It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

Chinese banks are seeing the writing on the wall in terms of the debt they've accumulated, and they are taking measures to protect themselves.

The Bank of China is planning the biggest sale of shares ever — $6.5 billion to offshore investors, Bloomberg says. It's all in an effort to create a capital cushion.

China's banking system has piled up the most bad loans of any time since the financial crisis, and the banks are preparing for the moment those debts collapse.

Especially in corporate and property sectors, things are looking dire.

China's Banks Are Getting Ready For A Debt Implosion

Ya know it's funny but I had come to think of China as the number 2 in the worlds financials markets.

I mean they did buy up a lot of bad stocks and bonds they just bought that hoittie-tottie hotel in NYC.

but I guess that was all hype to make themselves look better.

Last week the industry was rocked when the $20 billion development company Agile Property Holdings canceled a $360 million share offering. Then the company's chairman, billionaire Chen Zhuolin, disappeared.

But that — coupled with the March collapse of Zhejiang Xingrun Real Estate Co. under $571 million in debt — has investors spooked.

they say China's producer-price index has fallen 6.7% in the past 36 months. I'm not a big shot money guy but I know enough about the markets to say... this looks bad...esp right now with everyone worried about the European economy...might even be bad as our own 2008 meltdown???

this is one story to keep an eye on folks

China has made a lot of bad decisions in purchasing things. Like buying a trillion dollars of the United States bonds. That is like buying stock in

a ponzi scheme.

a reply to: rickymouse

Guess that puts an end to their hope of replacing the US dollar with their own Yuan as the new currency standard too..

Oh well, maybe prices will drop enough so I can buy me one of those new 70 inch HD TV for the chance I have in my pocket...

Guess that puts an end to their hope of replacing the US dollar with their own Yuan as the new currency standard too..

Oh well, maybe prices will drop enough so I can buy me one of those new 70 inch HD TV for the chance I have in my pocket...

This is all very similar to what Japan did 25 years ago with trying to spread its debt risk into real estate and other investments.

They still have not recovered.

They still have not recovered.

a reply to: AugustusMasonicus

It seems like people think they can succeed at something others failed at in this world. They think they are better salesmen. Selling deceit is very popular and profitable nowadays.

It seems like people think they can succeed at something others failed at in this world. They think they are better salesmen. Selling deceit is very popular and profitable nowadays.

a reply to: AugustusMasonicus

I just checked at the Yuan is 6.12 per USD... right now the markets are closed over there but it looks like the SSE had a rough up and down day... can't wait to see what happens when they open again in a few hours.

Shanghai Stock Exchange

I just checked at the Yuan is 6.12 per USD... right now the markets are closed over there but it looks like the SSE had a rough up and down day... can't wait to see what happens when they open again in a few hours.

Shanghai Stock Exchange

originally posted by: HardCorps

I just checked at the Yuan is 6.12 per USD...

Take the Yuan to Dollar ratio with a grain of salt, China has been rigging their currency for decades to support the illusion of double digit growth. They are due for a financial reset that will rival the one we had in 2008, it may even be worse.

a reply to: AugustusMasonicus

I'll have to hunt up a link for the story...

but I remember reading a report on Aug. Exports in China were there highest levels... yet money earned from those exports was pitifully low.

Found it...

China's Next Export: Deflation

I'll have to hunt up a link for the story...

but I remember reading a report on Aug. Exports in China were there highest levels... yet money earned from those exports was pitifully low.

Found it...

Anyone bracing for Federal Reserve rate hikes or a Japanese bond-market crash clearly isn't considering the deflationary currents coursing through the world's second-biggest economy. I'm not referring only to today's news that producer prices in China fell for a record-tying 31st month in September. Evidence is mounting that consumer prices are on a similar trajectory as exports wane

China's Next Export: Deflation

a reply to: HardCorps

What they do not openly tell you is that China is using it massive liquidity to subsidize material costs so that finished good prices can be continually lowered. In many cases the raw material price factor they are using is below the world average which should really make you question how they arrived at the price.

They are mortgaging their future by using their past profits.

What they do not openly tell you is that China is using it massive liquidity to subsidize material costs so that finished good prices can be continually lowered. In many cases the raw material price factor they are using is below the world average which should really make you question how they arrived at the price.

