It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

a reply to: John_Rodger_Cornman

Nothing would happen. For large enough corporations the tax rates are already effectively zero, actually scratch that the tax rates are into the negatives (meaning we pay them for their profits rather than taking some). On small business it's irrelevant because they're not in an international market, everyone is paying the same taxes, and everyone passes them off to the consumer.

The government is going to extract it's needed level of revenue somehow. If you remove business taxes you'll simply see those taxes move to progressive income taxes or to regressive sales taxes. Since all taxes are already passed along, the end user ultimately pays more or less the same amount.

Then revenues tank. The bottom 90% of the country simply doesn't have the purchasing power to keep the coffers filled and the top 10% doesn't purchase enough additional products relative to the disparity in income to make up the difference.

If your tax plan relies on the bottom 50% who collectively have .1% of the total purchasing power in the country, paying close to 50% of the taxes you're just not going to have the revenues to do anything from maintaining roads to keeping schools open to funding a military.

Nothing would happen. For large enough corporations the tax rates are already effectively zero, actually scratch that the tax rates are into the negatives (meaning we pay them for their profits rather than taking some). On small business it's irrelevant because they're not in an international market, everyone is paying the same taxes, and everyone passes them off to the consumer.

The government is going to extract it's needed level of revenue somehow. If you remove business taxes you'll simply see those taxes move to progressive income taxes or to regressive sales taxes. Since all taxes are already passed along, the end user ultimately pays more or less the same amount.

originally posted by: John_Rodger_Cornman

What if you remove both the corporate tax and the individual income tax but you keep a sales tax?

Then revenues tank. The bottom 90% of the country simply doesn't have the purchasing power to keep the coffers filled and the top 10% doesn't purchase enough additional products relative to the disparity in income to make up the difference.

If your tax plan relies on the bottom 50% who collectively have .1% of the total purchasing power in the country, paying close to 50% of the taxes you're just not going to have the revenues to do anything from maintaining roads to keeping schools open to funding a military.

edit on

4-5-2016 by Aazadan because: (no reason given)

originally posted by: Aazadan

a reply to: John_Rodger_Cornman

Nothing would happen. For large enough corporations the tax rates are already effectively zero, actually scratch that the tax rates are into the negatives (meaning we pay them for their profits rather than taking some). On small business it's irrelevant because they're not in an international market, everyone is paying the same taxes, and everyone passes them off to the consumer.

The government is going to extract it's needed level of revenue somehow. If you remove business taxes you'll simply see those taxes move to progressive income taxes or to regressive sales taxes. Since all taxes are already passed along, the end user ultimately pays more or less the same amount.

originally posted by: John_Rodger_Cornman

What if you remove both the corporate tax and the individual income tax but you keep a sales tax?

Then revenues tank. The bottom 90% of the country simply doesn't have the purchasing power to keep the coffers filled and the top 10% doesn't purchase enough additional products relative to the disparity in income to make up the difference.

If your tax plan relies on the bottom 50% who collectively have .1% of the total purchasing power in the country, paying close to 50% of the taxes you're just not going to have the revenues to do anything from maintaining roads to keeping schools open to funding a military.

What about with Gary Johnson's flat sales tax?

seems a lot of people confuse the over seas money with money that is taxable to the US and what and why companies do with that money.

First off, they are not "hiding" the money. They are taking advantage or in business jargon "leveraging" the laws of the countries in which they do business. look at some of the huge multinationals taking advantage of what they call the "double dutch irish sandwhich" or one of the other types such as the double irish arrangment, etc. Some of the lefty socialists favorite companies are on the list...Starbucks, Apple, Google, Facebook. If they wanted to bring that cash back to the states and most do, they would now be open to the US corp income tax of a marginal rate of 39.1 % plus the much lower, but still a tax in the other countries where they do business. When it comes to the leveraging of the Dutch laws, you have to have a physical facility in their country, and every facility not there, has to have a Dutch citizen in a high financial position, such as controller or director . it's not like company b just says "hey we are dutch, we dont pay taxes"

Everytime the US govt has a moratorium and allows companies to bring that cash back at lower tax rate (last time was 15%) billions came back to the US. Most of these companies have tons of cash just sitting there doing nothing offshore, because let's be honest, would you willingly hand over more than a third of all income over to someone, then let them raid your acount again in the form of payroll taxes, epa fees, business licenses, sales tax on utilities ( only in some locals) OSHA fees, unemployment insurance premiums, health insurance premiums and all the other fee and taxes that a business has to pay. people never think about that, like if you are a publicly traded company, you are required to have a third party firm audit firm, audit not only your financials, but also your internal controls and procedures every year prior to filing with the SEC. Most buinesses work off of slim profit margins, even the big boys, Proctor and Gamble typically has about 4-5% profit margin.

