-is-how-it-begins-x22report-the-people-are-no-longer-believing-their-government-2460320.html

(wow--- even ATS is trying to not let you access the video~~~by not generating a hot-link clickable address)

Max Keiser is one dude... but the other 2 dudes are even more apocalyptic than Max is....... enjoy and learn my friends

hey listen ti these 3 different guys""

for a 25:00 minute video on the FU way we are going..

heres' the segmented web address... put it together in an unbroken line

http://

beforeitsnews.com/economics-and-politics/2014/01/this-is-how-it-begins-x22report-the-people-are-no-longer-believing-their-government-2460320.html

(wow--- even ATS is trying to not let you access the video~~~by not generating a hot-link clickable address)

Max Keiser is one dude... but the other 2 dudes are even more apocalyptic than Max is....... enjoy and learn my friends

edit on

th31138888535104292014 by St Udio because: (no reason given)

edit on th31138888550504312014 by St Udio because: (no reason

given)

edit on th31138888562404332014 by St Udio because: (no reason given)

CosmicCitizen

US Dollar Index Forecast: I have been a dollar bull since the Spring of 2011....The dollar has made a fair recovery and is strong again after a correction down in late 2012. My original call was for a retest of the 89 area (a Fibonacci #, btw) and then (after another pull back to consolidate) a run to the 92.00~ area (+/- .50). Trade well.

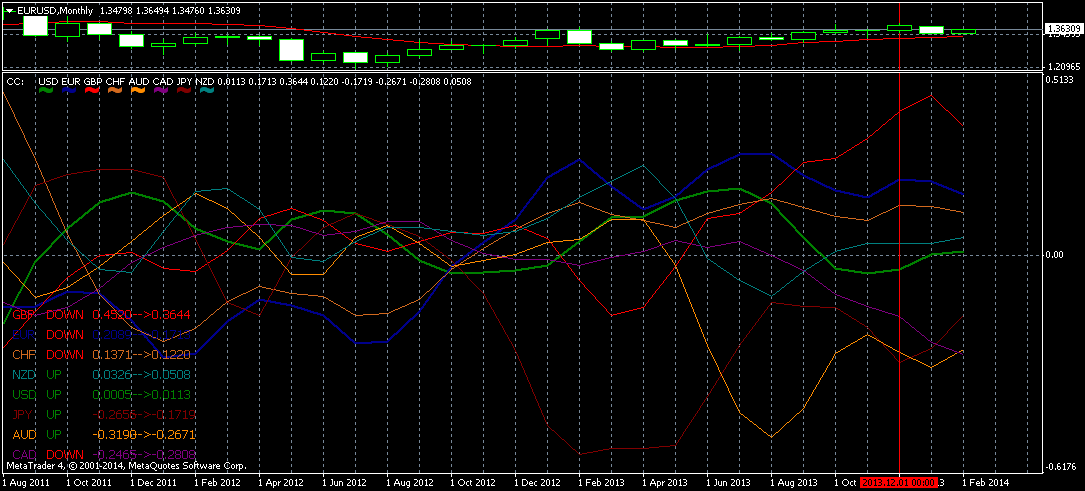

Yes, USD seems still far from collapse, probably due to Fed tightening the bond policy. My indicator support this.

However, I see trouble with GBP and Eurozone in general. Since I have uploaded it, gonna reuse it here, a monthly chart to see currency strength, Green is USD.

I'm expecting another 6 month or more before we see any trouble to USD. AUD and CAD seems already "prepared" at bottom (reflecting Gold and Oil), this go hand in hand with gold rumors about hitting the support area.I dont have oil chart.

View the chart in new window for bigger version.

edit on 13-3-2014 by NullVoid because: (no reason given)

reply to post by NullVoid

We will not see much changes on the USD, as long as the QEs are on schedule, remember back in June when the fed announced that they were to tapper off the QEs and the response of the Markets was a substantial drop that scared the Fed.

So as long as the QEs are delivered monthly things are going still look peachy, the sad thing is that without them the markets will not last for long.

