It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

3

share:

During the administration of President Dwight D. Eisenhower, from 1953 to 1961, the top income bracket in the United States climbed to a marginal tax rate of 91 percent. Taxes on corporate profits were two times as great as they are in 2017, and that’s before the current proposal to cut that rate to 21 percent. The tax on large estates rose to more than 70 percent. Businesses operated under a relatively high tax burden, and they employed a labor force in which one-third of the workers were unionized and bargained with executives as equals. Corporations served a diversity of stakeholders as opposed to stockholders.

In 1955, Fortune magazine noted approvingly that the incomes of the top 0.01 percent of Americans were less than half what they had been in the late 1920s, and their share of total income was down by 75 percent. In the 1950s, the average corporate CEO received 20 times more compensation than the firm’s typical employee; by 2016, CEOs’ salaries averaged more than 200 times those of the average worker.

Americans in the 1950s enjoyed what economists called “the virtuous circle of growth”: Well-paid workers fueled consumer demand, which, in turn, generated business expansion and hiring, raising corporate profits, which produced higher wages and more hiring. A consumer culture flourished and, therefore, so did the economy. Fortune noted that, by the mid-1950s, the number of middle-class families was increasing by 1.1 million a year.

www.zocalopublicsquare.org...

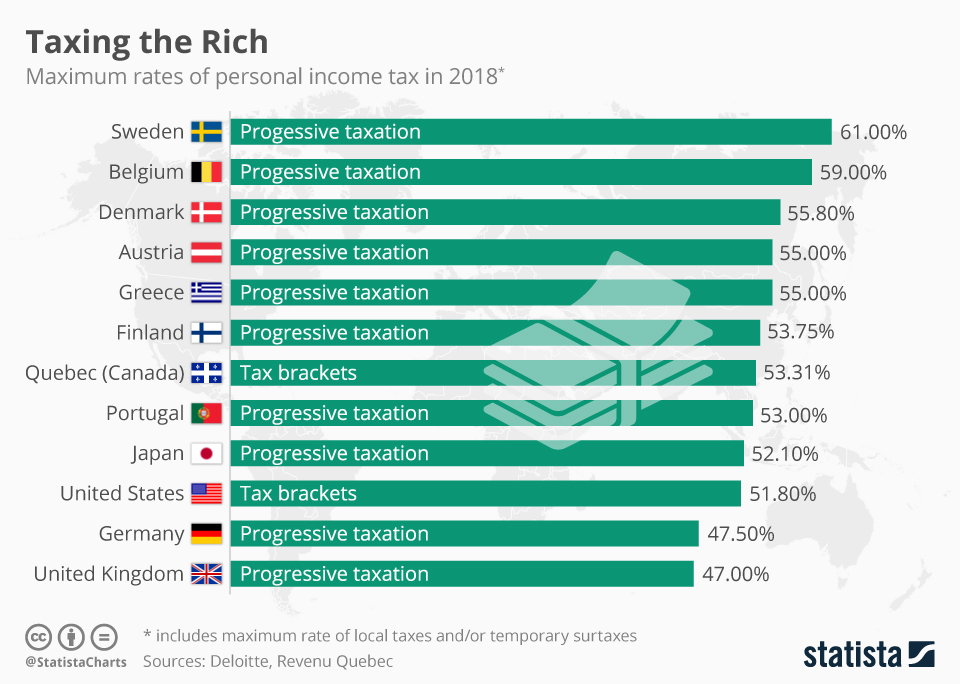

According to reports by Deloitte, this proposed rate does exceed individual income tax rates currently in use. Many nations known for imposing high taxes on their citizens, like Sweden, Belgium or Denmark, do not use rates as high as 70 percent. This is partly because most European nations use a system of progressive taxation: the higher the taxable income, the higher the tax rate on the total of that income. Countries with especially high maximum tax rates, like Portugal or Greece, often impose an additional rate on high incomes.

The U.S., like its neighbor Canada, works with tax brackets, meaning that any income under a certain amount is taxed at the same low rate. Income left after that is taxed at incrementally higher rates in all applicable higher tax brackets. Following Ocasio-Cortez’ proposal, the 70 percent rate would only kick in for any earnings above someone's 10 millionth dollar.

