It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

I heard this morning on NPR some of these same theories, except it was about the US Fracking industry. Apparently Fracking is more expensive than

traditional drilling/pumping and if OPEC continues to produce in these amounts the bottom will fall out of the Fracking industry.

a reply to: grey580

I think you're dead-on about your Russia observation. More specifically, I think it's targeted at Putin and the oligarchs running the show over there. Further, once the price per barrel falls to a certain level, that takes out Canada and oil production from the tar sands. Look at the effect on the Loonie. Might be a good time for me to visit Montreal.

I think you're dead-on about your Russia observation. More specifically, I think it's targeted at Putin and the oligarchs running the show over there. Further, once the price per barrel falls to a certain level, that takes out Canada and oil production from the tar sands. Look at the effect on the Loonie. Might be a good time for me to visit Montreal.

the usd is oil backed correct? if oil prices go down the usd drops right?

a reply to: PrinceRupertsDog

Do not follow the logic here, Oil would have to actually fall below 30 for Canada to not make a profit, they just complain that they do not profit so insanely as before.

Nothing is in slowdown in Canada, no one cares, and a lower dollar does not seem to be having much effect.

Too believe this is all about targeting Russia is classic media fed spin, this is about targeting ANYONE, why always focus on the so-called obvious.

Sure is going to get dicey soon, something is definitely trying to shake things up again, and push the world in yet another direction, a dark direction.

Do not follow the logic here, Oil would have to actually fall below 30 for Canada to not make a profit, they just complain that they do not profit so insanely as before.

Nothing is in slowdown in Canada, no one cares, and a lower dollar does not seem to be having much effect.

Too believe this is all about targeting Russia is classic media fed spin, this is about targeting ANYONE, why always focus on the so-called obvious.

Sure is going to get dicey soon, something is definitely trying to shake things up again, and push the world in yet another direction, a dark direction.

a reply to: ParasuvO

From reading several other threads here on ATS, as well as following the MSM spin on oil prices, it seems that OPEC is keeping production high to surpress the price of oil to knock out the nations that are producing oil through less traditional, but more expensive means. What is the extraction cost of a barrel of oil from tar sands? It has to be more from a well. Extracting oil from tar sands is basically akin to strip-mining, isn't it?

I'm not trying to be anti-Canada either. Its just an observation.

From reading several other threads here on ATS, as well as following the MSM spin on oil prices, it seems that OPEC is keeping production high to surpress the price of oil to knock out the nations that are producing oil through less traditional, but more expensive means. What is the extraction cost of a barrel of oil from tar sands? It has to be more from a well. Extracting oil from tar sands is basically akin to strip-mining, isn't it?

I'm not trying to be anti-Canada either. Its just an observation.

-Make oil number one resource

-Kill for oil

-launder money through oil

-Get rich

-Everyone is making oil now

- Prices drop

-Rich people complaining they arn't making enough money

-Fire workers and begin budget cuts

-more oil producers try to sell or buy up all they can

-Market is flooded with oil because or steps leading to here

-No longer a profit incentive

-Buy up every last drop of oil

- Crash the market

Rinse and repeat.

-Kill for oil

-launder money through oil

-Get rich

-Everyone is making oil now

- Prices drop

-Rich people complaining they arn't making enough money

-Fire workers and begin budget cuts

-more oil producers try to sell or buy up all they can

-Market is flooded with oil because or steps leading to here

-No longer a profit incentive

-Buy up every last drop of oil

- Crash the market

Rinse and repeat.

Of course in a world that functions on the basis of privately owned organizations. This will always occure.

Can't have unvoted people controlling our vital resources. And even charging us at a premium? Barbaric.

Can't have unvoted people controlling our vital resources. And even charging us at a premium? Barbaric.

a reply to: ParasuvO

Lol Canada? Dropping oil prices?

When was a the last time monopolies didn't control the economy here? As it were, This is the home of the Hudson Bay Company.

The rest of the world will crash before Canada gives it's citizens a deal.

