It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Pharmaceutical giant Pfizer Inc. will save nearly $35 billion in U.S. taxes over a decade through its merger with Irish drugmaker Allergan PLC because it will avoid paying tax on $148 billion in earnings stashed offshore, according to a report by Americans for Tax Fairness released on Thursday.

Source

Woah, how are they doing this?

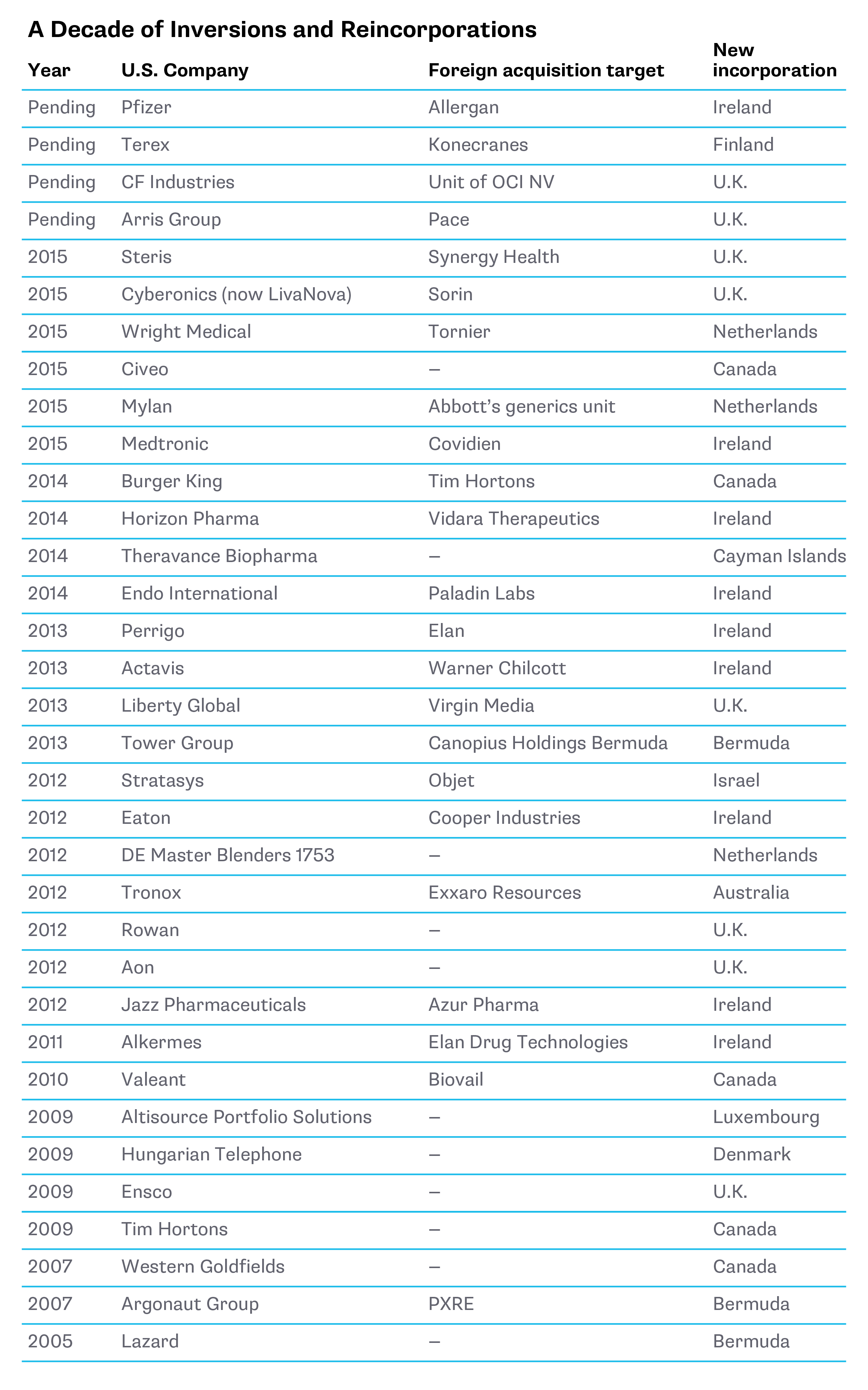

Pfizer is the latest of many corporations "relocating" outside of the US to obtain lower taxes. The $160 billion Pfizer-Allergan deal will be the largest so-called inversion transaction to date.

