It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Firstly to the OP......

61.24% no vs 38.76% yes after 55% of vote counted SO the Greeks haven't voted No yet....!

They probably will finish with a majority NO vote but I think you are misreporting the news especially as you posted an hour ago....!

Secondly, Greece's debt, standing at €360 Billion is unsustainable, unpayable and unrealistic.... Too many in power will lose too much if this is written down or Greece leaves the euro..... And it opens up opportunities for Ireland, Portugal et al to ask to have their debts written down to.......

Ho ho....what a mess those in power have made

PDUK

61.24% no vs 38.76% yes after 55% of vote counted SO the Greeks haven't voted No yet....!

They probably will finish with a majority NO vote but I think you are misreporting the news especially as you posted an hour ago....!

Secondly, Greece's debt, standing at €360 Billion is unsustainable, unpayable and unrealistic.... Too many in power will lose too much if this is written down or Greece leaves the euro..... And it opens up opportunities for Ireland, Portugal et al to ask to have their debts written down to.......

Ho ho....what a mess those in power have made

PDUK

originally posted by: SubTruth

What if..........What if they wanted Greece to fail as a message to the rest of the member countries. If they do exit the Euro times in Greece will become very hard I think. TPTB will want to send a clear message about what happens when you exit to Italy and Spain.

They would probably like that as their plan seems to be to create a 2 sides Eurozone North wealthy (creditors) and south poor (debt).

But Russia comes in and says; ''Certainly we have a priority to support investment projects and trade with Greece, and if financial assistance is needed we will consider that.''

rt.com...

Putin: '' If you owe someone a lot, then it is already not your problem but the problem of the one you owe''

www.express.co.uk...

Moscow should be "applauded" for sealing an investment agreement with Greece on a pipeline to carry Russian gas to Europe via Turkey, with transit payments potentially worth hundreds of millions of pounds a year to Athens after its completion in 2019.

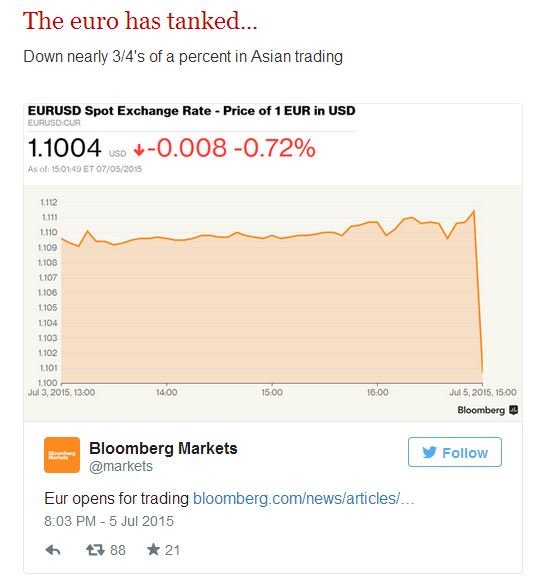

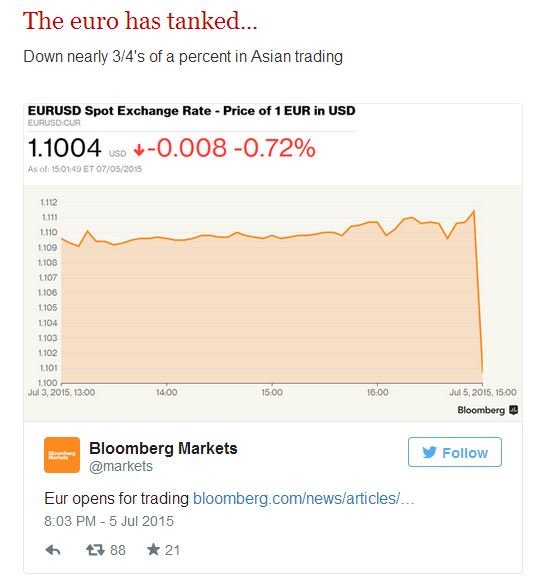

Stock markets showing euro affected.

www.telegraph.co.uk...

www.telegraph.co.uk...

edit on 5-7-2015 by theabsolutetruth because: (no reason given)

originally posted by: Dr1Akula

a reply to: crayzeed

Also Germany's dept was half ed after the 2nd world war

But Merkel doesn't want to remember that, they also don't remember the gold they stole from Greece back then!

Greece had their 50% debt haircut and debt buy-backs from private holders of Greek gov. bonds too.

Just saying.

Also, the claim brought up by Theodoros Pangalos about the stolen Greek gold has long been rebutted.

Investigations showed that the gold was in fact brought to the island of Crete first, in the spring of 1941, and then to Alexandria in Egypt... from there it was taken to Pretoria and then to London where the Bank of England kept it for the Greeks. After the war, the gold was returned to Athens.

Just saying.

edit on 5-7-2015 by ColCurious because: (no reason given)

a reply to: theabsolutetruth

I think you will see larger drops in this and other currencies globally too.

A Greek exit from the euro currency will have many different effects in various countries.....

The worlds politicians are going to start earning those big salaries and expenses in the next few weeks IMHO

Regards

PDUK

I think you will see larger drops in this and other currencies globally too.