They need all the extra Tax dollars they can get to fund their election campaigns and to subsitize internation companies to resource deals in Canada where our politicians sell our land for more money to fund elections and to fund more international projects. And it just goes round and round and round. Oh and they do this all without our concent.

Lol Canada? Dropping oil prices?

When was a the last time monopolies didn't control the economy here? As it were, This is the home of the Hudson Bay Company.

The rest of the world will crash before Canada gives it's citizens a deal.

They need all the extra Tax dollars they can get to fund their election campaigns and to subsitize internation companies to resource deals in Canada where our politicians sell our land for more money to fund elections and to fund more international projects. And it just goes round and round and round. Oh and they do this all without our concent.

Canada's worst nightmare is being right next door to America, just think about it, con's outnumber the pro's big time.

a reply to: AnuTyr

Rinse and repeat...yeah I got it...sounds like the Rothschilds or JP Morgan at it again. I wonder when the real elephant in the room starts rearing its ugly head....

from www.abc.net.au...

$710 trillion: that's a lot of exposure to derivatives

"In a speech to a symposium at the Federal Reserve Bank of San Francisco this week, Mr Stevens said that while the Basel III process to apply new capital and liquidity to banks are "well on track", efforts to better regulate derivatives are "running behind original timetables".

And last week the Bank for International Settlements revealed that the amount of over-the-counter (OTC) derivatives outstanding reached $US710 trillion at the end of 2013, a 12 per cent increase on the year before."

-Buy up every last drop of oil

- Crash the market

Rinse and repeat.

Rinse and repeat...yeah I got it...sounds like the Rothschilds or JP Morgan at it again. I wonder when the real elephant in the room starts rearing its ugly head....

from www.abc.net.au...

$710 trillion: that's a lot of exposure to derivatives

"In a speech to a symposium at the Federal Reserve Bank of San Francisco this week, Mr Stevens said that while the Basel III process to apply new capital and liquidity to banks are "well on track", efforts to better regulate derivatives are "running behind original timetables".

And last week the Bank for International Settlements revealed that the amount of over-the-counter (OTC) derivatives outstanding reached $US710 trillion at the end of 2013, a 12 per cent increase on the year before."

I'll be shocked if I see the price at the pump drop below $2.00 in my area. It's gotten near $2.00 a couple times the past month, but never past

it.

If the bottom does fall out of the market and we have a crash, I really hope we manage to build something better in it place. Not likely but I can still hope.

If the bottom does fall out of the market and we have a crash, I really hope we manage to build something better in it place. Not likely but I can still hope.

a reply to: BornAgainAlien

Well, you should look at the change of price in %'s and not in $'s. It's not the second time in history and not the last. And after every crash like this, there was a rebound in the coming weeks. Price will probably rebound to 80-85 levels in the coming weeks, considering the recent fall and winter season (rise in demand).

OPEC wants to hurt US fracking industry, since there won't be more investments in 2015 if the price of oils stays on thecurrent levels. OPEC is thinking long term and wants to keep it's market share.

Well, you should look at the change of price in %'s and not in $'s. It's not the second time in history and not the last. And after every crash like this, there was a rebound in the coming weeks. Price will probably rebound to 80-85 levels in the coming weeks, considering the recent fall and winter season (rise in demand).

OPEC wants to hurt US fracking industry, since there won't be more investments in 2015 if the price of oils stays on thecurrent levels. OPEC is thinking long term and wants to keep it's market share.

originally posted by: blkcwbyhat

a reply to: BornAgainAlien

while the observation is true on the surface,the rumors I've read and heard believe that OPEC maintained the production in order to hurt the soviet oil sales.If the soviets are supporting the ISIS ,oversupply will hurt the russin economy.It will also make investors think twice before investing in the keystone pipeline,fracking,or alt energy.This will keep the world dependant on middle east oil in the future.

Who are the soviets?

Are you suggesting Russia is supporting isis? Because it's actually the west and it's arab allies who created isis and all the other groups fighting in Syria. They armed them and trained them in Turkey Jordan and Saudi Arabia.

