It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

3

share:

Hola fellow compadres,

I'm not sure if this is the appropriate forum to post this in, but if it's not someone feel free to move it.

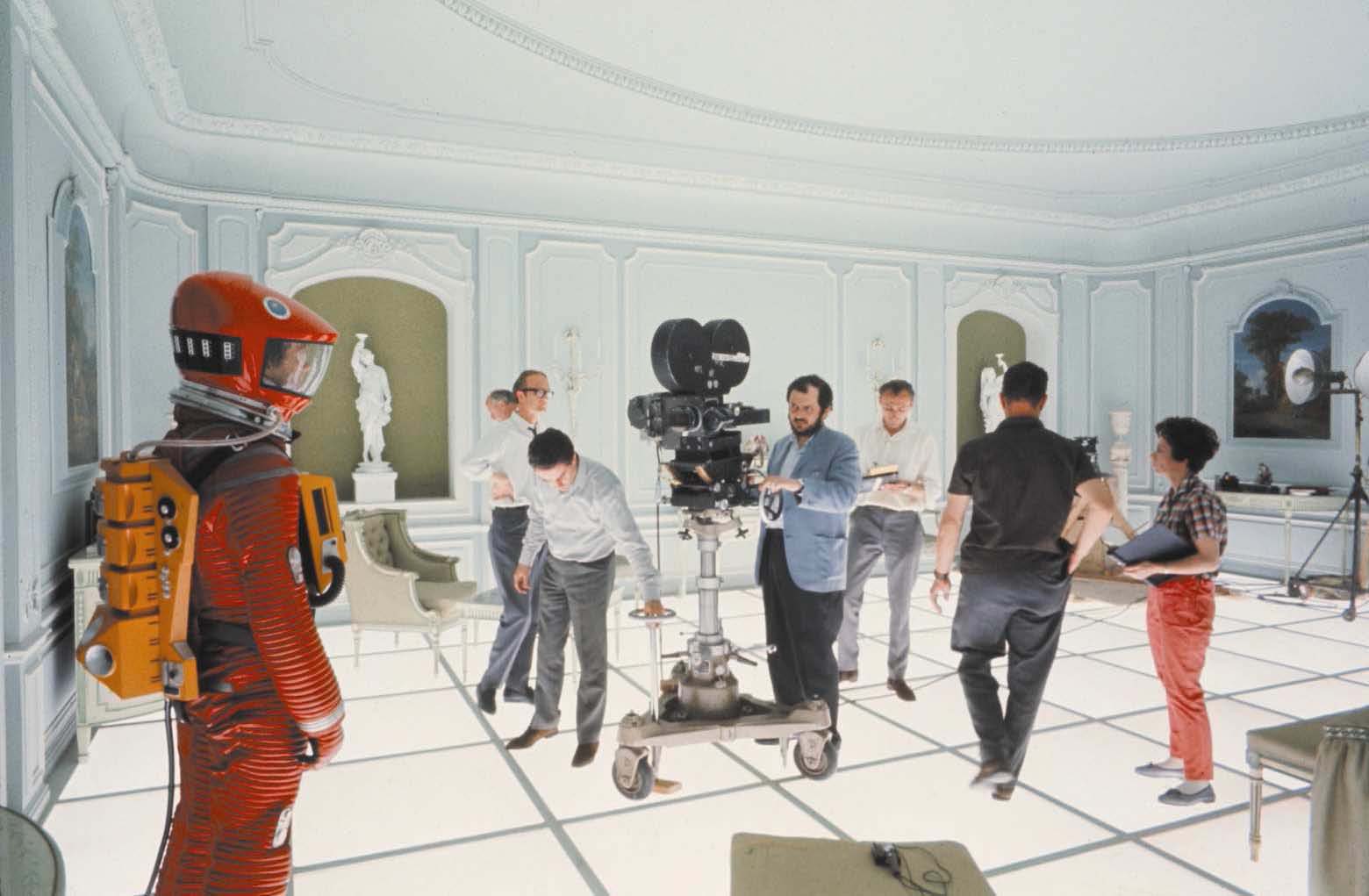

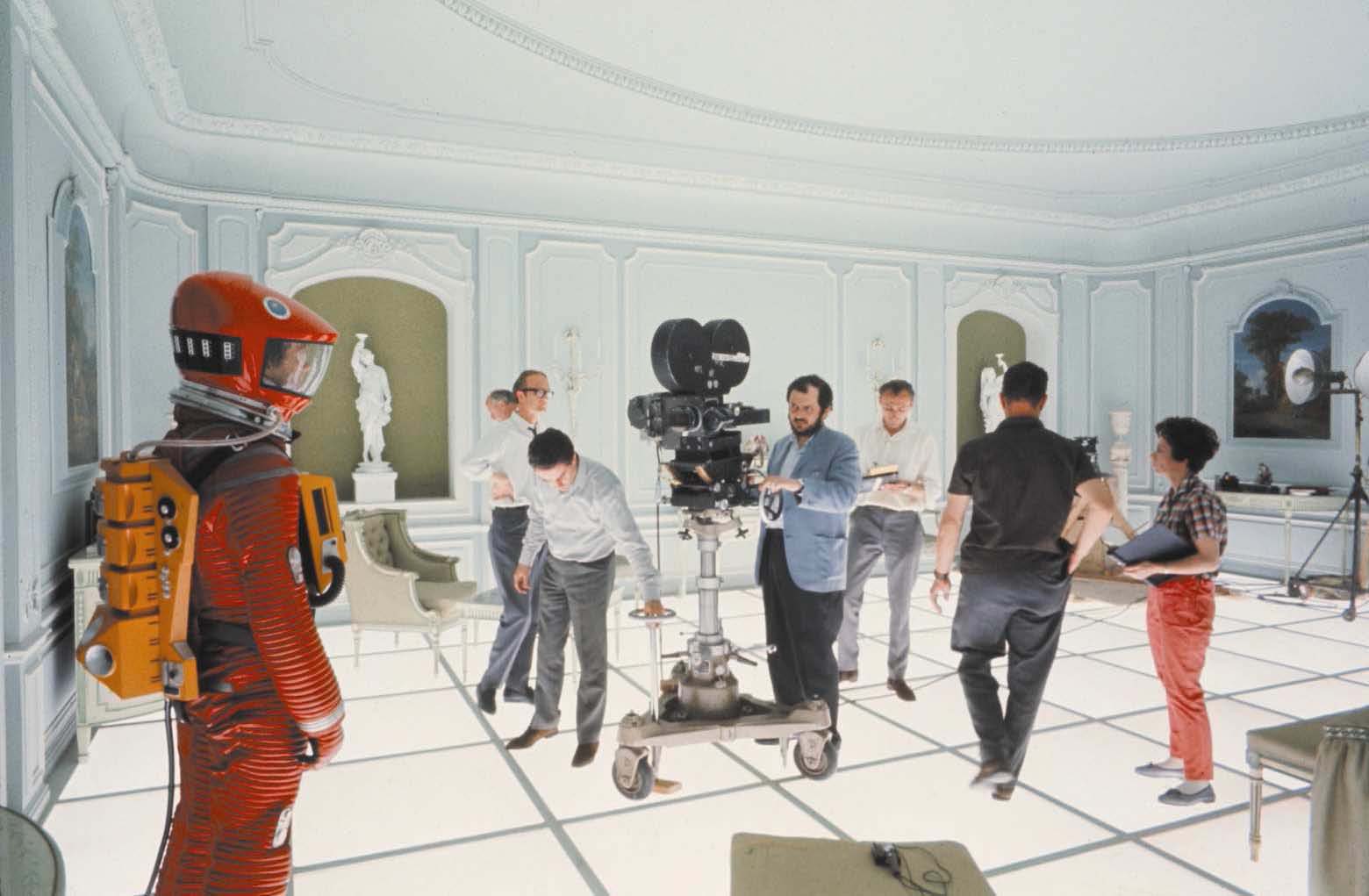

Panama Papers: What Stanley Kubrick Can Teach You About Tax Shelters

Stanley Kubrick is arguably one of the greatest filmmakers of in the history of cinema. Personally, Kubrick & Lynch are tied for my all-time favorite director. I frequently search the internet news sources for filmmakers I like to see what they're up to or in this case what the benefactors of Kubrick's estate are up to:

Even though Kubrick was pretty much non-religous, clearly he had always remained tapped into his Jewish roots. And I don't mean that in a derogatory way I just mean it simply as a fact that most Jewish people learn through their family & community, the most efficient means for managing money. The Rothschild central banking system is a perfect example.

