It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

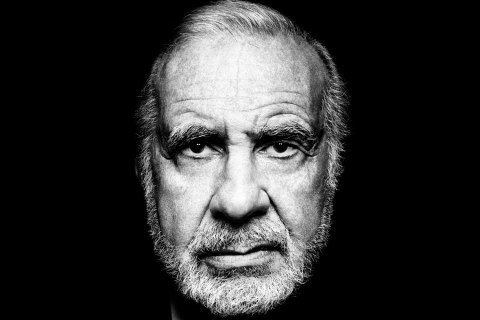

If you have ever watched a Donald Trump stump speech or an interview, he constantly refers to Carl Icahn as a supporter and strategist. So who is this

guy? I really didn't know but since it seemed like such a big deal to Trump and no explanation was readily offered by the media, I looked him up.

NOT impressed.

What Carl Icahn, according to Carl Icahn...

Okay. What's a "shareholder activist"?

www.investopedia.com...

That doesn't sound so bad right? Of course that's how the financial industry defines it. Here's another definition:

en.wikipedia.org...

Did you catch that? "Activist Shareholder/Shareholder Activist" is the neatly re-branded term for "Corporate Raider".

Here's a synopsis of what they are really about:

www.cnbc.com...

So how were these guys, so loathed 30 years ago, able to get back into the game with a new name?

www.forbes.com...

Anyways terms like "activist investor" or "shareholder activist" sound so magnanimous but, here's a more accurate characterization:

time.com...

NOT impressed.

What Carl Icahn, according to Carl Icahn...

As a leading shareholder activist, Carl Icahn’s efforts have unlocked billions of dollars of shareholder and bondholder value and have improved the competitiveness of American companies.

Okay. What's a "shareholder activist"?

www.investopedia.com...

A person who attempts to use his or her rights as a shareholder of a publicly-traded corporation to bring about social change. Some of the issues most often addressed by shareholder activists are related to the environment, investments in politically sensitive parts of the world and workers' rights (sweatshops).

That doesn't sound so bad right? Of course that's how the financial industry defines it. Here's another definition:

en.wikipedia.org...

An activist shareholder is one using an equity stake in a corporation to put public pressure on its management.[1] The goals of activist shareholders range from financial (increase of shareholder value through changes in corporate policy, financing structure, cost cutting, etc.) to non-financial (disinvestment from particular countries, adoption of environmentally friendly policies, etc.).[2] The attraction of shareholder activism lies in its comparative cheapness; a fairly small stake (less than 10% of outstanding shares) may be enough to launch a successful campaign. In comparison, a full takeover bid is a much more costly and difficult undertaking.

Shareholder activism has gained popularity as management compensation at publicly traded companies and cash balances on corporate balance sheets have risen. Not only are the aggregate dollars invested in the activist asset class continuing to grow, but activists are also generating significant positive attention from mainstream media by taking more sophisticated approaches to identifying their platforms and running their campaigns.[3] Once derided as corporate raiders, shareholder activists are now the recipients of admiration for sparking change in corporate boardrooms, leading to corporate boards developing best practices for responding to shareholder activism.[4]

Did you catch that? "Activist Shareholder/Shareholder Activist" is the neatly re-branded term for "Corporate Raider".

Here's a synopsis of what they are really about:

www.cnbc.com...

In the 1980s, they were known as corporate raiders. Names like Steinberg, Edelman, Jacobs, Pickens, Posner and Icahn dominated the headlines of their day. With the unbridled support of the philanthropic, Michael Milken, they used his enormous grants of cash to ply their trade. They raided corporations that were unloved, or undervalued, while promising to "unlock shareholder value" … a noble effort which they claimed would enrich the average investor.

In truth, they levered up cyclical companies, raided their overfunded pension plans and, in many cases, drove companies into bankruptcy after using a company's own cash to engage a multitude of strategies that aided the raider, but pilfered the company's coffers. Corporate CEOs cowered at their very names. They recapitalized, restructured, levered up, or did anything the raiders told them to do in hopes of keeping their own jobs while sending the raiders away with their booty.

In the end, the raiders enriched themselves far more than they did individual investors, and made quite a name for themselves in the process, while plundering many a good company. Many accepted generous buyouts from the companies they threatened to take over, a perfectly legal form of corporate extortion known as "greenmail. "Among the first to be labeled a "greenmailer" was none other than Carl Icahn.

