It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

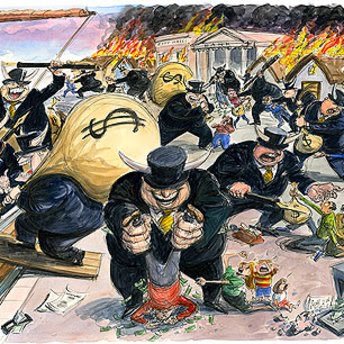

I would like to thank the banks for showing us all the true colors of the

- system

government

media

and stock holders

a reply to: conspiracy nut

Deficit 2/3 paid off: So this is a bit of a misrepresentation. We had the largest deficit ever, ever, massive deficit following the crash of 2008. So our current deficit (the amount we have to borrow each year, not the total borrowed) is 2/3 of what it was at the highest peak ever recorded. The deficit is still higher than it was pre-2008 .. so you can say "the deficit is much lower) but it's much lower only compared to a historical anomaly .. it's really quite high.

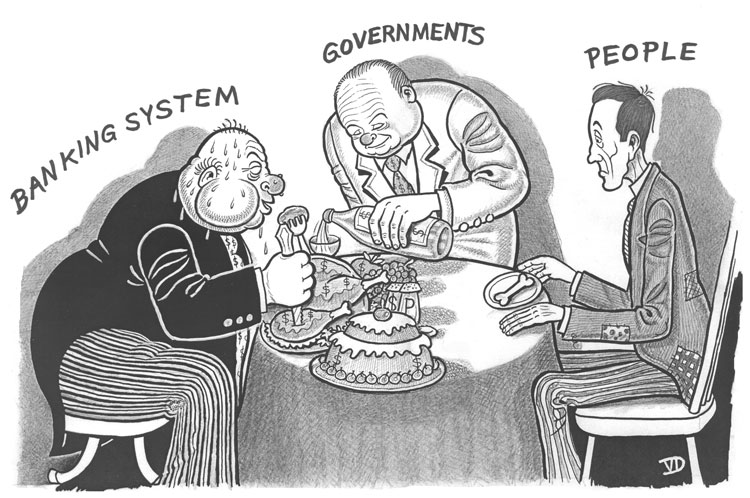

Dow Jones at record high: Yup! Soaring and soaring .. there's a crap ton of liquid cash out there being flung around by the financial institutions. This is why the market has recovered so extraordinarily. Corporate profits are also doing extremely well. Now if you get into "why" it's a little murky. Why is the USA doing better than Europe when technically we are in the same boat? Federal Reserve is the answer. Unlike Europe we have "Quantitive Easing" which pushes a TON of cash into the markets, as well as the remnants of the Bail Outs. It didn't take long after the fall for the cash to start stiring profits and liquidity in the markets sending equity markets sky rocketing.

Basically, if you don't see it in plain English: The stock market has nothing to do with the economy, it has everything to do with monetary policy.

Jobs: Lots of jobs being made, but we STILL have not made up for the total lost. If we have not made up for the total lost The Great Recession then we have a backlog .. we need to make up the jobs lost as well as all the jobs we should have positively gained. The jobs being created would need to tripple for at least 4 years to get back to where we need to be for positive employment and wage/income growth.

Oil: Is set by monetary policy .. the USD has been rising rapidly against other currencies, especially the Euro .. as well, the USA has dramatically increased production (surpassing Saudi Arabia). Of course there's also the conspiracy .. the main oil speculators seem to have backed off or vanished, no longer driving costs higher .. and all of this by magic happens to crash the Russian economy .. hrmmmm .. yeah, draw your own conclusions.

Is it recovering: Yes, super slow like. Given the cycle of Boom/Bust in a Keynesian Economy we won't fully recover before the next crash, which should occur sometime in the next 5 years.