See those bolds up there? They couldn't be more incorrect. Vivian Kubrick became a Scientologist during the filming for Eyes Wide Shut and hasn't spoken to or seen her family since her father's death. Meh, I'm just gonna save that for another thread...

Anyways:

Funny, I didn't think 20 Million would be within the 1%. Maybe like top 5%? There are a lot of billionaires now.

So this really isn't some huge bombshell about Kubrick, unless you believe that by dodging taxes and hiding his assets he's contributed to the slow erosion of public services and infrastructure.

So what do you think about it? Most of us, myself included, were ready to call out all the world leaders and politicians for funneling money and not being transparent. Should artists and entertainers be held to the same standard of transparency? Do you think what Kubrick did to preserve his fortune was unjustified & shady? Surely we can't always hate the player for playing by the rules. After all, most of us don't write the rules, we are just playing the game. And so far nothing Kubrick has done with his fortune was illegal.

I'm not sure if this is the appropriate forum to post this in, but if it's not someone feel free to move it.

Panama Papers: What Stanley Kubrick Can Teach You About Tax Shelters

Stanley Kubrick is arguably one of the greatest filmmakers of in the history of cinema. Personally, Kubrick & Lynch are tied for my all-time favorite director. I frequently search the internet news sources for filmmakers I like to see what they're up to or in this case what the benefactors of Kubrick's estate are up to:

Stanley Kubrick once wrote the script to a film called I Stole 16 Million Dollars that was rejected by Kirk Douglas as badly written and never got made. Because of the Panama Papers, we now know that Kubrick’s millions were concealed in tax shelters, along with the riches of hundreds of other Americans.

Kubrick, a famously eccentric filmmaker, was less known for being savvy with his taxes—but it turns out he was, both in and out of Hollywood. Kubrick moved to the English countryside in the early 1960s while working on Lolita because “there was a tax allowance for American films,” according to his wife, Christiane, a German who still lives at their 18th-century country manor in Hertfordshire.

When Kubrick died in March 1999, just after filming Eyes Wide Shut (much of it shot at his English country manor [actually incorrect, almost all of it was shot at Mentmore Towers & Elstree Studios]), he had an estimated net worth of $20 million. As has now been revealed by the Panama Papers, at least a part of that fortune—and probably a substantial part—was his country manor, purchased in 1978, which was transferred to offshore companies controlled by his family.

According to the Panama Papers, the companies were registered in the British Virgin Islands and consisted of shares that were distributed to trusts held by Kubrick’s children and grandchildren. This arrangement is believed to have saved the Kubrick family hundreds of thousands of dollars in inheritance taxes at the low end, and possibly millions at the high end. There’s no immediate indication Kubrick was doing anything illegal.

Even though Kubrick was pretty much non-religous, clearly he had always remained tapped into his Jewish roots. And I don't mean that in a derogatory way I just mean it simply as a fact that most Jewish people learn through their family & community, the most efficient means for managing money. The Rothschild central banking system is a perfect example.

The reason Kubrick took such pains to keep the house in his family is not hard to fathom: He chose to be buried on the grounds of Childwickbury Manor, under his favorite tree. One of his two daughters with Christiane, Anya, who died later in 2009, is also buried on the 1,100-acre estate. Christiane now lives at the manor with her other daughter by Kubrick, Vivian, and a third daughter she’d had prior to their marriage, Katharina, as well as her grandchildren. After shooting scenes there for the end of Kubrick’s 1980 film The Shining, which featured some of the grounds, Jack Nicholson once observed that Childwickbury Manor was, more or less, a family compound, and that Kubrick was “very much a family man.”

See those bolds up there? They couldn't be more incorrect. Vivian Kubrick became a Scientologist during the filming for Eyes Wide Shut and hasn't spoken to or seen her family since her father's death. Meh, I'm just gonna save that for another thread...

