It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

0

share:

Dont let the title be misleading. Im still for drilling - only now, im just "sort of" for drilling for domestic oil

However

this article has me thinking otherwise.

Im still doing my research on this new information - but i figured i'd post it here and see if i could get some input from others in the process.

disclaimer: dont turn this into a "obama" debate

The thread is:

Will drilling for domestic oil lower the cost of gasoline?

Also- before you shoot from the hip with an answer, go read the article

thanks

However

this article has me thinking otherwise.

Im still doing my research on this new information - but i figured i'd post it here and see if i could get some input from others in the process.

disclaimer: dont turn this into a "obama" debate

The thread is:

Will drilling for domestic oil lower the cost of gasoline?

Also- before you shoot from the hip with an answer, go read the article

thanks

It might...eventually.

There are somethings that need to be considered. First off is timeframe. I have been listening to some pretty conservative guys on the radio lately, and they seem to have absolutely no clue. They are all for drilling NOW, and think it will bring down gas prices tomorrow. Here is a quick list of considerations:

1. Refining. This is critical. Once you get the oil out you need to refine it into gas. New ones would have to be built. This takes time, alot of time. I have worked oilfield and have seen how long it takes to build these, you are looking at probably at least 7 years from the start of planning to having refined gas.

People might say "well what about the refineries we have?" They are pretty much at max capacity. It really doesn't make sense to have a huge monster gas factory running 24/7 and only run it at 60-80% capacity, that is wasting money, alot of it. This is probably why the oil companies are sitting on alot of their leases, no place to put the oil after getting it out of the ground.

2. Upgrading. When you pull the oil out of the ground it is not ready to go into the refinery. Depending on the field it could have quite a bit of sediment and water in it, that needs to get taken out. The mid-line facilities to remove this take about 2 years to build from planning to shipping. That is fine it fits in the timeframe to build the refineries.

3. Labour. Where are you going to get all of the people to do the drilling and the building and running of this stuff? Sure there are quite a few people out of jobs that could use the work, but there is the training required. That is fine though again it fits into the timeframe for the refinery.

Now you could go ahead and drill the oil and have someone else refine it for you...but that leaves you in the exact same situation you are in right now. The companies drill the oil, sell it to another company to refine it, then buy it back at a higher price. Might work until the refineries are done, but doesn't solve anything in the mean time. I think for the drill now to work they would have had to have started on it quite a while ago.

There are somethings that need to be considered. First off is timeframe. I have been listening to some pretty conservative guys on the radio lately, and they seem to have absolutely no clue. They are all for drilling NOW, and think it will bring down gas prices tomorrow. Here is a quick list of considerations:

1. Refining. This is critical. Once you get the oil out you need to refine it into gas. New ones would have to be built. This takes time, alot of time. I have worked oilfield and have seen how long it takes to build these, you are looking at probably at least 7 years from the start of planning to having refined gas.

People might say "well what about the refineries we have?" They are pretty much at max capacity. It really doesn't make sense to have a huge monster gas factory running 24/7 and only run it at 60-80% capacity, that is wasting money, alot of it. This is probably why the oil companies are sitting on alot of their leases, no place to put the oil after getting it out of the ground.

2. Upgrading. When you pull the oil out of the ground it is not ready to go into the refinery. Depending on the field it could have quite a bit of sediment and water in it, that needs to get taken out. The mid-line facilities to remove this take about 2 years to build from planning to shipping. That is fine it fits in the timeframe to build the refineries.

3. Labour. Where are you going to get all of the people to do the drilling and the building and running of this stuff? Sure there are quite a few people out of jobs that could use the work, but there is the training required. That is fine though again it fits into the timeframe for the refinery.

Now you could go ahead and drill the oil and have someone else refine it for you...but that leaves you in the exact same situation you are in right now. The companies drill the oil, sell it to another company to refine it, then buy it back at a higher price. Might work until the refineries are done, but doesn't solve anything in the mean time. I think for the drill now to work they would have had to have started on it quite a while ago.

Very Good points, i must say

The one thing i'd like to add to that is:

The oil comanies would have to invest MORE money into building, researching, and training all of what you just described above

do we really expect them to take the "cut" in profits to invest/build/research all these new oil fields if the moratorium is lifted?

