It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: Aazadan

How do you figure that when the top tax rate is 39.6%, and that's only on income over $500,000 a year! (individual)

Here's a breakdown for an individual with no additional deductions making $1,000,000 a year:

First $12,200 - no tax

The next $32,800 - 12%, or $3936

The next $85,000 - 25%, or $21,250

The next $370,000 - 35%, or $129,500

The last $500,000 - 39.6%, or $198,000

Grand total taxes (no deductions) for an individual making $1,000,000/year - $352,686,or 35.26% (all calculations based on HR1 (115th))

This person will still bring in, after Federal taxes, $647,314 a year, or $53,943 per month... I don't think that amount of income is insufficient to attend grad school. Exactly how is a maximum tax rate of 39.6% that doesn't even kick in until after the first $500K, equating to 45% taxes overall?

Either you know something I don't, or your math is whacked!

TheRedneck

My federal taxes (ignoring state/city) jump from 17% of my income to 45% of my income

How do you figure that when the top tax rate is 39.6%, and that's only on income over $500,000 a year! (individual)

Here's a breakdown for an individual with no additional deductions making $1,000,000 a year:

First $12,200 - no tax

The next $32,800 - 12%, or $3936

The next $85,000 - 25%, or $21,250

The next $370,000 - 35%, or $129,500

The last $500,000 - 39.6%, or $198,000

Grand total taxes (no deductions) for an individual making $1,000,000/year - $352,686,or 35.26% (all calculations based on HR1 (115th))

This person will still bring in, after Federal taxes, $647,314 a year, or $53,943 per month... I don't think that amount of income is insufficient to attend grad school. Exactly how is a maximum tax rate of 39.6% that doesn't even kick in until after the first $500K, equating to 45% taxes overall?

Either you know something I don't, or your math is whacked!

TheRedneck

originally posted by: TheRedneck

How do you figure that when the top tax rate is 39.6%, and that's only on income over $500,000 a year! (individual)

Because the changes to education means you're going to pay on money you never receive. Scholarships, grants, etc all now count as income. So if you're getting $20k/year in education assistance, but have a take home of 15k/year, you now pay taxes out of that 15k as if you're bringing home 35k. Furthermore, a whole bunch of deductions such as school supplies, loan interest, and so on have been removed.

In my case I actually get hit double, because I'm finishing school but also just got a decent job and am bringing home a paycheck. With my current school schedule I'm working about 1270 hours per year, which gives me a net income of about $55,000. However, I also get $20,000 a year in tuition assistance and $10,000 in what used to be tax free living assistance. Thus, I'm paying taxes on $85,000 in income. That's a tax bill of roughly $15,000 out of $55,000 in actual cash assets that can be leveraged.

So it looks like I confused the numbers a bit. I'm only paying 28% in federal. It gets up to 45% once you include state and local.

The point is, this is a tax rate that's higher than what upper middle class or the wealthy pay. Now, I'm used to this... working on disability you actually pay a near 75% tax rate (you pay taxes on the full value you make, but they also subtract income based on your pre tax income... so if you make $100, you'll pay $10 on a 10% tax but then also have $50 in income subtracted, so you pay $10 on $50 in income gain). Fortunately I'm off that program now, however it's a bit discouraging to see that I get out of one abusive tax structure, and as soon as I've finally pulled myself up by the bootstraps I end up in another one.

I've always wanted to live in the US, do good things and contribute to our country. I'll say this though. If they take away my ability to actually one day become an educated person, I have zero incentive to stay here. I would rather leave and go somewhere else as a second class citizen/immigrant for the rest of my life than be denied the education that could let me actually do whatever I want like our constitution says I should be able to do.

It's not about money, it's about being denied the ability to try and reach my potential. The house tax plan (and the Senate plan, if they vote for it) fundamentally take away that ability by making higher education unaffordable. I would have to give up school, give up any chance of ever owning a home, and save for years, likely decades just to be able to attend school... and that's assuming a major medical expense doesn't wipe out the savings.