They were paid handsomely to sell their stock back to the company, at a premium, if they would just go away, promising never to return. (That was politely called a "standstill agreement.")

When all was said and done, the raiders/greenmailers/financiers enriched themselves at the expense of corporations, and their shareholders, but claimed the high ground by pointing to rising share prices of the companies they targeted. Rarely did the bemoan the immense debt they saddled the companies with, that would eventually, create a crisis in the stock market.

In the aftermath of all those the raids, and the subsequent debt defaults they triggered, that style of investing fell into disrepute, as raiders of the lost art fell on hard times, lost their influence, or went to jail for trading and profiting on inside information. And that was at the end of the "roaring '80s." (more at link)

So how were these guys, so loathed 30 years ago, able to get back into the game with a new name?

www.forbes.com...

A Remarkable Public Relations Turnaround

Fuller suggests that the corporate raiders have pulled off a remarkable public relations triumph. They have engaged a wide array of partners to support the raids in extracting value from corporations. A change in name helped. No longer “corporate raiders,” they have adopted the kinder gentler term, “activist investors,” as if they were high-minded social activists totally devoted to serving the public interest, thus distracting attention from their agenda, which is actually extracting cash for themselves.

The fact that university endowments and state pension funds have been getting into bed with the corporate raiders has helped. These public institutions could hardly tell their stakeholders they were engaged in “corporate raids.” They became co-conspirators with the raiders to change their label to “activist investors.”

The corporate raiders also learned how to present their vulture-like activities in a more positive light. Now they are not engaged in corporate raids or sucking the blood from once valuable corporations. Instead they are merely performing the public service of “unlocking value.” (more at link)

Anyways terms like "activist investor" or "shareholder activist" sound so magnanimous but, here's a more accurate characterization:

time.com...

“Activism” calls to mind the image of idealistic political activists, but only a tiny slice of activist investors have political or social goals, like trying to get companies to reduce their carbon footprint. Most activists just want a higher share price, and tend to cash out once the price pops up.

edit on 2/25/2016 by HoldMyBeer because: (no reason given)

Another take:

www.marketwatch.com...

"...quick to adapt to social media, using Twitter and the Web to express his views and agitate for change." Hmmm..., who does that sound like? Trump. And it's so very Orwellian. Using the media and public opinion to bully an outcome.

Anyways, this is the guy Trump most proudly associates himself with.

Trump says he wants to tap Icahn as Secretary of the Treasury. Can you imagine if this guy is unleashed within a Trump administration? How much more wealthy would the already rich get with Carl Icahn "making deals" for a Trump administration? Remember the 80's closed with a recession after these types took what they wanted. Now Trump wants to but the fox in charge of the hen house. A literal cannibal capitalist, so busy making a profit under the guise of making a company more "efficient" that the company and it's employees are very often worse off than before this "Robin Hood" swooped in to advocate for shareholders. He's the very epitome of putting profit before people.

www.marketwatch.com...

Now, like most self-styled activists, Icahn doesn’t seek control of companies. Instead, he buys up a chunk of shares, agitates for representation on the board, and campaigns relentlessly for the changes he thinks will best benefit shareholders, including himself. While a younger generation of activists is also burning up the Street, the 78-year-old Icahn has been quick to adapt to social media, using Twitter and the Web to express his views and agitate for change.

"...quick to adapt to social media, using Twitter and the Web to express his views and agitate for change." Hmmm..., who does that sound like? Trump. And it's so very Orwellian. Using the media and public opinion to bully an outcome.

Anyways, this is the guy Trump most proudly associates himself with.

Trump says he wants to tap Icahn as Secretary of the Treasury. Can you imagine if this guy is unleashed within a Trump administration? How much more wealthy would the already rich get with Carl Icahn "making deals" for a Trump administration? Remember the 80's closed with a recession after these types took what they wanted. Now Trump wants to but the fox in charge of the hen house. A literal cannibal capitalist, so busy making a profit under the guise of making a company more "efficient" that the company and it's employees are very often worse off than before this "Robin Hood" swooped in to advocate for shareholders. He's the very epitome of putting profit before people.

a reply to: HoldMyBeer

All I can say is..........you got that damned skippy straight! Ichan would be a disaster. Trump's an idiot.

