It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

US Monetary Policy Dangers – ZIRP or NIRP Will Mean Bailouts or Im

(ZIRP = Zero Interest Rate Policy & NIRP = Negative Interest Rate Policy)

An Introduction:

In the past few years, I’ve become immersed in studying the capital markets, monetary policy, investing and also the insurance industry.

Studying the financial history of the globe, and more specifically the United States, Japan, China and the EU, I am constantly amazed at the general apathy and lack of care or understanding the general public has for what Central Banks and the powers that be are doing in terms of monetary policy.

I am not an economist, nor do I claim to be, but becoming familiar with the mechanics of the current global monetary system and that of the US, it doesn’t take a Ph. D to see that the entire system is not performing the way it should be.

Many countries around the globe have negative interest rates, meaning if you invest in a bond for that country, you are going to get less than you invested when the bond matures.

Japan has had negative interest rates for years and their stock market is 90% down from its all-time highs. The Bank of Japan buys its own bonds and also 77.5% of all Japanese ETFs.

Many countries in the EU now have negative interest rates for their bonds.

There is talk of Israel also joining the negative interest rates club, and academics and even former Fed Chairmen such as Ben Bernanke and Alan Greenspan are now in favor of the US going negative:

What tools does the Fed have left? Part 1: Negative interest rates (by Ben Bernanke)

Greenspan says ‘there is no barrier’ to negative yields in the US

Here is another article from the St. Louis Fed, discussing negative interest rates in an optimistic tone:

Looking for the Positives In Negative Interest Rates (St Louis Fed)

If US interest rates get closer to 0%... or if we go negative (frightening premise to think about), this could absolutely implode a lot of “too big to fail” institutions.

Setting Up the Scene:

So, what’s the point I’m trying to make? Well, if you look at our current situation, the federal funds rate is currently at 2.25%. Back in December of 2008 during the last financial crisis, the Fed lowered the federal funds rate from 5.25% to a range of 0-0.25% (in addition to “helicopter money”, Quantitative Easing, as well as government programs such as Cash for Clunkers to try to aid in economic stressors).

We aren’t even at 3% and could be in a worse situation than we were in 2008.

Corporate debt and public debt have risen, and Wall Street is up to the same old tricks (look up the $600+ billion in Collateralized Loan Obligations and similar toxic securities that have flooded the market in recent years). Consumers are tapped out and the policies of the Fed and the US government are continuing to drive us towards the precipice.

I know this is sounding like your typical “Doom Porn” thread, but the goal of this isn’t to strike fear into anyone – it is to open up a discussion about the larger implications of where things are headed and possible scenarios we could see play out in the next few years.

The bottom line is that there needs to be some country or union that has positive interest rates, or the global financial system will collapse under the weight of negativity – there needs to be a yield curve in some of these countries’ bonds or else there will be no where to go but lower.

In recent years, the US had positive interest rates while many other countries were going negative. If central banks are going negative across the board (especially the Federal Reserve, which is arguably the most influential of all central banks), there is no equilibrium. Negative yields across the globe would be a dire symptom, indicating an inevitable failure of the global monetary system.

Insurance and Broader Implications for the Economy:

Boy, has insurance morphed into an entirely new beast now that there are so many types of insurance, and so many types of investments and securities….

Until recently, I was completely unaware of this, but insurance companies invest a lot of capital into various types of investments, ranging from mortgage-backed securities, to non-performing loan pools, to real estate loans, municipal bonds, infrastructure and even agricultural loans.

Insurance companies need to be able to take the money they collect from insurance premiums for their own operating expenses and for profit. However, insurance companies also must be prepared to pay out large claims, so there needs to be a certain level of liquidity as well.

I found a great research paper that goes into detail about how insurance investments affect the rest of the U.S. economy.

If you remember back in 2007/2008, AIG which is a titan in the Insurance Industry, had to get bailed out because of investments in credit default swaps and mortgage-backed securities. Risky securities had AAA ratings from the ratings agencies, even though they were much riskier (that’s another story).

If you want to go deep into the 2008 Financial Crisis, I put together a detailed synopsis of this in another thread back in September of 2017:

Diving Head First into the 2008 Financial Crisis: An In-Depth Analysis of What Happened

Back to the matter at hand – insurance companies are a vitally important piece of the puzzle for our economy. Their massive contribution of capital into bonds and various other investments provide a stabilizing effect when there is volatility or uncertainty in other areas of our economy.

So what happens if we go to 0% or even negative interest rates? It doesn’t take a genius to put 2 and 2 together here.

(Continued below)

(ZIRP = Zero Interest Rate Policy & NIRP = Negative Interest Rate Policy)

An Introduction:

In the past few years, I’ve become immersed in studying the capital markets, monetary policy, investing and also the insurance industry.

Studying the financial history of the globe, and more specifically the United States, Japan, China and the EU, I am constantly amazed at the general apathy and lack of care or understanding the general public has for what Central Banks and the powers that be are doing in terms of monetary policy.

I am not an economist, nor do I claim to be, but becoming familiar with the mechanics of the current global monetary system and that of the US, it doesn’t take a Ph. D to see that the entire system is not performing the way it should be.

Many countries around the globe have negative interest rates, meaning if you invest in a bond for that country, you are going to get less than you invested when the bond matures.

Japan has had negative interest rates for years and their stock market is 90% down from its all-time highs. The Bank of Japan buys its own bonds and also 77.5% of all Japanese ETFs.

Many countries in the EU now have negative interest rates for their bonds.

There is talk of Israel also joining the negative interest rates club, and academics and even former Fed Chairmen such as Ben Bernanke and Alan Greenspan are now in favor of the US going negative:

What tools does the Fed have left? Part 1: Negative interest rates (by Ben Bernanke)

Greenspan says ‘there is no barrier’ to negative yields in the US

Here is another article from the St. Louis Fed, discussing negative interest rates in an optimistic tone:

Looking for the Positives In Negative Interest Rates (St Louis Fed)

If US interest rates get closer to 0%... or if we go negative (frightening premise to think about), this could absolutely implode a lot of “too big to fail” institutions.

Setting Up the Scene:

So, what’s the point I’m trying to make? Well, if you look at our current situation, the federal funds rate is currently at 2.25%. Back in December of 2008 during the last financial crisis, the Fed lowered the federal funds rate from 5.25% to a range of 0-0.25% (in addition to “helicopter money”, Quantitative Easing, as well as government programs such as Cash for Clunkers to try to aid in economic stressors).