Sorry, I can recognize a # sandwich when I see it.

Your own argument is predicated on the idea that a grad student should be bringing in 1 million a year just to be able to attend. We both know that's not realistic.

edit on 20-11-2017 by Aazadan because: (no reason given)

a reply to: Willtell

In case you missed it due to Partisan Blindness and or TDS (Trump Derangement Syndrome) it also doubles the starting income deduction from $12,500 to $25,000 which helps EVERYONE.

Overall, from my less partisan view its not a great bill which is a result of ZERO DNC participation and the business as usual approach by EVERY single politician in DC, they shape a bill to provide plenty of talking points and meet with every lobbyists in the country to make sure they are happy and that the money keeps rolling into their pockets.

In case you missed it due to Partisan Blindness and or TDS (Trump Derangement Syndrome) it also doubles the starting income deduction from $12,500 to $25,000 which helps EVERYONE.

Overall, from my less partisan view its not a great bill which is a result of ZERO DNC participation and the business as usual approach by EVERY single politician in DC, they shape a bill to provide plenty of talking points and meet with every lobbyists in the country to make sure they are happy and that the money keeps rolling into their pockets.

a reply to: Aazadan

Yes, this will hurt colleges, big time. I think that's by design. They've had a free gravy train of tax deductions and federally insured student loans that have made tuition insane. You could get a four year degree for 12k when I was younger. Now that same college is 36k for the same education.

But the standard deduction also doubles in this plan, so while you're paying on the 35k you get to deduct 13k instead of 6.5k.

Yes, this will hurt colleges, big time. I think that's by design. They've had a free gravy train of tax deductions and federally insured student loans that have made tuition insane. You could get a four year degree for 12k when I was younger. Now that same college is 36k for the same education.

But the standard deduction also doubles in this plan, so while you're paying on the 35k you get to deduct 13k instead of 6.5k.

a reply to: DJMSN

Math doesn't work that way. You can't lower taxes on everyone while also increasing spending, and project it will be deficit neutral.

It is doing one of two things. It's either massive deficit spending which is fiscally irresponsible, or it's shifting taxes paid from one group to another.

Math doesn't work that way. You can't lower taxes on everyone while also increasing spending, and project it will be deficit neutral.

It is doing one of two things. It's either massive deficit spending which is fiscally irresponsible, or it's shifting taxes paid from one group to another.

originally posted by: Look2theSacredHeart

a reply to: ketsuko

Condoms do fail.

Abysha said it best. Birth control fails. Even vasectomies.

Yes, birth control does fail, even vasectomies--I actually work with a guy who had to have a second one because the sperm found a way to swim through scar tissue that connected from the ends of the severed vas deferens. Mine, however, has been permanent from the first time, just like most men (failure rate of a vasectomy is 0.15% of the surgeries). The thing about my friend and me, though, is that we're smart enough to go back and have our sperm count evaluated, as prescribed by the surgeon, at least once after the surgery at a specified interval (a follow-up that is included in the cost of the procedure).

Condoms do fail, for sure. So does "the pill," and the pull-out method, and relying on one's cyle/timing, and everything else that one can do to prevent pregnancy other than abstinence (which is an unreasonable expectation of most people post-puberty).

