It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

In 1989 I lived in a small apartment. Dead of winter near Chicago. Almost flat broke. I had $1. I bought myself a can of tuna and my cat a can of

cat food. And that was it til more money came in. Times were pretty bleak.

2014 I was making good money and no longer living paycheck to paycheck. Then my job was sent to Mexico. Early 2017, I was pretty much flat broke again. Just now starting to crawl out of my financial hole. Child support ending and making my final truck payment, which I bought 6 months prior to the closure announcement, helps.

Point is, this stuff has always happened and it will always happen no matter what people go thru. Best thing people can do is cut debt and save some money for when things get bad. Because things will get bad for a lot people at some point or another in life. You never know what is coming. A person just needs to be prepared as much as possible which can be easier said than done, I know.

2014 I was making good money and no longer living paycheck to paycheck. Then my job was sent to Mexico. Early 2017, I was pretty much flat broke again. Just now starting to crawl out of my financial hole. Child support ending and making my final truck payment, which I bought 6 months prior to the closure announcement, helps.

Point is, this stuff has always happened and it will always happen no matter what people go thru. Best thing people can do is cut debt and save some money for when things get bad. Because things will get bad for a lot people at some point or another in life. You never know what is coming. A person just needs to be prepared as much as possible which can be easier said than done, I know.

edit on 8/26/2017 by Blueracer because: (no

reason given)

edit on 8/26/2017 by Blueracer because: (no reason given)

a reply to: face23785

Bull#. We spend $600+ BILLION annually on nothing but financing the military, that's WITHOUT adding the actual military action costs. Military spending is over 50% of our annual "discretionary" spending.This country only has a $4 trillion annual GDP.

Bull#. We spend $600+ BILLION annually on nothing but financing the military, that's WITHOUT adding the actual military action costs. Military spending is over 50% of our annual "discretionary" spending.This country only has a $4 trillion annual GDP.

edit on 26-8-2017 by SpeakerofTruth

because: (no reason given)

a reply to: SpeakerofTruth

Some think Social Security is welfare-guess the 13% work/employer pay in is just for fun...

Oh don't forget about medicare tax. If you use it you too can be a welfare recipient.

The media has done an excellent job convincing the masses 401K's are awesome, pensions are bad, unions cause job losses and the system you pay into for retirement is welfare.

6 Corps controlling almost all we see, hear and read is a huge mistake.

Some think Social Security is welfare-guess the 13% work/employer pay in is just for fun...

Oh don't forget about medicare tax. If you use it you too can be a welfare recipient.

The media has done an excellent job convincing the masses 401K's are awesome, pensions are bad, unions cause job losses and the system you pay into for retirement is welfare.

6 Corps controlling almost all we see, hear and read is a huge mistake.

originally posted by: SpeakerofTruth

a reply to: face23785

Bull#. We spend $600+ BILLION annually on nothing but financing the military, that's WITHOUT adding the actual military action costs. Military spending is over 50% of our annual "discretionary" spending.This country only has a $4 trillion annual GDP.

Not just military, but frivolous healthcare monopolies need to end now. I forget the percentage, but in Canada, Finland, France, and most our countries that have basic healthcare for all, spend less than what are government does currently on a pay into system, so something stinks.

Yes we allow our government to spend like idiots without curbs in, especially not allowing for a reasonable healthcare system for everyone. Medicare for all is most likely the best system to shore up, because it's already in place, and with a bit of tweaking will regulate these insurance A-holes from screwing us, and the people running the country.

Bernie Sanders: Why Medicare-for-All Is Good for Business

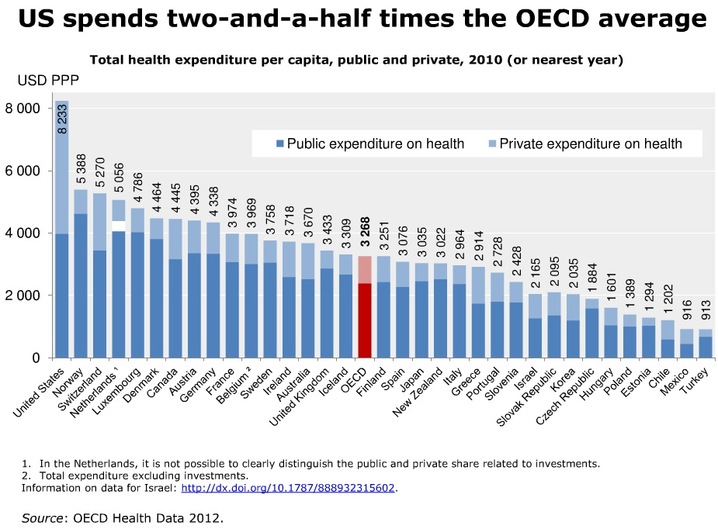

We spend almost $10,000 per capita each year on health care, while the Canadians spend $4,644, the Germans $5,551, the French $4,600, and the British $4,192. Meanwhile, our life expectancy is lower than most other industrialized countries and our infant mortality rates are much higher.

