It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: Puppylove

The problem with taxing based on consumption is after a point you have what you need and stop consuming. ...

After a certain point you just stop spending. ...

A consumption based tax rapes the poor and barely affects the rich.

This is absolute nonsensical rambling.

Do you even know how much rich and wealthy people spend on an annual basis, on average? Serious question, because I've seen many, many failure-to-pay-taxes cases come across my desk, and often contained in the data is what these tax-evaders spend their money on instead of paying their taxes, and they spend millions each year.

Millions. Often tens of millions.

And these are people in their 40s and up.

Please, stop with your nonsense about people stopping consumption at a certain age, because that's an utter lie. Even if all that they do on average is spend $100,000 (which is a very conservative estimate), that's nearly double the median annual household income in America. These people spend well more each year than the median household in America makes (before taxes, of course).

Whether or not a consumption tax "affects the rich" in comparison to their income or net worth is irrelevant--it is immoral for a government to assume that they have a right to our compensation for our time/effort/skills. A direct income tax is inappropriate for a government to do, yet only because it's the norm does no one complain anymore, and that's unfortunate.

Slash revenue and suddenly spending is a problem.

I get it though, the GOP thought they could magically increase revenue through lower taxes and the deficit would disappear.

2014 spending: $3.78 trillion

2015 spending: $3.688 trillion

2016 spending: $3.853 trillion

2017 spending: $3.982 trillion

2018 spending: $4.173 trillion

We should go back to 50% top tax rate for those making more than $1 million/year. We should do a half cent tax on every dollar worth of stock trading. Restore the death tax to the previous level. The last NDAA (defense spending) had 40% set aside for just contract obligations.

That's the whole GOP plan; cut taxes, increase spending and then, when the Democrats come back to power, whine and whine and whine about how Democrats want to raise taxes. The whole idea is to keep the top of the economic spectrum way beyond reach of anyone in the middle all while claiming to do just the opposite. "The middle class can't escape their income level unless we give their employer more money."

I get it though, the GOP thought they could magically increase revenue through lower taxes and the deficit would disappear.

2014 spending: $3.78 trillion

2015 spending: $3.688 trillion

2016 spending: $3.853 trillion

2017 spending: $3.982 trillion

2018 spending: $4.173 trillion

We should go back to 50% top tax rate for those making more than $1 million/year. We should do a half cent tax on every dollar worth of stock trading. Restore the death tax to the previous level. The last NDAA (defense spending) had 40% set aside for just contract obligations.

That's the whole GOP plan; cut taxes, increase spending and then, when the Democrats come back to power, whine and whine and whine about how Democrats want to raise taxes. The whole idea is to keep the top of the economic spectrum way beyond reach of anyone in the middle all while claiming to do just the opposite. "The middle class can't escape their income level unless we give their employer more money."

Some humor... Just let the feds print up a 100 Trillion dollar bill and deposit it into the treasury.

Fred..

Fred..

Federal income tax is most definitely being collected illegally! It completely disregards the Constitution on numerous levels. The same goes for the

flame-retardant pieces of copy paper a PRIVATE entity distributes throughout our nation (for a hefty fee, of course), and calls it United States

"currency". It's an ab-so-lute JOKE!!

And don't even get me started about their removal of precious metals from our coinage...

And don't even get me started about their removal of precious metals from our coinage...

Taxes should be based on what you don't consume and instead on the wealth you compile. If you spend all your money, no taxes. Once you have saved $2.5

million or so + then you start paying some taxes on that wealth. At $100 million+ you pay a very high rate.

a reply to: xuenchen

As self employed even in the 12% bracket, I pay 13% in FICA taxes, I pay about 5% in property tax and another 4-5% in sales taxes. I pay another 20% of so to the health insurance racketeers, and between tolls , gas taxes and all the other taxes another 5% or so. So basically I can spend only 40% of my actual earnings. For those in the higher brackets these extras make much less of an effect, making the higher brackets pay less % tax overall. This is where all the low taxes on the rich people are missing the boat.

As self employed even in the 12% bracket, I pay 13% in FICA taxes, I pay about 5% in property tax and another 4-5% in sales taxes. I pay another 20% of so to the health insurance racketeers, and between tolls , gas taxes and all the other taxes another 5% or so. So basically I can spend only 40% of my actual earnings. For those in the higher brackets these extras make much less of an effect, making the higher brackets pay less % tax overall. This is where all the low taxes on the rich people are missing the boat.

originally posted by: Tempter

originally posted by: CriticalStinker

originally posted by: Breakthestreak

So the richer you are, the more tax you pay.

