It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Many people on ATS have praised DT over his tax cut plan without knowing all the facts. Taxes will be going up in 2021 but don't blame Biden, the GOP

is behind this one.

The GOP planned the tax hike way back in 2017 when Donald Trump passed the 2017 Tax Cuts and Jobs Act and calculated the plan would cause a tax increase after the 202O election regardless of who won the election.

To pay for the tax cut, an automatic increase is planned for this year with stepped increases every two years. The bill will affect 65% of Americans who make income under $75,000 and leaving the extremely wealthy unscathed.

This will undoubtedly spark the Republicans to blame Biden when the tax increases were reckoned when the 2017 Tax Cuts and Jobs Act was passed. The stepped increases will reach full maturity by 2027.

Joe Biden, the GOP's political tool in office.

Taxes Going up in 2021 Due to GOP-Passed Bill

The GOP planned the tax hike way back in 2017 when Donald Trump passed the 2017 Tax Cuts and Jobs Act and calculated the plan would cause a tax increase after the 202O election regardless of who won the election.

To pay for the tax cut, an automatic increase is planned for this year with stepped increases every two years. The bill will affect 65% of Americans who make income under $75,000 and leaving the extremely wealthy unscathed.

This will undoubtedly spark the Republicans to blame Biden when the tax increases were reckoned when the 2017 Tax Cuts and Jobs Act was passed. The stepped increases will reach full maturity by 2027.

Joe Biden, the GOP's political tool in office.

Taxes Going up in 2021 Due to GOP-Passed Bill

edit on 29-1-2021 by eManym because: (no reason given)

edit on 29-1-2021 by eManym because: (no reason

given)

Biden can be a hero by making the current tax cut permanent, and lowering the Federal tax rate even further.

The ball is now in President Biden's court.

The ball is now in President Biden's court.

a reply to: carewemust

I doubt if he could get congress to go along with that. Why didn't Trump make his tax plan permanent?

I doubt if he could get congress to go along with that. Why didn't Trump make his tax plan permanent?

edit on 29-1-2021 by eManym because: (no reason given)

originally posted by: carewemust

Biden can be a hero by making the current tax cut permanent, and lowering the Federal tax rate even further.

The ball is now in President Biden's court.

The Trump tax plan raises taxes on the middle class every year until 2027. But none of you ever talk about that. Just the meager cuts for the first two years.

That’s the only part any of you acknowledge.

Well, if Biden's hand isn't cramped from signing all those executive orders, I'm sure he could manage one more to fix this......unless of course he's

in favor of higher taxes.....

a reply to: MiddleInsite

Yeah, I don't think he'll do that. Biden is the epitome of the rich, white corrupt corporatist. It'll be the middle to lower class that cops the brunt of his tax policies.

Yeah, I don't think he'll do that. Biden is the epitome of the rich, white corrupt corporatist. It'll be the middle to lower class that cops the brunt of his tax policies.

originally posted by: MiddleInsite

OR,

Biden can tax the piss out of the rich. How about that?

That's where all the money is.

a reply to: Flatcoat

OR,

His lackeys can start making calls to brokerages to save his rich hedge fund friends from their sneaky investments.

Actions seem to be speaking louder than words on how Biden feels about the peasants.

Us regular folks are looked down on as a necessary annoyance. If they could have what they have without having to rely on us to pay for what they have

they’d get rid of us.

That’s why you see the Uber rich doing what they do.

That’s why you don’t see regular folks friends with the elite, they despise us.

That’s why you see the Uber rich doing what they do.

That’s why you don’t see regular folks friends with the elite, they despise us.

originally posted by: eManym

a reply to: carewemust

I doubt if he could get congress to go along with that. Why didn't Trump make his tax plan permanent?

Part of the problem is that not enough people pay taxes, and that is one both ends of the spectrum. Wealthy people pay too much on paper, but they have the loopholes in the code to exploit. Poorer people just in general get to write all their liability off and then see no reason who tax rates cannot go up forever because they never feel any of the responsibility at tax time.

So, yeah, people who don't make as much need to feel it when tax man cometh so they think twice about endorsing paying their fair share because they don't do it now, but they need to just as much as rich guy who can pay an accountant to figure out how to hide his money from the percentage he's supposed to pay.

Remember, straight percentage doesn't matter when you can slide that money around in ways that avoid it.

a reply to: wheresthebody

No.