We aren’t even at 3% and could be in a worse situation than we were in 2008.

Corporate debt and public debt have risen, and Wall Street is up to the same old tricks (look up the $600+ billion in Collateralized Loan Obligations and similar toxic securities that have flooded the market in recent years). Consumers are tapped out and the policies of the Fed and the US government are continuing to drive us towards the precipice.

I know this is sounding like your typical “Doom Porn” thread, but the goal of this isn’t to strike fear into anyone – it is to open up a discussion about the larger implications of where things are headed and possible scenarios we could see play out in the next few years.

The bottom line is that there needs to be some country or union that has positive interest rates, or the global financial system will collapse under the weight of negativity – there needs to be a yield curve in some of these countries’ bonds or else there will be no where to go but lower.

In recent years, the US had positive interest rates while many other countries were going negative. If central banks are going negative across the board (especially the Federal Reserve, which is arguably the most influential of all central banks), there is no equilibrium. Negative yields across the globe would be a dire symptom, indicating an inevitable failure of the global monetary system.

Insurance and Broader Implications for the Economy:

Boy, has insurance morphed into an entirely new beast now that there are so many types of insurance, and so many types of investments and securities….

Until recently, I was completely unaware of this, but insurance companies invest a lot of capital into various types of investments, ranging from mortgage-backed securities, to non-performing loan pools, to real estate loans, municipal bonds, infrastructure and even agricultural loans.

Insurance companies need to be able to take the money they collect from insurance premiums for their own operating expenses and for profit. However, insurance companies also must be prepared to pay out large claims, so there needs to be a certain level of liquidity as well.

I found a great research paper that goes into detail about how insurance investments affect the rest of the U.S. economy.

If you remember back in 2007/2008, AIG which is a titan in the Insurance Industry, had to get bailed out because of investments in credit default swaps and mortgage-backed securities. Risky securities had AAA ratings from the ratings agencies, even though they were much riskier (that’s another story).

If you want to go deep into the 2008 Financial Crisis, I put together a detailed synopsis of this in another thread back in September of 2017:

Diving Head First into the 2008 Financial Crisis: An In-Depth Analysis of What Happened

Back to the matter at hand – insurance companies are a vitally important piece of the puzzle for our economy. Their massive contribution of capital into bonds and various other investments provide a stabilizing effect when there is volatility or uncertainty in other areas of our economy.

So what happens if we go to 0% or even negative interest rates? It doesn’t take a genius to put 2 and 2 together here.

(Continued below)

edit on 30-8-2019 by FamCore because: (no reason given)

A few excerpts from the research paper I mentioned earlier:

From the Executive Summary of this research paper put out by the Center for Capital Markets:

Insurance companies are embedded in the fabric of our economic operations. If they are unable to make returns on investments such as municipal bonds or real estate, that could spell trouble for our entire economy.

One more excerpt from the research paper:

The investment models do depend on the type of insurance company... Property & Casualty insurance companies (for things like auto insurance, homeowners, businessowners policies, etc.) have policy terms that are much shorter than say, your life insurance policies or annuities.

Here is a link to the research paper in case anyone is interested:

The Role of Insurance Investments In The U.S. Economy

An entirely different ticking time bomb are the pension crises we keep hearing more and more about. Pensions need to take on more and more risk to try to hit their required targets of about 7% per year. This is a sub-topic, but also worth mentioning.

Low interest rates are compounding the big problems facing pension funds (MarketWatch)

And...

If pensions can’t make returns, will some get bailed out? How will that work when there are other too big to fail institutions that also need bailouts? These are important scenarios our “leaders” should be working on. I won’t even go down that rats nest of a topic… it is clear to me that our society and the Fed and politicians in Washington have learned nothing from history (or everyone is just hoping it will come crashing down on the next elected politician, not them… or a bit of both).

Things are going to get messy folks.

A Request:

I’d like to ask you, ATS. What are you seeing in your hometown? In your own companies or employers? Borrowing rates at the bank, infrastructure in your state and town, conversations with friends and family? Are there that many people who are oblivious, or who don’t care? Or is the general public simply too busy trying to pay the bills and keep their head above water with general errands and upkeep that they don’t have time to worry about this stuff?

The bright minds of ATS, let’s hear what you have to say. Do you see storm clouds on the horizon? What do you think about the state of the U.S. and global monetary system? I genuinely value your insights, opinions, anecdotes, and speculations. Thank you in advance ATS.

-FamCore

From the Executive Summary of this research paper put out by the Center for Capital Markets:

U.S. insurance companies finance long-term improvements in the U.S. real economy that drive much-needed municipal infrastructure investments, support developers as they improve and construct commercial and multifamily properties, help farmers purchase needed land, buildings, and equipment, and fund a wide variety of business activity. As a large and important part of U.S. capital markets, insurers fill a vital role as institutional investors with a unique investment strategy. By investing policyholder premiums in anticipation of future claims, U.S. insurers deploy capital focused on longer-duration, relatively lower-volatility investments. These investments support businesses, households, and local governments and are an important source of stability to financial markets.

Insurance companies are embedded in the fabric of our economic operations. If they are unable to make returns on investments such as municipal bonds or real estate, that could spell trouble for our entire economy.

One more excerpt from the research paper:

U.S. insurance companies have a unique business model that creates a distinct set of investment criteria. Specifically, U.S. insurance companies aim to invest in longer-duration, lower-risk assets. The long duration of their investments is used to pay off claims that are expected far in the future. As a result, U.S. insurance companies invest for the long term. This results in insurance companies holding longer-term positions than other investors. As a result, insurance companies are able to hold positions in illiquid investments and capture a “liquidity premium”—ensuring investment in longer-term, positive-return projects

The investment models do depend on the type of insurance company... Property & Casualty insurance companies (for things like auto insurance, homeowners, businessowners policies, etc.) have policy terms that are much shorter than say, your life insurance policies or annuities.

Here is a link to the research paper in case anyone is interested:

The Role of Insurance Investments In The U.S. Economy

An entirely different ticking time bomb are the pension crises we keep hearing more and more about. Pensions need to take on more and more risk to try to hit their required targets of about 7% per year. This is a sub-topic, but also worth mentioning.

Low interest rates are compounding the big problems facing pension funds (MarketWatch)

With lower interest rates, it is getting harder to meet expected return targets without taking on more risk.

And...

There are only three ways for a pension plan to meet its pension obligations. 1) Generate investment returns, 2) increase contributions, or 3) amend the benefit structure / risk sharing.