As has always been the case.

The tax system is antiquated, I doubt anyone could argue that effectively.

But rather than present a problem, present a solution.

Consumption tax, you pay based off of what you put strain on.

Why should everyone pay a flat rate for roads if some of us drive 2 miles to work vs someone who has a company that has a line haul fleet?

If you tax something, you get less of it. Do you want growth to stall? None of this matters if we stop growing. We can't pay tomorrow's borrowed money with less people.

This is the economic problem. There is a finite cap on growth. At some point in time, you have to just accept the revenue coming it will not get bigger. This happens to every public traded company on the planet. Shareholders chase growth, when growth stagnates [it doesn't matter if we made 2$ billion this year, we want 2.5$ billion] etc, then investors pull out and tank companies.

Things are finite, so when a company reaches it's total saturation point [it's doing absolutely excellent] but the investors see it as failing. Imagine the impossible case of a company reaching 100% of the money supply in the country, it cannot take in another dollar because it took in every single dollar already; how do you grow? Growth has a finite physical cap, and that cap is different depending on the industry of the business. Once these businesses hit their cap, they start to venture out into new products, like Mitsubishi, the car company making Televisions. Or like Activision Blizzard trying to tap into the mobile game market. Publicly traded companies will always fail, and they don't fail from being big, they fail for chasing impossible growth. The harder you chase growth, the worse the product you create is, and that starts the downfall of a company. At this point in time, there are so many people at the top trying to protect their positions at the top; who weren't present before that business reached the top, and don't know how to right the ship.

You always right the ship by going back to quality products. I digress though; government is business, and government keeps chasing growth despite the founders purposefully creating a small government. The big government is bankrupting the country through extraction caused by heavy expenditures. This cannot be fixed, because greed at the individual level provides incentives towards impossible growth.

In short; we as a society need to understand that limits need to be put on spending and individual income, and because we're not civilized to really understand the economic ceiling, we bite the hands of the people trying to educate. This is why Millennials are the poorest generation in American history.

It has nothing to do with them being lazy, or less educated. It has everything to do with the amount of work for money being completely flipped upside down vs the price of their educations and inflation of goods and services. This requires millenials to work 2-3x more for 1/2 as much, which is not only unhealthy, but also robs jobs from other Millenials as they have to double or triple up just to pay their bills.

This isn't even a political issue, this is a math problem with an obvious answer.

edit on 1-12-2018 by SRPrime because: (no reason

given)

originally posted by: xuenchen

Some slight adjustment for inflation according to the IRS

Not bad eh.

Better than before.

Standard deduction is $12,200 😎

But Bad according to many elected politicians !!!!!

Here are the new tax brackets for 2019

10%: Individuals with incomes of $9,700 or less/Married couples with $19,400 or less

12%: Individuals with incomes over $9,700/Married couples with more than $19,400

22%: Individuals with incomes over $39,475/Married couples with more than $78,950

24%: Individuals with incomes over $84,200/Married couples with more than $168,400

32%: Individuals with incomes over $160,725/Married couples with more than $321,450

35%: Individuals with incomes over $204,100/Married couples with more than $408,200

37%: Individuals with incomes over $510,300/Married couples with more than $612,350

