It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

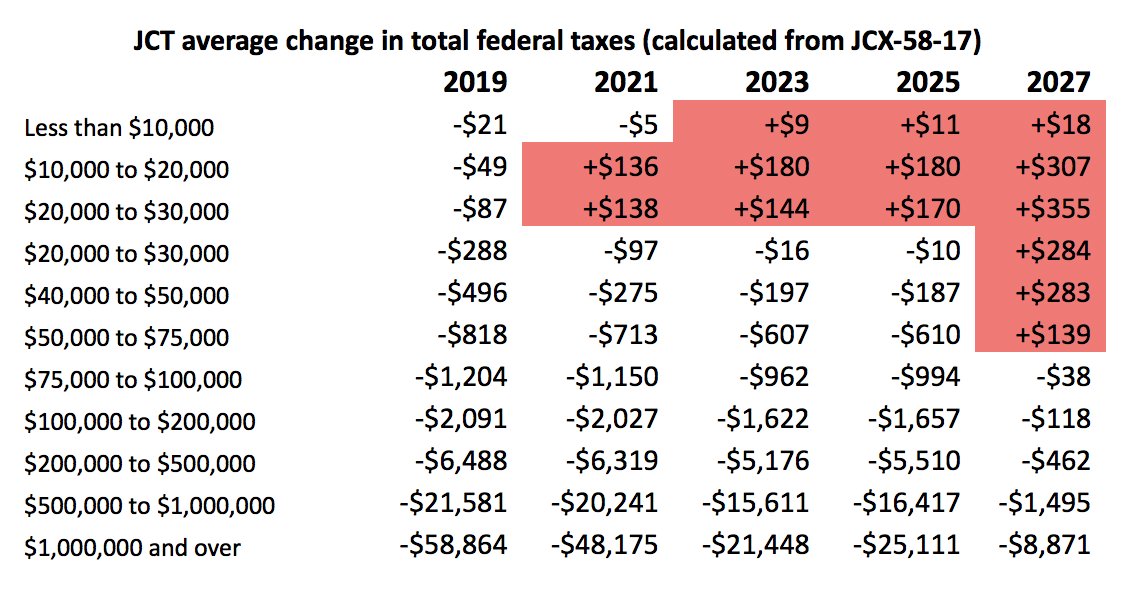

I thought that this simple table from the Joint Committee on Taxation

Text

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at 26 U.S.C. § 8001.

Wikipedia

www.jct.gov...

See how you will come out (on average) with the new tax plan:

Doesn't look to bad. I'd like to see the same type of chart by state.

Due to high medical costs i have deductions greater than the standard deduction. Running the numbers for myself i will pay about $4,000 more in taxes

if this plan goes through. If you look at the chart over the next 10 years taxes will increase for everyone earning under $75,000 and go down for

everyone earning over $75,000.

What was that you said again?

What was that you said again?

What is disingenuous about charts like these and people like the OP is that they assume people don't change income brackets. So just because you are

paying X this year, it doesn't mean you may not be in a lower or higher bracket in the future.

Sowell does a good job explaining it...

Sowell does a good job explaining it...

a reply to: sligtlyskeptical

It balances out the tax burden a bit.

What difference does it make to you what the government does with tax money if you aren't paying any to them?

I also have to wonder how many of the people who will have increases are currently not paying anything in taxes but still receiving a "tax return" (Earned Income Credit)? So this will likely just mean that will be less.

It balances out the tax burden a bit.

What difference does it make to you what the government does with tax money if you aren't paying any to them?

