It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

reply to post by titian

Is people like me that follow the markets pretty good and you do not need an expert to tell you that if the jobs claims were high and no jobs are recreated we are losing jobs on any sector and do to the fact that we are now a nation that has lost its manufacturing the only jobs out there are mostly service jobs creation.

So guess which jobs are going to be going down the hill, the only ones we have right now.

Service.

I am no financial expert but even I can add two and two make a pretty good prediction.

Is people like me that follow the markets pretty good and you do not need an expert to tell you that if the jobs claims were high and no jobs are recreated we are losing jobs on any sector and do to the fact that we are now a nation that has lost its manufacturing the only jobs out there are mostly service jobs creation.

So guess which jobs are going to be going down the hill, the only ones we have right now.

Service.

I am no financial expert but even I can add two and two make a pretty good prediction.

LOL.

Subprime may be over. Just wait until the:

-Prime ARM resets

-Option Adjustable Resets

-The commercial real estate market (which usually lags housing a year or two) goes under

Here's a good way of putting it:

The chart starts January 2007 and Ends January 2013. 2012 looks to be the year the world is happy.

Subprime may be over. Just wait until the:

-Prime ARM resets

-Option Adjustable Resets

-The commercial real estate market (which usually lags housing a year or two) goes under

Here's a good way of putting it:

The chart starts January 2007 and Ends January 2013. 2012 looks to be the year the world is happy.

great! KEEP SELLING.........I will keep buying....I invest long term, 20 to 30 years. Ups and downs give me some great deals

reply to post by St Udio

In all honesty St. Udio. Keep an eye on the S&P. It is the best "market" to follow. Technically the 1320-1325 area is a point of support. A close below that would show 1300 as the next support level, although its not a strong support level. The next strong support level (where buying would occur) would be 1260 and the next level below that is 1200.

The top part of the trading range we are looking at for the S&P is 1380-1385 on the first level followed by 1420-1425 on the upper extreme. I don't see any closes above the 1425 level for some time, but we could have our normal summer rally.

If the Democrats win the White House (surprisingly I do not think they will) the biggest fear is repealing tax cuts. If they even start talking about tax cuts expect to see big time selling of stocks, especially the "safer" dividend stocks as people have flocked to them due to tax cuts on investments.

Personally I would like to see Mr. Romney in there, but I guess I will settle for John McLame. Forget what everyone keeps talking about Ron Paul....I just don;t get any of his mumbo jumbo. (Just my humble opinion)

In all honesty St. Udio. Keep an eye on the S&P. It is the best "market" to follow. Technically the 1320-1325 area is a point of support. A close below that would show 1300 as the next support level, although its not a strong support level. The next strong support level (where buying would occur) would be 1260 and the next level below that is 1200.

The top part of the trading range we are looking at for the S&P is 1380-1385 on the first level followed by 1420-1425 on the upper extreme. I don't see any closes above the 1425 level for some time, but we could have our normal summer rally.

If the Democrats win the White House (surprisingly I do not think they will) the biggest fear is repealing tax cuts. If they even start talking about tax cuts expect to see big time selling of stocks, especially the "safer" dividend stocks as people have flocked to them due to tax cuts on investments.

Personally I would like to see Mr. Romney in there, but I guess I will settle for John McLame. Forget what everyone keeps talking about Ron Paul....I just don;t get any of his mumbo jumbo. (Just my humble opinion)

Originally posted by titian

Hate to burst the conspiratorial bubbles here; but today's fall was due to the first drop in service sector jobs in five years.

MSNBC

Furthermore, St Udio brings up a very good point that should be considered.

Irrational exuberance has a cost. I sincerely hope noone bought GOOG near its alltime high.

I was short GOOG (through options to minimize risk) around there, but was afraid to hold it through the earnings so I got out of the trade. BIG mistake.

At that time, I'd love to see the "safer" stocks getting sold. I should have my degree, hopefully a decent job, and since I like investing in my

future, I'd love to see stocks like GE trading for $25, and hopefully AT&T back at that price again. If I had money now, I'd be taking my chances

with the banks, but that's just me. You can get some really good deals now, and if you get the good dividend stocks, in 20 or so years, that's a

nice return.

