It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

Half of Americans can’t afford their house, while 84% young people delay major life decisions due

page: 1share:

As the housing market slowly recovers, a majority of homeowners and renters are finding it hard to meet rising rents and mortgage payments, new

research finds

Although mortgage rates are still quite low, down payments, poor credit and tighter lending standards remain three of the biggest hurdles for buying a home, especially among young people, Blomquist says.

“The slow jobs recovery for young adults has made it harder for them to save and to get a mortgage.”

Some 84% of young people are delaying major life decisions due to the poor economy, according to a 2013 survey by Generation Opportunity, a nonprofit think tank based in Arlington, Va.

www.marketwatch.com...

This is not a very good turn around for the housing market much less the so-called American dream of owning a home

Hopefully, in time, the prices will be more affordable or at least people's yearly income will increase.....hopefully

Owning a home is not for everyone and by the looks of it, it's a good thing

And if you can't afford it, don't do it....don't get caught up in debt just to be one of the Jones'

Over half of Americans (52%) have had to make at least one major sacrifice in order to cover their rent or mortgage over the last three years, according to the “How Housing Matters Survey,” which was commissioned by the nonprofit John D. and Catherine T. MacArthur Foundation and carried out by Hart Research Associates. These sacrifices include getting a second job, deferring saving for retirement, cutting back on health care, running up credit card debt, or even moving to a less safe neighborhood or one with worse schools.

“Affordability issues are real and a major hurdle,” says Lawrence Yun, chief economist at the National Association of Realtors, an industry group. Home prices have increased 20% over the past two years while wages have barely gone up, he says. “Only by adding more new supply, via housing starts, can home prices be tamed,” Yun adds. In fact, construction of housing units has averaged around 1.5 million a year for the past five decades, he says, but it’s likely to be less than 1 million in 2014.

Although mortgage rates are still quite low, down payments, poor credit and tighter lending standards remain three of the biggest hurdles for buying a home, especially among young people, Blomquist says.

“The slow jobs recovery for young adults has made it harder for them to save and to get a mortgage.”

Some 84% of young people are delaying major life decisions due to the poor economy, according to a 2013 survey by Generation Opportunity, a nonprofit think tank based in Arlington, Va.

www.marketwatch.com...

This is not a very good turn around for the housing market much less the so-called American dream of owning a home

Hopefully, in time, the prices will be more affordable or at least people's yearly income will increase.....hopefully

Owning a home is not for everyone and by the looks of it, it's a good thing

And if you can't afford it, don't do it....don't get caught up in debt just to be one of the Jones'

edit on 4-6-2014 by snarky412 because: (no reason given)

Young America is not preoccupied with getting a home or property. Prices are inflated even after the housing crisis. The government is not trying to

promote home ownership either; they are trying to end home ownership. The fact that out in California for instance, some farmers are being told that

they cannot bequeth land to their offspring once they are deceased is a testament to what is going on. Citizens in Pennsylvania are going through

excessive taxation to get their land...stories are abound.

Our friends own some property just outside of town, and after 40 years of living there, now the city officials are demanding changes....changes that

are going to cost them several thousands of dollars or else

[not to mention their legal fees]

Can't help but wonder if owning property is worth it now a days

To many hoops to jump through it seems, maybe on purpose

[not to mention their legal fees]

Can't help but wonder if owning property is worth it now a days

To many hoops to jump through it seems, maybe on purpose

edit on 4-6-2014 by snarky412 because: (no reason given)

Lots of people can't afford a home because of poor life decisions.

My wife is a bank manager and sees that kind of thing all the time. They can't make their car payment but made two trips to the liquor store last week. Way to many people buy a house that is really out of their price range to. One thing happens like medical bills or car repairs and they run short.

My wife is a bank manager and sees that kind of thing all the time. They can't make their car payment but made two trips to the liquor store last week. Way to many people buy a house that is really out of their price range to. One thing happens like medical bills or car repairs and they run short.

