It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

So I just stepped into a thread filled with ridicule and ignorance so I decided to go ahead and make a mini thread of my own.

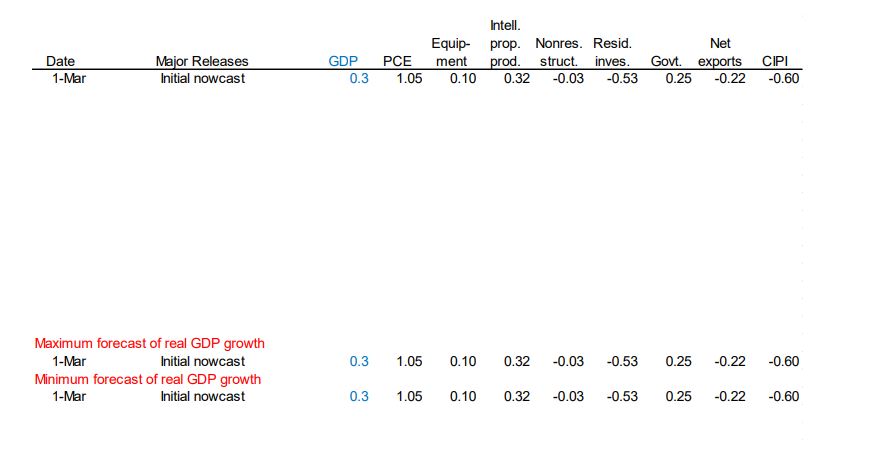

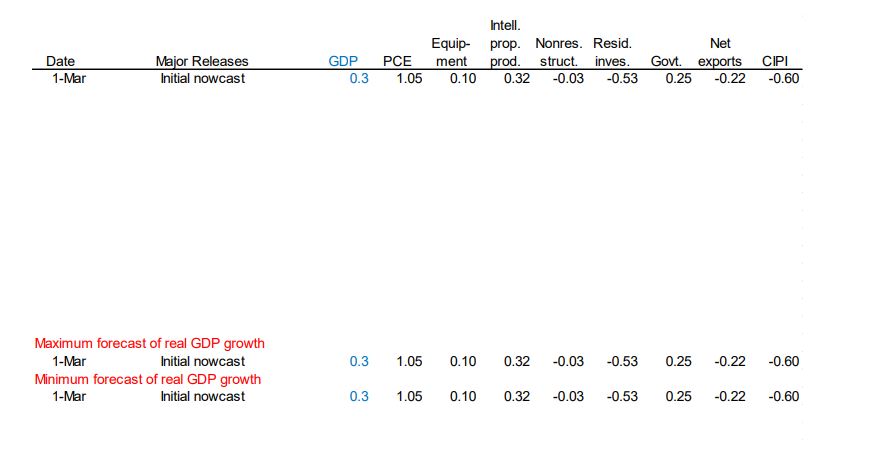

Atlanta Fed

.3% estimated GDP growth.

Historical GDP chart

Historical data for perspective. The only time GDP drops this low is during recession, which wouldn't be a surprise right now if you pulled your head out of your butt and looked at actual data. Some of you know what I mean and some of you are going to be sideways in a few months to a year.

Seeking Alpha

Seeking Alpha is one of my favorite analysis sites you should check them out if you are a market watcher/ trader.

China is a behemoth economy like the US. Pay attention. China is creating inflation, this may be part of the negotiations happening with the US. By devaluing their currency they can leverage the US manufacturing market by making their products cheaper to foreign investment. This could also be bad for US manufacturing as foreign investor's/ buyers will always seek to increase their bottom line.

I could be wrong about that. They could also have a debt/ credit crisis forming like the US.

Seeking Alpha

This is just corporate debt. This is one of the reasons why the Fed can't raise rates which is going to lead to inflationary monetary policy rendering your raises worthless in 2019.

If you are doing good this should bother you because this is going to make the extra money you are making worthless IE similar purchasing power but higher number.

Don't worry. You are doing really good and got a raise. You couldn't possibly lose out in a deflationary debt bubble collapse.

