It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: superman2012

If China was just looking to increase the RMB's value (only reason I can think of why they would sell en masse) then why wouldn't they sell the US debt at a discount?

Because long term Treasury Bonds have such little yield you end up losing money typically.

If other countries see this happening, why would they buy it? Who is in a position to buy it? Japan, Russia, and maybe a couple others?

Because if you can get a stable, consistently-paid debt instrument, why would you not buy it and include it in your diversified portfolio. Any one of the countries and then some could purchase the debt if they were able to get it below par.

Honestly, it wouldn't matter to me who was selling it. If I wanted to buy it and everyone had the same price, why would it matter if you bought from the source or a third party? What if that third party were offering different incentives to help you buy? There are honestly so many different scenarios that you can't say for sure, but neither can I.

That is the point I am making, they would need to incentivize the debt, meaning it would be a money loser, to entice others to buy it.

Also, the reason you would but it from the source (the United States) is because you can dictate what term bonds you want instead of having to take the hodge-podge of Chinese debt with variable yields and maturity dates.

originally posted by: Flavian

a reply to: SLAYER69

Wowsers, didn't realise the UK held 1% of US debt. As a long time ally and partner, i propose we let you off that in exchange for say California (on a 2 week every summer time share basis rather than permanently). Deal?

Hmmm...

As a 'Merikan citizen and stake holder in US debt I'll consider it....

a reply to: AugustusMasonicus

Maybe you can clarify for me your point as I'm having trouble following it.

then

So my question still stands, why would a country buy this debt if China decided to sell it? Also, even if there were no incentive, it wouldn't matter where you bought something. You say you can dictate terms with the US, couldn't you do the same with China?

Edit: Just as a side note, I'm only asking because I don't understand. The best way for me to understand is to challenge your points and ask questions. I appreciate you sharing your knowledge.

Maybe you can clarify for me your point as I'm having trouble following it.

Because long term Treasury Bonds have such little yield you end up losing money typically.

then

Because if you can get a stable, consistently-paid debt instrument, why would you not buy it and include it in your diversified portfolio. Any one of the countries and then some could purchase the debt if they were able to get it below par.

So my question still stands, why would a country buy this debt if China decided to sell it? Also, even if there were no incentive, it wouldn't matter where you bought something. You say you can dictate terms with the US, couldn't you do the same with China?

Edit: Just as a side note, I'm only asking because I don't understand. The best way for me to understand is to challenge your points and ask questions. I appreciate you sharing your knowledge.

edit on 8-7-2015 by superman2012 because: (no reason given)

originally posted by: superman2012

Because long term Treasury Bonds have such little yield you end up losing money typically.

You asked why someone would not sell it at a discount. The returns are so low that selling at a discount makes it a complete money loser for the seller. You are better off holding them and selling other assets.

So my question still stands, why would a country buy this debt if China decided to sell it? Also, even if there were no incentive, it wouldn't matter where you bought something. You say you can dictate terms with the US, couldn't you do the same with China?

Because if purchased below par it is a good buy since the payment history is stellar meaning there is little to no risk.

China has a more limited pool of instruments vis a vis the United States so you could only dictate so far before the more profitable debt is picked through.

edit on 8-7-2015 by AugustusMasonicus because: networkdude has no beer

i.imgur.com...

I'd expect less than a few more weeks of this rate of free fall (slowed a bit, actually) before contagion breaches the east and is on every news channel, and into the global markets.

edit on 8-7-2015 by pl3bscheese because: (no reason given)

originally posted by: Flavian

a reply to: SLAYER69

Wowsers, didn't realise the UK held 1% of US debt. As a long time ally and partner, i propose we let you off that in exchange for say California (on a 2 week every summer time share basis rather than permanently). Deal?

Done, except that we don't want it back even for two weeks and we'll throw in Massachusetts as a token of goodwill. Does that work for you guys?

a reply to: pl3bscheese

The reaction has started.

I went to Drudge to see the latest and it was full of US market negative reactions.

I'll go and see if I can copy/paste all the articles it links to.

The reaction has started.

I went to Drudge to see the latest and it was full of US market negative reactions.

I'll go and see if I can copy/paste all the articles it links to.

edit on 10Wed, 08 Jul 2015 10:19:57 -0500am70807amk083 by grandmakdw because: addition

a reply to: Rocker2013

It's amazing people still believe such utter nonsense. The US was still the largest exporter until 2009, and although China did surpass the US, they also have 4 times as many people, and their economy relies entirely on exporting cheap goods through cheap labor.

The best thing for the US economy would be China failing, thus helping us end our addiction to unneeded cheap goods. We would spend less, start creating more internally, and that is exactly what we need.

China needs the US, the US doesn't need China. The US merely WANTS excess cheap goods from China, but we don't NEED it.