Tax rates are hard to compare across countries not only because of the different systems of taxation. Each country of course sets a different amount of tax-free income. In some countries, income tax is tied to a national health care system. Again others have steep local taxes that vary depending on where you live or currently use a temporary surcharge because of a national emergency or the like.

www.statista.com...

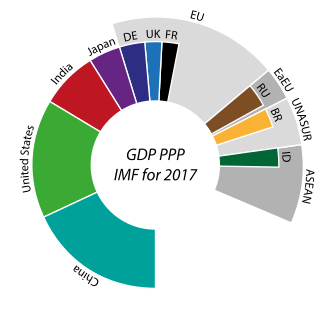

Notice where the United States ranks on this chart and the one below.

List by the International Monetary Fund (estimates for 2018)

Rank/Country/GDP (billions of Current Int$)

1 China 25,238.56

2 United States 20,412.87

3 India 10,385.43

4 Japan 5,619.49

5 Germany 4,373.95

6 Russia 4,168.88

7 Indonesia 3,492.21

8 Brazil 3,388.96

9 United Kingdom 3,028.57

10 France

Then, consider the new deal in perspective:

Ocasio-Cortez has put forward a "Green New Deal" that includes generating all of the nation's power from renewable sources, building a national smart grid and entirely eliminating industrial greenhouse gas emissions. A proposal from the democratic socialist lawmaker calls for achieving those goals within 10 years.

In the "60 Minutes" interview, Ocasio-Cortez acknowledges that taxes would have to rise to underwrite the necessary investments. Asked for a specific proposal, Ocasio-Cortez suggested the plan might require returning to policies that preceded the overhauls of the 1980s, which significantly reduced the top income tax rate.

"You know, you look at our tax rates back in the '60s and when you have a progressive tax rate system, your tax rate, you know, let's say, from zero to $75,000 may be 10 percent or 15 percent, et cetera," she told "60 Minutes."

"But once you get to, like, the tippy tops, on your 10 millionth dollar, sometimes you see tax rates as high as 60 or 70 percent. That doesn't mean all $10 million are taxed at an extremely high rate, but it means that as you climb up this ladder you should be contributing more."

The top tax rate dropped to 37 percent following the passage of the 2017 Tax Cuts and Jobs Act.

www.cnbc.com...

Are we being too lenient with taxes on the wealthiest? Honestly, it's worth consideration outside of a left vs right, Democrat vs Republican, or conditioned response to anything Ocasio-Cortez says (I see the idea behind right wing media trolling her more than anyone now). Alright, so the taxes were really high in the 50's and we coincidentally had amazing growth, prosperity, and standard of living. I don't care to debate why we had those things, perhaps there was a boon post WWII from our war time strength economy and the spoils from our victory. Whatever the case, the tax rates existed, and the growth happened. I'm certain there's plenty of people well versed in this who could write an essay explaining how the tax rate was unjust and had no positive effect on our growth, in fact, had the wealthy been taxed less in the 50's we would've grown even faster. Or, the high tax rates worked then because of X, but will hurt us now because of Y, and what we need is Z which is even slightly lower tax rates on the wealthiest.

If there's a genuine reason why it's a deeply flawed comparison, you also have to consider it in comparison to the tax rates in the graph above, as well as the GDP rankings. Is there a convincingly explainable good reason that the deepest coffers of untapped wealth that isn't being used for much can't be taxed even a little bit more, or a compromise amount fairly less than 70% but higher than the current? And while we're on the subject.. why were wages and standard of living higher for lower and middle working class people in the 50's vs today? Obviously they didn't have nice televisions and iphones, but keeping it in perspective. Also, couldn't even a few percentage points of an increase on the highest bracket of taxes fund entire Government programs to increase the standard of living for everyone? When I say everyone, the people living in houses that are worth more than $500,000 (just incase one of them is extremely frugal) and being in the highest bracket, the small group of people.

When you argue against the Green New Deal, is it the tax rate? Or the reason for the plan, the plan itself, in addition to the person who's presenting the plan and their party affiliation? You couldn't possibly be defending billionaires because higher taxes for them is going to hurt the economy in a significant way. If you are defending them for that reason and believe it'd hurt the economy, that means you believe it'd hurt the lower working class tax bracket people because of it, correct? You're concerned for predominantly Democratic voters?

edit on 2/11/2019 by r0xor because: (no reason

given)

One key differentiation was, at the time, the majority of the manufacturing of goods purchased in the US was created in the US. It was more of a

turnkey process. However, now, the majority of production is overseas, and therefore, the jobs needed to produce that required tax base have also been

shipped overseas. The economic burden is higher....and business incentives to remain here in the are much much less. In the 1950's it was near

impossible for a company to move overseas and maintain their income (or make profit).....so, acceptance of that level of corporate tax was easier.

