It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

e U.S. Department of Commerce has clobbered aerospace giant Bombardier with a hefty 220 per cent countervailing duty on the sale of its CS100 commercial jets to a U.S. airline following a trade complaint from an American rival.

Boeing has filed the papers resulting in the unprecedented and arguably punitive duty. They contend that Bombardier is selling Delta 125 CS100 airliners at below market price. Boeing is ignoring the fact that such deals are common between aircraft builders and "roll-out" customers, which is a term used when an airline signs up to be the first to use a new aircraft. Boeing also ignored the fact that no American manufacturer builds a competing aircraft in the 100-110 seat class. Boeing quit building its "babyjet" 717 10 years ago.

The Trump administration Department of Commerce is in violation of a 1980 trade agreement (1980 WTO Agreement on Trade in Civil Aircraft). The DoC action may turn out to be extremely shortsighted since aircraft are the number 3 US export, with $135 Billion in exports last year. Other countries can be expected to retaliate with new tariff impositions on US aircraft. And if the airlines' capital costs increase, who do you think ends up footing that bill? Passenger and freight ticket costs will rise. And since these short-haul narrowbody jets are used on routes serving smaller markets, these tickets are already high, particularly since the end of the Essential Air Service Subsidy Program.

Source: www.cbc.ca...

a reply to: Silentvulcan

Canada was supposed to buy eighteen "stopgap" super-hornets from Boeing to bolster our fleet of legacy hornets until a new fighter could be selected. That deal is now likely off the table, and our air-force will suffer from it.

I believe this is all the result of our Federal government's "policy". As an election promise, the Trudeau led Liberals stated they would back out of the F-35 program. Once elected, they essentially did so, but then deferred on selecting a new fighter for another five years, pending a new competition, which puts that decision until well after the next election; hence the "stopgap" Super-Hornets. Interestingly, they also said the F-35 would be considered in any new competition. Clowns.

Further, the current NAFTA re-negotiations are not helping. Somebody neglected to inform the Trudeau government that the deal was to be about trade and jobs, and we're approaching a protectionist, right-wing Trump administration with demands that gender and aboriginal rights protections be included in a trade agreement. Is it any surprise that this is one of the outcomes.

The "bright side" of this, we are being told here in the Great White North, is that the government expects to close a deal for many Bombardier CS300's with a few Chinese airlines. Hurray. Maybe Bombardier's government "bailout" won't be for nothing, but I'm not going to hold my breath.

Canada was supposed to buy eighteen "stopgap" super-hornets from Boeing to bolster our fleet of legacy hornets until a new fighter could be selected. That deal is now likely off the table, and our air-force will suffer from it.

I believe this is all the result of our Federal government's "policy". As an election promise, the Trudeau led Liberals stated they would back out of the F-35 program. Once elected, they essentially did so, but then deferred on selecting a new fighter for another five years, pending a new competition, which puts that decision until well after the next election; hence the "stopgap" Super-Hornets. Interestingly, they also said the F-35 would be considered in any new competition. Clowns.

Further, the current NAFTA re-negotiations are not helping. Somebody neglected to inform the Trudeau government that the deal was to be about trade and jobs, and we're approaching a protectionist, right-wing Trump administration with demands that gender and aboriginal rights protections be included in a trade agreement. Is it any surprise that this is one of the outcomes.

The "bright side" of this, we are being told here in the Great White North, is that the government expects to close a deal for many Bombardier CS300's with a few Chinese airlines. Hurray. Maybe Bombardier's government "bailout" won't be for nothing, but I'm not going to hold my breath.

edit

on 27-9-2017 by Orwells Ghost because: (no reason given)

It is stupid, and probably a Trumpism this time round. In any case Boeing gets tax breaks, exports and use of government funded research in NASA or

defence contracts.

