It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: CynConcepts

Yeah, was looking forward to having our taxes go lower, but 'oops' hubby just received a raise! Dangnabbit! Frustrating since now his raise actually will cost us more in taxes annually than what it actually is monetarily. Sigh. My husband has actually stated he should just refuse the raise!

...why is that?

The entire salary shouldn't be taxed at that rate, only the part of it that falls within the higher tax bracket. That's why they are "brackets".

Let's tax someone earning $40k p/a:

CURRENT SCHEME

$9,275 falls into the tax bracket @ 10%;

$28,375 falls into the tax bracket @ 15%

$2,350 falls into the tax bracket @ 25%

Tax payable on $40k under the current brackets: $5771

NEW SCHEME

$37,500 falls into the tax bracket @ 12%

$2,500 falls into the tax bracket @ 25%

Tax payable on $40k under the new brackets: $5,125

Someone on $40k should be paying less under the new scheme than under the old scheme.

If we consider $20k, then Current Scheme = $2,536; New Scheme = $2,400

If we considered $60k, then Current Scheme = $10,771; New Scheme = $10,125

The proposed scheme actually results in you paying less tax.

All this assumes there isn't something incredibly screwy about how the tax calculation works.

EDITED And oops, forgot about the deductions available, which paints an even better picture!

edit on Ev27SundaySundayAmerica/ChicagoSun, 11 Dec

2016 19:27:38 -06001022016b by EvillerBob because: (no reason given)

a reply to: Blue_Jay33

A little FYI for everyone arguing the Rich are not paying high enough taxes.

Guess what?

They never pay what they are supposed to anyhow because they can afford the best accountants, and money shelters, so it almost doesn't matter what they raise the richest people's tax bracket to.

A little FYI for everyone arguing the Rich are not paying high enough taxes.

Guess what?

They never pay what they are supposed to anyhow because they can afford the best accountants, and money shelters, so it almost doesn't matter what they raise the richest people's tax bracket to.

edit on 11-12-2016 by Realtruth because: (no reason given)

originally posted by: CynConcepts

Yeah, was looking forward to having our taxes go lower, but 'oops' hubby just received a raise! Dangnabbit! Frustrating since now his raise actually will cost us more in taxes annually than what it actually is monetarily. Sigh. My husband has actually stated he should just refuse the raise!

I imagine it will be frustrating for a few who fall in that tax border zone between 12% and 25% taxation. I guess I will have a year to get creative with our finances and plan on how to jump through some more deductible loopholes to try and lower our future taxable income. It is what it is.

Edit add: here's hoping maxing out our 401k contributions will offset our adjusted balance, otherwise I am going to have save medical expense/charity/etc. receipts and actually use them! Ugh. In the past, it really was more work than it was worth...but if our taxes double up...well, obviously, it will need to be done.

Trumps new rates aren't doing away with our progressive tax system. Under such a system you can never be punished for getting a raise. Dollars are taxed by the category they fall into. Only the money earned at a certain rate is taxed at that rate. So your first dollar is taxed at the lowest rate, your last dollar at the highest rate. It's not your entire income that jumps from 12 to 25%.

originally posted by: Realtruth

a reply to: Blue_Jay33

A little FYI for everyone arguing the Rich are not paying high enough taxes.

Guess what?

They never pay what they are supposed to anyhow because they can afford the best accountants, and money shelters, so it almost doesn't matter what they raise the richest people's tax bracket to.

Bingo!

Thanks for remembering this. Not to mention the money they keep offshore which is never claimed as income.

a reply to: Blue_Jay33

Paper today shows taxes just went up on Obama's watch. Highest in history. Entire Obama been in my taxes flat out suck. Yea, you should get back $1200.. oh can't afford health insurance? well let us just take half of that and give it to an illegal. I'm telling ya, I almost flew plane into federal reserve.

So, don't know about you guys but this is great news for me. One and only thing miss about Bush was those taxes. I thought Obama was going help me out but can't get school tuition so paying school, gas, car insurance, rent, electric.. I have $30 phone and free wifi. how hell can you do that to someone... and wonders why no one poor has it. I paid total of 3200 to fines slowly last 8 years. Never went to hospital once. If you're under 30 and in good health why hell pay $80 month? It's free in other countries, just can't be free in America.

Marijuana should be legal and thus taxes should pay our medical bills. That's what Obama should have done.

Paper today shows taxes just went up on Obama's watch. Highest in history. Entire Obama been in my taxes flat out suck. Yea, you should get back $1200.. oh can't afford health insurance? well let us just take half of that and give it to an illegal. I'm telling ya, I almost flew plane into federal reserve.

