It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

12

share:

There is a thread in the forums which has a graph claiming to show President elect Donald Trump tax plan. I did a little digging and this is the real

tax plan and not the one claimed in the other thread.

taxfoundation.org...

Below I am showing some excerpts and giving the links to both President elect Donald Trump tax plan for 2017, and President Obama's tax plan for 2016.

taxfoundation.org...

What were/are President Obama's tax plans for 2016?...

taxfoundation.org...

taxfoundation.org...

Below I am showing some excerpts and giving the links to both President elect Donald Trump tax plan for 2017, and President Obama's tax plan for 2016.

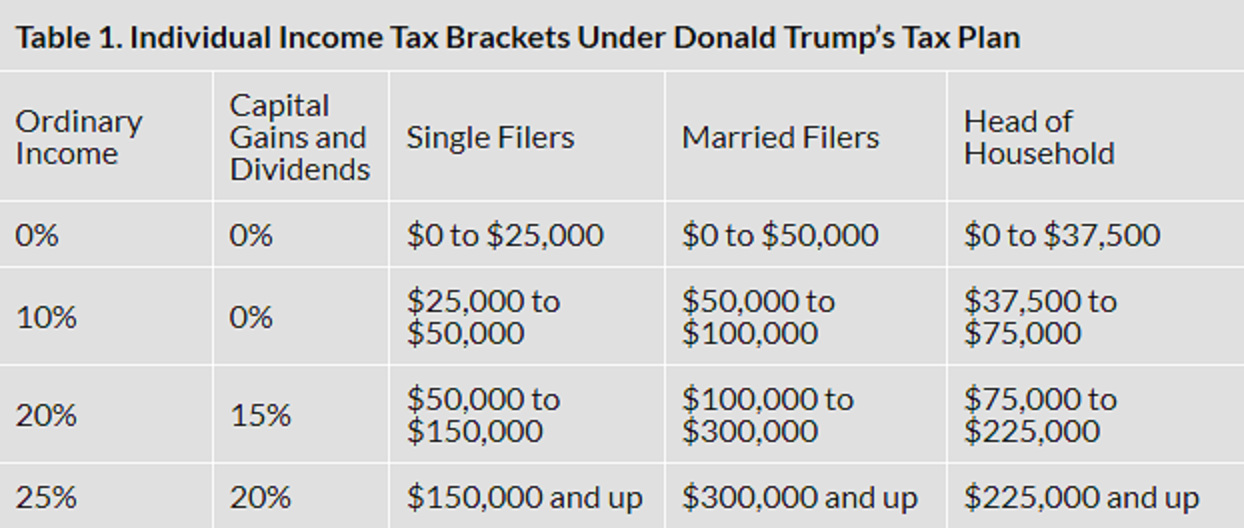

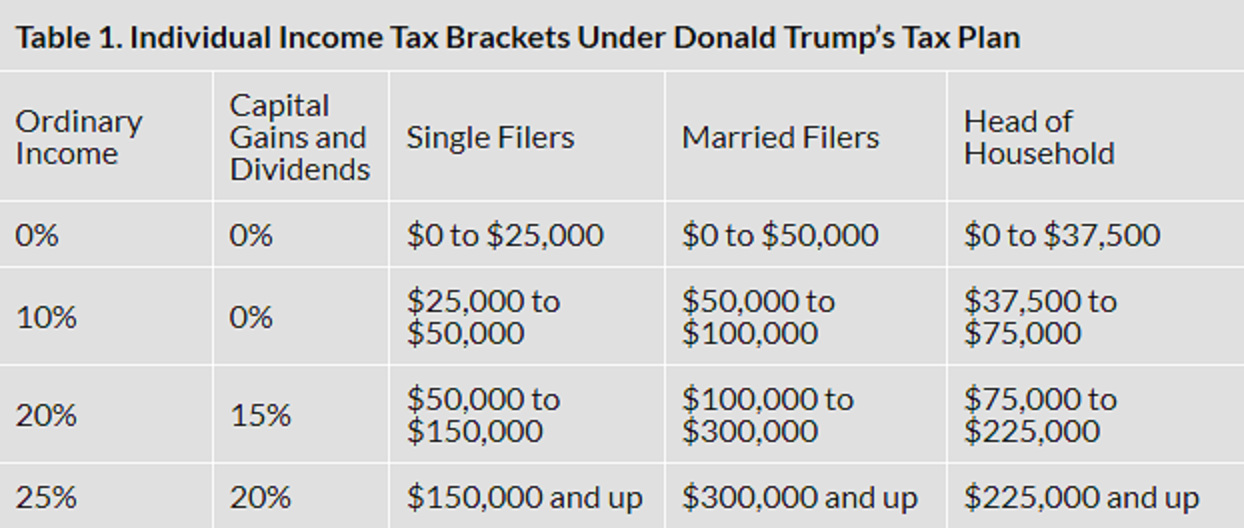

Details and Analysis of Donald Trump’s Tax Plan

September 29, 2015

By

Alan Cole

Key Findings:

Mr. Trump’s tax plan would substantially lower individual income taxes and the corporate income tax and eliminate a number of complex features in the current tax code.

Mr. Trump’s plan would cut taxes by $11.98 trillion over the next decade on a static basis. However, the plan would end up reducing tax revenues by $10.14 trillion over the next decade when accounting for economic growth from increases in the supply of labor and capital.

The plan would also result in increased outlays due to higher interest on the debt, creating a ten-year deficit somewhat larger than the estimates above.

According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly reduce marginal tax rates and the cost of capital, which would lead to an 11 percent higher GDP over the long term provided that the tax cut could be appropriately financed.

The plan would also lead to a 29 percent larger capital stock, 6.5 percent higher wages, and 5.3 million more full-time equivalent jobs.

The plan would cut taxes and lead to higher after-tax incomes for taxpayers at all levels of income.

...

