It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

With regard to the possible NESARA American banking changes which I alluded to on this thread at 06:28 this morning, I now learn that an insider

Casper Report dated 26.08.07 suggests that the main public financial announcement to do with NESARA has been tentatively scheduled for Tuesday 18th

September 2007. This is three days before the alleged multi-billion dollar index put position expires. Other smaller, preparatory NESARA statements to

do with conceptual, legal and constitutional matters may emerge in the days before the financial announcement of the 18th September 2007.

The full text of the Casper Report can be found here:

fourwinds10.com...

The full text of the Casper Report can be found here:

fourwinds10.com...

My goodness this is a lot to take in all at once.

I have very little idea how the whole stock market works as my only exposure to it being the film "Tradeing Spaces" which I'm certain Hollywoodized the entire process but at least it gave me the basics, or I hope it did.

Supply and Demand is more my speed anyway and it's a system that works, well for the most part anyway or it's supposted to work.

Wow, so basicly if the market goes down a ton of points, SOMEONE will be making money off it, while someone else will loose thier shirt, so to speak.

Metaphoricly of course, they won't really loose thier shirt, eh ?

That's about all I can understand, hope i'm close, beyond that I know it will effect the rest of the economy "Trickle Down From Above" so it will affect the rest of us just how much it will depends on many factors, right ?

Like Houseing / Credit / Ect.

I have very little idea how the whole stock market works as my only exposure to it being the film "Tradeing Spaces" which I'm certain Hollywoodized the entire process but at least it gave me the basics, or I hope it did.

Supply and Demand is more my speed anyway and it's a system that works, well for the most part anyway or it's supposted to work.

Wow, so basicly if the market goes down a ton of points, SOMEONE will be making money off it, while someone else will loose thier shirt, so to speak.

Metaphoricly of course, they won't really loose thier shirt, eh ?

That's about all I can understand, hope i'm close, beyond that I know it will effect the rest of the economy "Trickle Down From Above" so it will affect the rest of us just how much it will depends on many factors, right ?

Like Houseing / Credit / Ect.

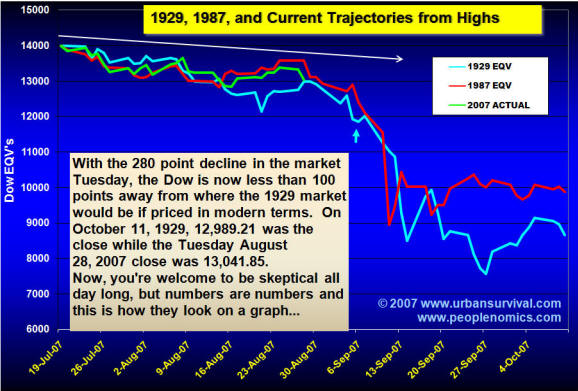

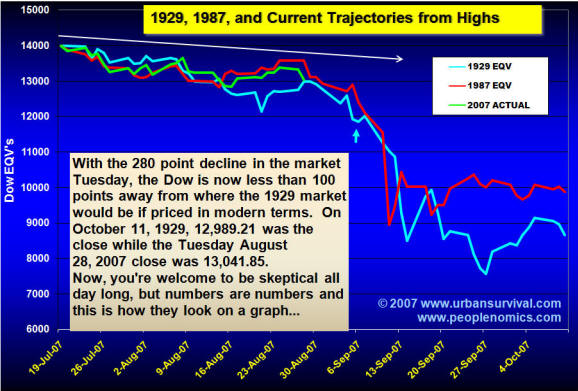

Have a peek at George Ure's little three squiggle chart. It tracks the current DOW in relation to the price movements of 1987 & 1929....the crash

years. The 3 events are averaged to nominal highs - adjusted to the 14,000 July top. The current DOW is showing an amazing parallel to the pre-crash

weeks of 1987, with the possibility of a powerful move to the downside beginning around Sept. 6. A break above the white arrow could signal a

retest of 14,000...at this point, it will prolly take two rate cuts & ten Hail-Mary's to pull that off.