First off, they are not "hiding" the money. They are taking advantage or in business jargon "leveraging" the laws of the countries in which they do business. look at some of the huge multinationals taking advantage of what they call the "double dutch irish sandwhich" or one of the other types such as the double irish arrangment, etc. Some of the lefty socialists favorite companies are on the list...Starbucks, Apple, Google, Facebook. If they wanted to bring that cash back to the states and most do, they would now be open to the US corp income tax of a marginal rate of 39.1 % plus the much lower, but still a tax in the other countries where they do business. When it comes to the leveraging of the Dutch laws, you have to have a physical facility in their country, and every facility not there, has to have a Dutch citizen in a high financial position, such as controller or director . it's not like company b just says "hey we are dutch, we dont pay taxes"

Everytime the US govt has a moratorium and allows companies to bring that cash back at lower tax rate (last time was 15%) billions came back to the US. Most of these companies have tons of cash just sitting there doing nothing offshore, because let's be honest, would you willingly hand over more than a third of all income over to someone, then let them raid your acount again in the form of payroll taxes, epa fees, business licenses, sales tax on utilities ( only in some locals) OSHA fees, unemployment insurance premiums, health insurance premiums and all the other fee and taxes that a business has to pay. people never think about that, like if you are a publicly traded company, you are required to have a third party firm audit firm, audit not only your financials, but also your internal controls and procedures every year prior to filing with the SEC. Most buinesses work off of slim profit margins, even the big boys, Proctor and Gamble typically has about 4-5% profit margin.

edit on 54052 by SM2 because: (no reason given)

a reply to: John_Rodger_Cornman

I don't follow his tax plan all that closely so I'm going to go by what's posted on his website

If I'm understanding it correctly, he essentially wants a VAT with no other taxation. The problem with this type of system is that lets say the tax is at 20%. A 20% tax on a lower class person making say 30k/year results in them being taxed on the full 30k. However, he wants to exempt the tax on savings and investments. That means that if a person makes 250k, they can put say 75k into savings, live on 175k and only pay tax on that 175k while also investing for the future on the rest, tax free. This means the person at 250k is paying an effective 14% rate, and if you're making a million but only spending 250k on living expenses you're only being taxed at 5%. This creates an inverted pyramid where the wealthy pay the lowest effective rate, and it shifts the tax burden to the poor. As I said before, you cannot shift the tax burden to the poor because they simply don't have the assets to tax.

Someone like Trump who is doing a "flat" tax is a bit more reasonable. He's using a progressive rate with a few flat brackets of 0, 10, 15, 20, and 25 (I think those are the brackets). Oddly enough, this plan actually represents a substantial increase over our current effective rates that are between 0 and 16% for most people.

In the end sales taxes don't work, because not enough goods are actually bought and sold to make any substantial taxation numbers. The real money flows through Wall Street and banking, not through buying a pair of shoes, or gardening supplies, or anything else.

I don't follow his tax plan all that closely so I'm going to go by what's posted on his website

Today’s federal tax code does all the wrong things. It penalizes productivity, savings and investment, while rewarding inefficiency and designating winners and losers according to political whim. For far too long, tax laws have been used not just as a means to collect needed revenues, but as a weapon with which to manipulate our behavior, create and destroy industries and fulfill politicians’ dreams of social engineering. The result is a tax code that is more than 70,000 pages long enforced by a government agency with almost 100,000 employees.

It is nothing less than a massive deployment of government force on our lives, our finances and our freedom.

Governor Johnson advocates the elimination of tax subsidies, the double taxation embodied in business income taxes, and ultimately, the replacement of all income and payroll taxes with a single consumption tax that will allow every American and every business to determine their tax burden by making their own spending decisions. Taxes on purchases for basic necessities would be “prebated”, with all other purchases taxed equally regardless of income, status or purpose.

Many leading economists have long advocated such a shift in the way we are taxed, and Gary Johnson believes the time has come to eliminate the punishing tax code we have today and replace it with a system that rewards productivity, investment and savings. The IRS as we know it today would no longer be necessary, and Americans would no longer need to live in fear of the force of government being wielded under the guise of tax collection.