There was a play/movie about people like Ichan, it was entitled "Other People's Money".

All I can say is..........you got that damned skippy straight! Ichan would be a disaster. Trump's an idiot.

There was a play/movie about people like Ichan, it was entitled "Other People's Money".

a reply to: HoldMyBeer

He is actually one of Trumps rivals when it comes to savvy investors, but already Mr. Icahn said he will not take the proposition.

He is on the top wealthiest persons in the world, he doesn't need a political career at this time and point in his 70 something life.

I wonder who are the other two Trump is thinking about.

He is actually one of Trumps rivals when it comes to savvy investors, but already Mr. Icahn said he will not take the proposition.

He is on the top wealthiest persons in the world, he doesn't need a political career at this time and point in his 70 something life.

I wonder who are the other two Trump is thinking about.

a reply to: HoldMyBeer

Wait, wait, are you the same people saying that the people should stand up and fight against the government and corporations?

Stockholder activists are the people against the corporation's board and officers, mismanagement, stagnation, and internal corruption that causes decline in stockholder value. They fight for the rights of the investors. Are you telling me you (or, rather, that people should) invest in public companies to take losses or not receive maximum gains?

Stockholder activists are the ones fighting against entrenchment at Fortune 500 companies, attacking corruption, and trying to improve ROI for the stockholders. I understand they may be self-interested, but what investor isn't?

Listen, I am not saying their involvement is always a good thing. There are definitely pros and cons to activist stockholders. My point is that you need to find more measured sources that look at both sides of the debate.

Oh, and I believe Trump's point about people like Carl Icahn is that they are very KNOWLEDGEABLE about business, the economy, and how things work. Much more so than politicians. In that (regardless of their motives), it is hard to disagree.

Wait, wait, are you the same people saying that the people should stand up and fight against the government and corporations?

Stockholder activists are the people against the corporation's board and officers, mismanagement, stagnation, and internal corruption that causes decline in stockholder value. They fight for the rights of the investors. Are you telling me you (or, rather, that people should) invest in public companies to take losses or not receive maximum gains?

Stockholder activists are the ones fighting against entrenchment at Fortune 500 companies, attacking corruption, and trying to improve ROI for the stockholders. I understand they may be self-interested, but what investor isn't?

Listen, I am not saying their involvement is always a good thing. There are definitely pros and cons to activist stockholders. My point is that you need to find more measured sources that look at both sides of the debate.

An activist shareholder is a large stakeholder who attempts to gain control of a company and replace its management. This generally occurs when the activist is dissatisfied with management. American billionaire investor Carl Icahn is one such example; he is known for buying large amounts of a company's stock and then pressuring the company to make significant changes to increase the stock's value.

This sounds like a good thing for shareholders, right? Well, not always. Let's take a look at the potential pros and the cons of having activist investors involved in a particular stock.

The Potential Advantages to Activist Involvement

1.Holding Feet to the Fire

Individual shareholders generally don't have too much pull with management. That's because they may hold only a few hundred or few thousand shares, which is likely to be a relatively small percentage of the outstanding stock. However, activist investors often have more influence for several reasons.

Because they often purchase, or have the ability to purchase, (or short) large quantities of stock, activist shareholders are powerful. They may also have a stated desire to replace the existing board. As a result, management and the board may be more willing to work with an activist. In addition, activist firms tend to garner a fair amount of press and often have a podium to air their grievances. (For more insight, see Can You Invest Like Carl Icahn?)

The point is that activists often have the ability to hold management's feet to the fire and demand results. This in turn can make them work harder and cause them to try to find ways to enhance stakeholder value.

2.New Faces May Mean New Ideas

Clearly not every activist firm will bring fresh ideas to the table. However, those that do establish a large position over time often have ideas about how management should use the company's assets, improve operations or enhance shareholder value. To be clear, management may or may not be receptive to such ideas. However, the presentation of options and a dialog could end up being productive and may open doors of opportunity for the company that hadn't been there in the past.

