It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

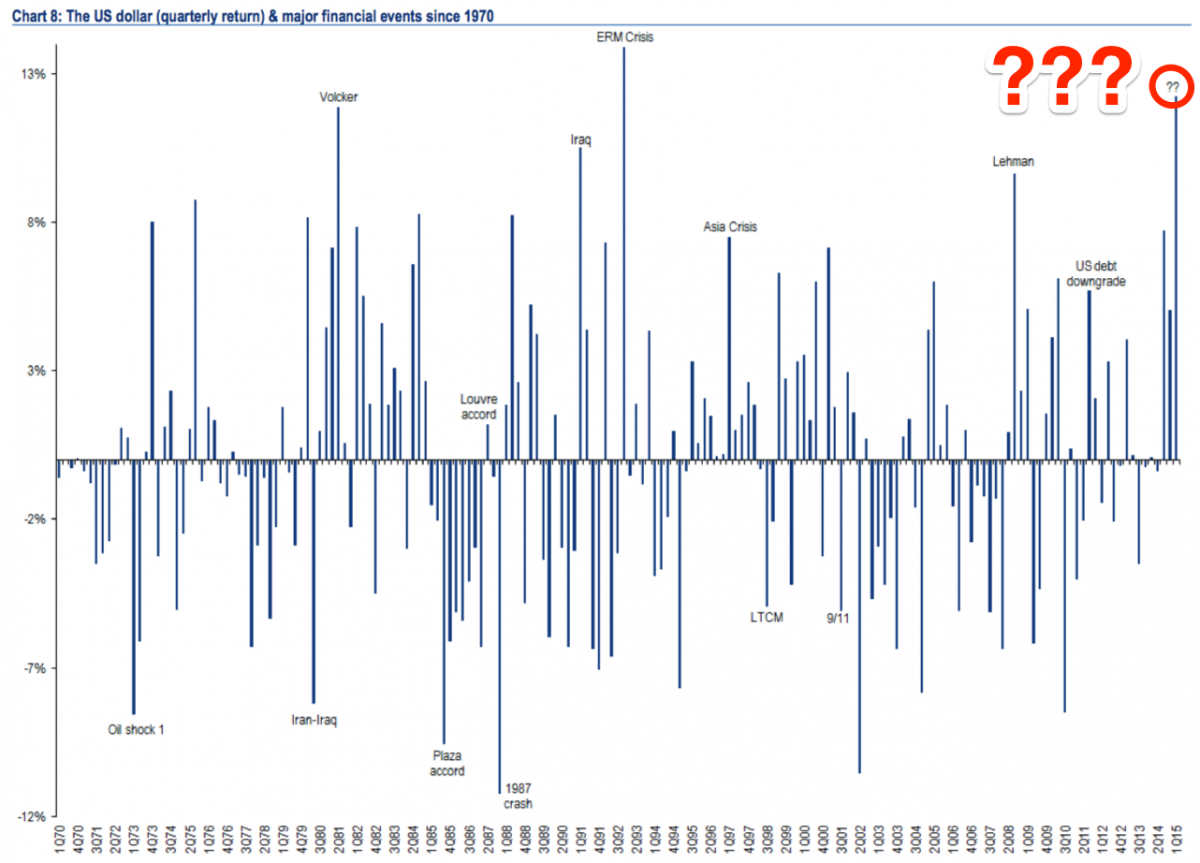

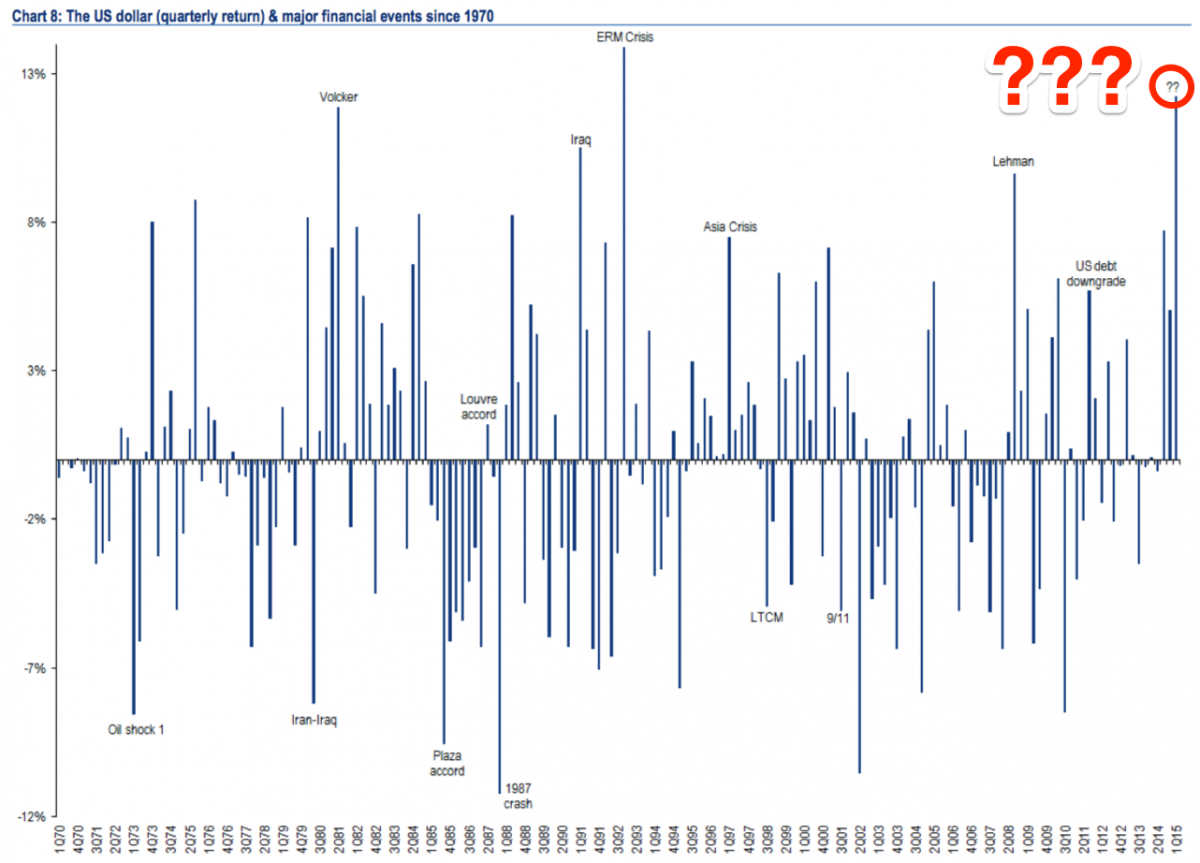

Not to be an alarmist, but when I saw this graph I realized something was wrong.

The surge in value for the US dollar right now is incredible. Moves this strong in value tend to be accompanied by large economic shocks.

www.businessinsider.com...

So what happened? Or what is about to happen? Let your imagination run wild...

The surge in value for the US dollar right now is incredible. Moves this strong in value tend to be accompanied by large economic shocks.

www.businessinsider.com...

So what happened? Or what is about to happen? Let your imagination run wild...

originally posted by: noeltrotsky

So what happened? Or what is about to happen? Let your imagination run wild...

We are nearing the end of a bubble expansion. It's been about 7 years since the economy crashed. It's about time it did again. I wonder what will happen when it does.

You will all be reading about this sooner than later so, here goes:

The USD as a reserve currency is dead.

The Petro-Dollar is dead.

Normalization is taking place now to see the new Reserve currency segway in the new Reserve Currency the SDR.

The USD as a reserve currency is dead.

The Petro-Dollar is dead.

Normalization is taking place now to see the new Reserve currency segway in the new Reserve Currency the SDR.

It's inevitable. I can't understand how this economy which is riddled with deceit has lasted that long

a reply to: noeltrotsky

If we fall everyone falls. We dug our fingers deep enough to ensure survivability even thriving. In the most despicable way. Seems to me the only real way is debt forgiveness and abandoning the American empire. But even as such America would still thrive rich lands would still sustain I just don't see the dooms day others are anxious and wishful for.

If we fall everyone falls. We dug our fingers deep enough to ensure survivability even thriving. In the most despicable way. Seems to me the only real way is debt forgiveness and abandoning the American empire. But even as such America would still thrive rich lands would still sustain I just don't see the dooms day others are anxious and wishful for.

Hm, people have been talking about the student loan debt bubble for a while now, could this somehow play a part in this?

I know the Euro is amost on par now with the USD. It's to bad I can't afford to take a vacation!

I know the Euro is amost on par now with the USD. It's to bad I can't afford to take a vacation!

I was expecting another bubble to burst again, but I am inclined to the housing market again, because as we know nothing was fixed, the QEs are still

been funneled to keep the financial institutions and they still have plenty of the junk paper circulating around.

My mortgage alone has been sold three more times since BoA bought for pennies on the dollars after Countrywide.

The Irony, now is owned by some shady company with roots oversea.

My mortgage alone has been sold three more times since BoA bought for pennies on the dollars after Countrywide.

