It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: TheRedneck

a reply to: Greven

I know exactly what i wrote.

Your chart shows only Obama's administration. If you include the curve both before and after, the initial rise is a (painfully slow) correction from the sudden crash that started the recession, and the slope markedly increases starting November 2016.

I know that doesn't match your narrative, but it does match reality.

TheRedneck

You really want to see how flat the market was during George W. Bush?

01,000 mark: November 14, 1972

----------------------------------------

02,000 mark: January 8, 1987

----------------------------------------

03,000 mark: April 17, 1991

----------------------------------------

04,000 mark: February 23, 1995

05,000 mark: November 21, 1995

06,000 mark: October 14, 1996

07,000 mark: February 13, 1997

08,000 mark: July 16, 1997

09,000 mark: April 6, 1998

10,000 mark: March 29, 1999

11,000 mark: May 3, 1999

----------------------------------------

12,000 mark: October 19, 2006

13,000 mark: April 25, 2007

14,000 mark: July 19, 2007

----------------------------------------

15,000 mark: May 7, 2013

16,000 mark: November 21, 2013

17,000 mark: July 3, 2014

18,000 mark: December 23, 2014

19,000 mark: November 22, 2016

----------------------------------------

20,000 mark: January 25, 2017

21,000 mark: March 1, 2017

22,000 mark: August 2, 2017

23,000 mark: October 18, 2017

24,000 mark: November 30, 2017

originally posted by: TheRedneck

a reply to: Greven

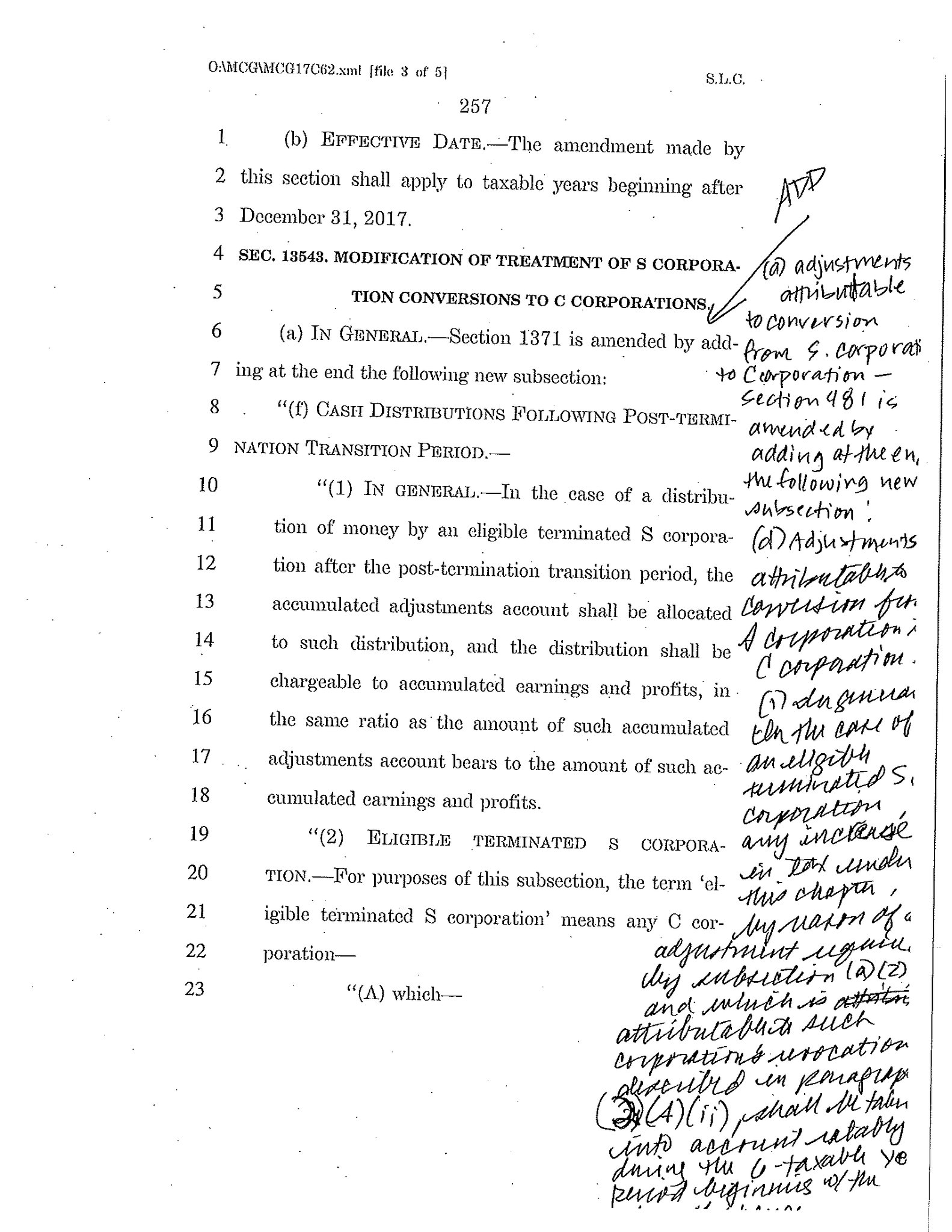

What you have been carrying on about are mark-up amendments. The authors of the amendments take the original bill and mark it up by hand to reflect the changes they want. Then the marked up bill is sent to the transcriptionists who type up the amendment formally and distribute it to the congressmen for consideration.

No one voted based on a scribble (unless they are dumb enough to think the scribble was the final amendment - I suppose that's possible since we're talking about the US Senate).

If you got that from a congressman who claimed it was a final draft, I highly recommend you send someone else next time you get the chance. He/she is an idiot.

TheRedneck

Those scribbles are how they got the 2 extra yes votes they needed to pass it.

originally posted by: Tempter

originally posted by: oddnutz

taxplancalculator.com...

how much worse off will you be under the new tax plan?

Thanks!

Just did it an it said I'd save over $4600 in taxes!

Ask yourself this. How can everyone be saving money if revenues are supposed to go up?

a reply to: Aazadan

Oh, the exuberance of youth!