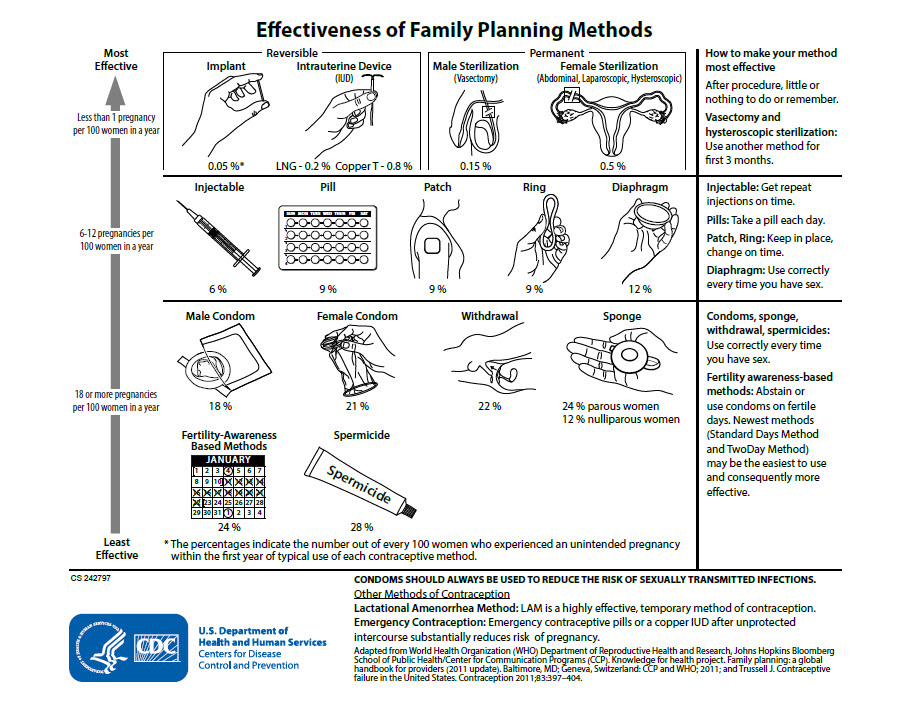

But, as the following graphic notes, citing these instances as being a norm or something that needs to be overly-hyped is absurd--it's the epitome of fallacious logic when one cites anecdotal evidence and generalized statements to make a problem seem worse than it is (a common tactic surrounded the "deadliness" of Measles):

Can we please stop with hyperbole? I've been reading along in this thread, just searching for anything--a rebuttal or agreement with the OP--that is backed by links, or valid information, or anything, and it's simply a thread of ideological opinion or dismissed comments (presumably based on confirmation bias).

As you can see, vasectomies have a 99.85% efficacy rate. Condoms, while less effective, still come in at 82% effective, and the bulk of the majority of the ineffectiveness is because of improper use by the parties involved (according to the CDC's own website). The pill is 91% effective, and again, much of the ineffectiveness can be attributed to improper use by the individual.

Can we stop playing the hyperbole game? Abysha didn't "[say] it best," she cited anecdotal evidence and implied that these problems occur "all the time" from her family. Statistically speaking, she's lying, not 'saying it best.' Either that, or her famlily is woefully inept at properly using contraceptives as described by the manufacturers.

edit on 20-11-2017 by SlapMonkey because: (no reason given)

Ah, it wouldn't be another Monday if liberal media weren't publishing articles that Republicans are killing the poor and the seniors.

What a complete load of crap, as usual. There are plenty of other news outlets saying the tax plan is a cut for pretty much EVERYONE. But sure, ignore all those. I've posted them in threads before but it's not worth the hassle. I know Dems won't read them.

What a complete load of crap, as usual. There are plenty of other news outlets saying the tax plan is a cut for pretty much EVERYONE. But sure, ignore all those. I've posted them in threads before but it's not worth the hassle. I know Dems won't read them.

a reply to: Aazadan

I'm reponding to this one out of order,because I want to start off by saying that might be a fairer assessment.

I was not aware of that, and as of now cannot refute it. I do not think scholarships paid to the school should be counted as income; the purpose of the tax bill is to stimulate the economy, and I know of no better stimulation than to improve the ability of Americans. Can you take the time to point me to the part of that bill I linked above where this is stated?

Under present law, yes, but not under the new bill. You're comparing future to past here - like comparing apples to oranges.

The issue is this: do we want the special deductions or not? We have seen clearly that special deductions become primarily beneficial for the wealthy; that is how the wealthy are able to avoid paying higher percentages. As much as you and I may agree on not taxing certain incomes (like scholarships, which are a form of income), the fact remains that this is a special deduction.

