It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

The price of gas is crashing because Saudi Arabia is pumping gas like crazy.

The GD 'central banks' ain't got jacksnip to do with anything at this point.

With the rise of fracking and Saudi's on the record with snip like this.

Saudi Prince: Fracking Is Threat To Kingdom

Dunno why people are crying.

Goods across the board will get cheaper.

Terrorists of the Sunni, and Shia kind won't have as much money to blow people up.

But decline of oil/gas is only going to be short lived.

The GD 'central banks' ain't got jacksnip to do with anything at this point.

With the rise of fracking and Saudi's on the record with snip like this.

Saudi Prince: Fracking Is Threat To Kingdom

Dunno why people are crying.

Goods across the board will get cheaper.

Terrorists of the Sunni, and Shia kind won't have as much money to blow people up.

But decline of oil/gas is only going to be short lived.

a reply to: BornAgainAlien

Local indicators that the economy is slowing down.

Local pumpkin patch. About 2 acres, is empty pretty much this time of year. Usually cleaned out by Halloween. Went by it the other day and it looks untouched. I mean it laterally looks like less than 5% of the pumpkins were sold. Looked the same as it did 2 weeks before Halloween.

Bad meat now a frequent encounter. Meat is being re-wrapped and sold as "manager specials" with new expiration date. We have gotten more bad meat in the last two month that we have in 3 years.

10 to 12 $ an hour is a base wage for almost everything. No one is really competing for good help with higher wage incentives. Easy jobs are more coveted because the wages for hard work are not worth the difference.

Local indicators that the economy is slowing down.

Local pumpkin patch. About 2 acres, is empty pretty much this time of year. Usually cleaned out by Halloween. Went by it the other day and it looks untouched. I mean it laterally looks like less than 5% of the pumpkins were sold. Looked the same as it did 2 weeks before Halloween.

Bad meat now a frequent encounter. Meat is being re-wrapped and sold as "manager specials" with new expiration date. We have gotten more bad meat in the last two month that we have in 3 years.

10 to 12 $ an hour is a base wage for almost everything. No one is really competing for good help with higher wage incentives. Easy jobs are more coveted because the wages for hard work are not worth the difference.

The lower the gas prices drop the more people will be out of jobs and gas stations will go belly up. They got used to making 4 dollars off every sale

now for a long time. They are paying workers $9.10 an hour versus $6 when this fiasco first started...the minimum wage will go up $9.25 in 2015. So

adios amigo game over. Somebody is cooking up another war to keep them balls lubed.

a reply to: AlphaExray

Nice post. You're very well-versed in the hydrocarbon economy. Quick question: what suggest QE wasn't a good idea/success? What suggest that the total credit markets denominated in dollars isn't growing (they are - stood at $57 trillion this summer)? Do you honestly believe that the Chinese aren't still hoarding dollars?

Nice post. You're very well-versed in the hydrocarbon economy. Quick question: what suggest QE wasn't a good idea/success? What suggest that the total credit markets denominated in dollars isn't growing (they are - stood at $57 trillion this summer)? Do you honestly believe that the Chinese aren't still hoarding dollars?

Yeah, let's trust a blog dedicated to a financial collapse... They're not biased or anything! Let's just say we may be headed for a pullback, but

it has nothing to do with oil and oil collapsing has nothing to do with a weak economy in this instance.

a reply to: BornAgainAlien

Or it could be because we are now pumping much of the oil from the U.S instead of being heavily reliant on foreign oil?

Or it could be because we are now pumping much of the oil from the U.S instead of being heavily reliant on foreign oil?

edit on 3-12-2014 by

Emerys because: (no reason given)

@Dfairlite, Dawgishly and Emerys...you all seem to have missed it`s about the junk bonds.

a reply to: Xeven That's what I been saying.

Noone wants to admit the economy peaks and valleys are almost a reverse of oil prices in the last 10 years. As oil gets extremely expensive the economy craps out, it's getting cheap, goods get cheaper to transport and produce, the entire country is given a raise by oil prices going down.

Noone wants to admit the economy peaks and valleys are almost a reverse of oil prices in the last 10 years. As oil gets extremely expensive the economy craps out, it's getting cheap, goods get cheaper to transport and produce, the entire country is given a raise by oil prices going down.

edit on 4-12-2014 by Vaedur because: (no reason given)

LoL - Russia should be one of THE last country we should be looking towards. If anything, U.S. and company should begin “normalization of

relations” with Russia.