Please.

They'll pass along the cost right back to us. Only instead of 4 dollar gasoline being blamed on the Saudis, we'll finally be able to blame those whom are really responsible.

I think this is a case cracked wide open.

How can this actually lower the cost of Gas?

They claim they already invest billions into new solutions - but the same gas i put in my tank 10 years ago, is the same gas i put in my tank this morning

the

The one thing i'd like to add to that is:

The oil comanies would have to invest MORE money into building, researching, and training all of what you just described above

do we really expect them to take the "cut" in profits to invest/build/research all these new oil fields if the moratorium is lifted?

Please.

They'll pass along the cost right back to us. Only instead of 4 dollar gasoline being blamed on the Saudis, we'll finally be able to blame those whom are really responsible.

I think this is a case cracked wide open.

How can this actually lower the cost of Gas?

They claim they already invest billions into new solutions - but the same gas i put in my tank 10 years ago, is the same gas i put in my tank this morning

the

ONLY

difference is the price. god *snip* double posting laggy "post reply" button

[edit on 7/4/2008 by Andrew E. Wiggin]

[edit on 7/4/2008 by Andrew E. Wiggin]

The thing about oil companies is that they are more than willing to spend that money if they know they will be increasing their bottom line long term.

A refinery might cost them $500 million, but they know it will more than pay for itself in the long run.

The company I worked already had an upgrading system and they added a second one to boost thier output from 150,000 barrels a day to 250,000 a day. It took them over 7 years before it was operational, cost a metric assload to build (over a billion $), and yet they are making money hand over fist, especially now. They sell synthetic crude (made from tarsands) at just less than market value, about 94% of value. With $140 a barrel they are making just about $35mil a DAY. That more than makes up for the cost of the building and personnel to run it.

The company I worked already had an upgrading system and they added a second one to boost thier output from 150,000 barrels a day to 250,000 a day. It took them over 7 years before it was operational, cost a metric assload to build (over a billion $), and yet they are making money hand over fist, especially now. They sell synthetic crude (made from tarsands) at just less than market value, about 94% of value. With $140 a barrel they are making just about $35mil a DAY. That more than makes up for the cost of the building and personnel to run it.

Here is another thing to ponder (i feel like its just us two talking, rook)

Here is a picture of a modern gas pump. All fancy, bells and whistles, etc.

here is a gas pump stripped down, to the bare essentials

--------------------------------------------------------------------------------

Now i could not find the prices for these pumps, so we'll just have to pretend.

What i COULD find is this

How is the cost of a gallon o' gasoline broken down?

Source

So lets set a few "definitives"

1 barrel of crude oil nets 19.6 gallons of motor grade gasoline. Source

Here is a picture of a modern gas pump. All fancy, bells and whistles, etc.

here is a gas pump stripped down, to the bare essentials

--------------------------------------------------------------------------------

Now i could not find the prices for these pumps, so we'll just have to pretend.

What i COULD find is this

How is the cost of a gallon o' gasoline broken down?

73% - Crude oil

11% - Federal and state taxes

10% - Refining costs and profits

6% - Distribution and marketing

Source

So lets set a few "definitives"

1 barrel of crude oil nets 19.6 gallons of motor grade gasoline. Source

IF the US were to develop a strict energy policy to really develop non-fossil-fuel alternatives where possible and drastically improve

efficiency of use where not, then maybe this would make sense.

Let's say the information in the article is right, and there is a ton of oil sitting around... 45 billion barrels, OK.

So we start drilling for and using it. Great. Cost of fuel comes down a bit. Wonderful. So we don't change anything, just keep going along, with too many people thinking they have some God-given right to drive alone in a vehicle that gets 6mpg...

OK? All is well, now.

Ooops, what about when that oil is gone? What then? The US would be in the same boat it is now, only worse, because now, assuming the article is correct, we have an untapped reserve upon which we can draw while we do the research necessary to move to something else.

But unless we do that, we will at some point in the not too distant future be right back where we are now.

So will it help? Not without a drastic change in mindset.