Our analysis finds that the plan would reduce federal revenues by $11.98 trillion over the next decade. However, it also would improve incentives to work and invest, which could increase gross domestic product (GDP) by 11 percent over the long term. This increase in GDP would translate into 6.5 percent higher wages and 5.3 million new full-time equivalent jobs. After accounting for increased incomes due to these factors, the plan would only reduce tax revenues by $10.14 trillion.

...

taxfoundation.org...

What were/are President Obama's tax plans for 2016?...

Proposed Tax Changes in President Obama’s Fiscal Year 2016 Budget

February 11, 2015

By

Andrew Lundeen

President Obama recently presented his budget proposal for the 2016 fiscal year. The budget proposes $3.99 trillion in spending and $3.53 trillion in revenue for a deficit of $474 billion for 2016 and a number of new tax proposals.

In total, the plan includes $2.4 trillion in proposed tax increases offset by $713 billion in new credits, deductions, and other offsets, for a total tax increase of nearly $1.7 trillion over the next ten years.

...

Tax Increases

The president proposes $1.85 trillion in tax increases, with many of the tax increases focused on high-income earners.

Increase Capital Gains Tax Rate to 28 Percent and Eliminate Stepped Up Basis

The president’s proposal would increase the top capital gains tax rate from 23.8 percent to 28 percent (37.2 percent in California) and eliminate stepped-up basis—a change would potentially create a 68 percent tax on capital gains upon death. Our analysis finds that the capital gains tax increase alone would shrink the economy by 0.8 percent, eliminate 135,000 jobs and actually lose revenue in the long run. Revenue estimate: $208 billion over ten years.

...

taxfoundation.org...

edit on 12-12-2016 by ElectricUniverse because: add link.

I like it.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

My question would be while cutting federal taxes what's to stop State governments from feeling free to raise them exponentially? Without addressing

both in many places I can see any gains being sucked up in new taxes by local government and the State.

