It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: projectvxn

originally posted by: olaru12

After reading Trumps foreign policy speech, I'm convinced we will be in a shooting war sooner rather than later.

Who among all you ardent Trump supporters are going to sign up for the "new war"?

www.cnn.com...

Not me! I'm gonna wait for a Democrat to be in office. That way war will be just again. That's what I did during the Obama years!

I did the same under Bush..

originally posted by: Spider879

Wells Fargo CEO admits he won’t use his tax windfall to create more jobs

And water is wet, they gave 0 fks about a deficit they cried about , but some folks will always vote against their interest, just to spite the other side, as I'm sure the vast majority of Trumpets will benefit in no way from this admin's king john's tax policies, rob from the poor and working class and keep it.

OK, gauntlet throwdown time, Spider. Please elucidate your position and explain how this tax plan "robs from the poor and working class." I'm seeing this claim parroted frequently, but I have yet to see anyone explain how that's going to actually manifest itself.

originally posted by: Throes

originally posted by: Southern Guardian

Can you still picture that money trickling down?

In an interview with CNN Money, Wells Fargo CEO Tim Sloan made it clear what he plans to do with the corporation’s tax windfall — and it doesn’t benefit the average American worker.

“Is it our goal to increase return to our shareholders and do we have an excess amount of capital? The answer to both is, yes,” Sloan told CNN Money. “So our expectation should be that we will continue to increase our dividend and our share buybacks next year and the year after that and the year after that.”

And it’s not just Wells Fargo that stands to benefit. Goldman Sachs could also see a tax break worth up to $6 billion dollars from the GOP tax bill.

thinkprogress.org...

That $1.5 trillion deficit is looking like a giant bottomless pit I tell ya. There's already a wide consensus among various economic groups, individuals, that this tax plan will do little to nothing to benefit the economy as a whole let along the lower classes. This is just a kickback for the rich.... plain and simple. Not sure what more evidence people want. Straight from the horses mouth.

I'm saving at least $3k next year it this passes. That's not chump change.

Before or after you healthcare premium or contribution spikes?

That would put you in the top quintile.

I also assume you have low state and property taxes? As the SALT was capped at 10K.

edit on 20-12-2017 by soberbacchus because: (no reason given)

originally posted by: soberbacchus

Before or after you healthcare premium or contribution spikes?

Amazingly, this is the first year since the ACA was crapped all over our heads that my insurance premium and deductable didn't change. Just found out the new rates this week and was amazed to see they were identical. This administration is working for most of us, maybe you should get with the program yourself.

originally posted by: burdman30ott6

originally posted by: soberbacchus

Before or after you healthcare premium or contribution spikes?

Amazingly, this is the first year since the ACA was crapped all over our heads that my insurance premium and deductable didn't change. Just found out the new rates this week and was amazed to see they were identical. This administration is working for most of us, maybe you should get with the program yourself.

That is a statistical anomaly. Strange you say "most of us"?

www.kff.org...

According to the Congressional Budget Office (CBO), the repeal of the individual mandate penalties could result in as many as 13 million fewer Americans having health insurance. About 5 million are projected to be people who previously bought health insurance as individuals either within or outside the ACA’s marketplaces. Some will choose not to buy insurance because the penalty has disappeared. Others, especially higher-income individuals who don’t qualify for subsidies under the ACA, will drop insurance because of increases in average premiums predicted by the CBO. These premium increases will occur because, with the repeal of the mandate, many young, healthy people will exit markets, leaving a sicker, more costly insurance pool behind. Older individuals will be most affected. For example, a 60-year-old not receiving subsidies could face premium increases of $1,781, $1,469, $1,371, and $1,504, respectively, in Alaska, Arizona, Nevada, and Maine.

hbr.org...

a reply to: burdman30ott6

I could have kept the same service standard I had for about $50/paycheck more. I upgraded my plan to cover some long term treatments Ill be having to do, and it cost me $200/mo more than last year.

Its still nowhere near as good a plan as I had in 2009 when I paid 1/3 of what I pay today.

I could have kept the same service standard I had for about $50/paycheck more. I upgraded my plan to cover some long term treatments Ill be having to do, and it cost me $200/mo more than last year.