Let's say the information in the article is right, and there is a ton of oil sitting around... 45 billion barrels, OK.

So we start drilling for and using it. Great. Cost of fuel comes down a bit. Wonderful. So we don't change anything, just keep going along, with too many people thinking they have some God-given right to drive alone in a vehicle that gets 6mpg...

OK? All is well, now.

Ooops, what about when that oil is gone? What then? The US would be in the same boat it is now, only worse, because now, assuming the article is correct, we have an untapped reserve upon which we can draw while we do the research necessary to move to something else.

But unless we do that, we will at some point in the not too distant future be right back where we are now.

So will it help? Not without a drastic change in mindset.

Thats awesome. I had a saved draft to come up, add a few finishing touches to ,and post it

and it wont let me do anything with it

un-*snip*ing believable

i guess ill go re-do it.

anyone got any ideas wtf is going on with the 'draft' issue

and it wont let me do anything with it

un-*snip*ing believable

i guess ill go re-do it.

anyone got any ideas wtf is going on with the 'draft' issue

The real answer is not oil its zero point energy,But there is no money in free energy.So our best intrest are not in mind when it comes to any

oil,natrual gas ect.Its all a shame to bleed as much money from avrage people as possible,Oil company supress anything thats free.

There was a very good interview with PeakOil.org's Matt Savinar on July 3rds Coast to Coast show.

The short answer is we can drill all we want, but we are still forked. Too little, too late (world oil peaked in 2006). While there may still be a lot of oil left on the planet, typically, the easiest crude to get is extracted first and the last oil is the hardest (by cost and by energy expenditure) to retrieve.

We had a chance in 1973 to turn things around, but let is slip away. We had another chance 20 years ago, but let it slip away...

The show also included economics topics with Gerald Celenta and Catherine A. Fitts. Overall, a good show.

The short answer is we can drill all we want, but we are still forked. Too little, too late (world oil peaked in 2006). While there may still be a lot of oil left on the planet, typically, the easiest crude to get is extracted first and the last oil is the hardest (by cost and by energy expenditure) to retrieve.

We had a chance in 1973 to turn things around, but let is slip away. We had another chance 20 years ago, but let it slip away...

The show also included economics topics with Gerald Celenta and Catherine A. Fitts. Overall, a good show.

For me, the question lies in the numbers. ill do my best to be thorough, so let me know if i missed anything

May of 2008 - average barrel of oil: $117.40

( Source )

Lets break each barrel down

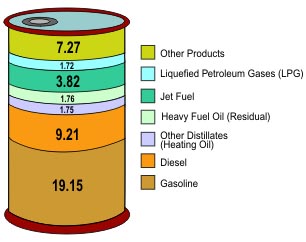

Which is better represented by:

We can see how many gallons of each "fuel" is contained within each barrel (rough estimates, again, vary by refining gains/losses)

Since "other" encompasses a wide variety of things (crayons, wax, plastic bags, etc)

We'll concentrate only on fuel

Lets use some recent data and a picture or two:

Source

gasoline and diesel - the two heavy hitters per each barrel of crude oil

GASOLINE

taxes = 37 cents per gallon

Distribution = 19 cents per gallon

Refining = 37 cents per gallon

Crude = $2.83 per gallon

__________________________

$3.76 cost (usually lose 1c per gallon in each major oil company)

DIESEL

taxes= 43 cents a gallon

distribution = 22 cents per gallon

refining = 93 cents per gallon

crude = 2.84 per gallon

____________________________

$4.42 per gallon

So - lets recap so far.

Already - we are up to

4.42 per gallon of diesel - and you can get 9.21 gallons per barrel. So $40.71 per barrel for diesel

+ 3.76 per gallon of gasoline - and you can get 19.15 gallons of gasoline per barrel - So $72.00 for gasoline per barrel

72+40.71 = $112.71 (getting very close to that cost of a barrel)

and we have expended roughly 70% of the barrel on diesel and gasoline.