The Irony, now is owned by some shady company with roots oversea.

a reply to: noeltrotsky

I'm not sure what exactly is going on but I think we're seeing a collapse in the Eurozone. Which in turn may play into the collapse in the dollar. I mean the situation in America isn't much different with the exception that our currency is the reserve currencey of the world.

I'm not sure what exactly is going on but I think we're seeing a collapse in the Eurozone. Which in turn may play into the collapse in the dollar. I mean the situation in America isn't much different with the exception that our currency is the reserve currencey of the world.

edit on

13-3-2015 by asmall89 because: (no reason given)

ya speaking of euros what is an easy way to transfer them into dollars? I've got about 50 Euros worth that my son brought home while in the service

seems like a good time to exchange them into dollars and turn the dollars into something more useful.

As far as what could be happening?

Don't know read somewhere that the big bank might not be able to pass the stress test.

Or maybe Russia, China, and the rest of the brics nations have now built up enough of a backbone for an alternate reserve currency to take root that the dollar's dominace is destined to see it's death.

Or like someone mentioned there could be an explosion in the student loan debt.

Heard something about secret plans in germany to head over russia's way.

I could go on with the list but won't. Heck I've even heard that if china and russia just started buying the dirivatives in gold and silver as much as they could get their hands on and then just demanded delivery of the metals the gig would be up!! We could never deliver..

As far as what could be happening?

Don't know read somewhere that the big bank might not be able to pass the stress test.

Or maybe Russia, China, and the rest of the brics nations have now built up enough of a backbone for an alternate reserve currency to take root that the dollar's dominace is destined to see it's death.

Or like someone mentioned there could be an explosion in the student loan debt.

Heard something about secret plans in germany to head over russia's way.

I could go on with the list but won't. Heck I've even heard that if china and russia just started buying the dirivatives in gold and silver as much as they could get their hands on and then just demanded delivery of the metals the gig would be up!! We could never deliver..

I think the student loan debt and the amount of students defaulting on their school loans is going to cause another economic crisis. The banks won't

allow students to refinance their debt and the interests rates are higher than the current mortgage rate! A lot of students have loans in excess of

30,000 and many have loans pushing or have surpassed the $100,000 mark. They're carrying loans that are comparable to a small mortgage yet lenders

will not allow them to refinance to a lower interest rate.

Universities and housing landlords have taken advantage of this generation. Unless something isn't done to relieve this debt and bring down the tuition cost of a college education, universities will be closing their doors because the average Joe will not be able to afford a college education. This will directly impact the U.S. economy.

Universities and housing landlords have taken advantage of this generation. Unless something isn't done to relieve this debt and bring down the tuition cost of a college education, universities will be closing their doors because the average Joe will not be able to afford a college education. This will directly impact the U.S. economy.

Well, from my understanding..

1. Stocks are over-valued from 200% to 400% of the value, for starters..

2. All the QE and Twists have helped pump things up, and there is no interest rate set by the fed to balance things out.

3. GDP is at all time lows..

4. Unemployment #s are still not reported properly..

5. We're still pumping money out of the USA like a bleeding sponge..

6. NOTHING has been fixed since 2008, it's all been band-aids and cheap scotch tape, instead of repairing the financials.

7. Three major banks failed the Fed stress test, and BofA asked for a re-filing. (So, essentially 4 failed).

8. Housing is still broken..

9. Sub-prime auto loans are still being widely used for auto-financing.

10. There has not been a 10% correction in over 800 days, the third longest period without a correction since 1929, 1999 was the longest of 1200 days of no correction, and that is when the dot.com bubble popped.

So, since nothing has been fixed, and things have been adjusted to make things work, even tho it's busted, we're headed for a worse correction then what we had in 2008. This could be worse then the 1929 crash as well. There has been too much divergence from reality in the financial markets, and they have been, magically, making $100 bills out of pennies.

Looking at numbers across all the world governments, no one is doing well, debt is piled higher then all the plastic waste on the planet, and it's getting worse.

When things get bad, the past two times, we had wars to stimulate the economy. WW1, and WW2 are perfect examples of this.

We are gearing up for WW3, it's coming, and will come just before, or just after the next major crash.

I do suggest stocking up on staples, while you can. Projections range from this spring/summer to 2016 for both war, and the next massive crash. So, anytime, best to error on the side of caution, then to kick the prep down the road.

(Apologies for the long-winded post, the bullet-points are just short notes from the things I've read from other places, and things I've heard from other financial people.).

1. Stocks are over-valued from 200% to 400% of the value, for starters..

2. All the QE and Twists have helped pump things up, and there is no interest rate set by the fed to balance things out.

3. GDP is at all time lows..

4. Unemployment #s are still not reported properly..

5. We're still pumping money out of the USA like a bleeding sponge..

6. NOTHING has been fixed since 2008, it's all been band-aids and cheap scotch tape, instead of repairing the financials.