If pensions can’t make returns, will some get bailed out? How will that work when there are other too big to fail institutions that also need bailouts? These are important scenarios our “leaders” should be working on. I won’t even go down that rats nest of a topic… it is clear to me that our society and the Fed and politicians in Washington have learned nothing from history (or everyone is just hoping it will come crashing down on the next elected politician, not them… or a bit of both).

Public pension plans are underfunded — with an average funded status of 72.1% across the 100 largest public pension plans, according to the 2018 Public Pension Fund Report by actuarial consulting firm Milliman.

Things are going to get messy folks.

A Request:

I’d like to ask you, ATS. What are you seeing in your hometown? In your own companies or employers? Borrowing rates at the bank, infrastructure in your state and town, conversations with friends and family? Are there that many people who are oblivious, or who don’t care? Or is the general public simply too busy trying to pay the bills and keep their head above water with general errands and upkeep that they don’t have time to worry about this stuff?

The bright minds of ATS, let’s hear what you have to say. Do you see storm clouds on the horizon? What do you think about the state of the U.S. and global monetary system? I genuinely value your insights, opinions, anecdotes, and speculations. Thank you in advance ATS.

-FamCore

edit on 30-8-2019 by FamCore because: (no reason given)

a reply to: FamCore

This is an excellent OP -- amazing research, great links, and well presented. Thank you!!!

I've bookmarked so I can come back to this when I have the time and patience to read it all.

What I'm seeing is a mixed bag. We were hit hard in the 2008/2009 crash, and while we've rebounded fairly well, we are not where we could be and once were. And many people have acted cautiously, understanding that absolute NOTHING WAS FIXED in the last go round. If anything, everything Obama and Congress did only set us up for a second crash. And some of us see it coming sooner rather than later. Not everyone though. Especially the ever increasing number of California refugees bringing their failed ideas and attitudes along with them. They don't get it.

That's all I got for now. But I'll be reading all your links and your OP again when I can. Thanks. I appreciate your hard work and thoughtfulness.

This is an excellent OP -- amazing research, great links, and well presented. Thank you!!!

I've bookmarked so I can come back to this when I have the time and patience to read it all.

What I'm seeing is a mixed bag. We were hit hard in the 2008/2009 crash, and while we've rebounded fairly well, we are not where we could be and once were. And many people have acted cautiously, understanding that absolute NOTHING WAS FIXED in the last go round. If anything, everything Obama and Congress did only set us up for a second crash. And some of us see it coming sooner rather than later. Not everyone though. Especially the ever increasing number of California refugees bringing their failed ideas and attitudes along with them. They don't get it.

That's all I got for now. But I'll be reading all your links and your OP again when I can. Thanks. I appreciate your hard work and thoughtfulness.

Consumers are tapped out?

Despite all the FUD we recently opened a savings account that pays out over 2%, 2% is not a huge return (above inflation though) that's crazy for a savings account.

here are a whole bunch of places offering 2% savings accounts:

www.nerdwallet.com...

A zero percent or negative percent rate is a bad thing for the reasons you outlined.

Despite all the FUD we recently opened a savings account that pays out over 2%, 2% is not a huge return (above inflation though) that's crazy for a savings account.

here are a whole bunch of places offering 2% savings accounts:

www.nerdwallet.com...

A zero percent or negative percent rate is a bad thing for the reasons you outlined.

a reply to: funbobby

Thanks for the response.

I've been hard-pressed to find a savings account that actually has a debit card tied to it that offers anything near 2%, and also finding a legitimate institution that offers such an interest rate and is insured by FDIC.

I have a Goldman Sachs Marcus Account and in a matter of months the savings rate went from 2.5% and now is down to 2.15%, no debit cards tied to it so it is an online-only account.

Other options like "Wealthfront" are not FDIC insured. I would double check the agreements/disclosures with these types of accounts.

Also, yes many middle-class Americans are living paycheck to paycheck and standard of living is going down:

The Secret Shame of Middle-Class Americans: Nearly half of Americans would have trouble finding $400 to pay for an emergency. I’m one of them.

If you look up Shadow Stats or the Chapwood Inflation Index, you will see that the true rate of inflation is MUCH higher than the reported 2-ish%

Thanks for the response.

I've been hard-pressed to find a savings account that actually has a debit card tied to it that offers anything near 2%, and also finding a legitimate institution that offers such an interest rate and is insured by FDIC.

I have a Goldman Sachs Marcus Account and in a matter of months the savings rate went from 2.5% and now is down to 2.15%, no debit cards tied to it so it is an online-only account.

Other options like "Wealthfront" are not FDIC insured. I would double check the agreements/disclosures with these types of accounts.

Also, yes many middle-class Americans are living paycheck to paycheck and standard of living is going down:

The Secret Shame of Middle-Class Americans: Nearly half of Americans would have trouble finding $400 to pay for an emergency. I’m one of them.

If you look up Shadow Stats or the Chapwood Inflation Index, you will see that the true rate of inflation is MUCH higher than the reported 2-ish%

edit on 30-8-2019 by FamCore because: (no reason given)

a reply to: FamCore

Thank you FamCore for the post and I will respond in segments and I read them and research them myself. I feel it is irrresponsible to 'state as fact' things that have no outside reference and so will provide some of my own.

I am in agreement that the 'general public' would be better served by having basic economics taught at all levels of education but, i suspect, it is deliberate that the basics are not taught in public primary and secondary schools to all students.

I quote from your paragraph:

My sources of support for negative interest rates (yields) on bonds:

The conclusion of a NPR piece "Why Buys Bonds with a Negative Interest Rate?"

An Important question to ask.....

www.npr.org...

From the Washington post, on the above question in a different specific:

www.washingtonpost.com... -bada-11e9-a091-6a96e67d9cce_story.html?noredirect=on

These are the people pushing "negative interest rates". This piece is more a history of The Fed and central banking but well worth the read. Written May 31st, 2019.

Thank you FamCore for the post and I will respond in segments and I read them and research them myself. I feel it is irrresponsible to 'state as fact' things that have no outside reference and so will provide some of my own.

I am in agreement that the 'general public' would be better served by having basic economics taught at all levels of education but, i suspect, it is deliberate that the basics are not taught in public primary and secondary schools to all students.

I quote from your paragraph:

I am not an economist, nor do I claim to be, but becoming familiar with the mechanics of the current global monetary system and that of the US, it doesn’t take a Ph. D to see that the entire system is not performing the way it should be.