There’s an oil war beginning, right now. And a nuclear race between Iran/Saudi!

If for any reason people actually buy into believing that the world is gonna enjoy these new low gas prices for more than 2yrs (MAX) - - well, then I have some swamp land to sell you (it’ll give you beachfront type of income lol).

Keep your eyes on Iraq/Syria. Saudi has had TWO attacks on their pipelines within the last 2 months. Just an itty bitty attack sent prices up. . . Wait until this really kicks-off beginning of Spring 2015 - - took 1-2yrs to get all the pieces in place & now they are, just in time for the end of 2014. If I was ATS, I would stock up on that ‘cheap’ gas.

Here’s a taste sampler (see which 3 countries are concerned about Iranian airstrikes):

US claims Iran is bombing ISIS in Iraq

Here's The 'Buffer Zone' Where The US Says Iran Is Bombing ISIS

I really don’t think ATS members have any idea that the setup for the KO has begun. . . For Every Action - there’s an Equal & Opposite Reaction

There’s an oil war beginning, right now. And a nuclear race between Iran/Saudi!

If for any reason people actually buy into believing that the world is gonna enjoy these new low gas prices for more than 2yrs (MAX) - - well, then I have some swamp land to sell you (it’ll give you beachfront type of income lol).

Keep your eyes on Iraq/Syria. Saudi has had TWO attacks on their pipelines within the last 2 months. Just an itty bitty attack sent prices up. . . Wait until this really kicks-off beginning of Spring 2015 - - took 1-2yrs to get all the pieces in place & now they are, just in time for the end of 2014. If I was ATS, I would stock up on that ‘cheap’ gas.

Here’s a taste sampler (see which 3 countries are concerned about Iranian airstrikes):

US claims Iran is bombing ISIS in Iraq

Here's The 'Buffer Zone' Where The US Says Iran Is Bombing ISIS

I really don’t think ATS members have any idea that the setup for the KO has begun. . . For Every Action - there’s an Equal & Opposite Reaction

originally posted by: BornAgainAlien

a reply to: Vaedur

The middle class has been wiped out, and those are the consumers when it`s a consumer bases economy, the situation is different now. All the lost GDP in a lot of countries reflects lost in wages and wages is what drives consumption.

Understood. But that happened before the prices dropped. They can only help us now.

originally posted by: rusblued9217

The facts are as such:

-Russia is wholly dependent on oil revenues for state income

Actually Oil and Gas revenues are just over 50% of state revenues...but don't let the truth stop your 'facts'.

originally posted by: rusblued9217

Say a Russian petroleum company has a gross debt of 50 billion dollars at 5% per annum, if the ruble was trading at 30 dollars then it would pay [30 x (50 billion x 0.05)] = 75 billion rubles to service that debt each year.

Then assuming all profits remain the same for the company, if the ruble drops 40% in value so that 42 rubles now buys 1 dollar, then they suddenly have to pay 105 billion rubles to service the same debt at the same rate.

A Russian petroleum company gets 100% of it sales in US $ so is entirely insulated from the devaluation of the Ruble. In fact, it's cost base inside Russia is paid out in Rubles so the company generates much more profit due to the Ruble devaluation.

The rest of the Russian economy gets destroyed by the devaluation of course.

It's disappointing to see posts like this that get such fundamental things wrong. Ruins my faith in the educational system.

originally posted by: AlphaExray

a reply to: BornAgainAlien

I am weary about getting into the fray on this topic, but the economics being bandied around here is painful to read. There are a lot more factors involved in oil trading, and strategic reserves of both currency and oil than people seem to realize.

First of all, fracking condensate is very expensive to produce, and ranks just below the Canadian tar sands in terms of cost per barrel for extraction. That is the main reason Ali al-Naimi, the oil minister of OPEC kingpin Saudi Arabia, warned his fellow OPEC members they must allow the price to drop to combat the U.S. shale boom, which is basically to ensure market share.

U.S. exports of lightly processed condensate, also known as light oil, started arriving in Asia in August and exports doubled to about 600,000 barrels in October. Royal Dutch Shell bought the last cargo coming to Asia, due to arrive at its Singapore refinery in December, but as a result of the price shifts no more cargoes are expected to head east any time soon. That means they will need to head to Europe, but the Shortage of tanker capacity (thanks to nations like Venezuela and and China) being booked up by Middle eastern and African supply will cause a backlog here in the US that will not clear up until it reaches market at a tremendous loss.

