It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: toysforadults

There is no expiration date on a 2x4, or vynil plank, or box of screws. Material prices were stagnant until the upswing, then spiked when new construction saw gains. Purchasing was held off keeping prices tight across all retailers im sure. Demand was low, so they bought less.

There is no expiration date on a 2x4, or vynil plank, or box of screws. Material prices were stagnant until the upswing, then spiked when new construction saw gains. Purchasing was held off keeping prices tight across all retailers im sure. Demand was low, so they bought less.

edit on 27-8-2019 by drewlander because: (no reason given)

originally posted by: toysforadults

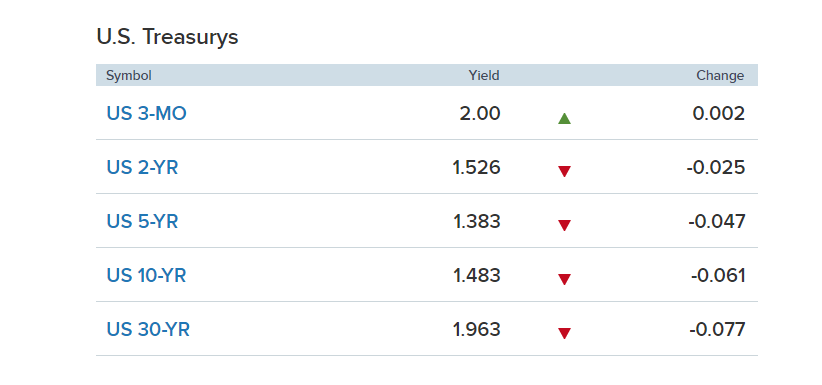

Pic of the current treasury rates...

Traders what are you thinking?

I just took all of my stock yesterday and sold ALL OF IT and dumped my money into a junior miner that just signed an investment deal for Aug 30th where the investor bought in at 1.50 price point and it's currently at 1.20.

I will be dumping more into that junior miner this week. Current bond yields are crazy and Trump is about to pay for destroying investor confidence with his Tweets.

I'm thinking things are going exactly as planned.

First you bring the system down before another can be instituted. It's the New World Order, we better get used to it. And it slipped in right under our noses while people were divided and bickering.

originally posted by: Edumakated

originally posted by: 38181

How will this correlate with the average near and long term housing markets?

Mortgage rates are falling. They are highly correlated with the 10 year treasury. People are still buying, but I do think we are at the top of the housing market right now.

In my market here in Chicago, any gains are being eroded by property taxes that keep going up which is the elephant in the room. Some areas have seen no gains in property values in like 15 years...

I live in a highly desirable wealthy suburb in Chicago area. I'd be lucky to get what I paid for my house 15 years ago. However, my property tax bill has more than doubled in that time frame.

I feel your pain, imagine this. I live in a desirable suburb in Wisconsin, our property has gone up significantly, but but but... our taxes have gone down. I didn't even think this was a possibility having had lived in Illinois, but it is. I hate to say it, but I think it is going to get worse there, especially when the pension crisis happens in 2-3 years.

originally posted by: matafuchs

Where the hell is Clarence Beeks????

No more cockamamie cigar smoke.

No more Swedish meatballs there, tootsie.

And no more phoney Irish whisky.

No more goddamn jerky beef.

The party's over.

edit on 27/8/2019 by shooterbrody because: (no reason given)

>US investments

haha, ok

>private investments

Big boy stuff, I know, but if you're relying on federal interest rates, prepare yourself for federal sadness.

haha, ok

>private investments

Big boy stuff, I know, but if you're relying on federal interest rates, prepare yourself for federal sadness.

a reply to: Archivalist

buying assets that produce a value or investing in something that produces a value is great of course but I enjoy reading/ playing the market

and I'm not working with that kind of $$ yet either

buying assets that produce a value or investing in something that produces a value is great of course but I enjoy reading/ playing the market

and I'm not working with that kind of $$ yet either

a reply to: operation mindcrime

I would think they would want a lot more lithium than zinc, I can't find any electric vehicle batteries that use any zinc in their chemistry. Perhaps with everyone buying boats they will need zinc anodes?

if batteries are your play go with the cobalt, manganese and nickle.

I would think they would want a lot more lithium than zinc, I can't find any electric vehicle batteries that use any zinc in their chemistry. Perhaps with everyone buying boats they will need zinc anodes?

if batteries are your play go with the cobalt, manganese and nickle.

a reply to: toysforadults

I think most "analysts" have determined it takes far less actual investing accumen and is far easier to simply say "Huge crash coming!!!" every few months than it is to correctly pick individual stocks that will post better than average gains over the next period. Marketwatch has an entire squadron of asshats who make their case monthly that "Oh noes!!! Crash is a'coming!!!" and eventually one will happen and said asshats will strain their shoulders patting themselves on the back for "seeing" the crash beforehand, please ignore the months/years of saying it was going to happen when it didn't happen.

