It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

*-

here's my take on the Phoenix 10 Emblem/Medallion/Coin....

recall in Revelation prophecy the Resurrected Beast has 10 horns & 7 heads...

the economist magazine is identifying Its' Globalist Elites with this iconic end-times global empire that conquers All

& money control is one resource they will command in the fabulous Rothschild tradition....

take a second glance to reflect on the OP wording...

the 1988 graphic depicts a 'Gold Chain' that supports a 'Coin' ==>> were They telling the future public about a gold backed block-chain which would provide the asset support of the new Crypto-Coin-of-the-Realm ??

We may even speculate more in saying the image of a domineering Phoenix Bird with a Crypto coin medallion might be the 'Mark' everyone dreads on their right hand... the Number 666 or the Name of-the-beast marks may be only for the more prominent elites in the end-times

originally posted by: FamCore

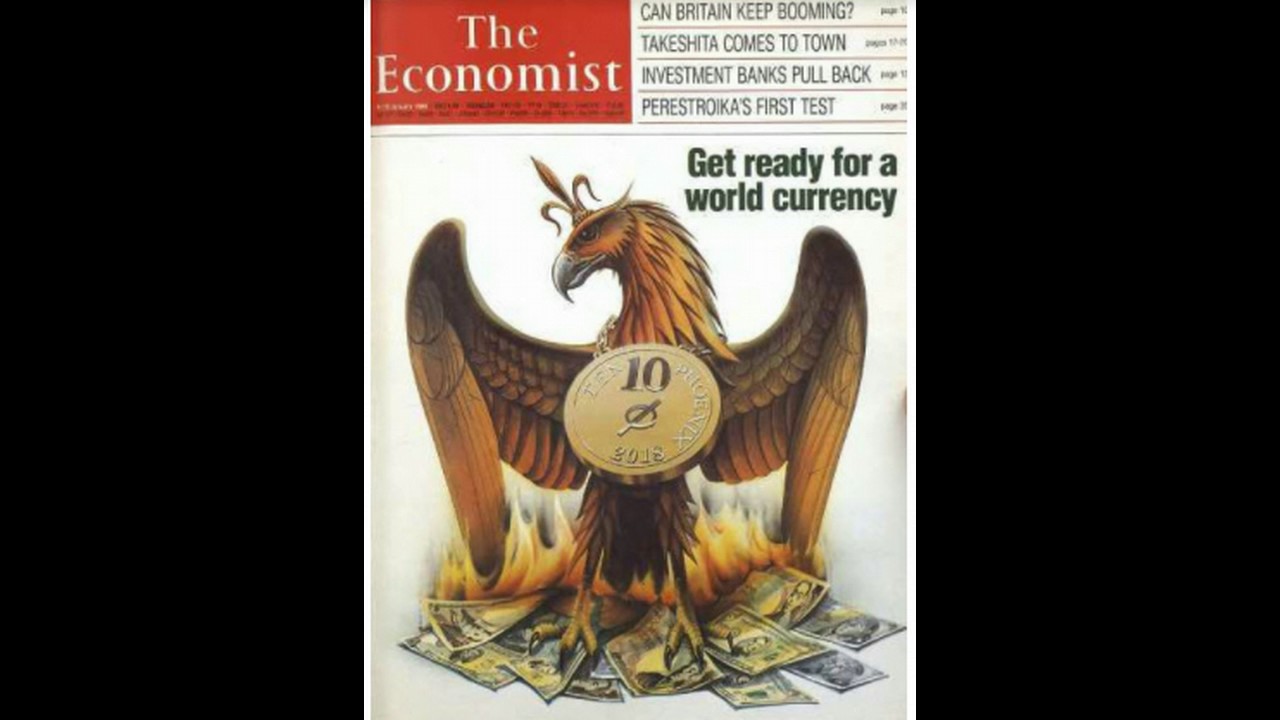

The cover of the Economist magazine from September of 1988 shows....

