It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

8

share:

Just noticed this wanted to post really fast before work. The government of Norway is taking continuing lower oil prices as a risk to their wealth

fund, and is therefore dumping stocks in may companies. They stress this has less to do with environmental activism and more so simply trying to

reduce risk in a sector with declining prices and profit.

Quick and brief.

Maybe oil is slowly being phased out of favor?? Well the future always shows up one little act at a time.

Quick and brief.

The Associated Press

Published: March 8, 2019 - 12:28 PM

TAVANGER, Norway — Norway’s US$1-trillion wealth fund, the biggest of its kind in the world, will begin dumping shares in oil and gas companies including some Canadian names, but stopped short of barring major producers like Suncor, ExxonMobil and Chevron.

The fund is looking to sell some US$7.5 billion in shares in 134 energy companies over time, including 26 Canadian names.

The Norwegian government said its motivation was not climate activism but financial. The fund, somewhat ironically, derives its income from Norway’s booming oil and gas industry. So reinvesting those proceeds in other sectors is considered a way to keep the money safe should oil and gas prices fall.

“The objective is to reduce the aggregate oil price risk on the whole Norwegian economy,” Minister of Finance Siv Jensen told The Associated Press. “The Norwegian state is highly exposed to oil.”

The Norwegian fund has a stake in more than 9,000 companies worldwide, including the likes of Apple, Nestle, Microsoft and Samsung. On average, the fund holds 1.4 per cent of all of the world’s listed companies. About 70 per cent of its holdings are in shares.

Maybe oil is slowly being phased out of favor?? Well the future always shows up one little act at a time.

Good find Op...looks like change is coming sooner rather than later.

And its going to be one hell of a painful ride for the average Joe!

And its going to be one hell of a painful ride for the average Joe!

a reply to: worldstarcountry

My first though was that we've had such good relations with them for so long, it would be a shame for us to have to import some freedom over there...

Joking aside though, I think they are just trying to get ahead of the curve. Their economy thrives from the oil industry, but maybe they want to start diversifying now rather than being forced too.

Also, if they save some of that oil, it may sell for much more once the world reserves aren't where they're at now.

Even if we find an alternative fuel source, I'd venture to think it would still have industrial applications or be the basis of lubricant blends.... And could still fetch a good amount of coin.

My first though was that we've had such good relations with them for so long, it would be a shame for us to have to import some freedom over there...

Joking aside though, I think they are just trying to get ahead of the curve. Their economy thrives from the oil industry, but maybe they want to start diversifying now rather than being forced too.

Also, if they save some of that oil, it may sell for much more once the world reserves aren't where they're at now.

Even if we find an alternative fuel source, I'd venture to think it would still have industrial applications or be the basis of lubricant blends.... And could still fetch a good amount of coin.

I say it a stupid move considering how many by products are made from oil.

There's easily another century left in oil, most all of them are diversified in alternative energies.

There's easily another century left in oil, most all of them are diversified in alternative energies.

edit on 8-3-2019 by neo96 because: (no

reason given)

Norway is in the global top 5 exporters of crude oil. The oil and gas sector constitutes around 22% of Norwegian GDP and 67% of Norwegian exports.

link

Norway is Western Europe's most important source of natural gas. Norwegian gas exports account for approximately 20% of EU gas consumption (in 2010), with almost all

Interesting shift the government is taking.

The question is what impact will this have on the companies after the fund sells off?

Will the government start regulating differently once it doesn't have the same stake?

Or is there more to the story?

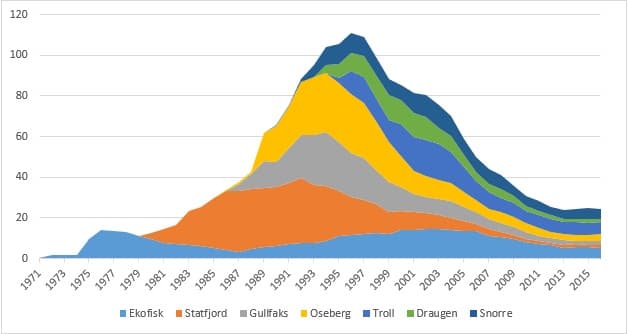

The demise of the North Sea doesn’t necessarily mean the end of Norway’s petroleum era—far from it. Still, despite significant reserves in the Barents Sea, Norway is about to embark upon a long period of structural decline as its benchmark fields inch closer to depletion and its reserves taper before our very eyes.

Oil production from largest fields-

link

It looks like they still have vast amounts of resources, but maybe the low hanging fruit is picked....

The rest will likely not be thriving in today's market with low prices, which wouldn't leave much room for profit for areas where more work is involved.

a reply to: worldstarcountry

I love it when AP posts scaremongery stuff. Misinformed and misdirecting.

Source: wikipedia.

Dumping stocks is not the same as stopping oil and gas production.

I love it when AP posts scaremongery stuff. Misinformed and misdirecting.