Further, as of September 2016, 28 million Americans were uninsured and millions more underinsured with premiums, deductibles, and copayments that are too high. We also pay, by far, the highest prices in the world for prescription drugs.

originally posted by: toysforadults

Ok enough with the fricken protest already.

Here is a real issue we could be talking about that actually effects everyone's lives.

Stressed couple reviewing documents Why a six-figure income is not enough for many in the U.S.

11:45 AM ET Tue, 18 July 2017 | 01:18

No matter how much you earn, getting by is still a struggle for most people these days.

Seventy-eight percent of full-time workers said they live paycheck to paycheck, up from 75 percent last year, according to a recent report from CareerBuilder.

Overall, 71 percent of all U.S. workers said they're now in debt, up from 68 percent a year ago, CareerBuilder said.

While 46 percent said their debt is manageable, 56 percent said they were in over their heads. About 56 percent also save $100 or less each month, according to CareerBuilder. The job-hunting site polled over 2,000 hiring and human resource managers and more than 3,000 full-time employees between May and June.

Well, the numbers are in, people are having a hard time saving money. This should come as no surprise to any of you because although the numbers look good on CNN, the economy in fact hasn't been doing so well for the average American. People are not buying houses cars or any of the fancy things of the past 2 generations (which isn't that big of a deal really more of a call back to reality) due to one thing in particular, rising cost of living. One of our biggest problems in this nation is the fact that cost of living has more than doubled in most cases and the wages haven't only not gone up but have actually gone done, way down.

Anyway, since this isn't about the main popular topic here I'm sure this will be glossed over.

What's the source? Maybe this one?

Study Highlights:

- 78 percent of U.S. workers live paycheck to paycheck to make ends meet

- Nearly one in 10 workers making $100,000+ live paycheck to paycheck

- More than 1 in 4 workers do not set aside any savings each month

- Nearly 3 in 4 workers say they are in debt today - more than half think they will always be

- More than half of minimum wage workers say they have to work more than one job to make ends meet

CHICAGO and ATLANTA, Aug. 24, 2017 /PRNewswire/ -- Do you countdown to payday? You're not alone. More than three-quarters of workers (78 percent) are living paycheck-to-paycheck to make ends meet — up from 75 percent last year and a trait more common in women than men — 81 vs. 75 percent, according to new CareerBuilder research. Thirty-eight percent of employees said they sometimes live paycheck-to-paycheck, 17 percent said they usually do and 23 percent said they always do.

The national survey, which was conducted online by Harris Poll on behalf of CareerBuilder from May 24 to June 16, 2017, included representative samples of 2,369 full-time employers and 3,462 full-time U.S. workers across industries and company sizes in the private sector.

Living Paycheck to Paycheck is a Way of Life for Majority of U.S. Workers, According to New CareerBuilder Survey

originally posted by: toysforadults

Ok enough with the fricken protest already.

Here is a real issue we could be talking about that actually effects everyone's lives.

Stressed couple reviewing documents Why a six-figure income is not enough for many in the U.S.

11:45 AM ET Tue, 18 July 2017 | 01:18

No matter how much you earn, getting by is still a struggle for most people these days.

Seventy-eight percent of full-time workers said they live paycheck to paycheck, up from 75 percent last year, according to a recent report from CareerBuilder.

Overall, 71 percent of all U.S. workers said they're now in debt, up from 68 percent a year ago, CareerBuilder said.

While 46 percent said their debt is manageable, 56 percent said they were in over their heads. About 56 percent also save $100 or less each month, according to CareerBuilder. The job-hunting site polled over 2,000 hiring and human resource managers and more than 3,000 full-time employees between May and June.