The progressive tax rate is the issue. You make the percentage too high and people start demanding loopholes and write-offs.

You want to know why corporations pay nothing? It's because they have exemptions they take advantage of in the code. Politicians use those to determine their special winners and losers in specific industries. Some industries or corporations can effectively write off enough to more or less pay zero. This works with the super rich too.

Meanwhile, the people at the bottom have the ability to not even be liable. During the Obama years, that was roughly 47% of US "tax payers".

A flat rate percentage for everyone top to bottom regardless of entity with no exemptions would be the easiest and fairest system.

No.

The progressive tax rate is the issue. You make the percentage too high and people start demanding loopholes and write-offs.

You want to know why corporations pay nothing? It's because they have exemptions they take advantage of in the code. Politicians use those to determine their special winners and losers in specific industries. Some industries or corporations can effectively write off enough to more or less pay zero. This works with the super rich too.

Meanwhile, the people at the bottom have the ability to not even be liable. During the Obama years, that was roughly 47% of US "tax payers".

A flat rate percentage for everyone top to bottom regardless of entity with no exemptions would be the easiest and fairest system.

edit on 29-1-2021 by ketsuko because: (no reason given)

a reply to: ketsuko

Seems to me the people with all the time on their hands to protest constantly for 4 years , destroy cities and businesses are not paying their fair Share.

I have a job and could never afford to protest day in and day out.. You know the SAME Crowd today shouting UNITY which for 4 years that pledged to #Resist the 45 POTUS at every turn.

Politicians screaming to rally the anarchists to make the USA Fail , because the direction wasn't marxist, are now trying to look like the adults in the room while their diapers are full of #e for the world to see. Not a good look, but politicians don't care in fact I believe most enjoy it.

NOW we are facing tax increases to cover a China Virus impact, business loss due to unwarranted shut-downs, unemployment , a total technology shift with energy ...and all this is a grand scheme to judas goat every human into the reality of the left.

Now they want to undo the Wall yet want to build one to protect themselves .... The Irony of the situation is absolutely a slap to any Freedom loving Human on the planet.

And them Electric cars - lol - The plan at first is you can buy one - But this will be pay as you go sooner than later with Credit scores and getting charged per mile will determine your ability to travel ... But think about it ... You don't own anything under Communism.

Taxes to subsidize this insane Administrations attempts at forcing what the UN wants is off the hook.

The Meme below is more true today than anytime in the history of the USA

Seems to me the people with all the time on their hands to protest constantly for 4 years , destroy cities and businesses are not paying their fair Share.

I have a job and could never afford to protest day in and day out.. You know the SAME Crowd today shouting UNITY which for 4 years that pledged to #Resist the 45 POTUS at every turn.

Politicians screaming to rally the anarchists to make the USA Fail , because the direction wasn't marxist, are now trying to look like the adults in the room while their diapers are full of #e for the world to see. Not a good look, but politicians don't care in fact I believe most enjoy it.

NOW we are facing tax increases to cover a China Virus impact, business loss due to unwarranted shut-downs, unemployment , a total technology shift with energy ...and all this is a grand scheme to judas goat every human into the reality of the left.

Now they want to undo the Wall yet want to build one to protect themselves .... The Irony of the situation is absolutely a slap to any Freedom loving Human on the planet.

And them Electric cars - lol - The plan at first is you can buy one - But this will be pay as you go sooner than later with Credit scores and getting charged per mile will determine your ability to travel ... But think about it ... You don't own anything under Communism.

Taxes to subsidize this insane Administrations attempts at forcing what the UN wants is off the hook.

The Meme below is more true today than anytime in the history of the USA

edit on 1292021 by MetalThunder because: (no reason given)

a reply to: MetalThunder

They've already told us the taxes are going up. Team 80million are going to raise rates far in excess of anything Trump's plans were going to do, and they will raise them on everyone Raimondo admitted as much in her confirmation hearing.

They've already told us the taxes are going up. Team 80million are going to raise rates far in excess of anything Trump's plans were going to do, and they will raise them on everyone Raimondo admitted as much in her confirmation hearing.

a reply to: eManym

People tried this same tactic when Obama let Bush's tax cuts lapse, too. Biden is on his way to reversing everything Trump did, including the tax cuts that Biden could easily keep in motion. He said it himself when he said he'd be reversing everything. Then he said he wouldn't be raising taxes and kamal backed him up.

Did you forget all of that? It hasn't even been 4 months since then.