Its still nowhere near as good a plan as I had in 2009 when I paid 1/3 of what I pay today.

a reply to: soberbacchus

Alaska's healthcare system is broken and, frankly, it was the ACA which broke it. It shouldn't be used as any sort of measurement against repeal of the mandate.

And yes, I said most of us. America has 323 million citizens. The 13 million Americans who will lose the healthcare someone else is paying for them to have represent a whopping 4% of our citizens. Last I checked, 4% is about as far from "most" as one can get without dipping into the high 3's and below.

So, cheers to you and yours on this blessed Christmas season! If you find yourself in Alaska, look me up and I'll join you in toasting the tax plan.

Alaska's healthcare system is broken and, frankly, it was the ACA which broke it. It shouldn't be used as any sort of measurement against repeal of the mandate.

And yes, I said most of us. America has 323 million citizens. The 13 million Americans who will lose the healthcare someone else is paying for them to have represent a whopping 4% of our citizens. Last I checked, 4% is about as far from "most" as one can get without dipping into the high 3's and below.

So, cheers to you and yours on this blessed Christmas season! If you find yourself in Alaska, look me up and I'll join you in toasting the tax plan.

originally posted by: bigfatfurrytexan

Its still nowhere near as good a plan as I had in 2009 when I paid 1/3 of what I pay today.

On this I agree. The ACA didn't just let the devil out of the bottle, it smashed the bottle into dust. It will take a number of years of sanity, some additional ACA repealing, and some years of pain as people return to understanding the concept of personal responsibility for rates and benefits we are paying for to even start to balance out again.

originally posted by: bigfatfurrytexan

a reply to: burdman30ott6

I could have kept the same service standard I had for about $50/paycheck more. I upgraded my plan to cover some long term treatments Ill be having to do, and it cost me $200/mo more than last year.

Its still nowhere near as good a plan as I had in 2009 when I paid 1/3 of what I pay today.

Paid bi-monthly?

That is +1200 per year 2018 if you didn't upgrade.

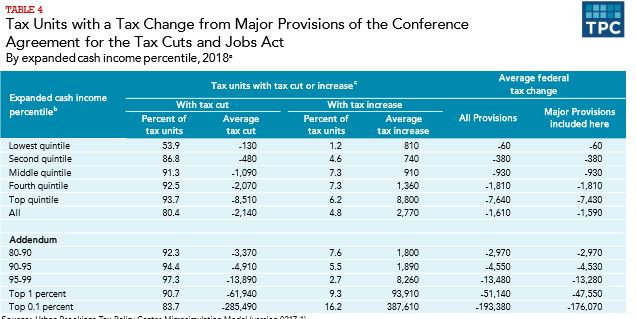

The average tax cut

Bottom 20% of earners: $130

20-40%: $480

(Theoretical Middle Class) 40-60%: $1090

Top 1%: $62,000

top .1%: $285,000

*This also varies by state and home owner. You can no longer deduct what you pay in property and state taxes above 10K (it's been capped)

From my link above:

These premium increases will occur because, with the repeal of the mandate, many young, healthy people will exit markets, leaving a sicker, more costly insurance pool behind.

Older individuals will be most affected.

For example, a 60-year-old not receiving subsidies could face premium increases of $1,781, $1,469, $1,371, and $1,504, respectively, in Alaska, Arizona, Nevada, and Maine.

edit on 20-12-2017 by soberbacchus because: (no reason given)

a reply to: soberbacchus

What you just posted is for individuals. BFFT may be referring to a family medical plan, which would mean his tax cut would also be greater if he files with dependents/married/etc.

What you just posted is for individuals. BFFT may be referring to a family medical plan, which would mean his tax cut would also be greater if he files with dependents/married/etc.

originally posted by: soberbacchus

This also varies by state and home owner. You can no longer deduct what you pay in property and state taxes above 10K (it's been capped)

...and you do realize that's one of the most brilliant parts of the tax plan, right? That issue will manifest itself in high tax states in the form of earners and home owners demanding lower state and local taxes, lower property taxes, and more accountability in terms of where those taxes are going and what they're being used for. Bye-bye state welfare sanctuaries like CA, NY, and Chicago... hello to major local tax protests.

originally posted by: burdman30ott6

a reply to: soberbacchus

And yes, I said most of us. America has 323 million citizens. The 13 million Americans who will lose the healthcare someone else is paying for them to have represent a whopping 4% of our citizens. Last I checked, 4% is about as far from "most" as one can get without dipping into the high 3's and below.