Crash on the 6th...FOMC on the 18th...I think they have it backwards.

Crash on the 6th...FOMC on the 18th...I think they have it backwards.

Originally posted by syrinx high priest

Someone with an online trading system looked into this for me, and told me the put orders were called already, and the profit was made, but the story hasn't been updated. Can anyone confirm ?

Originally posted by SkepticOverlord

I'm seeing that in other financial discussions as well. The drama might be over.

Source?

I found this:

SPZ IT (2007 Sep 700.00 Call) 747.40 0.0

Aug 30, 2007 @ 08:01 ET (DELAYED 15 MINUTES)

Last Sale 747.40 Tick Up

Time of Last Sale 08/29/2007 16:00 Exchange CBOE

Net Change 0.0 Previous Close 747.40

Open 0.0 High 0.0

Bid 0.0 Low 0.0

Ask 0.0 Volume 0

Open Interest 63230 Expiration Date 09/21/2007

www.cboe.com...

www.cboe.com...

Check: All exchange option quotes (if multiply listed)

and

Check: List all options, LEAPS, Credit Options & Weeklys if avail.

symbol SPX

but it is a call for about half of the put being discussed. What about the other half?

Sri

Originally posted by OBE1

Oh My.... Uhm, that's like really scary, it's like a pattern emerging there.

Numbers don't lie and this looks like it's gonna hit and hit hard.

Troops around DC because of a market crash on it's way ?

You bet, if Joe 6-pack finds himself broke for haveing 20 credit cards.

I'm so glad I never got a credit card myself, I paid for everything with cold hard cash.

World War 3 after that ? Who knows, will we be able to wage it after a huge dip downward ? What would this do world wide ? What would be the long term impact ? What would be the short term impact ?

- W -

* So many unknowns at this time *

reply to post by Agit8dChop

Hi Agit8dChop, yeah, I believe his data is honest...even if he isn't.....just kidding I have been following updates/analysis of this little chart on George's peoplenomics subscriber page since the 12th..he just began posting it on his public peoplenomics page yestestday, so I thought I would share it here. Several Internet financial analysts, and web-articles are making similar comparisons -->1929 - 1987 - 2007.

George & his buddy Cliff (the Web-Bot-Guy) were the featured guests on C2C this past July 4th. If you are a C2C StreamLink-member, or have access to a free radio link, their interview is worth a listen in my opinion. The month of September has been on their radar for a long time.

If you go to George's site, check-out his public disclaimer. Scroll down to where it says; Additional Discalimer for Regular Folks. It will tell you a lot about his demeanor...funny...totally irreverent. Take the Mogombo Guru; Richard Daughty...sprinkle-in a cup of Web-Bot predictive linguistics...add a pinch of Bradley System (planetary) technical analysis, bring to a slow boil...and you get George Ure

Igor says something may be up for the 2nd & 19th - Sept.

Hi Agit8dChop, yeah, I believe his data is honest...even if he isn't.....just kidding I have been following updates/analysis of this little chart on George's peoplenomics subscriber page since the 12th..he just began posting it on his public peoplenomics page yestestday, so I thought I would share it here. Several Internet financial analysts, and web-articles are making similar comparisons -->1929 - 1987 - 2007.

George & his buddy Cliff (the Web-Bot-Guy) were the featured guests on C2C this past July 4th. If you are a C2C StreamLink-member, or have access to a free radio link, their interview is worth a listen in my opinion. The month of September has been on their radar for a long time.

If you go to George's site, check-out his public disclaimer. Scroll down to where it says; Additional Discalimer for Regular Folks. It will tell you a lot about his demeanor...funny...totally irreverent. Take the Mogombo Guru; Richard Daughty...sprinkle-in a cup of Web-Bot predictive linguistics...add a pinch of Bradley System (planetary) technical analysis, bring to a slow boil...and you get George Ure

Igor says something may be up for the 2nd & 19th - Sept.