3.Demand For the Shares Could Perk Up

Activists may snap up a large percentage of a company's outstanding stock in a relatively short period of time. In response, other firms and/or individuals might attempt to copy these activists by buying the stock as well in the hope of turning a tidy profit. This could push the stock price up and, by extension, benefit common shareholders.

4.Management May Bend

Activists can sometimes press for and/or demand certain changes from existing management. As an example, in 2006, Trian Partners pushed for fast food chain Wendy's (NYSE:WEN) to spin off its Tim Hortons (NYSE:THI) donut business as a means of increasing value. Some shareholders seemed excited by the idea, and Wendy's board reportedly decided to spin off the business. The spin off allowed Wendy's to focus more on its core business and on competing with its rivals, including Burger King (NYSE:BKC) and McDonalds (NYSE:MCD). (For more on spin offs, see Parents And Spinoffs: When To Buy And When To Sell.)

The Potential Downsides to Activist Involvement

1.Selling Could Be an Issue

In some cases, activists may purchase large blocks of stock. When that happens, the share price may increase. However, when the activist decides it is time to unload the shares, it may logically place a significant amount of downward pressure on the share price.

2.Activists Look Out for Themselves

Activist firms often try to convince existing shareholders and the media to understand and buy into their agenda, but at the end of the day, they may be looking out primarily for themselves and doing what is in their best interests. In short, it would be wise for investors (big and small) to keep this possibility in mind when listening to an activist's agenda in the press.

3.Activists Aren't Always Right

Right or wrong, many individuals perceive activists as being smarter than the average investor because they have extensive experience on the buy and/or sell-side. There is a belief that activists may have important industry contacts and access to solid research. However, activists aren't always right. Their timing can be off and they can (and do) lose money or become involved in situations that take an extraordinarily long time to pan out. Investors should to keep this in mind when the temptation arises to copy an activist's buying or selling.

4.Activists May Have a Different Investment Horizon

Activists can be a very fickle bunch. In some cases they may latch onto a position and hold it for years. In others, if it doesn't appear that they will win board seats or get the company to accept their agenda, they may bail at the drop of a hat. In short, it's important to note that activists may have a very different investment horizon from the average investor. They may also be more willing and financially able to accept a loss on the position. Again, investors who are looking to or are considering copying an activist (as some may do) might be wise to keep this in mind.

Bottom Line

Having an activist engaged in a stock you own may be a good thing or a bad thing depending upon the situation. Perhaps the most important things to understand is that sometimes activists have influence over companies that the average common shareholder would generally not have. In addition, they sometimes bring new ideas to the table that could potentially lift value and/or open doors. On the downside, they can be extremely fickle, and sometimes when it comes down to it, they may keep their financial interests above those of all others.

Source

Oh, and I believe Trump's point about people like Carl Icahn is that they are very KNOWLEDGEABLE about business, the economy, and how things work. Much more so than politicians. In that (regardless of their motives), it is hard to disagree.

edit on 25-2-2016 by ExNihiloRed because: (no

reason given)

a reply to: ExNihiloRed

Well that just reads they are people who are looking to make money off the backs of the companies and if some of the smaller investors make money cool but if not they still made theirs so on to the next one.

Sounds like their main focus is to just make more money. Either by the company making more or if they can use its money to make the 'activist' more. I doubt they care about the workers and thier families.

Well that just reads they are people who are looking to make money off the backs of the companies and if some of the smaller investors make money cool but if not they still made theirs so on to the next one.

Sounds like their main focus is to just make more money. Either by the company making more or if they can use its money to make the 'activist' more. I doubt they care about the workers and thier families.

originally posted by: Sremmos80

a reply to: ExNihiloRed

Well that just reads they are people who are looking to make money off the backs of the companies and if some of the smaller investors make money cool but if not they still made theirs so on to the next one.

Sounds like their main focus is to just make more money. Either by the company making more or if they can use its money to make the 'activist' more. I doubt they care about the workers and thier families.

They don't care at all about the workers and their families, nor should they. They are investors not humanitarians.

If you care about workers and their families or the less fortunate, then you should take the gains you receive from your pension or 401(k) or other investments (if you invest) and give it away to them. But you won't do that. Because you invest (or, rather, people invest) to have your money GROW for YOU.

An activist investor is a stockholder like anyone, and they cannot get any disparate treatment in their returns. Every dollar per share they get, every investor will get.