Lots of efforts have been made to force ship owners to convert new built vessels to Dual fuel/LNG under the guise of Ecological emissions program to ensure the demand for Fracking condensate, but it seems it is too little too late. Just today Norway’s Siem Offshore Inc. and Rem Offshore ASA lost a contract to work for Exxon’s joint venture with Rosnef to work in the Russian arctic, which hammered their markets. This is expected to precede the loss of Exxon’s contract to service the Russian arctic reserve. This means, Russia is signalling it is planning on cutting off the US ability to profit from their oil reserves.

People are being told that Russia is losing in this scenario. I am really not so sure. It is the mantra of all the mainstream market rags like Bloomberg, but these are the same sources that keep touting we are in an economic recovery, that quantitative easing was a good idea, and that the US dollar in forever. There is always the possibility that these measures make Russia stronger. The Russian billionaires that are “exposed”, have already been warned by Putin when sanctions were first considered that they needed to prepare for the blowback and reduce their exposure. They seem to have shown that they are willing to see their US/Euro holdings devalued as long as they are compensated in Ruan/Ruble futures. Russia and China have also been divesting themselves of the US dollar holdings, especially bonds. It is also known that they are converting their US cash reserves to buy tangible gold. That is an important factor. Thanks to US quantitative easing, and both dollar and metal market manipulation, physical gold is valued at less than the actual average extraction cost of 1600 USD per ounce. So we have the Chinese converting their massive USD currency reserves into Physical gold, land holdings globally, and they are also building a huge strategic oil bank that they are stockpiling by paying off Russian dollar debt for oil with what they feel are worthless US dollars. Essentially, the Ruble and the Ruan are going to be a gold backed currency, despite being downgraded by a rapidly inflating US fiat Currency. It all becomes moot when the dollar tanks, and these moves are making it more likely.

This is far messier than people realize. Yeah, it is cheaper to fill your car, but these is a very real war going on between the elites, and soon they are going to start throwing us into the mix

AX

FTNWO

I quoted the whole thing so people may read it again because it is SPOT ON.

AlphaExray, thank you for joining the fray and taking the time to type that.

Interesting times ahead.

originally posted by: rusblued9217

a reply to: Realtruth

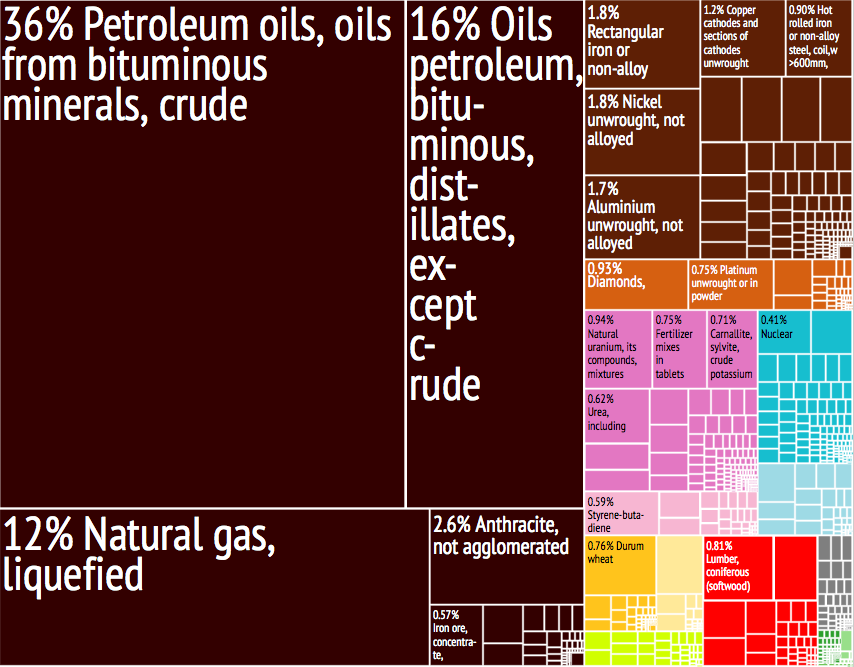

Treemap of Russian Exports, area denotes relative size.

Your pic is about Russian EXPORTS....not Russian Government Revenues. Huge difference. The truth is that the Kremlin's budget is just over 50% based on Oil and Gas exports.

The difference between your assertion of this government completely relying on Oil and Gas and only relying 50% on it can be easily illustrated by considering the current situation in Venezuela. They are over 90% dependent on Oil exports and they are on the verge of defaulting and likely will in 2015. Line ups around the block at stores and limits on toilet paper purchases today. Russia is nowhere near that currently or in the next several years even with the added pressure of punishing economic sanctions.

