It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

$GBTC down to $9.80

Now.

The perfect storm.

More snip from China today.

Expect everything to go lower.

Now.

The perfect storm.

More snip from China today.

Expect everything to go lower.

a reply to: liejunkie01

I second guess my decisions all the time.

I am feeling a little wishy-washy on my decisions..lol

I second guess my decisions all the time.

I'm putting my toe in the water. Going to buy small amounts of crypto...

What you need to know bout $GBTC.

www.investors.com...

Be aware of the annual fee. 2% of assets.

And the premium.

www.investors.com...

Although many publications call GBTC an ETF, it's not — it's a grantor trust. It is not registered with the SEC under the Investment Company Act of 1940 and it doesn't trade on an exchange. It trades on the over-the-counter market, which has less stringent participation rules than exchanges. And unlike most ETFs, GBTC charges a high annual fee of 2% of assets.

At the Jan. 29 closing price, Bitcoin was $11,233.95. That would make the NAV for a share of GBTC (11,233.95 x 0.00100733) $11.31. However, shares of GBTC closed at $19.14, a 69% premium to the NAV. So investors would have to pay 69% more per share than the underlying asset is worth.

Grayscale recently declared a 91-for-1 stock split for the trust for shareholders of record on Jan. 22. They received 90 additional shares on Jan. 26. This lowered GBTC's share price and increased the supply adding more shares to meet demand, thus increasing liquidity.The premium of share price over NAV has fallen but is still a whopping 47%.

GBTC has plunged 66% from its Dec. 19 intraday high to trade at 13.11 Thursday. Can it rally to new highs? Perhaps, but investors should be aware of points of technical analysis before weighing in. First, GBTC has knifed below its 50-day moving average and so far has been unsuccessful in getting past that line of resistance. Also, Bitcoin and GBTC had a climax run late last year, in which prices rose rapidly after a long run-up. It can take months, even years, for securities to mount another sustained advance after a climax run.

Be aware of the annual fee. 2% of assets.

And the premium.

Bitcoin's price was $952 a year ago.

Ethereums price was $11 a year ago.

Litecoins price was $3 a year ago.

Bitcoin cash last July was $233

According to coinbase.

Ethereum was at $11 bucks and was over $1,100 not so long ago.

Freggin crazy.

HODL pays.

Ethereums price was $11 a year ago.

Litecoins price was $3 a year ago.

Bitcoin cash last July was $233

According to coinbase.

Ethereum was at $11 bucks and was over $1,100 not so long ago.

Freggin crazy.

HODL pays.

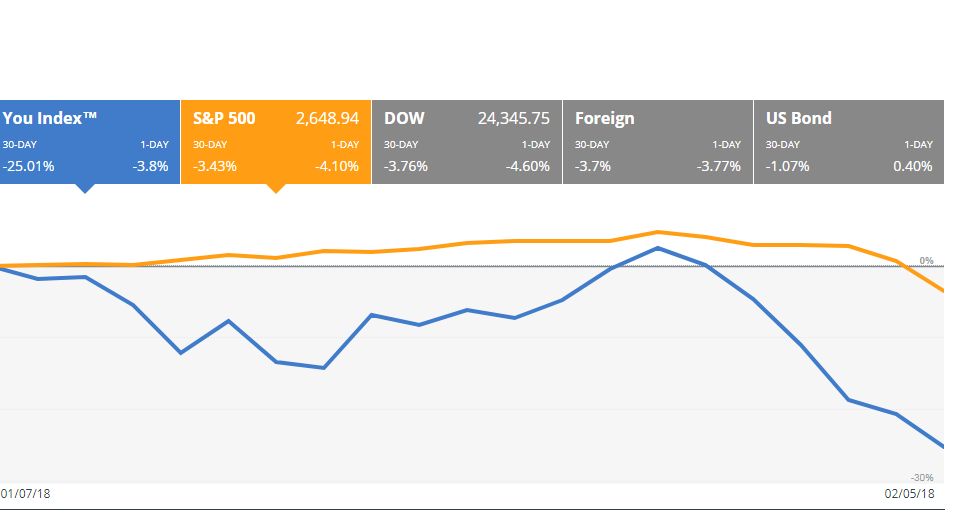

Stocks are down 1200 points in two days.

Bond market is bleeding.

Crypto is bleeding.

Crackdowns from China/India,Korea.

The perfect storm.

Worse before better?

Bond market is bleeding.

Crypto is bleeding.

Crackdowns from China/India,Korea.

The perfect storm.

Worse before better?

a reply to: neo96

Silver and Gold are the real fear index. I 'm watching those like a hawk. I see a parabolic rise then a smack down, it will be interesting to see if they want to keep spending to smack them down. When the Nikkei opened it fell of a cliff, then they sent in the plunge protection team it must be costing them.

Silver and Gold are the real fear index. I 'm watching those like a hawk. I see a parabolic rise then a smack down, it will be interesting to see if they want to keep spending to smack them down. When the Nikkei opened it fell of a cliff, then they sent in the plunge protection team it must be costing them.

I'm always curious as to why folks see gold and silver as a safe investment. Nobody's currency is backed by it anymore, so really, it's worth is just

like any other currency (a matter of agreement and consensus). Eventually, the public at large will realize this, and the prices for both will go into

the toilet.

I'm putting my toe in the water. Going to buy small amounts of crypto...

