It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: DanDanDat

originally posted by: luthier

a reply to: DanDanDat

Or the younger workforce never joins the equation and dont effect unemployment numbers at all.

I'm not sure when students that graduate school are added to the unemployment roles.

But if the rate is dropping (even if it's not the best indicator) it would mean that it's a better time for them to enter the work force than has been for the last decade and a half.

Only if the wages and quality of work are not considered.

Again does job growth created by consumer spending through debt mean a sustainable economy?

No.

The indications are loan application processes are being loosened and people are spending credit. It is also mirrored by the government.

Car loan defaults could very well be the first indicator of the over stretching of means coming to a head.

a reply to: TheGreatWork

Not by me. I posted employment statistic. It's the highest it's been in a decade.

Not by me. I posted employment statistic. It's the highest it's been in a decade.

a reply to: OccamsRazor04

And economists said it was from min wage laws across the states.

We also have the highest levels of debt per expansion in history.

The highest levels of personal debt.

And the largest national debt.

Loan defaults are starting...

And economists said it was from min wage laws across the states.

We also have the highest levels of debt per expansion in history.

The highest levels of personal debt.

And the largest national debt.

Loan defaults are starting...

a reply to: TheGreatWork

Right. If we use those numbers obama brought unemployment from almost 10 percent to 4.2. Which again is bs.

Right. If we use those numbers obama brought unemployment from almost 10 percent to 4.2. Which again is bs.

I'm no expert, but doesn't our current, strong economic growth support a lower unemployment number and vice versa? For those coming up with reasons to

discredit the unemployment number, how can you explain the booming stock market? Doesn't the stock market reflect the economic conditions of our

economy?

www.timothysykes.com...

NEWS FROM TODAY:

www.bloomberg.com...