Such a system does not exist, and cannot exist at present. How are you going to stop all illness? Any chance at an accident? How are you going to control luck?

You can't; no one can. I don't like for anyone to lose, but I also know I am not God. People get sick; people have runs of bad luck; people get hurt. That's life. All we can do is the best we can to help them as much as we can and a chance to recover if they can. Anything more is a pipe dream.

I'd rather concentrate on changing the things we can change: minimize regulations and taxes, and give a hand up to those who fall.

You most certainly do have much to learn...

TheRedneck

We've been over this before, I want a system where people don't lose. You want a system where some people lose catastrophically so that you can look at them and feel good about yourself because you're doing better than them.

Oh, the exuberance of youth!

Such a system does not exist, and cannot exist at present. How are you going to stop all illness? Any chance at an accident? How are you going to control luck?

You can't; no one can. I don't like for anyone to lose, but I also know I am not God. People get sick; people have runs of bad luck; people get hurt. That's life. All we can do is the best we can to help them as much as we can and a chance to recover if they can. Anything more is a pipe dream.

I'd rather concentrate on changing the things we can change: minimize regulations and taxes, and give a hand up to those who fall.

You most certainly do have much to learn...

TheRedneck

originally posted by: FatSoldier

a reply to: Greven

Jim Hansen is someone who thinks he's a god. He was predicting Earth would be a frozen ball without CO2. That is wrong. Earth is sufficiently close to the Sun and has sufficient atmosphere to be warm and support life. CO2 has nothing to do with it.

The Earth would be about 255 Kelvin at the surface if not for the greenhouse effect. Water freezes at 273 K. In fact, the whole of the atmosphere averages to ~255 K. The atmosphere nearest the surface is warmer, but falls in temperature rapidly with height - it is much cooler up to the tropopause where the temperature is roughly the same, then warms in the stratosphere. The greenhouse effect redistributes heat.

a reply to: Greven

Not really. Bush made a mess. My high hopes for him left long before he did. Bill Clinton did a better job overall than li'l George.

Oh, wait... you thought I was a Republican?

TheRedneck

You really want to see how flat the market was during George W. Bush?

Not really. Bush made a mess. My high hopes for him left long before he did. Bill Clinton did a better job overall than li'l George.

Oh, wait... you thought I was a Republican?