If I'm understanding it correctly, he essentially wants a VAT with no other taxation. The problem with this type of system is that lets say the tax is at 20%. A 20% tax on a lower class person making say 30k/year results in them being taxed on the full 30k. However, he wants to exempt the tax on savings and investments. That means that if a person makes 250k, they can put say 75k into savings, live on 175k and only pay tax on that 175k while also investing for the future on the rest, tax free. This means the person at 250k is paying an effective 14% rate, and if you're making a million but only spending 250k on living expenses you're only being taxed at 5%. This creates an inverted pyramid where the wealthy pay the lowest effective rate, and it shifts the tax burden to the poor. As I said before, you cannot shift the tax burden to the poor because they simply don't have the assets to tax.

Someone like Trump who is doing a "flat" tax is a bit more reasonable. He's using a progressive rate with a few flat brackets of 0, 10, 15, 20, and 25 (I think those are the brackets). Oddly enough, this plan actually represents a substantial increase over our current effective rates that are between 0 and 16% for most people.

In the end sales taxes don't work, because not enough goods are actually bought and sold to make any substantial taxation numbers. The real money flows through Wall Street and banking, not through buying a pair of shoes, or gardening supplies, or anything else.

a reply to: John_Rodger_Cornman

The retail price of everything would be up to 40% cheaper.

And more money would be spent on capital improvement and new inventions.

The retail price of everything would be up to 40% cheaper.

And more money would be spent on capital improvement and new inventions.

originally posted by: Semicollegiate

a reply to: John_Rodger_Cornman

The retail price of everything would be up to 40% cheaper.

And more money would be spent on capital improvement and new inventions.

I doubt this because businesses aren't actually paying those 39.6% rates. The US may have one of the highest corporate tax rates, but our effective tax rate is among the lowest once you take advantage of the various deductions available. From the large businesses you would probably see prices rise because they're paying negative rates right now and from the small businesses you would probably see prices fall, but not by 40%, probably closer to 5-10%. Of course, at the same time you would also see an X% VAT added on to the price of all your purchases which would cancel out any price decreases you might see.