Ok, right here, right now. Forget Ben Stein, the Mogambo Guru. The US financial markets are toast. For free!!! -------------PC

Let's hope it's just a temporary dip.

It might be related to public opinion, which can change on the drop of a dime, so let's hope the word gets around that all is well and there is no reason to withdraw for good!

[edit on 6-2-2008 by GENERAL EYES]

It might be related to public opinion, which can change on the drop of a dime, so let's hope the word gets around that all is well and there is no reason to withdraw for good!

[edit on 6-2-2008 by GENERAL EYES]

Originally posted by Freedom ERP

Stock Markets have to be considered over the longer term and not just months or even the odd year.

Typically in 20 year cycles which I feel is a fair time frame, global stock markets have continued to rise and which will continue to rise.

In this current market adjustment, and I think it is fair to call these downturns, market adjustments, those who deal and trade in shares which are used as the cornerstone of a great many of the investments we have, are taking profits.

It does not help that many of us and the businesses we depend on have higher levels of debt to service. Some parts of the marketplace have made it too easy in my opinion to get credit, and now we have having to pay the piper so to speak for the money we have used.

And just think about this....interest rates are very low, and we have had a sustained period of lower interest rates coupled with an expanding economy across the world.

The bad news of being the world's largest economy is the impact any downturn has around the world and economics is about cycles and we are in a down cycle for the time being.

Drops in interest rates around the world should help us service the debt we have more easy, it just that is takes time to ripple down from the marketplaces to our pockets, and just how long are we prepared to wait before we start pestering our Governments to change something else as things are not happening fast enough.

The growing percentage of baby boomers facing retirement in the next five years and their investments in stock markets should be taken into consideration. They do not have a life time left, going forward they can not afford (nor would it be intelligent) to weather this storm coming, as the fear level rises, those watching their shrinking nest egg, more and more will sell.

and that 20 year "cycle" will be remembered in the larger context as having validity for less than a hundred years.

Also banks are strapped for money, and any they get will not be used toward lending us, A fed reserve survey showed bank lending is tightening faster than ever before. lenders don't trust borrower's (and they don't have much to lend thanks to big writeoffs)

the inflationary pressure's the fed's easing has caused are due to massive deflationary forces in the face of falling home values (with a steep drop to come as banks are selling repo's for cheap to get cash) and failing financial instruments (MBS's CDO's SiV's) are causing banks capital to deflate. Asset prices built on massive leverage provided by the above mentioned 3 letter instruments and a carry trade in yen are being unwound, and any gov't inflationary counter measure's will go to sure up banks and wall street first.

Baring monthly stimulus checks , The consumer is left out to dry, and spending will fall and inflict pain on employment, which will be a re-inforcing cycle. Which is why monthly stimulus checks would be a far-fetched but desperate option to keep service sector employment and thus society together. This may actually be (initially) supported by Asian counterparts (not european) who depend on our consumption because their exports economy's employ millions. w/o this employment they would have chaos.

If china and india can boost their domestic consumption to keep demand for their products high enough to maintain employement as well as cushion the blow falling consumption in america will lead to then perhaps they can maintain order as America gov't desperately try's to mail out more stimulus check (welfare) to keep citizen's from getting too unrestful. American's would painfully get used to a low standard of living.

still the big problem i see is that their are just too many non production jobs based on this pyramid of debt spending and too many people will be left unemployed and "useless eaters".

[edit on 6-2-2008 by cpdaman]

reply to post by cpdaman

You make some great points, cpdaman, and if the baby boomers are worrying about the last five years of their investments they have not been paying attention. Retirement investments are a long term investment and over the cycle that the baby boomers have been investing, the markets have grown, its just that prices have grown fast.

I think your point about China and India's ability to grow their domestic markets is most interesting. India, I think have the great opportunity to grow its home markets. China does have a growing marketplace but the gulf between those who make the comsumer products and those who can afford them is huge.

I fear that neither economy can expand its local marketplace fast enough to make up for the drop in demand from the first world.

You make some great points, cpdaman, and if the baby boomers are worrying about the last five years of their investments they have not been paying attention. Retirement investments are a long term investment and over the cycle that the baby boomers have been investing, the markets have grown, its just that prices have grown fast.

