It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: SkeptiSchism

It seems the new tax law will start to reign in on welfare states. They will either have to lower state taxes or inevitably start losing residents in the state due to outrageous taxation. And the residents they will lose will not be of the poor class.

What is happening in places like Chicago and Dallas is that cities are increasing taxes to pay for their underfunded pension funds

It seems the new tax law will start to reign in on welfare states. They will either have to lower state taxes or inevitably start losing residents in the state due to outrageous taxation. And the residents they will lose will not be of the poor class.

The pensions are much like social security in that they are screwed mathematically. The math doesn't work. They are a hair away from just being an

outright ponzi scheme at this point.

The big problem is that people are living longer and thus receiving pension payouts far in excess of what they actually contributed.

I don't think current retirees and those close to retirement should be screwed, but going forward government pensions should be eliminated in their entirety. Only government employees that should be entitled to a pension imho is police and fire. Teachers shouldn't get one. Government administrative drones should not receive pensions either.

The big problem is that people are living longer and thus receiving pension payouts far in excess of what they actually contributed.

I don't think current retirees and those close to retirement should be screwed, but going forward government pensions should be eliminated in their entirety. Only government employees that should be entitled to a pension imho is police and fire. Teachers shouldn't get one. Government administrative drones should not receive pensions either.

a reply to: toysforadults

Schiff, MoneyGPS are two of my faves - - if you love this stuff like I do you should look into these analysts as well - not sure if you have heard of Smaul Gld, Ken Schortgen, or WallStforMainSt but if you like Peter Schiff and MoneyGPS you will appreciate the insights and analysis from these folks too:

Smaul Gld

Kenneth Schortgen Jr.

WallStforMainSt

Schiff, MoneyGPS are two of my faves - - if you love this stuff like I do you should look into these analysts as well - not sure if you have heard of Smaul Gld, Ken Schortgen, or WallStforMainSt but if you like Peter Schiff and MoneyGPS you will appreciate the insights and analysis from these folks too:

Smaul Gld

Kenneth Schortgen Jr.

WallStforMainSt

originally posted by: Metallicus

a reply to: toysforadults

I don't like pensions, but if someone is working their entire life under the assumption that they are accruing a pension then it is unfair to suddenly just change the rules and take it from them. California put themselves in this position and now they need to keep their word to their employees.

You know this attitude really bothers me. Money does not grow on trees. Who do you think pays for the shortfall, other taxpayers who have nothing to do with the irresponsible promises made by these pensions.

Sorry - if the pensioners were promised something that could not be delivered on - that is not anyone else's problem. It is a shortfall in funding by the pension - and the beneficiary's should be the only ones affected.

If you don't have the money to pay your mortgage because of other debts do the taxpayers bail you out? NO. A pension is no different. Did Madoff's victims get bailed out by taxpayers? NO. People have to take responsibility for their finances.

It's not like this is a sudden problem - there has been funding shortfalls nearly every year because many of these pensions require 8% plus of secure returns minimum. That is unrealistic. I don't have a pension and I have known about this issue for 10 years. What has been done in that time, nothing that I can tell. Just because the average person does not understand this does not mean they are not responsible for it. Who let it continue? The truth is nobody ever gives people really bad news voluntarily - you have to look out for yourself or you get burned. That is the way it should be.

So I will give people a hint here. If you are 45 or younger - you have almost zero chance of collecting full social security. It is just another pension - and it too is having short falls.

I am assuming I will get none - you should too, or you will likely be sorry.

originally posted by: proximo

originally posted by: Metallicus

a reply to: toysforadults

I don't like pensions, but if someone is working their entire life under the assumption that they are accruing a pension then it is unfair to suddenly just change the rules and take it from them. California put themselves in this position and now they need to keep their word to their employees.

You know this attitude really bothers me. Money does not grow on trees. Who do you think pays for the shortfall, other taxpayers who have nothing to do with the irresponsible promises made by these pensions.

Sorry - if the pensioners were promised something that could not be delivered on - that is not anyone else's problem. It is a shortfall in funding by the pension - and the beneficiary's should be the only ones affected.

If you don't have the money to pay your mortgage because of other debts do the taxpayers bail you out? NO. A pension is no different. Did Madoff's victims get bailed out by taxpayers? NO. People have to take responsibility for their finances.