So, don't know about you guys but this is great news for me. One and only thing miss about Bush was those taxes. I thought Obama was going help me out but can't get school tuition so paying school, gas, car insurance, rent, electric.. I have $30 phone and free wifi. how hell can you do that to someone... and wonders why no one poor has it. I paid total of 3200 to fines slowly last 8 years. Never went to hospital once. If you're under 30 and in good health why hell pay $80 month? It's free in other countries, just can't be free in America.

Marijuana should be legal and thus taxes should pay our medical bills. That's what Obama should have done.

a reply to: Blue_Jay33

hummm...

taxfoundation.org...

What were/are President Obama's tax plans for 2016?...

taxfoundation.org...

hummm...

Details and Analysis of Donald Trump’s Tax Plan

September 29, 2015

By

Alan Cole

Key Findings:

Mr. Trump’s tax plan would substantially lower individual income taxes and the corporate income tax and eliminate a number of complex features in the current tax code.

Mr. Trump’s plan would cut taxes by $11.98 trillion over the next decade on a static basis. However, the plan would end up reducing tax revenues by $10.14 trillion over the next decade when accounting for economic growth from increases in the supply of labor and capital.

The plan would also result in increased outlays due to higher interest on the debt, creating a ten-year deficit somewhat larger than the estimates above.

According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly reduce marginal tax rates and the cost of capital, which would lead to an 11 percent higher GDP over the long term provided that the tax cut could be appropriately financed.

The plan would also lead to a 29 percent larger capital stock, 6.5 percent higher wages, and 5.3 million more full-time equivalent jobs.

The plan would cut taxes and lead to higher after-tax incomes for taxpayers at all levels of income.

...

Our analysis finds that the plan would reduce federal revenues by $11.98 trillion over the next decade. However, it also would improve incentives to work and invest, which could increase gross domestic product (GDP) by 11 percent over the long term. This increase in GDP would translate into 6.5 percent higher wages and 5.3 million new full-time equivalent jobs. After accounting for increased incomes due to these factors, the plan would only reduce tax revenues by $10.14 trillion.

...

taxfoundation.org...

What were/are President Obama's tax plans for 2016?...

Proposed Tax Changes in President Obama’s Fiscal Year 2016 Budget

February 11, 2015

By

Andrew Lundeen

President Obama recently presented his budget proposal for the 2016 fiscal year. The budget proposes $3.99 trillion in spending and $3.53 trillion in revenue for a deficit of $474 billion for 2016 and a number of new tax proposals.

In total, the plan includes $2.4 trillion in proposed tax increases offset by $713 billion in new credits, deductions, and other offsets, for a total tax increase of nearly $1.7 trillion over the next ten years.

...

Tax Increases

The president proposes $1.85 trillion in tax increases, with many of the tax increases focused on high-income earners.

Increase Capital Gains Tax Rate to 28 Percent and Eliminate Stepped Up Basis

The president’s proposal would increase the top capital gains tax rate from 23.8 percent to 28 percent (37.2 percent in California) and eliminate stepped-up basis—a change would potentially create a 68 percent tax on capital gains upon death. Our analysis finds that the capital gains tax increase alone would shrink the economy by 0.8 percent, eliminate 135,000 jobs and actually lose revenue in the long run. Revenue estimate: $208 billion over ten years.

...

taxfoundation.org...