It's amazing people still believe such utter nonsense. The US was still the largest exporter until 2009, and although China did surpass the US, they also have 4 times as many people, and their economy relies entirely on exporting cheap goods through cheap labor.

The best thing for the US economy would be China failing, thus helping us end our addiction to unneeded cheap goods. We would spend less, start creating more internally, and that is exactly what we need.

China needs the US, the US doesn't need China. The US merely WANTS excess cheap goods from China, but we don't NEED it.

a reply to: grandmakdw

There are headlines like that every day, no matter what. Doom porn is what the stock market lives on. It's what allows the big boys to make money.

There are headlines like that every day, no matter what. Doom porn is what the stock market lives on. It's what allows the big boys to make money.

a reply to: Danke

I'm pretty sure we need it. If we were the worlds largest oil exporter with an EROI of greater than 30:1 (pre70s) or had a debt to gdp ratio of less than 50% (80s) we could manage, but it's no longer doable with the way our infrastructure is setup. We rely on the current service/consumer model, and system as is.

I'm pretty sure we need it. If we were the worlds largest oil exporter with an EROI of greater than 30:1 (pre70s) or had a debt to gdp ratio of less than 50% (80s) we could manage, but it's no longer doable with the way our infrastructure is setup. We rely on the current service/consumer model, and system as is.

edit on 8-7-2015 by pl3bscheese because: (no reason given)

That's basically what my friend said on another forum, i thought the information would be useful here...

This is the result of several factors:

-poor accounting standards (fraud)

-poor regulation (fraud, allowing investors to take risks unsuitable for their risk profile)

-excessive leverage (unprecedented levels of margin as a percent of float, and now putting up houses as collateral, dear G-d)

-lack of market depth (contrary to the propaganda, due to capital controls and misguided nationalism, foreign qualified investors are insignificant participants, and local institutional investors comprise too small a percent of ownership)

-incompetent economic leadership by the CCP (China was supposed to move away from debt-funded investment after the real estate market fell, but instead of encouraging consumption, the leadership has chosen the quick fix of inflating a different asset bubble--stocks, and China is suffering the same outcome that the US did in solving its dot-com bust by inflating the real estate bubble, only in reverse)

-that bit by the propagandist telling the huddled masses to invest even if they lose every penny is absolute insanity. The CCP's legitimacy since Tiananmen rests on prosperity for the people, not national glory. If the CCP is seen as destroying the populace's life savings, we will see many more "mass events" going forward.

The market will eventually recover from this, but I have to admit that I am increasingly disillusioned with the Xi/Keqiang economic management decisions. A lot of talk of reform, not nearly enough action.

originally posted by: SLAYER69

I doubt that to be accurate ... the annual figures for the US this year (and last) seem a little off the charts. Whose buying US goods? ain't me, and certainly ain't US consumers, who don't get paid. I would "guess" that these books are cooked, in the form of "expanditure" being booked down as "asset", as in the cost of the war effort being put down on other nations, that are to pay for it.

Same thing would go for China, though ... China's "consumption" has increased, and their exports shrunk (at least that is what I could observe last year). Although I'd guess they'd use similar sort of "cooking" as the US to make their books look better. Although in the Case of China, they are a "real" exporter ... the US isn't. The only "commodity" the US exports, is war. However, that is a very profitable commodity.

One difference can be observed between the US and China. China's official population numbers, are somewhere around 75-80% of actual numbers. And I suspect the same applies to consumption and exports. Lots of stuff is being consumed outside of normal channels, and enormous exports outside of that as well.

Same does not hold for the US ...

All in all, Markets are not what they seem. Manipulation is evident ... just like in the EU, where banking and stock markets, are more legalized theft, than businesses.