Part of my point is that it seems odd to me to go after activist investors as an attack on Trump. There is no doubt activist investors are more intelligent in business issues than most (if not all) politicians. Also, activist stockholders can be good or bad depending on the circumstances, and I felt the OP was way too one-sided without discussing the pros and cons and reaching an informed conclusion.

edit on 25-2-2016 by ExNihiloRed

because: (no reason given)

a reply to: ExNihiloRed

That's a fairly predictable defense of shareholder activists.

The reality on the ground is that a business exists within a community. The community includes stakeholders, investors, executives, employees, customers and the economy/society at large.

A "shareholder activist" only looks at the interests of the shareholders and extracting as much value as possible for them. The problem with that narrow view is that their profit is wholly dependent on the work others, the quality of the product and the needs of customers. If you start squeezing any of those, it devalues the overall corporate commodity/brand. There is a sweet spot that activist shareholders disregard at all of our peril because they only consider profit. Not people. Not products. Any thinking person understands that the three are not mutually exclusive.

dealbook.nytimes.com...

It's a mindset that focuses entirely on short-term needs, quarter to quarter, instead of the long game which is the health of the company and the economy in general.

The problem with having someone as singularly minded as Icahn as Treasury Secretary or even just as a trusted adviser is that he likely only considers the quick and easy. What about long term? What about quality? There is a saying in business that everyone knows - you can get something cheap, you can get it fast or you can get it high quality. You can get any combination of two of those, but never all three at once. Shareholder investors like Icahn strive for cheap and fast and that never lasts.

That's a fairly predictable defense of shareholder activists.

The reality on the ground is that a business exists within a community. The community includes stakeholders, investors, executives, employees, customers and the economy/society at large.

A "shareholder activist" only looks at the interests of the shareholders and extracting as much value as possible for them. The problem with that narrow view is that their profit is wholly dependent on the work others, the quality of the product and the needs of customers. If you start squeezing any of those, it devalues the overall corporate commodity/brand. There is a sweet spot that activist shareholders disregard at all of our peril because they only consider profit. Not people. Not products. Any thinking person understands that the three are not mutually exclusive.

dealbook.nytimes.com...

It’s a bedrock principle of our era: Companies should be run for the sole purpose of increasing their stock prices, or returning “value” to shareholders, the ultimate “owners.”

To Lynn A. Stout, however, it amounts to nothing more than a “shareholder dictatorship.”

Ms. Stout, a professor at Cornell Law School, has written a slim and elegant polemic, “The Shareholder Value Myth” (Berrett-Koehler Publishers) to explain the idea’s two problems: It’s worked out horribly and, as a matter of law, it’s not true.

The blame lies with economists and business professors who have pushed the idea, with generous enabling from the corporate governance do-gooder movement, Ms. Stout contends. Stocks, as a result, have become the playthings of hedge funds, warping corporate motivation and eroding stock market returns.

It's a mindset that focuses entirely on short-term needs, quarter to quarter, instead of the long game which is the health of the company and the economy in general.

The problem with having someone as singularly minded as Icahn as Treasury Secretary or even just as a trusted adviser is that he likely only considers the quick and easy. What about long term? What about quality? There is a saying in business that everyone knows - you can get something cheap, you can get it fast or you can get it high quality. You can get any combination of two of those, but never all three at once. Shareholder investors like Icahn strive for cheap and fast and that never lasts.

edit on 2/25/2016 by HoldMyBeer because: (no reason given)

a reply to: HoldMyBeer

Sorry but I have to disagree. I don't see anything wrong with what he is doing. Oh, and comparing him to how corporate raiders dealt with business in the 80's is not going to float.

Gonna need some more dirt on this guy to label him a 'bad egg'.

Sorry but I have to disagree. I don't see anything wrong with what he is doing. Oh, and comparing him to how corporate raiders dealt with business in the 80's is not going to float.

Gonna need some more dirt on this guy to label him a 'bad egg'.

a reply to: angryhulk

I agree, Icahn is not the first and the last "activist" that a president will surround their administration with, Obama have more extremist activist in his administration than any other president.

Still is very clear, that Trumps is talking about one of his rivals, that obviously already said he will not take the position, sounds to me more like a prank played by Trump on Icahn than anything else.