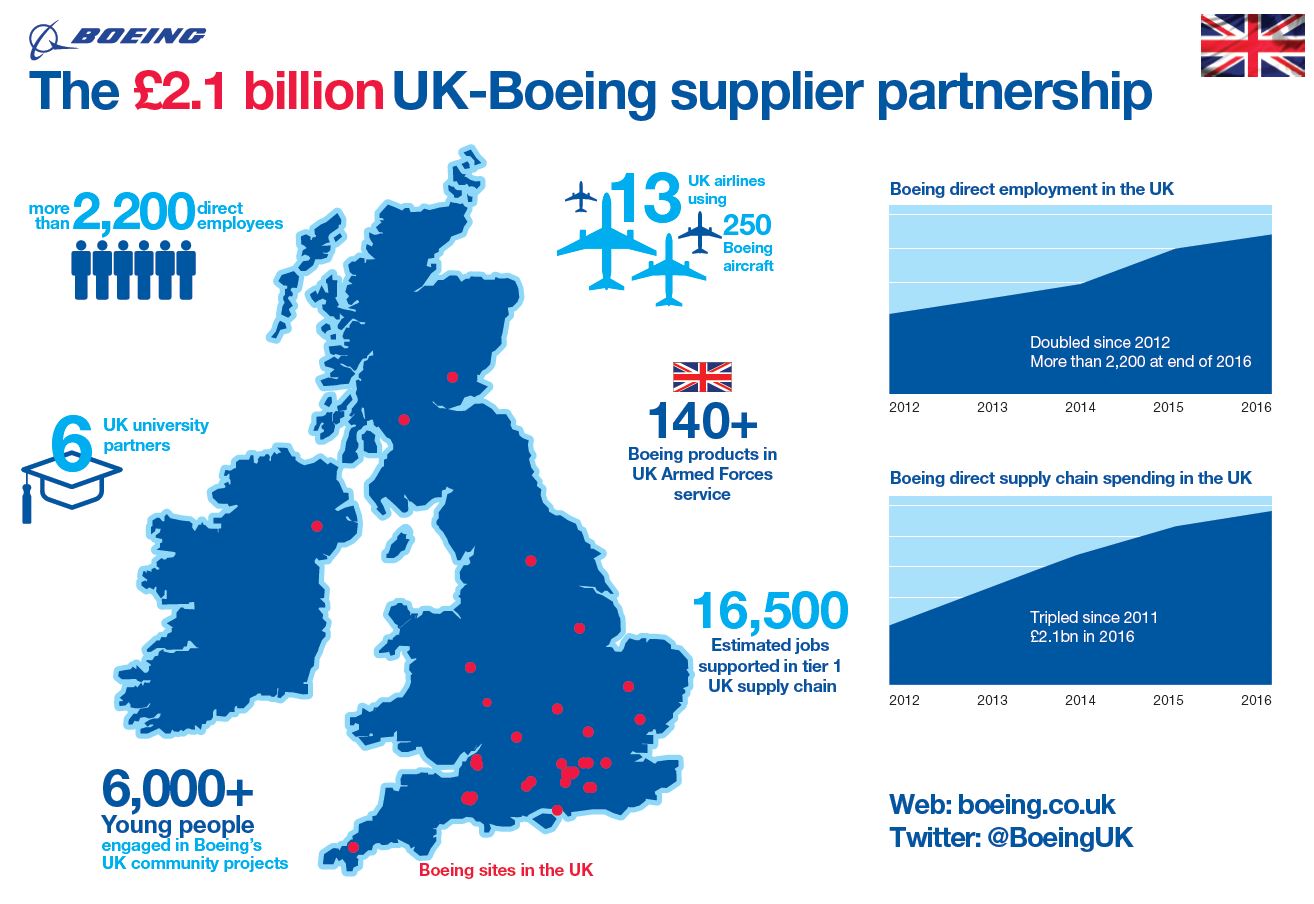

Boeing just doesn't like the 50/50 exchange between them and Airbus, and that row has been going on for years, with nobody none the wiser..other than what is published. It doesn't look good for a UK/US trade deal either if all that happens is that the feud goes on, while Boeing does have companies in the UK for bye. It's probably debateable that Bombardier is gaining over Boeing with their aircraft at the end of the day anyway.

Boeing just doesn't like the 50/50 exchange between them and Airbus, and that row has been going on for years, with nobody none the wiser..other than what is published. It doesn't look good for a UK/US trade deal either if all that happens is that the feud goes on, while Boeing does have companies in the UK for bye. It's probably debateable that Bombardier is gaining over Boeing with their aircraft at the end of the day anyway.

www.reuters.com...

Looks like this has implications beyond North-America. The British PM is none to pleased with Boeing's behavior as it seems that Bombardier employs several thousand folks in Northern Ireland, a place where PM May derives a good deal of her remaining support following her waning fortunes in the last British election.

Looks like this has implications beyond North-America. The British PM is none to pleased with Boeing's behavior as it seems that Bombardier employs several thousand folks in Northern Ireland, a place where PM May derives a good deal of her remaining support following her waning fortunes in the last British election.

edit on 28-9-2017 by Orwells Ghost because: (no reason given)

originally posted by: smurfy

It is stupid, and probably a Trumpism this time round. In any case Boeing gets tax breaks, exports and use of government funded research in NASA or defence contracts.