???

And everyone else's insurance premiums increase.

This isn't a partisan claim. The Congressional Budget Office and every independent analyst and the insurance companies themselves have said the same.

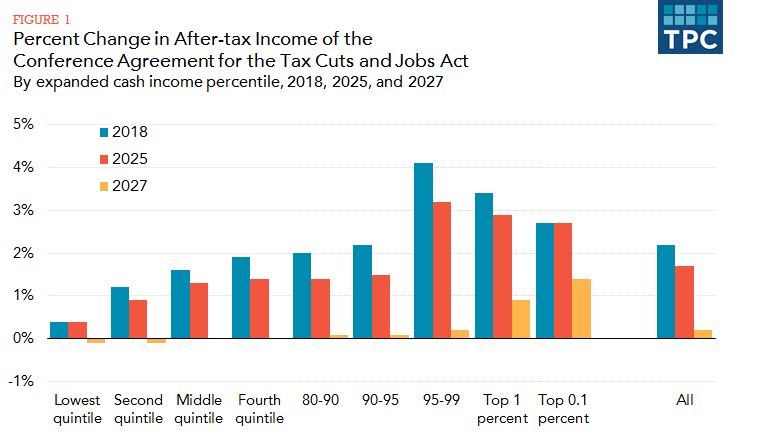

By any analysis, for the bottom 60% (and a chunk of the 60-80% of earners group) of the country, their tax break will not cover their insurance premium increases in the next couple years and from there it only gets worse.

originally posted by: burdman30ott6

a reply to: soberbacchus

Alaska's healthcare system is broken and, frankly, it was the ACA which broke it. It shouldn't be used as any sort of measurement against repeal of the mandate.

...You don't seem to be aware that the ACA was the reason your healthcare costs stayed the same in Alaska.

ANCHORAGE, Alaska (AP) — Alaskans buying health insurance on the individual market will see a decrease of 26.5 percent in rates next year, the sole insurer in the state announced Tuesday.

Alaskans had been paying some of the highest premiums in the nation.

Premera Blue Cross Blue Shield attributed the decrease to a significant reduction in the use of medical services and the state's establishment of a program to address high claims separately, called reinsurance.

Premera's announcement "shows that my team's out-of-the box thinking in creating the Alaska Reinsurance Program — approved by the Legislature — has paid off," Alaska Gov. Bill Walker said in an email statement.

"It also supports a need for Congress to fully examine the impacts of any changes to the Affordable Care Act, which enabled the creation of this program," said Walker, an independent who favors a bipartisan approach to healthcare overhaul.

www.usnews.com...

Good luck to you.

a reply to: burdman30ott6

It's not just Democrats that own expensive homes, nor just in NY and CA and NJ.

Lots of Trump voters will get hammered with the SALT cap.

Your hope that they will blame democrats next year for their tax hit is strange.

It's not just Democrats that own expensive homes, nor just in NY and CA and NJ.

Lots of Trump voters will get hammered with the SALT cap.

Your hope that they will blame democrats next year for their tax hit is strange.

originally posted by: burdman30ott6

originally posted by: soberbacchus

This also varies by state and home owner. You can no longer deduct what you pay in property and state taxes above 10K (it's been capped)

...and you do realize that's one of the most brilliant parts of the tax plan, right? That issue will manifest itself in high tax states in the form of earners and home owners demanding lower state and local taxes, lower property taxes, and more accountability in terms of where those taxes are going and what they're being used for. Bye-bye state welfare sanctuaries like CA, NY, and Chicago... hello to major local tax protests.

It will be real interesting to see how this plays out as the limousine liberals in these high tax states start assessing what their ideology is really costing them at a local level. I live in a high property tax area that is rabidly liberal.

a reply to: soberbacchus

BiMonthly would equate to every 2 months. We remit payroll deductions when payroll runs biweekly (i.e., 26 deductions per calendar year).

For plan year 2018 my premium totals for medical insurance will be a total of $8017.10

In plan year 2009 it was $2980.06.