a reply to: Aazadan

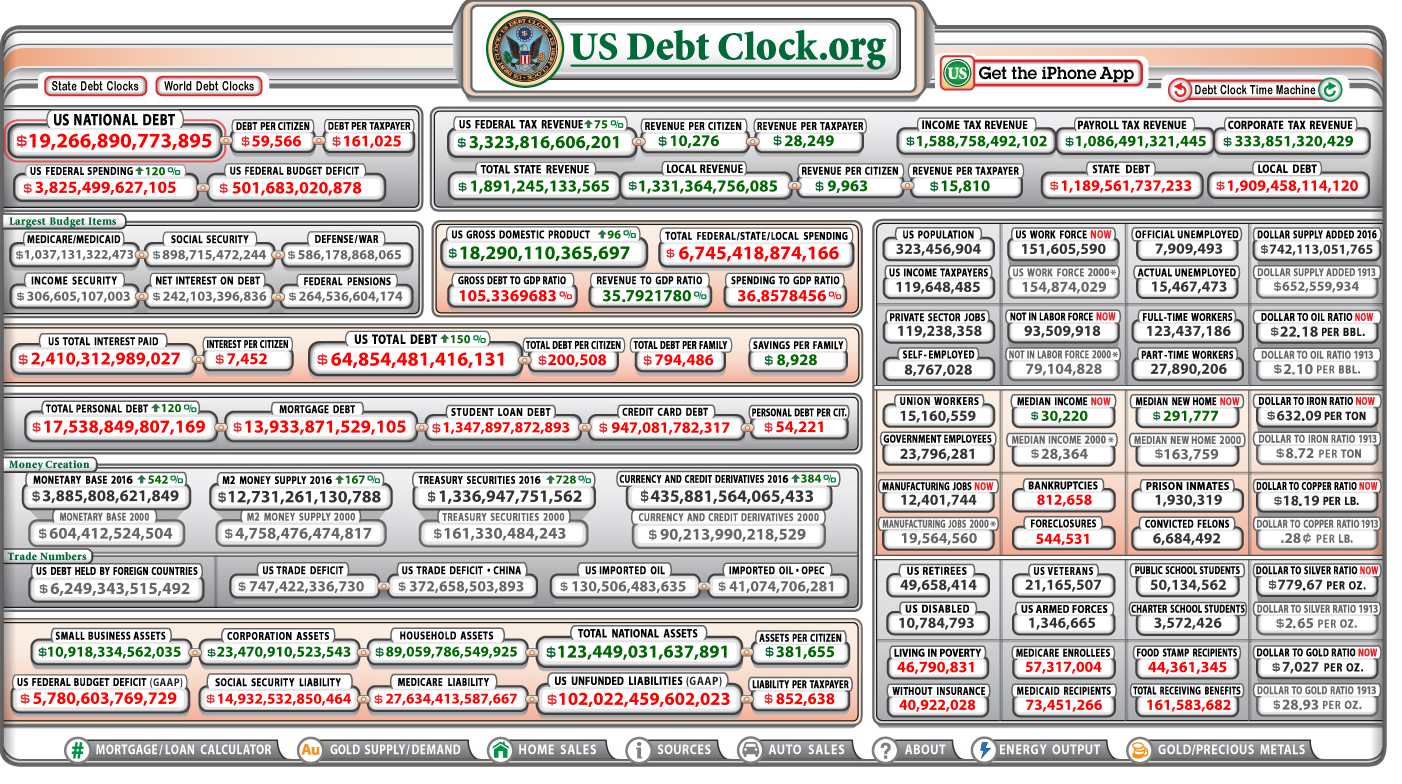

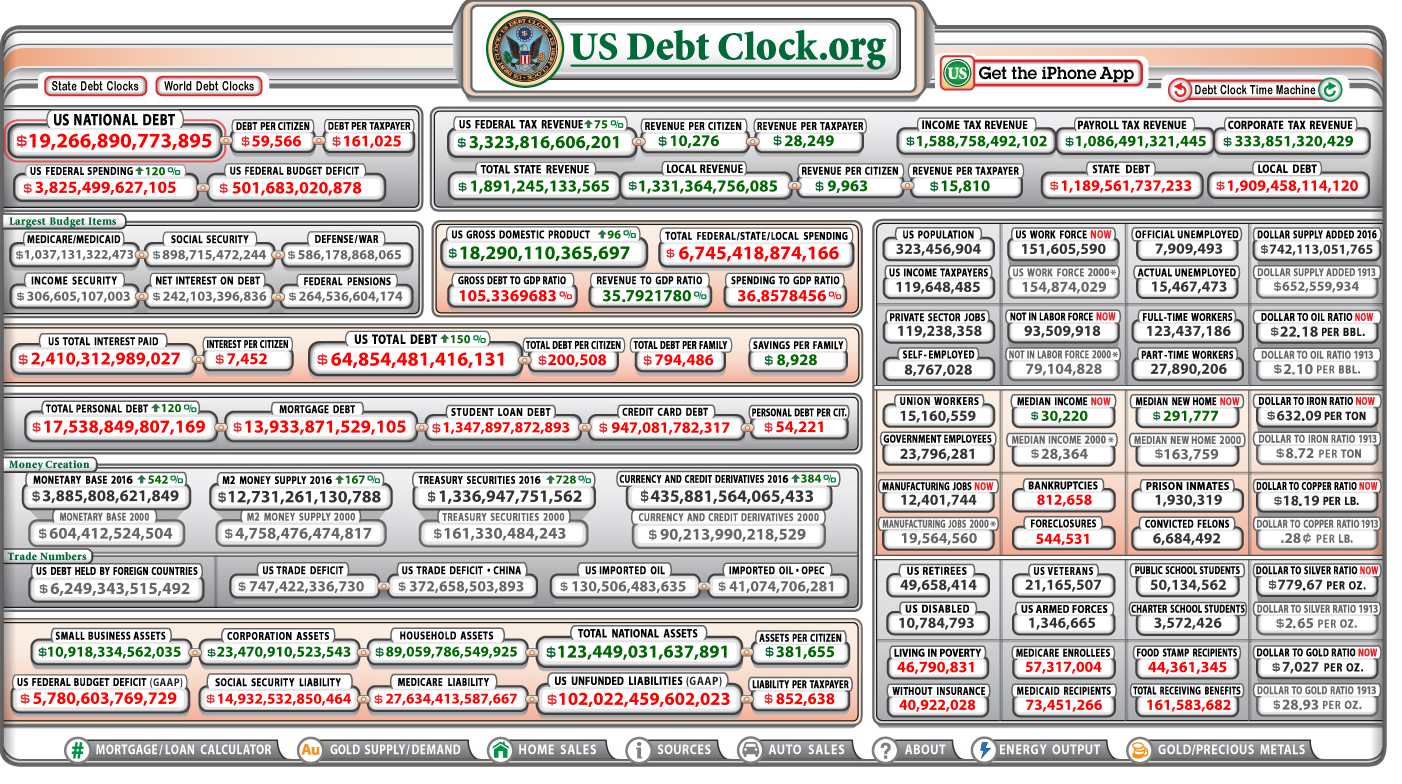

Corporate tax revenue is 333 billion growing.

www.usdebtclock.org...