Not so much now....just the opposite.

That is what I have against this GND. It doesn't accept that those being taxed higher to pay for all the "free stuff" have an easier time to simply leave the US for a more favorable country. Which actually means "officially" they are not here for tax reasons, but in reality they remain here in the US.

Also, there is no mention or thought about making our entire energy base a single-point failure by placing it all into non storage and "just-in-time" energy production. The transmission of electricity for this new infrastructure will be ripe for disruption, creating a serious national security issue.

Not so much now....just the opposite.

That is what I have against this GND. It doesn't accept that those being taxed higher to pay for all the "free stuff" have an easier time to simply leave the US for a more favorable country. Which actually means "officially" they are not here for tax reasons, but in reality they remain here in the US.

Also, there is no mention or thought about making our entire energy base a single-point failure by placing it all into non storage and "just-in-time" energy production. The transmission of electricity for this new infrastructure will be ripe for disruption, creating a serious national security issue.

a reply to: r0xor

Higher taxes on billionaires, if you're talking income taxes, isn't going to raise a lot of money. Their lifestyles are funded by way of stock option sales and revenue types not characterized as income, such as sales of stocks that amount to capital gains. You could hurt them somewhat by raising the capital gains tax; but an income tax isn't really going to garner much in the way of money to the Treasury.

The real problem with taxing billionaires is that their excess cash is ploughed back into their business interests which in turn causes greater earnings and thus stock appreciation. So the people who would be hurt are those who are heavily invested in the Stocks and Bonds markets.

The real reason many people such as myself are opposed to the GND is that they simply don't want Big Brother intruding into their everyday lives. They don't want to be reliant upon some dopey public transportation scheme that works like the NY subway system wherein people are stabbed and robbed on a daily basis. They don't want some stranger inspectors rooting through their homes to see if the homes are energy compliant. They don't want to be told where they can and can't live and they sure as hell don't want to be dependent upon some Amtrak type government rail system to visit the Grand Canyon.

You couldn't possibly be defending billionaires because higher taxes for them is going to hurt the economy in a significant way. If you are defending them for that reason and believe it'd hurt the economy, that means you believe it'd hurt the lower working class tax bracket people because of it, correct?

Higher taxes on billionaires, if you're talking income taxes, isn't going to raise a lot of money. Their lifestyles are funded by way of stock option sales and revenue types not characterized as income, such as sales of stocks that amount to capital gains. You could hurt them somewhat by raising the capital gains tax; but an income tax isn't really going to garner much in the way of money to the Treasury.

The real problem with taxing billionaires is that their excess cash is ploughed back into their business interests which in turn causes greater earnings and thus stock appreciation. So the people who would be hurt are those who are heavily invested in the Stocks and Bonds markets.

The real reason many people such as myself are opposed to the GND is that they simply don't want Big Brother intruding into their everyday lives. They don't want to be reliant upon some dopey public transportation scheme that works like the NY subway system wherein people are stabbed and robbed on a daily basis. They don't want some stranger inspectors rooting through their homes to see if the homes are energy compliant. They don't want to be told where they can and can't live and they sure as hell don't want to be dependent upon some Amtrak type government rail system to visit the Grand Canyon.

Its not your money.

Lenient? So now we're punishing success because people in the government thinks it belongs to them?

This line of thinking is totalitarian.

Lenient? So now we're punishing success because people in the government thinks it belongs to them?

This line of thinking is totalitarian.

originally posted by: r0xor

Are we being too lenient with taxes on the wealthiest?

When you argue against the Green New Deal, is it the tax rate? Or the reason for the plan, the plan itself, in addition to the person who's presenting the plan and their party affiliation? You couldn't possibly be defending billionaires because higher taxes for them is going to hurt the economy in a significant way. If you are defending them for that reason and believe it'd hurt the economy, that means you believe it'd hurt the lower working class tax bracket people because of it, correct? You're concerned for predominantly Democratic voters?