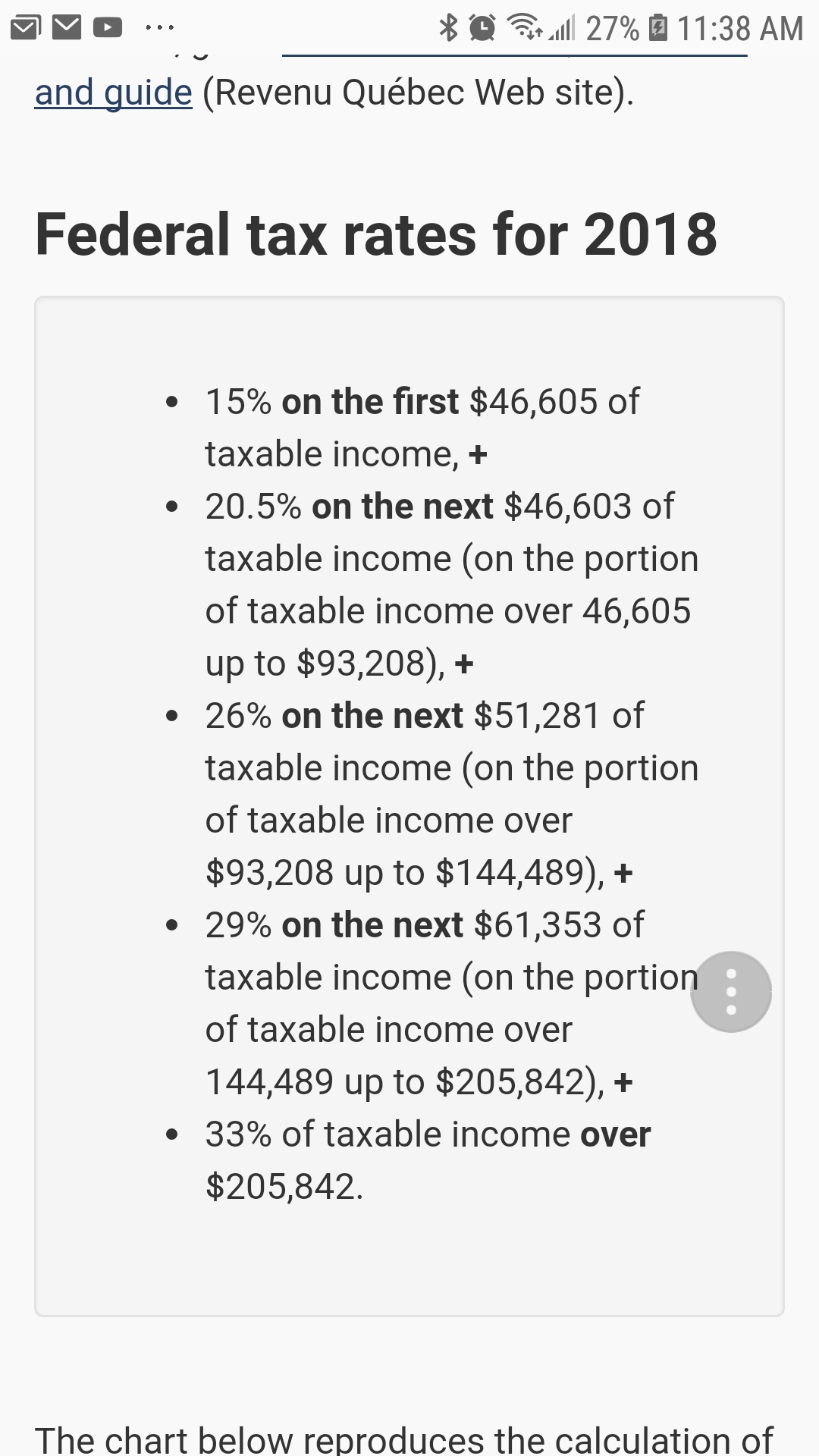

In Canada my rate is 2% higher for my tax bracket compared to the US but I get free healthcare with that.

That can't be right.

originally posted by: xuenchen

a reply to: MALBOSIA

Sounds cool.

Maybe you can post the tax rates for Canada for comparison ?

😎

You still have to pay property tax to the cities her which isnt cheap and public transportation costs almost as much a owning and maintaining a small car depending on your commute.

I hear the healthcare insurance in the US can cost $1500/mnth or more for a family of 5 so i THINK the extra 2% we are paying is worth the money.

new topics

-

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 4 minutes ago -

12 jurors selected in Trump criminal trial

US Political Madness: 2 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 3 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago -

George Knapp AMA on DI

Area 51 and other Facilities: 9 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 9 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 16 hours ago, 25 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 9 hours ago, 24 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 17 hours ago, 18 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 3 hours ago, 12 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 17 hours ago, 7 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 11 hours ago, 7 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 9 hours ago, 5 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 14 hours ago, 5 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 3 hours ago, 5 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 12 hours ago, 3 flags

active topics

-

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 64 • : Degradation33 -

Iran launches Retalliation Strike 4.18.24

World War Three • 14 • : Cloudbuster1 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 0 • : Consvoli -

African "Newcomers" Tell NYC They Don't Like the Free Food or Shelter They've Been Given

Social Issues and Civil Unrest • 17 • : SchrodingersRat -

Canadian Forces bow out and loose interest in UFO’s

Aliens and UFOs • 20 • : Ophiuchus1 -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 50 • : WeMustCare -

Max Loughan Boy Genius Or Something More?

Science & Technology • 69 • : SchrodingersRat -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics • 21 • : glen200376 -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 45 • : Irishhaf -

George Knapp AMA on DI

Area 51 and other Facilities • 22 • : SchrodingersRat