It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I was surprised to find that Nixon took us off of the Gold Standard in 1971, and one year later the last walk on the moon happened in 1972.

originally posted by: visitedbythem

Most of the guys at my plant are now temps with no insurance coverage and getting paid only $15 per hour. Most cant afford affordable care, and pay the penalty instead

Exactly where I've been ......

Since 2009~! 😡

For one hundred and two years the centralized banking system has gotten everything that it wanted and asked for. Everything. Even when it meant

taking blood from stones. No one refuses them.

Why then ... when we have fifty times as many states as Germany DO WE NOT HAVE MORE THAN ONE FUNCTIONING GODDAMN SPACE PROGRAMS!?

Compare the past to now.

Nasa Family.

Modern family.

Mike Grouchy

Why then ... when we have fifty times as many states as Germany DO WE NOT HAVE MORE THAN ONE FUNCTIONING GODDAMN SPACE PROGRAMS!?

Compare the past to now.

Nasa Family.

Modern family.

Mike Grouchy

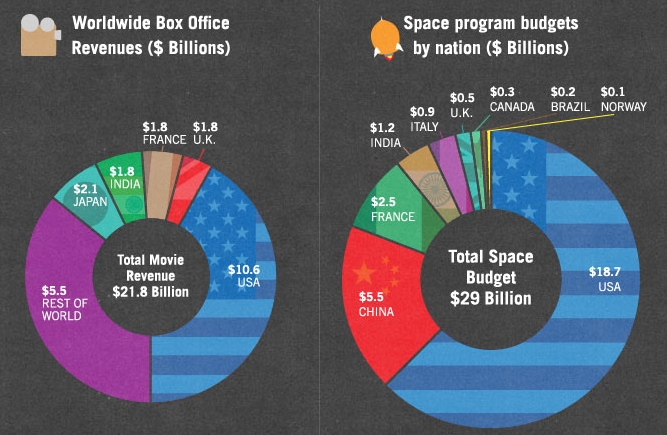

Can someone design me a banking system that is capable of sustaining a space program?

Mike Grouchy

originally posted by: marg6043

a reply to: texasgirl

Yes, that is how it works, my husband and I were talking about that yesterday as we have very low interest rates card left, I told him that if they send the letter of increases if used by after certain day, we will close the accounts.

But doesn't closing your accounts negatively affect your credit score? I'm just keeping mine at very low balances. I've been through bad credit and don't intend to go through that again!

The quarter-point hike in the federal funds rate still leaves interest rates only slightly above near-zero levels. But the move shows the central bank believes the U.S. economy has recovered enough from the 2008 financial crisis to start moving rates back to "normal" levels.

Recovering enough doesn't even begin to describe it.

The Economy might be recovered enough to enter a period of eternal torment.

The Economy is recovered enough like crops are recovered enough during Rains of Fire.

The Economy is as solid as A new Ice age, and just as flexible.

The Economy has recovered enough of its places in the pits of hell.

Mike Grouchy

edit on 18-12-2015 by mikegrouchy because: format

How many people have died penny-less because someone else took ownership of their invention. Who owns all the space patents now, and what the hell

are they doing just sitting on them.

Mike Grouchy

Mike Grouchy

a reply to: mikegrouchy

So this means....

-credit interest rates go up.

-loan interest rates go up.

-savings interest rates go up.(a good thing)

So what they did is use $5-6 trillion in bailouts to "smooth-out" the recession and prevent the credit systems from crashing. Now we have almost $20 trillion in national debt. Did we spend our way out of a recession ala Reagan?

Is this more smoke and mirrors?

So this means....

-credit interest rates go up.

-loan interest rates go up.

-savings interest rates go up.(a good thing)

So what they did is use $5-6 trillion in bailouts to "smooth-out" the recession and prevent the credit systems from crashing. Now we have almost $20 trillion in national debt. Did we spend our way out of a recession ala Reagan?

Is this more smoke and mirrors?

a reply to: texasgirl

No, when you pay off your cards you wait until your scores goes up to close the accounts, when you close and existing balance account it doesn't matter, but if you don't want to close it, just don't charge anything after the day that you will be charge higher interest if used.