That is about $1000 dollars per US citizen.

Corporate taxes are paid by consumers, and all taxes remove money from the people who would spend it best.

Edit To Add

Bigger Image

Corporate tax revenue is 333 billion growing.

www.usdebtclock.org...

That is about $1000 dollars per US citizen.

Corporate taxes are paid by consumers, and all taxes remove money from the people who would spend it best.

Edit To Add

Bigger Image

edit on 4-5-2016 by Semicollegiate because: (no reason given)

originally posted by: Semicollegiate

a reply to: Aazadan

Corporate tax revenue is 333 billion growing.

www.usdebtclock.org...

That is about $1000 dollars per US citizen.

Corporate taxes are paid by consumers, and all taxes remove money from the people who would spend it best.

I realize corporate taxes are paid by consumers. Maybe I haven't been clear in this thread, I'm actually in favor of a 0% corporate tax rate. I'm just not in favor of recouping that money through a sales tax. I think it works much more effectively to gather it through an income tax.

The wealthiest 1% would become even wealthier and the corporations would completely eradicate government and would have all the power.

Everything would become privatized.. education.. the police.. and it would be corrupted by the all powerful owners and CEOs who are in I only to make more $$.

Everything would become privatized.. education.. the police.. and it would be corrupted by the all powerful owners and CEOs who are in I only to make more $$.

What would happen if the corporate taxes were reduced to 0%?

For those that don't know, and sure ignore the hell out of.

Corporations are triple taxed.

www.investopedia.com...

Double taxation occurs because corporations are considered separate legal entities from their shareholders. As such, corporations pay taxes on their annual earnings, just as individuals do. When corporations pay out dividends to shareholders, those dividend payments incur income-tax liabilities for the shareholders who receive them, even though the earnings that provided the cash to pay the dividends were already taxed at the corporate level

The are taxed again via pay roll taxes paying employees social security and medicare contributions.

But that is only part of the equation.

Another part is the fact we ALL pay more for the labor to produce goods, and services that what it takes to 'make' them.

Reducing corporate taxes would do little.

It would help the little guys that by law have to form them or other business entities just to do business at all.

Most of those are CORPORATIONS.

originally posted by: Aazadan

a reply to: John_Rodger_Cornman

I don't follow his tax plan all that closely so I'm going to go by what's posted on his website

Today’s federal tax code does all the wrong things. It penalizes productivity, savings and investment, while rewarding inefficiency and designating winners and losers according to political whim. For far too long, tax laws have been used not just as a means to collect needed revenues, but as a weapon with which to manipulate our behavior, create and destroy industries and fulfill politicians’ dreams of social engineering. The result is a tax code that is more than 70,000 pages long enforced by a government agency with almost 100,000 employees.

It is nothing less than a massive deployment of government force on our lives, our finances and our freedom.

Governor Johnson advocates the elimination of tax subsidies, the double taxation embodied in business income taxes, and ultimately, the replacement of all income and payroll taxes with a single consumption tax that will allow every American and every business to determine their tax burden by making their own spending decisions. Taxes on purchases for basic necessities would be “prebated”, with all other purchases taxed equally regardless of income, status or purpose.

Many leading economists have long advocated such a shift in the way we are taxed, and Gary Johnson believes the time has come to eliminate the punishing tax code we have today and replace it with a system that rewards productivity, investment and savings. The IRS as we know it today would no longer be necessary, and Americans would no longer need to live in fear of the force of government being wielded under the guise of tax collection.

If I'm understanding it correctly, he essentially wants a VAT with no other taxation. The problem with this type of system is that lets say the tax is at 20%. A 20% tax on a lower class person making say 30k/year results in them being taxed on the full 30k. However, he wants to exempt the tax on savings and investments. That means that if a person makes 250k, they can put say 75k into savings, live on 175k and only pay tax on that 175k while also investing for the future on the rest, tax free. This means the person at 250k is paying an effective 14% rate, and if you're making a million but only spending 250k on living expenses you're only being taxed at 5%. This creates an inverted pyramid where the wealthy pay the lowest effective rate, and it shifts the tax burden to the poor. As I said before, you cannot shift the tax burden to the poor because they simply don't have the assets to tax.