30 % to go for each barrel, and we are 96% of the way there for the cost of the barrel

JET FUEL

Average = $4.09 per gallon ( Source )

3.82 gallons of jet fuel per barrel = $15.62 per barrel

LPG fuels cost (roughly) half that of gasoline. ( Source )

So if gasoline is 3.76 a gallon, we'll call LPG fuels 1.88 per gallon

for a total of

1.72 x 1.88 = $3.23 per barrel of oil

HEATING OIL

even at a "low cost" for heating homes, as most oil companies put it, it still costs ~ $3.00 a gallon for heating oil ( Source )

so 1.75 x 3.00 = $5.25 per barrel of oil from heating oil

Heavy fuel oil

A little trickier to figure, but there is actually a scary technique involved (you divide the USD per metric ton of the fuel oil, by 6.66 , and you get price per barrel for Heavy fuel oil)

which in this case is rounded off to $50 for arguments sake

(its actually higher, but these figures only go as far as 2006)

Source

So - a final recap:

Gasonline - $72 per barrel

Diesel - $40.71 per barrel

Jet Fuel - $15.62 per barrel

LPG - $3.23 per barrel

Heating Oil - $5.25 per barrel

Heavy Fuel Oil - $60 per barrel

So - if i am doing this right ( ) that comes to $196.81 per barrel, and we still have 7.27 gallons of "other product" (or roughly 10% of the barrel of crude oil) to go.

Other product encompasses many things (like garbage bags, wax, crayons, etc) so ill do the oil companies a favor and just exclude this all together, cause i dont feel like finding out what "other" encompasses entirely.

196.81 dollars per barrel is a 67.7% markup of 117.40

and we havent even used the entire barrel yet.

So - after we expend the cost of each product from every barrel, we are left with $79.41 per barrel.

The united states (in 2007) consumed 7.5 billion barrels of oil.

$595,575,000,000 (billions....with a B) is what you get when you take the "overage" (79.41) times 7.5 billion barrels.

Now, of course, not all of that is profit. You have to pay your employees' hourly wages, the salaries, donations, investments, etc etc etc

and some estimated figures still put the profits for 2007 in the billions of dollars

Chevon 18.7 billion (profit)

Exxon Mobil surpasses 40 billion (profit)

Those are just the two biggest, there are more (my eyes hurt...)

Thats two companies, profiting 58.7 billion dollars, on one year, beacuse we're paying record prices at the pump.

What is their excuse for this?

They claim that thier % profit is "in line" with other businesses.

Story here

lets not forget that oil companies get tax subsidies, as well.

interesting article snippet

Full Story

So are their "profits" in line with other companies?

Sure.

Until you consider their tax incentives, breaks, and write-offs.

And what about all this money that they're supposedly investing in new technologies since God knows when? (or atleast so they claim)

Well, two comments on that.

1.) - read the snippet above. They invest 100 million, but still profit 40 billion. By the way - a lot of tier investments are tax write offs under the 'renewable energies' tax code.

2.) - Why hasnt gas changed - at all - in the last 10-30 years? The same gas i pump in my car today - is the same gas i pumped 10 years ago. If billions gets invested, where's the results?

if you took the amount of money that big oil 'claims' to invest in new technology for better energies, and invested it into Cancer, or AIDS research, im sure we'd have a cure by now.

My overall opinion.

They will not lower prices by drilling domestically. They already have a surplus as it is, read the other articles here, and it'll show you that they are at 100% capacity in all refineries, and set on the rest of it.

Absolutely appauling.

They make 40 billion in one year, and im paying 4.00 a gallon, which they blame on saudi arabia

usually - in business, when "cost goes up" and "price goes up" then you still have "the same exact profits"

not in this case.

40 billion profit is a record for any company.

and 4 dollar a gallon is a record for this nation.

But what can i do about it besides post this column?

I'd write my congressman, though he'd probably laugh at me while he's opening his 'incentive check' for exxon mobil.

I hope you find these facts interesting. I put a lot of work into it - and had to re-do it after the 'draft' option failed me again.

I eagerly await your comments

Happy 4th !!!

[edit on 7/4/2008 by Andrew E. Wiggin]

Big Oil

May of 2008 - average barrel of oil: $117.40

( Source )

Lets break each barrel down

Source

A barrel of oil yields these refined products (percent of barrel):

47% gasoline for use in automobiles

23% heating oil and diesel fuel

18% other products, which includes petrochemical feedstock—products derived from petroleum principally for the manufacturing of chemicals, synthetic rubber and plastics

10% jet fuel

4% propane

3% asphalt

(Percentages equal more than 100 because of an approximately 5% processing gain from refining.)