The phoenix is wearing a golden necklace with a large coin on the front that says "10 Phoenix" and the year 2018 inscribed on it.

here's my take on the Phoenix 10 Emblem/Medallion/Coin....

recall in Revelation prophecy the Resurrected Beast has 10 horns & 7 heads...

the economist magazine is identifying Its' Globalist Elites with this iconic end-times global empire that conquers All

& money control is one resource they will command in the fabulous Rothschild tradition....

take a second glance to reflect on the OP wording...

...The phoenix is wearing a golden necklace with a large coin...

the 1988 graphic depicts a 'Gold Chain' that supports a 'Coin' ==>> were They telling the future public about a gold backed block-chain which would provide the asset support of the new Crypto-Coin-of-the-Realm ??

edit on nd31151668052622082018 by St Udio because: (no reason

given)

We may even speculate more in saying the image of a domineering Phoenix Bird with a Crypto coin medallion might be the 'Mark' everyone dreads on their right hand... the Number 666 or the Name of-the-beast marks may be only for the more prominent elites in the end-times

edit on

nd31151668098322162018 by St Udio because: (no reason given)

originally posted by: projectvxn

originally posted by: hopenotfeariswhatweneed

originally posted by: projectvxn

Get out of paper and buy gold, silver, and crypto.

Long term sure, in the meantime buy land, learn to grow food and keep some livestock, food and water will be worth more than gold or any other non edible currency.

So one for capital to do the other.

No reason you can't do both. But if you don't have a lot of money, investing for mid-long term (1-5 years) taking regular profits and saving will probably get you where you need to be with careful planning.

Assuming the breakdown is short term certainly both is beneficial, however I'm betting any breakdown at this point will last a few generations and hoarding wealth or money will just be using unnescasarry energy.

a reply to: hopenotfeariswhatweneed

I just think folks should not worry too much about what could happen, and plan for the likely.

It is not likely that the US dollar will collapse in the next 5 years. However, if in that time you haven't put your money to work for you, turned some of it into hedges like gold/silver/crypto/commodity stocks, then the same amount of money you had that won't help you, will now be devalued and DEFINITELY won't help you.

Plan ahead, my friend. It isn't about hoarding, it's about making your money do work for you that can then be used to weather a future storm.

I just think folks should not worry too much about what could happen, and plan for the likely.

It is not likely that the US dollar will collapse in the next 5 years. However, if in that time you haven't put your money to work for you, turned some of it into hedges like gold/silver/crypto/commodity stocks, then the same amount of money you had that won't help you, will now be devalued and DEFINITELY won't help you.

Plan ahead, my friend. It isn't about hoarding, it's about making your money do work for you that can then be used to weather a future storm.

a reply to: projectvxn

That's pretty solid advice, in the event of a complete breakdown anarchy would rule so the only real plan is to be a survivalist. Personally at this stage I am doing exactly as you advised, I'm slowly finding what I consider to be the right investments, I already own land and have studied horticulture for many years,i already grow lots of food and am good at it.

My earlier response to you was based on a complete breakdown.

That's pretty solid advice, in the event of a complete breakdown anarchy would rule so the only real plan is to be a survivalist. Personally at this stage I am doing exactly as you advised, I'm slowly finding what I consider to be the right investments, I already own land and have studied horticulture for many years,i already grow lots of food and am good at it.

My earlier response to you was based on a complete breakdown.

a reply to: FamCore

The picture of the hawke is interesting because it goes some way to explaing why I read a post here about 12 months that said the IMF or some such body run by the bankers, told all the cnetral banks to start ramping up inflation.

This is now happening in my country. I have seen a big jumps in all the shops in my local shopping center and busienss park over most of the last year.

Mind you, you don't hear anything about it the 'news.'

Putting these two things together makes me think this big rise in infalation that is upon us now will end with "In order to stop such high levels of inflation we must have a global currency so we can prevent these kinds of rises in inflation."