Seeking Alpha

Corporations and consumers are over leveraged in the market, there's an actual liquidity crisis forming as we speak, but you got a raise don't worry this won't affect you. You should actually buy property right now, as much as possible because everything is going so good there's no reason for you not to invest your money in real estate.

That's professional advice btw. #MAGA (I keed I keed).

When everyone else is buying, sell.

Wow, Target is the most surprising on the list to me, I didn't even know that, Starbucks as well. Guess those damn Millennial's stopped buying both Starbucks and iPhones last year... well what am I going to do without that key talking point now?

MMmmmm... my favorite mining stocks took a hit last week, looks like a buying opportunity.

Don't worry though, you got a raise you'll be fine.

And I will leave you with that.

Atlanta Fed

.3% estimated GDP growth.

Historical GDP chart

Historical data for perspective. The only time GDP drops this low is during recession, which wouldn't be a surprise right now if you pulled your head out of your butt and looked at actual data. Some of you know what I mean and some of you are going to be sideways in a few months to a year.

Seeking Alpha

The Atlanta and New York Fed's models estimating Q1 real GDP growth both start out at below 1%.

Both measures are estimates that become more refined as the quarter progresses and more data is gathered.

The Atlanta Fed's initial Q1 GDPNow model is 0.3% and the New York Fed's estimate is 0.9%.

The Commerce Department's initial estimate for Q4 real GDP, released yesterday, was 2.6%--0.8 percentage points higher than the Atlanta Fed's most recent Q4 GDPNow model and 0.3 pp higher than the New York Fed's Q4 Nowcast.

Previously: Q4 GDP growth as expected at 2.6% (Feb. 28)

Seeking Alpha is one of my favorite analysis sites you should check them out if you are a market watcher/ trader.

China is a behemoth economy like the US. Pay attention. China is creating inflation, this may be part of the negotiations happening with the US. By devaluing their currency they can leverage the US manufacturing market by making their products cheaper to foreign investment. This could also be bad for US manufacturing as foreign investor's/ buyers will always seek to increase their bottom line.

I could be wrong about that. They could also have a debt/ credit crisis forming like the US.

Seeking Alpha

Rising rates will result in significantly higher re-financing costs for maturing U.S. government bonds Over the next five years, $7 trillion in U.S. government bonds (IEF)(IEI)(GOVT) will mature with an (current) average coupon of 2%. With the two to ten-year portion of the yield curve at or near 3%, that would represent (today) a 50% increase in interest expense. Keep in mind in 2017 alone, the government spent $263 billion on interest, and according to the Wall Street Journal, that figure will spike to $915 billion by 2028, a nearly 250% increase.

This is just corporate debt. This is one of the reasons why the Fed can't raise rates which is going to lead to inflationary monetary policy rendering your raises worthless in 2019.

If you are doing good this should bother you because this is going to make the extra money you are making worthless IE similar purchasing power but higher number.

Corporate debt (LQD)(VCIT) has exploded to the upside having grown to over $6.3 trillion from $3.5 trillion since 2008, an 80% increase.

Don't worry. You are doing really good and got a raise. You couldn't possibly lose out in a deflationary debt bubble collapse.

Seeking Alpha

Nominal levels of household debt are up above the pre-crisis peak.

Leverage levels (debt to household income ratio) is at a 17-year low.

Mortgage debt is increasing, and is approaching its pre-crisis peak: Mortgage debt stood at $10.1 trillion in 1Q 2018, just 5.7% below the 2008 peak.

Consumer credit has been growing steadily throughout the 'recovery' period, averaging annual growth of 5.2% since 2010, bringing total consumer debt to an all-time high of nearly $14 trillion in early 2018.

While leverage has stabilized at around 95%, down from the 124% at the pre-crisis peak, current leverage ratio is still well-above the 58% average for 1946-1999 period.

Corporations and consumers are over leveraged in the market, there's an actual liquidity crisis forming as we speak, but you got a raise don't worry this won't affect you. You should actually buy property right now, as much as possible because everything is going so good there's no reason for you not to invest your money in real estate.

That's professional advice btw. #MAGA (I keed I keed).

When everyone else is buying, sell.