I also have to wonder how many of the people who will have increases are currently not paying anything in taxes but still receiving a "tax return" (Earned Income Credit)? So this will likely just mean that will be less.

edit on 17-11-2017 by ketsuko because: (no reason given)

a reply to: FyreByrd

Need to get rid of welfare. Stop the corrupt government spending. Do away with any program that benefits anyone who is not handicapped and won't work. Do away with letting corporate America rob everyone with slave wages and everything would be fine

Need to get rid of welfare. Stop the corrupt government spending. Do away with any program that benefits anyone who is not handicapped and won't work. Do away with letting corporate America rob everyone with slave wages and everything would be fine

You would have to take the higher exemption into consideration wouldn't you? I do not know if that is included in this chart.

a reply to: ketsuko

You should look at it as a rate rather than the pure number, $100 to someone who makes $10,000/year isn't the same as $100 to someone who makes $100,000/year. Over and over we see that when you make poor people pay more money in taxes the economy slows because they have less to spend on goods and services. When you make rich people pay less we see the economy slow because they don't spend more on goods and services, they reinvest it in themselves (more in savings/investments). When the economy slows people lose jobs, when people lose jobs the economy slows more.

It's like this dumb argument that rich people already pay more in taxes than everyone else...well...duh, they make all the money. You can slash their tax rate in half and they'll still pay a higher dollar amount then everyone else because they make so...much...more money.

Eight people own more wealth than 50% of the entire world right now. America hasn't seen wealth disparity this sharp since before the Great Depression. So yeah....support the tax bill now but try not to jump off a building in the next decade.

You should look at it as a rate rather than the pure number, $100 to someone who makes $10,000/year isn't the same as $100 to someone who makes $100,000/year. Over and over we see that when you make poor people pay more money in taxes the economy slows because they have less to spend on goods and services. When you make rich people pay less we see the economy slow because they don't spend more on goods and services, they reinvest it in themselves (more in savings/investments). When the economy slows people lose jobs, when people lose jobs the economy slows more.

It's like this dumb argument that rich people already pay more in taxes than everyone else...well...duh, they make all the money. You can slash their tax rate in half and they'll still pay a higher dollar amount then everyone else because they make so...much...more money.

Eight people own more wealth than 50% of the entire world right now. America hasn't seen wealth disparity this sharp since before the Great Depression. So yeah....support the tax bill now but try not to jump off a building in the next decade.

a reply to: ketsuko

Non-citizens received more than $30 Billion in refunds using the EIC in 2014.

Straight up $3,000 for every dependent you claim and there's no verification of whether these dependents even live at the same address! Many don't, they live in Central America others still don't even exist.

That HAS to stop.

Illegal immigration is bleeding this country dry.

Non-citizens received more than $30 Billion in refunds using the EIC in 2014.

Straight up $3,000 for every dependent you claim and there's no verification of whether these dependents even live at the same address! Many don't, they live in Central America others still don't even exist.

That HAS to stop.

Illegal immigration is bleeding this country dry.

edit on 17-11-2017 by Asktheanimals because: (no reason given)

Double post

edit on 17-11-2017 by Asktheanimals because: (no reason given)

a reply to: sligtlyskeptical

This is an average number - as stated.

But it is still unclear how the 'medical deduction' issue will pan out:

www.washingtonpost.com...

Let us hope you are right.

This is an average number - as stated.

But it is still unclear how the 'medical deduction' issue will pan out:

“We are pleased that the Senate tax proposal includes some important improvements over the House bill voted out of the Ways and Means Committee,” AARP executive vice president Nancy LeaMond said in a statement.

“The Senate proposal would keep the medical expense deduction for millions of Americans with high medical costs — something that is especially important for middle income seniors. The House tax bill repeals the medical expense deduction, resulting in a health tax for taxpayers who get sick or have chronic conditions.”

But the elimination of the medical deduction could still happen.

“If the full House and Senate approve different proposals, negotiators from the two bodies will hammer out a compromise version that both would have to approve before it can become law,” wrote Sabrina Eaton at cleveland.com.

www.washingtonpost.com...

Let us hope you are right.

originally posted by: sligtlyskeptical

a reply to: ketsuko

Because it is better for everyone involved if they spend the money on goods rather than submitting it to the government. For those who earn much more than they spend it is better that much of the excess is submitted to the government.

The high income persons don't ever spend 'all their income' on goods (or services) - lower income people tend to spend their income at a much higher rate thereby stimulating the local economies.

Your logic is flawed.

a reply to: Edumakated

Whatever.....