The picture of the hawke is interesting because it goes some way to explaing why I read a post here about 12 months that said the IMF or some such body run by the bankers, told all the cnetral banks to start ramping up inflation.

This is now happening in my country. I have seen a big jumps in all the shops in my local shopping center and busienss park over most of the last year.

Mind you, you don't hear anything about it the 'news.'

Putting these two things together makes me think this big rise in infalation that is upon us now will end with "In order to stop such high levels of inflation we must have a global currency so we can prevent these kinds of rises in inflation."

edit on 23-1-2018 by Azureblue because: (no reason given)

edit on 23-1-2018 by Azureblue because: (no reason given)

20 trillion in debt sounds a big scary number however.

Almost half of that is owned by the federal government itself via intergovernmental holdings and the federal reserve.

Of what remains almost half is owed to US financial institutions such as pension funds. So is an asset owned by the private sector.

About 6 trillion is owed to overseas entities (both private and government). And what really scary stuff can they do with it? Well they can buy things in dollars.

As long as the overseas owed part does not rise to to much in relation to the overall size of the economy then there is very little to worry about from the national debt.

Almost half of that is owned by the federal government itself via intergovernmental holdings and the federal reserve.

Of what remains almost half is owed to US financial institutions such as pension funds. So is an asset owned by the private sector.

About 6 trillion is owed to overseas entities (both private and government). And what really scary stuff can they do with it? Well they can buy things in dollars.

As long as the overseas owed part does not rise to to much in relation to the overall size of the economy then there is very little to worry about from the national debt.

a reply to: FamCore

I am curious to why the linked article describes the dollars having failed when it ended it last link with gold in the 70s, but considers the pound sterling to be one long runningg currency when it has came on/ off commodity standards several times?

I am curious to why the linked article describes the dollars having failed when it ended it last link with gold in the 70s, but considers the pound sterling to be one long runningg currency when it has came on/ off commodity standards several times?

a reply to: ScepticScot

You are assuming we didn't monetize over 100 trillion dollars in PRIVATE debt almost immediately after the crash of 07 by buying hundreds of trillions in junk financial instruments, and then continued the process through a policy called Quantitative Easing.

What is that?

Investopedia:

They bought the debt and used it to print money. That's called money laundering. The Treasury under Secretary Geithner and the Fed under Ben Bernanke laundered hundreds of trillions of dollars and parked most of it in overseas banks as "liquidity assistance".

The only thing that keeps the dollar under control is our ability to export inflation.

It pays to be the reserve currency.

You are assuming we didn't monetize over 100 trillion dollars in PRIVATE debt almost immediately after the crash of 07 by buying hundreds of trillions in junk financial instruments, and then continued the process through a policy called Quantitative Easing.

What is that?

Investopedia:

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply.

They bought the debt and used it to print money. That's called money laundering. The Treasury under Secretary Geithner and the Fed under Ben Bernanke laundered hundreds of trillions of dollars and parked most of it in overseas banks as "liquidity assistance".

The only thing that keeps the dollar under control is our ability to export inflation.

It pays to be the reserve currency.

edit on 23 1 18 by projectvxn because: (no reason given)

a reply to: projectvxn

I am assuming it didn't happen because it didn't happen.

And no QE is not money laundering.

I am assuming it didn't happen because it didn't happen.

And no QE is not money laundering.

a reply to: ScepticScot

It is if you're letting the same banks you bought the garbage from borrow money at -.05% (which they did for about 1 week).

QE was definitely money laundering.

Let me guess, you bought the idea that Tim Geithner and Ben Bernanke saved the economy.

It is if you're letting the same banks you bought the garbage from borrow money at -.05% (which they did for about 1 week).

QE was definitely money laundering.

Let me guess, you bought the idea that Tim Geithner and Ben Bernanke saved the economy.

a reply to: projectvxn

The risk profile I represent to a commercial bank is entirely different from the risk profile a commercial represents to a central one. Even more importantly the reason for charging interest is entirely different.

