It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The payment schedule makes sense as Social security payments are mailed on the 15th or the 2d Wednesday of the month which ever comes last. There are

no doubt many people are in a world of hurt without money for necessaries. Let us hope those in need do indeed get the checks without a bunch of

bureaucratic screw ups.

nypost.com...

A senior Treasury official told Fox News on Friday that by the middle of next week, tens of millions of eligible Americans will have money from the federal government directly deposited into their bank accounts.

The official told Fox News that the Treasury will transmit the batch of payments to the Federal Reserve for distribution to financial institutions across the nation. Those financial institutions will then distribute the payments into Americans’ bank accounts.

The official explained that this first batch of payments will be received by Americans who filed their taxes in 2018 and/or in 2019 and received a refund via direct deposit.

Filers who did not receive a refund electronically in the last tax year will soon be able to expedite their payment by submitting their bank information to the IRS via the “Get My Payment” app, which the federal government is launching next week.

Those who do not file taxes are now able to go to the IRS website and use the “Non-Filers: Enter Payment Info Here” section to enter their bank information in order to receive their payment faster than they would via regular mail.

nypost.com...

Hells yyeah. Gimme some money! Better me than some goddamnnbank.

a reply to: IAMALLYETALLIAM

The security of the application site I'm sure leaves a bit to be desired.

The security of the application site I'm sure leaves a bit to be desired.

a reply to: 727Sky

I use a card that has direct deposit 2 days faster so I got it Friday. Credit unions have the same thing but most banks hold your deposits. If a deposit is sent Friday evening, you'd get it Wednesday morning with it pending Tuesday.

Half of it goes to paying a couple fines, renewing insurance for a few months and renewing expired registration. I've been taking the bus to and from work and getting rides/ubers home late at night since February. The DMV offices are closed but they're doing everything over the phone and via mail. 👍

I use a card that has direct deposit 2 days faster so I got it Friday. Credit unions have the same thing but most banks hold your deposits. If a deposit is sent Friday evening, you'd get it Wednesday morning with it pending Tuesday.

Half of it goes to paying a couple fines, renewing insurance for a few months and renewing expired registration. I've been taking the bus to and from work and getting rides/ubers home late at night since February. The DMV offices are closed but they're doing everything over the phone and via mail. 👍

edit on 12-4-2020 by FlyingSquirrel because: (no reason given)

As long as you filed a tax return you should get it.

Im an expat, vet living in the UK and I am supposed to get one. I need some stimulus. Quarantine is boring the bejejus outta me.

a reply to: musicismagic

Im an expat, vet living in the UK and I am supposed to get one. I need some stimulus. Quarantine is boring the bejejus outta me.

a reply to: musicismagic

originally posted by: musicismagic

Is it just for Americans living in America only?

If you get social security I would bet you will get it deposited where you social security check gets deposited every month.

IAMALLYETALLIAM

As far as this being screwed up like the Obama health care web site (which was due to nepotism and unqualified idiots not knowing what they were doing) I will bet it will not happen. Furthermore people will get fired if they screw this up instead of taking the millions and retiring like the Obama care web designers did..

edit on 727thk20 by 727Sky because: (no reason given)

a reply to: ArMaP

Folks who get refunds by check will get a check. People who didn't get refunds at all will get a check unless they register their bank info to get direct deposit.

I get SS direct deposit every month so I know this will just happen for me but those who don't have that info on file with the IRS will get a check but it might take five months to get to you.

Folks who get refunds by check will get a check. People who didn't get refunds at all will get a check unless they register their bank info to get direct deposit.

I get SS direct deposit every month so I know this will just happen for me but those who don't have that info on file with the IRS will get a check but it might take five months to get to you.

a reply to: musicismagic

It's for every tax payer or SS recipient. Whether you get a refund or not.

The limits are in the income field. Over 75K for an individual and 150K for a couple.

It's for every tax payer or SS recipient. Whether you get a refund or not.

The limits are in the income field. Over 75K for an individual and 150K for a couple.

I wonder if we unlucky bastards that owe the IRS will get it?

Damn, I hope so, but the answer seems kind of elusive, and I really wouldnt be surprised if they just kept mine , lol

Damn, I hope so, but the answer seems kind of elusive, and I really wouldnt be surprised if they just kept mine , lol

Found this Forbes article for you with a bit of shoe box money advice, lol.

originally posted by: Maverick1

I wonder if we unlucky bastards that owe the IRS will get it?

