It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

5

share:

How Low can the Dollar go? Zero Value

www.funnymoneyreport.com

(visit the link for the full news article)

The Federal Reserve is stuck between a rock and a hard place. If they raise interest rates to the point where holding U.S. Dollars can outpace inflation they would need to raise them to around 20%. This would hurt not only the American people but the elite financial interests as well. As a result, the Federal Reserve is attempting to manage a slow inflationary decline of the U.S. Dollar which will allow the financial elite to more easily reposition themselves. Inflation hurts the poor and the middle class far more than the financial elite where as a deflation like what we saw during the Great Depression would hurt everybody across the board.

As this financial calamity continues, the corporate controlled media will likely say we are in a recession even though it will resemble more of a depression. Gold and silver remain good hedges against inflation and their price will rise in U.S. Dollar denominated terms. There continues to be more upside to silver but there will also be more short term volatility in silver. There is no doubt that an inflationary depression is a very likely scenario and there is always the chance that the U.S. Dollar could go to zero. This is why having physical gold and silver is always a smart move.

What an absolute nightmare...We are in such a bad way right now, and things really have no where to go but down for some time, due to the disastrous

policy of the Fed. Unfortunately, in a recurring theme, the only folks who will be shielded from this are the rich elitists. While our countrys'

financial infrastructure folds in on itself and decimates the middle class and poor, these people will be enjoying all the wealth they have made off

this scam system. Sickening.

www.funnymoneyreport.com

(visit the link for the full news article)

www.funnymoneyreport.com

(visit the link for the full news article)

The Rich may not be as insulated as you think. A rapid deterioration of civil law and order favors only those who can protect themselves. I remember

an article not too long ago about a rich guy who wrote a book about how his rich buddies should buy hideaways and stock them for just such a

situation.

Stagflation has been happening and is getting worse as litigation starts against bond 'insurers' and house prices keep dropping. An avalanche of derivatives at least three times the size of the US Economy is coming at us. Do everything you can to secure a food source!

Stagflation has been happening and is getting worse as litigation starts against bond 'insurers' and house prices keep dropping. An avalanche of derivatives at least three times the size of the US Economy is coming at us. Do everything you can to secure a food source!

Considering that one U.S. Dollar is worth less than 2 cents of early 20th century money, we have already been devalued on a massive scale.

NO CURRENCY should inflate the way American currency has. But because we consider American currency a measuring stick to all others, countries go along with inflation and assume that America is just setting the trend... a trend which leads to collapse of any economy.

[edit on 9-3-2008 by NewWorldOver]

NO CURRENCY should inflate the way American currency has. But because we consider American currency a measuring stick to all others, countries go along with inflation and assume that America is just setting the trend... a trend which leads to collapse of any economy.

[edit on 9-3-2008 by NewWorldOver]

In large part, I believe we're witnessing an intentional devaluation of the Dollar as a defense against spiraling unsustainable debt. Conversely,

foreign entities trapped holding massive dollar reserves (specifically China and oil producing sovereigns) are defending by gradually converting their

devaluing paper assets into hard assets i.e., precious metals...base metals.

As a combined result of M3 expansion, and the fact that fewer people want to hold them, Jim Sinclair believes the Dollar will eventually achieve his long-term price objective of USDX 52. Around that point, he foresees the reconstitution of a "modified" Federal Reserve Gold Certificate Ratio as an official-sector rescue, resulting in a rebound to USDX 72 - 82.

The traditional Gold Certificate Ratio, as a discipline, controlled the effect of escalating M3 by triggering a rise in general interest rates...not a viable option in today's environment. This new GCR would react directly to M3 growth on an annual % basis, as opposed to Treasury debt/interest rates. Gold would not be redeemable as in the past, and he Dollar amount of Gold held by the US Treasury would have to equal the amount of foreign held Treasury debt within a specified margin.

As I understand it, this action would not only support renewed confidence in the Dollar, but it would be extremely bullish for a stable, high value market price of gold.

For a better understanding/explanation of Jim's thesis you can read Gold to be Remonitized!, written in 2003...@USD 99.81...Gold $368.50.

*As I was fiddling with my keyboard here tonight, the Dollar printed a new 52wk low @USDX 72.76.

As a combined result of M3 expansion, and the fact that fewer people want to hold them, Jim Sinclair believes the Dollar will eventually achieve his long-term price objective of USDX 52. Around that point, he foresees the reconstitution of a "modified" Federal Reserve Gold Certificate Ratio as an official-sector rescue, resulting in a rebound to USDX 72 - 82.

The traditional Gold Certificate Ratio, as a discipline, controlled the effect of escalating M3 by triggering a rise in general interest rates...not a viable option in today's environment. This new GCR would react directly to M3 growth on an annual % basis, as opposed to Treasury debt/interest rates. Gold would not be redeemable as in the past, and he Dollar amount of Gold held by the US Treasury would have to equal the amount of foreign held Treasury debt within a specified margin.

As I understand it, this action would not only support renewed confidence in the Dollar, but it would be extremely bullish for a stable, high value market price of gold.