originally posted by: AugustusMasonicus

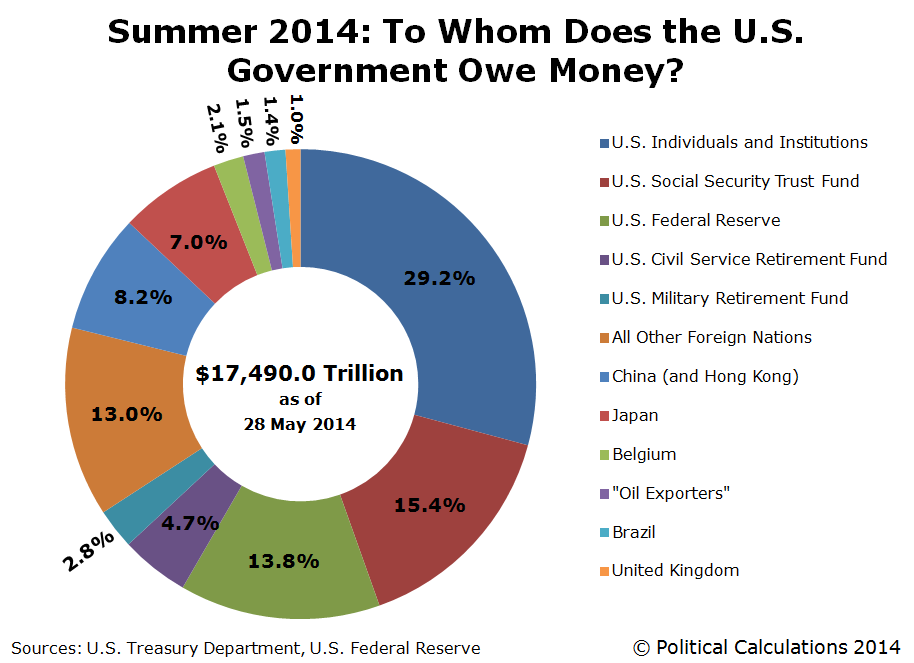

That is not a manufacturing chart, it is a chart of who owns United States debt.

Yeah, but that is what I find odd ... take "owner of dept being US army personnel". This personnel has already had their pay, otherwise the US economy would already had collapsed, as people were out on the streets having no money to pay for their housing or food.

Same thing goes for "US Federal Reserve". They "own" a depth, they don't have the money to provide ... except to "print" money. Creating money out of nothing, is a criminal offense ... so their is a dept behind their "owning" of the dept.

It's a simple cooking of the books ... looks odd

edit on 8/7/2015 by bjarneorn because: (no reason given)

a reply to: tothetenthpower

The majority of stocks on the NYSE aren't even traded specifically via the NYSE...only about 20%. So it doesn't really matter.

The majority of stocks on the NYSE aren't even traded specifically via the NYSE...only about 20%. So it doesn't really matter.

edit on

8-7-2015 by Danke because: (no reason given)

originally posted by: bjarneorn

Yeah, but that is what I find odd ... take "owner of dept being US army personnel". This personnel has already had their pay, otherwise the US economy would already had collapsed, as people were out on the streets

having no money to pay for their housing or food.

It is not their pay, it is in their pension funds.

edit on 8-7-2015 by AugustusMasonicus because: networkdude has no beer

a reply to: maddy21

This is an example of what happens when a country

as large as China

uses communism (which as we all know, China has moved toward socialism in the past 10-20 years)

uses socialism (which China is mainly now)

and controlled capitalism (as the Chinese economy has become in recent years, that is business which is highly regulated and controlled by the government)

to run the country's economy

They have openly used slave labor (ie prison labor)

(ie forced labor as in do this work or go to jail)

They have built lots of ghost cities

to employ people and keep up

unemployment rates

They have been so heavy handed with businesses

to succeed that the people who run them have

allowed dangerous items into pet food items

to keep costs down and to keep people employed

(I don't know about any of you, but I no longer purchase

any consumable pet product from China as a result)

It was all bound to implode eventually,

as more and more consumers of their products

began to realize the quality and safety

could not be guaranteed and that the safety

of the products could be easily questioned

with legitimacy. Therefore, consumers like me

have begun to look at place of manufacture

and avoid products from China whenever possible.

This is an example of what happens when a country

as large as China

uses communism (which as we all know, China has moved toward socialism in the past 10-20 years)

uses socialism (which China is mainly now)

and controlled capitalism (as the Chinese economy has become in recent years, that is business which is highly regulated and controlled by the government)

to run the country's economy

They have openly used slave labor (ie prison labor)

(ie forced labor as in do this work or go to jail)

They have built lots of ghost cities

to employ people and keep up

unemployment rates

They have been so heavy handed with businesses

to succeed that the people who run them have

allowed dangerous items into pet food items

to keep costs down and to keep people employed

(I don't know about any of you, but I no longer purchase

any consumable pet product from China as a result)

It was all bound to implode eventually,

as more and more consumers of their products

began to realize the quality and safety

could not be guaranteed and that the safety

of the products could be easily questioned

with legitimacy. Therefore, consumers like me

have begun to look at place of manufacture

and avoid products from China whenever possible.

new topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 8 hours ago -

Electrical tricks for saving money

Education and Media: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 13 hours ago, 10 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 17 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 14 hours ago, 5 flags -

Sunak spinning the sickness figures

Other Current Events: 13 hours ago, 4 flags -

Electrical tricks for saving money

Education and Media: 11 hours ago, 4 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 15 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 4 hours ago, 2 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 2 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 8 hours ago, 0 flags

active topics

-

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 49 • : YourFaceAgain -

Electrical tricks for saving money

Education and Media • 6 • : lordcomac -

Scientists Say Even Insects May Be Sentient

Science & Technology • 57 • : FlyersFan -

Sunak spinning the sickness figures

Other Current Events • 16 • : Freeborn -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 139 • : xuenchen -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 9 • : Vermilion -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections • 50 • : YourFaceAgain -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 57 • : baablacksheep1 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 39 • : crayzeed -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 147 • : Annee