Invers-what now?

"Inversion." Let's talk about inversions.

Tax inversion, or corporate inversion, is a largely American term for the relocation of a corporation's legal domicile to a lower-tax nation, or corporate haven, usually while retaining its material operations in its higher-tax country of origin. Most companies achieve inversion by acquiring a foreign company at least 25 percent their size. Companies are free to keep their top executives in the US, and most of them do.

About 51 US companies have reincorporated in low-tax countries since 1982, including 20 since 2012.

Those companies include Medtronic, the medical device giant founded in a Minneapolis garage in 1949, turned Irish, and Burger King, the Miami fast-food chain that became Canadian.

So companies do this to lower their taxes?

It seems. The US corporate income tax rate is the highest in the developed world.

The main reason [for inversions] is that the corporation tax regime in the US is the most demanding among developed economies. American firms are taxed on their domestic earnings at up to 39%, and also on income repatriated from foreign subsidiaries.

For example, a US firm with a subsidiary based in Dublin pays the 12.5% headline rate of corporation tax in Ireland. The US taxman then levies a 26.5% rate on earnings from that subsidiary that flow back to America. That means the company’s overall tax bill has effectively been topped up to the domestic rate of up to 39%.

Most other countries impose a much lower rate than the US on repatriated earnings. If a company can shift its country of incorporation, the US taxman loses the right to take a slice of income from foreign subsidiaries.

This system has led American firms to stash an estimated $2 trillion overseas, rather than repatriate the money. It is also seen as a key motivation behind most tax inversions.

Source

Wait a second, isn't there a law that prohibits inversions?