TheRedneck

originally posted by: TheRedneck

Just because you said it, it doesn't follow that it is true. You even admitted not knowing the actual definition of a 'small business' if I remember correctly.

It wasn't not knowing. It's that I'm using a more widespread definition, not the actual definition according to the US tax code. I would use a more precise definition for the businesses I'm referring to such as micro businesses or tiny businesses, but the US makes no such distinction.

So one guy who priced himself out of business is your basis for saying that small businesses are irrelevant?

Not at all. He didn't price himself out, the community just can't support the business anymore because the number of local customers declined. Instead he's going purely online as most in this industry do. I was throwing it out as a recent anecdote, not the basis of my beliefs.

originally posted by: TheRedneck

a reply to: Aazadan

Ask yourself this. How can everyone be saving money if revenues are supposed to go up?

Because the economy is not zero-sum.

TheRedneck

Then we should do even better at a 1% tax rate right? What about a 0% rate? Why not a -20% rate?

originally posted by: FatSoldier

a reply to: Greven

Earth has a lot of atmosphere. Earth is warm without CO2.

That's not how physics works, sorry.

originally posted by: TheRedneck

a reply to: Greven

You really want to see how flat the market was during George W. Bush?

Not really. Bush made a mess. My high hopes for him left long before he did. Bill Clinton did a better job overall than li'l George.

Oh, wait... you thought I was a Republican?

TheRedneck

You complained that it only showed Obama's term. So I added more. I had mentioned Bush in my last response to you. Nothing about Republican or Democrat.

originally posted by: TheRedneck

a reply to: Aazadan

Ask yourself this. How can everyone be saving money if revenues are supposed to go up?

Because the economy is not zero-sum.

TheRedneck

A hypothetical, since this road is being taken:

If you were to look at the money supply at a single millisecond in time, would it be a fixed amount?

a reply to: Aazadan

The US makes no such distinction because it's not relevant. If you want to say that Mom&Pop convenience stores with one or two employees and no chain affiliation are not a large part of the economy, fine. I can't disagree with that. But it's irrelevant. Most small businesses grow and eventually become mature businesses (or fail at some point while trying).

We're not talking about Mom&Pops.

Think about a recent example, MyPillow. One guy had an idea for a better pillow. He tested several designs and found one that worked. He got his friends to test it out and they liked it. So he went into production in a small business. He hired a lot of people in MN and sells his pillows across the country. That's a small business. That creates jobs. And if he gets a tax break, he'll use part of it to build a bigger factory and hire more people to make more pillows... that way he makes more money. If he gets big enough and the taxes are too high, he'll move his plant to Mexico or China and make them there instead, again so he can make more money.

This ain't rocket science.

If you add up all the jobs from small businesses like MyPillow, some larger, some smaller, all trying to grow and make more money, the total far exceeds the jobs in the mature businesses. That's the real point.

Oh, and your friend... that is what we call "buying a job." He wasn't running a business; he was working at a job he paid to have. That's where he went wrong, and why he failed.

TheRedneck

It wasn't not knowing. It's that I'm using a more widespread definition, not the actual definition according to the US tax code. I would use a more precise definition for the businesses I'm referring to such as micro businesses or tiny businesses, but the US makes no such distinction.

The US makes no such distinction because it's not relevant. If you want to say that Mom&Pop convenience stores with one or two employees and no chain affiliation are not a large part of the economy, fine. I can't disagree with that. But it's irrelevant. Most small businesses grow and eventually become mature businesses (or fail at some point while trying).

We're not talking about Mom&Pops.

Think about a recent example, MyPillow. One guy had an idea for a better pillow. He tested several designs and found one that worked. He got his friends to test it out and they liked it. So he went into production in a small business. He hired a lot of people in MN and sells his pillows across the country. That's a small business. That creates jobs. And if he gets a tax break, he'll use part of it to build a bigger factory and hire more people to make more pillows... that way he makes more money. If he gets big enough and the taxes are too high, he'll move his plant to Mexico or China and make them there instead, again so he can make more money.

This ain't rocket science.

If you add up all the jobs from small businesses like MyPillow, some larger, some smaller, all trying to grow and make more money, the total far exceeds the jobs in the mature businesses. That's the real point.

Oh, and your friend... that is what we call "buying a job." He wasn't running a business; he was working at a job he paid to have. That's where he went wrong, and why he failed.