The super wealthy including billionaires have teams of accountants and tax attorneys who's only job in life is to hide that money in a non-taxable way. Raising taxes on them will not have any desired or noticeable effect. We have a progressive tax system that has so many legal loopholes that hiding money is not just a bonus, but an expectation.

For the tax system to truly be fair, a flat tax of a set percentage with no loopholes would have to be set. And further, ultra large corporations should be expected to pay taxes...not just receive refunds without ever paying. And even then, we would still have to find a way to bring manufacturing jobs between our two oceans and north of Mexico and south of Canada.

There is no easy solution. There will always be those that can offer reasons, essays and even theses on why this plan or that plan will not work.

The historical data though was pretty cool, but it's not necessarily applicable here...as in the 1950s the USA was still fresh from it's wartime economy, when the big bosses learned just how much they could push their workers.

originally posted by: r0xor

Are we being too lenient with taxes on the wealthiest?

When you argue against the Green New Deal, is it the tax rate? Or the reason for the plan, the plan itself, in addition to the person who's presenting the plan and their party affiliation? You couldn't possibly be defending billionaires because higher taxes for them is going to hurt the economy in a significant way. If you are defending them for that reason and believe it'd hurt the economy, that means you believe it'd hurt the lower working class tax bracket people because of it, correct? You're concerned for predominantly Democratic voters?

The super wealthy including billionaires have teams of accountants and tax attorneys who's only job in life is to hide that money in a non-taxable way. Raising taxes on them will not have any desired or noticeable effect. We have a progressive tax system that has so many legal loopholes that hiding money is not just a bonus, but an expectation.

For the tax system to truly be fair, a flat tax of a set percentage with no loopholes would have to be set. And further, ultra large corporations should be expected to pay taxes...not just receive refunds without ever paying. And even then, we would still have to find a way to bring manufacturing jobs between our two oceans and north of Mexico and south of Canada.

There is no easy solution. There will always be those that can offer reasons, essays and even theses on why this plan or that plan will not work.

The historical data though was pretty cool, but it's not necessarily applicable here...as in the 1950s the USA was still fresh from it's wartime economy, when the big bosses learned just how much they could push their workers.

originally posted by: projectvxn

Its not your money.

Lenient? So now we're punishing success because people in the government thinks it belongs to them?

This line of thinking is totalitarian.

No, no.. it's not like that. Even the wealthiest will admit that they're dumb wealthy. It's not punishment. You'd have to have that kind of wealth before you could accurately suggest that it is one. The mindset is entirely different. I hardly make anything, but when I have a few hundred in extra spending cash, I'll give a bum a couple of bucks if they aren't rude or obnoxious. Half of the time, I honestly need a couple of bucks, nobody gives it to me. I don't mind because I'm not asking and bearing the shame and scrutiny of doing so.

By the way you worded that, any tax percentage that is significantly higher than what 90% of the country has is a form of punishment on people who were exceedingly successful monetarily. You could even take it a step further and insinuate that any taxation is punishment on hard earned money, be it considered successful because it's a large amount or not. And in a way, I agree with you. Considering what I get from the Government vs what I pay (I get no benefits, no medicare, no SNAP) even the tax on my low bracket is too much. I could honestly use that to live a bit better, but still probably below the calculated average. I don't see you championing lower taxes or no taxes for me (a 'rats natural habitat is filth right?). If I had a few hundred million dollars however, I'd be thankful for you defending it.

Edit: It could be said that it doesn't matter what I get in Government assistance personally, my tax should be paid for the betterment of the nation and those who need the assistance I could use but actually get it. If no one paid taxes, nothing would get funded, it's the blood or the oil of our country. Really? Suppose we increased taxation on the wealthiest of the wealthy then to feed the country and grow it like watering a garden. I work physically and mentally harder and spend more calories just to fill my stomach with more calories and sleep under a roof so I can physically and mentally work harder the next day.

edit on 2/11/2019 by r0xor because: (no reason given)

Just two points.

1. Before we talk about raising taxes, can we have a discussion on responsible spending?

And #2.

Thank you. Have a pleasant evening.

1. Before we talk about raising taxes, can we have a discussion on responsible spending?

And #2.

Thank you. Have a pleasant evening.

originally posted by: DBCowboy

Just two points.

1. Before we talk about raising taxes, can we have a discussion on responsible spending?

And #2.

Thank you. Have a pleasant evening.