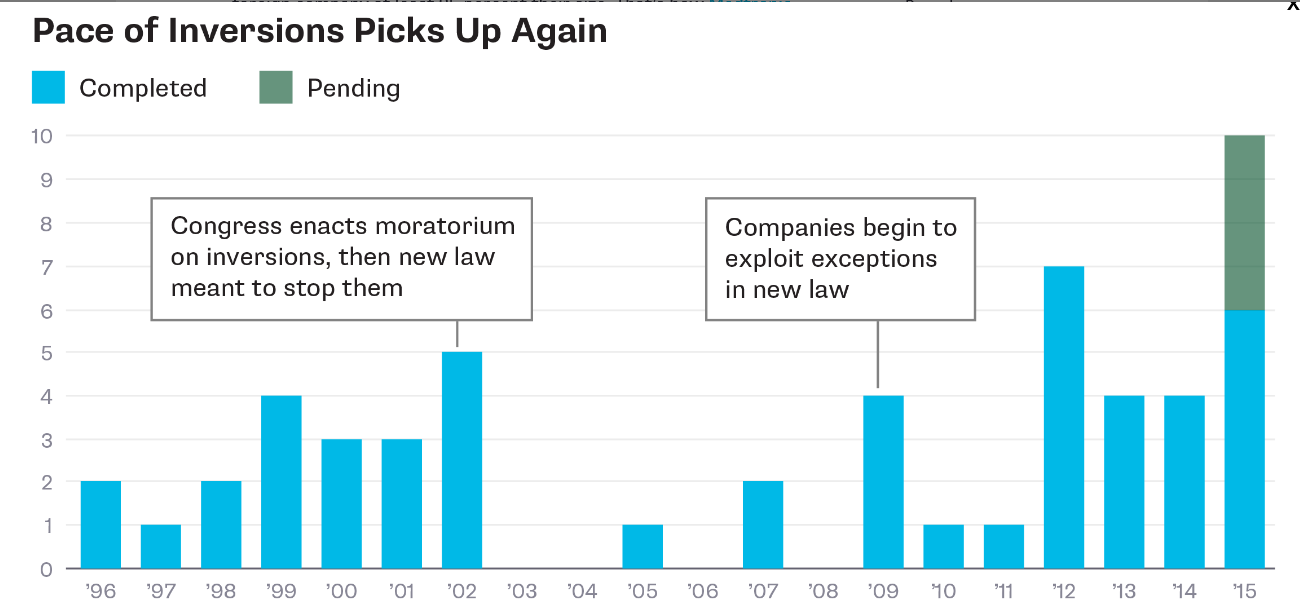

Well, sort of. In 2004, legislators passed a law that was promised to end the practice of corporate inversions. Companies have managed to find a way around that law as well as further attempts by the Obama administration to tighten the rules to limit inversions.

Okay, so what's the deal?

In a November 2014 notice, the Treasury said it was going to issue regulations to prevent hopscotch loans, but the rules would apply only to inverted companies whose former shareholders own at least 60 percent of the new foreign parent. The Pfizer-Allergan deal would not run afoul of the rules because it is structured such that the former Pfizer shareholders retain only 56 percent ownership of the new company, ATF said.

“The rule’s prohibition on ‘hopscotch loans,’ which are used by inverted corporations to dodge U.S. taxes owed on offshore profits at the time of the inversion, should be applied to all foreign acquisitions of U.S. corporations,” ATF said.

Pfizer said in a statement that the inversion deal "is not structured to move jobs out of the United States, where we conduct the majority of our research." The merger with Allergan "will create a global, R&D-focused company," the statement said.

How can we stop this?

President Obama has called such companies “corporate deserters” who are being “unpatriotic” by seeking to reduce their contribution to US coffers.

For the most part, though, US politicians have been happy enough for companies to buy foreign firms when the deal makes obvious sense, even if the end result is a lower tax bill. What many object to is an artificial takeover designed purely to avoid tax.

This was the take of the US treasury secretary, Jack Lew, in an editorial written for the Washington Post: “There is nothing wrong with cross-border merger activity; our economy is stronger for our investment overseas and for foreign investment in the United States. But these activities should be based on economic efficiency, not tax savings.”

In fact, both Democrats and Republicans want to end inversions. Like everything, however, the two sides disagree on how to fix the problem.

Republicans call them the inevitable consequence of a flawed tax system, and say the only solution is a full revamp of the tax code, including lowering the corporate rate and limiting taxes on foreign profits.

Although some Democrats agree on the broad outlines of a corporate-tax revision — Obama’s 2016 budget calls for lowering domestic and foreign rates — the parties disagree on so many other things that there’s little chance that a big tax bill will pass Congress any time soon.

Unfortunately, despite this general disapproval, inversions are on the rise.

edit on 26-2-2016 by ExNihiloRed because: (no reason given)

"We Need to Stop This!"

Ok, try adopting Ireland's tax system..

These companies are only doing the sensible thing in response to America's insane tax laws. I'm looking at working overseas just to travel a bit in my youth and... jeez, being an American being makes doing that 10 times harder than being a citizen of any other first world country.

I think that a lot of overseas companies straight up implicitly ban Americans from working for them and don't allow American investors because of the effects our crazy tax system would have on them once they did so.

Try doing anything in your working life more complex than filling out a 1040-EZ and America's tax laws make your head spin, and honestly -- scared.

Ok, try adopting Ireland's tax system..

These companies are only doing the sensible thing in response to America's insane tax laws. I'm looking at working overseas just to travel a bit in my youth and... jeez, being an American being makes doing that 10 times harder than being a citizen of any other first world country.

I think that a lot of overseas companies straight up implicitly ban Americans from working for them and don't allow American investors because of the effects our crazy tax system would have on them once they did so.

Try doing anything in your working life more complex than filling out a 1040-EZ and America's tax laws make your head spin, and honestly -- scared.

edit on 2/26/16 by RedDragon because: (no reason given)

edit on 2/26/16 by RedDragon because: (no reason

given)

It's out of our ability to control it.