I haven't gone through it all yet (big bill!), but there is a special section concerning unearned income,which would include scholarships and tuition assistance... when I get through that section, I may or may not have an adjusted opinion.

No, it wasn't. I chose the figure of $1,000,000/year because your original statement of paying 45% meant that I needed to use worst case to illustrate that was not realistic. I used grad school as an example because that was one of your goals that was out of reach. Anyone capable of attending grad school and willing to work for it should be able to attend.

TheRedneck

So it looks like I confused the numbers a bit. I'm only paying 28% in federal. It gets up to 45% once you include state and local.

I'm reponding to this one out of order,because I want to start off by saying that might be a fairer assessment.

Because the changes to education means you're going to pay on money you never receive. Scholarships, grants, etc all now count as income.

I was not aware of that, and as of now cannot refute it. I do not think scholarships paid to the school should be counted as income; the purpose of the tax bill is to stimulate the economy, and I know of no better stimulation than to improve the ability of Americans. Can you take the time to point me to the part of that bill I linked above where this is stated?

The point is, this is a tax rate that's higher than what upper middle class or the wealthy pay.

Under present law, yes, but not under the new bill. You're comparing future to past here - like comparing apples to oranges.

The issue is this: do we want the special deductions or not? We have seen clearly that special deductions become primarily beneficial for the wealthy; that is how the wealthy are able to avoid paying higher percentages. As much as you and I may agree on not taxing certain incomes (like scholarships, which are a form of income), the fact remains that this is a special deduction.

I haven't gone through it all yet (big bill!), but there is a special section concerning unearned income,which would include scholarships and tuition assistance... when I get through that section, I may or may not have an adjusted opinion.

Your own argument is predicated on the idea that a grad student should be bringing in 1 million a year just to be able to attend. We both know that's not realistic.

No, it wasn't. I chose the figure of $1,000,000/year because your original statement of paying 45% meant that I needed to use worst case to illustrate that was not realistic. I used grad school as an example because that was one of your goals that was out of reach. Anyone capable of attending grad school and willing to work for it should be able to attend.

TheRedneck

a reply to: Aazadan

In case you did not know, the ability to deduct educational expenses from your income was a deduction which expired in 2016 so this plan is not responsible for the loss of that deduction which only allowed up to 4 thousand a year plus some other qualifying expenses which hardly makes education affordale which can exceed 20 grand per year at some Universities.

I have yet to hear a single Democrat bring forth that tidbit, their only intrest is to obstruct at every step, maybe if both sides can one day work together in the intrest of their constituents instead of their own.

As for our education system as a whole, it needs lots of work from lower to higher. Education is rather tightly controlled at the State and local levels with the Federal entities mostly throwing large sums of money into the dark holes of state governors coffers and trickle down into the bottomless cess pools we refer to as school boards.

The majority of our Universities have very large endowments which were provided by the extremely rich families thru the years which more than fund free education for every student they have or at least very large scholarships. Instead they choose to spend these funds which were provided in some cases for very specific reasons and those in control go to court to have those directions nullified and proceed to pay professors who beat people with bike locks or to fund studies on the sex lives of gulf shrimp.

We need to realize that we are being played by our politicians. When Democrats were in full control of the White House and the House and Senate did they ban the earth of the evil guns they claim the other side is responsible for ? Never fails that just enough vote no if by chance a bill is introduced.

When the Republicans own the votes to make changes they view as favorable, like repealing some measures of an unaffordable health care plan they just can't vote for it however even though they voted unanimously for repeal when they knew it would never pass much less be signed as law by its very creator. Its sad that We the People are so easily distracted and allow the patients to run the insanity institute up on the hill

In case you did not know, the ability to deduct educational expenses from your income was a deduction which expired in 2016 so this plan is not responsible for the loss of that deduction which only allowed up to 4 thousand a year plus some other qualifying expenses which hardly makes education affordale which can exceed 20 grand per year at some Universities.