TheRedneck

a reply to: Aazadan

Because of the same principle that sets prices... at which rate do we maximize tax revenue? If we go to 0%, then yes, GDP will increase even more. But at 0% there will be no tax revenue from business. Just like if we increased the corporate tax rate to 100%... sure, we'd make a fortune from one business, but no one would have that one business because they could not possibly make anything with it.

Total revenue forms an inverse hyperbolic curve plotted with tax rate versus production, just as total income does plotted with price versus sales. The ultimate point is the maximum on that curve. Everything so far is an attempt to hit that maxima... and it is obvious we are well past it with present tax rates.

TheRedneck

Then we should do even better at a 1% tax rate right? What about a 0% rate? Why not a -20% rate?

Because of the same principle that sets prices... at which rate do we maximize tax revenue? If we go to 0%, then yes, GDP will increase even more. But at 0% there will be no tax revenue from business. Just like if we increased the corporate tax rate to 100%... sure, we'd make a fortune from one business, but no one would have that one business because they could not possibly make anything with it.

Total revenue forms an inverse hyperbolic curve plotted with tax rate versus production, just as total income does plotted with price versus sales. The ultimate point is the maximum on that curve. Everything so far is an attempt to hit that maxima... and it is obvious we are well past it with present tax rates.

TheRedneck

a reply to: Greven

Assuming that you are referring to an instantaneous snapshot instead of a millisecond, then at that single moment in time, yes, the value would be fixed by definition. It would not necessarily be the same fixed amount a minute later, or a minute before, because every transaction produces some change in the value of the money supply.

TheRedneck

A hypothetical, since this road is being taken:

If you were to look at the money supply at a single millisecond in time, would it be a fixed amount?

Assuming that you are referring to an instantaneous snapshot instead of a millisecond, then at that single moment in time, yes, the value would be fixed by definition. It would not necessarily be the same fixed amount a minute later, or a minute before, because every transaction produces some change in the value of the money supply.

TheRedneck

Some of the posts here are astounding. The guy making $60/hour complaining about his entitlements I find particularly disgusting, honestly. Sadly,

there are many my age who feel this way these days (I'm in my early 20s).

This bill will help me and my husband. It will lower our tax rate, and increase our deduction. And guess what? We aren't rich! So this tax bill isn't just something that hurts the poor and helps the rich! Anyone saying this doesn't help the average person is a liar, or simply ignoring the facts.

For perspective.. I would say we are below middle class or perhaps very low middle class, especially for our state, which is one of the most expensive states to live in. He is currently the only one able to work due to my health issues and, by extension, inability to drive. It is a very rural area, so no transportation services. I am, however, working hard towards starting my own home business - fingers crossed it will work out. More to the point - as a mechanic he currently takes home maybe 20,000 per year after taxes and paying for health insurance. About 1,600 per month. Cost of living is high here - rent was 1,200 (anything less would have landed us square in a dangerous, crime infested area), though we eventually were able to purchase a home and now pay 1,300, which is worth it to have something that will one day be ours vs. paying someone else's mortgage. Homes are so expensive here, that type of mortgage was for one of the cheapest homes we could find that wasn't sure to be burglarized or shot up within days of receiving the keys, though it is still not in a very safe area.

Our weekly food budget is $15 (bread, peanut butter, bag of potatoes - leftover funds go towards things like toothpaste, soap), we keep the heat at 50 degrees absolute max in winter, no A/C in summer, we don't have internet/TV service (I use my phone, the only luxury we agree is somewhat necessary in our circumstance, which has a hotspot with a small amount of data per month so I can pay bills, etc), we try to never use any electricity unless absolutely crucial, we don't spend any money on anything that is not an absolute necessity to live aside from what I have mentioned.

And you know what? We would never, EVER even consider any kind of handout/government assistance/what have ye. Our quality of life is NOT what the government is for, it is OUR responsibility to improve it - and we have SO MUCH MORE than the average person in this world! For which we are so grateful, and it is why I do whatever I can to help charities.