If you haven't noticed, everything that keeps happening is a move towards globalism and global government in order to regulate the mega corps.

In other news the US added 700,000 Macdonalds jobs!

If you haven't noticed, everything that keeps happening is a move towards globalism and global government in order to regulate the mega corps.

In other news the US added 700,000 Macdonalds jobs!

a reply to: ExNihiloRed

Corporations Quest, to make the World a Ghetto. Great, then see how well your stinking products sell.

Corporations Quest, to make the World a Ghetto. Great, then see how well your stinking products sell.

Well all we keep hearing about is this "Global" trade etc. etc.

Makes sense for companies to "relocate" as long as the U.S. is way behind in the tax structures.

Not to mention all the recent "talk" of higher taxes to fund social programs that are already riddled with corruption on multiple levels.

Makes sense for companies to "relocate" as long as the U.S. is way behind in the tax structures.

Not to mention all the recent "talk" of higher taxes to fund social programs that are already riddled with corruption on multiple levels.

Leave or not they are already getting away w MURDER

and should pay an income tax of 28% just like rest of us.

If all Corps actually paid what they owe

Bernies ideas could not only be a reality but we could

gold plate our schools and institutions just for the bling factor.

These "ideas" are made by the 600 billionaires on the planet,

and all this does is make them richer.

The fact they are already billionaires should be enough perk.

I say no tax havens anywhere ! Don't like it ? Don't have a business.

and should pay an income tax of 28% just like rest of us.

If all Corps actually paid what they owe

Bernies ideas could not only be a reality but we could

gold plate our schools and institutions just for the bling factor.

These "ideas" are made by the 600 billionaires on the planet,

and all this does is make them richer.

The fact they are already billionaires should be enough perk.

I say no tax havens anywhere ! Don't like it ? Don't have a business.

edit on 26-2-2016 by UnderKingsPeak because: 600 vs 7,500,000,000 seems

fair

So how does this tax thing work anyhow?

Toyota sells loads of cars in america. Do they pay income tax on those sales?

Pfizer makes and sells drugs overseas and in america. Do they pay tax on American sales?

Toyota sells loads of cars in america. Do they pay income tax on those sales?

Pfizer makes and sells drugs overseas and in america. Do they pay tax on American sales?

originally posted by: Bluntone22

So how does this tax thing work anyhow?

Toyota sells loads of cars in america. Do they pay income tax on those sales?

Pfizer makes and sells drugs overseas and in america. Do they pay tax on American sales?

Foreign Cars Made in America: Where Does the Money Go

Why are Americans complaining about tax avoidance ?

The U.S. was founded on that very issue. What goes around comes around.

The U.S. was founded on that very issue. What goes around comes around.

a reply to: alldaylong

I'm pretty sure the lack of representation was what that issue was. Kind of like what's fueling a lot of the political climate this year.

As for the OP:

This is what happens when government taxes corporations and small businesses to the point of no return. They go out of business, or if they're rich enough, they move. GE moving out of Connecticut is a perfect example. The same thing might happen in Oregon with three huge companies if the state's tax plans go through in 2016.

Companies warn Oregon: Tax us and we might move

I'm pretty sure the lack of representation was what that issue was. Kind of like what's fueling a lot of the political climate this year.

As for the OP:

This is what happens when government taxes corporations and small businesses to the point of no return. They go out of business, or if they're rich enough, they move. GE moving out of Connecticut is a perfect example. The same thing might happen in Oregon with three huge companies if the state's tax plans go through in 2016.

Companies warn Oregon: Tax us and we might move

John North, the vice president of finance for Ashland-based Lithia Motors, said the auto retailer would see almost all its profits from Oregon stores wiped out under a tax measure headed toward the November 2016 ballot.

"That's not really sustainable," said North, adding that Lithia, one of the state's three Fortune 500 companies, might reduce its presence in Oregon if the measure passes.