Damn, I hope so, but the answer seems kind of elusive, and I really wouldnt be surprised if they just kept mine , lol

“If people are worried about debt collectors, they should take the money out right away,” says Lauren Saunders, Associate Director at the National Consumer Law Center. The NCLC advises those consumers who are at risk of garnishment to keep a close eye on their accounts and move the money out as soon as it arrives by withdrawing it as cash, transferring it electronically, or using it to pay for groceries or other essentials.

The federal government, on the other hand, will not be able to take money you owe for defaulted federal student loans or back taxes out of a stimulus check. It will be able to take the money for back child support. (The CARES Act also blocks the IRS from taking money from your tax refund for defaulted student loans.)

So you *SHOULD be fine.........

Source: www.forbes.com...=158670077297 68&referrer=https%3A%2F%2Fwww.google.com&_tf=From%20%251%24s

edit on 12-4-2020 by Arnie123 because: (no reason given)

edit

on 12-4-2020 by Arnie123 because: (no reason given)

I noticed they say that the money will be sent to "those eligible", so I went looking for what makes someone eligible for this aid.

I found this page, is that information correct?

Here are what I found about being eligible for the aid.

I found this page, is that information correct?

Here are what I found about being eligible for the aid.

Who’s eligible for a check from the government?

Congress will spend about $250bn for checks up to $1,200 per person that will go directly to taxpayers.

To be eligible for the full amount, a person’s most recently filed tax return must show that they made $75,000 or under. For couples, who can receive a maximum of $2,400, the cutoff is $150,000.

If a person makes more than $75,000, the amount given goes down incrementally by $5 for every $100 increase in salary. So a person who makes $85,000 would get $700 while a person who makes $95,000 would get $200.

If a person makes above $99,000, or a couple makes above $198,000, no check will be given.

There are some requirements and exceptions. Those getting a check must be living and working in the US and have a valid social security number. If a person is listed as a dependent on their parents’ tax return – the case for many college students – they are excluded.

What about parents?

Taxpayers will be given $500 per child 16 or under listed as a dependent on their latest tax return.

What if a person did not file their 2018 or 2019 return?

The IRS recommends people file their 2018 or 2019 tax return as soon as possible to get the payment. A check will be sent to any qualified person so long as they file their return within 2020.

What if a person does not file their taxes?

A person may still be eligible even if they do not file the taxes. The IRS says people who typically do not file taxes – low-income taxpayers and some veterans – will need to file a “simple tax return” in order to get the payment. Social security beneficiaries will not need to fill out the tax return, even if they do not file their taxes, to get the payment.

