It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: burdman30ott6

Except they've been struggling to keep crude oil up long before the corona virus outbreak started. They keep coming up with excuses every time to keep the illusion of a strong economy.

Meanwhile they just printed something like 45 billion dollars last night alone to prop up system.

It's all a distraction.

Except they've been struggling to keep crude oil up long before the corona virus outbreak started. They keep coming up with excuses every time to keep the illusion of a strong economy.

Meanwhile they just printed something like 45 billion dollars last night alone to prop up system.

It's all a distraction.

a reply to: booyakasha

no the market is crashing because the worlds second largest economy and manufacturing base is shutdown, the supply chain is completely #ed and inventories are going to dry up

this is going to crash the market this isn't a joke

no the market is crashing because the worlds second largest economy and manufacturing base is shutdown, the supply chain is completely #ed and inventories are going to dry up

this is going to crash the market this isn't a joke

a reply to: burdman30ott6

When not being directly manipulated, the market isn't as complex as most think it is.

As John Kenneth Galbraith said, the 'derivatives market' is "highly sophisticated Stupidity"

and they have ALWAYS been "manipulated" since their inception a few hundred years ago

a reply to: booyakasha

I disagree. Ultimately, oil is one of the few remaining true "supply and demand" commodities remaining. The simple fact is that artificial regulations (with ridiculously histrionic rationales) caused oil price spikes over the last 2 decades. Some folks want oil prices through the roof, most do not. That said, there is a price of about $25-$30 per barrel which is the true floor of oil, any lower and it simply wont be pumped or sold at all because it would become a loss. I think the current $50 a barrel is an manipulated price point based on what we have seen in real growth and demand over the past 5-8 years. That demand, however, is SERIOUSLY threatened by this virus. If they dont get a handle on in in the next 2 weeks, and especially if China remains effectively shut down for all of February (as they frighteningly seem resigned to in Beijing) we will see tremendous pressure on oil exporting countries to cut production... if those cuts exceed 20%, then this world is in for a nasty economic recession that will probably be worse than 2008 because, unlike 2008, this one will be driven by a tangible and measurable physical crisis rather than the arbitrary fear that drove 2008.

I disagree. Ultimately, oil is one of the few remaining true "supply and demand" commodities remaining. The simple fact is that artificial regulations (with ridiculously histrionic rationales) caused oil price spikes over the last 2 decades. Some folks want oil prices through the roof, most do not. That said, there is a price of about $25-$30 per barrel which is the true floor of oil, any lower and it simply wont be pumped or sold at all because it would become a loss. I think the current $50 a barrel is an manipulated price point based on what we have seen in real growth and demand over the past 5-8 years. That demand, however, is SERIOUSLY threatened by this virus. If they dont get a handle on in in the next 2 weeks, and especially if China remains effectively shut down for all of February (as they frighteningly seem resigned to in Beijing) we will see tremendous pressure on oil exporting countries to cut production... if those cuts exceed 20%, then this world is in for a nasty economic recession that will probably be worse than 2008 because, unlike 2008, this one will be driven by a tangible and measurable physical crisis rather than the arbitrary fear that drove 2008.

SPY 300 strike 30-60 DTE (days till expirations), also 285 and 290 strikes on SPY puts, GLD calls 152-155-160 152 will hit next week probably

Monday-Tuesday you might miss out on that but the 155 and 160 will be cheap 30-60 days out

if you are a market player buy those options, if anything is green Monday such as Apple or Tesla, sell call options $2 OTM

if you are a market player buy those options, if anything is green Monday such as Apple or Tesla, sell call options $2 OTM