I'd wait and watch it through the week. It's probably going to get worse before it gets better.

I'd advise getting Coinbase first, and getting into those coins to start. It's easy to use, and is a good intro. May want to avoid Litecoin (LTC) as the founder already sold off all of his, so....not a great sign (to me).

To get into the other coins, you'll have to set up an account with other exchanges like Binance, etc. Keep in mind, these typically have minimum transaction amounts that could require dipping a little more than you're comfortable with.... which is why I recommend Coinbase first. (also, when it's really volitile like this, a lot of times, they can't accept new accounts)...

Ha that's why, all the big boys are buying it.

Maybe so, but when paper money goes the way of the dodo, I have a feeling gold and silver won't be too far behind it.

TRX is hanging out at .03..lol

There is only one way for Tron. It should be up..lol

Almost tempted to buy more, but I think ethereum would make more money holding.

There is only one way for Tron. It should be up..lol

Almost tempted to buy more, but I think ethereum would make more money holding.

Can I make a serious suggestion?

Stop looking at your portfolio for a while. Focus on reading about the technologies you're invested in, what they can do, what the company is actually worried about. Stop looking at the numbers going up and down on your screen. That's psychologically draining.

Instead, approach this market like professional poker players do, don't let the wild swings fool you into making mistakes, and focus on the objectives you've set out for your investments.

I only look at buying opportunities during these downturns. I do not look at what I'm "losing" because if I did that is miss out on serious long-term gains.

Stop looking at your portfolio for a while. Focus on reading about the technologies you're invested in, what they can do, what the company is actually worried about. Stop looking at the numbers going up and down on your screen. That's psychologically draining.

Instead, approach this market like professional poker players do, don't let the wild swings fool you into making mistakes, and focus on the objectives you've set out for your investments.

I only look at buying opportunities during these downturns. I do not look at what I'm "losing" because if I did that is miss out on serious long-term gains.

edit on 5 2 18 by projectvxn because: (no reason given)

a reply to: projectvxn

Exactly. Developers of good tech and projects aren't stopping because of market swings.

Exactly. Developers of good tech and projects aren't stopping because of market swings.

a reply to: projectvxn

That is good advice.

I have been taking time to read about different companies and start ups.

I have been reading about BAT coin. I kind of like where they are going with their advertising and search engine approach. They seem to have some good advisors and investing partners.

That is good advice.

I have been taking time to read about different companies and start ups.

I have been reading about BAT coin. I kind of like where they are going with their advertising and search engine approach. They seem to have some good advisors and investing partners.

I only look at buying opportunities during these downturns. I do not look at what I'm "losing" because if I did that is miss out on serious long-term gains.

Sound advice. I've purposefully avoided even opening up my Coinbase app, etc. and haven't even logged into Binance after my last buy.

But I will watch the values on coinmarket (I just don't want to see my dollar amounts, lol)....

Got my set buy points, and man, it's getting close to some of them.

edit on 6-2-2018 by Gazrok because: (no reason given)

Getting close....

Ripple (current = 69 cents, buy point = 40 cents)

Bitcoin (current = 7024, buy point = 6000)

Stellar (current = 33 cents, buy point = 25 cents)

Ethereum (current = 706, buy point = 600)

Not even thinking about getting into other coins at the moment, even though a few I like. I am watching them though.

EDIT: And of course, it starts creeping up this morning, instead of going lower, lol.... oh well, still holding to those points.

Ripple (current = 69 cents, buy point = 40 cents)

Bitcoin (current = 7024, buy point = 6000)

Stellar (current = 33 cents, buy point = 25 cents)

Ethereum (current = 706, buy point = 600)

Not even thinking about getting into other coins at the moment, even though a few I like. I am watching them though.

EDIT: And of course, it starts creeping up this morning, instead of going lower, lol.... oh well, still holding to those points.

edit on

6-2-2018 by Gazrok because: (no reason given)

new topics

-

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 33 minutes ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 1 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 1 hours ago -

I hate dreaming

Rant: 2 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 4 hours ago -

Biden says little kids flip him the bird all the time.

2024 Elections: 4 hours ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 4 hours ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 5 hours ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 6 hours ago -

MH370 Again....

Disaster Conspiracies: 7 hours ago

top topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 6 hours ago, 14 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 4 hours ago, 12 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 17 hours ago, 8 flags -

A man of the people

Medical Issues & Conspiracies: 12 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 4 hours ago, 7 flags -

Biden says little kids flip him the bird all the time.

2024 Elections: 4 hours ago, 6 flags -

4 plans of US elites to defeat Russia

New World Order: 14 hours ago, 4 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 1 hours ago, 4 flags -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 5 hours ago, 3 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 9 hours ago, 3 flags

active topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 47 • : ImagoDei -

Man sets himself on fire outside Donald Trump trial

Mainstream News • 31 • : watchitburn -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 40 • : RickyD -

12 jurors selected in Trump criminal trial

US Political Madness • 109 • : ImagoDei -

Boston Dynamics say Farewell to Atlas

Science & Technology • 2 • : theatreboy -

The defamation of Mary Magdalene

Religion, Faith, And Theology • 15 • : Solvedit -

A man of the people

Medical Issues & Conspiracies • 9 • : tarantulabite1 -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 47 • : Naftalin -

George Knapp AMA on DI

Area 51 and other Facilities • 28 • : theshadowknows -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs • 4 • : Ophiuchus1