And no it's not the same. I am not sure if you are confused about the meaning of money laundering or the meaning of QE or both

Money laundering is making illegally obtained money and making them appear to have been created legally.

QE is a method of monetary policy used by central banks, thee orginisations responsible for monetary policy. Not even remotely the same.

The risk profile I represent to a commercial bank is entirely different from the risk profile a commercial represents to a central one. Even more importantly the reason for charging interest is entirely different.

And no it's not the same. I am not sure if you are confused about the meaning of money laundering or the meaning of QE or both

Money laundering is making illegally obtained money and making them appear to have been created legally.

QE is a method of monetary policy used by central banks, thee orginisations responsible for monetary policy. Not even remotely the same.

a reply to: ScepticScot

A lot of pension funds are unfunded liabilities, and do not count towards that $21 trillion in national debt. Unfunded US Liabilities is something to the tune of $111 trillion. Also, whether the US owns some of its own debt or not.. it is costing something like $300 billion per year just to service the debt, without paying it down at all. With rising interest rates that amount goes up.

This is unsustainable.

A lot of pension funds are unfunded liabilities, and do not count towards that $21 trillion in national debt. Unfunded US Liabilities is something to the tune of $111 trillion. Also, whether the US owns some of its own debt or not.. it is costing something like $300 billion per year just to service the debt, without paying it down at all. With rising interest rates that amount goes up.

This is unsustainable.

a reply to: FamCore

Pension fund liabilities are a separate issue from national debt. (although I would agree that pension funds are a potential issue unless addressed).

It does matter who owns the debt as if the debt is owned by the federal government it pays the interest back to itself.

The interest paid in US debt is set by the US government as part of overall monetary policy. If interest rates are increased then it is generally because the economy is growing to fast in which case payments as a % of GDP will be going down.

The US government can always afford to pay any debt payment in its own currency. There is no substantiality issue over interest on the debt.

The potential issues are what is the effect on the economy of the payments.

Too high a % of GDP on Interest can increase inequality as interest on government debt is generally redistributive upwards.

Too a high a % owed overseas can also be bad as represents a future claim on real production on the US economy.

Pension fund liabilities are a separate issue from national debt. (although I would agree that pension funds are a potential issue unless addressed).

It does matter who owns the debt as if the debt is owned by the federal government it pays the interest back to itself.

The interest paid in US debt is set by the US government as part of overall monetary policy. If interest rates are increased then it is generally because the economy is growing to fast in which case payments as a % of GDP will be going down.

The US government can always afford to pay any debt payment in its own currency. There is no substantiality issue over interest on the debt.

The potential issues are what is the effect on the economy of the payments.

Too high a % of GDP on Interest can increase inequality as interest on government debt is generally redistributive upwards.

Too a high a % owed overseas can also be bad as represents a future claim on real production on the US economy.

Charts numbers every one saying this and that .

In the 1920s the world was small and no country exported much so most of the economy were internal and when a sell off happened then it was what every country left hold its own bag .

Now the bag is a world bag saying how much any one country owes is silly as its just charts and any thing that happens to use happens to you equally .

So yes the dollar is falling and yes we have dept But on the day we decide we no longer want to play who owes who in the worlds Bag then tell me just what do you think any one will do ?

you can say the dollar is zero but I promise most country's will still happly trade with us . Nk proves that if nothing else .

Its a world economy and as such the world has no option to cut off its nose to spite its face frankly america is the legs china is the arms Russia is the nose Uk is the rear end and NK is the but hole . We need all that to live even if the but hole stinks lol

In the 1920s the world was small and no country exported much so most of the economy were internal and when a sell off happened then it was what every country left hold its own bag .

Now the bag is a world bag saying how much any one country owes is silly as its just charts and any thing that happens to use happens to you equally .