People tried this same tactic when Obama let Bush's tax cuts lapse, too. Biden is on his way to reversing everything Trump did, including the tax cuts that Biden could easily keep in motion. He said it himself when he said he'd be reversing everything. Then he said he wouldn't be raising taxes and kamal backed him up.

Did you forget all of that? It hasn't even been 4 months since then.

originally posted by: eManym

a reply to: carewemust

I doubt if he could get congress to go along with that. Why didn't Trump make his tax plan permanent?

Trump could and would have made it permanent if he was re-elected, which was his plan. Again, the ball in Joe's court.

You guys do not know how the Federal government works, in order to fun all the spending that now Biden is signing with EOs he is going to need

money.

Federal government do not make money they get their money with taxation, soo yes get ready for the tax increase and bend over everybody.

When a president makes a gesture to ease taxes on the public is just that a gesture, but without taxation the Federal government can not work.

All those trillions of dollar been promised to foreign countries and the pans for all that green energy is not free, first it have to give away funding for projects before money can be generated into the economy.

www.ced.org...

Federal government do not make money they get their money with taxation, soo yes get ready for the tax increase and bend over everybody.

When a president makes a gesture to ease taxes on the public is just that a gesture, but without taxation the Federal government can not work.

All those trillions of dollar been promised to foreign countries and the pans for all that green energy is not free, first it have to give away funding for projects before money can be generated into the economy.

The chief way the government gets the money it spends is through taxation. Figure 1 shows the relative sizes of sources of federal government tax revenues. Forty-five percent of federal tax revenue comes from individuals’ personal income taxes. Another 39 percent comes from Social Security and Medicare withholdings. Since half of Social Security and Medicare taxes come directly out of people’s paychecks, about 65 percent of taxes the federal government collects come from individuals. Thirty-two percent of taxes come to the government from corporations. Estate and gift taxes, sources of significant debate, account for only 1 percent of federal tax revenues.

www.ced.org...

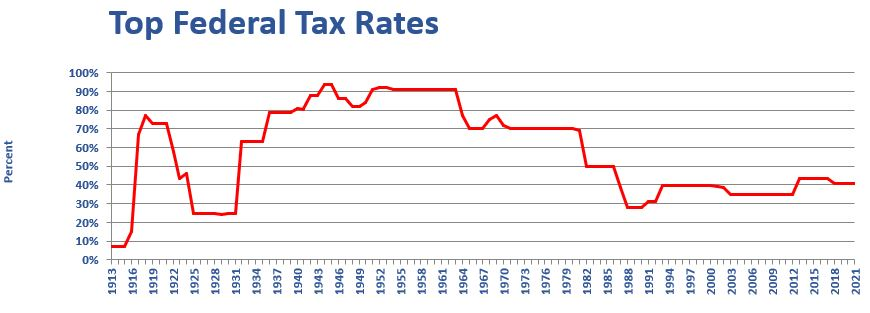

The chart below from - History of Federal Income Tax Rates: 1913

– 2021

Shows tax rates decreasing from 1964 to 1989 then a gradual increase from there to present.

Current tax rates a historically low. Of course the chart only displays the top tax bracket but its all relative.

Shows tax rates decreasing from 1964 to 1989 then a gradual increase from there to present.

Current tax rates a historically low. Of course the chart only displays the top tax bracket but its all relative.

edit on 29-1-2021 by eManym

because: (no reason given)

new topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 1 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 3 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 7 hours ago -

Electrical tricks for saving money

Education and Media: 10 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 12 hours ago, 10 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 16 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 13 hours ago, 4 flags -

Electrical tricks for saving money

Education and Media: 10 hours ago, 4 flags -

Sunak spinning the sickness figures

Other Current Events: 12 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 14 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 3 hours ago, 2 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 7 hours ago, 0 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 1 hours ago, 0 flags

active topics

-

Late Night with the Devil - a really good unusual modern horror film.

Movies • 5 • : chiefsmom -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 33 • : andy06shake -

Sunak spinning the sickness figures

Other Current Events • 11 • : McUrnsalso -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 6 • : ImagoDei -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 1 • : PorkChop96 -

Reason of the Existence

The Gray Area • 20 • : belkide -

Black mirror, what happened.

Television • 20 • : seekshelter -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 25 • : andy06shake -

Russia Ukraine Update Thread - part 3

World War Three • 5730 • : Arbitrageur -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 43 • : Hakaiju