It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

12

share:

I finished my own tax return yesterday, and after reviewing the President's executive order and a very quiet change at the IRS, I have discovered the

following.

NOTE: This is not legal advice, and is not a substitute for proper guidance from a tax professional or attorney. This is the result of research I personally conducted, and cannot guarantee its accuracy. That said, this is how I handled the healthcare section of my 1040.

President Trump signed the EO in order to reduce the burden on American citizens being forced to pay for others healthcare expenses (or a fine for exercising your right to decline healthcare)

For those who do not wish to simply leave the question blank (I left mine blank, opting not to participate in line with the President's EO) there is also an exemption form available which grants broad exemptions to those who opted against healthcare. For instance, one exemption is having healthcare available, but declining it because it costs more than ~8% of your income. Unpaid medical expenses, homelessness and many other exemptions also exist, ensuring Americans are no longer burdened by the ACA.

reason.com...

The relevant text of the President's Executive Order:

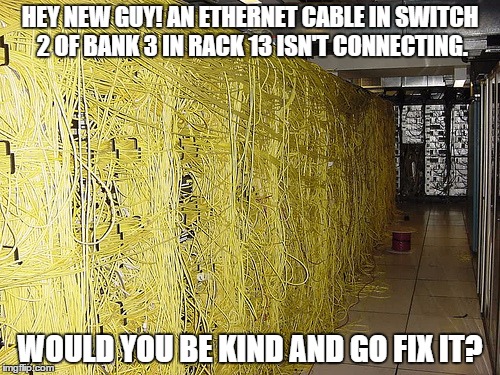

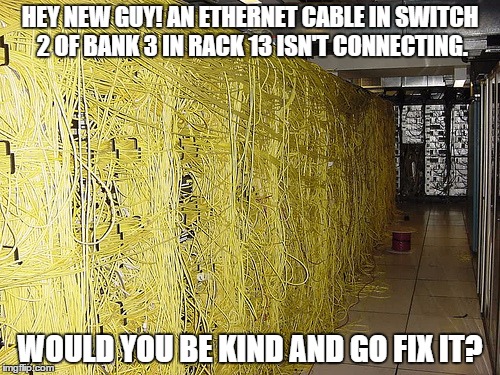

In my case, we owed no such penalty however still declined to answer out of solidarity with others not answering. That way, if uncle IRS ever decides to install another corrupt director (like Lois Lerner, criminal & bitter clinger) they will have a very fun time sorting through that mess. Us patriots need to stick together in all things. The more people that opt not to answer line 61 the better off everybody else will be. This is the exact same principle behind TOR = more users, more anonymity

^Essentially sums up this concept "needle in a haystack"

NOTE: This is not legal advice, and is not a substitute for proper guidance from a tax professional or attorney. This is the result of research I personally conducted, and cannot guarantee its accuracy. That said, this is how I handled the healthcare section of my 1040.

President Trump signed the EO in order to reduce the burden on American citizens being forced to pay for others healthcare expenses (or a fine for exercising your right to decline healthcare)

The health law's individual mandate requires everyone to either maintain qualifying health coverage or pay a tax penalty, known as a "shared responsibility payment." The IRS was set to require filers to indicate whether they had maintained coverage in 2016 or paid the penalty by filling out line 61 on their form 1040s. Alternatively, they could claim exemption from the mandate by filing a form 8965.

For most filers, filling out line 61 would be mandatory. The IRS would not accept 1040s unless the coverage box was checked, or the shared responsibility payment noted, or the exemption form included. Otherwise they would be labeled "silent returns" and rejected.

Instead, however, filling out that line will be optional.

Earlier this month, the IRS quietly altered its rules to allow the submission of 1040s with nothing on line 61. The IRS says it still maintains the option to follow up with those who elect not to indicate their coverage status, although it's not clear what circumstances might trigger a follow up.

But what would have been a mandatory disclosure will instead be voluntary. Silent returns will no longer be automatically rejected. The change is a direct result of the executive order President Donald Trump issued in January directing the government to provide relief from Obamacare to individuals and insurers, within the boundaries of the law.

For those who do not wish to simply leave the question blank (I left mine blank, opting not to participate in line with the President's EO) there is also an exemption form available which grants broad exemptions to those who opted against healthcare. For instance, one exemption is having healthcare available, but declining it because it costs more than ~8% of your income. Unpaid medical expenses, homelessness and many other exemptions also exist, ensuring Americans are no longer burdened by the ACA.

reason.com...

The relevant text of the President's Executive Order:

“waive, defer, grant exemptions from, or delay the implementation of any provision … that would impose a fiscal burden on any State or a cost, fee, tax, penalty, or regulatory burden on individuals, families, healthcare providers, health insurers, patients, recipients of healthcare services, purchasers of health insurance, or makers of medical devices, products, or medications.”

In my case, we owed no such penalty however still declined to answer out of solidarity with others not answering. That way, if uncle IRS ever decides to install another corrupt director (like Lois Lerner, criminal & bitter clinger) they will have a very fun time sorting through that mess. Us patriots need to stick together in all things. The more people that opt not to answer line 61 the better off everybody else will be. This is the exact same principle behind TOR = more users, more anonymity

^Essentially sums up this concept "needle in a haystack"

edit on 2/6/2018 by JBurns because: (no reason given)

edit on Tue Feb 6 2018 by DontTreadOnMe because: trimmed overly long

quote IMPORTANT: Using Content From Other Websites on ATS

new topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 2 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 3 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 5 hours ago -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 6 hours ago -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 8 hours ago -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 9 hours ago -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 9 hours ago -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 11 hours ago -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 11 hours ago

12