Which is better represented by:

We can see how many gallons of each "fuel" is contained within each barrel (rough estimates, again, vary by refining gains/losses)

Since "other" encompasses a wide variety of things (crayons, wax, plastic bags, etc)

We'll concentrate only on fuel

Lets use some recent data and a picture or two:

Source

gasoline and diesel - the two heavy hitters per each barrel of crude oil

GASOLINE

taxes = 37 cents per gallon

Distribution = 19 cents per gallon

Refining = 37 cents per gallon

Crude = $2.83 per gallon

__________________________

$3.76 cost (usually lose 1c per gallon in each major oil company)

DIESEL

taxes= 43 cents a gallon

distribution = 22 cents per gallon

refining = 93 cents per gallon

crude = 2.84 per gallon

____________________________

$4.42 per gallon

So - lets recap so far.

Already - we are up to

4.42 per gallon of diesel - and you can get 9.21 gallons per barrel. So $40.71 per barrel for diesel

+ 3.76 per gallon of gasoline - and you can get 19.15 gallons of gasoline per barrel - So $72.00 for gasoline per barrel

72+40.71 = $112.71 (getting very close to that cost of a barrel)

and we have expended roughly 70% of the barrel on diesel and gasoline.

30 % to go for each barrel, and we are 96% of the way there for the cost of the barrel

JET FUEL

Average = $4.09 per gallon ( Source )

3.82 gallons of jet fuel per barrel = $15.62 per barrel

LPG fuels cost (roughly) half that of gasoline. ( Source )

So if gasoline is 3.76 a gallon, we'll call LPG fuels 1.88 per gallon

for a total of

1.72 x 1.88 = $3.23 per barrel of oil

HEATING OIL

even at a "low cost" for heating homes, as most oil companies put it, it still costs ~ $3.00 a gallon for heating oil ( Source )

so 1.75 x 3.00 = $5.25 per barrel of oil from heating oil

Heavy fuel oil

A little trickier to figure, but there is actually a scary technique involved (you divide the USD per metric ton of the fuel oil, by 6.66 , and you get price per barrel for Heavy fuel oil)

which in this case is rounded off to $50 for arguments sake

(its actually higher, but these figures only go as far as 2006)

Source

So - a final recap:

Gasonline - $72 per barrel

Diesel - $40.71 per barrel

Jet Fuel - $15.62 per barrel

LPG - $3.23 per barrel

Heating Oil - $5.25 per barrel

Heavy Fuel Oil - $60 per barrel

So - if i am doing this right ( ) that comes to $196.81 per barrel, and we still have 7.27 gallons of "other product" (or roughly 10% of the barrel of crude oil) to go.

Other product encompasses many things (like garbage bags, wax, crayons, etc) so ill do the oil companies a favor and just exclude this all together, cause i dont feel like finding out what "other" encompasses entirely.

196.81 dollars per barrel is a 67.7% markup of 117.40

and we havent even used the entire barrel yet.

So - after we expend the cost of each product from every barrel, we are left with $79.41 per barrel.

The united states (in 2007) consumed 7.5 billion barrels of oil.

$595,575,000,000 (billions....with a B) is what you get when you take the "overage" (79.41) times 7.5 billion barrels.

Now, of course, not all of that is profit. You have to pay your employees' hourly wages, the salaries, donations, investments, etc etc etc

and some estimated figures still put the profits for 2007 in the billions of dollars

Chevon 18.7 billion (profit)

Exxon Mobil surpasses 40 billion (profit)

Those are just the two biggest, there are more (my eyes hurt...)

Thats two companies, profiting 58.7 billion dollars, on one year, beacuse we're paying record prices at the pump.

What is their excuse for this?

They claim that thier % profit is "in line" with other businesses.

Story here

lets not forget that oil companies get tax subsidies, as well.

interesting article snippet

lawmakers were far less sympathetic to the executives.