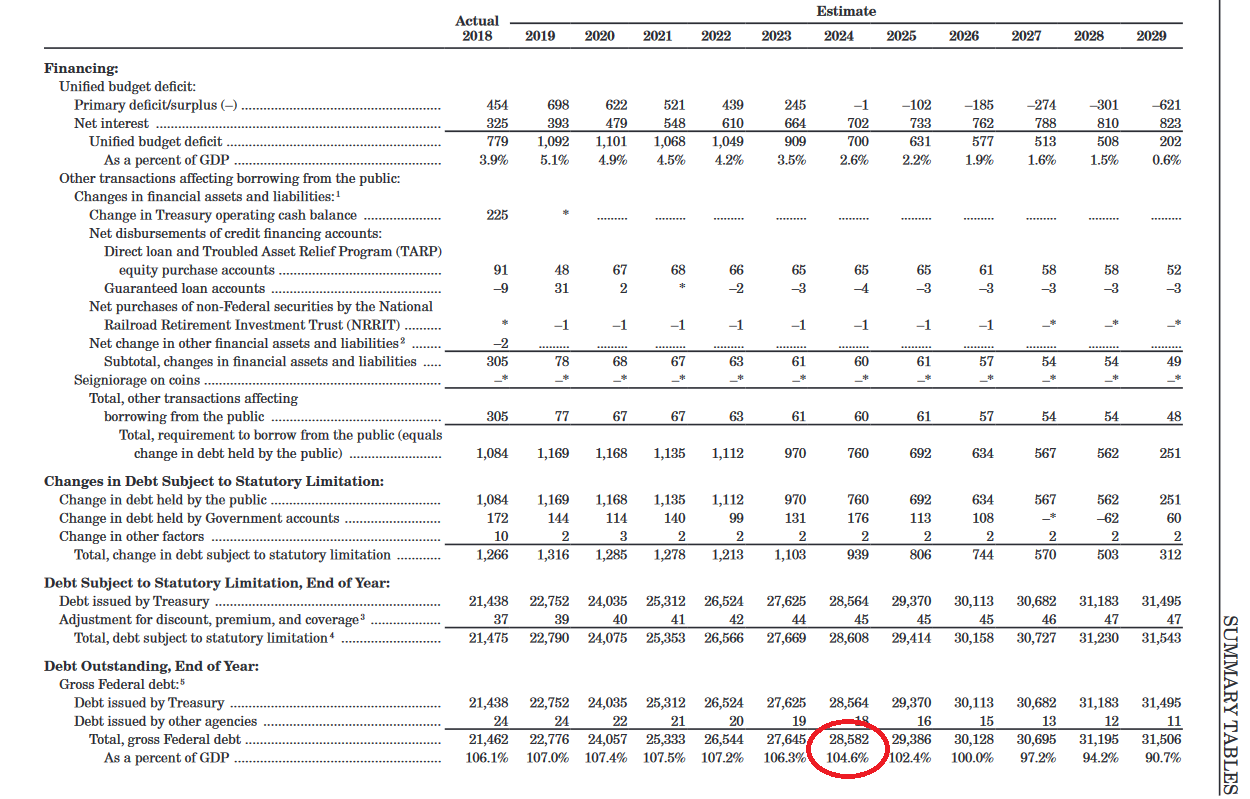

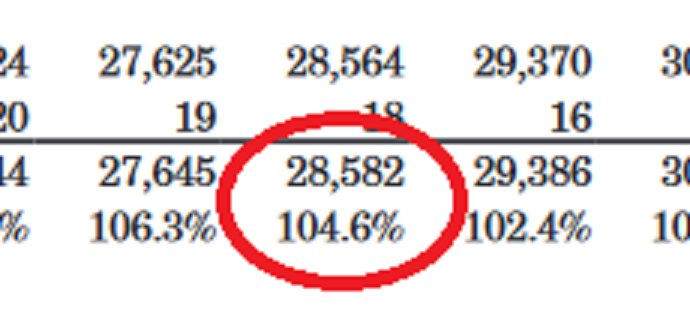

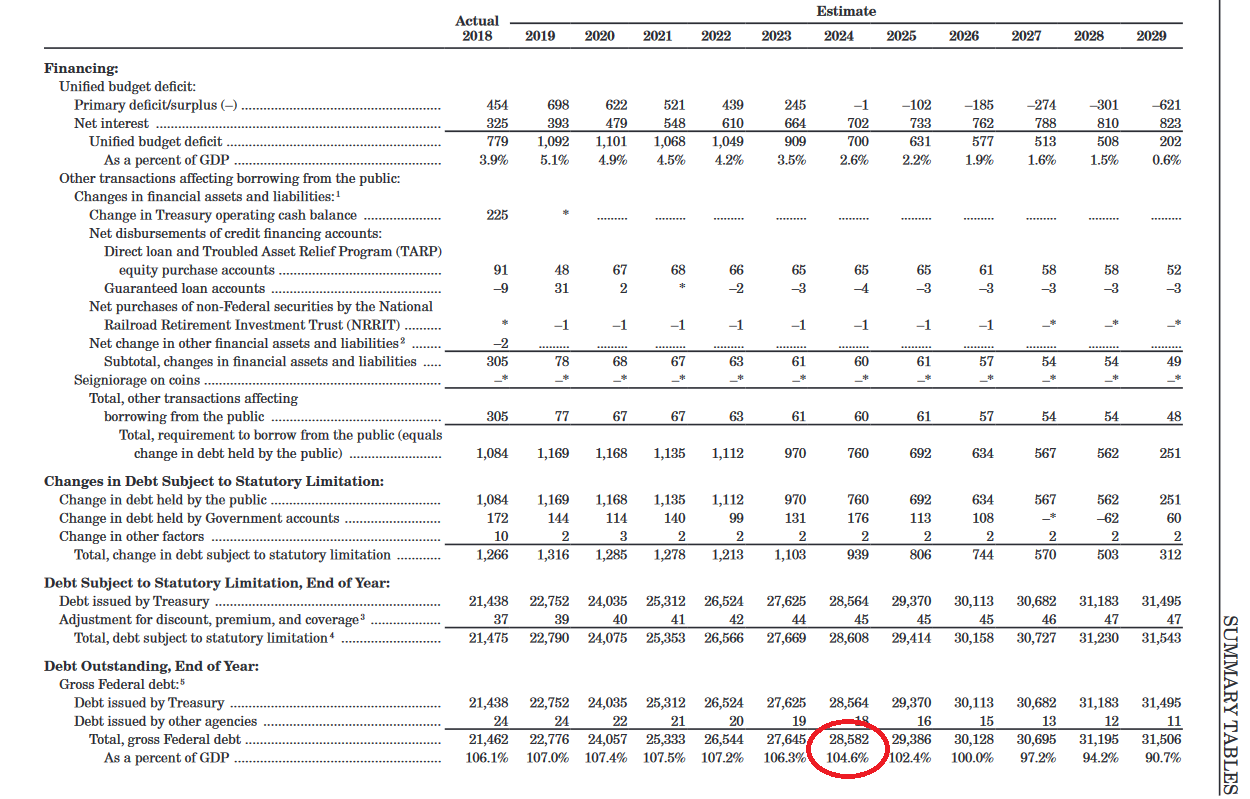

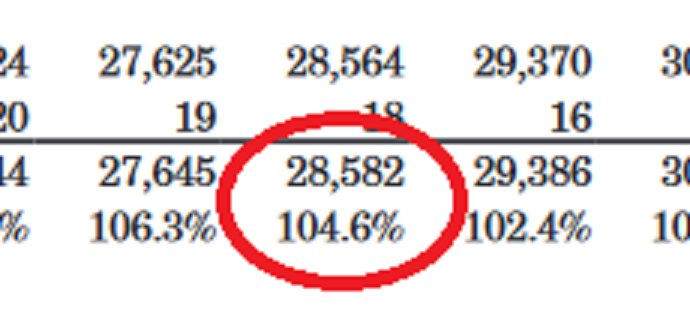

Personally, I'm more concerned about our national debt, which is creeping past $22 Trillion Dollars.

www.cnbc.com...

Trump had better start doing something about the national debt, or he'll be no better than Obama. Even though I'm happy at how our economy is doing, during his 2016 presidential campaign, Trump promised he would eliminate the nation’s debt in eight years. Some are predicting that the national debt could be as high as $29 Trillion Dollars according to Trump's budget estimates. Something tells me that Trump won't keep his promise.

Graph taken from: www.whitehouse.gov...

According to Investopedia, it’s a lagging indicator, which means that it “generally rises or falls in the wake of changing economic conditions, rather than anticipating them. When the economy is in poor shape and jobs are scarce, the unemployment rate can be expected to rise. When the economy is growing at a healthy rate and jobs are relatively plentiful, it can be expected to fall.”

www.timothysykes.com...

NEWS FROM TODAY:

U.S. stocks advanced, trading near a record, while Treasury yields and the dollar retreated, reflecting the cross-currents facing investors.

The gain in payrolls exceeded all estimates in a Bloomberg survey. The jobless rate unexpectedly fell to a fresh 49-year low of 3.6 percent while annual average hourly earnings growth was unchanged at 3.2 percent, below projections.

“It’s clearly telling you this economy is still chugging along very nicely,” Torsten Slok, chief economist at Deutsche Bank Securities, said on Bloomberg Television. “It is inflationary in the sense that wages did go up but they didn’t go up as much as we had expected.”

www.bloomberg.com...

Personally, I'm more concerned about our national debt, which is creeping past $22 Trillion Dollars.

President Barack Obama’s administration racked up nearly as much debt in eight years than in the entire 232-year history of the country before he took office. He entered with $10.6 trillion in total debt and left with the country owing $19.9 trillion. That’s an average tab of $1.16 trillion a year.

www.cnbc.com...