Anyways:

Documents from Mossack Fonseca show Kubrick created tax shelters to protect not just the value and ownership of his home, but also profits from some of his movies through a complex network of offshore companies. Others who were named included Hong Kong entertainer Jackie Chan; TV personality Simon Cowell; the ex-wife of Paul McCartney, Heather Mills; and a billionaire American DreamWorks co-founder, David Geffen.

Since the Panama Papers first came to light, there’s been widespread revulsion toward those who attempt to shield their riches from taxes—not just those abusing offshore tax havens for criminal or money-laundering purposes. “We’ve had another reminder in this big dump of data coming out of Panama that tax avoidance is a big, global problem,” President Barack Obama said last week, calling on Congress to do more. “It’s not unique to other countries. A lot of it is legal, but that is exactly the problem. It’s not that they’re breaking the laws, it’s that the laws are so poorly designed.”

In fact, what the scandal really shows is that the laws are poorly designed for everyone—the poor, the super-rich billionaires and those somewhere in between, like Kubrick, whose millions place them well within the 1 percent, but not in the same league as Bill Gates.

Funny, I didn't think 20 Million would be within the 1%. Maybe like top 5%? There are a lot of billionaires now.

As an American, Kubrick would have had to pay U.S. taxes in addition to U.K. taxes, subject to treaties, even though he had lived in the U.K. since the 1960s. While billionaires like Geffen will still have some billions to pass down to family members after inheritance taxes, the heirs of someone like Kubrick might have to sell his home to pay the tax bill. And yet the two are in the same bracket for inheritance tax.

In other words, once you have more than $5.43 million in the U.S. or 325,000 pounds in the U.K., you have enormous incentive to start looking into tax shelters. Although many start looking into them sooner. This is how money is drained from the broader global financial system, chipping away at public services and, ultimately, raising the tax burden for those who cannot afford the accountants and lawyers required to arrange tax deals that, as Obama said last week, are “gaming the system.”

For someone like Kubrick, the question becomes, if you don’t shelter your assets from taxes, are you prepared to potentially see your family lose its home?

So this really isn't some huge bombshell about Kubrick, unless you believe that by dodging taxes and hiding his assets he's contributed to the slow erosion of public services and infrastructure.

So what do you think about it? Most of us, myself included, were ready to call out all the world leaders and politicians for funneling money and not being transparent. Should artists and entertainers be held to the same standard of transparency? Do you think what Kubrick did to preserve his fortune was unjustified & shady? Surely we can't always hate the player for playing by the rules. After all, most of us don't write the rules, we are just playing the game. And so far nothing Kubrick has done with his fortune was illegal.

a reply to: ColdWisdom

Many people have a misconception of who the 1% are.

money.cnn.com...

Funny, I didn't think 20 Million would be within the 1%. Maybe like top 5%? There are a lot of billionaires now.

Many people have a misconception of who the 1% are.

money.cnn.com...

It takes at least $389,000 to make the club: That was the minimum threshold of adjusted gross income in 2011, the most recent year for which the IRS has final data.

a reply to: queenofswords

CNN didn't make it clear in that link (and neither did the link in my OP) whether they are talking about the 1% of the US or the 1% of the world economy. Still I think the 1% mark bottoms out at around 50 million (in the global economy).

Now how about you post something referring to Kubrick & the Panama Papers.

CNN didn't make it clear in that link (and neither did the link in my OP) whether they are talking about the 1% of the US or the 1% of the world economy. Still I think the 1% mark bottoms out at around 50 million (in the global economy).

Now how about you post something referring to Kubrick & the Panama Papers.

a reply to: ColdWisdom

Accuracy is important to understand the scope.

www.investopedia.com...

As far as Kubrick goes, if he did nothing illegal, then I don't have a beef.

Accuracy is important to understand the scope.

But policy concerns aside, this raises an interesting question: Who exactly are the 1% ? The surprising answer: If you’re an American, you don’t have to be even close to uber-rich to make the list.

Ranking by Income

According to the Global Rich List, a website that brings awareness to worldwide income disparities, an income of $32,400 a year will allow you to make the cut. Using current exchange rates, that amounts to roughly:

Making 1% Ranks in U.S.