During the first weeks of 2019, retailers shut down 23% more stores than they did at the start of 2018, according to Coresight Research. The firm concludes there's "no light at the end of the tunnel" for troubled store companies.

Wow, Target is the most surprising on the list to me, I didn't even know that, Starbucks as well. Guess those damn Millennial's stopped buying both Starbucks and iPhones last year... well what am I going to do without that key talking point now?

MMmmmm... my favorite mining stocks took a hit last week, looks like a buying opportunity.

Don't worry though, you got a raise you'll be fine.

And I will leave you with that.

edit on 3-3-2019 by toysforadults because: (no reason given)

edit on 3-3-2019 by toysforadults

because: (no reason given)

a reply to: toysforadults

It's doesn't matter what you pay in taxes. It doesn't matter what your wages are. What DOES matter is the purchasing power of your take home pay:

Purchasing Power of the Consumer Dollar

It's doesn't matter what you pay in taxes. It doesn't matter what your wages are. What DOES matter is the purchasing power of your take home pay:

Purchasing Power of the Consumer Dollar

originally posted by: toysforadults

a reply to: dfnj2015

Totally agree, which is basically nothing from a historical point of view. I mean you really can't compare fiat to gold standard.

Any standard is better than fiat fabrications:

President Lincoln had the answer:

www.michaeljournal.org...

During the Civil War (1861-1865), President Lincoln needed money to finance the War from the North. The Bankers were going to charge him 24% to 36% interest. Lincoln was horrified and went away greatly distressed, for he was a man of principle and would not think of plunging his beloved country into a debt that the country would find impossible to pay back.

Eventually President Lincoln was advised to get Congress to pass a law authorizing the printing of full legal tender Treasury notes to pay for the War effort. Lincoln recognized the great benefits of this issue. At one point he wrote:

"(we) gave the people of this Republic the greatest blessing they have ever had – their own paper money to pay their own debts..."

The Treasury notes were printed with green ink on the back, so the people called them "Greenbacks".

Every president in the United States that has given the people of this country their own interest free money has been assassinated.

"Give me control of a nations money supply, and I care not who makes it’s laws". Mater Amschel Rothschild

edit on Sun Mar 3 2019 by DontTreadOnMe because: EX tags and trimmed overly long quote

IMPORTANT: Using Content From Other Websites on ATS

We're not concerned over here in the land of magic internet money. We're building a whole new economy.

The closely watched Atlanta Fed’s initial estimate for first quarter growth is just 0.3 percent.

The forecast shows an economy that has stalled after the fourth quarter’s 2.6 percent gain.

Economists have been expecting first-quarter growth below 2 percent.

Goldman Sachs economists see 0.9 percent for the first quarter and a bounce to 2.9 percent in the second quarter.

Isnt it normal to have an up and down cycle? been riding a wave now there is a lull.

The forecast shows an economy that has stalled after the fourth quarter’s 2.6 percent gain.

Economists have been expecting first-quarter growth below 2 percent.

Goldman Sachs economists see 0.9 percent for the first quarter and a bounce to 2.9 percent in the second quarter.

Isnt it normal to have an up and down cycle? been riding a wave now there is a lull.

edit on 3-3-2019 by putnam6 because: (no reason

given)

a reply to: toysforadults

It's my new mission in life to bring as many people with me on this technological journey as I can.

They're trying to leave you behind by making you hold on to their antiquated bull# system.

I'm not saying it's all bad and I do believe in investing. I just think the Machine Economy offers us more, especially when it has SO MUCH potential for growth.

It's my new mission in life to bring as many people with me on this technological journey as I can.

They're trying to leave you behind by making you hold on to their antiquated bull# system.

I'm not saying it's all bad and I do believe in investing. I just think the Machine Economy offers us more, especially when it has SO MUCH potential for growth.

originally posted by: projectvxn

a reply to: toysforadults

It's my new mission in life to bring as many people with me on this technological journey as I can.

They're trying to leave you behind by making you hold on to their antiquated bull# system.

I'm not saying it's all bad and I do believe in investing. I just think the Machine Economy offers us more, especially when it has SO MUCH potential for growth.