Fair enough. At this rate, left unchanged because it's not your money yet a direct result of your economic system and sheeple customer citizens, the wealthiest will continue to be wealthier, new members of the wealthiest bracket will rise over time while hardly any of the sheeple customer citizens do, and the wealth gap will exponentially increase at an increasing detrimental rate.

Hey, they earned it and will keep doing so through their ingenius wit and skill sets, vastly out-performing almost everyone with their exceedingly high IQs and seemingly superhuman cognitive abilities. Regular men and women, if given the circumstances or being born into wealth (even a token gesture like the President got from Dad of a mere million dollars even though word has it that you have to multiply it by 100) would fumble it.

a reply to: r0xor

So are you saying that in America it is simply impossible to rise from nothing to multi-billionaire?

We live in a country where it is not only possible to do so, but many of our billionaires fit the bill.

And what's a wealth gap... some sort of indicator of envy?

Make more than you spend, invest wisely and at the end of the day you retire to live the good life.

Oh... and three points you probably won't like... statistically if you want to succeed you should just do three things.

1. Graduate High school.

2. Get a job.

3. Don't have children till you are married.

So are you saying that in America it is simply impossible to rise from nothing to multi-billionaire?

We live in a country where it is not only possible to do so, but many of our billionaires fit the bill.

And what's a wealth gap... some sort of indicator of envy?

Make more than you spend, invest wisely and at the end of the day you retire to live the good life.

Oh... and three points you probably won't like... statistically if you want to succeed you should just do three things.

1. Graduate High school.

2. Get a job.

3. Don't have children till you are married.

a reply to: Lumenari

I have a great 15 year old son. He gets an allowance.

He often does not spend money wisely.

Since I've gotten a raise, some here think that I should just increase my son's allowance to compensate for his poor spending because I have more money to actually give.

It's insanity.

And once again, people are ignoring the Effective tax rates versus the Statutory tax rates of the Eisenhower era.

It boggles the mind!

I have a great 15 year old son. He gets an allowance.

He often does not spend money wisely.

Since I've gotten a raise, some here think that I should just increase my son's allowance to compensate for his poor spending because I have more money to actually give.

It's insanity.

And once again, people are ignoring the Effective tax rates versus the Statutory tax rates of the Eisenhower era.

It boggles the mind!

a reply to: DBCowboy

We can't get into the tax issue because the left is stupid, apparently.

So no reason to address it because it is apparently too challenging for them to understand.

As for the "wealth Inequality" thing, I guess I'm the stupid one.

Do I go and ask all my neighbors what they make so I can determine which one I don't like anymore?

Or do I not care about what everyone else makes and spend my time and energy making money myself?

I swear, if half of these people take the time and energy they are using to be upset at someone with more money then they have and use it to make money then they wouldn't worry about it anymore.

~shrug~

We can't get into the tax issue because the left is stupid, apparently.

So no reason to address it because it is apparently too challenging for them to understand.

As for the "wealth Inequality" thing, I guess I'm the stupid one.

Do I go and ask all my neighbors what they make so I can determine which one I don't like anymore?

Or do I not care about what everyone else makes and spend my time and energy making money myself?

I swear, if half of these people take the time and energy they are using to be upset at someone with more money then they have and use it to make money then they wouldn't worry about it anymore.

~shrug~

I must be looking at it wrong. Another way to say it is that there's no way to really know, understand, or relate to what it's like having

several hundred million or billions of dollars. There's probably competition and your image to uphold. Intense scrutiny on what you do, what you have,

what you say. It'd be a bad look if 10 billion in wealth became 9 billion in an unusual amount of time. There's probably hundreds of people

surrounding your net worth and anything you do with it like flies on feces. Only someone always liberal with their money could progressively lose net

worth year after year without an uproar or getting accused of mental illness.

Yet, I can't help but think when wealth reaches that level, it becomes more of a point score and is totally disempowered from its potential.

Yet, I can't help but think when wealth reaches that level, it becomes more of a point score and is totally disempowered from its potential.

a reply to: r0xor

So?

The second I stopped worrying about what other people made and concentrated on what I could do was probably the best time of my life because I realized that what other people have is none of my freaking business!

Everyone is always on about raising taxes because some have more.

But no one focuses on the idiotic spending that the government does.

The US spends more per capita on education than any other nation in the world and we are sinking.