The country has the fourth-highest per capita income in the world on the World Bank and IMF lists. The petroleum industry accounts for around a quarter of the country's gross domestic product (GDP).[14] On a per-capita basis, Norway is the world's largest producer of oil and natural gas outside of the Middle East.

Source: wikipedia.

Dumping stocks is not the same as stopping oil and gas production.

originally posted by: neo96

I say it a stupid move considering how many by products are made from oil.

There's easily another century left in oil, most all of them are divested in alternative energies.

For sure, but right now with the prices are where they are, maybe the fund doesn't want the liability of the petro market taking a plunge in Norway if the biggest fields aren't producing like they used to.

a reply to: LightSpeedDriver

Certainly not... But my understanding has been that the government and people were vested in the industry.

The question is what will the industry look like when that changes.

Dumping stocks is not the same as stopping oil and gas production.

Certainly not... But my understanding has been that the government and people were vested in the industry.

The question is what will the industry look like when that changes.

a reply to: CriticalStinker

Price is irrelevant since many of those pay dividends.

$7.5 billion worth is several million of year for doing nothing.

Price is irrelevant since many of those pay dividends.

$7.5 billion worth is several million of year for doing nothing.

a reply to: LightSpeedDriver

Exactly... Halliburton just trained 40 some odd new mud engineers for Norway. Their oil industry isn't going any where.

Jaden

Exactly... Halliburton just trained 40 some odd new mud engineers for Norway. Their oil industry isn't going any where.

Jaden

With the way new energy technologies are coming out, it could be a decade or so before oil and coal are obsolete.

There is that one group in Sweden that developed a solar thermal fuel, that can store energy from the sun for well over a decade. Then there is another group that is testing the ability to tap geothermal energy with graphene cables.

Both are believed to be cheaper than fossil fuel.

There is that one group in Sweden that developed a solar thermal fuel, that can store energy from the sun for well over a decade. Then there is another group that is testing the ability to tap geothermal energy with graphene cables.

Both are believed to be cheaper than fossil fuel.

The developed world who consume oil and gas in vast quantities are weaning themselves off oil. Not just electric cars and renewables, but plastics

and other products made from oil.

The Norwegian fund is taking the long view. Good idea.

The Norwegian fund is taking the long view. Good idea.

The decision to float $7.5 billion worth of new public paper from a privately owned trillion dollar fund would be timed for a profitable

price/earnings ratio if I'm reading this correctly.

They will offer a dividend and the offering price will have to compete with other international P/E ratios for similar products.

If Norway waited till later in the year when the US Federal Reserve is actively unwinding debt by selling bonds they might have to settle for a lower price per share for the initial offering.

We really don't know how much other paper might be floated by other countries and funds.

Jerome Hayden the US Fed chief said he wanted to pay off the US national debt before dividend rates soared.

Possibly this announcement was to get people thinking about global debt strategy?

They will offer a dividend and the offering price will have to compete with other international P/E ratios for similar products.

If Norway waited till later in the year when the US Federal Reserve is actively unwinding debt by selling bonds they might have to settle for a lower price per share for the initial offering.

We really don't know how much other paper might be floated by other countries and funds.

Jerome Hayden the US Fed chief said he wanted to pay off the US national debt before dividend rates soared.

Possibly this announcement was to get people thinking about global debt strategy?

Since one of the purposes of the wealth fund is to insulate Norwegan economy from changes in the oil price, it doesn't really make a lot of sense for

it to hold too much in oil stocks anyway.

a reply to: LightSpeedDriver

Luckily AP did nothing of the sort, neither did my op or the article in question. This is literally nothing more than a personal financial decision by the Norwegian government for it's folks. There has been no mention of production cuts. It'd be nice if every US state did something similar with a sovereign wealth fund, but thats just dreaming big.

Baby steps though.

Luckily AP did nothing of the sort, neither did my op or the article in question. This is literally nothing more than a personal financial decision by the Norwegian government for it's folks. There has been no mention of production cuts. It'd be nice if every US state did something similar with a sovereign wealth fund, but thats just dreaming big.

Baby steps though.

a reply to: worldstarcountry

IMVVO I believe that the 'earth's production of oil' is a continuous process ... but this knowledge is a well hidden Fact, for it would instantly remove even the possibility of "peak oil" ever occurring!

This knowledge, like how it's amazingly easy to have a car that gets 140MPG! They had them in the 1940's!

BUT thanks to the big media and advertising agencies lobbyists were quick to have their "media pals" shut down any such knowledge should it cut into their Profits

Roswell was an example of such a "media shutdown and Mis-information operation" ... and most people 'believed the official line' and/or didn't want to be called "crazy" for even thinking such things are possible!

Stopping the world from knowing about the 140mpg carburettors was a piece of cake in comparison!

[url=http://fuel-efficient-vehicles.org/energy-news/?page_id=986[/url]

And this was 80 Years ago! The link takes you to some names and places but the info is quite hard to find without using esoteric knowledge to search with

IMVVO I believe that the 'earth's production of oil' is a continuous process ... but this knowledge is a well hidden Fact, for it would instantly remove even the possibility of "peak oil" ever occurring!