It's not like this is a sudden problem - there has been funding shortfalls nearly every year because many of these pensions require 8% plus of secure returns minimum. That is unrealistic. I don't have a pension and I have known about this issue for 10 years. What has been done in that time, nothing that I can tell. Just because the average person does not understand this does not mean they are not responsible for it. Who let it continue? The truth is nobody ever gives people really bad news voluntarily - you have to look out for yourself or you get burned. That is the way it should be.

So I will give people a hint here. If you are 45 or younger - you have almost zero chance of collecting full social security. It is just another pension - and it too is having short falls.

I am assuming I will get none - you should too, or you will likely be sorry.

You changed my mind. Those of us without pensions have to worry about our investments... 401k and other retirement could lose substantial value, so why should pensions be guaranteed? Especially considering that the unions extorted these unsustainable benefits. Screw 'em.

a reply to: Edumakated

Why would these pension funds be better then me learning how to manage my own money and making my own investments??

Imagine if you were a bitcoin miner back in 2011 when it first hit the boards here?? Well, youlda been one of those guys who withdrew some money from gold, art or real estate equity and purchased a massive mining rig and boom you would be retired right now.

Or you coulda seen the crash coming in 08 and purchased a #load of gold.

I mean who the f knows. The Federal Reserve has been itching to raise interests rates but they can't because all of this market rise is coming from stock buy backs and the big banks buying up stock.

Why would these pension funds be better then me learning how to manage my own money and making my own investments??

Imagine if you were a bitcoin miner back in 2011 when it first hit the boards here?? Well, youlda been one of those guys who withdrew some money from gold, art or real estate equity and purchased a massive mining rig and boom you would be retired right now.

Or you coulda seen the crash coming in 08 and purchased a #load of gold.

I mean who the f knows. The Federal Reserve has been itching to raise interests rates but they can't because all of this market rise is coming from stock buy backs and the big banks buying up stock.

a reply to: proximo

It's actually very destructive the economy as a whole because people trust either the financial system or the government for their retirement. In the 'good old days' people saved for their retirement. That builds capital and capital (savings) is the seed corn for other new growth.

When we let the fed push down interest rates to try and 'stimulate' the economy they can't really they just enrich the financial industry. It's really like dilution, it's not increasing productivity or overall economic activity it's just diluting it and shifting wealth to financiers.

And it encourages speculation, recklessness and waste.

It's actually very destructive the economy as a whole because people trust either the financial system or the government for their retirement. In the 'good old days' people saved for their retirement. That builds capital and capital (savings) is the seed corn for other new growth.

When we let the fed push down interest rates to try and 'stimulate' the economy they can't really they just enrich the financial industry. It's really like dilution, it's not increasing productivity or overall economic activity it's just diluting it and shifting wealth to financiers.

And it encourages speculation, recklessness and waste.

a reply to: watchitburn

California is a "mess" when it comes to receiving the wrath of God (aka Mother Nature) too.

California is a "mess" when it comes to receiving the wrath of God (aka Mother Nature) too.

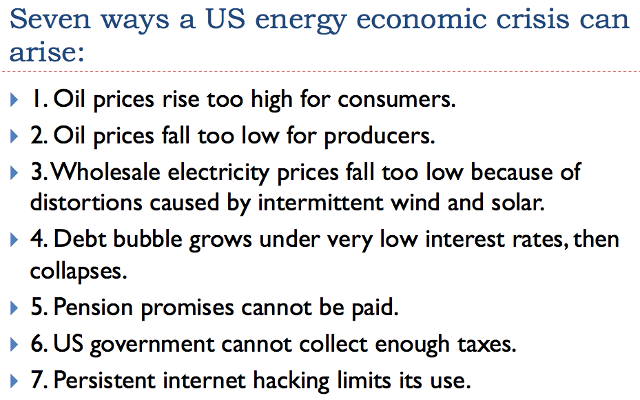

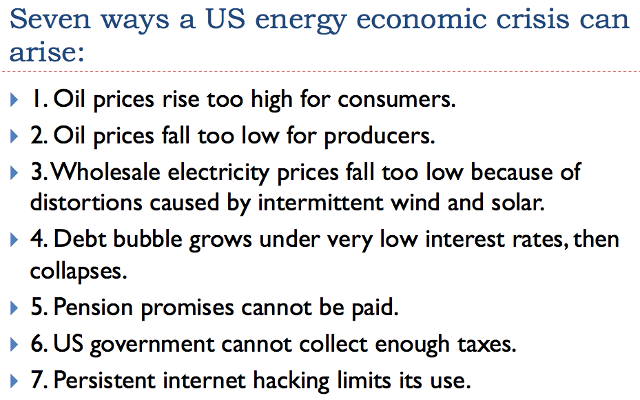

This figure here is really scary;

From: ourfiniteworld.com...