7. Three major banks failed the Fed stress test, and BofA asked for a re-filing. (So, essentially 4 failed).

8. Housing is still broken..

9. Sub-prime auto loans are still being widely used for auto-financing.

10. There has not been a 10% correction in over 800 days, the third longest period without a correction since 1929, 1999 was the longest of 1200 days of no correction, and that is when the dot.com bubble popped.

So, since nothing has been fixed, and things have been adjusted to make things work, even tho it's busted, we're headed for a worse correction then what we had in 2008. This could be worse then the 1929 crash as well. There has been too much divergence from reality in the financial markets, and they have been, magically, making $100 bills out of pennies.

Looking at numbers across all the world governments, no one is doing well, debt is piled higher then all the plastic waste on the planet, and it's getting worse.

When things get bad, the past two times, we had wars to stimulate the economy. WW1, and WW2 are perfect examples of this.

We are gearing up for WW3, it's coming, and will come just before, or just after the next major crash.

I do suggest stocking up on staples, while you can. Projections range from this spring/summer to 2016 for both war, and the next massive crash. So, anytime, best to error on the side of caution, then to kick the prep down the road.

(Apologies for the long-winded post, the bullet-points are just short notes from the things I've read from other places, and things I've heard from other financial people.).

originally posted by: WeRpeons

I think the student loan debt and the amount of students defaulting on their school loans is going to cause another economic crisis. The banks won't allow students to refinance their debt and the interests rates are higher than the current mortgage rate! A lot of students have loans in excess of 30,000 and many have loans pushing or have surpassed the $100,000 mark. They're carrying loans that are comparable to a small mortgage yet lenders will not allow them to refinance to a lower interest rate.

Universities and housing landlords have taken advantage of this generation. Unless something isn't done to relieve this debt and bring down the tuition cost of a college education, universities will be closing their doors because the average Joe will not be able to afford a college education. This will directly impact the U.S. economy.

*tin-foil hat*

When the next major war breaks out, Uncle Sam will offer debt forgiveness for enlisting in the military, or offer a much sweeter deal then is currently being offered.. Debts are paid two ways, money, or blood, and I feel Uncle Sam will be happy to take blood even more so then money.

I wonder if there is a clause in the student loan papers saying that "Since your in debt to us, we can draft you at a time of need" or some such wording.. Would be something to look for in the legalese of the papers people signed..

/tin foil off.

Yup.. More and more people are defaulting on those payments as people are unable to find work for those degrees they went to college to get. It's a shame, really. At no time have we had so many people with degrees, then at this point in history. (Or so I am willing to bet).

I keep hearing that people should buy physical gold to have a real commodity against a failure of the fiat monetary system. But didn't the government

confiscate gold around the great depression? If it is true that we can't get enough gold together to give it back to Germany, or to pay our debts

after a big crash, where do you think the government is going to get it from? They can't just print up more gold when payback time comes. Ultimately,

the less you own, the less you have that can be taken from you, except your very life. Watch out, they will be coming for your organs and other spare

parts.

edit on 13-3-2015 by MichiganSwampBuck because: added extra comments

edit on 13-3-2015 by MichiganSwampBuck because:

typo

edit on 13-3-2015 by MichiganSwampBuck because: another typo

originally posted by: notmyrealname

You will all be reading about this sooner than later so, here goes:

The USD as a reserve currency is dead.

Then why is everyone rushing to the dollar instead of the other way around?

EDIT: And, by the by, anybody who frequents sites like this has been reading for years about the end of the dollar as a reserve currency.

Not saying it ain't gonna happen soon but all the same.....

edit on 13-3-2015 by DelMarvel because: (no reason given)

a reply to: noeltrotsky

It's coming. I pulled everything out of stocks about 6 months ago too and put it into money market accounts. A correction is coming. Then I'll start putting money back into stock after it bottoms out. Crashes are really a good opportunity for investing when you can see them coming and this one is a no-brainer.

It's coming. I pulled everything out of stocks about 6 months ago too and put it into money market accounts. A correction is coming. Then I'll start putting money back into stock after it bottoms out. Crashes are really a good opportunity for investing when you can see them coming and this one is a no-brainer.

originally posted by: Ksihkehe

a reply to: noeltrotsky

It's coming. I pulled everything out of stocks about 6 months ago too and put it into money market accounts. A correction is coming. Then I'll start putting money back into stock after it bottoms out. Crashes are really a good opportunity for investing when you can see them coming and this one is a no-brainer.