Boeing just doesn't like the 50/50 exchange between them and Airbus, and that row has been going on for years, with nobody none the wiser..other than what is published. It doesn't look good for a UK/US trade deal either if all that happens is that the feud goes on, while Boeing does have companies in the UK for bye. It's probably debateable that Bombardier is gaining over Boeing with their aircraft at the end of the day anyway.

You are quite right about Boeing v. Bombardier. Boeing stopped making the type of aircraft that Bombardier specializes in. Boeing dropped the 717 10 years ago. Actually, the 717 wasn't really a Boeing product. It was a McDonnell-Douglas design that Boeing inherited in the merger. There are still about 150 of them flying. Bombardier has found a niche in the short-haul airliner arena with over 1900 of their CRJ series in the air in 90 countries. They make a good airplane. I've flown their Learjet models, the Challenger, and the CRJ. Boeing makes great airplanes, my favorite being the 747. It's a beast, but a fast beast with a .85-.86 Mach. If you don't mind using all the fuel at your departure point. We figure about 5 gallons/mile, or a gallon every second (3600 gallons/hour.) I'm really glad I don't have to pay for the fuel. A fill up can cost $200,000 in the US. Don't ask about Europe.

I doubt the UK will do much - given the investment we have in projects like the C-17, Rivet Joint etc.

Good article today about this :

The Register

Good article today about this :

The UK isn't ditching Boeing defence kit any time soon

The British government is publicly threatening to stop giving defence contracts to American aerospace firm Boeing – even though this is laughably unrealistic.

The Register

edit on 28-9-2017 by Silk because: Fixed

URL

originally posted by: Woody510

Isn't a 747 actually quite economical when you take into account the weight it can transport?

The maintenance costs are what is ending its run in passenger service. With ETOPS and the extended range of the 777/787/350 you no longer need 4 engine aircraft. United is retiring their last 747 in Nov and replacing them all with 773s.

originally posted by: Woody510

a reply to: F4guy

Isn't a 747 actually quite economical when you take into account the weight it can transport?

Not when you consider that the Airbus A-350 can carry about the same number of passengers (in the typical 3 class layout) with half the number of engines. The 747 is more economical in one way - they are cheap. You can pick up a decent 747 for 10 million and up while a 350 is going to be $311 million plus options. You can buy a lot of jet fuel for 300 million dollars. But if, like Delta, you put 800-1000 hours/year each on your long-haul fleet, the fuel adds up. That explains why Delta is ditching (or deserting, as in Mohave desert, its 747s) and going with the A350 for its high density long haul routes. Fuel economy is one reason why A380 sales are tanking, with production now knocked down to one per month, and Singapore Airlines dumping 5 A380s on the market this year. There is a reason why the biggest users of the 380 are the oil producing countries that own Qatar and Emirates Airlines. My company considered picking up a 380 and converting it to a freighter, but it's cheaper to buy 2 747-400s than to convert one 380. The 380 is doomed, except as an ostentatious headliner for some nationalized airlines. Airbus has delivered 215 of them and they claim to have another 140 backlogged orders. However of that number 20 are from Amedeo, an aircraft lessor, who now can't find a home for any of them, Virgin Atlantic is trying to back out of accepting their 6, and Emirates has delayed delivery on all aircraft until 2021. Airbus cancelled the 380 freighter program. All in all, it looks like the day of the 4 engine widebody is over. Airbus has already killed the A340 program.

originally posted by: F4guyIt's a beast, but a fast beast with a .85-.86 Mach. If you don't mind using all the fuel at your departure point. We figure about 5 gallons/mile, or a gallon every second (3600 gallons/hour.) I'm really glad I don't have to pay for the fuel. A fill up can cost $200,000 in the US. Don't ask about Europe.

And here I was fretting about the prospect of paying for 20 gph consumption when I build multi-engine hours .

Doesn't the 380 have an even faster cruise speed than the 747, though? I can only imagine what the fuel capacity/burn numbers are for those monsters. Here's to hoping that the slow deflation of futures prices continues and the 380's last as long in service as the 747-400's did.

On a more selfish note, I hope BBD settles this and the CSeries enters the US market after all. They seem to make a really solid aircraft otherwise, and the "baby 787" CSeries might just be able to eclipse the 737 (or the MD-80s, depending on who you ask) as the most exciting narrowbody in US service. The industry seems to be in the most exciting place that it's been since the 1965-1985 period, at least in terms of diverse new metal (or plastic) that has either entered service or will in the next few years.

edit on 28-9-2017 by Barnalby because: (no reason given)

originally posted by: F4guy

e U.S. Department of Commerce has clobbered aerospace giant Bombardier with a hefty 220 per cent countervailing duty on the sale of its CS100 commercial jets to a U.S. airline following a trade complaint from an American rival.