For a better understanding/explanation of Jim's thesis you can read Gold to be Remonitized!, written in 2003...@USD 99.81...Gold $368.50.

*As I was fiddling with my keyboard here tonight, the Dollar printed a new 52wk low @USDX 72.76.

They will cut rates BY 100 BASIS POINT next week. That's crazy.

Here

You know the reason they stated for that? TO AVOID A RECESSION!!!

Goddamn this will crash the dollar sooner than I expected. I will buy stuff in the US next week because the dollar will fall at least 10%...compare to the canadian loonie. Compare to the Euro, probably more. Just watch gas exploding the 115$ a barrel in the next 2 weeks and gold explode 1000$ before the end of the week.

[edit on 10-3-2008 by Vitchilo]

[edit on 10-3-2008 by Vitchilo]

Here

You know the reason they stated for that? TO AVOID A RECESSION!!!

Goddamn this will crash the dollar sooner than I expected. I will buy stuff in the US next week because the dollar will fall at least 10%...compare to the canadian loonie. Compare to the Euro, probably more. Just watch gas exploding the 115$ a barrel in the next 2 weeks and gold explode 1000$ before the end of the week.

[edit on 10-3-2008 by Vitchilo]

[edit on 10-3-2008 by Vitchilo]

reply to post by DimensionalDetective

About as far as the price of oil can go up. But in the end I think its time we stopped sending so much money out to everybody else and call in some of our loans .

About as far as the price of oil can go up. But in the end I think its time we stopped sending so much money out to everybody else and call in some of our loans .

PM's may get POUNDED HARD thise year if the central banks dump up to 400 tonnes of Gold to try and maintain liquidity.

That gold will get snapped up by everyone, especially China. What better way to trade out toxic Dollars. Dumping any Gold in this environment is just

a stupid ploy on their part. Another pathetic attempt at manipulation. Metals are goin' way up!

I have a question... Is it possible to be obligated to pay for the possession of money, if the dollar hit $0.00?

That would suck!

That would suck!

reply to post by HimWhoHathAnEar

MAYBE in the long run, unless it becomes seizable, otherwise in the short term it will get pounded, statistical charts are already expecting a down turn of a few hundred dollars and this is WITHOUT the rumored dump.

MAYBE in the long run, unless it becomes seizable, otherwise in the short term it will get pounded, statistical charts are already expecting a down turn of a few hundred dollars and this is WITHOUT the rumored dump.

Originally posted by pityocamptes

reply to post by HimWhoHathAnEar

MAYBE in the long run, unless it becomes seizable, otherwise in the short term it will get pounded, statistical charts are already expecting a down turn of a few hundred dollars and this is WITHOUT the rumored dump.

Your Statistical Charts are AKA Propaganda. History has no precedent for the amount of worthless debt that has been generated by the neglectful practices of Alan Greenspan. The 'conservative' estimate is 27 Trillion worth of garbage derivatives. As they have STARTED to unwind, the FED has been using their printing presses to try and stop it. Monetizing Debt always creates inflation. 'Trying' to monetize that much debt will destroy the Dollar. Commodities will become worth more and more of those worthless Dollars.

The Weimar Republic tried to monetize war debt. Look into it. Yugoslavia early 90's. Look into it. Zimbabwe Today!

Originally posted by StoneGarden

I have a question... Is it possible to be obligated to pay for the possession of money, if the dollar hit $0.00?

That would suck!

No. If it hit zero you would still have that worthless piece of paper. That's where it ends. They burned it in 1930's Germany since you could get more heat from the bills than the coal you could buy with them!

Actually the Federal Reserve Note is a Debt Instrument to start with. It is not backed by anything. It is simply the evaporation of a mirage. And since Debt has been used to enslave so many, it is an irrational fear to see it go. Maybe like the fear a slave would feel about actually being free and the responsibility involved with freedom.

Originally posted by pityocamptes

PM's may get POUNDED HARD thise year if the central banks dump up to 400 tonnes of Gold to try and maintain liquidity.

Oh, really

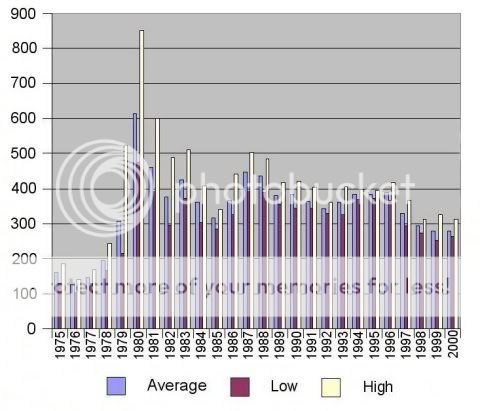

Auctions and " restitution" sales (1976–80). The IMF sold approximately one third (50 million ounces) of its then-existing gold holdings following an agreement by its members to reduce the role of gold in the international monetary system. IMF Factsheet

That's 50MM ounces (1,600 tonnes) "dumped" between 1976 - 1980 ( 400 tonnes per year equivalent).

And the end results?