a reply to: Blue_Jay33

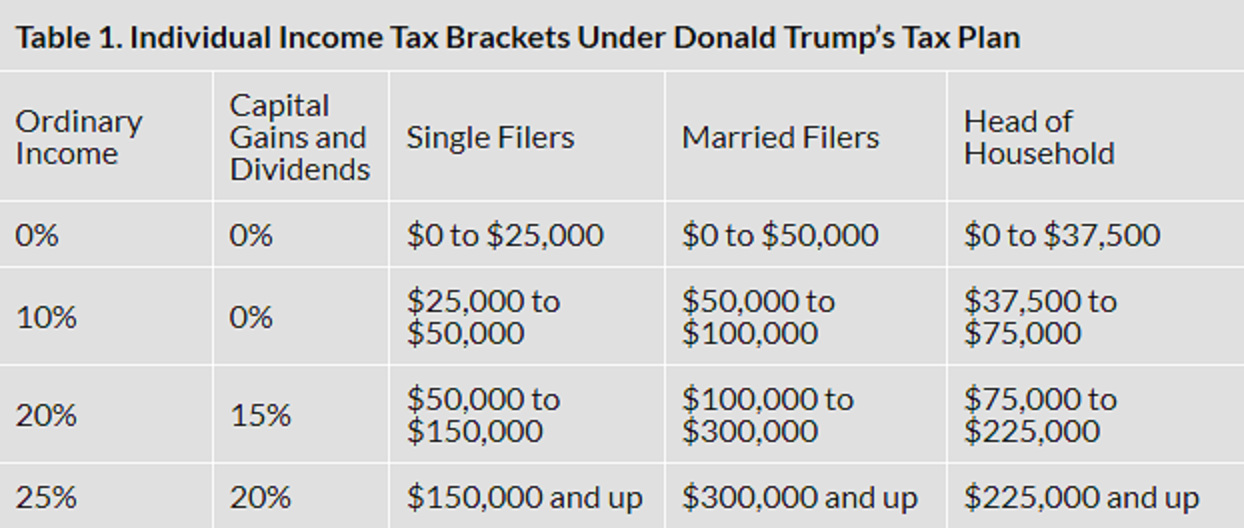

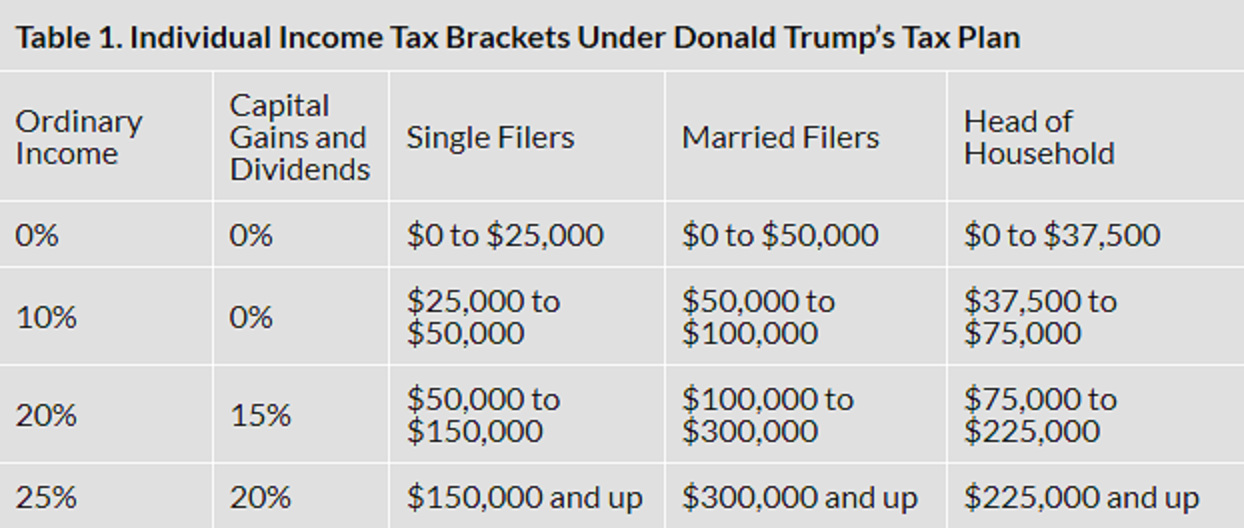

I wonder where you got that graph.

According to the tax foundation this is the real tax plan of President elect Donald Trump.

Tell me if i have to increase the size of this graph so you can read it.

taxfoundation.org...

I wonder where you got that graph.

According to the tax foundation this is the real tax plan of President elect Donald Trump.

Tell me if i have to increase the size of this graph so you can read it.

taxfoundation.org...

edit on 12-12-2016 by ElectricUniverse because: add

link.

originally posted by: ElectricUniverse

a reply to: Blue_Jay33

I wonder where you got that graph.

According to the tax foundation this is the real tax plan of President elect Donald Trump.

Tell me if i have to increase the size of this graph so you can read it.

taxfoundation.org...

I hope the one you posted is the correct one, it is much better, but it is from 2015, and Trumps own website says different.

edit on 12-12-2016

by Blue_Jay33 because: (no reason given)

originally posted by: jtma508

Come om man get with it. Screw the little guy. What's he gonna do about it? Besides, only the rich know what to do with money. Ask the Rockefellers and they'll tell you the same thing. There's still about 10% of the wealth of the country that the 1% doesn't have so there's more work to be done. More work to be done. Keep in mind, the last time we lived in a feudal culture the king owned everything. And that is the plan.

Feudalism is still the culture we live in. They do own everything. People just see it differently because any real truths about how the system really works is kept secret.

We take part in this "democracy" of limited freedom, and in exchange we never question the system.

Has anybody considered the standard tax deductions ?

Lots of confusion.

Lots of confusion.

originally posted by: xuenchen

Has anybody considered the standard tax deductions ?

Lots of confusion.

I am sure it was considered by CNBC when they posted that chart - but it did not fit the narrative so they engaged in some fake news.

This kind of fake news is the really thought out kind. Not a mistake, but a concerted effort to mislead Americans with a simple (but incorrect) positioning of a before and after picture of what will be paid in taxes.

edit on 12/12/2016 by UKTruth because: (no reason given)

a reply to: Blue_Jay33

You have to remember that a lot of people in power, including the elites, don't want Trump as President, and these people would do anything to smear and destroy the candidacy for President of President elect Donald Trump.