They are mortgaging their future by using their past profits.

originally posted by: ThichHeaded

Dont China have an ass ton of gold?

Yeah but....

when you talk about 'Deflation' it means that value of everything drops.... costs of goods and services, of exports and imports, raw materials and finished goods... the price of everything falls including the value of gold.

if their market does implode having an ""ass ton of gold"" is not going to help them buy there way out of anything.

So even if their money goes to crap they will still be rich because well... They have all the things and well we will be still stuck wit the dollars

as toilet paper.. Think Denmark I think or Zimbabwe..

About the gold not worth anything.. ya.. no.. for millions a yrs gold has been used as currency for humans for since forever.

About the gold not worth anything.. ya.. no.. for millions a yrs gold has been used as currency for humans for since forever.

edit on

10/17/2014 by ThichHeaded because: (no reason given)

a reply to: ThichHeaded

yeah but if China started to flood the world markets with all there gold to prop up their nations economy... then the market value for gold would plummet... making it less valuable and causing them to need to sell off more gold which drops the price all the lower ...

All that hype about gold being the only safe investment is total BS

if you look at the 10yr you see gold prices hit their peek back in 2011 and been falling...slowly.. but steadily.

Plus if we ever did see a real economic collapse.... you could have a truck load of gold... but my box of 12ga shotgun shells will have way more value as a trade item.

yeah but if China started to flood the world markets with all there gold to prop up their nations economy... then the market value for gold would plummet... making it less valuable and causing them to need to sell off more gold which drops the price all the lower ...

All that hype about gold being the only safe investment is total BS

if you look at the 10yr you see gold prices hit their peek back in 2011 and been falling...slowly.. but steadily.

Plus if we ever did see a real economic collapse.... you could have a truck load of gold... but my box of 12ga shotgun shells will have way more value as a trade item.

Ya I agree with you on the guns and things.. I am just saying they have it.. even if the prices of an oz of gold is say 50 dollars they have tons and

tons of it so it really wouldn't matter.. They can literally f*ck the rest of the world so to speak.. Kill all this fiat money and force countries to

use real sound money..

In actuality that doesn't sound half bad really.. We wouldn't be working for slave wages then..

But if it did end up like that.. You should probably learn to make your gunpowder and or make arrows for a bow because the last depression lasted 10 yrs.

In actuality that doesn't sound half bad really.. We wouldn't be working for slave wages then..

But if it did end up like that.. You should probably learn to make your gunpowder and or make arrows for a bow because the last depression lasted 10 yrs.

originally posted by: ThichHeaded

Ya I agree with you on the guns and things.. I am just saying they have it.. even if the prices of an oz of gold is say 50 dollars they have tons and tons of it so it really wouldn't matter.. They can literally f*ck the rest of the world so to speak..

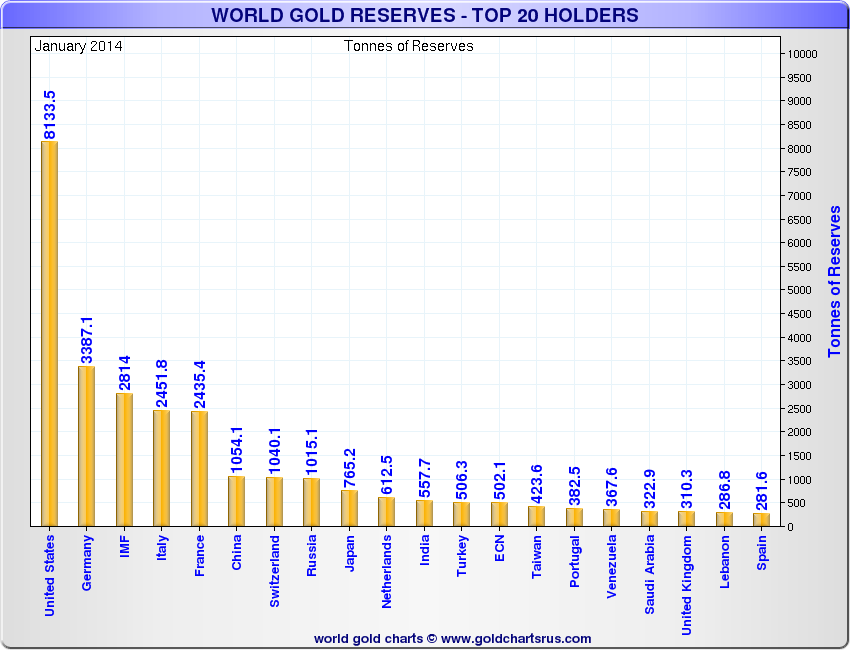

Just how much Gold are you imagining China having?