Boeing has filed the papers resulting in the unprecedented and arguably punitive duty. They contend that Bombardier is selling Delta 125 CS100 airliners at below market price. Boeing is ignoring the fact that such deals are common between aircraft builders and "roll-out" customers, which is a term used when an airline signs up to be the first to use a new aircraft. Boeing also ignored the fact that no American manufacturer builds a competing aircraft in the 100-110 seat class. Boeing quit building its "babyjet" 717 10 years ago.

The Trump administration Department of Commerce is in violation of a 1980 trade agreement (1980 WTO Agreement on Trade in Civil Aircraft). The DoC action may turn out to be extremely shortsighted since aircraft are the number 3 US export, with $135 Billion in exports last year. Other countries can be expected to retaliate with new tariff impositions on US aircraft. And if the airlines' capital costs increase, who do you think ends up footing that bill? Passenger and freight ticket costs will rise. And since these short-haul narrowbody jets are used on routes serving smaller markets, these tickets are already high, particularly since the end of the Essential Air Service Subsidy Program.

Source: www.cbc.ca...

You and the Canadian article claim the deal is "below market value," but the complaint is:

Boeing has filed a complaint with the International Trade Commission charging Canada’s Bombardier with “dumping” its C Series narrowbody airliner at below cost into the U.S. The charges stem from the 2016 sale of 75 CS100s to Delta Air Lines. In its complaint, the U.S. company claims Bombardier sold the airplanes for $19.6 million each, or some $13.8 million less than they cost to manufacture.

“Bombardier has embarked on an aggressive campaign to sell C Series aircraft into the U.S. market at absurdly low prices—less than $20 million for airplanes that cost $33 million to produce, based on publicly available information,” said Boeing in a statement. “Notably, it is selling the aircraft into the United States at prices that are millions lower than those charged in Canada—the very definition of dumping.”

The Canadian article is altering the complaint to seem like Bombardier is just selling things on sale, not taking a massive loss on each plane.

There is a significant difference between the two. How do you suppose a company might continue to operate like that?

Boeing had offered Delta the 737 Max 7, a re-engined derivate of the 737-700 that competes directly with the C Series. The U.S. company estimates that the C Series has received government support totaling more than $3 billion.

Delta’s order came six months after the province of Quebec agreed to infuse $1 billion in the financially strapped C Series program, giving it a 49.5-percent stake in a limited partnership with Bombardier. Less than a year later the Canadian federal government agreed to grant Bombardier C$372.5 million in interest-free loans for both the C Series and the Global 7000 business jet.

Note here that they went to the International Trade Commission. The duty in question applies if the ITC finds Bombardier in violation.

From that Fortune article, you see the market price for the jet:

The CSeries starts at $79.5 million, according to list prices, but carriers usually receive discounts of about 50%.

As 50% of $79.5 million is almost $40 million, but they were sold half of that: $19.6 million. A 75% markup over cost in the highly competitive aviation world seems unlikely, don't you think?

edit on 8Fri, 29 Sep 2017 08:28:39 -0500America/ChicagovAmerica/Chicago9 by Greven because: (no

reason given)

a reply to: Greven

Cost depends on the accounting. The first a

ircraft off the line to be sold are always going to be sold below cost. It cost Boeing $7 billion to get the first 777 out the door in 1995. The first 777 was sold for $258 million to United Airlines. That first aircraft was sold at a six and three quarter billion dollar loss, using Bombardier's method of accounting.

A much better accounting method computes the marginal unit cost. Although it cost 7 billion to get the first one to a customer, the second one doesn't cost another 7 billion. It costs whatever the cost is for the materials used and the labor to build it. Everything over that can go to pay back the development costs and for profit. United bought 128 777s for 22 billion, which means that the computedmarginal unit cost would be in the neighborhood of $118 million, or less than 50% of the price to United. So they could sell for half of normal market price and still be selling for more than unit cost to manufacture. I think Boeing is making a big mistake. And the stock market seems to agree. Its stock has steadily declined since its action. And it probably will lose a $5 billion sale of F18s to Canada.

Cost depends on the accounting. The first a

ircraft off the line to be sold are always going to be sold below cost. It cost Boeing $7 billion to get the first 777 out the door in 1995. The first 777 was sold for $258 million to United Airlines. That first aircraft was sold at a six and three quarter billion dollar loss, using Bombardier's method of accounting.

