It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

Trump said tax cuts would bring $4 trillion back to America. Just 3.5 percent of that returned

page: 2share:

If I had a pile of money safely outside the country, I wouldn’t be eager to return it where I know half the governement wants to scoop it up the

second Trump is out of office. Would you?

a reply to: JasonBillung

" so what do I know?"

Not Much Apparently .......Something , Anything , Or Nothing ? What Puts You in the Black ?

" so what do I know?"

Not Much Apparently .......Something , Anything , Or Nothing ? What Puts You in the Black ?

originally posted by: JasonBillung

originally posted by: howtonhawky

Hmmm...I wonder what's in that link.

According to a 2016 GOBankingRates survey, 35 percent of all adults in the U.S. have only several hundred dollars in their savings accounts and 34 percent have zero. Only 15 percent have over $10,000 stashed away.Jun 19, 2017 Here's how many Americans have nothing at all in savings - CNBC.com www.cnbc.com...

He could score a big win if he would just eliminate taxing labor.

It is ashame that poor Americans continue to vote against their best interests, and choose to cheer on activities that only benefit the top 10%.

Maybe they hope that if they win the lottery they will be better off?

Keep buying those tickets folks, don't go to college, and hope that your children will follow in your footsteps of unenlightened wage slavery!

That is largely the democrat platform.

a reply to: Zanti Misfit

I make bank on my job, my C-Corp, some real estate, an oil lease and my really big stock market investments. What's in your wallet?

I make bank on my job, my C-Corp, some real estate, an oil lease and my really big stock market investments. What's in your wallet?

a reply to: Southern Guardian

I'm confused do you want me taxed more or less? I'm getting taxed less. I need to know if you're pushing for the government to take more of my hard earned $$$$

I'm confused do you want me taxed more or less? I'm getting taxed less. I need to know if you're pushing for the government to take more of my hard earned $$$$

originally posted by: Southern Guardian

Of course he said that! Dear old uncle Trump, he just says things ya know? Take it with a grain of salt. Different standards.

So far, just $143 billion has been repatriated, The Wall Street Journal reported Monday.

The Republican tax bill eliminated taxes for U.S. companies that bring home profits made abroad. Some companies have said the tax prevented them from repatriating those profits because they wanted to avoid that additional cost. "We expect to have in excess of $4 trillion brought back very shortly," Trump said last year. "Close to $5 trillion will be brought back into our country. This is money that would never, ever be seen again by the workers and the people of our country."

The Source

Should we even be surprised? That those Corporate and elite tax cuts to the tune of $100's of billions disappeared into offshore accounts and private pockets? Gosh? Somewhere, I'd bet there's a million mattresses filled with cash, hoarded cash. I mean that's essentially it ya know?

Further.

But an analysis by the Journal found that the new one-time tax on foreign profits and removal of future federal taxes hasn't led to a sudden boom in repatriations. Out of the 108 public companies that hold the vast majority of an estimated $2.7 trillion in foreign profit, just a handful have made substantial efforts to bring money back to the U.S.

What can I say.... it's only been like what a year? Maybe we outta give it until 2020 for that money to trickle back down into the economy heh?

Geez! You believed that? He lies daily, constantly... and will probably go down as a better backtracking President than Michael Jackson moon-walking....

"Mr. Prez? RELEASE YOUR TAXES!!"

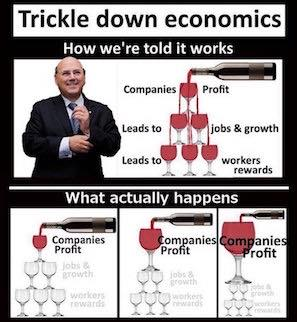

I'll just leave this here...

www.cnbc.com...

OP, you may even outdo your 'curtains' thread...

www.cnbc.com...

OP, you may even outdo your 'curtains' thread...

Companies took major advantage of last year's tax cuts to bring home profits they had stored overseas. In the first quarter alone, multinational enterprises brought home about $300 billion of the $1 trillion held abroad, according to a recent Federal Reserve study. A good chunk of that repatriated money went to share repurchases — for the top 15 cash holders, some $55 billion was used on buybacks, more than double the $23 billion in the fourth quarter of 2017. Goldman Sachs economists expect that the total buybacks from all companies in 2018 could exceed $1 trillion. The Fed's estimate of total cash overseas is a good deal lower than other estimates that have been as high as $2.5 trillion, so the amount of cash brought home might be even higher.

Companies had been holding profits in foreign countries to avoid additional taxation when it was brought back to the U.S. Under the Tax Cuts and Jobs Act, the foreign holdings were subject to just a one-time tax, thus eliminating the incentive to keep the money offshore. As the Fed's chart shows, the return of cash compared to previous years was dramatic.

a reply to: JasonBillung

Enough to Pay the Bills . Something that Unexpectedly came to Pass Right After Donald J. Trump became President . Just a CoWinkyDink Maybe ? ..Hmm....