Some people keeps the cards after they pay them off, charge just a minimal amount and pay off within the month to keep the cards active.

Then you have store cards that give you incentives of not interest rates if the amount you charge is paid within certain amount of months.

My husband and I do the latest and avoid the interest rates completely.

No, when you pay off your cards you wait until your scores goes up to close the accounts, when you close and existing balance account it doesn't matter, but if you don't want to close it, just don't charge anything after the day that you will be charge higher interest if used.

Some people keeps the cards after they pay them off, charge just a minimal amount and pay off within the month to keep the cards active.

Then you have store cards that give you incentives of not interest rates if the amount you charge is paid within certain amount of months.

My husband and I do the latest and avoid the interest rates completely.

Im really sorry Bro. I trully am.

originally posted by: Komodo

originally posted by: visitedbythem

Most of the guys at my plant are now temps with no insurance coverage and getting paid only $15 per hour. Most cant afford affordable care, and pay the penalty instead

Exactly where I've been ......

Since 2009~! 😡

originally posted by: mikegrouchy

How many people have died penny-less because someone else took ownership of their invention. Who owns all the space patents now, and what the hell are they doing just sitting on them.

Mike Grouchy

Kinda like Nikolai Tesla?

originally posted by: FamCore

a reply to: mikegrouchy

Can someone PLEASE spell out for me what this means to regular Joe Schmoe?

Does it mean companies have to pay more, so we also have to pay more?

I don't quite get it :/

It's actually a good thing for the regular person, if they don't have debt. The way consumer interest rates are calculated is it takes the base interest rate which is set by the fed, plus the interest rate the bank is charging you for the loan. So if the base rate is 0.01% and the bank wants 3% you pay 3.01%, by increasing the rate .25% you now pay 3.26% instead of 3.01%.

An increase in the interest rate means people spend/borrow less, which in turn reduces the velocity of money. This means people have more in their pockets, which makes individual dollars less desirable so inflation occurs.

There is an advantage to inflation however. When CPI is recalculated, inflation gets factored in, and wages for the following year reflect that. So wages basically break even with inflation rates, albeit at a 1 year delay. This is better than the alternative though where CPI doesn't factor in any inflation which leads to stagnant wages while goods still become more expensive. With a higher interest rate it also means that your investments and even your checking account will yield higher returns, but with this small of a change those returns won't be much.

originally posted by: marg6043

a reply to: intrptr

I am glad that my husband and I pay off our highest interest credit cards and got the lowest interest on the ones we still have.

Things are going to be very interesting after 10 years of low interest rates, after all the regular consumer has not gotten any better, actually most of them has taken cuts after the 2008 housing bubble crash, so we are not prosperous at all.

3 years ago student loans overtook personal credit card debt at 1.1 trillion to 1 trillion. 3 years later it's 1.2 trillion to 3.34 trillion. In the past 3 years we've nearly tripled credit card debt mostly as people are trying to finance their standard of living that they can no longer afford thanks to stagnant wages.

Increasing interest rates will eventually fix this problem as people borrow less and wages rise. Though it will be painful for those with debt to pay it off, but that's what happens... atleast wages will eventually rise and inflate people out of their debt a bit if they don't continue to add to it.

originally posted by: mikegrouchy

Can someone design me a banking system that is capable of sustaining a space program?

Mike Grouchy

Working on it, sir!

www.abovetopsecret.com...

originally posted by: John_Rodger_Cornman

So what they did is use $5-6 trillion in bailouts to "smooth-out" the recession and prevent the credit systems from crashing. Now we have almost $20 trillion in national debt. Did we spend our way out of a recession ala Reagan?

Is this more smoke and mirrors?