Disappointed again as you can see.

originally posted by: AlphaExray

a reply to: BornAgainAlien

I am weary about getting into the fray on this topic, but the economics being bandied around here is painful to read.

Agreed wholeheartedly! Good post and a pleasure to read and comment on.

originally posted by: AlphaExray

a reply to: BornAgainAlien

That is the main reason Ali al-Naimi, the oil minister of OPEC kingpin Saudi Arabia, warned his fellow OPEC members they must allow the price to drop to combat the U.S. shale boom, which is basically to ensure market share.

I understand the 'protect market share' argument but think it is superficial. The deeper reality is that the Saudis don't want to sell oil at such a low price for the foreseeable future. If you understand monopolistic pricing theory then you very quickly see a huge market player setting a price that is intended to KILL OFF higher cost 'new entrants' to the field. It has cost billions and billions of investment to begin pumping all that US shale Oil and gas. All the while the Saudi's could have pumped more and lowered the price and stopped that. Instead they sat back and waited until all the investment was done. Then they jump in and sewer the price making that investment a very poor one.

The price has been sewered on purpose, but not to protect sales. It's happening to teach Oil and Gas companies an investment lesson. One they won't forget for a long time.

originally posted by: AlphaExray

a reply to: BornAgainAlien

People are being told that Russia is losing in this scenario. I am really not so sure.

I am positive Russia is losing due to the Oil price manipulation going on. The currency situation you briefly covered is a bit separate from the revenue Russia gets from Oil. Only a full US dollar tanking would change that...and that is quite a difficult situation to believe happening in the near term. While I do appreciate the currency battles going on in the shadows I can't see a massive US dollar correction, even given unheard of and largely unknown QE effects.

A pleasure to read and discuss....don't be shy with your thoughts!

originally posted by: neo96

The price of gas is crashing because Saudi Arabia is pumping gas like crazy.

The GD 'central banks' ain't got jacksnip to do with anything at this point.

With the rise of fracking and Saudi's on the record with snip like this.

Saudi Prince: Fracking Is Threat To Kingdom

Dunno why people are crying.

Goods across the board will get cheaper.

Terrorists of the Sunni, and Shia kind won't have as much money to blow people up.

But decline of oil/gas is only going to be short lived.

For once, I actually agree with you. This is what's going on. The Saudis want to kill the fracking industry because fracking has become a serious threat against OPEC domination. No other reason. Well, Russia as a bonus. We are currently observing a cartel protecting its turf.

Fracking is a curious dilemma, and one I find it really difficult to take a position on, because both sides have valid arguments, and both sides protect something critical to this country.

On one hand, fracking gives us access to energy reserves so vast that we could really give the finger to OPEC if we wanted to. We could finally abandon the Middle East, and they could go back to whatever it was they were doing before we discovered oil there. No more desert wars. Fracking creates a lot of jobs, and good paying ones with a lot of benefits. Not part time or temp ones supplemented with food stamps for survival.Through the creation of good paying jobs, the economy gets a nice kick start in other sectors. Even more potential jobs.

However, fracking also carries heavy environmental, health and ecological costs, as does all oil extraction. It uses up entirely too much water in areas of the country under pretty harsh droughts, and I personally believe water should be the number one environmental concern globally. We not only need water to live, we need fresh uncontaminated water, and fracking uses chemicals that you don't want leeching into ground water. It also destroys habitat and wildlife when you have to construct infrastructure such as pipelines. Then, there is the hazards of pipeline sabotage or malfunction causing massive amounts of damage to surrounding areas.

So, in choosing either, we will sacrifice something critical.

originally posted by: APT1Yksnidnak

LoL - Russia should be one of THE last country we should be looking towards. If anything, U.S. and company should begin “normalization of relations” with Russia.

There’s an oil war beginning, right now. And a nuclear race between Iran/Saudi!

If for any reason people actually buy into believing that the world is gonna enjoy these new low gas prices for more than 2yrs (MAX) - - well, then I have some swamp land to sell you (it’ll give you beachfront type of income lol).

Keep your eyes on Iraq/Syria. Saudi has had TWO attacks on their pipelines within the last 2 months. Just an itty bitty attack sent prices up. . . Wait until this really kicks-off beginning of Spring 2015 - - took 1-2yrs to get all the pieces in place & now they are, just in time for the end of 2014. If I was ATS, I would stock up on that ‘cheap’ gas.