"Everything is on the table," he said. "We may have to change our headquarters."

edit on 2/26/2016 by EternalSolace because: Clarity

originally posted by: onequestion

It's out of our ability to control it.

Lower corperate tax.....There solved

The same trick is being used in UK and it is crippling our economy. At the same time wee companies get hounded by the tax office for owing a couple of

thousand pounds. The companies are doing nothing illegal, it is the fault of the government, who are basically owned by these corporations, who are

not closing the loopholes. The very same loopholes that have made their own families super rich, so it is no surprise they are doing nothing to change

the law. On top of that the big corporations hold the government over a barrel with threats of relocating to other countries and closing premises

here, thus creating massive unemployment on top of the huge unemployment we already have.

Okay, so is Ireland seeing a TON of new jobs because these companies are "moving" there? It seems to me they're moving there on paper-only, for the

most part. It's not like they're moving their entire corporate headquarters and manufacturing there. It's not like Ireland now doesn't have enough

people to fill all the jobs these companies are bringing.

So clearly, if we lowered our corporate taxes it wouldn't suddenly make everything unicorns and friggen rainbows people. Come on.

This is all about greed, pure and simple -- and pleasing the shareholders.

Unless the USA had the ABSOLUTE LOWEST TAXES ON EARTH, companies are going to go where they pay the least taxes.

I say, if you want to be considered a corporation in the USA, have patent and copyright protection under US law -- you can't do this. If you want to market and sell a product in the USA, then you have to pay fair taxes from your business. None of this hiding behind tax haven crap. If the bulk of your executive workforce is here in the USA, we slap tax liens on you, revoke your corporate charter, tear up your patents and kick you out.

If you want to operate out of Ireland, do it. Ask them to protect your intellectual property and enforce it. Ask Ireland to give you all of the same protections and advantages of the USA.

And above all else? We need to stop this corporation crap. Way back, it used to be pretty hard to get incorporated and you needed a damn good reason before you got a nod from the government to allow all the protections and advantages it grants.

I've seen some really good private companies go downhill fast (well they made more profit but the overall product suffered, employees suffered, economy suffered) due to going public.

They call it going "public" by offering shares...but in the end the company is really controlled by a handful of people with stock options and large chunks of stock. It's not like if I have 250 shares in Apple I can really voice a concern and be heard. I wouldn't even own .5 percent of the company.

So clearly, if we lowered our corporate taxes it wouldn't suddenly make everything unicorns and friggen rainbows people. Come on.

This is all about greed, pure and simple -- and pleasing the shareholders.

Unless the USA had the ABSOLUTE LOWEST TAXES ON EARTH, companies are going to go where they pay the least taxes.

I say, if you want to be considered a corporation in the USA, have patent and copyright protection under US law -- you can't do this. If you want to market and sell a product in the USA, then you have to pay fair taxes from your business. None of this hiding behind tax haven crap. If the bulk of your executive workforce is here in the USA, we slap tax liens on you, revoke your corporate charter, tear up your patents and kick you out.

If you want to operate out of Ireland, do it. Ask them to protect your intellectual property and enforce it. Ask Ireland to give you all of the same protections and advantages of the USA.

And above all else? We need to stop this corporation crap. Way back, it used to be pretty hard to get incorporated and you needed a damn good reason before you got a nod from the government to allow all the protections and advantages it grants.

I've seen some really good private companies go downhill fast (well they made more profit but the overall product suffered, employees suffered, economy suffered) due to going public.

They call it going "public" by offering shares...but in the end the company is really controlled by a handful of people with stock options and large chunks of stock. It's not like if I have 250 shares in Apple I can really voice a concern and be heard. I wouldn't even own .5 percent of the company.

edit on 27-2-2016 by MystikMushroom because: (no reason given)

a reply to: ExNihiloRed

A couple of years ago it was declared that we have more federal workers than people working in manufacturing. Welcome to the great service industry. Warning sign right there. Every time someone says our corporate tax rate is running companies out of America some socialist will come by and say they need to pay more... Folks, no jobs, means no money... No money means government hand outs or starve.