80 Billion dollars a month is a lot of money at the end of the year.

We will not see much changes on the USD, as long as the QEs are on schedule, remember back in June when the fed announced that they were to tapper off the QEs and the response of the Markets was a substantial drop that scared the Fed.

So as long as the QEs are delivered monthly things are going still look peachy, the sad thing is that without them the markets will not last for long.

80 Billion dollars a month is a lot of money at the end of the year.

Has the global economy collapsed yet???

Jeese its taking so long.......

Hurry up already been waiting for this since 2007...seriously 7 years already im sure they could have done something by now.

Jeese its taking so long.......

Hurry up already been waiting for this since 2007...seriously 7 years already im sure they could have done something by now.

It ain't crashed as yet because the elites are still amassing resources & wealth

also the real threat of a massive conflict looms because of Ukraine &/or Syria, Involving Russia vs NATO

besides the war threat, economic statistics manipulations...there is the moving trends of what assets to pillage next...

that sector might well be prescious metals as this link suggest that the 'golden cross' will be forthcoming in Gold Bullion prices particularly after Monday when the USA-Russia sanction threat deadline comes

kingworldnews.com...

RE: my last 'signature' quote (currently out of the rotation)=

also the real threat of a massive conflict looms because of Ukraine &/or Syria, Involving Russia vs NATO

besides the war threat, economic statistics manipulations...there is the moving trends of what assets to pillage next...

that sector might well be prescious metals as this link suggest that the 'golden cross' will be forthcoming in Gold Bullion prices particularly after Monday when the USA-Russia sanction threat deadline comes

kingworldnews.com...

RE: my last 'signature' quote (currently out of the rotation)=

...2013 will be known as they year that America died. 2014 will be the year where the vultures begin to pick our carcass clean, get ready for the austerity and bail ins.(the economist known as 'V')

TiM3LoRd

Has the global economy collapsed yet???

Jeese its taking so long.......

Hurry up already been waiting for this since 2007...seriously 7 years already im sure they could have done something by now.

Patience my friend, patience.

Gold is low and will go lower a bit more, Eurozone have another doom pending, tensions are high, trade balance are low, debt are high, all seems set. We wait how Ukraine develops. (read as "Bail out from EUR, ready to drop USD, amass gold and bull prepare for wealth maker and long term security hedgers/traders").

But remember guys - "Bulls make money, bears make money, pigs get slaughtered", dont be too greedy.

When war occurs, we will see gold and oil news slip between the war news, and how EUR and USD collapsing and how it will bring the entire world to economy collapse. By that time, you dont have time to reply to this thread anymore and by that time, when you bought gold if you could, you are already inside the bull run.

Chance and fortune favors the prepared mind.

I knew its time to buy, but I dont have money to waste, dang crab nabbit!

Something has to give. When I was going to school, I was taught that there are three fundamentals when it come to business.

The ECB has lowered their cash rate to .15%

It now costs investors money to park there cash in the ECB.

The only weapon which the ECB has left in it's arsenal is a form

of QE to fight this currency war. with japans loosening of monetry policy

and the US QE infinity the last cog to turn in this is china, who can't

because they will see higher inflation, and the bottom fall out of

the hyperinflated housing market.

It now costs investors money to park there cash in the ECB.

The only weapon which the ECB has left in it's arsenal is a form

of QE to fight this currency war. with japans loosening of monetry policy

and the US QE infinity the last cog to turn in this is china, who can't

because they will see higher inflation, and the bottom fall out of

the hyperinflated housing market.

As we now move in to the typically volatile period of the year for stocks there are a few hints in the USA and UK markets that perhaps we should be

looking down once more after such a period of sustained highs. As someone who has traded in the past I know how easy it is to get sucked in and lose a

lot of money, I stopped though when it appears 'professional' traders don't seem to know how to. News that professional traders have gotten themselves

into more debt than ever is a little bit worrying.

Spectre of 1929 crash looms over the FTSE

Spectre of 1929 crash looms over the FTSE

Nothing has been learnt from the madness of the 1929 stock market crash as once again traders reach for record amounts of debt to pile into rising share prices.

The level of margin debt that traders are using to buy shares in the stock market reached the highest levels on record, according the latest data from the New York stock exchange.