Wow that graph is pretty amazing. It's unreal how closely the "actual" numbers line up for 87', and 07' up till right now.

Though I'm sure if one did enough digging over the past 20-30 years they should in all probability find something as close as to what we see there.

Whether or not it follows the projected trnd in light blue from here on in is another story entirely.

I would like to see what happened to the 87' graph line from Sept 1st to the end of September, whether or not it even resembles the projected light blue line at all.

Disclaimer: I could be totally mis-interpruting that map, i have zero knowledge in stocks, and the like so if my points make no sense at all, please disregard.

*EDIT* Just went back and looked at the graph again, and they DO show the 87 line through Sept, and that is what they are basing their projections on I would assume. So as I said in my disclaimer, DISREGARD this post as I totally didn't read the graph correctly.

In any event it is scary. But interesting all the same.

[edit on 30-8-2007 by Nola213]

Though I'm sure if one did enough digging over the past 20-30 years they should in all probability find something as close as to what we see there.

Whether or not it follows the projected trnd in light blue from here on in is another story entirely.

I would like to see what happened to the 87' graph line from Sept 1st to the end of September, whether or not it even resembles the projected light blue line at all.

Disclaimer: I could be totally mis-interpruting that map, i have zero knowledge in stocks, and the like so if my points make no sense at all, please disregard.

*EDIT* Just went back and looked at the graph again, and they DO show the 87 line through Sept, and that is what they are basing their projections on I would assume. So as I said in my disclaimer, DISREGARD this post as I totally didn't read the graph correctly.

In any event it is scary. But interesting all the same.

[edit on 30-8-2007 by Nola213]

Dispelling the 'Bin Laden' Options Trades

8/30/2007 3:23 PM EDT

However, Dan Perper, a Partner at Peak 6, one of the largest option market makers and proprietary trading firms, has confirmed that the trades are part of a "box-spread trade."

"This was done as a package in which the box spread was used [as a] means of alternative financing at more attractive interest rates" explained Perper. link

Please visit the link provided for the complete story.

I think suggestions that this trade was 'boxed' were already considered, both on this thread & elsewhere...now it appears that it's being officially confirmed in the media outlets. Pretty good article describing how 'boxed-spread trades' can essentially function as a loan at better than prevailing intererest rates.

8/30/2007 3:23 PM EDT

However, Dan Perper, a Partner at Peak 6, one of the largest option market makers and proprietary trading firms, has confirmed that the trades are part of a "box-spread trade."

"This was done as a package in which the box spread was used [as a] means of alternative financing at more attractive interest rates" explained Perper. link

Please visit the link provided for the complete story.

I think suggestions that this trade was 'boxed' were already considered, both on this thread & elsewhere...now it appears that it's being officially confirmed in the media outlets. Pretty good article describing how 'boxed-spread trades' can essentially function as a loan at better than prevailing intererest rates.

Originally posted by Nola213

Wow that graph is pretty amazing. It's unreal how closely the "actual" numbers line up for 87', and 07' up till right now.

Nola213, a few days ago, a knowledgeable subscriber told George that with 1 being a perfect correlation...the 2007 parallel to the weeks prior to the crash of 1987, was running about .91

This correlation was probably influenced [temporarily] by yesterday's pump. Continued Fed market intervention on the scale of the past couple of weeks must be reeking havoc on the technicals. I wonder how much yesterday's rally actually cost them? Looking at the chart, it appears the DJIA would trade more or less flat today & tomorrow with a downward bias...show increasing weakness throughout most of next week...then...BUNKER-TIME!

We'll see I guess.