I think your point about China and India's ability to grow their domestic markets is most interesting. India, I think have the great opportunity to grow its home markets. China does have a growing marketplace but the gulf between those who make the comsumer products and those who can afford them is huge.

I fear that neither economy can expand its local marketplace fast enough to make up for the drop in demand from the first world.

02/11/08 Pacific Standard Time

7:40 Am Dow down 82.10 points -067%

7:40 Am Nasdaq down 5.12 points -.22%

7:40 Am Dow down 82.10 points -067%

7:40 Am Nasdaq down 5.12 points -.22%

reply to post by cpdaman

you sure laid that out well...

and the boomers with their trillion$ of paper wealth will get whiplashed

when the Bond Market itself goes hyperbolic...

so one should not try to seek cover or refuge in long term Treasuries

which seems to be the fashion right now. ... as the Fed chairman continues to

lower rates --- principally for the favor of the banks & lending institutions

NOTE: today, Monday the 11th, Feb 2008, it was announced that two of the DOW 30 components are going to replaced...

that should skew things up for a while, as fund managers are required to adjust their funds holdings accordingly to reflect the revised DOW

you sure laid that out well...

and the boomers with their trillion$ of paper wealth will get whiplashed

when the Bond Market itself goes hyperbolic...

so one should not try to seek cover or refuge in long term Treasuries

which seems to be the fashion right now. ... as the Fed chairman continues to

lower rates --- principally for the favor of the banks & lending institutions

NOTE: today, Monday the 11th, Feb 2008, it was announced that two of the DOW 30 components are going to replaced...

that should skew things up for a while, as fund managers are required to adjust their funds holdings accordingly to reflect the revised DOW

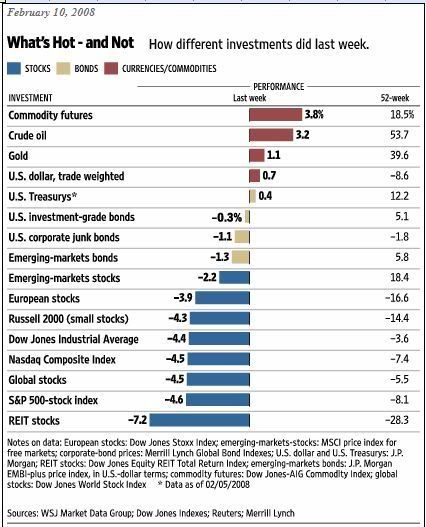

I only read when there's no alternative...otherwise, I just look at the perdy pictures. If you're a commodities Bull...this one's for you.

The Golden Rule Pictorial (annotated english edition). Foreign SWF's rule....grains, oil...precious metals.

[edit on 12-2-2008 by OBE1]

The Golden Rule Pictorial (annotated english edition). Foreign SWF's rule....grains, oil...precious metals.

[edit on 12-2-2008 by OBE1]

new topics

-

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 29 minutes ago -

Hurt my hip; should I go see a Doctor

General Chit Chat: 1 hours ago -

Israel attacking Iran again.

Middle East Issues: 2 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 3 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 4 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 5 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 5 hours ago -

I hate dreaming

Rant: 5 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 8 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 10 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 16 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 8 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago, 7 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 5 hours ago, 6 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago, 5 flags -

Israel attacking Iran again.

Middle East Issues: 2 hours ago, 5 flags -

4 plans of US elites to defeat Russia

New World Order: 17 hours ago, 4 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 5 hours ago, 4 flags

active topics

-

Hurt my hip; should I go see a Doctor

General Chit Chat • 11 • : TheLieWeLive -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 7 • : Caver78 -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 48 • : Encia22 -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 52 • : cherokeetroy -

Israel attacking Iran again.

Middle East Issues • 22 • : Boomer1947 -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies • 1 • : WakeofPoseidon -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 67 • : WeMustCare -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 53 • : ghandalf -

Boston Dynamics say Farewell to Atlas

Science & Technology • 5 • : Caver78 -

Biden says little kids flip him the bird all the time.

Politicians & People • 16 • : stelth2