hold on to your seat belts people this # is going to get crazy

a reply to: burdman30ott6

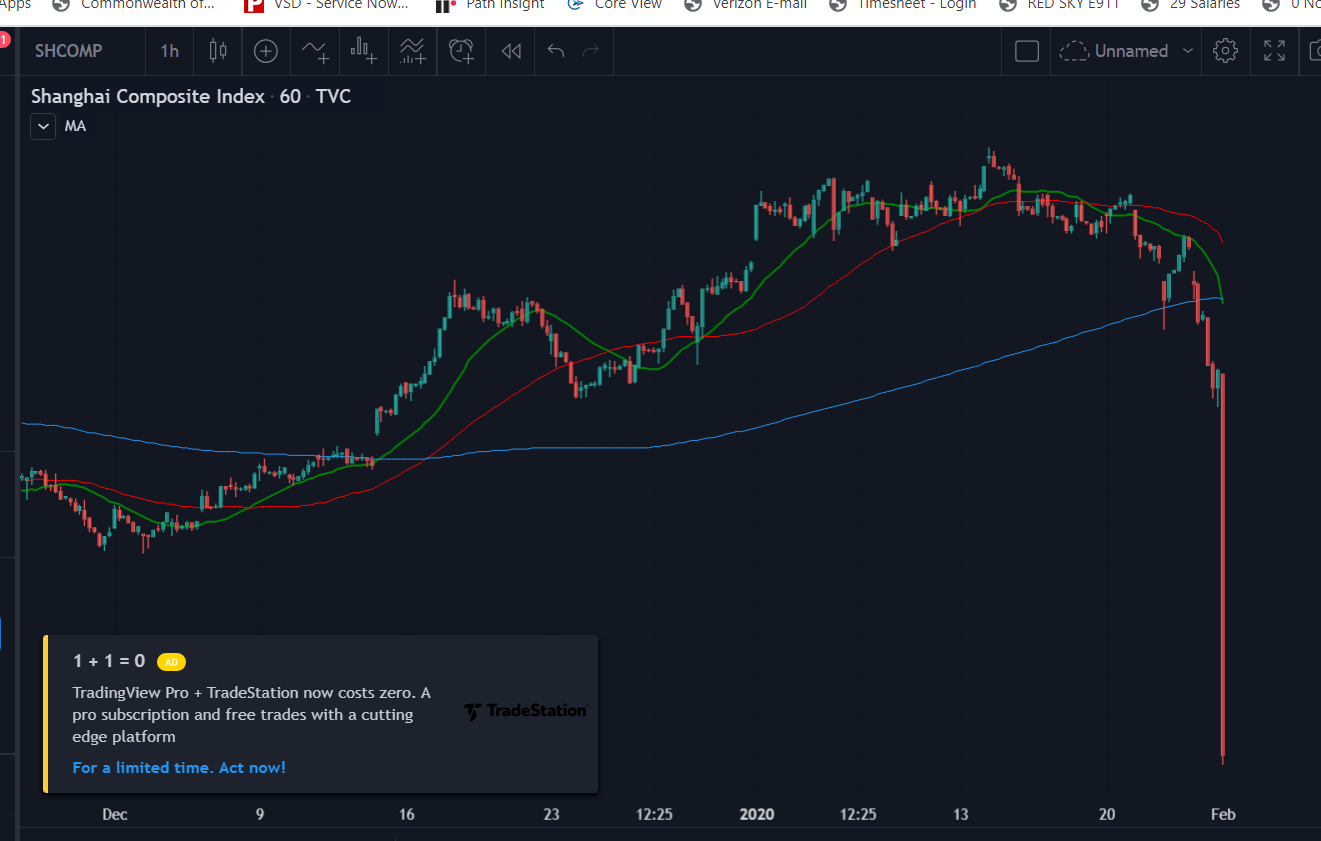

They pulled the pin at minus 7.49 per cent its back up now at 7.36 Id say sellers are currently stuck in the elevator...to hell

They pulled the pin at minus 7.49 per cent its back up now at 7.36 Id say sellers are currently stuck in the elevator...to hell

originally posted by: khnum

a reply to: burdman30ott6

They pulled the pin at minus 7.49 per cent its back up now at 7.36 Id say sellers are currently stuck in the elevator...to hell

they banned short selling, and they have to get approval for larger trades so they literally put the market on lockdown and its still down 8% at open

thats scary

We have a new trend forming in the SP500 and Shanghai opens for the second tme in an hour and a half