Someone like Trump who is doing a "flat" tax is a bit more reasonable. He's using a progressive rate with a few flat brackets of 0, 10, 15, 20, and 25 (I think those are the brackets). Oddly enough, this plan actually represents a substantial increase over our current effective rates that are between 0 and 16% for most people.

In the end sales taxes don't work, because not enough goods are actually bought and sold to make any substantial taxation numbers. The real money flows through Wall Street and banking, not through buying a pair of shoes, or gardening supplies, or anything else.

"Under the FairTax, all Americans consume what they see as their necessities of life free of tax. While

permitting no exemptions, the FairTax (HR25 / S122) provides a monthly, universal prebate to ensure

that each family unit can consume tax-free up to the poverty level, with the overall effect of making the

FairTax progressive in application. This is not an entitlement, but a rebate (in advance) of taxes paid –

thus the term prebate. Everyone pays taxes at the cash register."

www.flfairtax.org...

So no this is not a burden on the poor and middle class.

a reply to: John_Rodger_Cornman

43% pay no federal income taxes

Sure doesn't.

Aint that a snip ?

People whining about corporations supposedly 'not' paying taxes. When they are getting triple taxed.

By people that really are not paying any income taxes.

So no this is not a burden on the poor and middle class.

43% pay no federal income taxes

Sure doesn't.

Aint that a snip ?

People whining about corporations supposedly 'not' paying taxes. When they are getting triple taxed.

By people that really are not paying any income taxes.

Coming from a pretty conservative individual, I think lowering corporate taxes is moronic. I would say they are at about an appropriate level. All we

need to do now is close the tax loopholes they use(and yes there are some out there), and more efficiently spend our taxes revenue. Those are where

the primary issues are.

originally posted by: John_Rodger_Cornman

"Under the FairTax, all Americans consume what they see as their necessities of life free of tax. While

permitting no exemptions, the FairTax (HR25 / S122) provides a monthly, universal prebate to ensure

that each family unit can consume tax-free up to the poverty level, with the overall effect of making the

FairTax progressive in application. This is not an entitlement, but a rebate (in advance) of taxes paid –

thus the term prebate. Everyone pays taxes at the cash register."

www.flfairtax.org...

So no this is not a burden on the poor and middle class.

It's still a burden on the poor because the wealthy don't spend more proportionate to their income. If you make 10x the average wage in the country you don't buy 10x as many pairs of jeans, or 10x as many pillows, or 10x the food. You might spend a little more per item but the percentages of your budget that these things take are smaller. Once you hit a certain point, you stop spending money on items that are going to be taxed at a cash register and instead begin to invest it. This causes a large portion of income to not be taxed, and instead your main tax base becomes the people who are spending 100% or near 100% of their income. The resulting tax base has far too little purchasing power, and that causes tax rates to be increased significantly.

A tax system cannot work when the poor and middle class are the largest contributors to it, unless you make some deep and significant spending cuts. And when I see deep and significant I'm talking, cutting budgets to 5% of what they are now, across the board, but society cannot function with so little tax revenue.

edit on 6-5-2016 by Aazadan because: (no reason given)

originally posted by: Aazadan

originally posted by: John_Rodger_Cornman

"Under the FairTax, all Americans consume what they see as their necessities of life free of tax. While

permitting no exemptions, the FairTax (HR25 / S122) provides a monthly, universal prebate to ensure

that each family unit can consume tax-free up to the poverty level, with the overall effect of making the

FairTax progressive in application. This is not an entitlement, but a rebate (in advance) of taxes paid –

thus the term prebate. Everyone pays taxes at the cash register."

www.flfairtax.org...

So no this is not a burden on the poor and middle class.

It's still a burden on the poor because the wealthy don't spend more proportionate to their income.