There's more going on with the oil price collapse then the Saudi trying to hurt US shale oil developments.

originally posted by: Agit8dChop

I think the price of oil is heavily manipulated.

There wasn't a glut all of a sudden over night.

This is the US and Saudi putting their collective might together to squeeze Russia.

It proves to me 2 things.

1. The oil companies have greatly manipulated the price of oil to make incredible profits for the past decade.

2. The Australian Government is full of BS. Oil hasn't changed in price here, yet the cost of oil has halved.

Oil is sold on the futures market. Oil being pumped 6 months from now is being purchased today. News of increasing production has an immediate impact on the price as a result even though the supply hasn't yet caught up.

a reply to: PrinceRupertsDog

Even though our propaganda has been saying for years that Canada is super and came out on top of the global economic crisis, the average person is affected. I know countless people who are jobless and unemployment is growing. Lots of production is dropping. One of my friends who builds warehouses and company buildings showed me an entire row of warehouses up for sale, because the original companies went bankrupt!

a reply to: AnuTyr

Harper's quite the patriot, eh?

Even though our propaganda has been saying for years that Canada is super and came out on top of the global economic crisis, the average person is affected. I know countless people who are jobless and unemployment is growing. Lots of production is dropping. One of my friends who builds warehouses and company buildings showed me an entire row of warehouses up for sale, because the original companies went bankrupt!

a reply to: AnuTyr

Harper's quite the patriot, eh?

a reply to: SkipperJohn

I have posted this before in another thread, the sound and video quality isn`t that good, but it gives a real good explanation about the Petrodollar...

The Petrodollar | War Machine

I have posted this before in another thread, the sound and video quality isn`t that good, but it gives a real good explanation about the Petrodollar...

The Petrodollar | War Machine

Here I thought is was so much simpler.

It hasn't been as dramatic maybe, but it seems to do this every winter and I thought there were more "domestic" reasons. Like, the average temperature and how much can be stored or the fact that people don't take cross-country road trips in the winter (as a simple example). Also, this kinda encourages us to spend all our money elsewhere over the holidays.

But yea, it's probably more global than that. I'll see myself out.

It hasn't been as dramatic maybe, but it seems to do this every winter and I thought there were more "domestic" reasons. Like, the average temperature and how much can be stored or the fact that people don't take cross-country road trips in the winter (as a simple example). Also, this kinda encourages us to spend all our money elsewhere over the holidays.

But yea, it's probably more global than that. I'll see myself out.

IMO Oil prices are being manipulated for 2 reasons.

First is to show Russia that their game on trying to bypass the dollar with China was a massive mistake, and they are about to find out who the real boss in in the world.

Second is to put all the small fracking companies out of business and for the cartel to buy the remaining large ones.

Ever hear of killing 2 birds with one stone?

This is a classic example.

First is to show Russia that their game on trying to bypass the dollar with China was a massive mistake, and they are about to find out who the real boss in in the world.

Second is to put all the small fracking companies out of business and for the cartel to buy the remaining large ones.

Ever hear of killing 2 birds with one stone?

This is a classic example.

a reply to: Realtruth

An excellent critique.

Multiple birds indeed.

- Russia is pummeled by a currency crisis and dollar/euro loans are defaulted on by non hydrocarbon producing corporations as a result, public services & investment will be scaled back due to lack of funds

- Iran, whom back Assad and hav very strong ties with Russia are also pummeled, strengthening Saudi/US/Israeli/Egyptian hegemony in the ME.

- The smaller fracking enterprises will be swallowed up by the huge energy giants, funded of course by wall street/the city.

- The boom currently going on in US manufacturing production strengthens due to very low energy costs.

- Chinese exports are less competitive when compared with US productivity gains/cheap energy allowing those gains to be utilized.

Indeed this is killing multiple birds with one big stone!