It's all so manipulated and such a game that I honestly don't see it as a reliable indicator of jack squat anymore. Plus, when we know the feds will bail out the big boys, why in the hell would anyone sell their shares on an across all stocks downturn? Hold your stocks for the long game and reap rewards when the tax payers bail your companies out.

I think most "analysts" have determined it takes far less actual investing accumen and is far easier to simply say "Huge crash coming!!!" every few months than it is to correctly pick individual stocks that will post better than average gains over the next period. Marketwatch has an entire squadron of asshats who make their case monthly that "Oh noes!!! Crash is a'coming!!!" and eventually one will happen and said asshats will strain their shoulders patting themselves on the back for "seeing" the crash beforehand, please ignore the months/years of saying it was going to happen when it didn't happen.

It's all so manipulated and such a game that I honestly don't see it as a reliable indicator of jack squat anymore. Plus, when we know the feds will bail out the big boys, why in the hell would anyone sell their shares on an across all stocks downturn? Hold your stocks for the long game and reap rewards when the tax payers bail your companies out.

a reply to: burdman30ott6

I'm waiting for QE and getting into the mining stocks early

I play the long game

I'm waiting for QE and getting into the mining stocks early

I play the long game

originally posted by: toysforadults

a reply to: burdman30ott6

I'm waiting for QE and getting into the mining stocks early

I play the long game

Mining stocks are one of those things that are highly dependent on the politics currently running the show. If one of the left pushing the green new deal nonsense got elected, your mining stock (if it's in American companies) won't be worth spit.

a reply to: Edumakated

I was lucky to find a place to rent in my price range that was in one of the better areas of my city.

Found out that this is the ONLY apartments for this cheap in this area.

I'd have to go back to renting in gang areas if I lose this place.

But the owner of this place has raised the rent each year I have lived here.

When I first moved in this place was full now I'm one of the few that hasn't had to leave , yet.

If she raises it again next year I have to go.

Housing market sucks for poor people like me. It takes everything I make just to have a decent roof over my head and and be in a place where I don't have to worry about being robbed.

Rent is my highest bill by far.

I was lucky to find a place to rent in my price range that was in one of the better areas of my city.

Found out that this is the ONLY apartments for this cheap in this area.

I'd have to go back to renting in gang areas if I lose this place.

But the owner of this place has raised the rent each year I have lived here.

When I first moved in this place was full now I'm one of the few that hasn't had to leave , yet.

If she raises it again next year I have to go.

Housing market sucks for poor people like me. It takes everything I make just to have a decent roof over my head and and be in a place where I don't have to worry about being robbed.

Rent is my highest bill by far.

a reply to: burdman30ott6

That's why trump should think before he tweets.

It's all so manipulated and such a game

That's why trump should think before he tweets.

a reply to: operation mindcrime

There are massive lithium deposits in Montana. Zinc is abundant and cheap, even if it can be made into as good a battery as a lithium battery that might not raise the price of zinc very much. And if somehow the price of zinc was increased enough then people would use cheaper materials for batteries. It's an interesting technology though.

There are massive lithium deposits in Montana. Zinc is abundant and cheap, even if it can be made into as good a battery as a lithium battery that might not raise the price of zinc very much. And if somehow the price of zinc was increased enough then people would use cheaper materials for batteries. It's an interesting technology though.

new topics

-

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 3 hours ago -

Bobiverse

Fantasy & Science Fiction: 6 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago -

Former Labour minister Frank Field dies aged 81

People: 8 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 15 hours ago, 17 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 8 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 16 hours ago, 3 flags -

This is our Story

General Entertainment: 12 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 6 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 3 hours ago, 1 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago, 0 flags

active topics

-

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 54 • : Asher47 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 17 • : diaclonethunder -

LaBTop is back at last.

Introductions • 15 • : LaBTopOld -

Russia Ukraine Update Thread - part 3

World War Three • 5727 • : YourFaceAgain -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 259 • : SourGrapes -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 479 • : ArMaP -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 31 • : Thefineblackharm -

Tucker Carlson UFOs are piloted by spiritual entities with bases under the ocean and the ground

Aliens and UFOs • 45 • : gippo88 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 71 • : DBCowboy -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 276 • : marg6043