The government tosses money around like it's fairy dust because money "always fixes everything".

pfft.

So?

The second I stopped worrying about what other people made and concentrated on what I could do was probably the best time of my life because I realized that what other people have is none of my freaking business!

Everyone is always on about raising taxes because some have more.

But no one focuses on the idiotic spending that the government does.

The US spends more per capita on education than any other nation in the world and we are sinking.

The government tosses money around like it's fairy dust because money "always fixes everything".

pfft.

edit on 11-2-2019 by DBCowboy because: (no reason given)

If I was a billionaire and I was all of a sudden saddled with a higher tax burden I would just move to another country like the Bahamas or any other

country with a lower tax rate. Ultimately you end up driving wealth out of the United States. This is because you cannot tax your way to prosperity.

It just doesn't happen.

I honestly don't worry about what other people make and I do concentrate on my (pitifully small in comparison) finances because I have to live from

check to check. I'll be wealthy (for me) by the end of the month with $500 from my federal tax return and $100 from Virginia whenever they can agree

and vote on the tax law.

Blame NPR. I heard it while driving home from work on the radio earlier today. I didn't get his name, but he was being interviewed about taxes and gave the Eisenhower example along with other examples from Europe. He also said it's proven that a shorter work week in total hours increases productivity when the work week is too high. He thought it was funny that the U.S. has jobs like greeters at Wal-Mart and jobs for things that countries in Europe and elsewhere don't have, simply for the sake of having jobs. The interviewer asked him if he thought Davos would invite him to speak again next year and they chuckled about it. So, I looked at the taxes in the 50's like he mentioned and noticed that the Green New Deal had a 20% lower tax rate or more vs the 1950s. I also noticed that the wealthiest have much more wealth in comparison to everyone else vs the 1950s, less taxation than ever, and the difference was drastic.

Blame NPR. I heard it while driving home from work on the radio earlier today. I didn't get his name, but he was being interviewed about taxes and gave the Eisenhower example along with other examples from Europe. He also said it's proven that a shorter work week in total hours increases productivity when the work week is too high. He thought it was funny that the U.S. has jobs like greeters at Wal-Mart and jobs for things that countries in Europe and elsewhere don't have, simply for the sake of having jobs. The interviewer asked him if he thought Davos would invite him to speak again next year and they chuckled about it. So, I looked at the taxes in the 50's like he mentioned and noticed that the Green New Deal had a 20% lower tax rate or more vs the 1950s. I also noticed that the wealthiest have much more wealth in comparison to everyone else vs the 1950s, less taxation than ever, and the difference was drastic.

edit on 2/11/2019 by r0xor because: (no reason given)

originally posted by: Metallicus

If I was a billionaire and I was all of a sudden saddled with a higher tax burden I would just move to another country like the Bahamas or any other country with a lower tax rate. Ultimately you end up driving wealth out of the United States. This is because you cannot tax your way to prosperity. It just doesn't happen.

Or just buy Mexico's northern border, set yourself up on the Gulf side then build a wall..

new topics

-

Who guards the guards

US Political Madness: 34 minutes ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 2 hours ago -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 7 hours ago -

1980s Arcade

General Chit Chat: 9 hours ago -

Deadpool and Wolverine

Movies: 10 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 11 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 14 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 16 hours ago, 13 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 12 hours ago, 8 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 17 hours ago, 6 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 7 hours ago, 6 flags -

1980s Arcade

General Chit Chat: 9 hours ago, 4 flags -

Deadpool and Wolverine

Movies: 10 hours ago, 3 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 11 hours ago, 3 flags -

Who guards the guards

US Political Madness: 34 minutes ago, 1 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 2 hours ago, 0 flags

active topics

-

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 607 • : IndieA -

House Overwhelmingly Passes Funding for Ukraine, Israel and Taiwan

US Political Madness • 56 • : Justoneman -

Michael Avenatti Says He Will Testify FOR Trump

US Political Madness • 60 • : Justoneman -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 17 • : Scratchpost -

1980s Arcade

General Chit Chat • 9 • : theatreboy -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 40 • : seekshelter -

Who guards the guards

US Political Madness • 0 • : annonentity -

Man possibly killed by werewolf in Texas

Cryptozoology • 27 • : burritocat -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 620 • : Threadbarer -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration • 5 • : Justoneman

3