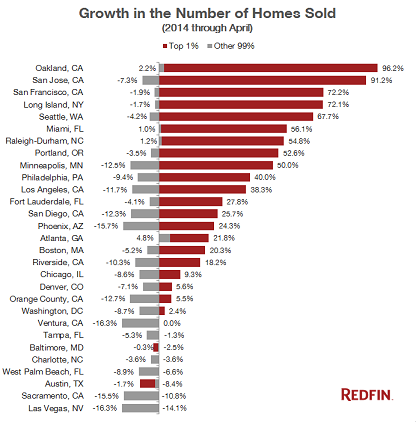

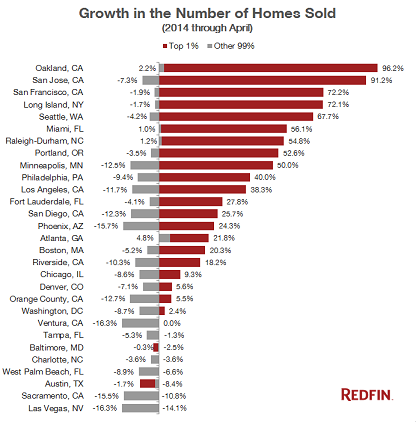

And an alarming report says that only the "1%" are buying homes so far this year !!!

2014 Luxury Report: Sales of Priciest 1% of Homes Climb While Rest of Home Sales Still Down

2014 Luxury Report: Sales of Priciest 1% of Homes Climb While Rest of Home Sales Still Down

a reply to: Hoosierdaddy71

That was one of the problems for the housing crash in 2008

People getting loans that could not afford it

Partly the banks fault as well as the home owners, who should have had the common sense to realize their income would not keep up with the house payments, not to mention insurance and the overall up keep on the house

Way to many people buy a house that is really out of their price range to. - See more at: www.abovetopsecret.com...

That was one of the problems for the housing crash in 2008

People getting loans that could not afford it

Partly the banks fault as well as the home owners, who should have had the common sense to realize their income would not keep up with the house payments, not to mention insurance and the overall up keep on the house

edit on 4-6-2014 by snarky412 because: (no reason given)

a reply to: snarky412

I live in southern Ontario, I WAS living with a roommate, but when he moved in with his girlfriend I found myself looking for an apartment with someone else. Luckily, we owned a condo together, and we sold it, I had a lump sum of money to put another down payment on a townhouse, condo, or cheaper house, but I would never be able to afford a mortgage on my own or even dream of being approved.

Long story short, I found myself stranded, and needed to bunk with some relatives for a bit until I got back on my feet job wise (I work as a welder and it's sort of a seasonal job and experienced based) I finally got a cheap basement apartment, and am now waiting for my girlfriend to finish school so we can actually afford a townhouse or what ever.

Bottom line, it's pretty tough to be a young person and afford housing, even just a one bedroom apartment would set me back 1200 a month, the place I live now sets me back 900 or so. Plus, food, car insurance, gas, internet, cell phone bill, etc. it adds up, I feel like I have been a starving student for the last 9 years!

I know as I get older it'll come easier, but it's literally impossible to do what my grand father, or even my parents did, and that was own a house by 25, and get a full fledged career by 27, and live comfortable for the rest, oh and raise a family on one salary. Me on the other hand, probably won't see an actual house till I am in my late 30's, unless I land an awesome job sometime soon. Just my 2 cents from a younger guy.

I live in southern Ontario, I WAS living with a roommate, but when he moved in with his girlfriend I found myself looking for an apartment with someone else. Luckily, we owned a condo together, and we sold it, I had a lump sum of money to put another down payment on a townhouse, condo, or cheaper house, but I would never be able to afford a mortgage on my own or even dream of being approved.

Long story short, I found myself stranded, and needed to bunk with some relatives for a bit until I got back on my feet job wise (I work as a welder and it's sort of a seasonal job and experienced based) I finally got a cheap basement apartment, and am now waiting for my girlfriend to finish school so we can actually afford a townhouse or what ever.

Bottom line, it's pretty tough to be a young person and afford housing, even just a one bedroom apartment would set me back 1200 a month, the place I live now sets me back 900 or so. Plus, food, car insurance, gas, internet, cell phone bill, etc. it adds up, I feel like I have been a starving student for the last 9 years!

I know as I get older it'll come easier, but it's literally impossible to do what my grand father, or even my parents did, and that was own a house by 25, and get a full fledged career by 27, and live comfortable for the rest, oh and raise a family on one salary. Me on the other hand, probably won't see an actual house till I am in my late 30's, unless I land an awesome job sometime soon. Just my 2 cents from a younger guy.

a reply to: snarky412

Actually is one group that are buying homes in the US are record numbers, they are foreigners.

Americans may not be able to afford homes but they do.

Chart of the Day: Which Foreigners Are Buying Houses in America

www.citylab.com...

Canada is first in the list, followed by China and third comes mexico.

Owning a home in America is now a foreign national dream

Actually is one group that are buying homes in the US are record numbers, they are foreigners.