So yes the dollar is falling and yes we have dept But on the day we decide we no longer want to play who owes who in the worlds Bag then tell me just what do you think any one will do ?

you can say the dollar is zero but I promise most country's will still happly trade with us . Nk proves that if nothing else .

Its a world economy and as such the world has no option to cut off its nose to spite its face frankly america is the legs china is the arms Russia is the nose Uk is the rear end and NK is the but hole . We need all that to live even if the but hole stinks lol

The NY Fed holds 600 tons of Chinese gold (among other 60 other nations) they will not return:

Why not? Most likely because they've written so many leases and derivatives on that gold in order to suppress gold's price in the future's market they can't straighten the whole mess out.

www.bullionstar.com...

A final Point Chinese gold at the NY Fed: 600 tonnes

After translating the 11 January BWChinese article from Chinese into English, I noticed that the last few paragraphs discussed Chinese gold being held at the Federal Reserve Bank of New York, and the inability of the Chinese to get this gold back. The relevant paragraphs are as follows (which I translated and re-edited):

A BWC Chinese network report mentioned that the Federal Reserve had on several occasions rejected China’s request to ship back about 600 tonnes of gold reserves stored in underground vaults in the New York.

Some analysts said at the time that for China to overcome the sanctions imposed by the United States, it had no choice but to use gold as collateral. A report by People’s Daily’s IFC in December 2012, How Much Gold Has Been Pocketed by the United States has been confirmed:

It is reported that more than 60 countries have allocated some or most of their gold reserves hidden in the New York Federal Reserve Bank’s underground vault.

Some experts said that China once had shipped 600 tons of gold reserves to the United States and continuing its search, found that China first deposited its gold reserves with the United States in 1990.

This is the first time I have heard of such a scenario. Perhaps its true. If its true, it could mean that the People’s Bank of China (PBoC), the agent of the Chinese State, could still be holding a significant quantity of its gold in the vaults of the NY Fed, that the Fed will not return.

Why not? Most likely because they've written so many leases and derivatives on that gold in order to suppress gold's price in the future's market they can't straighten the whole mess out.

a reply to: SkeptiSchism

I would think that by refusing to ship back China's own gold in the amount of 600 tonnes, would be considered an act of war. But what little I know.

I would think that by refusing to ship back China's own gold in the amount of 600 tonnes, would be considered an act of war. But what little I know.

a reply to: ScepticScot

A lot has been written on this. I know exactly what money laundering is, and how QE was used to do it.

Where are all those toxic assets now?

A lot has been written on this. I know exactly what money laundering is, and how QE was used to do it.

Where are all those toxic assets now?

edit on 23 1 18 by projectvxn because: (no reason given)

new topics

-

A man of the people

Diseases and Pandemics: 42 minutes ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 1 hours ago -

4 plans of US elites to defeat Russia

New World Order: 2 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 5 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 8 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 8 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 9 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 15 hours ago, 25 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 9 hours ago, 16 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 17 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 8 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 15 hours ago, 5 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 5 hours ago, 4 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 8 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 2 hours ago, 2 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 1 hours ago, 1 flags -

A man of the people

Diseases and Pandemics: 42 minutes ago, 0 flags

active topics

-

4 plans of US elites to defeat Russia

New World Order • 10 • : andy06shake -

Elites disapearing

Political Conspiracies • 32 • : SchrodingersRat -

A man of the people

Diseases and Pandemics • 1 • : chr0naut -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 3 • : Consvoli -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 67 • : Consvoli -

The Fight for Election Integrity Continues -- Audits, Criminal Investigations, Legislative Reform

2024 Elections • 4138 • : IndieA -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 63 • : Consvoli -

Mandela Effect - It Happened to Me!

The Gray Area • 112 • : CCoburn -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 31 • : Encia22 -

AARO/Dr Kirkpatrick-Caught Lying in UAP report.

Aliens and UFOs • 25 • : Jukiodone