A much better accounting method computes the marginal unit cost. Although it cost 7 billion to get the first one to a customer, the second one doesn't cost another 7 billion. It costs whatever the cost is for the materials used and the labor to build it. Everything over that can go to pay back the development costs and for profit. United bought 128 777s for 22 billion, which means that the computedmarginal unit cost would be in the neighborhood of $118 million, or less than 50% of the price to United. So they could sell for half of normal market price and still be selling for more than unit cost to manufacture. I think Boeing is making a big mistake. And the stock market seems to agree. Its stock has steadily declined since its action. And it probably will lose a $5 billion sale of F18s to Canada.

originally posted by: F4guy

a reply to: Greven

Cost depends on the accounting. The first a

ircraft off the line to be sold are always going to be sold below cost. It cost Boeing $7 billion to get the first 777 out the door in 1995. The first 777 was sold for $258 million to United Airlines. That first aircraft was sold at a six and three quarter billion dollar loss, using Bombardier's method of accounting.

A much better accounting method computes the marginal unit cost. Although it cost 7 billion to get the first one to a customer, the second one doesn't cost another 7 billion. It costs whatever the cost is for the materials used and the labor to build it. Everything over that can go to pay back the development costs and for profit. United bought 128 777s for 22 billion, which means that the computedmarginal unit cost would be in the neighborhood of $118 million, or less than 50% of the price to United. So they could sell for half of normal market price and still be selling for more than unit cost to manufacture. I think Boeing is making a big mistake. And the stock market seems to agree. Its stock has steadily declined since its action. And it probably will lose a $5 billion sale of F18s to Canada.

Ya they just found an old Avro-Arrow in lake ontario

maybe should start building them again LOL

Avro-Arrows

edit on

30-9-2017 by Trillium because: (no reason given)

originally posted by: F4guy

a reply to: Greven

Cost depends on the accounting. The first a

ircraft off the line to be sold are always going to be sold below cost. It cost Boeing $7 billion to get the first 777 out the door in 1995. The first 777 was sold for $258 million to United Airlines. That first aircraft was sold at a six and three quarter billion dollar loss, using Bombardier's method of accounting.

A much better accounting method computes the marginal unit cost. Although it cost 7 billion to get the first one to a customer, the second one doesn't cost another 7 billion. It costs whatever the cost is for the materials used and the labor to build it. Everything over that can go to pay back the development costs and for profit. United bought 128 777s for 22 billion, which means that the computedmarginal unit cost would be in the neighborhood of $118 million, or less than 50% of the price to United. So they could sell for half of normal market price and still be selling for more than unit cost to manufacture. I think Boeing is making a big mistake. And the stock market seems to agree. Its stock has steadily declined since its action. And it probably will lose a $5 billion sale of F18s to Canada.

This post makes literally no sense.

R&D is a different animal than material costs and labor. The complaint against Bombardier seems to be about selling planes to Delta below material costs. R&D has nothing to do with it. Bombardier sold the planes for less than 25% of the list price.

Additionally, your claim about the stock is highly wrong. The complaint to the ITC was in April, and the stock is up 40% since then. The stock has almost doubled since this time last year.

edit on 8Sun, 01 Oct 2017 08:56:15 -0500America/ChicagovAmerica/Chicago10 by Greven because: (no

reason given)

I saw yesterday that an

add

itional tariff on dumping has been imposed by the U.S. Department of Commerce. Like the previous tariff, it is an initial ruling only and may

change.

This brings the total initial tariffs to about 300%.

This brings the total initial tariffs to about 300%.

A US Trade Representative claims the real target is technology transfers to China.

aviationweek.com...

aviationweek.com...

new topics

-

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago -

Hurt my hip; should I go see a Doctor

General Chit Chat: 2 hours ago -

Israel attacking Iran again.

Middle East Issues: 3 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 4 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 5 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago -

I hate dreaming

Rant: 7 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 9 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 11 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 17 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 9 hours ago, 9 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 8 hours ago, 8 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 3 hours ago, 6 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 6 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 3 hours ago, 5 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 6 hours ago, 4 flags -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 1 hours ago, 4 flags

active topics

-

Man sets himself on fire outside Donald Trump trial

Mainstream News • 39 • : TheMisguidedAngel -

When an Angel gets his or her wings

Religion, Faith, And Theology • 5 • : randomuser2034 -

Anyone one else having Youtube problems

Computer Help • 11 • : charlyv -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 68 • : Mahogani -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 404 • : Zanti Misfit -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 10 • : Degradation33 -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 100 • : WeMustCare -

Israel attacking Iran again.

Middle East Issues • 23 • : KrustyKrab -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 37 • : charlyv -

Hurt my hip; should I go see a Doctor

General Chit Chat • 11 • : TheLieWeLive