Fuel on the fire culminating in the 1980 blow-off top.

....statistical charts are already expecting a down turn of a few hundred dollars and this is WITHOUT the rumored dump.

pityocamptes...if you can provide TA indicating a near-term price objective of minus "a few hundred dollars" from today's closing...I would appreciate the opportunity to evaluate it

Well, those of you lucky enough to live along the northern border, you can trade your money in for Canadian dollars and easily spend them on your own

side of the border.

With the way things are looking up for the Canadian economy, nobody's going to refuse you using Canadian currency.

The issue with that though, is the Canadian economy can only hold out for so long with it's largest trading partner unable to afford its goods. I would expect a couple of years at most of safe Canadian currency before Canada's financial supports begin to crumble as well.

After that, I should hope you've managed to get your hands on gold with your spare time.

Problem is, I'm not entirely sure how to get my hands on it... I know I can ask a stock broker to invest in gold for me... but I have no clue how to PHYSICALLY get my hands on it... and help?

With the way things are looking up for the Canadian economy, nobody's going to refuse you using Canadian currency.

The issue with that though, is the Canadian economy can only hold out for so long with it's largest trading partner unable to afford its goods. I would expect a couple of years at most of safe Canadian currency before Canada's financial supports begin to crumble as well.

After that, I should hope you've managed to get your hands on gold with your spare time.

Problem is, I'm not entirely sure how to get my hands on it... I know I can ask a stock broker to invest in gold for me... but I have no clue how to PHYSICALLY get my hands on it... and help?

reply to post by johnsky

Hi johnsky. Maybe the best way to purchase bullion is by establishing a friendly relationship with your local [reputable] coin shop. Barring that possibility, everybody seems to have their favorite Internet dealers etc. For larger physical purchases (20oz min), I've had excellent luck with Tulving. Responsive by telephone, free overnight shipping, fully insured. Another good guy & reliable source for smaller lots is Colorado Gold (currently 10oz min Gold - 100oz min Silver).

My personal preference: Gold American Eagles.

You can google-search Gold Dealers, buy bullion through a bank, or there's always ebay.

GL

Hi johnsky. Maybe the best way to purchase bullion is by establishing a friendly relationship with your local [reputable] coin shop. Barring that possibility, everybody seems to have their favorite Internet dealers etc. For larger physical purchases (20oz min), I've had excellent luck with Tulving. Responsive by telephone, free overnight shipping, fully insured. Another good guy & reliable source for smaller lots is Colorado Gold (currently 10oz min Gold - 100oz min Silver).

My personal preference: Gold American Eagles.

You can google-search Gold Dealers, buy bullion through a bank, or there's always ebay.

GL

Then many people may go to the barter system. If you have a skill, as in being able to physically do something, like make things or fix things, then

you can trade that skill with others with other types of tangible assets to trade. Money is ignored, and the banks will be forced to try and forcible

take over assets such as houses and land based on debt owed, and then things will become very interesting. Build up your stock of tools and weapons.

Grow yourself a garden, and start raising chickens. Then anarchy will reign.

When the last great depression hit, the numbers of the super rich declined hugely. The reality is that if the economic indicators were to be calculated the way they were in the thirties, it would be known that we are currently in another great depression that began around 2001 or 2002. Being that the U.S. has by far the greatest military power in the world, it will be very hard for our creditors to collect. Without the technology to utilize them, ownership of precious metals isn't worth much, especially when your do not have the military might to control the resources that you claim to own. Once again, it all becomes very interesting.

When the last great depression hit, the numbers of the super rich declined hugely. The reality is that if the economic indicators were to be calculated the way they were in the thirties, it would be known that we are currently in another great depression that began around 2001 or 2002. Being that the U.S. has by far the greatest military power in the world, it will be very hard for our creditors to collect. Without the technology to utilize them, ownership of precious metals isn't worth much, especially when your do not have the military might to control the resources that you claim to own. Once again, it all becomes very interesting.

new topics

-

Hurt my hip; should I go see a Doctor

General Chit Chat: 47 minutes ago -

Israel attacking Iran again.

Middle East Issues: 1 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 2 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 3 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 4 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 4 hours ago -

I hate dreaming

Rant: 5 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago -

Biden says little kids flip him the bird all the time.

Politicians & People: 7 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 8 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 10 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 15 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 7 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago, 7 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 4 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 1 hours ago, 5 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago, 4 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 4 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 17 hours ago, 4 flags

active topics

-

Biden says little kids flip him the bird all the time.

Politicians & People • 16 • : stelth2 -

Hurt my hip; should I go see a Doctor

General Chit Chat • 6 • : charlest2 -

When an Angel gets his or her wings

Religion, Faith, And Theology • 2 • : stelth2 -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 51 • : Zaphod58 -

Israel attacking Iran again.

Middle East Issues • 19 • : stelth2 -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs • 7 • : Ophiuchus1 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 549 • : cherokeetroy -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 9 • : VariedcodeSole -

A man of the people

Medical Issues & Conspiracies • 14 • : chr0naut -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 68 • : ToneD

5