Americans may not be able to afford homes but they do.

Chart of the Day: Which Foreigners Are Buying Houses in America

Foreigners are buying more and more American houses. They spent $82.5 billion, about 10 percent of the home sales market, in 2011 alone. According to a survey from the National Association of Realtors, that's a 25 percent increase from 2010. Arizona, California, Florida and Texas are the most popular states for home-buying foreigners. But as The Economist reports, there is some location bias:

www.citylab.com...

Canada is first in the list, followed by China and third comes mexico.

Owning a home in America is now a foreign national dream

edit on 4-6-2014 by marg6043 because: (no reason given)

originally posted by: strongfp

a reply to: snarky412

I live in southern Ontario, I WAS living with a roommate, but when he moved in with his girlfriend I found myself looking for an apartment with someone else. Luckily, we owned a condo together, and we sold it, I had a lump sum of money to put another down payment on a townhouse, condo, or cheaper house, but I would never be able to afford a mortgage on my own or even dream of being approved.

Long story short, I found myself stranded, and needed to bunk with some relatives for a bit until I got back on my feet job wise (I work as a welder and it's sort of a seasonal job and experienced based) I finally got a cheap basement apartment, and am now waiting for my girlfriend to finish school so we can actually afford a townhouse or what ever.

Bottom line, it's pretty tough to be a young person and afford housing, even just a one bedroom apartment would set me back 1200 a month, the place I live now sets me back 900 or so. Plus, food, car insurance, gas, internet, cell phone bill, etc. it adds up, I feel like I have been a starving student for the last 9 years!

I know as I get older it'll come easier, but it's literally impossible to do what my grand father, or even my parents did, and that was own a house by 25, and get a full fledged career by 27, and live comfortable for the rest, oh and raise a family on one salary. Me on the other hand, probably won't see an actual house till I am in my late 30's, unless I land an awesome job sometime soon. Just my 2 cents from a younger guy.

Sadly, times have changed my friend

Hang in there and I wish you the best

Many people rather rent due to less responsibilities--hence less money paid out for repairs and such

Plus one is not tied down in case they have a job offer come up some where else, they can move easier than trying to unload a house/property that may take weeks if not months to sell

a reply to: strongfp

I don't see it getting better, and the reason for that is as plain as the nose on my face. The job market sucks for the employee. You can no longer go to your employer and tell him you're leaving the company and expect them to care about that. There are ten people waiting in line for 'your job' (figuratively speaking).

My grandfather worked six short months out of a year. Granted ... he worked his butt off, but there was no one willing to undercut his rate of salary either. You just can't compete with sweatshop rates in a corporate environment so willing to seek cheap overseas labor. As long as corporate is setup to get away with this ... manufacturing will stay overseas ... and America's "labor dollar" can be kissed goodbye.

I know as I get older it'll come easier, but it's literally impossible to do what my grand father, or even my parents did, and that was own a house by 25, and get a full fledged career by 27, and live comfortable for the rest, oh and raise a family on one salary. Me on the other hand, probably won't see an actual house till I am in my late 30's, unless I land an awesome job sometime soon. Just my 2 cents from a younger guy.

I don't see it getting better, and the reason for that is as plain as the nose on my face. The job market sucks for the employee. You can no longer go to your employer and tell him you're leaving the company and expect them to care about that. There are ten people waiting in line for 'your job' (figuratively speaking).

My grandfather worked six short months out of a year. Granted ... he worked his butt off, but there was no one willing to undercut his rate of salary either. You just can't compete with sweatshop rates in a corporate environment so willing to seek cheap overseas labor. As long as corporate is setup to get away with this ... manufacturing will stay overseas ... and America's "labor dollar" can be kissed goodbye.

Part of the reason is your local government, which dictates how new housing can be built. In a survey done in Seattle it was determined that

governmental requirements added over $200K to every new house built in Seattle. Now just think about that. Seattle is very expensive. People can't

afford to move there. If the house cost $200K less, could they? The economic impact of government regulation is horrendous. MOST houses already built

could not be built using the newest regulations. It simply could not be done.

A lot of these regs are based on "ecology," but translate that to economic terms. Because the government is worried about "runoff" because the footprint of the house takes away from drainage of soil, they now require a "retention system" to slow that down. It amounts to a hole in the ground filled with a certain type and size of gravel "unpolluted" (at all) with anything but this fine special gravel that costs (ready?) $20,000 to build. If you ever look at one of these things you will come away knowing it is completely ridiculous and does not even accomplish the job it is set out to do.