Enough to Pay the Bills . Something that Unexpectedly came to Pass Right After Donald J. Trump became President . Just a CoWinkyDink Maybe ? ..Hmm....

originally posted by: Zanti Misfit

a reply to: JasonBillung

Enough to Pay the Bills . Something that Unexpectedly came to Pass Right After Donald J. Trump became President . Just a CoWinkyDink Maybe ? ..Hmm....

Yeah, I'm making bank...

a reply to: network dude

Says a guy who posts to ATS day and night. Don't act like you're coughing up coal dust.

crumbs. I makes me laugh to see people so out of touch with reality. Ask your house boy what that means, he'll know.

Says a guy who posts to ATS day and night. Don't act like you're coughing up coal dust.

originally posted by: JasonBillung

a reply to: burdman30ott6

If you ever ran a company (have run 2) you would know that most firms are required to start their fiscal year on Jan. 1st, after initial inception.

Also, you might want to reconsider how a company reacts to the market and other forces - if it isn't agile, it is dead. My own private C-Corp has been meeting with my tax attorney on a monthly basis for over 16 years to leverage the best strategic plans moving forward. Maybe you should go back to school and learn about business.

If your C-corp is a small business, then your experiences don't equal (even remotely) what we're talking about with off shore multinational conglomerates. It's akin to a Pop Warner assistant coach telling Vince Lombardi how to run plays.

originally posted by: jjkenobi

originally posted by: JasonBillung

a reply to: burdman30ott6

If you ever ran a company (have run 2) you would know that most firms are required to start their fiscal year on Jan. 1st, after initial inception.

Also, you might want to reconsider how a company reacts to the market and other forces - if it isn't agile, it is dead. My own private C-Corp has been meeting with my tax attorney on a monthly basis for over 16 years to leverage the best strategic plans moving forward. Maybe you should go back to school and learn about business.

Dude what? I've had several jobs and not a single one has ever had the FY the same as the CY. Most of the ones I worked for have the FY start in April or May.

Notice how it jumped from "The Federal Government - the largest employers and biggest driver of the US economy - operates on a fiscal year starting on October 1st." to "If you ever ran a company (have run 2) you would know that most firms are required to start their fiscal year on Jan. 1st, after initial inception." If we keep this up, we may get to take a hosted tour of the 12 months of the year before this discussion is done, surely one of the dozen will stick when thrown against the wall instead of slithering down it, leaving a goo trail across the wallpaper, ya?

a reply to: burdman30ott6

It is a small business. That is defined by the amount of employees. Nothing to do with how much I make a year.

Maybe go back to school, learn about business, and then you won't have to place your hopes and dreams on some crappy job in a factory that is never coming back. You might want to learn about 21st century American capitalism, and how brain power is the real way to get ahead.

Rather than wearing a red cap and huddling in a crowd of sheep yelling slogans.

Or you could move to Asia and work in some crappy job in a factory.

It is a small business. That is defined by the amount of employees. Nothing to do with how much I make a year.

Maybe go back to school, learn about business, and then you won't have to place your hopes and dreams on some crappy job in a factory that is never coming back. You might want to learn about 21st century American capitalism, and how brain power is the real way to get ahead.

Rather than wearing a red cap and huddling in a crowd of sheep yelling slogans.

Or you could move to Asia and work in some crappy job in a factory.

I didn’t see an exact time frame stated anywhere. Dealing with an entire countries economics soon could mean a few years even a decade.

GDP is up BIGLY cool cool.

Unemployment down (more people paying tax) cool cool

Looks pretty good from over here in not america land.

So sorry you guys didn’t get a check in the mail for a few hundred bucks just because 🤷♂️.

Would you be happy then?

a reply to: Southern Guardian

GDP is up BIGLY cool cool.

Unemployment down (more people paying tax) cool cool

Looks pretty good from over here in not america land.

So sorry you guys didn’t get a check in the mail for a few hundred bucks just because 🤷♂️.

Would you be happy then?

a reply to: Southern Guardian

new topics

-

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago -

Hurt my hip; should I go see a Doctor

General Chit Chat: 2 hours ago -

Israel attacking Iran again.

Middle East Issues: 3 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 4 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 5 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago -

I hate dreaming

Rant: 7 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 9 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 11 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 17 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 9 hours ago, 9 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago, 8 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago, 6 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 3 hours ago, 5 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago, 4 flags -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago, 4 flags

active topics

-

Man sets himself on fire outside Donald Trump trial

Mainstream News • 39 • : TheMisguidedAngel -

When an Angel gets his or her wings

Religion, Faith, And Theology • 5 • : randomuser2034 -

Anyone one else having Youtube problems

Computer Help • 11 • : charlyv -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 68 • : Mahogani -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 404 • : Zanti Misfit -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 10 • : Degradation33 -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 100 • : WeMustCare -

Israel attacking Iran again.

Middle East Issues • 23 • : KrustyKrab -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 37 • : charlyv -

Hurt my hip; should I go see a Doctor

General Chit Chat • 11 • : TheLieWeLive