HERE WE GO

30 MINUTES LETS DO THIS!!

30 MINUTES LETS DO THIS!!

edit on 3-2-2020 by toysforadults because: (no reason given)

a reply to: toysforadults

The ramifications of a trade halt with China, seem to have some inevitable consequences. The Dollars China gets are bought by the Peoples Bank of China , which keeps them off the international money markets,, the China Bank then buys treasuries, gets the interest then rolls them over. This keeps the dollars in circulation down so all is well. If China is forced to put dollars on the Foreign Exchange Markets to get the stuff they want from other countries. Then the dollar will go down. At the moment the MSM is playing it down, because if they played it up the plot gets thicker, it might get thicker very fast if the real transfer rate of this virus operates outside of China.

The ramifications of a trade halt with China, seem to have some inevitable consequences. The Dollars China gets are bought by the Peoples Bank of China , which keeps them off the international money markets,, the China Bank then buys treasuries, gets the interest then rolls them over. This keeps the dollars in circulation down so all is well. If China is forced to put dollars on the Foreign Exchange Markets to get the stuff they want from other countries. Then the dollar will go down. At the moment the MSM is playing it down, because if they played it up the plot gets thicker, it might get thicker very fast if the real transfer rate of this virus operates outside of China.

a reply to: anonentity

apparently China asked Trump to put the breaks on phase 1 deal so they can print money...

apparently China asked Trump to put the breaks on phase 1 deal so they can print money...

originally posted by: toysforadults

a reply to: booyakasha

no the market is crashing because the worlds second largest economy and manufacturing base is shutdown, the supply chain is completely #ed and inventories are going to dry up

this is going to crash the market this isn't a joke

Yeah so is the market rising because of the virus now too? Corona Virus is over?

Wake up people, this is all show.

originally posted by: toysforadults

Yuan lost value again last night

As the old Chinese proverb says:

"May you live in interesting times"

new topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 18 minutes ago -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 1 hours ago -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 1 hours ago -

The good, the Bad and the Ugly!

Diseases and Pandemics: 3 hours ago -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 5 hours ago -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 6 hours ago -

Russia Flooding

Other Current Events: 7 hours ago -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three: 8 hours ago -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 9 hours ago -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 9 hours ago

top topics

-

Go Woke, Go Broke--Forbes Confirms Disney Has Lost Money On Star Wars

Movies: 16 hours ago, 13 flags -

Pro Hamas protesters at Columbia claim hit with chemical spray

World War Three: 12 hours ago, 11 flags -

Elites disapearing

Political Conspiracies: 14 hours ago, 9 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 1 hours ago, 8 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

Freddie Mercury

Paranormal Studies: 16 hours ago, 7 flags -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness: 9 hours ago, 6 flags -

911 emergency lines are DOWN across multiple states

Breaking Alternative News: 9 hours ago, 6 flags -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs: 14 hours ago, 5 flags -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 18 minutes ago, 5 flags

active topics

-

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 129 • : RussianTroll -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness • 1 • : nugget1 -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 19 • : CarlLaFong -

Russia Flooding

Other Current Events • 8 • : TheMisguidedAngel -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 11 • : GENERAL EYES -

Mood Music Part VI

Music • 3052 • : BrucellaOrchitis -

I Guess Cloud Seeding Works

Fragile Earth • 23 • : BrucellaOrchitis -

The good, the Bad and the Ugly!

Diseases and Pandemics • 2 • : BernnieJGato -

Canadian Forces bow out and loose interest in UFO’s

Aliens and UFOs • 16 • : baablacksheep1 -

A Personal Cigar UFO/UAP Video footage I have held onto and will release it here and now.

Aliens and UFOs • 12 • : baablacksheep1