To this day the DNC is still working in trying to stop President elect Donald Trump from becoming President. Making up false claims about his plans is one of those ways. Then there are the news media, controlled by the DNC, that are claiming any news that doesn't come from them is "fake news".

You have to remember that a lot of people in power, including the elites, don't want Trump as President, and these people would do anything to smear and destroy the candidacy for President of President elect Donald Trump.

To this day the DNC is still working in trying to stop President elect Donald Trump from becoming President. Making up false claims about his plans is one of those ways. Then there are the news media, controlled by the DNC, that are claiming any news that doesn't come from them is "fake news".

edit on 12-12-2016 by ElectricUniverse because: add and correct comment.

originally posted by: UKTruth

originally posted by: xuenchen

Has anybody considered the standard tax deductions ?

Lots of confusion.

I am sure it was considered by CNBC when they posted that chart - but it did not fit the narrative so they engaged in some fake news.

This kind of fake news is the really thought out kind. Not a mistake, but a concerted effort to mislead Americans with a simple (but incorrect) positioning of a before and after picture of what will be paid in taxes.

no it's not a concerted effort to mislead Americans, you and others are the only ones doing that....don't you have your own British government you can screw with and betray? or is it just fun to do it to us Americans...and another thing, why do you even care?....London is one big surveillance camera.

a reply to: Blue_Jay33

If it were up to me, I would disband the IRS and nullify income tax. I would fund the federal government only for it's constitutionally allowed duties with tariffs and consumption based taxes.

But what do I know.

If it were up to me, I would disband the IRS and nullify income tax. I would fund the federal government only for it's constitutionally allowed duties with tariffs and consumption based taxes.

But what do I know.

Are people in this thread really that I'll minded toward "the evil" rich people???

Everyone DOES know that less taxes on the rich means more money going towards goods and services from the rich, right?

Everyone's job and living depends on someone else paying for it. If there is no rich person to start spending money from the start, that means there will be no income in the first place.

Is this that hard of a concept, or will envy always be the most prevalent cardinal sin for humanity? Nature is unfair and unbalanced, nothing is "designed" and nothing "exists" to be fair.

The ant gets stepped on. The fish gets captured from the stream by the eagle. Forests burn from fire. Black holes swallow just about everything. All of life is struggle on a balance beam.

What everyone wants is some non existent idea in this thread. Consider your existence, are we going to start a protest because we are not invincible planetary bodies either? Shall the sun share its wealth of energy with the planets because it is more powerful?

Everyone DOES know that less taxes on the rich means more money going towards goods and services from the rich, right?

Everyone's job and living depends on someone else paying for it. If there is no rich person to start spending money from the start, that means there will be no income in the first place.

Is this that hard of a concept, or will envy always be the most prevalent cardinal sin for humanity? Nature is unfair and unbalanced, nothing is "designed" and nothing "exists" to be fair.

The ant gets stepped on. The fish gets captured from the stream by the eagle. Forests burn from fire. Black holes swallow just about everything. All of life is struggle on a balance beam.

What everyone wants is some non existent idea in this thread. Consider your existence, are we going to start a protest because we are not invincible planetary bodies either? Shall the sun share its wealth of energy with the planets because it is more powerful?

a reply to: Realtruth

Exactly, unless you go to a hybrid flat tax which they wouldn't be able to do deductions or hide their money.

They never pay what they are supposed to anyhow because they can afford the best accountants, and money shelters, so it almost doesn't matter what they raise the richest people's tax bracket to.

Exactly, unless you go to a hybrid flat tax which they wouldn't be able to do deductions or hide their money.

originally posted by: Winstonian

a reply to: Blue_Jay33

If it were up to me, I would disband the IRS and nullify income tax. I would fund the federal government only for it's constitutionally allowed duties with tariffs and consumption based taxes.

But what do I know.

That would give the people too much control of their gov't .

edit on 571231America/ChicagoTue, 13 Dec 2016 14:57:46 -0600000000p3142 by interupt42 because: (no reason given)

new topics

-

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago -

Bobiverse

Fantasy & Science Fiction: 9 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago

top topics

-

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 9 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 13 hours ago, 7 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 2 hours ago, 7 flags -

This is our Story

General Entertainment: 16 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 12 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 9 hours ago, 3 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 6 hours ago, 2 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 1 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 4 hours ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 98 • : rigel4 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 23 • : Disgusted123 -

Hi folks I'm Leon Grad

Introductions • 9 • : leongrad -

The Reality of the Laser

Military Projects • 41 • : 5thHead -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 136 • : NorthOS -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 8 • : lordcomac -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 140 • : Annee -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 16 • : grey580 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 35 • : Consvoli -

Late Night with the Devil - a really good unusual modern horror film.

Movies • 1 • : DAVID64