And it's not a situation of a builder gouging the market--quite the opposite. My neighbor is a builder and what has driven him out of the market is that it costs MORE TO BUILD a house than he can sell it for on the open market. Indeed, his last house, across from me, just sold for less than 75% of what is actually cost to build. No builder can stay in a market like that. Only old houses that were built long ago can even hope to compete.

And from the other side here comes the government (again) telling the banks they MUST make loans to "people of less means" because it is discriminatory not to, they can't pay, the loans go bad, and it's "all the bank's fault" when they fail.

This is not capitalism. It is not a free market. It is a market polluted by government. Getting them out of the process is the single biggest thing that would create an "affordable housing market," which will never ever happen.

A lot of these regs are based on "ecology," but translate that to economic terms. Because the government is worried about "runoff" because the footprint of the house takes away from drainage of soil, they now require a "retention system" to slow that down. It amounts to a hole in the ground filled with a certain type and size of gravel "unpolluted" (at all) with anything but this fine special gravel that costs (ready?) $20,000 to build. If you ever look at one of these things you will come away knowing it is completely ridiculous and does not even accomplish the job it is set out to do.

And it's not a situation of a builder gouging the market--quite the opposite. My neighbor is a builder and what has driven him out of the market is that it costs MORE TO BUILD a house than he can sell it for on the open market. Indeed, his last house, across from me, just sold for less than 75% of what is actually cost to build. No builder can stay in a market like that. Only old houses that were built long ago can even hope to compete.

And from the other side here comes the government (again) telling the banks they MUST make loans to "people of less means" because it is discriminatory not to, they can't pay, the loans go bad, and it's "all the bank's fault" when they fail.

This is not capitalism. It is not a free market. It is a market polluted by government. Getting them out of the process is the single biggest thing that would create an "affordable housing market," which will never ever happen.

a reply to: snarky412

City officials county to county are making changes that are designed to keep American born citizens from having porperty ownership. The fact that people that have owned and kept property for 40 plus years are being targeted for all types of new regulations or face imminent domain or asset seizure is ridiculous. I know senior citizens that are over eighty fighting to keep their homes and the 1000 senior exemption tax rate that eats up a tremendous amount of the SSI/disability savings/pensions. Seems like the Judge Dredd world of blocks and blocks of high rise projects in cities stretching 300 miles is beckoning closer and closer.

City officials county to county are making changes that are designed to keep American born citizens from having porperty ownership. The fact that people that have owned and kept property for 40 plus years are being targeted for all types of new regulations or face imminent domain or asset seizure is ridiculous. I know senior citizens that are over eighty fighting to keep their homes and the 1000 senior exemption tax rate that eats up a tremendous amount of the SSI/disability savings/pensions. Seems like the Judge Dredd world of blocks and blocks of high rise projects in cities stretching 300 miles is beckoning closer and closer.

I was just watching the financial news concerning what is happening in the economy. Even though things are not doing the greatest and the outlook is

not good, the DOW keeps hitting highs. In a few months the stimulus will be ending. According to one economist we are in the same place we were in

the fall of 2007. The other economist said "we'll be all right, keep your money in the market" The first economist had lots of evidence, the

second economist had just an opinion with nothing to back it....who is right?

We are in trouble in this country, people are still overextended. Nothing has been really done to fix the problem. The government just poured fuel on the fire, that gas will be all burnt up as soon as it is gone. They should have been putting logs in the fire to make the fire last longer after they quit feeding it or maybe they should have created a lasting program to tend the fire and keep it constantly fed. This takes honesty and integrity though, something our present administration lacks. They like throwing gas on the fire instead and recording pictures of the roaring flames that occur every quarter.

We are in trouble in this country, people are still overextended. Nothing has been really done to fix the problem. The government just poured fuel on the fire, that gas will be all burnt up as soon as it is gone. They should have been putting logs in the fire to make the fire last longer after they quit feeding it or maybe they should have created a lasting program to tend the fire and keep it constantly fed. This takes honesty and integrity though, something our present administration lacks. They like throwing gas on the fire instead and recording pictures of the roaring flames that occur every quarter.

a reply to: Hoosierdaddy71

Poor life decisions? Maybe, but factor in the cost of high education is a major deterrent of owning property. People who own vehicles now have to get a car note, as as some ATSers have stated time and again, the inflated cost of a vehicle is now taking people 10 years to pay off. Used cars are not always an option if you factor in the high cost of them as well. This isn't the 70s anymore when a 77 Tbird was 3K flat off the showroom floor.