Of course, Americans live in the United States, contending with U.S. prices. Who constitutes the 1% if you just look at the U.S.? Not surprisingly, it takes a massively higher income to crack the top percentile of wage earners: You’d have to make $434,682 in adjusted gross income to make the cut, according to the non-partisan Tax Foundation.

And to rank amongst the highest 1% of Americans by wealth? That requires net assets of more than $7 million, based on the latest Federal Reserve figures.

www.investopedia.com...

As far as Kubrick goes, if he did nothing illegal, then I don't have a beef.

a reply to: ColdWisdom

Believe it or not, but the stats are even worse than that for the rest of the population. Something like 80% of the world's population lives off of $10 a day or less ($3,650/year). And around 40% of the world's population lives off of $2.50 a day or less ($912.50/year). Places like Bangladesh have minimum wages of less than 40 cents an hour, which is why so many clothing companies make their products there. (note: I haven't checked those stats lately, but it should still be relatively close to that.)

As for Kubrick, the article says it all appears legal so far, even though it saved his family a lot of money in inheritance taxes. And I'm not too confident that any major laws will be passed to change this system. I can't imagine a lot of powerbrokers choosing to increase their personal taxes, much less the taxes of their friends, families, and major donors.

Believe it or not, but the stats are even worse than that for the rest of the population. Something like 80% of the world's population lives off of $10 a day or less ($3,650/year). And around 40% of the world's population lives off of $2.50 a day or less ($912.50/year). Places like Bangladesh have minimum wages of less than 40 cents an hour, which is why so many clothing companies make their products there. (note: I haven't checked those stats lately, but it should still be relatively close to that.)

As for Kubrick, the article says it all appears legal so far, even though it saved his family a lot of money in inheritance taxes. And I'm not too confident that any major laws will be passed to change this system. I can't imagine a lot of powerbrokers choosing to increase their personal taxes, much less the taxes of their friends, families, and major donors.

But do you think the laws should be changed? It's pretty lame if all the public services, roads, and hospitals etc, are losing out on budget

surpluses because the nation's most wealthy pay the least in taxes. What kind of incentives could the United States offer the the wealthy that would

motivate them to declare more of their income?

a reply to: ColdWisdom

They should definitely be changed. Then again, I'm a socialist so of course I'd say that. lol I don't have a problem with people making large amounts of money, just as long as there's a strong social safety net for everyone else. Well, and as long as everyone else has a chance to improve their economic conditions too (so technically, I like a mix of socialism and capitalism).

They should definitely be changed. Then again, I'm a socialist so of course I'd say that. lol I don't have a problem with people making large amounts of money, just as long as there's a strong social safety net for everyone else. Well, and as long as everyone else has a chance to improve their economic conditions too (so technically, I like a mix of socialism and capitalism).

a reply to: ColdWisdom

4 simple tax reforms to stop the high end tax cheats

•All accounts of all companies on public record

•All beneficial ownership on public record, proven by a requirement that banks confirm the beneficial ownership of companies they provide services to

•Directorships on public record

•Forcing trusts to be on public record.

Do you think your sevant government who claims to govern only the with consent of the govverned will implement these reforms?

4 simple tax reforms to stop the high end tax cheats

•All accounts of all companies on public record

•All beneficial ownership on public record, proven by a requirement that banks confirm the beneficial ownership of companies they provide services to

•Directorships on public record

•Forcing trusts to be on public record.

Do you think your sevant government who claims to govern only the with consent of the govverned will implement these reforms?

a reply to: Azureblue

No, because if any one of those things you listed became a reality then I think even more corporations and wealthy individuals will book their money off shore.

I asked what kind of incentives could the US Government offer its citizens and companies to motivate them to declare more of their income. Not what kind of regulations could we pass.

Although I am in favor of all of those things, sort of. Bitcoin & Blockchain may be the nearest solution to the transparency issue.

Do you think your sevant government who claims to govern only the with consent of the govverned will implement these reforms?

No, because if any one of those things you listed became a reality then I think even more corporations and wealthy individuals will book their money off shore.

I asked what kind of incentives could the US Government offer its citizens and companies to motivate them to declare more of their income. Not what kind of regulations could we pass.