Trump had better start doing something about the national debt, or he'll be no better than Obama. Even though I'm happy at how our economy is doing, during his 2016 presidential campaign, Trump promised he would eliminate the nation’s debt in eight years. Some are predicting that the national debt could be as high as $29 Trillion Dollars according to Trump's budget estimates. Something tells me that Trump won't keep his promise.

Graph taken from: www.whitehouse.gov...

edit on 5/3/2019 by shawmanfromny because: (no

reason given)

a reply to: luthier

Keep spinning. Want to know when personal debt increases? When people are doing better financially.

The money I made in the 90s and early 2000s paid for college education. After Democrats destroyed the economy I had to put off finishing it up. I made a ton of money since Trump took office, but I have already had to postpone things too long costing me millions of dollars so far. So I have about $40k in debt right now to finish more of my schooling, my first time ever in debt, and I am doing it because things are so rosy it's as close to risk free debt as you can get, I'll have it paid off in a year.

So the great economy is why my debt increased.

Keep spinning. Want to know when personal debt increases? When people are doing better financially.

The money I made in the 90s and early 2000s paid for college education. After Democrats destroyed the economy I had to put off finishing it up. I made a ton of money since Trump took office, but I have already had to postpone things too long costing me millions of dollars so far. So I have about $40k in debt right now to finish more of my schooling, my first time ever in debt, and I am doing it because things are so rosy it's as close to risk free debt as you can get, I'll have it paid off in a year.

So the great economy is why my debt increased.

originally posted by: butcherguy

Source; NPR

U.S. employers added a better-than-expected 263,000 jobs in April, as the nearly decade-old economic expansion shows no signs of slowing. And the unemployment rate dropped to 3.6 % — the lowest in nearly 50 years.

The US unemployment rate is the lowest it has been in 49 years.

Remember when Obama asked what Trump was going to do about the economy?.... Wave a magic wand?

I'm liking it.

People working 3 jobs to make ends meet is not exactly something I like.

a reply to: shawmanfromny

Trump can literally do nothing about the debt, Congress has to do it. It requires entitlement cuts, political suicide for any party that goes it alone, so no party will. They will run it up until it's too late.

All Trump can do is try to run up the economy faster than they run up the debt.

Trump can literally do nothing about the debt, Congress has to do it. It requires entitlement cuts, political suicide for any party that goes it alone, so no party will. They will run it up until it's too late.

All Trump can do is try to run up the economy faster than they run up the debt.

a reply to: shawmanfromny

The stock market is a representation of consumer spending. People feel good about spending.

The bad part is they dont have the money. Credit is easy because of artificially low interest rates created to boost the economy. It was called QE during the recession. It's a bond program and injection from the government of printed money created to trickle into easier credit.

But if your into the government printing press controlling market value it's a good system.

In reality we make it all up anyway so whatever works.

I just have doubts a credit heavy system doesnt have bubbles.

The stock market is a representation of consumer spending. People feel good about spending.

The bad part is they dont have the money. Credit is easy because of artificially low interest rates created to boost the economy. It was called QE during the recession. It's a bond program and injection from the government of printed money created to trickle into easier credit.

But if your into the government printing press controlling market value it's a good system.

In reality we make it all up anyway so whatever works.

I just have doubts a credit heavy system doesnt have bubbles.

a reply to: dfnj2015

www.forbes.com...

Noah Smith of Bloomberg pointed out, the number of Americans working two jobs is around 5 percent of the workforce, another historic low.

www.forbes.com...

originally posted by: OccamsRazor04

a reply to: luthier

Keep spinning. Want to know when personal debt increases? When people are doing better financially.

The money I made in the 90s and early 2000s paid for college education. After Democrats destroyed the economy I had to put off finishing it up. I made a ton of money since Trump took office, but I have already had to postpone things too long costing me millions of dollars so far. So I have about $40k in debt right now to finish more of my schooling, my first time ever in debt, and I am doing it because things are so rosy it's as close to risk free debt as you can get, I'll have it paid off in a year.