Because I have an "upgraded policy" my employer contribution dropped from the standard 80% to 44%. My employer is paying the max contribution that our management contracts will allow for. Perhaps when we get new contracts with our clients, our share of who pays what will change. Until then, I pay 56% of the total plan cost, which is $8017.10 for 2018 to cover my family.

For context, my insurance costs my family more than half what a minimum wage employee would make this year (54%). If my employer weren't paying for any of it, it would cost me right up against $15k for 2018. Were we minimum wage earners, one of our household would have to work 40 hours a week just to pay for our insurance.

BiMonthly would equate to every 2 months. We remit payroll deductions when payroll runs biweekly (i.e., 26 deductions per calendar year).

For plan year 2018 my premium totals for medical insurance will be a total of $8017.10

In plan year 2009 it was $2980.06.

Because I have an "upgraded policy" my employer contribution dropped from the standard 80% to 44%. My employer is paying the max contribution that our management contracts will allow for. Perhaps when we get new contracts with our clients, our share of who pays what will change. Until then, I pay 56% of the total plan cost, which is $8017.10 for 2018 to cover my family.

For context, my insurance costs my family more than half what a minimum wage employee would make this year (54%). If my employer weren't paying for any of it, it would cost me right up against $15k for 2018. Were we minimum wage earners, one of our household would have to work 40 hours a week just to pay for our insurance.

edit on 12/20/2017 by bigfatfurrytexan because: (no reason given)

originally posted by: soberbacchus

...You don't seem to be aware that the ACA was the reason your healthcare costs stayed the same in Alaska.

I'm not insured through an Alaska insurer. My insurance is via an out of state company. Prior to the ACA, Alaska based insurance cost about 1/3rd of what it does now with the ACA, had half the deductible for that cost, and was still considered among the most expensive in the USA. Now with the ACA it is absolutely unaffordable. My healthcare costs stayed the same this year because my company is projecting the tax bill's individual mandate removal to stabilize costs.

a reply to: bigfatfurrytexan

FYI: Here is a calculator for how much of a tax break or increase some might expect:

www.nytimes.com...

FYI: Here is a calculator for how much of a tax break or increase some might expect:

www.nytimes.com...

a reply to: Southern Guardian

I believe he was joking or it was fake news as Wells Fargo is increasing the minimum wage of EVERY employee to a minimum $15 an hour because of the tax decrease...lol

I believe he was joking or it was fake news as Wells Fargo is increasing the minimum wage of EVERY employee to a minimum $15 an hour because of the tax decrease...lol

originally posted by: burdman30ott6

originally posted by: soberbacchus

...You don't seem to be aware that the ACA was the reason your healthcare costs stayed the same in Alaska.

I'm not insured through an Alaska insurer. My insurance is via an out of state company. Prior to the ACA, Alaska based insurance cost about 1/3rd of what it does now with the ACA, had half the deductible for that cost, and was still considered among the most expensive in the USA. Now with the ACA it is absolutely unaffordable. My healthcare costs stayed the same this year because my company is projecting the tax bill's individual mandate removal to stabilize costs.

What insurance company?

new topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 1 hours ago -

Ode to Artemis

General Chit Chat: 2 hours ago -

Ditching physical money

History: 5 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 6 hours ago -

VirginOfGrand says hello

Introductions: 7 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 7 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 10 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 11 hours ago -

God lived as a Devil Dog.

Short Stories: 11 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 16 hours ago, 20 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 10 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 13 hours ago, 9 flags -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 1 hours ago, 7 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 14 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 7 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 6 hours ago, 4 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 6 hours ago, 4 flags -

God lived as a Devil Dog.

Short Stories: 11 hours ago, 3 flags -

Ditching physical money

History: 5 hours ago, 3 flags

active topics

-

Why to avoid TikTok

Education and Media • 17 • : mooncake -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 22 • : mooncake -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 23 • : BigDuckEnergy -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 3 • : BingoMcGoof -

Russia Ukraine Update Thread - part 3

World War Three • 5717 • : Arbitrageur -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 44 • : budzprime69 -

Hundreds of teenagers flood into downtown Chicago, smashing car windows

Other Current Events • 111 • : 777Vader -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 125 • : Annee -

Who guards the guards

US Political Madness • 4 • : kwaka -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 44 • : pianopraze