A man that is known to be a reclusive, already in his 70s, considered on the top wealthiest, this sounds one of Trumps pranks.

I agree, Icahn is not the first and the last "activist" that a president will surround their administration with, Obama have more extremist activist in his administration than any other president.

Still is very clear, that Trumps is talking about one of his rivals, that obviously already said he will not take the position, sounds to me more like a prank played by Trump on Icahn than anything else.

A man that is known to be a reclusive, already in his 70s, considered on the top wealthiest, this sounds one of Trumps pranks.

originally posted by: HoldMyBeer

a reply to: ExNihiloRed

It’s a bedrock principle of our era: Companies should be run for the sole purpose of increasing their stock prices, or returning “value” to shareholders, the ultimate “owners.”

In fact, that is the law.

A "shareholder activist" only looks at the interests of the shareholders and extracting as much value as possible for them. The problem with that narrow view is that their profit is wholly dependent on the work others, the quality of the product and the needs of customers. If you start squeezing any of those, it devalues the overall corporate commodity/brand. There is a sweet spot that activist shareholders disregard at all of our peril because they only consider profit. Not people. Not products. Any thinking person understands that the three are not mutually exclusive.

I think they try and find that "sweet spot." Once you move to the wrong side of that "sweet spot" your ROI drops. They want to maximize ROI.

I do no disagree that this whole corporations v. workers v. politicians, etc. is a complicated issue (which way too many people try to make seem simple). Corporations serve a single purpose: to make their investors money. The immediate reaction to this is that if left unchecked this will result in disaster because corporations will then squeeze every penny they can at the cost of their workers, the environment, etc. Corporations have lobbyists, for example, because they want laws on the books that allow them to generate the most profit possible.

The "check," however, can come from free market conditions. Right now, we have way too many workers and not enough jobs. This puts the leverage in the hands of the corporations. People take jobs where they are underpaid and poorly treated. With more jobs, comes more negotiating leverage for the worker. Being qualified and skilled helps too. The reason CEOs get paid so much is competition. If you want the best CEO, you need to pay top dollar. If you do not pay top dollar, some other company will. Also, let's not forget the green movement over the last decade. This was consumer driven. Customers demanded it and companies obliged. Nike just cut endorsements with Manny Pacquiao for homophobic statements. That's free market forces.

edit on 25-2-2016 by ExNihiloRed because: (no reason given)

Carl Icahn rejects Donald Trump's Treasury Secretary offer

"I was extremely surprised to learn that Donald was running for president and even more surprised that he stated he would make me Secretary of Treasury," wrote Icahn.

Reason No.1 why Icahn is unfit for the Treasury: he doesn't wake up early enough. Icahn, 79, would rather kick it in the mornings than do the Washington D.C. grind every day.

"I am flattered but do not get up early enough in the morning to accept this opportunity," Icahn said.

But there is one thing Icahn agrees fully with Trump on: there's a "a big fat bubble coming up" in the market. Icahn says that years of near zero interest rates from the Federal Reserve have inflated asset prices.

"I personally believe we are sailing in dangerous unchartered waters. I can only hope we get to shore safely," Icahn said, praising Trump for speaking out about the issue on the campaign trail.

This man is a savvy investor, if Icahn say that we are to be heading to another bubble in the markets I will take whatever advise he may have very seriously.

money.cnn.com...

edit on 25-2-2016 by marg6043 because: (no reason given)

a reply to: marg6043

That was June. In August:

www.washingtonpost.com...

That was June. In August:

Icahn seemed surprised and initially balked when Trump mentioned his name as one of three potential treasury secretary nominees in a televised interview in June. In a statement on his Web site, Icahn responded that he was "flattered but do not get up early enough in the morning to accept this opportunity."

But Icahn apparently came around. In August, Icahn said in a series of tweets that he would accept the secretary post if offered it. He called America's methods of electing corporate and political leaders "completely dysfunctional" and said "in both areas, we are in dire need of a breath of fresh air."

www.washingtonpost.com...

edi

t on 2/25/2016 by HoldMyBeer because: (no reason given)

a reply to: HoldMyBeer

I will keep with the main sources, knowing Trump and how he likes to prank, I say this is just another issue to keep his opponents giving him free time and on the spot light.