I think it is just an insiders view of the subprime "teaser rates" expiring which should send a wave of eminent foreclosures through the market

place. The subsequent panic could/should cause a sell off. Not to mention the FED rate will

come into play on the 23rd of September. well that and the fact that the sky is falling

come into play on the 23rd of September. well that and the fact that the sky is falling

Guys, this thing has legs like you wouldn't believe. I don't know what the ramifications are but lots of crazy stuff going on.

www.bloomberg.com...

Heavy options activity in chinese stocks by forbes

Trader vanishes by the mail

S&P names new President after previous one QUITS by bloomberg

And those are just a few of the stories in the MSM i believe are related. Something is definately going on. Want more?

They are talking about it here

Even Cramer's site mentions it

So, what's going on? Hell if I know. Looks like lots of people with tons of money around the world are betting on a major EVENT that brings global markets down. I'm trying to decide if i should buy my first put against the market or liquidate and like Brain says in Gremlins 2 "put it all in canned goods and shotguns". Even our "great leader" is getting in on it.

Bush to Offer Proposals To Ease Mortgage Crisis by Washington Post

So what does everyone think about this thing? I know that Fear and Greed are the primary market movers. So which is it? What are they trying to get the retail investor to do? Keep the faith, or run like hell? Bernake speaks tommorrow, the market could easily go either way BIG. It's not supposed to happen on the Friday before Labor day. Wallstreet seems to be expecting a bailout, will they get it?

If you're invested (I am but if I lost every penny, I'd not be in horrible shape) what are you gonna do? I'd love to make some money off of this, I'll be up early to see if there is an advantage to be had one way or the other. Heck you may even be able to win on both ways if Ben says something favorable to the Street tommorrow and we get a bump and things flush a couple of weeks down the road anyway.

It's interesting and exciting, and with everything else going on, this may be showtime.

(as always, in all things financial I could be (and probably am) wrong) I hope i'm wrong about showtime.)

[edit on 31-8-2007 by jefwane]

www.bloomberg.com...

Heavy options activity in chinese stocks by forbes

Trader vanishes by the mail

S&P names new President after previous one QUITS by bloomberg

And those are just a few of the stories in the MSM i believe are related. Something is definately going on. Want more?

They are talking about it here

Even Cramer's site mentions it

So, what's going on? Hell if I know. Looks like lots of people with tons of money around the world are betting on a major EVENT that brings global markets down. I'm trying to decide if i should buy my first put against the market or liquidate and like Brain says in Gremlins 2 "put it all in canned goods and shotguns". Even our "great leader" is getting in on it.

Bush to Offer Proposals To Ease Mortgage Crisis by Washington Post

So what does everyone think about this thing? I know that Fear and Greed are the primary market movers. So which is it? What are they trying to get the retail investor to do? Keep the faith, or run like hell? Bernake speaks tommorrow, the market could easily go either way BIG. It's not supposed to happen on the Friday before Labor day. Wallstreet seems to be expecting a bailout, will they get it?

If you're invested (I am but if I lost every penny, I'd not be in horrible shape) what are you gonna do? I'd love to make some money off of this, I'll be up early to see if there is an advantage to be had one way or the other. Heck you may even be able to win on both ways if Ben says something favorable to the Street tommorrow and we get a bump and things flush a couple of weeks down the road anyway.

It's interesting and exciting, and with everything else going on, this may be showtime.

(as always, in all things financial I could be (and probably am) wrong) I hope i'm wrong about showtime.)

[edit on 31-8-2007 by jefwane]

reply to post by SevenThunders

You are completely right by saying that the real winners are the market maker, and selling options generally yields more profit than buying (covered or otherwise). I myself am more experienced in Forex Options which I am sure is more volitile and "implied volitility" is also a major component in the premium associated with an option. Thanks for sharing your perspective.

You are completely right by saying that the real winners are the market maker, and selling options generally yields more profit than buying (covered or otherwise). I myself am more experienced in Forex Options which I am sure is more volitile and "implied volitility" is also a major component in the premium associated with an option. Thanks for sharing your perspective.