Although I am in favor of all of those things, sort of. Bitcoin & Blockchain may be the nearest solution to the transparency issue.

originally posted by: ColdWisdom

a reply to: Azureblue

Do you think your sevant government who claims to govern only the with consent of the govverned will implement these reforms?

No, because if any one of those things you listed became a reality then I think even more corporations and wealthy individuals will book their money off shore.

I asked what kind of incentives could the US Government offer its citizens and companies to motivate them to declare more of their income. Not what kind of regulations could we pass.

Although I am in favor of all of those things, sort of. Bitcoin & Blockchain may be the nearest solution to the transparency issue.

Its good that you raised the question of whether or not will electronic money eliminate tax havens. I doubt it myself as I think the money in tax havens, accounts is in all likelyhood, electronic money anyway, so despite the talk in recent times about why the govt wants to abolish cash, I don't think either electronic bitcoin of electronic cash will fix the problem.

I think the issue is the transparency of banking laws.

thanks

a reply to: Azureblue

That's certainly one of the many big issues. And Blockchain Technology is already being adopted by some banking systems throughout the world because of its public ledger system.

I think the issue is the transparency of banking laws.

That's certainly one of the many big issues. And Blockchain Technology is already being adopted by some banking systems throughout the world because of its public ledger system.

President and Chairman of the Communist Party, Xi Jinping is probably in the 1%, unlike Stanley Kubrick. Xi was able to use online agents and other

means to direct attention away from his brother-in-law and toward Prime Minister of England, David Cameron, after the second scandal involving

ultra-wealthy Chinese citizens, breaking Chinese laws, by moving money into foreign banks. In a misinformation project aimed at blaming "The West" for

creating the Panama Papers, Xi agents were also able to direct attention at "friends" of President Putin of Russia, without naming the alleged

"friends." The law firm, Mossack Fonseca that leaked news of the Panama Papers has more offices in China than ANY other nation. Read this news, which

is over two years old that features the original scandal in the Panama Papers:

www.theguardian.com...

a reply to: queenofswords

a reply to: queenofswords

edit on 24-4-2016 by Jeffersons111Ghost because: Not enough information was provided in the original post. In upcoming posts, more information

will become obvious to readers.

edit on 24-4-2016 by Jeffersons111Ghost because: (no reason given)

edit on 24-4-2016

by Jeffersons111Ghost because: puntuation correction

a reply to: Jeffersons111Ghost

That's very interesting. I did not know that. Welcome to ATS by the way.

The law firm, Mossack Fonseca that leaked news of the Panama Papers has more offices in China than ANY other nation.

That's very interesting. I did not know that. Welcome to ATS by the way.

new topics

-

A man of the people

Diseases and Pandemics: 3 minutes ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 26 minutes ago -

4 plans of US elites to defeat Russia

New World Order: 1 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 5 hours ago -

12 jurors selected in Trump criminal trial

US Political Madness: 8 hours ago -

Iran launches Retalliation Strike 4.18.24

World War Three: 8 hours ago -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 8 hours ago

top topics

-

George Knapp AMA on DI

Area 51 and other Facilities: 14 hours ago, 25 flags -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 8 hours ago, 16 flags -

Louisiana Lawmakers Seek to Limit Public Access to Government Records

Political Issues: 16 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 8 hours ago, 6 flags -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs: 14 hours ago, 5 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 5 hours ago, 4 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 8 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 1 hours ago, 2 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 26 minutes ago, 0 flags -

A man of the people

Diseases and Pandemics: 3 minutes ago, 0 flags

active topics

-

Russia Flooding

Fragile Earth • 17 • : Kurokage -

So I saw about 30 UFOs in formation last night.

Aliens and UFOs • 30 • : BrotherKinsMan -

A man of the people

Diseases and Pandemics • 0 • : PrivateAngel -

The Acronym Game .. Pt.3

General Chit Chat • 7729 • : CCoburn -

It has begun... Iran begins attack on Israel, launches tons of drones towards the country

World War Three • 889 • : bally001 -

12 jurors selected in Trump criminal trial

US Political Madness • 23 • : gspatfound -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics • 0 • : BrotherKinsMan -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 62 • : whereislogic -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 538 • : cherokeetroy -

4 plans of US elites to defeat Russia

New World Order • 6 • : andy06shake

3