Everyone in America should pray or wish the next POTUS actually convinces the congress and the senate to get to work and pass a total tax overhaul of the system and whittle the IRS down to a receiving entity instead of a political tool used by some in power to persecute perceived enemies ..

Is it to late ? I dunno.. but.... no journey begins without the first step...

youtu.be...

A couple of years ago it was declared that we have more federal workers than people working in manufacturing. Welcome to the great service industry. Warning sign right there. Every time someone says our corporate tax rate is running companies out of America some socialist will come by and say they need to pay more... Folks, no jobs, means no money... No money means government hand outs or starve.

Everyone in America should pray or wish the next POTUS actually convinces the congress and the senate to get to work and pass a total tax overhaul of the system and whittle the IRS down to a receiving entity instead of a political tool used by some in power to persecute perceived enemies ..

Is it to late ? I dunno.. but.... no journey begins without the first step...

youtu.be...

America - the land where corporations can make billions without paying a penny in taxes, where guest workers can file a return using the child tax

credit get more in tax returns than they earned all year. Our tax system works for everyone but the American worker.

originally posted by: alldaylong

Why are Americans complaining about tax avoidance ?

The U.S. was founded on that very issue. What goes around comes around.

Those Boston tea party people didn't pay their taxes either !

However, their cry was "no taxation without representation". I think our new cry should be "no taxation no market for your products". Not very catchy, I'll grant, but you get the drift.

a reply to: ExNihiloRed

And the best part for Pfizer is while leaving the country they still get to keep their moles in DC and keep their lobbyists paying off US politicians.

www.opensecrets.org...

REVOLVING DOOR

58 out of 84 Pfizer Inc lobbyists in 2013-2014 have previously held government jobs

Campaign Contributions

$21,310,978

since 1990

LOBBYING

$160,347,918

since 1999

And the best part for Pfizer is while leaving the country they still get to keep their moles in DC and keep their lobbyists paying off US politicians.

www.opensecrets.org...

REVOLVING DOOR

58 out of 84 Pfizer Inc lobbyists in 2013-2014 have previously held government jobs

Campaign Contributions

$21,310,978

since 1990

LOBBYING

$160,347,918

since 1999

originally posted by: xuenchen

Well all we keep hearing about is this "Global" trade etc. etc.

Makes sense for companies to "relocate" as long as the U.S. is way behind in the tax structures.

Not to mention all the recent "talk" of higher taxes to fund social programs that are already riddled with corruption on multiple levels.

If they leave the US, they need to take their lobbyists and Revolving Door Industry insiders with them

But they are not doing that

They want the benefits of the US Government and the benefits of foreign governments

new topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 2 minutes ago -

MH370 Again....

Disaster Conspiracies: 34 minutes ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 2 hours ago -

Chronological time line of open source information

History: 4 hours ago -

A man of the people

Diseases and Pandemics: 5 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 5 hours ago -

4 plans of US elites to defeat Russia

New World Order: 7 hours ago -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 10 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 14 hours ago, 17 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 10 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 13 hours ago, 6 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 13 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 7 hours ago, 4 flags -

A man of the people

Diseases and Pandemics: 5 hours ago, 3 flags -

Chronological time line of open source information

History: 4 hours ago, 2 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 2 hours ago, 1 flags -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 5 hours ago, 1 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 2 minutes ago, 1 flags

active topics

-

Scarface does Tiny Desk Concert

Music • 8 • : zosimov -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 0 • : underpass61 -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 17 • : Vermilion -

4 plans of US elites to defeat Russia

New World Order • 28 • : Oldcarpy2 -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 72 • : DBCowboy -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 67 • : strongfp -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 10 • : TruthJava -

Not Aliens but a Nazi Occult Inspired and then Science Rendered Design.

Aliens and UFOs • 13 • : Ophiuchus1 -

12 jurors selected in Trump criminal trial

US Political Madness • 36 • : Cvastar -

MH370 Again....

Disaster Conspiracies • 0 • : Cvastar