It is not about taxing the wealthy it's about lowering the cost for small business,creating jobs, and minimizing government by removing the IRS If you make 10x the average wage in the country you don't buy 10x as many pairs of jeans, or 10x as many pillows, or 10x the food. You might spend a little more per item but the percentages of your budget that these things take are smaller. Once you hit a certain point, you stop spending money on items that are going to be taxed at a cash register and instead begin to invest it. This causes a large portion of income to not be taxed, and instead your main tax base becomes the people who are spending 100% or near 100% of their income.How are they spending 100% of their income? The resulting tax base has far too little purchasing power, and that causes tax rates to be increased significantly.No. The fair tax rate is 23% with pre-bates for the poor

A tax system cannot work when the poor and middle class are the largest contributors to it,Isn't that how it is now? unless you make some deep and significant spending cuts.Corporations pass their triple taxation and overhead on to the consumer yet we can't afford to have the fairtax system. And when I see deep and significant I'm talking, cutting budgets to 5% of what they are now, across the board, but society cannot function with so little tax revenueThis is blatant FUD..

No it won't be a burden on the poor.

What about the small business that can hire more staff because they have more money to?

What about how much money we would save not having an IRS anymore?

www.wsj.com...

The top 20% of the US pay 84% of the federal income taxes.

edit on 6-5-2016 by John_Rodger_Cornman because: added content

a reply to: John_Rodger_Cornman

In order to raise enough revenue to matter, it would be a burden on the poor. I think I'm not explaining this concept clearly. Over a certain level of income (which varies by person), sales taxes cease to collect anything. You can exempt the first $X in spending if you want, that helps the poor but it ultimately doesn't matter. What does matter is that you don't collect anything from the wealthy. The amount spent at a cash register between people making $250k, $500k, $1 mil, and $2 mil is not all that different, and the person making $2 mil is certainly not spending 8x as much as the person making $250k. This ultimately creates a point that above a certain level of earnings, everything you make is tax free.

This creates a situation where you cannot tax the poor (even if you do, they don't have the assets to pay for it), you cannot tax the rich (they don't buy things you're taxing in large volume), and that just leaves the middle class. It's arguable if the middle class even has the assets to cover government budgets, but if they do you need a very high tax rate.

Oh, and the small business wouldn't hire more, because they would be increasing wages and costs in order to pay the sales tax.

In order to raise enough revenue to matter, it would be a burden on the poor. I think I'm not explaining this concept clearly. Over a certain level of income (which varies by person), sales taxes cease to collect anything. You can exempt the first $X in spending if you want, that helps the poor but it ultimately doesn't matter. What does matter is that you don't collect anything from the wealthy. The amount spent at a cash register between people making $250k, $500k, $1 mil, and $2 mil is not all that different, and the person making $2 mil is certainly not spending 8x as much as the person making $250k. This ultimately creates a point that above a certain level of earnings, everything you make is tax free.

This creates a situation where you cannot tax the poor (even if you do, they don't have the assets to pay for it), you cannot tax the rich (they don't buy things you're taxing in large volume), and that just leaves the middle class. It's arguable if the middle class even has the assets to cover government budgets, but if they do you need a very high tax rate.

Oh, and the small business wouldn't hire more, because they would be increasing wages and costs in order to pay the sales tax.

edit on 7-5-2016

by Aazadan because: (no reason given)

originally posted by: Aazadan

a reply to: John_Rodger_Cornman

In order to raise enough revenue to matter, it would be a burden on the poor.No. It won't be a burden on the poor. It would create thousands of jobs for the poor and middle class. I think I'm not explaining this concept clearly. Over a certain level of income (which varies by person), sales taxes cease to collect anything. You can exempt the first $X in spending if you want, that helps the poor but it ultimately doesn't matter. I thought it was a burden on the poor? What does matter is that you don't collect anything from the wealthy.Where did I say that the wealthy won't be taxed? The amount spent at a cash register between people making $250k, $500k, $1 mil, and $2 mil is not all that different, and the person making $2 mil is certainly not spending 8x as much as the person making $250k. This ultimately creates a point that above a certain level of earnings, everything you make is tax free.

No. Everyone pays a 23% consumption tax it does not vanish above a certain point.

This creates a situation where you cannot tax the poor (even if you do, they don't have the assets to pay for it), you cannot tax the rich (they don't buy things you're taxing in large volume), and that just leaves the middle class. It's arguable if the middle class even has the assets to cover government budgets, but if they do you need a very high tax rate.

Like I said. Corporations pass their costs on to the consumer so we are paying their taxes anyway.

Oh, and the small business wouldn't hire more, because they would be increasing wages and costs in order to pay the sales tax.

Yes they will hire more people to increase sales. The risks for hiring new employees would go down considerably.

edit on 7-5-2016 by John_Rodger_Cornman because: removed content

edit on 7-5-2016 by John_Rodger_Cornman because: added

content

Your reply style makes this hard to reply to.