Why should someone working as hard as my husband, or even harder, who manages to make more/move up in the world have to pay for us to have some kind of benefit/entitlement? Ridiculous. You work for what you have. If people want to give to others, that's one thing, but forcing high taxes on some so that a few get unnecessary benefits is stupid. And I know many people personally who qualify/are on welfare who have much more than we do. It's really very disturbing. One person in particular has no job, has every video game system/new tech/game known to man, sits on their behind all day and complains that he doesn't get enough benefits. That is not to say that there aren't genuinely those that need help, of course.

That aside, the absolute most ASTOUNDING thing to me is what people these days consider 'necessary' or a 'low quality of life.' SUCH an attitude of entitlement abounds! So many are so very spoiled. I can say, with full confidence, anyone making anywhere CLOSE to $60 per hour need not complain about their quality of life (monetarily speaking)! Take a look at the real world - broaden your scope to other nations, even. You aren't owed ANYTHING, nor do you deserve any special kind of standard of living just for being born. If you aren't without shelter, starving, half frozen and you are complaining about your situation using the luxury called "internet" via the luxury called a "computer," I really think some introspection is called for - in addition to some education regarding what life is, and always has been, really like. Hint: it's hard!

This bill will help me and my husband. It will lower our tax rate, and increase our deduction. And guess what? We aren't rich! So this tax bill isn't just something that hurts the poor and helps the rich! Anyone saying this doesn't help the average person is a liar, or simply ignoring the facts.

For perspective.. I would say we are below middle class or perhaps very low middle class, especially for our state, which is one of the most expensive states to live in. He is currently the only one able to work due to my health issues and, by extension, inability to drive. It is a very rural area, so no transportation services. I am, however, working hard towards starting my own home business - fingers crossed it will work out. More to the point - as a mechanic he currently takes home maybe 20,000 per year after taxes and paying for health insurance. About 1,600 per month. Cost of living is high here - rent was 1,200 (anything less would have landed us square in a dangerous, crime infested area), though we eventually were able to purchase a home and now pay 1,300, which is worth it to have something that will one day be ours vs. paying someone else's mortgage. Homes are so expensive here, that type of mortgage was for one of the cheapest homes we could find that wasn't sure to be burglarized or shot up within days of receiving the keys, though it is still not in a very safe area.

Our weekly food budget is $15 (bread, peanut butter, bag of potatoes - leftover funds go towards things like toothpaste, soap), we keep the heat at 50 degrees absolute max in winter, no A/C in summer, we don't have internet/TV service (I use my phone, the only luxury we agree is somewhat necessary in our circumstance, which has a hotspot with a small amount of data per month so I can pay bills, etc), we try to never use any electricity unless absolutely crucial, we don't spend any money on anything that is not an absolute necessity to live aside from what I have mentioned.

And you know what? We would never, EVER even consider any kind of handout/government assistance/what have ye. Our quality of life is NOT what the government is for, it is OUR responsibility to improve it - and we have SO MUCH MORE than the average person in this world! For which we are so grateful, and it is why I do whatever I can to help charities.

Why should someone working as hard as my husband, or even harder, who manages to make more/move up in the world have to pay for us to have some kind of benefit/entitlement? Ridiculous. You work for what you have. If people want to give to others, that's one thing, but forcing high taxes on some so that a few get unnecessary benefits is stupid. And I know many people personally who qualify/are on welfare who have much more than we do. It's really very disturbing. One person in particular has no job, has every video game system/new tech/game known to man, sits on their behind all day and complains that he doesn't get enough benefits. That is not to say that there aren't genuinely those that need help, of course.

That aside, the absolute most ASTOUNDING thing to me is what people these days consider 'necessary' or a 'low quality of life.' SUCH an attitude of entitlement abounds! So many are so very spoiled. I can say, with full confidence, anyone making anywhere CLOSE to $60 per hour need not complain about their quality of life (monetarily speaking)! Take a look at the real world - broaden your scope to other nations, even. You aren't owed ANYTHING, nor do you deserve any special kind of standard of living just for being born. If you aren't without shelter, starving, half frozen and you are complaining about your situation using the luxury called "internet" via the luxury called a "computer," I really think some introspection is called for - in addition to some education regarding what life is, and always has been, really like. Hint: it's hard!

originally posted by: Greven

originally posted by: face23785

originally posted by: Greven

originally posted by: face23785

originally posted by: Greven

originally posted by: face23785

originally posted by: Aazadan

originally posted by: face23785

All the changes have been being talked about all week. They were no surprise. Fail. You got lied to bro.