And REGARDLESS of what the pro-Putin and pro-Russia fans out there think (Putin is so wonderful, making independent journalism and sites like this one illegal in Russia, along with openly expressing ones sexuality) Russia will be hit incredibly hard as long as oil is < $100. The Russian government, as I have previously noted, is wholly dependent on hydrocarbon exports for revenue, and this is exacerbated when it comes to inflows of foreign hard capital.

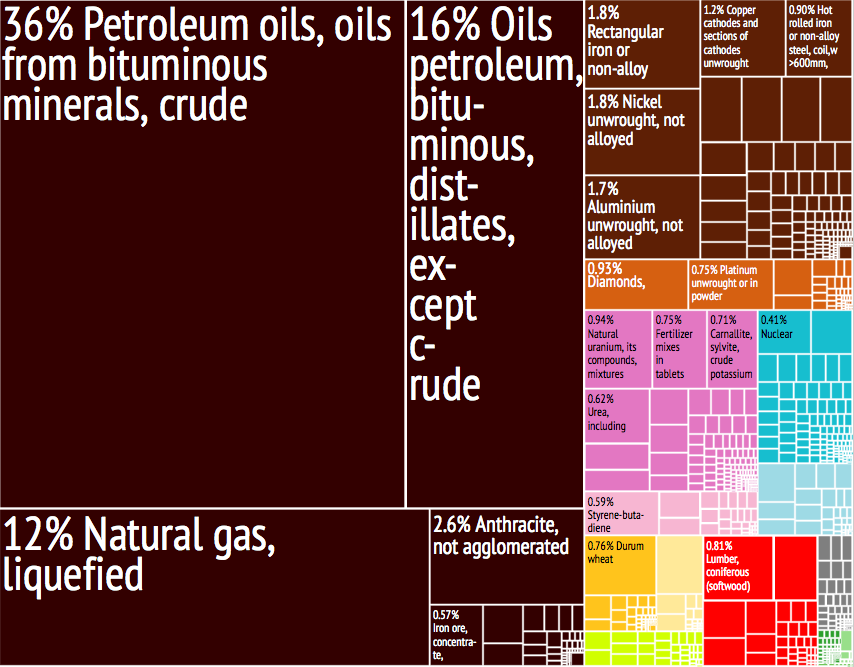

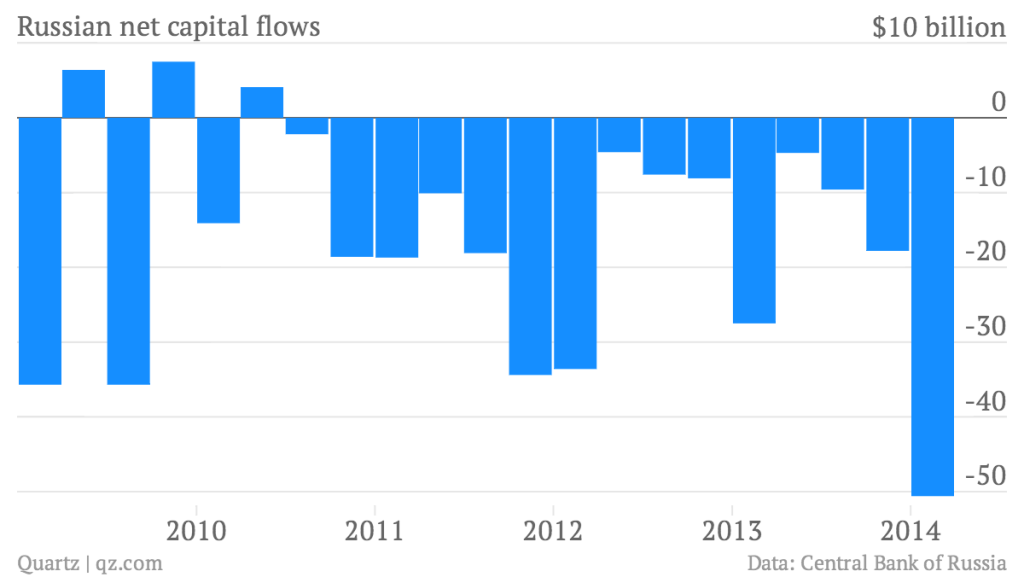

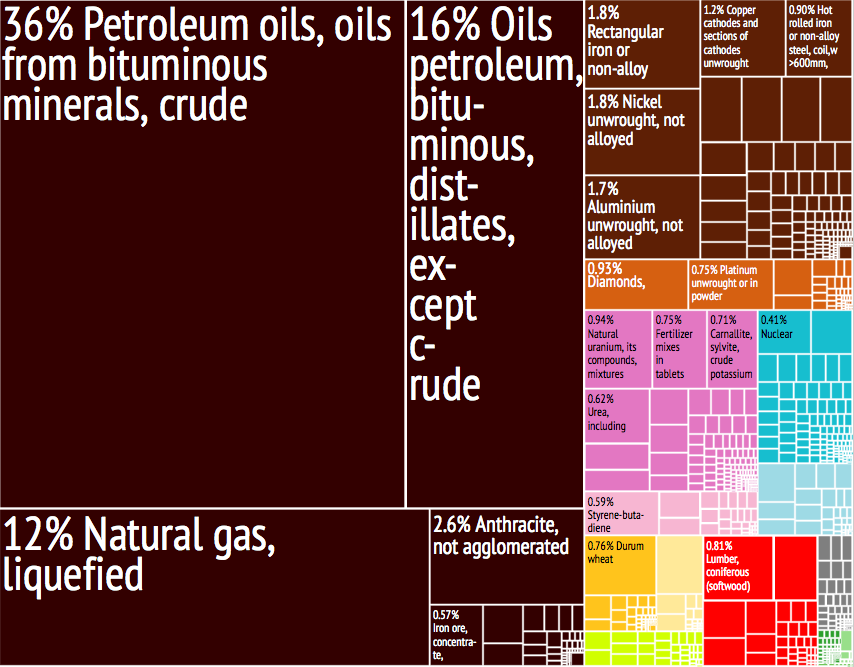

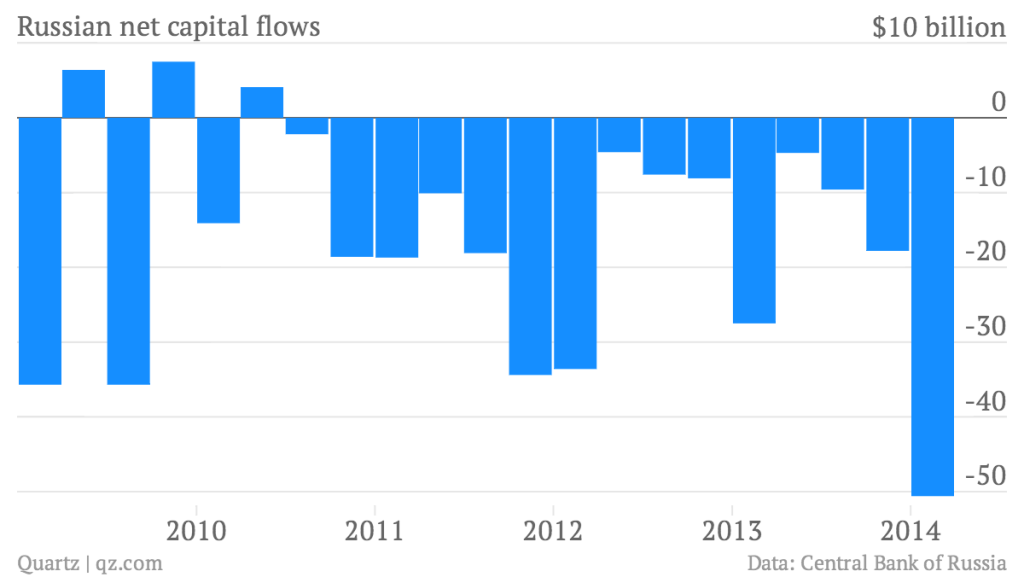

Treemap of Russian Exports, area denotes relative size.