I will keep with the main sources, knowing Trump and how he likes to prank, I say this is just another issue to keep his opponents giving him free time and on the spot light.

a reply to: ExNihiloRed

In the link above, Ms. Stout offers her rationale as to how it is a misinterpretation. One that has been pushed by lawyers and investors, hedge fund managers.

In the link above, Ms. Stout offers her rationale as to how it is a misinterpretation. One that has been pushed by lawyers and investors, hedge fund managers.

originally posted by: marg6043

a reply to: HoldMyBeer

I will keep with the main sources, knowing Trump and how he likes to prank, I say this is just another issue to keep his opponents giving him free time and on the spot light.

Now that's probably true.

a reply to: HoldMyBeer

Actually while Icahn had backed Trump publicly he has not come forward for any interviews on the Proposed position.

I mean Icahn is 79 years old, I can hardly imagine him that is worth 29 billion dollars lowering himself to work as the secretary of treasury.

Actually while Icahn had backed Trump publicly he has not come forward for any interviews on the Proposed position.

I mean Icahn is 79 years old, I can hardly imagine him that is worth 29 billion dollars lowering himself to work as the secretary of treasury.

edit on 25-2-2016 by ExNihiloRed because: Not worth the argument

you're dead on about this dude. what he does is buy out desperate companies and screw the shareholders.

new topics

-

Planned Parenthood Targets Black Neighborhoods

Social Issues and Civil Unrest: 46 minutes ago -

Who could it beeee now?

New World Order: 3 hours ago -

The Russian Vostok complex has been put into operation in Antarctica

Science & Technology: 4 hours ago -

Letitia James tells judge to Reject Trumps $175 Million Bond

2024 Elections: 4 hours ago -

Tucker Carlson UFOs are piloted by spiritual entities with bases under the ocean and the ground

Aliens and UFOs: 4 hours ago -

Hello from burritocat

Introductions: 6 hours ago -

An Apology From the Dunderbeck Sausage Company

Music: 8 hours ago -

Tucker on Joe Rogan talking Kona Blue and UFOs

Aliens and UFOs: 9 hours ago -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections: 9 hours ago -

Predicting The Future: The Satanic Temple v. Florida

Conspiracies in Religions: 9 hours ago

top topics

-

Michigan school district cancels lesson on gender identity and pronouns after backlash

Education and Media: 14 hours ago, 10 flags -

The Russian Vostok complex has been put into operation in Antarctica

Science & Technology: 4 hours ago, 9 flags -

WF Killer Patents & Secret Science Vol. 1 | Free Energy & Anti-Gravity Cover-Ups

General Conspiracies: 11 hours ago, 8 flags -

Pentagon acknowledges secret UFO project, the Kona Blue program | Vargas Reports

Aliens and UFOs: 16 hours ago, 7 flags -

Remember These Attacks When President Trump 2.0 Retribution-Justice Commences.

2024 Elections: 9 hours ago, 7 flags -

Boston Dynamics say Farewell to Atlas

Science & Technology: 16 hours ago, 6 flags -

Israel attacking Iran again.

Middle East Issues: 13 hours ago, 5 flags -

Letitia James tells judge to Reject Trumps $175 Million Bond

2024 Elections: 4 hours ago, 5 flags -

Who could it beeee now?

New World Order: 3 hours ago, 4 flags -

Hurt my hip; should I go see a Doctor

General Chit Chat: 12 hours ago, 3 flags

active topics

-

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News • 13 • : crayzeed -

Planned Parenthood Targets Black Neighborhoods

Social Issues and Civil Unrest • 6 • : FlyersFan -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 23 • : TheGoodNews -

Israel attacking Iran again.

Middle East Issues • 51 • : JAY1980 -

The Russian Vostok complex has been put into operation in Antarctica

Science & Technology • 11 • : stonerwilliam -

George Knapp AMA on DI

Area 51 and other Facilities • 30 • : BeTheGoddess2 -

Hurt my hip; should I go see a Doctor

General Chit Chat • 16 • : mysterioustranger -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 80 • : ImagoDei -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 60 • : Xtrozero -

Elites disapearing

Political Conspiracies • 37 • : seekshelter