Many countries around the globe have negative interest rates, meaning if you invest in a bond for that country, you are going to get less than you invested when the bond matures.

My sources of support for negative interest rates (yields) on bonds:

GOLDSTEIN: He didn't want to tell me the details, but you can think of it this way - he bought a bond for $100 with the promise of getting paid back $99. Today, people will buy that same bond for $101. Jacob Goldstein, NPR News.

The conclusion of a NPR piece "Why Buys Bonds with a Negative Interest Rate?"

An Important question to ask.....

www.npr.org...

From the Washington post, on the above question in a different specific:

The sudden increase suggests that a fast-rising share of investors are so nervous about the future they’re willing to actually lose a little money by lending it to a borrower that is almost certain to pay it back, rather than risk betting on something that could go bust.

In a healthy economy, investors would put their money to work in profit-making ventures such as factories or office buildings.

www.washingtonpost.com... -bada-11e9-a091-6a96e67d9cce_story.html?noredirect=on

These are the people pushing "negative interest rates". This piece is more a history of The Fed and central banking but well worth the read. Written May 31st, 2019.

edit on 30-8-2019 by FyreByrd because: (no reason given)

a reply to: FamCore

Now I'll jump to your paragraph:

And will quote from Ellen Brown regarding the debt problem:

From "The Bankers’ “Power Revolution”: How the Government Got Shackled by Debt" by Ellen Brown

ellenbrown.com...

Now I'll jump to your paragraph:

Corporate debt and public debt have risen, and Wall Street is up to the same old tricks (look up the $600+ billion in Collateralized Loan Obligations and similar toxic securities that have flooded the market in recent years).

Consumers are tapped out and the policies of the Fed and the US government are continuing to drive us towards the precipice.

And will quote from Ellen Brown regarding the debt problem:

In fact it is the interest, not the debt itself, that is the problem with a burgeoning federal debt.

The principal just gets rolled over from year to year. But the interest must be paid to private bondholders annually by the taxpayers and constitutes one of the biggest items in the federal budget.

Currently the Fed’s plans for “quantitative tightening” are on hold; but assuming it follows through with them, projections are that by 2027 U.S. taxpayers will owe $1 trillion annually just in interest on the federal debt.

That is enough to fund President Donald Trump’s trillion-dollar infrastructure plan every year, and it is a direct transfer of wealth from the middle class to the wealthy investors holding most of the bonds.

From "The Bankers’ “Power Revolution”: How the Government Got Shackled by Debt" by Ellen Brown

ellenbrown.com...

edit on 30-8-2019 by FyreByrd because: (no reason given)

a reply to: FamCore

Here is a supurb article "The politics of negative interest rates" by Yanis Varoufakis:

Find behind a paywall at: www.project-syndicate.org...

Or not behind a paywall at: www.jordantimes.com...

I quote from the not behind the paywall source:

The initial "it" above refers to the Cost of Money.

Positivist referes to

Lenin's definition of politics.....

Ever heard it before?

This last point is key, I'll reiterate:

He goes on to list some 'out-of-the-neoliberal-box' economic thinking.

Here is a supurb article "The politics of negative interest rates" by Yanis Varoufakis:

Find behind a paywall at: www.project-syndicate.org...

Or not behind a paywall at: www.jordantimes.com...

I quote from the not behind the paywall source:

And how can it possibly ever become negative, as it now is in much of the global economy, with the world’s moneyed people “bribing” governments to borrow from them more than $5.5 trillion?

The answer can only be of a type that economists loathe: philosophical, political and thus irreducible to neat positivist explanation.

The initial "it" above refers to the Cost of Money.

Positivist referes to

Positivism is a philosophical theory stating that certain ("positive") knowledge is based on natural phenomena and their properties and relations.

Thus, information derived from sensory experience, interpreted through reason and logic, forms the exclusive source of all certain knowledge.

To understand how money can be our societies’ supreme good while fetching a negative price, it helps to start with the realisation that, unlike potatoes, money has no intrinsic private value.

Its utility comes from what its holder can make others do. Money, to recall Lenin’s definition of politics, is about “who does what to whom”.

Lenin's definition of politics.....

Ever heard it before?

So you abandon your investment plan.

Better to borrow money at almost no cost,” you think, “and buy back a few more of my company’s shares, boost their price, earn more on the stock exchange, and bank the profits for the rainy days that are coming.”

And so it is that the price of money falls, even as the supply of it burgeons.

Central bankers who never predicted the Great Deflation are now busily trying to find a way out with economic and econometric models that could never explain it, let alone point to solutions.

This last point is key, I'll reiterate:

Central bankers who never predicted the Great Deflation are now busily trying to find a way out with economic and econometric models that could never explain it, let alone point to solutions.

He goes on to list some 'out-of-the-neoliberal-box' economic thinking.

a reply to: FamCore

Also, from the Guardian, on the subject of the crumbling neo-liberal agenda (and that informs most of the 'accepted wisdom" of both Republicans and Democrates), this tibit of information:

www.theguardian.com...

Also, from the Guardian, on the subject of the crumbling neo-liberal agenda (and that informs most of the 'accepted wisdom" of both Republicans and Democrates), this tibit of information:

The question now is whether Lagarde’s skills are in tune with the task of leading the ECB in the post-Draghi era.

Much has been made, by supporters and detractors, of both her unquestionable talent for managing complex institutional tensions and her non-existent monetary policy background.

Perhaps it is not a coincidence that the two most influential central banks, the Federal Reserve and the ECB, are now to be led by lawyers with no academic monetary background.

The shifting consensus on who is best placed to oversee monetary policy reflects a crisis of financialised capitalism that traditional central banking can no longer address.

www.theguardian.com...

a reply to: FamCore

4 of the 10 on the list said they were fdic insured. I got mine from a local bank that is also FDIC insured.

Surveys like that might reveal more about people's insecurity or mental state than how many Americans could actually come up with $400 in a pinch, saying you don't think you could and really not being able to do so are not the same.

"Shadow Stats" has the "true rate of inflation" which is more credible than the "reported" one, what do they peg it at?

You don't have $400?

4 of the 10 on the list said they were fdic insured. I got mine from a local bank that is also FDIC insured.

Surveys like that might reveal more about people's insecurity or mental state than how many Americans could actually come up with $400 in a pinch, saying you don't think you could and really not being able to do so are not the same.

"Shadow Stats" has the "true rate of inflation" which is more credible than the "reported" one, what do they peg it at?