A Greek exit from the euro currency will have many different effects in various countries.....

The worlds politicians are going to start earning those big salaries and expenses in the next few weeks IMHO

Regards

PDUK

Secondly, Greece's debt, standing at €360 Billion is unsustainable, unpayable and unrealistic.... Too many in power will lose too much if this is

written down or Greece leaves the euro..... And it opens up opportunities for Ireland, Portugal et al to ask to have their debts written down

to.......

Ho ho....what a mess those in power have made

PDUK

These debts owed to each others countries banks to make interest for those banks should be re-organised, Halved or quartered or even wiped. Maybe Greece will kick the brains of those in power who should know that things are broken..

www.bbc.co.uk...

A 2011 link above, but the point is there..

Ho ho....what a mess those in power have made

PDUK

These debts owed to each others countries banks to make interest for those banks should be re-organised, Halved or quartered or even wiped. Maybe Greece will kick the brains of those in power who should know that things are broken..

www.bbc.co.uk...

A 2011 link above, but the point is there..

edit on 5 7 2015 by skywatcher44 because: Added

a reply to: PurpleDog UK

There will probably be sell offs of global equities.

It will affect global economics in various ways.

There will probably be sell offs of global equities.

It will affect global economics in various ways.

originally posted by: theabsolutetruth

Stock markets showing euro affected.

www.telegraph.co.uk...

3/4 of a % is not tanking.

originally posted by: Dr1Akula

originally posted by: SubTruth

They would probably like that as their plan seems to be to create a 2 sides Eurozone North wealthy (creditors) and south poor (debt).

I think the pound sterling (£) should become the first currency of Europe and that the Euro (€) should be the second tier.....

:-))

Regards

PDUK

originally posted by: ufoorbhunter

The Germas also sent away your Jewish Greeks on death trains and murdered them while also killing masses of Christian Greeks too and causing tragedy on many of the survivors. They destroyed Greece ....

That's right my friend and they did many more barbaric acts, including burning entire villages, killing every single male of some cities including children and babies, raping women, mass killings of Greek Jews, and various other tortures.

As I've already said in another thread, I am only half Greek, and although I don't have Greek nationality, I served voluntarily in the Greek Army, and I've spend nearly every summer there.

I have many Greek friends and some relatives and I happen to know first hand the situation here.

I do worry about Greece's future, but I can't help but being proud of their resistance tonight.

Look who

Guess who

Guess who

In early 2010, it was revealed that through the assistance of Goldman Sachs, JPMorgan Chase and numerous other banks, financial products were developed which enabled the governments of Greece, Italy and many other European countries to hide their borrowing.[93][94] Dozens of similar agreements were concluded across Europe whereby banks supplied cash in advance in exchange for future payments by the governments involved; in turn, the liabilities of the involved countries were "kept off the books".

Economy of Greece

a reply to: xuenchen

The scum behind this whole scheme and its crisis. Who else.

And they will rule forever... as long as people are stupid enough to blame "Ze evil Germans" for everything.

*I get it... its easier.

The scum behind this whole scheme and its crisis. Who else.

And they will rule forever... as long as people are stupid enough to blame "Ze evil Germans" for everything.

*I get it... its easier.

edit on 5-7-2015 by ColCurious because: (no reason given)

originally posted by: ColCurious

a reply to: xuenchen

The scum behind this whole scheme and its crisis. Who else.

And they will rule forever... as long as people are stupid enough to blame "Ze evil Germans" for everything.

*I get it... its easier.

Germany is nothing more than a proxy for the real power........The banks.

a reply to: theabsolutetruth

Hope this link works it's from the AP.hosted.ap.org...

Sounds like an Greexit could happen. Was also reading another article before I found yours. Germany isn't going to be happy. Am going to see what the markets do. I hope the Greek people are going to be okay.

Hope this link works it's from the AP.hosted.ap.org...

Sounds like an Greexit could happen. Was also reading another article before I found yours. Germany isn't going to be happy. Am going to see what the markets do. I hope the Greek people are going to be okay.

edit on 5-7-2015 by Tarzan the apeman. because: (no reason given)

yep, I'm an expert on this from a currency war viewpoint....agreed....they should run like basturds.....make a new democracy with Iclandic banking

rules of conduct....with several public watchdogs

one chance at it here...leave out the central money anything.....small government is natural and more cost effective

one chance at it here...leave out the central money anything.....small government is natural and more cost effective

edit on 5-7-2015 by

GBP/JPY because: last minute thought there....yezz

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 1 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 4 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 4 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 6 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 7 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Weinstein's conviction overturned

Mainstream News: 6 hours ago, 7 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 7 hours ago, 6 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 10 hours ago, 6 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 4 hours ago, 4 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 12 hours ago, 2 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago, 1 flags

active topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 54 • : mashtun -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 8 • : chr0naut -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 680 • : 777Vader -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 73 • : xuenchen -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2 -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 89 • : whereislogic -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 197 • : NorthOS -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 790 • : Oldcarpy2 -

Weinstein's conviction overturned

Mainstream News • 20 • : Xtrozero -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 22 • : NoviceStoic4