I have yet to hear a single Democrat bring forth that tidbit, their only intrest is to obstruct at every step, maybe if both sides can one day work together in the intrest of their constituents instead of their own.

As for our education system as a whole, it needs lots of work from lower to higher. Education is rather tightly controlled at the State and local levels with the Federal entities mostly throwing large sums of money into the dark holes of state governors coffers and trickle down into the bottomless cess pools we refer to as school boards.

The majority of our Universities have very large endowments which were provided by the extremely rich families thru the years which more than fund free education for every student they have or at least very large scholarships. Instead they choose to spend these funds which were provided in some cases for very specific reasons and those in control go to court to have those directions nullified and proceed to pay professors who beat people with bike locks or to fund studies on the sex lives of gulf shrimp.

We need to realize that we are being played by our politicians. When Democrats were in full control of the White House and the House and Senate did they ban the earth of the evil guns they claim the other side is responsible for ? Never fails that just enough vote no if by chance a bill is introduced.

When the Republicans own the votes to make changes they view as favorable, like repealing some measures of an unaffordable health care plan they just can't vote for it however even though they voted unanimously for repeal when they knew it would never pass much less be signed as law by its very creator. Its sad that We the People are so easily distracted and allow the patients to run the insanity institute up on the hill

a reply to: Aazadan

We have been running large deficits for many years after all how do you account for 20 trillion in debt. No one seems at all concerned that the Affordable Health Care Act creates massive deficits and continues to contribute to the national debt each and every day

We have been running large deficits for many years after all how do you account for 20 trillion in debt. No one seems at all concerned that the Affordable Health Care Act creates massive deficits and continues to contribute to the national debt each and every day

originally posted by: Aazadan

originally posted by: Metallicus

immoral and unnecessary tax cut

Now it is 'immoral' for me to keep more of my money.

Nice hyperbole there.

How is keeping more of your money at the expense of society moral?

Which society?

a reply to: Aazadan

I worked out your specifics based on the new tax code. You're right; section 1204 of the bill repeals §222, which allowed for 100% deduction of qualified expenses (which ended last year; there was already zero deduction for education expenses in 2017). But section 1201 adds it back in as the American Opportunity Tax Credit. Under it, the first $2000 of qualified expenses is deducted at 100%, and the remaining can be deducted at 25%. Based on your $20,000 figure, that means a deduction of $2000 + $4500 = $6500. 40% of that ($2600) may be used as a tax credit.

Your income of $85,000 total means you will pay 0% on 12,500 ($0), plus 12% on 32,500 ($4500), plus 25% on $40,000 ($10,000), for a total tax of $14,500. The tax credit on $20,000 of qualified expenses is equal to $6500, meaning a final tax owed of $8000. If you use your earned income of $55,000 as a base, that means you will be paying 14.55%.

That is assuming you are single with no dependents, and there is no new provision for the $10,000 in assisted housing. I haven't looked at that.

That's a far cry from the 45% reiterated as 28% you originally thought. It's a little more than you pay now (but much less with the sunset clause on educational expenses), and someone in a worse position than you (around here, $55K/yr means you are rich! Most students live on $30K or less if they're lucky) will get their taxes lowered considerably.

Oh, and don't forget that whether or not this bill passes, you have already lost your tuition deduction... ALL of it, for 2017. That was allowed to expire under the Obama administration and has nothing to do with Trump or the Republican party.

TheRedneck

I worked out your specifics based on the new tax code. You're right; section 1204 of the bill repeals §222, which allowed for 100% deduction of qualified expenses (which ended last year; there was already zero deduction for education expenses in 2017). But section 1201 adds it back in as the American Opportunity Tax Credit. Under it, the first $2000 of qualified expenses is deducted at 100%, and the remaining can be deducted at 25%. Based on your $20,000 figure, that means a deduction of $2000 + $4500 = $6500. 40% of that ($2600) may be used as a tax credit.