You don't have $400?

a reply to: FamCore

The source of your quote The Center for Capital Markets:

www.sourcewatch.org...

... And while I'm not opposed to you using this as a source, true analysis requires a balanced approach.

Also from the Guardian:

www.theguardian.com...

Sound like what you are hearing/reading/talking about?

Doubling down on the same methods, time and time again, when they don't work.

Here's something to think about from two modern economists:

This is a subject of interest to the grassroots, both left, right and inbetween. The power's that be and their media flunkies push this idea of economics as separate (heavenly inspired perhaps) from daily life and only high priests can understand.

The 'Bread and Circuses' are all about there being no alternative to Free Market Capitalism.

Rigged elections, debates and workplaces. Do you have any personal input into any of this? Or is it only the rich that get a say....

I was doing a little research on the religious right... two of their premises are

1) That God uses imperfect people for his work, and

2) Wealth is a sign of God's approval.

These intertwined interest groups becoming ever more authoritarian as they see people, left and right, waking up to the scam.

I get the negative interest rate scam - it's caused by Capitalists fear.

There are solutions - but no political will - to do things that are truly 'disurptive', 'original' or 'creative'. In fact there is no will to do 'democracy' at all.

The source of your quote The Center for Capital Markets:

The Capital Research Center (CRC) is a right-wing "think tank" whose stated mission is to do "opposition research" exposing the funding sources behind consumer, health and environmental groups. CRC is an associate member of the State Policy Network, a web of right-wing “think tanks” and tax-exempt organizations in 49 states, Puerto Rico, Washington, D.C., and the United Kingdom.

www.sourcewatch.org...

... And while I'm not opposed to you using this as a source, true analysis requires a balanced approach.

Also from the Guardian:

Instead, the right has had one. Privatisation, deregulation, lower taxes for business and the rich, more power for employers and shareholders, less power for workers – these interlocking policies have intensified capitalism, and made it ever more ubiquitous.

There have been immense efforts to make capitalism appear inevitable; to depict any alternative as impossible.

In this increasingly hostile environment, the left’s economic approach has been reactive – resisting these huge changes, often in vain – and often backward-looking, even nostalgic.

For many decades, the same two critical analysts of capitalism, Karl Marx and John Maynard Keynes, have continued to dominate the left’s economic imagination.

Marx died in 1883, Keynes in 1946. The last time their ideas had a significant influence on western governments or voters was 40 years ago, during the turbulent final days of postwar social democracy.

Ever since, rightwingers and centrists have caricatured anyone arguing that capitalism should be reined in – let alone reshaped or replaced – as wanting to take the world “back to the 70s”. Altering our economic system has been presented as a fantasy – no more practical than time travel.

www.theguardian.com...

Sound like what you are hearing/reading/talking about?

Doubling down on the same methods, time and time again, when they don't work.

Here's something to think about from two modern economists:

“It is no longer good enough to see the economy as some kind of separate technocratic domain in which the central values of a democratic society somehow do not apply.”

Moreover, Guinan and O’Neill argue, making the economy more democratic will actually help to revitalise democracy: voters are less likely to feel angry, or apathetic, if they are included in economic decisions that fundamentally affect their lives.

This is a subject of interest to the grassroots, both left, right and inbetween. The power's that be and their media flunkies push this idea of economics as separate (heavenly inspired perhaps) from daily life and only high priests can understand.

The 'Bread and Circuses' are all about there being no alternative to Free Market Capitalism.

Rigged elections, debates and workplaces. Do you have any personal input into any of this? Or is it only the rich that get a say....

I was doing a little research on the religious right... two of their premises are

1) That God uses imperfect people for his work, and

2) Wealth is a sign of God's approval.

These intertwined interest groups becoming ever more authoritarian as they see people, left and right, waking up to the scam.

I get the negative interest rate scam - it's caused by Capitalists fear.

There are solutions - but no political will - to do things that are truly 'disurptive', 'original' or 'creative'. In fact there is no will to do 'democracy' at all.

Money does have the reputation of bring out the worst in people, if it can be exploited it will be. 0 or negative interest rates on the bond market is

a good start to get the out of control interest burden under control. The distribution of wealth is getting top heavy with the compounding effects of

interest contributing to this imbalance. Sure there will be some rich people saying the sky is falling as they lose a few points on their portfolios,

it is just the nature of greedy people to complain about not enough money. I would not stress over economic collapse with this, looks more like

economic reason at work.

The pension holders have a tough job trying to do the right thing for the community in a system where right is based on self interest. The clean up of the 2008 GFC has reinforced this standard. Some money is better than no money so having the pensions work a cautious line through it all is important. Are there insurance and government options if targets are not met?

How money starts with all the accounting tricks and guidelines is concerning. How the balance sheet is used to transfer wealth between asset classes and justify value makes one wonder. How money is leveraged through repetitive lending at a low liquidity rate has scam written all over it. But it works as long a a big call is not made. Having a more clear and concise definition in the creation of money will help the public trust and fairness with it. How money translate to other asset class and this perception of value is a murky world.

The pension holders have a tough job trying to do the right thing for the community in a system where right is based on self interest. The clean up of the 2008 GFC has reinforced this standard. Some money is better than no money so having the pensions work a cautious line through it all is important. Are there insurance and government options if targets are not met?

How money starts with all the accounting tricks and guidelines is concerning. How the balance sheet is used to transfer wealth between asset classes and justify value makes one wonder. How money is leveraged through repetitive lending at a low liquidity rate has scam written all over it. But it works as long a a big call is not made. Having a more clear and concise definition in the creation of money will help the public trust and fairness with it. How money translate to other asset class and this perception of value is a murky world.

a reply to: FyreByrd

I’m sorry but I don’t even know where to start with a reply, your most recent post is all over the place.

You talk about Marx and Keynes, and Capitalism and making the economy “more democratic” whatever that means.

The research paper I posted in the OP provided information about insurance companies and their investment approach in an objective way. Feel free to show me where it was biased.

Also, are you saying socialism and Marx are both good, but capitalism = bad?

Zero or negative interest rates are ok?

Just trying to follow your train of thought.

The OP had nothing to do with political leanings or agendas... I study economics, history and industry and the entire thread I stated was with purpose of presenting objective facts and concerns based on what we’ve seen in history, and the way the markets typically respond to monetary policy.

I’m sorry but I don’t even know where to start with a reply, your most recent post is all over the place.