So the great economy is why my debt increased.

Your debt increased because of your choices. Debt is literally the cancellation of wealth. Artificially lowering borrowing rates creates people over extending and defaulting. The easier credit is the more defaults. Like the Democrats you blame (they are no different) this president actually advocates for printing money and ignoring the national debt. Lower rates make it easier to get a loan...

At some point you need to pay the money back or give complete market control to a central bank.

originally posted by: Mandroid7

Quick question...

How's this calculated?

Surely it doesn't mean only 3.6% of people don't have jobs.

Can someone please clarify?

Basically this number is typically crap. What it represents is those in the job force actively looking for a job. So what it doesn't show is those not looking and more importantly those who would like a job, but have stopped looking. Today maybe we could say 10% is more of a reality, but under Obama that was actually a huge number because many stop looking after awhile though they wanted a job and many more where under paid based on their skills as they lost their skill job and took an unskilled low paying job.

originally posted by: OccamsRazor04

originally posted by: luthier

Only if the wages and quality of work are not considered.

2016-2017 saw the highest average wage jump in history. Try again.

Without a credible source, it's just spinning in the trump echo site. try again....

And by credible, I don't mean Drudge or Fox.

a reply to: Xtrozero

The truth is until we can head somewhere that isn't an economy on the edge of collapse if credit dries up we just dont know.

Also allowing a debt system with central bank and government becoming one entity just makes political use of banking and interest rates even worse. The end result of government using QE type philosphy of print and boom around current inflation indicators is government controlled market. I know the fed creates something close but no need to go all the way and think a credit extension based economy where most Americans are in debt without real wealth is a good economy.

The truth is until we can head somewhere that isn't an economy on the edge of collapse if credit dries up we just dont know.

Also allowing a debt system with central bank and government becoming one entity just makes political use of banking and interest rates even worse. The end result of government using QE type philosphy of print and boom around current inflation indicators is government controlled market. I know the fed creates something close but no need to go all the way and think a credit extension based economy where most Americans are in debt without real wealth is a good economy.

originally posted by: olaru12

originally posted by: OccamsRazor04

originally posted by: luthier

Only if the wages and quality of work are not considered.

2016-2017 saw the highest average wage jump in history. Try again.

Without a credible source, it's just spinning in the trump echo site. try again....

And by credible, I don't mean Drudge or Fox.

My source was SSA.gov

www.ssa.gov...

There is my source. Now I need a source showing the average American works 3 jobs.

edit on 3-5-2019 by OccamsRazor04 because: (no reason

given)

originally posted by: OccamsRazor04

a reply to: luthier

Keep spinning. Want to know when personal debt increases? When people are doing better financially.

The money I made in the 90s and early 2000s paid for college education. After Democrats destroyed the economy I had to put off finishing it up. I made a ton of money since Trump took office, but I have already had to postpone things too long costing me millions of dollars so far. So I have about $40k in debt right now to finish more of my schooling, my first time ever in debt, and I am doing it because things are so rosy it's as close to risk free debt as you can get, I'll have it paid off in a year.

So the great economy is why my debt increased.

Yep we are doing something similar is our sales rep business, finally, business on the road has perked up, so we are spending more traveling while the getting is good. Traveling expenses go on credit cards mostly but as shipping catches up the commission checks get larger and you can pay off the debt easier. My debt has increased 35% the past year but working hard could easily erase most of it in 12-18 months.

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 5 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 11 hours ago, 6 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago, 5 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago, 2 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 76 • : YourFaceAgain -

The Acronym Game .. Pt.3

General Chit Chat • 7750 • : bally001 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 681 • : MetalThunder -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 20 • : chr0naut -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 7 • : rickymouse -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 10 • : chr0naut -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 23 • : Ravenwatcher -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2