Your income of $85,000 total means you will pay 0% on 12,500 ($0), plus 12% on 32,500 ($4500), plus 25% on $40,000 ($10,000), for a total tax of $14,500. The tax credit on $20,000 of qualified expenses is equal to $6500, meaning a final tax owed of $8000. If you use your earned income of $55,000 as a base, that means you will be paying 14.55%.

That is assuming you are single with no dependents, and there is no new provision for the $10,000 in assisted housing. I haven't looked at that.

That's a far cry from the 45% reiterated as 28% you originally thought. It's a little more than you pay now (but much less with the sunset clause on educational expenses), and someone in a worse position than you (around here, $55K/yr means you are rich! Most students live on $30K or less if they're lucky) will get their taxes lowered considerably.

Oh, and don't forget that whether or not this bill passes, you have already lost your tuition deduction... ALL of it, for 2017. That was allowed to expire under the Obama administration and has nothing to do with Trump or the Republican party.

TheRedneck

edit on 11/20/2017 by TheRedneck because: clarification

a reply to: TheRedneck

That's not true, the republicans are mostly responsible for that since they controlled the house and senate when it expired. But trump is blameless on that one.

That was allowed to expire under the Obama administration and has nothing to do with Trump or the Republican party

That's not true, the republicans are mostly responsible for that since they controlled the house and senate when it expired. But trump is blameless on that one.

a reply to: DJMSN

www.latimes.com...

Why the GOP tax plan's big boost in the standard deduction won't be a windfall for some average Americans

What this means is that they didn’t do much research and the fact may be that people with children will be worse off.

Additionally, after a few years low and middle income taxes will go up

www.latimes.com...

Why the GOP tax plan's big boost in the standard deduction won't be a windfall for some average Americans

A family with two or more children actually could end up worse off than under the current tax code, depending on the final shape of the law, a sign that the Republican plan might not help the middle class as much as it does the wealthy.

“Under this framework, the first $12,000 of income earned by a single individual will be tax free, and a married couple won’t pay a dime in taxes on their first $24,000 of income,” Trump said as he pitched the plan in a speech Wednesday in Indianapolis.

“But Trump didn’t mention that the framework also proposes to eliminate the existing $4,050 exemption that can be claimed by taxpayers for themselves, their spouses and their dependents and also reduces taxable income. That exemption currently phases out at upper-income levels. But it’s a different story for people with children.

Under existing tax law, a married couple with two children can combine the $12,700 standard deduction and $16,200 in personal and dependent exemptions to shield $28,900 from federal income tax. Under the Republican plan, that same couple would be able to shield just $24,000.

“Increasing the standard deduction and losing the personal exemption is a trade-off that might work for single filers with no kids,” said Howard Gleckman, a senior fellow at the nonpartisan Tax Policy Center. “It doesn’t work at all for a single filer with two kids. They’d be worse off.”

These are the facts

What this means is that they didn’t do much research and the fact may be that people with children will be worse off.

Additionally, after a few years low and middle income taxes will go up

By 2023, a key middle-class tax break expires. Many of the people facing tax hikes are solidly middle class ($40,000 to $75,000) or else in the “upper upper” middle class ($200,000 to $400,000), JCT found. A key savings for the middle class — the Family Flexibility Credit — goes away after 2022. The House bill also uses a low measure of inflation after 2022, meaning more and more people start to jump from the 12 percent tax bracket to the 25 percent bracket (which starts to kick in at $67,500 for heads of households). Higher income earners are impacted by the elimination of numerous itemized deductions (see more explanation on those below).

it just a game for the republicans being repeated again......huge tax cuts leads to not enough money coming into the federal government, creating more

debt....more debt is used as a weapon to then complain that there is to much government spending on social services...outrage over that, prompts cuts

to programs that actually help the poor and middle class, and enables the wealthy to own more assets and increase their own income.....wash, rinse,

and repeat.

IF they wanted to give ALL the middle and lower class a real legitimate tax cut they would have kept all the deductions along with the higher standard

deduction.