Deficit 2/3 paid off: So this is a bit of a misrepresentation. We had the largest deficit ever, ever, massive deficit following the crash of 2008. So our current deficit (the amount we have to borrow each year, not the total borrowed) is 2/3 of what it was at the highest peak ever recorded. The deficit is still higher than it was pre-2008 .. so you can say "the deficit is much lower) but it's much lower only compared to a historical anomaly .. it's really quite high.

Dow Jones at record high: Yup! Soaring and soaring .. there's a crap ton of liquid cash out there being flung around by the financial institutions. This is why the market has recovered so extraordinarily. Corporate profits are also doing extremely well. Now if you get into "why" it's a little murky. Why is the USA doing better than Europe when technically we are in the same boat? Federal Reserve is the answer. Unlike Europe we have "Quantitive Easing" which pushes a TON of cash into the markets, as well as the remnants of the Bail Outs. It didn't take long after the fall for the cash to start stiring profits and liquidity in the markets sending equity markets sky rocketing.

Basically, if you don't see it in plain English: The stock market has nothing to do with the economy, it has everything to do with monetary policy.

Jobs: Lots of jobs being made, but we STILL have not made up for the total lost. If we have not made up for the total lost The Great Recession then we have a backlog .. we need to make up the jobs lost as well as all the jobs we should have positively gained. The jobs being created would need to tripple for at least 4 years to get back to where we need to be for positive employment and wage/income growth.

Oil: Is set by monetary policy .. the USD has been rising rapidly against other currencies, especially the Euro .. as well, the USA has dramatically increased production (surpassing Saudi Arabia). Of course there's also the conspiracy .. the main oil speculators seem to have backed off or vanished, no longer driving costs higher .. and all of this by magic happens to crash the Russian economy .. hrmmmm .. yeah, draw your own conclusions.

Is it recovering: Yes, super slow like. Given the cycle of Boom/Bust in a Keynesian Economy we won't fully recover before the next crash, which should occur sometime in the next 5 years.

originally posted by: conspiracy nut

heard these 2 stats on cnn the other day, u.s. deficit is 2/3 paid off under obama & dow jones is at record highs.

That is your first problem.

Turn CNN and ALL MSM news OFF.

Do some research on media manipulation, what you heard on CNN is what the elite bankers WANT you to hear.

I spent the last 2 days seeing how deep the MSM manipulation went.

It is all lies, and controlled by a closely knit sorority of elites. Research the 'counsel on foreign relations'.

Then compare the media mogul owners, all 6 or whatever, to the CFR list.

To the OP, no, it is not doing better. I will be shocked if the world economy doesn't crash by the end of this year, so we can all get our 'new' currency.

But 'they' have a little more to squeeze out of the sheep yet.

edit on 1 23 2015 by stosh64 because: (no reason given)

I think it's best to take the growth into perspective. The oil boom is where most of the recovery has come from. We're also inflating the housing

market again, flooding the market with cheap rates on loans. Both of these are setting us up for disaster in the coming years. The drop in price of

oil from over supply means investment dries up for projects which will be needed to support growth and the inevitable increase in demand. The housing

bubble... does that really need any explaining in 2015?

There's growth, and some people are feeling it, others not so much, many not at all. What there has been is a push to twist people's perceptions towards growth when there was no leg for it to stand. Now there's 3 legs on a square top, and the media is positioning weight on the table in an attempt to counterbalance the gravity of the situation.

There's growth, and some people are feeling it, others not so much, many not at all. What there has been is a push to twist people's perceptions towards growth when there was no leg for it to stand. Now there's 3 legs on a square top, and the media is positioning weight on the table in an attempt to counterbalance the gravity of the situation.

new topics

-

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 1 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 5 hours ago -

Electrical tricks for saving money

Education and Media: 8 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 10 hours ago -

Sunak spinning the sickness figures

Other Current Events: 10 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 10 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 14 hours ago, 8 flags -

Electrical tricks for saving money

Education and Media: 8 hours ago, 4 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 11 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 10 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 12 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 16 hours ago, 1 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 1 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 5 hours ago, 0 flags