I think you are right. Our archaic view of the economy is the main driving point I am making with all of my market related post.

I am just providing data points to prove my position over longer periods of time rather than just parroting age old talking points that as you say are antiquated and irrelevant to our economy (our age group).

At the end of the movie The Big Short...it explains that nothing changed. Nothing was put in place to prevent 2008 again so this does not surprise me.

I dont think it would have mattered WHO was president. Nobody can stop the corporatocracy now.

Your arguments did not even include school debt.

However, disparaging giving people a raise is pretty ridiculous as that raise money probably went right back into the economy through spending. I believe over 80% of americans do not even have 400 dollars in savings.

Your arguments did not even include school debt.

However, disparaging giving people a raise is pretty ridiculous as that raise money probably went right back into the economy through spending. I believe over 80% of americans do not even have 400 dollars in savings.

edit on 4-3-2019 by lakenheath24 because: (no reason given)

Most of us being pleased with our 5 percent raises will see our cost of living increase in the coming year and make that raise worthless- I agree.

But at the same time, that happens every year, while raises don't.

Fiat will fail, the only questions are when, what to do to prepare for it, and what to do when it happens.

Will buying stocks in corporations help? More than hoarding cash, no doubt... But when faith is lost in the US dollar, nobody will sell you their bread for it.

There will be millionaires starving, in the end.

But at the same time, that happens every year, while raises don't.

Fiat will fail, the only questions are when, what to do to prepare for it, and what to do when it happens.

Will buying stocks in corporations help? More than hoarding cash, no doubt... But when faith is lost in the US dollar, nobody will sell you their bread for it.

There will be millionaires starving, in the end.

originally posted by: projectvxn

a reply to: putnam6

There have also been halting events with weather and other issues.

Pointing to one metric to the exclusion of so many others may be a recipe for missing the boat.

I agree 100% I'm less than a novice on this subject, but I am here to learn because it fascinates me and LOL kind of disturbs me at the same time. Loved the move the Big Short, but staying with the boat metaphor, it makes you feel like you are in a raft in the rapids approaching a waterfall without a paddle or life vest.

originally posted by: projectvxn

a reply to: toysforadults

It's my new mission in life to bring as many people with me on this technological journey as I can.

They're trying to leave you behind by making you hold on to their antiquated bull# system.

I'm not saying it's all bad and I do believe in investing. I just think the Machine Economy offers us more, especially when it has SO MUCH potential for growth.

Oh you're just trying to make your coins worth more by getting more people to buy in.

a reply to: toysforadults

Well, since you're having a doom porn festival let me take a dump on it for you.

First, the atlanta fed prediction is usually way too high or way too low to start. Your quote even admits as much. The St Louis fed is much more consistent throughout the projection period and they have it at 2.3% for Q1 '19, so there goes that. Link

But it gets worse, you erroneously compare a quarterly GDP number (0.3% projected for Q1, by a couple of nowcasts) to annual GDP numbers. As you can see here we have had quarterly GDP numbers below 0.5% 7x since 2011. We even had three negative GDP rates (contraction) and still no recession. Just a weaker economy, thanks obama.

Seeking Alpha is hit or miss, anyone can write for them. Lots of knowledgeable people, lots of wannabe's.

Now wait a minute, I thought those evil corporations were hoarding cash and buying stock back? But now you're telling me they're borrowing like mad? This seems like a tear in the narrative. But your contention here is correct, they are leveraged pretty good. However, interest rates were near zero for most of the rise in corporate debt meaning it's very serviceable. Not only that, but that debt has begun to trail off in 2018 with the rise in interest rates. This indicates that businesses are being wise with their borrowing. It's foolish to spend your own money when someone will loan you theirs with none or very little interest.

But these debt levels could make a recession worse. No doubt about that. However, on their own they're not going to make a recession. You need another catalyst. The good news is that the trailing off of corporate debt has already begun. So they're making headway in advance of a recession. Every month that goes by and this number declines is a blow to those who are hoping for disaster.

Brick and mortar retail has been suffering for well over a decade. Monitoring store closures over a two week period is a very poor way measure anything. What happens if in the following two weeks the close 50% fewer than the same time period last year? Is everything all better then?