Dispelling the 'Bin Laden' Options Trades

www.thestreet.com...

By Steven Smith and Aaron L. Task

Staff Reporters

8/30/2007 3:23 PM EDT

Posted on The Street.

www.thestreet.com...

By Steven Smith and Aaron L. Task

Staff Reporters

8/30/2007 3:23 PM EDT

Posted on The Street.

Originally posted by RogerT

Dispelling the 'Bin Laden' Options Trades

www.thestreet.com...

By Steven Smith and Aaron L. Task

Staff Reporters

8/30/2007 3:23 PM EDT

Posted on The Street.

Great article and great find.

Although, the ending of the article expresses some skepticism as to why the spreads were so deep. I still hold that those who engaged in this hedged what if's in two scenarios: One, that the Fed will hold rates on Sept. 18 or that two, the Fed actually would cut rates by more than fifty basis points.

As I stated before, if the Fed doesn't cut interest rates for fear of further destabilizing the dollar worldwide (which I think is a very likely scenario), then the market will roil and the S&P could conceivably drop by 700 points as investors take their money and run. In fact, I think the German banking conglomerates (or what we call syndicates) are pressuring Bernanke to do just that. There was a good story on NPR today about the growing number of German bank bailouts because of heavily investing in our mortgage debt, and how banking leaders fear a rate cut.

But since the market has already priced in a 1/2 a percent interest rate cut, if the Fed were to cut the rate by even 2/3's, there could be a huuuuge market rally. So, bet on an extreme upside and bet on an extreme downside, and you'll likely land somewhere inbetween.

The market is up this morning, Dow is up over 120 points. Should be interesting to see what it does after Bush and Bernanke talk about mortgages and

the economy.

This may have been answered in this thread or another but I'm still very confused as to how large transactions, or any trasactions for that matter, can be done anonymously. I would love it if my investments were suddenly able to be hidden from the prying eyes and grabbing hands of the Government and IRS but that's never going to happen! Even investments that I have overseas are required to be reported to the IRS. How is it that ANY investment, especially those in the millions and billions of dollars, can remain anonymous when money is paid out?

Jemison

This may have been answered in this thread or another but I'm still very confused as to how large transactions, or any trasactions for that matter, can be done anonymously. I would love it if my investments were suddenly able to be hidden from the prying eyes and grabbing hands of the Government and IRS but that's never going to happen! Even investments that I have overseas are required to be reported to the IRS. How is it that ANY investment, especially those in the millions and billions of dollars, can remain anonymous when money is paid out?

Jemison

Originally posted by RogerT

Dispelling the 'Bin Laden' Options Trades

www.thestreet.com...

By Steven Smith and Aaron L. Task

Staff Reporters

8/30/2007 3:23 PM EDT

Posted on The Street.

From source:

...confirmed that the trades are part of a "box-spread trade."

"This was done as a package in which the box spread was used [as a] means of alternative financing at more attractive interest rates" []

Simply put, two parties agree to trade the box at a price that essentially splits the difference between current rates.

For example, the rough numbers would be that given the September 700/1700 box must settle at a value of 1,000 -- it is currently trading around 997 -- that translates into a 5% interest rate.

For the seller it is a way to borrow money at a slight discount to the prevailing rate, and for the buyer, it is a way to lend money at a low rate of return, but it's better than nothing[]

I'm still a little lost. Can someone elucidate?

Why would someone go this far out of their way to borrow money?

Why annonymously?

Where does a billion dollars come from without being traceable and public knowlege? What is the billion dollars being used for?

Why impose scare tactics upon the market?

Terror? Staged Terror?

Is that what this whole "impending staged terror attack" is all about...

a financial scare by the (insert your nemesis here)?

I mean... what was that? A crazy unanounced, annonymous, HUGE bet that the market will nosedive? Who are these people? Who does things like this? What country are they from?