Well, the numbers are in, people are having a hard time saving money. This should come as no surprise to any of you because although the numbers look good on CNN, the economy in fact hasn't been doing so well for the average American. People are not buying houses cars or any of the fancy things of the past 2 generations (which isn't that big of a deal really more of a call back to reality) due to one thing in particular, rising cost of living. One of our biggest problems in this nation is the fact that cost of living has more than doubled in most cases and the wages haven't only not gone up but have actually gone done, way down.

Anyway, since this isn't about the main popular topic here I'm sure this will be glossed over.

You're a total moron if you can't live on six figures...I feel absolutely no sympathy for these fools.

originally posted by: testingtesting

I do a good moral job one that most can not or will not do and I made 17k last year (UK) and I live paychec

k to paycheck .

I have found when I was on 37k a year running pubs I still lived paycheck to paychecdk but that was in London.

100k a year and struggling? I think it depends on how many kids and the area you live in.

He3y but lets face it we in the USA and UK are a lot better off then most.

How does this work? I'm on disability and get live on 5K a year. With that money I rent a 3 bedroom terrace house. Tax insure and maintain a motorbike. Saved enough money to have build a high end gaming PC with VR. Went on holiday to Ireland. I have zero outstanding bills and have enough left over every month to put small amounts into a savings account to cover any surprises. You have over 7x more income than me, more money than I've ever had in my life, but you're struggling while I'm getting by alright. That doesn't make sense to me.

originally posted by: Aazadan

So my mom asks me to give up my cash reserves, so she can use it on a down payment for a house. It lead to a big fight but I refused. All that would do is put both of us into a bad financial situation, while I'm still trying to get myself out of a precarious one. If she had some understanding about finances, she would understand my position... instead she thinks I'm being greedy and not willing to help out because I have the money to do so, since I have a nice salary now.

Your mom is right. She is actually very smart. Interest rates are the lowest in history right now, so its a good time to take out a mortgage and lock in that low rate. Your "saved money" won't buy very much in the future when interest rates go back up and you feel psychologically ready to buy a home. But, right now that money can buy good value. Just make sure to get a mortgage with "fixed interest rate" and not "floating rate." The fact that you have a nice salary now means you can qualify for the lowest interest rate mortgages. That's the time to take advantage of your good position. If you wait until your situation becomes more unstable, then you'll find it difficult to get such a great deal on mortgages or homes in the future. Your money should be invested, since you're rather young, it should not be just sitting in a bank account. Real estate is good investment, provided you can keep it for 15 years or more, to ride out any down swings. So, if your mom has 15 years of life left, buy the home, earn the capital appreciation over the 15 years, and sell it for a profit when your mom passes away. That's about the best investment you can find today in this environment of low return assets. Your money is wasting away in the bank, earning practically nothing, just declining in value every day that inflation raises the prices of everything else but your cash.

Do as you mom says, and you'll be richer in the end.

new topics

-

Ditching physical money

History: 2 hours ago -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 2 hours ago -

Don't take advantage of people just because it seems easy it will backfire

Rant: 2 hours ago -

VirginOfGrand says hello

Introductions: 3 hours ago -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 4 hours ago -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 6 hours ago -

Geddy Lee in Conversation with Alex Lifeson - My Effin’ Life

People: 7 hours ago -

God lived as a Devil Dog.

Short Stories: 8 hours ago -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 9 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 10 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 12 hours ago, 20 flags -

Who guards the guards

US Political Madness: 15 hours ago, 13 flags -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media: 6 hours ago, 12 flags -

Police clash with St George’s Day protesters at central London rally

Social Issues and Civil Unrest: 9 hours ago, 9 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 10 hours ago, 7 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 4 hours ago, 5 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 17 hours ago, 3 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 2 hours ago, 3 flags -

God lived as a Devil Dog.

Short Stories: 8 hours ago, 3 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 2 hours ago, 3 flags

active topics

-

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 37 • : WeMustCare -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry • 5 • : nugget1 -

Hate makes for strange bedfellows

US Political Madness • 37 • : YourFaceAgain -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 742 • : Annee -

Ditching physical money

History • 11 • : BernnieJGato -

1980s Arcade

General Chit Chat • 24 • : 5thHead -

Don't take advantage of people just because it seems easy it will backfire

Rant • 4 • : VirginOfGrand -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies • 21 • : VirginOfGrand -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 633 • : Justoneman -

VirginOfGrand says hello

Introductions • 1 • : VirginOfGrand