Source

edit on 17-10-2014 by SLAYER69 because: (no reason given)

Not everything is written on paper Slayer.. You should already know that.

a reply to: ThichHeaded

Even if China were able to triple it's known Gold reserve that would put them in third place, ahead of the IMF but behind Germany. If they were able to somehow quadruple their reserve that would put them just a hair ahead of Germany and be in second which would still be at about half of the US.

Even if China were able to triple it's known Gold reserve that would put them in third place, ahead of the IMF but behind Germany. If they were able to somehow quadruple their reserve that would put them just a hair ahead of Germany and be in second which would still be at about half of the US.

edit on 17-10-2014 by SLAYER69 because: (no reason given)

Ya I dont see a country thats been around for thousands of yrs and would trade in gold only have very little of it..

They aren't stupid.. They own most of the US and we willingly give them money freely.. Just saying..

They aren't stupid.. They own most of the US and we willingly give them money freely.. Just saying..

a reply to: ThichHeaded

Sorry

I forget which site I'm on sometimes but I do appreciate your sentiment. If China were able to somehow buy and put away the amount you're suggesting they have people would taken notice a long time ago. Large Gold purchases would be a sign that things were moving and is looked out for.

Sorry

I forget which site I'm on sometimes but I do appreciate your sentiment. If China were able to somehow buy and put away the amount you're suggesting they have people would taken notice a long time ago. Large Gold purchases would be a sign that things were moving and is looked out for.

edit on 17-10-2014 by SLAYER69 because: (no reason given)

originally posted by: AugustusMasonicus

This is all very similar to what Japan did 25 years ago with trying to spread its debt risk into real estate and other investments.

They still have not recovered.

The Japanese were in the same situation that the Chinese are in now. The Japanese worked hard to manufacture and mass produce billions of Yen of exports; electronics, TV's, music players, memory chips. They were successful, perhaps too successful, because once they had billions of Yen pouring in they had to do something with that money, otherwise it is just devalued rapidly through inflation. So the Japanese invested in new high-rise office blocks, leading to more demand for apartment blocks and houses and economic growth. Even after all that construction work, they still had money left over, so they bought up property everywhere from California to New York. But the USA had a recession too - that caused those properties to make a loss. Those Japanese corporations went bankrupt, had to sell off all that property, and since they were multi-national, the recession spread like a virus and hit Japanese cities as well. The whole country ended up with a property crash with corporations going bankrupt, leading to a chain-reaction through the whole economy.

new topics

-

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 17 minutes ago -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 2 hours ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 6 hours ago -

Electrical tricks for saving money

Education and Media: 10 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 11 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 15 hours ago, 8 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 12 hours ago, 4 flags -

Electrical tricks for saving money

Education and Media: 10 hours ago, 4 flags -

Sunak spinning the sickness figures

Other Current Events: 12 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 14 hours ago, 2 flags -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area: 2 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 17 hours ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 6 hours ago, 0 flags -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media: 17 minutes ago, 0 flags

active topics

-

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 25 • : Consvoli -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 24 • : randomuser2034 -

15 Unhealthiest Sodas On The Market

Health & Wellness • 43 • : JPRCrastney -

University of Texas Instantly Shuts Down Anti Israel Protests

Education and Media • 0 • : FlyersFan -

Sunak spinning the sickness figures

Other Current Events • 9 • : Ohanka -

The Acronym Game .. Pt.3

General Chit Chat • 7748 • : bally001 -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 37 • : FlyersFan -

Any one suspicious of fever promotions events, major investor Goldman Sachs card only.

The Gray Area • 3 • : seekshelter -

-@TH3WH17ERABB17- -Q- ---TIME TO SHOW THE WORLD--- -Part- --44--

Dissecting Disinformation • 662 • : F2d5thCavv2 -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 61 • : andy06shake