And let's not pretend any Democrats were gonna vote yea even if they re-read the entire bill. A few of them may vote yes on the reconciled bill, because they know their talking points are false and at that point if it's about to come law anyway it'll be politically beneficial to them to get on the record supporting a beneficial tax bill, even if it does prove them to be liars for opposing it now.

I know they weren't going to vote for it, I wanted to see the reform fail.

Yes I'm aware of that. You still got lied to. They all knew what the changes were. They purposefully misled you to think some phantom changes got snuck in that they were unaware of. That's a straight up lie. Don't be ok with being lied to as long as the lies suit your agenda.

Oh okay, so what does this change say:

You appear to have ignored my response to this on the previous page. Any thoughts on how you were misled by your elected representatives and the media?

Oh, do I need to respond to every post in the thread now? A good guess as to what that said.

The cut off words came from the Republicans' photocopying. The bill originated with them. That wasn't the only change, but one of many. Media had nothing to do with this at all - that image was taken from a Senator.

Also, my representatives are Republicans, so I would say they did indeed mislead.

They rushed the changes so quickly that they had to photocopy handwritten changes rather than type them up.

The media spread the false idea that some changes no one knew about were snuck in. That myth was invented by elected officials and passed on by the media to suckers like you. If your reps aren't Democrats, then it wasn't your elected officials that willfully lied to you. Regardless, the officials you chose to believe willfully misled you. I've demonstrated how you were misled. With my limited legal experience, none of which dealt with tax law, I was able to readily decipher that text. Anyone with marginal experience in tax language would have an even easier time. No one was scrambling to figure out what the changes were. That's a lie. It's a lie you fell for. The truth has now been explained to you in very simple terms. Do you embrace the truth or not?

Again no, I haven't listened to any 'media' telling me # I watched on live streams up until 2am this morning when I was following this vote. It was kinda hard to do so on the Republican side, given that they didn't have any available to explain to the public what was in their bill that the forced through under budget reconciliation.

Yet, here you are going on making up stupid bull# things, then saying I fell for the lies you are yourself spinning.

Cool, you figured out partially what a scribble said. You have prior experience doing that, in fact. I couldn't make heads or tails on half of that. There were more than one of these revisions. Other sections were marked out. Other words were marked out or added to change meanings. This was done on a number of the nearly 500 pages. They were given the revised bill hours before it was voted on.

One Democrat on the floor of the chamber challenged anyone to swear an oath that they had read and understood the law. Nobody took him up on it. Telling, don't you think?

I would suggest that you stop lying.

Right, so now that you know you were misled by the Dem reps who were pretending the changes were a big deal (I know you can't admit it), just ask yourself: What other aspects of this bill are they lying to you about?

Time to take the blinders off man.

new topics

-

Is the origin for the Eye of Horus the pineal gland?

General Conspiracies: 55 minutes ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 1 hours ago -

Biden says little kids flip him the bird all the time.

2024 Elections: 1 hours ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 1 hours ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 1 hours ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 3 hours ago -

MH370 Again....

Disaster Conspiracies: 4 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 6 hours ago -

Chronological time line of open source information

History: 7 hours ago -

A man of the people

Diseases and Pandemics: 9 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 17 hours ago, 19 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 3 hours ago, 14 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 1 hours ago, 8 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 14 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 17 hours ago, 6 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 17 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 10 hours ago, 4 flags -

A man of the people

Diseases and Pandemics: 9 hours ago, 4 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 1 hours ago, 4 flags -

Biden says little kids flip him the bird all the time.

2024 Elections: 1 hours ago, 3 flags

active topics

-

12 jurors selected in Trump criminal trial

US Political Madness • 74 • : Xtrozero -

Man sets himself on fire outside Donald Trump trial

Mainstream News • 10 • : andy06shake -

George Knapp AMA on DI

Area 51 and other Facilities • 26 • : nerbot -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 6 • : chiefsmom -

Is the origin for the Eye of Horus the pineal gland?

General Conspiracies • 1 • : ARM19688 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 25 • : twistedpuppy -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 46 • : Encia22 -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 15 • : matafuchs -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 17 • : TheValeyard -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 100 • : Astrocometus