This is magical thinking.

Of course - people move between brackets. And you can dream all you want about being rich - but the odds of it happening are infinitesimal.

It fact economic mobility in the US is on the decline:

www.theatlantic.com...

or the conservative take from across the pond:

www.economist.com...

writting about a Harvard study.

Dream all you want, it's the stuff of progress - but keep your feet on the real ground.

Whatever.....

This is magical thinking.

Of course - people move between brackets. And you can dream all you want about being rich - but the odds of it happening are infinitesimal.

It fact economic mobility in the US is on the decline:

It’s not an exaggeration: It really is getting harder to move up in America. Those who make very little money in their first jobs will probably still be making very little decades later, and those who start off making middle-class wages have similarly limited paths. Only those who start out at the top are likely to continue making good money throughout their working lives.

That’s the conclusion of a new paper by Michael D. Carr and Emily E. Wiemers, two economists at the University of Massachusetts in Boston. In the paper, Carr and Wiemers used earnings data to measure how fluidly people move up and down the income ladder over the course of their careers.

“It is increasingly the case that no matter what your educational background is, where you start has become increasingly important for where you end,” Carr told me. “The general amount of movement around the distribution has decreased by a statistically significant amount.”

www.theatlantic.com...

or the conservative take from across the pond:

They find that none of these measures has changed much (see chart).

In 1971 a child from the poorest fifth had an 8.4% chance of making it to the top quintile.

For a child born in 1986 the odds were 9%.

The study confirms previous findings that America’s social mobility is low compared with many European countries. (In Denmark, a poor child has twice as much chance of making it to the top quintile as in America.) But it challenges several smaller recent studies that concluded that America had become less socially mobile.

www.economist.com...

writting about a Harvard study.

Dream all you want, it's the stuff of progress - but keep your feet on the real ground.

originally posted by: rickymouse

You would have to take the higher exemption into consideration wouldn't you? I do not know if that is included in this chart.

Perhaps a republican lead joint committee is stupid enough not to factor in the higher personal deduction (I recall something about another error earlier in the year of an accounting error amounting to Billions) but one would hope it was.

You can see more at the direct link I posted in the OP for more information on methodology.

The conveniently left out 30k to 40k, which would be a huge chunk of citizens.

This bill is garbage, corporate America is drowning in money, they don't need any more and starving the government is going to destroy poor and a lot of middle class Americans too.

This bill is garbage, corporate America is drowning in money, they don't need any more and starving the government is going to destroy poor and a lot of middle class Americans too.

new topics

-

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 5 seconds ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 8 minutes ago -

I hate dreaming

Rant: 49 minutes ago -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 2 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 2 hours ago -

Biden says little kids flip him the bird all the time.

2024 Elections: 2 hours ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 3 hours ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 3 hours ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 5 hours ago -

MH370 Again....

Disaster Conspiracies: 5 hours ago

top topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 5 hours ago, 14 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 3 hours ago, 10 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 16 hours ago, 8 flags -

A man of the people

Medical Issues & Conspiracies: 10 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 2 hours ago, 7 flags -

Biden says little kids flip him the bird all the time.

2024 Elections: 2 hours ago, 6 flags -

4 plans of US elites to defeat Russia

New World Order: 12 hours ago, 4 flags -

Is the origin for the Eye of Horus the pineal gland?

Philosophy and Metaphysics: 2 hours ago, 4 flags -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 3 hours ago, 3 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 8 hours ago, 3 flags

active topics

-

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs • 0 • : Ophiuchus1 -

12 jurors selected in Trump criminal trial

US Political Madness • 100 • : ImagoDei -

I hate dreaming

Rant • 3 • : theatreboy -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 31 • : YourFaceAgain -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 542 • : cherokeetroy -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 28 • : ImagoDei -

Biden says little kids flip him the bird all the time.

2024 Elections • 13 • : DumbNut -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 73 • : Consvoli -

Boston Dynamics say Farewell to Atlas

Science & Technology • 0 • : gortex -

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7127 • : underpass61