A little pessimistic I know, but probably realistic.

A little pessimistic I know, but probably realistic.

originally posted by: projectvxn

I like it.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

So it's great to keep 800 factory jobs in Illinois but entire federal departments need to be axed?

And what about those jobs?

Keep 800 unskilled labor jobs while creating millions of unemployed?

Great plan.......

a reply to: Caver78

Then businesses would move to States that aren't taxing them into bankruptcy. That's how a free market works.

Federal jobs absolutely need to get axed. The Govt. is obscenely bloated with agencies doing redundant work, while doing it horribly inefficiently.

Those people will find jobs in the real economy and actually contribute to society instead of leaching off taxpayers while making life more difficult for everyone. Which is about the only thing the Govt. does well.

Less federal jobs means more tax money can go where it's needed most like infrastructure, education... or tax cuts.

Then businesses would move to States that aren't taxing them into bankruptcy. That's how a free market works.

originally posted by: AlbanArthur

originally posted by: projectvxn

I like it.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

So it's great to keep 800 factory jobs in Illinois but entire federal departments need to be axed?

And what about those jobs?

Keep 800 unskilled labor jobs while creating millions of unemployed?

Great plan.......

Federal jobs absolutely need to get axed. The Govt. is obscenely bloated with agencies doing redundant work, while doing it horribly inefficiently.

Those people will find jobs in the real economy and actually contribute to society instead of leaching off taxpayers while making life more difficult for everyone. Which is about the only thing the Govt. does well.

Less federal jobs means more tax money can go where it's needed most like infrastructure, education... or tax cuts.

edit on 12-12-2016 by watchitburn because: (no reason given)

a reply to: AlbanArthur

Government feeds off the labor of the people. Most departments work to some degree or another to eat the fruits of citizens' labor and liberty.

Government feeds off the labor of the people. Most departments work to some degree or another to eat the fruits of citizens' labor and liberty.

originally posted by: projectvxn

a reply to: Caver78

The federal government cannot tell states how to tax citizens.

It would have already if it had that power. It's a good thing they don't.

Yes they can . Federal Taxes. And any that have to do with Interstate Trade.

a reply to: AlbanArthur

Source?

Keep 800 unskilled labor jobs while creating millions of unemployed?

Source?

a reply to: ElectricUniverse

He isn't even in office,he has no tax plan etched in stone,I find it funny how everyone becomes a psychic,kind of like the phone call,on pure speculation

He isn't even in office,he has no tax plan etched in stone,I find it funny how everyone becomes a psychic,kind of like the phone call,on pure speculation

a reply to: AlbanArthur

They are un needed. The fed was never intended to be a gravy train

Op, this is more like it. Putting me in a better tax bracket will keep much more money available for recirculation into the economy via my family and farm

They are un needed. The fed was never intended to be a gravy train

Op, this is more like it. Putting me in a better tax bracket will keep much more money available for recirculation into the economy via my family and farm

edit on 12-12-2016 by BlueJacket because: Eta

originally posted by: Oldtimer2

a reply to: ElectricUniverse

He isn't even in office,he has no tax plan etched in stone,I find it funny how everyone becomes a psychic,kind of like the phone call,on pure speculation

There is zero reason to have a "tax plan" at all until congress can ballance the federal budget without shut downs every 2 years.

The one he proposed is deficit spending that hedges it's neutrality in/ at very specific and perfect scenario to unfold within a budget year.

His trade agreements could disrupt the cpi exponentially creating Walmart to double prices, suply lines to become expensive.

His drastic immigration will raise the cost of labor in food production from farming to cooking, and increase building labor costs.

These are all things that take decades and should be done by congress.

Any president Democrat or republican who wants to do it all should be strongly scrutinized.

Personally I was hoping for a lame duck Sanders with a Republican congress to completely stalemate any more "progress" the feds give us.