You talk about Marx and Keynes, and Capitalism and making the economy “more democratic” whatever that means.

The research paper I posted in the OP provided information about insurance companies and their investment approach in an objective way. Feel free to show me where it was biased.

Also, are you saying socialism and Marx are both good, but capitalism = bad?

Zero or negative interest rates are ok?

Just trying to follow your train of thought.

The OP had nothing to do with political leanings or agendas... I study economics, history and industry and the entire thread I stated was with purpose of presenting objective facts and concerns based on what we’ve seen in history, and the way the markets typically respond to monetary policy.

Forgive me if some of my questions are ignorant, but I'm trying to understand this financial world a little better. Please, anyone who thinks they

have a good answer to these questions, chime in.

So, you state that negative interest rates could have a cascade effect in the economy, causing it to collapse.

I agree that it could have disastrous effects for some facets of our economy, but I would like to ask this question:

Other than investors who are seeking yields and returns, who else would be affected by a downturn?

Is it because the remaining parts of the economy are so intimately intertwined in the complex relationships of exchange that they will suffer also during a collapse?

Can Joe farmer not grow food and sell it at the local market if Wall Street has a bad day?

Why couldn't Joe farmer just continue business as usual? Could he avoid the negative effects by switching his sales over to a digital currency or some alternative means of exchange?

Do you believe that the Fed's control over interest rates represents a threat to the average American if the Fed continues to reduce rates? In other words, do you believe it's necessary for rates to stay level or increase?

If rates stay level or increase but the economy doesn't respond by the purchase of bonds and issuance of loans because in general most people have little disposable capital with which to invest, would would be the consequences?

If "there is nowhere to go but lower" then wouldn't that spell deflation for most goods and services, especially real estate and rent prices? Considering most Americans can barely afford them at this point in time anyway, wouldn't that be a good thing? Wouldn't a dollar buying more help most people financially?

As I understand negative interest rates, borrowers would end up paying back less than they borrowed to square their debts. I've read that this technique can be used as a stimulus to urge borrowing for things such as home ownership and to get certain sectors of the economy moving.

Other than the investment class not finding yields anywhere, what should ordinary people be afraid of with negative interest rates?

You speak of insurance companies having financial trouble, that their capital investment has the effect of stabilizing economies, but I would also like to know how this can remain true if insurance companies can quickly withdraw or move their investments. In other words, if an insurance company's investments represent the momentum of a train where the normal investor is a fly, what if that train can accelerate and decelerate quickly in a world where something high frequency trading exists? I understand it takes time to move large sums of money and that the value of large investments can't easily fluctuate in a classical sense, but we've all seen markets make huge adjustments with a matter of hours or even minutes, so what else supports the necessity of insurance companies having large amounts invested if not to add stability? Is the duration of a bond and the volume invested in it the real stabilizer here?

Lastly, I often wonder why so much credence is given to large companies and their ability to invest in things such as infrastructure, housing, and other developments, but since these things really are made possible via the availability of resources and humans to do the work, why does our economy rely on investment to flourish and suffer from depressions when pencil-pushers don't want to cough up the money for investment because they don't see desirable returns coming from it? Couldn't or shouldn't there be some other area of the economy driving demand for these projects. Are we limited by materials and manpower... or by funding, which is merely digits on machines. Does one of these things bottleneck our progress unnecessarily, and if so, which is it?

If the demise of big companies such as insurance represent doom for the rest of us, doesn't that represent a somewhat vulnerable architecture from which to construct an economy? Is there a better arrangement we should be considering, and if so, what does it look like?

Thanks for any replies.

So, you state that negative interest rates could have a cascade effect in the economy, causing it to collapse.

I agree that it could have disastrous effects for some facets of our economy, but I would like to ask this question:

Other than investors who are seeking yields and returns, who else would be affected by a downturn?

Is it because the remaining parts of the economy are so intimately intertwined in the complex relationships of exchange that they will suffer also during a collapse?

Can Joe farmer not grow food and sell it at the local market if Wall Street has a bad day?

Why couldn't Joe farmer just continue business as usual? Could he avoid the negative effects by switching his sales over to a digital currency or some alternative means of exchange?

Do you believe that the Fed's control over interest rates represents a threat to the average American if the Fed continues to reduce rates? In other words, do you believe it's necessary for rates to stay level or increase?

If rates stay level or increase but the economy doesn't respond by the purchase of bonds and issuance of loans because in general most people have little disposable capital with which to invest, would would be the consequences?

If "there is nowhere to go but lower" then wouldn't that spell deflation for most goods and services, especially real estate and rent prices? Considering most Americans can barely afford them at this point in time anyway, wouldn't that be a good thing? Wouldn't a dollar buying more help most people financially?

As I understand negative interest rates, borrowers would end up paying back less than they borrowed to square their debts. I've read that this technique can be used as a stimulus to urge borrowing for things such as home ownership and to get certain sectors of the economy moving.

Other than the investment class not finding yields anywhere, what should ordinary people be afraid of with negative interest rates?

You speak of insurance companies having financial trouble, that their capital investment has the effect of stabilizing economies, but I would also like to know how this can remain true if insurance companies can quickly withdraw or move their investments. In other words, if an insurance company's investments represent the momentum of a train where the normal investor is a fly, what if that train can accelerate and decelerate quickly in a world where something high frequency trading exists? I understand it takes time to move large sums of money and that the value of large investments can't easily fluctuate in a classical sense, but we've all seen markets make huge adjustments with a matter of hours or even minutes, so what else supports the necessity of insurance companies having large amounts invested if not to add stability? Is the duration of a bond and the volume invested in it the real stabilizer here?

Lastly, I often wonder why so much credence is given to large companies and their ability to invest in things such as infrastructure, housing, and other developments, but since these things really are made possible via the availability of resources and humans to do the work, why does our economy rely on investment to flourish and suffer from depressions when pencil-pushers don't want to cough up the money for investment because they don't see desirable returns coming from it? Couldn't or shouldn't there be some other area of the economy driving demand for these projects. Are we limited by materials and manpower... or by funding, which is merely digits on machines. Does one of these things bottleneck our progress unnecessarily, and if so, which is it?

If the demise of big companies such as insurance represent doom for the rest of us, doesn't that represent a somewhat vulnerable architecture from which to construct an economy? Is there a better arrangement we should be considering, and if so, what does it look like?