Of course, the reason why they didn’t do this is because they gave a literal windfall to the rich corporate class by reducing corporate taxes from 34 to 20, as well eliminating the inheritance taxes for the rich—PEOPLE LIKE TRUMP.

By giving the rich donor class these PERMANENT tax cuts, the taxes on the lower (ARE NOT PERMANENT) they avoid a super bulging of the debt, though this tax cut for the rich WILL STILL BY 1.7 TRILLION raise the deficit.

Of course, the reason why they didn’t do this is because they gave a literal windfall to the rich corporate class by reducing corporate taxes from 34 to 20, as well eliminating the inheritance taxes for the rich—PEOPLE LIKE TRUMP.

By giving the rich donor class these PERMANENT tax cuts, the taxes on the lower (ARE NOT PERMANENT) they avoid a super bulging of the debt, though this tax cut for the rich WILL STILL BY 1.7 TRILLION raise the deficit.

edit on 20-11-2017 by Willtell because: (no reason given)

originally posted by: Willtell

IF they wanted to give ALL the middle and lower class a real legitimate tax cut they would have kept all the deductions along with the higher standard deduction.

Of course, the reason why they didn’t do this is because they gave a literal windfall to the rich corporate class by reducing corporate taxes from 34 to 20, as well eliminating the inheritance taxes for the rich—PEOPLE LIKE TRUMP.

By giving the rich donor class these PERMANENT tax cuts, the taxes on the lower (ARE NOT PERMANENT) they avoid a super bulging of the debt, though this tax cut for the rich WILL STILL BY 1.7 TRILLION raise the deficit.

yup...I guess all the poor and middle class taxpayers on ATS don't give a s**t about anything except making the wealthy wealthier...why else would they vote to put the entire government under the control of republicans?......I guess you all want a plutocracy like other 3rd world governments.

originally posted by: jimmyx

originally posted by: Willtell

IF they wanted to give ALL the middle and lower class a real legitimate tax cut they would have kept all the deductions along with the higher standard deduction.

Of course, the reason why they didn’t do this is because they gave a literal windfall to the rich corporate class by reducing corporate taxes from 34 to 20, as well eliminating the inheritance taxes for the rich—PEOPLE LIKE TRUMP.

By giving the rich donor class these PERMANENT tax cuts, the taxes on the lower (ARE NOT PERMANENT) they avoid a super bulging of the debt, though this tax cut for the rich WILL STILL BY 1.7 TRILLION raise the deficit.

yup...I guess all the poor and middle class taxpayers on ATS don't give a s**t about anything except making the wealthy wealthier...why else would they vote to put the entire government under the control of republicans?......I guess you all want a plutocracy like other 3rd world governments.

Yeah, it seems like they are idolaters of the rich

One wonders why

I always wondered why conservatives feel so concerned about the taxes of the super rich

strange…

new topics

-

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 3 hours ago -

Bobiverse

Fantasy & Science Fiction: 6 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago -

Former Labour minister Frank Field dies aged 81

People: 8 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 14 hours ago, 17 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 6 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 10 hours ago, 6 flags -

Former Labour minister Frank Field dies aged 81

People: 8 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 15 hours ago, 3 flags -

This is our Story

General Entertainment: 12 hours ago, 3 flags -

Bobiverse

Fantasy & Science Fiction: 6 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 3 hours ago, 1 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 1 hours ago, 0 flags

active topics

-

LaBTop is back at last.

Introductions • 14 • : LaBTopOld -

Russia Ukraine Update Thread - part 3

World War Three • 5727 • : YourFaceAgain -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 259 • : SourGrapes -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 14 • : Freeborn -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 479 • : ArMaP -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics • 31 • : Thefineblackharm -

Tucker Carlson UFOs are piloted by spiritual entities with bases under the ocean and the ground

Aliens and UFOs • 45 • : gippo88 -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 71 • : DBCowboy -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 276 • : marg6043 -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News • 8 • : lilzazz