Exon ceo as sec of state? Talk about welfare. That company who makes tens of billions in profits gets 1.8 billion in subsidies and pays 300k a day to lobby.

How about no subsidies for oil and gas or green energy and see who can out compete each other. My guess is oil becomes a market for plastics and chemicals and energy decides to use science that isn't based on steam engines from 140 years ago and we would have lots of new manufacturing jobs.

edit on 12-12-2016 by luthier because: (no reason given)

What worries me is that if we have more "disposable" income, the FED will increase interest rates on the ghost money they invent out of thin air. I

keep hearing that P.E. Trump has a plan to offset both the FED and the IRS. These two pseudo agencies basically keep the American economy held

down.

Could it be he is holding that info close to his chest so as not to spook them? IDK...

Could it be he is holding that info close to his chest so as not to spook them? IDK...

originally posted by: projectvxn

I like it.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

Yeah - maybe we'll get rid of the WAR MACHINE!!!

Has anybody considered the standard tax deductions ?

Lots of confusion.

Lots of confusion.

a reply to: projectvxn

LOL...I knew that. The problem is that States will see our extra income as a windfall and raise taxes on all sorts of things making the federal reduction moot. It's very conceivable that the gas tax will rise, local county taxes etc...

Of course businesses will move where taxes are cheaper, but for those of us who live in greedy states are rather hosed.

LOL...I knew that. The problem is that States will see our extra income as a windfall and raise taxes on all sorts of things making the federal reduction moot. It's very conceivable that the gas tax will rise, local county taxes etc...

Of course businesses will move where taxes are cheaper, but for those of us who live in greedy states are rather hosed.

originally posted by: projectvxn

I like it.

But without deep cuts to government spending it could cause solvency problems over the next decade.

Entire departments would have to be axed. Not that I have a problem with that, but good luck getting congress to go along with it. We all know republicans are just as much in favor of big government as are democrats.

Entire depts to be axed... sounds great. The CIA would be a good start.

new topics

-

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 29 minutes ago -

Hurt my hip; should I go see a Doctor

General Chit Chat: 1 hours ago -

Israel attacking Iran again.

Middle East Issues: 2 hours ago -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago -

When an Angel gets his or her wings

Religion, Faith, And Theology: 3 hours ago -

Comparing the theology of Paul and Hebrews

Religion, Faith, And Theology: 4 hours ago -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 5 hours ago -

Boston Dynamics say Farewell to Atlas

Science & Technology: 5 hours ago -

I hate dreaming

Rant: 5 hours ago -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago

top topics

-

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 8 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 10 hours ago, 16 flags -

A man of the people

Medical Issues & Conspiracies: 16 hours ago, 11 flags -

Biden says little kids flip him the bird all the time.

Politicians & People: 8 hours ago, 8 flags -

Man sets himself on fire outside Donald Trump trial

Mainstream News: 7 hours ago, 7 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 5 hours ago, 6 flags -

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 2 hours ago, 5 flags -

Israel attacking Iran again.

Middle East Issues: 2 hours ago, 5 flags -

4 plans of US elites to defeat Russia

New World Order: 17 hours ago, 4 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 5 hours ago, 4 flags

active topics

-

Hurt my hip; should I go see a Doctor

General Chit Chat • 11 • : TheLieWeLive -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 7 • : Caver78 -

Silent Moments --In Memory of Beloved Member TDDA

Short Stories • 48 • : Encia22 -

MULTIPLE SKYMASTER MESSAGES GOING OUT

World War Three • 52 • : cherokeetroy -

Israel attacking Iran again.

Middle East Issues • 22 • : Boomer1947 -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies • 1 • : WakeofPoseidon -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 67 • : WeMustCare -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 53 • : ghandalf -

Boston Dynamics say Farewell to Atlas

Science & Technology • 5 • : Caver78 -

Biden says little kids flip him the bird all the time.

Politicians & People • 16 • : stelth2

12