Thanks for any replies.

a reply to: FamCore

What's going to happen with negative interest rates when they hit? Basically the banks are then non performing ,and practically useless to man or beast .Shale oil, manufacturing, agriculture, retail, seem to have been driven into the ground. Nobody knows what to do because this is a totally novel situation. At the moment big business insiders are selling shares, but because the Plunge protection team move in it looks like all is well. One thing you can be sure off, if the share market tanks, theirs going to be a lot of money moving into safe havens. This will happen all at once because that's what sheep seem to do. Here a little heads up.'

What's going to happen with negative interest rates when they hit? Basically the banks are then non performing ,and practically useless to man or beast .Shale oil, manufacturing, agriculture, retail, seem to have been driven into the ground. Nobody knows what to do because this is a totally novel situation. At the moment big business insiders are selling shares, but because the Plunge protection team move in it looks like all is well. One thing you can be sure off, if the share market tanks, theirs going to be a lot of money moving into safe havens. This will happen all at once because that's what sheep seem to do. Here a little heads up.'

’d like to ask you, ATS. What are you seeing in your hometown? In your own companies or employers? Borrowing rates at the bank, infrastructure in your state and town, conversations with friends and family? Are there that many people who are oblivious, or who don’t care? Or is the general public simply too busy trying to pay the bills and keep their head above water with general errands and upkeep that they don’t have time to worry about this stuff?

Some people do notice, some don't. I'm in the heartland of the state. Construction is happening every where in surrounding areas. Houses, roads, schools, store properties. Clear it out for a subdivision, retail store property, or apartments. Then it stays mostly unoccupied. Someone(s) is betting big in NC, if they only knew that occupancy rate!

Building is moving along, forest and farm land are being cleared for developers. Common to see undeveloped land for sale.

You think that stores would be packed (NC shot to the top in population in less than a decade) but... *shivers*

Foot traffic ain't what it used to be. It's common to see vacant store fronts, people ain't spending like they used to, don't know if it's can't/won't.

Also, it's not the amount of homeless people you see, its the homeless people that you see sleeping their cars. That has become more common.

Way would anyone invest in something that has a negative return?

A zero interest rate is what I give to my friends or relatives if they need a loan, I might even take a negative return with them but not if it's business outside of that.

A zero interest rate is what I give to my friends or relatives if they need a loan, I might even take a negative return with them but not if it's business outside of that.

originally posted by: FamCore

a reply to: FyreByrd

I’m sorry but I don’t even know where to start with a reply, your most recent post is all over the place.

I agree, I am all over the place and my last post was only tangentially related to your OP.

'more democratic' means all people having a say it how things are run. Pretty simple really. Capitalism is by it's very definition non-democratic. Capital (and thereby Capitalists) dictates how things are run not the will of we the people.

You talk about Marx and Keynes, and Capitalism and making the economy “more democratic” whatever that means.

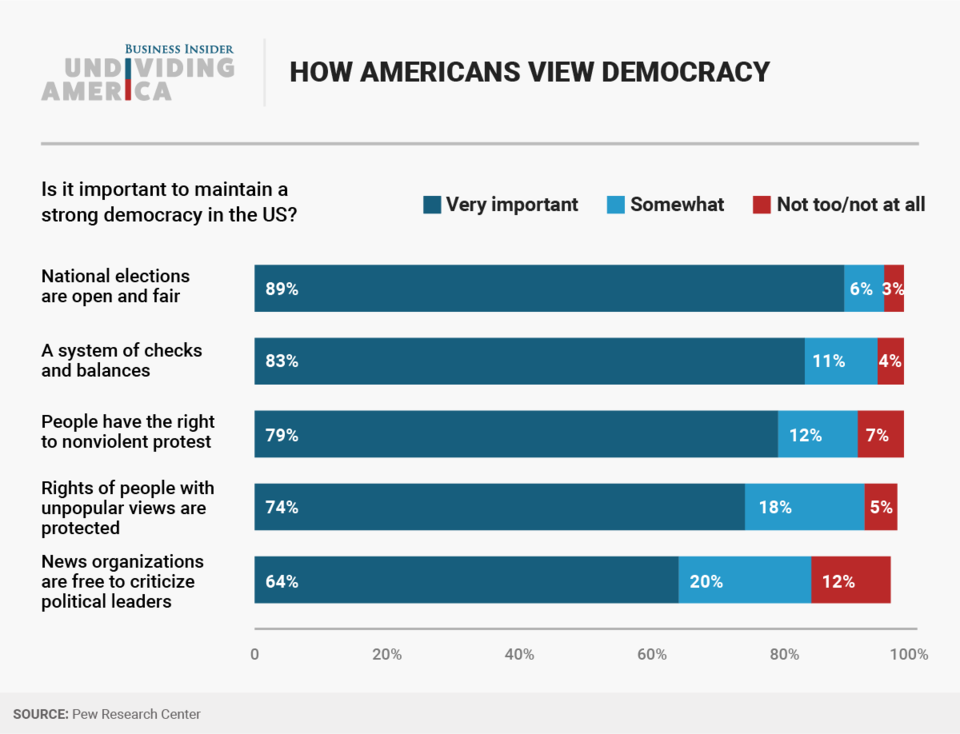

An Example: Take the following poll from Business Insider (not the most liberal of outlets)

Item one Election Integrity. The people agree it's a top priority however that priority is ignored by the establishment and actively lobbied against by monied interest behind the scenes.

The research paper I posted in the OP provided information about insurance companies and their investment approach in an objective way. Feel free to show me where it was biased.

Never said it was biased. Never talked about insurance company investment strategies whatsoever. Sorry. Do you want me to talk about it?

Also, are you saying socialism and Marx are both good, but capitalism = bad?

Actually no, What I am saying is that it is important to see where dogmatic adherence to an economic doctrine that is no longer working and trying to make the world fit that specific doctrine is making matters worse. New viewpoints and insights need to be included in the discussion.

It's not a matter of good or bad, it's a matter of what is realistic and workable in today's society.

Zero or negative interest rates are ok?

Never said that either. Just shared a couple of viewpoints about why they happen and have been happening.

Just trying to follow your train of thought.

The OP had nothing to do with political leanings or agendas... I study economics, history and industry and the entire thread I stated was with purpose of presenting objective facts and concerns based on what we’ve seen in history, and the way the markets typically respond to monetary policy.

If you think economics is a-political, you don't have a good grasp on the subject. Everything is economic and everything is political. Part of the BIG LIE of capitalism is that economics is beyond reality, a world of it's own, a higher power, the magic hand so to speak. Hence a religion, a belief system. I believe I shared a quote on the matter.