Russian capital flows.

Hmm, food for thought..............

An excellent critique.

Multiple birds indeed.

- Russia is pummeled by a currency crisis and dollar/euro loans are defaulted on by non hydrocarbon producing corporations as a result, public services & investment will be scaled back due to lack of funds

- Iran, whom back Assad and hav very strong ties with Russia are also pummeled, strengthening Saudi/US/Israeli/Egyptian hegemony in the ME.

- The smaller fracking enterprises will be swallowed up by the huge energy giants, funded of course by wall street/the city.

- The boom currently going on in US manufacturing production strengthens due to very low energy costs.

- Chinese exports are less competitive when compared with US productivity gains/cheap energy allowing those gains to be utilized.

Indeed this is killing multiple birds with one big stone!

And REGARDLESS of what the pro-Putin and pro-Russia fans out there think (Putin is so wonderful, making independent journalism and sites like this one illegal in Russia, along with openly expressing ones sexuality) Russia will be hit incredibly hard as long as oil is < $100. The Russian government, as I have previously noted, is wholly dependent on hydrocarbon exports for revenue, and this is exacerbated when it comes to inflows of foreign hard capital.

Treemap of Russian Exports, area denotes relative size.

Russian capital flows.

Hmm, food for thought..............

The oil price came down very quick in 2008 because it went up very fast before making new highs. There was a lot of hype in the price.

Oilprices kept falling because the Saudis are flooding the market. They have been asked to do so by America (Nato) to put pressure on Russia maybe Iran too.

EDIT: Ninjaed it looks like birds are singing this one from the rooftops for quite a while now.

Oilprices kept falling because the Saudis are flooding the market. They have been asked to do so by America (Nato) to put pressure on Russia maybe Iran too.

EDIT: Ninjaed it looks like birds are singing this one from the rooftops for quite a while now.

edit on 2-12-2014 by Merinda because: (no

reason given)

new topics

-

Bobiverse

Fantasy & Science Fiction: 1 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 2 hours ago -

Former Labour minister Frank Field dies aged 81

People: 4 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 5 hours ago -

This is our Story

General Entertainment: 8 hours ago -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 10 hours ago -

Ode to Artemis

General Chit Chat: 11 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 10 hours ago, 14 flags -

Should Biden Replace Harris With AOC On the 2024 Democrat Ticket?

2024 Elections: 17 hours ago, 6 flags -

One Flame Throwing Robot Dog for Christmas Please!

Weaponry: 15 hours ago, 6 flags -

Don't take advantage of people just because it seems easy it will backfire

Rant: 15 hours ago, 4 flags -

Ditching physical money

History: 15 hours ago, 4 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 5 hours ago, 4 flags -

Former Labour minister Frank Field dies aged 81

People: 4 hours ago, 4 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 2 hours ago, 4 flags -

Ode to Artemis

General Chit Chat: 11 hours ago, 3 flags -

This is our Story

General Entertainment: 8 hours ago, 3 flags

active topics

-

Post A Funny (T&C Friendly) Pic Part IV: The LOL awakens!

General Chit Chat • 7133 • : underpass61 -

VirginOfGrand says hello

Introductions • 2 • : TheMichiganSwampBuck -

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 50 • : TheMichiganSwampBuck -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 23 • : Justoneman -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 128 • : twistedpuppy -

The Reality of the Laser

Military Projects • 37 • : DronesandUFOs -

Breaking Baltimore, ship brings down bridge, mass casualties

Other Current Events • 476 • : IndieA -

So this is what Hamas considers 'freedom fighting' ...

War On Terrorism • 257 • : TheWoker -

Marjorie Taylor Greene Files Motion to Vacate Speaker Mike Johnson

US Political Madness • 65 • : WeMustCare -

Election Year 2024 - Interesting Election-Related Tidbits as They Happen.

2024 Elections • 71 • : WeMustCare