You assume that things will be like they were before.

If things crash bad, I can see the whole system being scrapped.

If you can't hold it in your hand, you don't own it. IMO, I'd rather have consumables that I need to survive.

Also, whats to stop them from emptying all those accounts into their coffers, if things get bad enough?

originally posted by: Ksihkehe

a reply to: noeltrotsky

It's coming. I pulled everything out of stocks about 6 months ago too and put it into money market accounts. A correction is coming. Then I'll start putting money back into stock after it bottoms out. Crashes are really a good opportunity for investing when you can see them coming and this one is a no-brainer.

I'm with you on this bet. 100% cash right now. It isn't a big bet, but I think you're right. Stock correction must be coming soonish...

originally posted by: Cygnis

You assume that things will be like they were before.

If things crash bad, I can see the whole system being scrapped.

If you can't hold it in your hand, you don't own it. IMO, I'd rather have consumables that I need to survive.

Also, whats to stop them from emptying all those accounts into their coffers, if things get bad enough?

Funny you mention that. The money market accounts are only temporary. I had a 3 month window before I could withdraw for cash a few months after I initially moved the money from stocks. That will be up in two weeks or so and I will have cash in hand which will likely go toward a home. As for reinvesting after the crash I always have a wait and see approach at first to see where things are going. If the system does indeed get scrapped I'll look toward opportunities elsewhere.

Of course who's to say they won't take my house, cash, or anything else I have in the end. I don't expect anything is beyond the realm of possibility if things get bad enough.

TPTB say everyone is expecting a US rate hike so the world is buying US dollars. I also read a nasty story that QE pumped a few trillion dollars of

US denominated loans into different countries, so the massive strengthening of the US dollar is killing corporations all around the world that

borrowed in US dollars.

www.businessinsider.com...

Hopefully it is just a rate hike and the US dollar can normalize again after the announcement.

www.businessinsider.com...

Hopefully it is just a rate hike and the US dollar can normalize again after the announcement.

edit on 13-3-2015 by noeltrotsky because: (no

reason given)

The Federal reserve bank watchers talking about raising interest rates should cause some would be house buyers to pull the trigger before rates go

up.

Actually raising interest rates when we have practically negative inflation in the US and average salaries are still lagging might be viewed as criminal by the millennials who are still saddled with student loans.

Actually raising interest rates when we have practically negative inflation in the US and average salaries are still lagging might be viewed as criminal by the millennials who are still saddled with student loans.

new topics

-

Las Vegas UFO Spotting Teen Traumatized by Demon Creature in Backyard

Aliens and UFOs: 2 hours ago -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago -

The functionality of boldening and italics is clunky and no post char limit warning?

ATS Freshman's Forum: 4 hours ago -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago -

Weinstein's conviction overturned

Mainstream News: 6 hours ago -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago -

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago

top topics

-

Krystalnacht on today's most elite Universities?

Social Issues and Civil Unrest: 8 hours ago, 9 flags -

Weinstein's conviction overturned

Mainstream News: 6 hours ago, 7 flags -

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics: 8 hours ago, 6 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 10 hours ago, 6 flags -

Massachusetts Drag Queen Leads Young Kids in Free Palestine Chant

Social Issues and Civil Unrest: 5 hours ago, 4 flags -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News: 5 hours ago, 4 flags -

Chris Christie Wishes Death Upon Trump and Ramaswamy

Politicians & People: 8 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 12 hours ago, 2 flags -

Gaza Terrorists Attack US Humanitarian Pier During Construction

Middle East Issues: 3 hours ago, 2 flags -

2024 Pigeon Forge Rod Run - On the Strip (Video made for you)

Automotive Discussion: 2 hours ago, 1 flags

active topics

-

Supreme Court Oral Arguments 4.25.2024 - Are PRESIDENTS IMMUNE From Later Being Prosecuted.

Above Politics • 74 • : Threadbarer -

Meadows, Giuliani Among 11 Indicted in Arizona in Latest 2020 Election Subversion Case

Mainstream News • 9 • : Oldcarpy2 -

University student disciplined after saying veganism is wrong and gender fluidity is stupid

Education and Media • 50 • : watchitburn -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 55 • : CarlLaFong -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 23 • : Ravenwatcher -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 680 • : 777Vader -

Is there a hole at the North Pole?

ATS Skunk Works • 40 • : Oldcarpy2 -

Fossils in Greece Suggest Human Ancestors Evolved in Europe, Not Africa

Origins and Creationism • 89 • : whereislogic -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 197 • : NorthOS -

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 790 • : Oldcarpy2