I hope my train of thought is clearer.

originally posted by: povray

Forgive me if some of my questions are ignorant, but I'm trying to understand this financial world a little better. Please, anyone who thinks they have a good answer to these questions, chime in.

So, you state that negative interest rates could have a cascade effect in the economy, causing it to collapse.

I agree that it could have disastrous effects for some facets of our economy, but I would like to ask this question:

Other than investors who are seeking yields and returns, who else would be affected by a downturn?

The negative interest is an indicator of Deflation. As the OP states, quite rightly, negative interest has been in use in some countries (Japan being the first I believe) and doesn't in itself cause a collapse. It indicates that investors (classical Capitalists, and large pools) are looking for SAFE non speculative places to keep their capital and are will to pay for the safety. (see one of my posts for more)

A downturn affects everyone, some more than others. Each one I've lived through seems to affect/effect (I have trouble with the difference) more individuals and industries than the last.

Is it because the remaining parts of the economy are so intimately intertwined in the complex relationships of exchange that they will suffer also during a collapse?

Can Joe farmer not grow food and sell it at the local market if Wall Street has a bad day?

Why couldn't Joe farmer just continue business as usual? Could he avoid the negative effects by switching his sales over to a digital currency or some alternative means of exchange?

Good Question! Maybe. Because of the intertwined and centralized nature of modern economic systems, it would be difficult and would be dependent of a myriad of conditions. Such as - the debt he carries, the availability of a local market and or distributor for his commodity. How will he cover his overhead, does he have to borrow to meet it or does he carry cash reserves.

A local farmer's market cannot sell any entire crop. And most farming in the US is by huge conglomerates not Joe E Farmer.

Small organic farms would do better. The small cash crop farms would go bust and be bought up by the big guys for pennies on the dollar.

Do you believe that the Fed's control over interest rates represents a threat to the average American if the Fed continues to reduce rates? In other words, do you believe it's necessary for rates to stay level or increase?

Honestly don't know, the more I read though, the less worried I become on this single point. But economics doesn't hinge on a single point.

If rates stay level or increase but the economy doesn't respond by the purchase of bonds and issuance of loans because in general most people have little disposable capital with which to invest, would would be the consequences?

If "there is nowhere to go but lower" then wouldn't that spell deflation for most goods and services, especially real estate and rent prices? Considering most Americans can barely afford them at this point in time anyway, wouldn't that be a good thing? Wouldn't a dollar buying more help most people financially?

One would think so, but these matters are arranged to suit the Capitalist, not John Q. public.

As I understand negative interest rates, borrowers would end up paying back less than they borrowed to square their debts. I've read that this technique can be used as a stimulus to urge borrowing for things such as home ownership and to get certain sectors of the economy moving.

Yes, but it goes against doctrine. To paraphase "Negative interest (including on small account holders) incentivizes the flow of capital throughout the economy by encouraging investment at all levels because it is expensive to warehouse cash.

Other than the investment class not finding yields anywhere, what should ordinary people be afraid of with negative interest rates?

I don't think average folk should worry about it, we don't have much capital to warehouse other than pension funds (which need to be the big part of the discussion).

You speak of insurance companies having financial trouble, that their capital investment has the effect of stabilizing economies, but I would also like to know how this can remain true if insurance companies can quickly withdraw or move their investments. In other words, if an insurance company's investments represent the momentum of a train where the normal investor is a fly, what if that train can accelerate and decelerate quickly in a world where something high frequency trading exists? I understand it takes time to move large sums of money and that the value of large investments can't easily fluctuate in a classical sense, but we've all seen markets make huge adjustments with a matter of hours or even minutes, so what else supports the necessity of insurance companies having large amounts invested if not to add stability? Is the duration of a bond and the volume invested in it the real stabilizer here?

Lastly, I often wonder why so much credence is given to large companies and their ability to invest in things such as infrastructure, housing, and other developments, but since these things really are made possible via the availability of resources and humans to do the work, why does our economy rely on investment to flourish and suffer from depressions when pencil-pushers don't want to cough up the money for investment because they don't see desirable returns coming from it? Couldn't or shouldn't there be some other area of the economy driving demand for these projects. Are we limited by materials and manpower... or by funding, which is merely digits on machines. Does one of these things bottleneck our progress unnecessarily, and if so, which is it?

If the demise of big companies such as insurance represent doom for the rest of us, doesn't that represent a somewhat vulnerable architecture from which to construct an economy? Is there a better arrangement we should be considering, and if so, what does it look like?

Thanks for any replies.

I don't know much about insurance companies and what I just believe is not helpful. So I refer you to the OP.

However, about investment by Large Companies (due to tax cuts perhaps) has not happened. What has happened is that large companies are buying back their stock to crank up the price. They are investing in fundamentals as they are not truly interesting in producing anything. Most big companies rely on these artificial maneuvers to make their living these days. It's call Financialization. Ford used to make money selling cars, now their biggest return comes from making loans.

a reply to: MichiganSwampBuck

Because it is a safe place to stash money. They are paying a price for the eventual return of their funds.

Because it is a safe place to stash money. They are paying a price for the eventual return of their funds.

new topics

-

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 47 minutes ago -

God lived as a Devil Dog.

Short Stories: 1 hours ago -

Happy St George's day you bigots!

Breaking Alternative News: 2 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 3 hours ago -

Hate makes for strange bedfellows

US Political Madness: 5 hours ago -

Who guards the guards

US Political Madness: 8 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 10 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 5 hours ago, 14 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 15 hours ago, 11 flags -

Who guards the guards

US Political Madness: 8 hours ago, 10 flags -

1980s Arcade

General Chit Chat: 17 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 3 hours ago, 4 flags -

Happy St George's day you bigots!

Breaking Alternative News: 2 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 10 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 1 hours ago, 1 flags -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 47 minutes ago, 0 flags

active topics

-

Happy St George's day you bigots!

Breaking Alternative News • 18 • : SprocketUK -

Michael Avenatti Says He Will Testify FOR Trump

US Political Madness • 62 • : WeMustCare -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 621 • : Justoneman -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 109 • : WeMustCare -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 245 • : RazorV66 -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 728 • : Justoneman -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 43 • : Ophiuchus1 -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 115 • : FlyersFan -

Republican Voters Against Trump

2024 Elections • 287 • : some_stupid_name -

Hate makes for strange bedfellows

US Political Madness • 31 • : ByeByeAmericanPie