A billion dollar bet; hanging out there annonmously for a week. "The sky is fall! The sky is falling!" Thats 35,000 brand new volkswagon beetles. 12,000 miles of 2x12 structural lumber; enough to go around the world. About the gross domestic product of Greenland, Gaza strip, or British Virgin Islands.

"This was done as a package in which the box spread was used as a means of alternative financing at more attractive interest rates"

I have a house to refinance on... usually the bank tells me what rate I get. How do I sign up for box spreads as a mean of alternative financing at more attractive interest rates? Maybe I'm just ignorant... you guys all have box spreads with attractive rates. Right?

I've got good credit. Where do I sign up?

I earn my living cutting boards and driving nails.

I am,

Sri Oracle

In the spiritual desert things are not what they seem

snakes camouflaged just fit the scene

Put your faith in a mirage it's just a smoke screen

-matisyahu

I hope this clears up some questions of how someone can trade anonymously-

Ok. Imagine if you owned all the nails and your buddy owned all the hammers

You agree to sell your buddy nails for 10% less than the standard price

and your buddy agrees to sell you hammers for 10% less than standard.

Now everybody that wants to build a house has to go through you two guys

because you own all the tools, then you would be a "market maker". You can sell the hammers and nails for whatever the market will bear, except when your buddy wants to buy nails you sell it to him for 10% less(discount rate)

You can also create other sweetheart deals with other buyers, you can also hoard nails and only sell them to your discount buddies, who in turn will resell them for a profit.

You can also change the discount agreement with your buddy to keep the market flowing with new money.

Its the new investor money that drives the market. Once an investor puts money into the market. the Market Makers use the new income to generate volatility, which generates exchange profits(transaction fees,ect.) for the market makers as investor jump from stock to stock and option to option

This exchange income is then traded between the market makers like an office party slush fund, it can be used to buy stocks in order to drive up the price or it can be used to hold positions to keep out unwanted investor action

The "market" allows you to make deals based on the promise of a realized profit(options) You can then discount your options and sell to your "market maker" buddies.

Now because the options and profits from the discount rates are not realized(cashed out) you can trade them for whatever you want: cash, tickets to the game, a ride to work, whatever. These are basically favors

that are traded between market makers and they can be for billions of dollars. The favors are gentlemens agreements(backed by legal documents) that carry no per trade bonded identification. This is how you can trade anonymously.

Yes, the market is a big fraternity and if you don't know the secret hand shake you get the flat beer

The key is to own a lot of stuff that other people need or want.

so its good work in you can find it

Ok. Imagine if you owned all the nails and your buddy owned all the hammers

You agree to sell your buddy nails for 10% less than the standard price

and your buddy agrees to sell you hammers for 10% less than standard.

Now everybody that wants to build a house has to go through you two guys

because you own all the tools, then you would be a "market maker". You can sell the hammers and nails for whatever the market will bear, except when your buddy wants to buy nails you sell it to him for 10% less(discount rate)

You can also create other sweetheart deals with other buyers, you can also hoard nails and only sell them to your discount buddies, who in turn will resell them for a profit.

You can also change the discount agreement with your buddy to keep the market flowing with new money.

Its the new investor money that drives the market. Once an investor puts money into the market. the Market Makers use the new income to generate volatility, which generates exchange profits(transaction fees,ect.) for the market makers as investor jump from stock to stock and option to option

This exchange income is then traded between the market makers like an office party slush fund, it can be used to buy stocks in order to drive up the price or it can be used to hold positions to keep out unwanted investor action

The "market" allows you to make deals based on the promise of a realized profit(options) You can then discount your options and sell to your "market maker" buddies.

Now because the options and profits from the discount rates are not realized(cashed out) you can trade them for whatever you want: cash, tickets to the game, a ride to work, whatever. These are basically favors

that are traded between market makers and they can be for billions of dollars. The favors are gentlemens agreements(backed by legal documents) that carry no per trade bonded identification. This is how you can trade anonymously.