Basically I think we can check off every single one of those items capable of creating a crisis the only issue is when it will happen. Best prepare for you and your own.

From: ourfiniteworld.com...

Basically I think we can check off every single one of those items capable of creating a crisis the only issue is when it will happen. Best prepare for you and your own.

edit on 11-1-2018 by SkeptiSchism because: sp

a reply to: SkeptiSchism

exactly, if the government welch`s on it`s contract and promise to past employees, then what kind of people will be willing to work for an untrustworthy government? I`ll tell you what kind of people, people who were turned down for fast food jobs,because no competent person will take a job working for a government that lies and cheats it`s workers.

you think government employees are lazy and incompetent now/ just wait and see what kind of people will be working for the government if the government screws it`s retirees.

exactly, if the government welch`s on it`s contract and promise to past employees, then what kind of people will be willing to work for an untrustworthy government? I`ll tell you what kind of people, people who were turned down for fast food jobs,because no competent person will take a job working for a government that lies and cheats it`s workers.

you think government employees are lazy and incompetent now/ just wait and see what kind of people will be working for the government if the government screws it`s retirees.

a reply to: Wildbob77

I agree ,I know a lot of friends and family retired from LB,LA,pulling in over 60k a year in retirement,plus free service from utilities,that was a no brainer,I'm sure this was a set up to make a 1 wage retirement in Calif,and will soon be all states,the big corporations are set,socialism,now we will be comrades

I agree ,I know a lot of friends and family retired from LB,LA,pulling in over 60k a year in retirement,plus free service from utilities,that was a no brainer,I'm sure this was a set up to make a 1 wage retirement in Calif,and will soon be all states,the big corporations are set,socialism,now we will be comrades

Eventually California will run out of places to steal from to pay for their sanctuary status. Time for that state to pay for their actions.

a reply to: toysforadults

a reply to: toysforadults

Go talk to any investment company

Edward Jones has offices in many cities.

You can invest in bonds, stocks, or mutual funds. A good financial analyst will help you assess your tolerance for risk and then help you invest accordingly.

Right now putting your money in a bank is not an investment.

You can also think about purchasing a house. Although, it seems to me that the stock market is approaching a bursting point and real estate is also very costly where I live.

a reply to: toysforadults

Edward Jones has offices in many cities.

You can invest in bonds, stocks, or mutual funds. A good financial analyst will help you assess your tolerance for risk and then help you invest accordingly.

Right now putting your money in a bank is not an investment.

You can also think about purchasing a house. Although, it seems to me that the stock market is approaching a bursting point and real estate is also very costly where I live.

a reply to: toysforadults

edit on 12-1-2018 by Wildbob77 because: spellling

At least they will have a kick ass High speed rail, if it ever gets done.

$64 bil and counting.

$64 bil and counting.

edit on 1 12 2018 by burgerbuddy because: (no reason given)

a reply to: Wildbob77

Real estate just seems like it's in another bubble to me, the younger generations can't afford to buy houses at the same rates.

I also prefer more aggressive speculative investments, something that can generate a value. It doesn't necessarily have to be passive.

Real estate just seems like it's in another bubble to me, the younger generations can't afford to buy houses at the same rates.

I also prefer more aggressive speculative investments, something that can generate a value. It doesn't necessarily have to be passive.

new topics

-

Sunak spinning the sickness figures

Other Current Events: 35 minutes ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 46 minutes ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 2 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 3 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 5 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 7 hours ago -

Bobiverse

Fantasy & Science Fiction: 10 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 10 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 10 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 14 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 3 hours ago, 7 flags -

This is our Story

General Entertainment: 17 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 13 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 10 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 2 hours ago, 2 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 7 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 5 hours ago, 0 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 46 minutes ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 114 • : ImagoDei -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 24 • : budzprime69 -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 482 • : IndieA -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 3 • : Irishhaf -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 30 • : annonentity -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections • 55 • : Zanti Misfit -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 36 • : anthelion -

Truth Social goes public, be careful not to lose your money

Mainstream News • 124 • : lilzazz -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 145 • : Annee -

Sunak spinning the sickness figures

Other Current Events • 0 • : annonentity