Markey hammered Exxon's Simon over the company's investment in renewable energy. "Why is Exxon Mobil resisting the renewable energy revolution?" asked Markey.

Simon said Exxon has given $100 million to Stanford to study renewables. "$100 million?" said Markey. "But you made $40 billion last year."

Full Story

So are their "profits" in line with other companies?

Sure.

Until you consider their tax incentives, breaks, and write-offs.

And what about all this money that they're supposedly investing in new technologies since God knows when? (or atleast so they claim)

Well, two comments on that.

1.) - read the snippet above. They invest 100 million, but still profit 40 billion. By the way - a lot of tier investments are tax write offs under the 'renewable energies' tax code.

2.) - Why hasnt gas changed - at all - in the last 10-30 years? The same gas i pump in my car today - is the same gas i pumped 10 years ago. If billions gets invested, where's the results?

if you took the amount of money that big oil 'claims' to invest in new technology for better energies, and invested it into Cancer, or AIDS research, im sure we'd have a cure by now.

My overall opinion.

They will not lower prices by drilling domestically. They already have a surplus as it is, read the other articles here, and it'll show you that they are at 100% capacity in all refineries, and set on the rest of it.

Absolutely appauling.

They make 40 billion in one year, and im paying 4.00 a gallon, which they blame on saudi arabia

usually - in business, when "cost goes up" and "price goes up" then you still have "the same exact profits"

not in this case.

40 billion profit is a record for any company.

and 4 dollar a gallon is a record for this nation.

But what can i do about it besides post this column?

I'd write my congressman, though he'd probably laugh at me while he's opening his 'incentive check' for exxon mobil.

I hope you find these facts interesting. I put a lot of work into it - and had to re-do it after the 'draft' option failed me again.

I eagerly await your comments

Happy 4th !!!

[edit on 7/4/2008 by Andrew E. Wiggin]

reply to post by Rook1545

I think you're missing the point. We are importing 70% of our oil. By drilling we will accomplish 2 things. First, increased supply on the global market will bring global prices down (supply/demand). Second, we will be reducing and replacing for imports with domestic supply.

It's not about increasing capacity (at least in the short term), it's about controlling the supply chain and replacing foreign oil with domestic oil. Even with our current refining capacity, the increased oil supply will bring the oil prices down; and yes, it will happen pretty much over night because current market prices are driven by future speculation.

I think you're missing the point. We are importing 70% of our oil. By drilling we will accomplish 2 things. First, increased supply on the global market will bring global prices down (supply/demand). Second, we will be reducing and replacing for imports with domestic supply.

It's not about increasing capacity (at least in the short term), it's about controlling the supply chain and replacing foreign oil with domestic oil. Even with our current refining capacity, the increased oil supply will bring the oil prices down; and yes, it will happen pretty much over night because current market prices are driven by future speculation.

That's a nice summary, Mr. Wiggins. I did something similar several months ago and pretty much came to the same conclusions. The one thing I did

differently than you is I dug deeper into the tax portion of the gas bill. I encourage you to do the same. You will be appaled when you find out how

much of that price you pay at the pump is taxes. Don't forget to include the actual income taxes on the gas companies as that is passed directly

onto the consumer as well. Most are really surprised when they see in black and white that those large profit $$s flaunted all over the news are

about half of what the federal government took in income taxes. The federal government is just as responsible for high gas prices as the gas

companies are.

new topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 1 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 1 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 4 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 6 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 10 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 15 hours ago, 11 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 15 hours ago, 6 flags -

Sunak spinning the sickness figures

Other Current Events: 15 hours ago, 5 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 1 hours ago, 4 flags -

Electrical tricks for saving money

Education and Media: 13 hours ago, 4 flags -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 1 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 17 hours ago, 3 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 6 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 4 hours ago, 2 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 1 hours ago, 1 flags

active topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 86 • : xuenchen -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 76 • : FlyersFan -

The Reality of the Laser

Military Projects • 49 • : 5thHead -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 154 • : PorkChop96 -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 2 • : xuenchen -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 142 • : xuenchen -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 6 • : mysterioustranger -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 282 • : 5thHead -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 745 • : network dude -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 664 • : 777Vader

0