Yes, the market is a big fraternity and if you don't know the secret hand shake you get the flat beer

The key is to own a lot of stuff that other people need or want.

so its good work in you can find it

Given the HUGE amount of attention these trades have garnered, it would be impossible for someone to collect on these contracts. After a major

terrorist attack, these people would be the prime suspects.

Hence, it makes sense that there has been a recent "effort" to downplay and ignore these highly suspicious trades.

Hence, it makes sense that there has been a recent "effort" to downplay and ignore these highly suspicious trades.

I've heard no mention here of the Chinese though I'm told they could crash the market overnight by simply dumping their american debt. Moneywise

folks..Is this real or just another conspiracy legend?

Also someome said the deployment of the Jeb Bush National Guard to Wash D.C. was just normal troop rotation? Who are they relieving? Which guard will be pulling out and returning home?

And finally, after so many years of this war on terrror in Iraq and the creation of Homland Security and passage of the Patriot Act etc. etc. I hear Al Krazy's are as strong as ever and we are still expecting terrorist attacts on U.S. soil but have no idea exactly when or where. So what have you guys acccomplished in the last six years? Isn't this where we were in '01 ?

Right after 911 the average joe on the street could have predicted more terror attacks although he couldn't say where or when. So how many tens of millions were spent to create a HS office so a Washington official could say exactly the same thing?

Expect an attack. Probably a false-flag operation. Fear has worked so well at keeping the masses in line for so long I doubt they'll abandon the formula now.

Also someome said the deployment of the Jeb Bush National Guard to Wash D.C. was just normal troop rotation? Who are they relieving? Which guard will be pulling out and returning home?

And finally, after so many years of this war on terrror in Iraq and the creation of Homland Security and passage of the Patriot Act etc. etc. I hear Al Krazy's are as strong as ever and we are still expecting terrorist attacts on U.S. soil but have no idea exactly when or where. So what have you guys acccomplished in the last six years? Isn't this where we were in '01 ?

Right after 911 the average joe on the street could have predicted more terror attacks although he couldn't say where or when. So how many tens of millions were spent to create a HS office so a Washington official could say exactly the same thing?

Expect an attack. Probably a false-flag operation. Fear has worked so well at keeping the masses in line for so long I doubt they'll abandon the formula now.

new topics

-

The good, the Bad and the Ugly!

Diseases and Pandemics: 1 hours ago -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 4 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 5 hours ago -

Russia Flooding

Other Current Events: 6 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 7 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 7 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 7 hours ago -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 10 hours ago -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 10 hours ago -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 10 hours ago

top topics

-

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 14 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 10 hours ago, 11 flags -

Elites disapearing

Political Conspiracies: 12 hours ago, 9 flags -

Freddie Mercury

Paranormal Studies: 15 hours ago, 7 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 5 hours ago, 7 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 7 hours ago, 5 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 7 hours ago, 5 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 12 hours ago, 5 flags -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media: 10 hours ago, 4 flags -

Why did Phizer team with nanobot maker

Medical Issues & Conspiracies: 10 hours ago, 4 flags

active topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 81 • : RussianTroll -

Abortions in first 12 weeks should be legalised in Germany, commission says

Medical Issues & Conspiracies • 27 • : Vermilion -

Elites disapearing

Political Conspiracies • 23 • : chiefsmom -

Israel ufo shoot down drones?

Aliens and UFOs • 27 • : Brigadier1970 -

Former NYT Reporter Attacks Scientists For Misleading Him Over COVID Lab-Leak Theory

Education and Media • 4 • : Vermilion -

Russia Flooding

Other Current Events • 4 • : Dalamax -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 8 • : FlyersFan -

I Guess Cloud Seeding Works

Fragile Earth • 22 • : Degradation33 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 520 • : cherokeetroy -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness • 9 • : Myhandle