Kind of, but the money used to maintain fluidity in the banks didn't go onto the national debt. The Fed can create whatever money it wants, the debt is just the portion of that created money that the government is responsible for. The fed made near 0% interest loans directly to large institutions, usually banks. The banks would then make low rate loans to people in order to buy things (keeping up with the jones's, new businesses, new cars, or lots of spending money) all in an effort to keep money flowing through the system. When people are spending all they have, there is a very high demand for new cash, and as a result increasing the supply won't lead to inflation.

So to answer your question, yes we did spend our way out of a recession but it was personal debt that was used rather than government debt, to the tune of about $3 trillion. We're still trying to spend our way out of it, while this rate increase was a good thing, just to get back to average levels will require 19 more rate increases of this size, and then to get above the average rate to balance things out will take another 10 such increases. So, there is a long way to go.

Have you guys heard about Clinton Teale being free now? #ing bull#. ok ok

He killed 13 people with his friends after starting a snuff psychology group to promote necrophilia and sadism. He was only given 1 year in prison, everyone else got life! He's free and him and Luka Magnotta are openly dating. Magnotta even confirmed it through letters to news stations in Canada.

His friends and him group name was Lievere

So this guy is free still promoting this #.

lievere.angelfire.com...

ericclintonnewmanteale.blogspot.com...

clintontealeobsessed.blogspot.com...

He killed 13 people with his friends after starting a snuff psychology group to promote necrophilia and sadism. He was only given 1 year in prison, everyone else got life! He's free and him and Luka Magnotta are openly dating. Magnotta even confirmed it through letters to news stations in Canada.

His friends and him group name was Lievere

So this guy is free still promoting this #.

lievere.angelfire.com...

ericclintonnewmanteale.blogspot.com...

clintontealeobsessed.blogspot.com...

edit on 23-12-2015 by Anomily34 because: (no reason given)

new topics

-

Biden says little kids flip him the bird all the time.

2024 Elections: 2 minutes ago -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 38 minutes ago -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 43 minutes ago -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 2 hours ago -

MH370 Again....

Disaster Conspiracies: 3 hours ago -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 5 hours ago -

Chronological time line of open source information

History: 6 hours ago -

A man of the people

Diseases and Pandemics: 8 hours ago -

Ramblings on DNA, blood, and Spirit.

Philosophy and Metaphysics: 8 hours ago -

4 plans of US elites to defeat Russia

New World Order: 9 hours ago

top topics

-

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three: 16 hours ago, 18 flags -

In an Historic First, In N Out Burger Permanently Closes a Location

Mainstream News: 2 hours ago, 14 flags -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events: 13 hours ago, 7 flags -

Iran launches Retalliation Strike 4.18.24

World War Three: 16 hours ago, 6 flags -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness: 38 minutes ago, 6 flags -

12 jurors selected in Trump criminal trial

US Political Madness: 16 hours ago, 4 flags -

4 plans of US elites to defeat Russia

New World Order: 9 hours ago, 4 flags -

A man of the people

Diseases and Pandemics: 8 hours ago, 4 flags -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest: 43 minutes ago, 2 flags -

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology: 5 hours ago, 2 flags

active topics

-

Are you ready for the return of Jesus Christ? Have you been cleansed by His blood?

Religion, Faith, And Theology • 16 • : FlyersFan -

The Democrats Take Control the House - Look what happened while you were sleeping

US Political Madness • 8 • : matafuchs -

12 jurors selected in Trump criminal trial

US Political Madness • 59 • : Vermilion -

MH370 Again....

Disaster Conspiracies • 6 • : KnowItAllKnowNothin -

Israeli Missile Strikes in Iran, Explosions in Syria + Iraq

World War Three • 86 • : Oldcarpy2 -

Biden says little kids flip him the bird all the time.

2024 Elections • 0 • : 5thHead -

4 plans of US elites to defeat Russia

New World Order • 34 • : Oldcarpy2 -

Sheetz facing racial discrimination lawsuit for considering criminal history in hiring

Social Issues and Civil Unrest • 2 • : Hecate666 -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 71 • : Consvoli -

SC Jack Smith is Using Subterfuge Tricks with Donald Trumps Upcoming Documents Trial.

Dissecting Disinformation • 99 • : matafuchs