a reply to: Maverick1

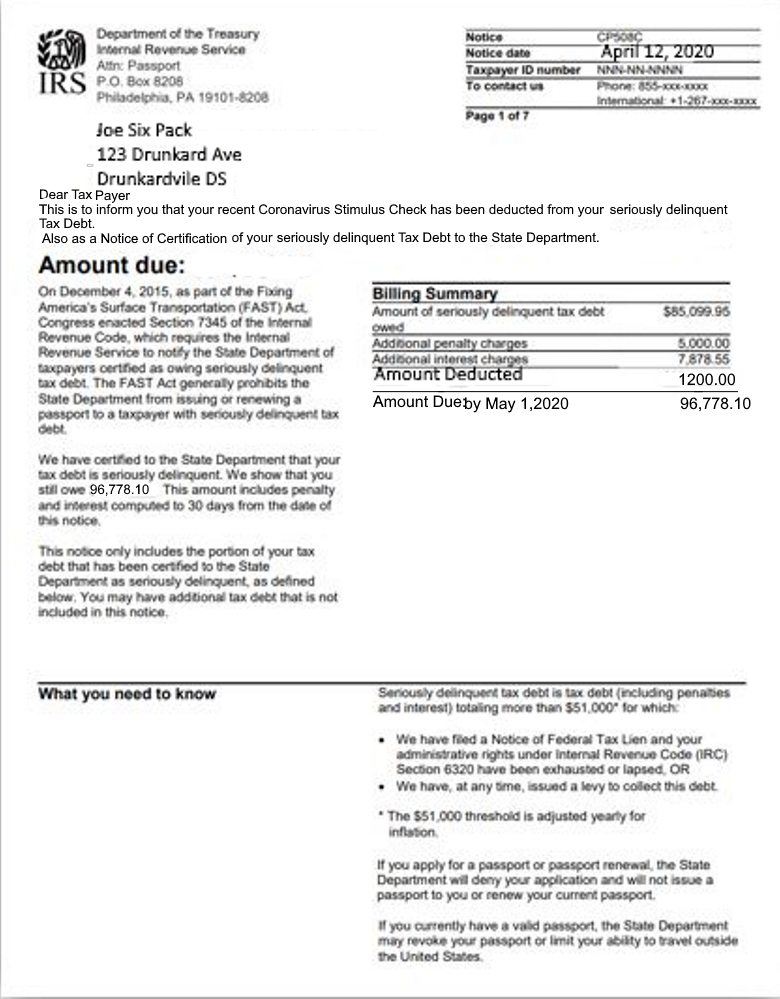

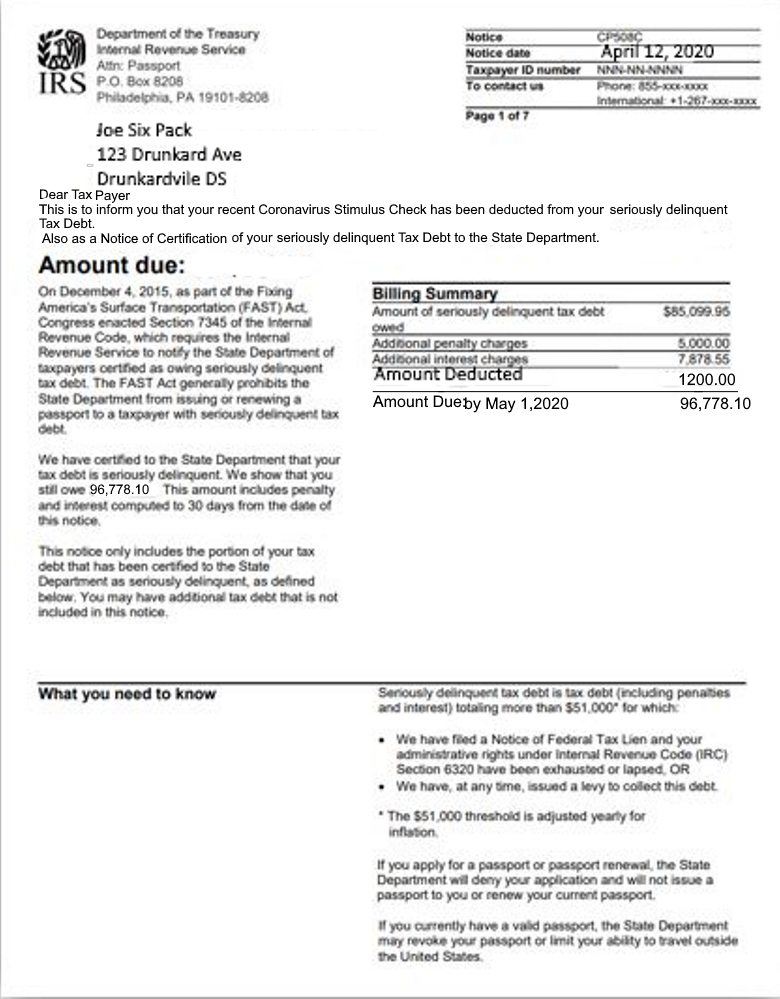

Dear Tax Payer,

ETA: this is not a official IRS letter, posted as entertainment purposes only.

I wonder if we unlucky bastards that owe the IRS will get it? Damn, I hope so, but the answer seems kind of elusive, and I really wouldnt be surprised if they just kept mine , lol

Dear Tax Payer,

ETA: this is not a official IRS letter, posted as entertainment purposes only.

edit on 12-4-2020 by hounddoghowlie because: (no reason

given)

new topics

-

Sunak spinning the sickness figures

Other Current Events: 23 minutes ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 34 minutes ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 2 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 3 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 5 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 7 hours ago -

Bobiverse

Fantasy & Science Fiction: 10 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 10 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 10 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 14 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 3 hours ago, 7 flags -

This is our Story

General Entertainment: 17 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 12 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 10 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 2 hours ago, 2 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 5 hours ago, 0 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 34 minutes ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 113 • : Zanti Misfit -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 30 • : annonentity -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 55 • : Zanti Misfit -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 36 • : anthelion -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 481 • : firerescue -

Truth Social goes public, be careful not to lose your money

Mainstream News • 124 • : lilzazz -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 145 • : Annee -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 2 • : Consvoli -

Sunak spinning the sickness figures

Other Current Events • 0 • : annonentity -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 9 • : ImagoDei