If you want to collect responsible levels of income, then yes it's a burden on the poor and an even bigger burden on the middle class. Then again, Gary Johnson isn't interested in collecting a responsible level of income, he's the type of person that thinks the penny plan doesn't go far enough.

The wealthy don't spend their money in the same places as others. The concept of investing doesn't work if you place a consumption tax on it. If you make 250k, but you're only spending 50k in the stores, the remaining 200k is tax free. The ratio gets higher the more money you make.

You're paying a 23% consumption tax. Consumption taxes are applied to things like food, utilities, clothing, sometimes rent. The greater a percentage of your income these things are, the greater the percentage is of your income that gets taxed. When you make 20k, or even 100k this percentage is rather large. When you start making a lot of money though, your spending doesn't rise proportionally. Someone making 2 million doesn't spend 100x what the 20k person does on clothing or food. As a result, they end up with a lot of disposable income that gets invested rather than taxed.

If things work correctly, the risks are the same. The same amount of money is sucked out of the system. The corporation might not be directly paying taxes but the prices of their products go up. That means the consumer buys fewer things unless their wages also rise.

The only way you get to remove the risks to new employees is to make them less expensive but that typically comes in the form of tax credits. Something you completely remove the ability to implement under this system.

originally posted by: John_Rodger_Cornman

I thought it was a burden on the poor?

If you want to collect responsible levels of income, then yes it's a burden on the poor and an even bigger burden on the middle class. Then again, Gary Johnson isn't interested in collecting a responsible level of income, he's the type of person that thinks the penny plan doesn't go far enough.

Where did I say that the wealthy won't be taxed?

The wealthy don't spend their money in the same places as others. The concept of investing doesn't work if you place a consumption tax on it. If you make 250k, but you're only spending 50k in the stores, the remaining 200k is tax free. The ratio gets higher the more money you make.

No. Everyone pays a 23% consumption tax it does not vanish above a certain point.

You're paying a 23% consumption tax. Consumption taxes are applied to things like food, utilities, clothing, sometimes rent. The greater a percentage of your income these things are, the greater the percentage is of your income that gets taxed. When you make 20k, or even 100k this percentage is rather large. When you start making a lot of money though, your spending doesn't rise proportionally. Someone making 2 million doesn't spend 100x what the 20k person does on clothing or food. As a result, they end up with a lot of disposable income that gets invested rather than taxed.

Yes they will hire more people to increase sales. The risks for hiring new employees would go down considerably.

If things work correctly, the risks are the same. The same amount of money is sucked out of the system. The corporation might not be directly paying taxes but the prices of their products go up. That means the consumer buys fewer things unless their wages also rise.

The only way you get to remove the risks to new employees is to make them less expensive but that typically comes in the form of tax credits. Something you completely remove the ability to implement under this system.

new topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 5 hours ago -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 5 hours ago -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 7 hours ago -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 9 hours ago -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 11 hours ago

top topics

-

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness: 12 hours ago, 24 flags -

George Knapp AMA on DI

Area 51 and other Facilities: 5 hours ago, 19 flags -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness: 13 hours ago, 18 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 7 hours ago, 7 flags -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest: 13 hours ago, 7 flags -

Russian intelligence officer: explosions at defense factories in the USA and Wales may be sabotage

Weaponry: 17 hours ago, 6 flags -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs: 11 hours ago, 5 flags -

The Tories may be wiped out after the Election - Serves them Right

Regional Politics: 9 hours ago, 3 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 5 hours ago, 3 flags -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works: 12 hours ago, 3 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 385 • : Vermilion -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 127 • : marg6043 -

Two Serious Crimes Committed by President JOE BIDEN that are Easy to Impeach Him For.

US Political Madness • 16 • : WeMustCare -

911 emergency lines are DOWN across multiple states

Breaking Alternative News • 6 • : nugget1 -

BREAKING: O’Keefe Media Uncovers who is really running the White House

US Political Madness • 12 • : Kaiju666 -

Biden--My Uncle Was Eaten By Cannibals

US Political Madness • 46 • : CarlLaFong -

Do we live in a simulation similar to The Matrix 1999?

ATS Skunk Works • 21 • : ByeByeAmericanPie -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 8 • : theatreboy -

I Guess Cloud Seeding Works

Fragile Earth • 25 • : Degradation33 -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 534 • : cherokeetroy