This knowledge, like how it's amazingly easy to have a car that gets 140MPG! They had them in the 1940's!

BUT thanks to the big media and advertising agencies lobbyists were quick to have their "media pals" shut down any such knowledge should it cut into their Profits

Roswell was an example of such a "media shutdown and Mis-information operation" ... and most people 'believed the official line' and/or didn't want to be called "crazy" for even thinking such things are possible!

Stopping the world from knowing about the 140mpg carburettors was a piece of cake in comparison!

“ In 1933 Charles Nelson Pogue made headlines when he drove a 1932 Ford V8, 200 miles on a gallon of gas during a demonstration conducted by The Ford Motor Company in Winnipeg, Manitoba using his super-carburetor system.”

In early 1936 Breen Motor Company, Winnipeg, Manitoba, Canada tested the Pogue carburetor on a Ford V-8 Coupe and got 26.2 miles on one pint of gasoline (That’s 200+ mpg).

The performance of the car was 100% in every way. Under 10 mph the operation was much smoother than a standard carburetor. T.G. Green, President of the Breen Motor Company did the tests.

Winnipeg’s largest automobile dealers tested the Pogue carburetor and got results of up to 216.8 mpg!

In 1945, according to an unnamed source, carburetors marked “POGUE CARBURETOR, DO NOT OPEN” were used on American Army tanks throughout WWII but were removed from circulation after the war ended.

[url=http://fuel-efficient-vehicles.org/energy-news/?page_id=986[/url]

In fact, many people attested to these mileage claims as The Pogue Carb went into production and was sold openly. [see Don Garlitz, above] However, one of the crucial factors of these systems is the use of “white” gasoline, which contained no additives. (aka Unleaded)

It was at this time oil companies started adding lead to the fuel. Lead is an anti-catalyst that rendered Pogue’s carburetor as inefficient as a regular carb. His invention caused such shock waves through the stock market, that the US and Canadian governments both stepped in and applied pressure to stifle him.

In the opening months of 1936, stock exchange offices and brokers were swamped with orders to dump all oil stock immediately.

Frank:

After my dad had sent me that copy of the Pogue Carburetor patent, and while I was working on my plans, an old retired gentleman with whom I was acquainted, came into my shop, and began to tell me of his experiences. He had been a machinist somewhere in Minnesota I think, when a French Canadian came to the shop. The Canadian had invented a carburetor, but was having trouble with it vapor locking. The machinist designed a valve for him that solved the problem. While the machinist was talking, he kept saying, “Oh, what was his name? Oh, what was his name?” I finally ask him, “Was that valve shaped like a rod split in half?” He looked at me in amazement, “Why, yes! How did you know?” I asked another question, “Was his name Pogue?” Then the old man was really amazed that I knew. I showed him the copy of the patent that I had, and he was really excited. He went over the papers like an excited child.

The old machinist went on to tell me how several months or was it several years later he had to take some paperwork up to the main office. He had to go through the conference room where he saw Mr. Pogue in the midst of a bunch of oil company big wigs. He named the wigs, but I forget the names. They were heads of Texaco, Shell, Esso, etc. Some of them had red faces, and Mr. Pogue looked like a trapped rabbit. Of course the machinist was very interested as to what was going on, but he knew he wasn’t supposed to be there, so he went on his way.

Later, one of the office boys came down to the shop, and told the machinist, “Hey, you know that Pogue guy that you made that valve for? Well, he sold that carburetor, and plans, lock stock and barrel to the oil company guys. They had a black man carry the whole thing down and put it into the trunk of a Pierce Arrow, and he drove off. That had been the last he had heard or seen of it until I showed him those patent papers.

www.blog.hasslberger.com/2007/04/pogue_carburetor_gasoline_vapo.html

And this was 80 Years ago! The link takes you to some names and places but the info is quite hard to find without using esoteric knowledge to search with

edit on 9-3-2019 by JohnnyJetson because: HIGHlights

edit on 9-3-2019 by JohnnyJetson because:

gasemfasis

edit on 9-3-2019 by JohnnyJetson because: gasgasgas

edit on 9-3-2019 by JohnnyJetson because:

duh!

edit on 9-3-2019 by JohnnyJetson because: aagggrrrhhhh

edit on 9-3-2019 by JohnnyJetson because: Pogo

stuck

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 5 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 7 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago, 8 flags -

Weinstein's conviction overturned

Mainstream News: 7 hours ago, 7 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 11 hours ago, 6 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 5 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago, 5 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago, 3 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 9 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 3 hours ago, 2 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 76 • : YourFaceAgain -

The Acronym Game .. Pt.3

General Chit Chat • 7750 • : bally001 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 681 • : MetalThunder -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People • 20 • : chr0naut -

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs • 7 • : rickymouse -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 10 • : chr0naut -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 23 • : Ravenwatcher -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2

8