US traders borrowed $460bn from banks and financial institutions to back shares, and once cash and credit balances held in margin accounts of $278bn is subtracted this left net margin debt of $182bn in July

Traders are now more exposed to a fall in share prices than at the height of the dot-com bubble at the turn of the century, and just before the financial crisis during the 2007 peak.

edit on 1-9-2014 by twfau because: (no reason given)

Reported by the ABC in Australia Reserve Bank Assistant Governor Guy Debelle is warning that markets are headed for a violent selloff and also that

when interest rates rise a lot of low to no cost financed positions will go belly up.

Hate to say this but Ebola is spearheading the revolution

Time to trade stocks in toilet paper.

Time to trade stocks in toilet paper.

edit on 14-10-2014 by all2human because: (no reason given)

originally posted by: khnum

Reported by the ABC in Australia Reserve Bank Assistant Governor Guy Debelle is warning that markets are headed for a violent selloff and also that when interest rates rise a lot of low to no cost financed positions will go belly up.

Well it didn't take long for this prediction to come true what a fun day on Wall Street congatulations to the Plunge Protection team and the Federal Reserve for their multi billion 300 point stick save today,where were the margin calls?,the S and P companies cant buy their own shares at the moment as they are in reporting season and who in their right mind would buy with todays wild treasury markets,ebola scares etc,maybe Warren Buffet who knows but that comeback was remarkable,indeed the Wizard of Oz never ceases to amaze.

a reply to: khnum

He is not the only one to think so :

Opinion: Brace yourselves for another financial crash

He is not the only one to think so :

Opinion: Brace yourselves for another financial crash

a reply to: theultimatebelgianjoke

There was an analyst on CNBC today that thinks the correction could be as high as 60 per cent,I don't think it will be that much after all they've spent according to a recent university study $27 trillion to prop everything up since 2008,whats another few trillion.

There was an analyst on CNBC today that thinks the correction could be as high as 60 per cent,I don't think it will be that much after all they've spent according to a recent university study $27 trillion to prop everything up since 2008,whats another few trillion.

a reply to: khnum

Add to the list that, among the bloomberg consoles newsfeeds, the info about the likely end of fossil-fuel era has surfaced.

One Mega Watt E-Cat Cold Fusion Device Test Successful

Lockheed says makes breakthrough on Fusion Energy project

Add to the list that, among the bloomberg consoles newsfeeds, the info about the likely end of fossil-fuel era has surfaced.

One Mega Watt E-Cat Cold Fusion Device Test Successful

Lockheed says makes breakthrough on Fusion Energy project

edit on 15-10-2014 by theultimatebelgianjoke because: Spelling

edit on 15-10-2014 by theultimatebelgianjoke because: (no

reason given)

a reply to: theultimatebelgianjoke

My genius government wants to lease the powerlines and infrastructure for 99 years to reduce its debt,I wonder what idiot will invest in technology that only has a 20 year lifespan for 99 years.

My genius government wants to lease the powerlines and infrastructure for 99 years to reduce its debt,I wonder what idiot will invest in technology that only has a 20 year lifespan for 99 years.

new topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 1 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 2 hours ago -

God lived as a Devil Dog.

Short Stories: 2 hours ago -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 3 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 4 hours ago -

Hate makes for strange bedfellows

US Political Madness: 6 hours ago -

Who guards the guards

US Political Madness: 9 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 6 hours ago, 14 flags -

Who guards the guards

US Political Madness: 9 hours ago, 13 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 16 hours ago, 11 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 3 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 4 hours ago, 5 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 1 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 11 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 2 hours ago, 2 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 2 hours ago, 2 flags

active topics

-

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 6 • : Consvoli -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest • 35 • : BedevereTheWise -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 119 • : FlyersFan -

Europe declares war on Russia?

World War Three • 65 • : Freeborn -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 731 • : Threadbarer -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 248 • : FlyersFan -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 626 • : cherokeetroy -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 19 • : FloridaManMatty -

Iranian Regime Escalates Hiijab Mandate Through Sexual Violence and Beatings of Women

Mainstream News • 166 • : purplemer -

They Killed Dr. Who for Good

Rant • 67 • : grey580