As usual, it gets worse. If you actually follow your link to the coresight "study" you learn that 2018 (the number we are to compare 2019 to) had 32% fewer store closures than 2017, meaning store closures in 2019 aren't even as bad as they were in 2017. Recession incoming lmao.

And you end by highlighting gold prices dropping. But aren't gold prices supposed to rise leading up to and during recessions?

And I will leave you with that.

Well, since you're having a doom porn festival let me take a dump on it for you.

First, the atlanta fed prediction is usually way too high or way too low to start. Your quote even admits as much. The St Louis fed is much more consistent throughout the projection period and they have it at 2.3% for Q1 '19, so there goes that. Link

But it gets worse, you erroneously compare a quarterly GDP number (0.3% projected for Q1, by a couple of nowcasts) to annual GDP numbers. As you can see here we have had quarterly GDP numbers below 0.5% 7x since 2011. We even had three negative GDP rates (contraction) and still no recession. Just a weaker economy, thanks obama.

Seeking Alpha is hit or miss, anyone can write for them. Lots of knowledgeable people, lots of wannabe's.

Corporations and consumers are over leveraged in the market, there's an actual liquidity crisis forming as we speak

Now wait a minute, I thought those evil corporations were hoarding cash and buying stock back? But now you're telling me they're borrowing like mad? This seems like a tear in the narrative. But your contention here is correct, they are leveraged pretty good. However, interest rates were near zero for most of the rise in corporate debt meaning it's very serviceable. Not only that, but that debt has begun to trail off in 2018 with the rise in interest rates. This indicates that businesses are being wise with their borrowing. It's foolish to spend your own money when someone will loan you theirs with none or very little interest.

But these debt levels could make a recession worse. No doubt about that. However, on their own they're not going to make a recession. You need another catalyst. The good news is that the trailing off of corporate debt has already begun. So they're making headway in advance of a recession. Every month that goes by and this number declines is a blow to those who are hoping for disaster.

During the first weeks of 2019, retailers shut down 23% more stores than they did at the start of 2018, according to Coresight Research.

Brick and mortar retail has been suffering for well over a decade. Monitoring store closures over a two week period is a very poor way measure anything. What happens if in the following two weeks the close 50% fewer than the same time period last year? Is everything all better then?

As usual, it gets worse. If you actually follow your link to the coresight "study" you learn that 2018 (the number we are to compare 2019 to) had 32% fewer store closures than 2017, meaning store closures in 2019 aren't even as bad as they were in 2017. Recession incoming lmao.

And you end by highlighting gold prices dropping. But aren't gold prices supposed to rise leading up to and during recessions?

And I will leave you with that.

originally posted by: dfnj2015

Every president in the United States that has given the people of this country their own interest free money has been assassinated.

Huh? What Lincoln did was very similar to what Nixon did, unlinking the dollar to gold. Did anyone assassinate Nixon?

new topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 2 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 2 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 5 hours ago -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 6 hours ago -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 8 hours ago -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 9 hours ago -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 9 hours ago -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 10 hours ago -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 10 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 9 hours ago, 23 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 10 hours ago, 18 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 2 hours ago, 16 flags -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest: 15 hours ago, 12 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 10 hours ago, 7 flags -

Russia Flooding

Fragile Earth: 17 hours ago, 7 flags -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 14 hours ago, 6 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 5 hours ago, 6 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 8 hours ago, 5 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 2 hours ago, 3 flags

active topics

-

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 6 • : visitedbythem -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry • 165 • : andy06shake -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 39 • : Zanti Misfit -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 18 • : alldaylong -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 43 • : Naftalin -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 120 • : DBCowboy -

Alabama Man Detonated Explosive Device Outside of the State Attorney General’s Office

Social Issues and Civil Unrest • 56 • : DBCowboy -

What do you do to get to sleep and stay asleep ??

Health & Wellness • 108 • : TheGoondockSaint -

George Knapp AMA on DI

Area 51 and other Facilities • 9 • : nerbot -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 28 • : Astrocometus