Here’s a taste sampler (see which 3 countries are concerned about Iranian airstrikes):

US claims Iran is bombing ISIS in Iraq

Here's The 'Buffer Zone' Where The US Says Iran Is Bombing ISIS

I really don’t think ATS members have any idea that the setup for the KO has begun. . . For Every Action - there’s an Equal & Opposite Reaction

Getting warmer. . .

Iran Army to stage anti-terror war games: General

Iran to hold massive military drill near strategic Strait of Hormuz

“The Army’s Navy, Air Force, Ground Forces and Air Defense will participate in the maneuvers.”

"New weapons and tactics will be tested and evaluated in the war games,” Mousavi said, adding the drill will also feature exercises on fighting terrorism.

Yup.

edit on 21-12-2014 by SurrenderingAmerica because: accentuation

a reply to: BornAgainAlien

I'll just leave this here....

www.israelnationalnews.com...#!

www.economist.com...

www.juancole.com...

www.vox.com...

Two words, economic warfare.

I'll just leave this here....

According to Foreign Policy, Saudi Arabia is behind the drop in prices, with the paper noting that in September the Gulf state boosted oil production by half a percent to 9.6 million barrels a day, and then offered increased discounts to major Asian customers, causing global prices to plummet by nearly 30%.

This isn't even the first time the Saudis have crashed the market to get at Iran according to the paper, which notes in 1977 Saudi Arabia flooded the markets by boosting production from 8 million to 11.8 million barrels a day and cutting crude prices, setting in motion the Iranian Revolution.

www.israelnationalnews.com...#!

Finally, the Saudis and their Gulf allies have decided not to sacrifice their own market share to restore the price. They could curb production sharply, but the main benefits would go to countries they detest such as Iran and Russia. Saudi Arabia can tolerate lower oil prices quite easily. It has $900 billion in reserves. Its own oil costs very little (around $5-6 per barrel) to get out of the ground.

www.economist.com...

Saudi Arabia did not cause the oil price fall, though since 2011 it has been flooding the market to offset the decrease in Iranian exports because of US sanctions. Riyadh, however, is the main geopolitical winner here, which is why the Saudis stopped the Organization of Petroleum Exporting Countries from reducing country production quotas. (That step would have reduced supply and put up prices). As it is, the Saudis can afford to wait as fracked oil is driven out of the market because too expensive, so that they regain their market share.

www.juancole.com...

On the other side of the debate was Saudi Arabia, the world's largest oil producer, which was opposed to cutting production and willing to let prices keep dropping.

www.vox.com...

Two words, economic warfare.

new topics

-

God lived as a Devil Dog.

Short Stories: 7 minutes ago -

Happy St George's day you bigots!

Breaking Alternative News: 1 hours ago -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 2 hours ago -

Hate makes for strange bedfellows

US Political Madness: 4 hours ago -

Who guards the guards

US Political Madness: 7 hours ago -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 9 hours ago

top topics

-

Hate makes for strange bedfellows

US Political Madness: 4 hours ago, 14 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 14 hours ago, 11 flags -

Who guards the guards

US Political Madness: 7 hours ago, 10 flags -

1980s Arcade

General Chit Chat: 16 hours ago, 7 flags -

Deadpool and Wolverine

Movies: 17 hours ago, 4 flags -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat: 2 hours ago, 3 flags -

Has Tesla manipulated data logs to cover up auto pilot crash?

Automotive Discussion: 9 hours ago, 2 flags -

Happy St George's day you bigots!

Breaking Alternative News: 1 hours ago, 2 flags -

God lived as a Devil Dog.

Short Stories: 7 minutes ago, 1 flags

active topics

-

Candidate TRUMP Now Has Crazy Judge JUAN MERCHAN After Him - The Stormy Daniels Hush-Money Case.

Political Conspiracies • 720 • : xuenchen -

TLDR post about ATS and why I love it and hope we all stay together somewhere

General Chit Chat • 6 • : Mantiss2021 -

Happy St George's day you bigots!

Breaking Alternative News • 10 • : BedevereTheWise -

God lived as a Devil Dog.

Short Stories • 0 • : BrotherKinsMan -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 240 • : TzarChasm -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 615 • : daskakik -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs • 16 • : pianopraze -

1980s Arcade

General Chit Chat • 21 • : chris_stibrany -

Hate makes for strange bedfellows

US Political Madness • 30 • : nugget1 -

Who guards the guards

US Political Madness • 3 • : theatreboy