Poor life decisions? Maybe, but factor in the cost of high education is a major deterrent of owning property. People who own vehicles now have to get a car note, as as some ATSers have stated time and again, the inflated cost of a vehicle is now taking people 10 years to pay off. Used cars are not always an option if you factor in the high cost of them as well. This isn't the 70s anymore when a 77 Tbird was 3K flat off the showroom floor.

originally posted by: Snarl

a reply to: strongfp

I know as I get older it'll come easier, but it's literally impossible to do what my grand father, or even my parents did, and that was own a house by 25, and get a full fledged career by 27, and live comfortable for the rest, oh and raise a family on one salary. Me on the other hand, probably won't see an actual house till I am in my late 30's, unless I land an awesome job sometime soon. Just my 2 cents from a younger guy.

I don't see it getting better, and the reason for that is as plain as the nose on my face. The job market sucks for the employee. You can no longer go to your employer and tell him you're leaving the company and expect them to care about that. There are ten people waiting in line for 'your job' (figuratively speaking).

My grandfather worked six short months out of a year. Granted ... he worked his butt off, but there was no one willing to undercut his rate of salary either. You just can't compete with sweatshop rates in a corporate environment so willing to seek cheap overseas labor. As long as corporate is setup to get away with this ... manufacturing will stay overseas ... and America's "labor dollar" can be kissed goodbye.

Yup. When I was in school for welding all the teachers and supervisors warned us about how competitive the job market is now, sure they need trades people, but, there isn't enough jobs to fill for the newer trades people!

My first job as a welder I was taken under the company's wing. I did odd jobs, cleaning of the product, and when the other main welder got a little over whelmed with work, I'd chip in to help. As time went on and my skills were more refined, I got better, and better, more efficient, and I was eventually keeping up with the older guy.

Then, I got laid off. No warning, no return date, just a phone call saying they had to let me go.

for four months I worked at my old college / highschool job, and they finally called me back and demanded me back, when I said I needed to hand in my two weeks, they just out right said they can fill the position and will keep me posted.

How was a young trades person like me ever supposed to find work?

It took me almost another 6 months to find another job in that field again, luckily I grew wiser, but it's the same pattern, these company's hire on cheap young labor, like me, and keep the old timers full time.

But the question now is, who is going to fill all these old guys jobs? I should have been on my way to master journeyman by now! Instead I am still working at my red seal certification.

a reply to: strongfp

In Chicago all of my trade friends found themselves unemployed. They would do their 5 year apprenticeship, join a union, pay their dues. When they finished year five and made journeymen, they couldn't find work anywhere. Too much cheap Mexican labor under the table. A friend of mine is a welder and he told me his teacher told all the american born labor that they should find another apprenticeship in another field to keep working because journeymen were avoided completely. Why pay 80 bucks an hour when they can get the apprentices for a flat grand a month? Sad.

In Chicago all of my trade friends found themselves unemployed. They would do their 5 year apprenticeship, join a union, pay their dues. When they finished year five and made journeymen, they couldn't find work anywhere. Too much cheap Mexican labor under the table. A friend of mine is a welder and he told me his teacher told all the american born labor that they should find another apprenticeship in another field to keep working because journeymen were avoided completely. Why pay 80 bucks an hour when they can get the apprentices for a flat grand a month? Sad.

a reply to: snarky412

I have no problem with those figures. It should be VERY hard to be approved for a loan the size of most mortgages. What makes it easier, as it should, is fronting 20% of the capital or more of the total value of the property. Heck . . . you know what makes it even easier to buy property . . . Stop wasting your money on frivolous items if you really want to buy a home (meaning: if it's that important to you) and don't buy a home until you can pay for it with cash.

That's exactly what the foreigners are doing, especially here in Arizona. Most of them, despite the other post talking about foreign investors are from India and Central Europe, in AZ. Although, Canadians are always big buyers in AZ. They use them as rentals until retirement.

We can look at you post as a negative and blame any and all regulation; however, that seems to be glossing over the fact that the very reason for the housing collapse was a government supported program to reduce regulation and "get everybody home". It started with Clinton and GB ran with it.

As for the "American Dream":

I don't know about you . . . or anyone else, but I see nothing about home or property ownership being part of the "American Dream".

I have no problem with those figures. It should be VERY hard to be approved for a loan the size of most mortgages. What makes it easier, as it should, is fronting 20% of the capital or more of the total value of the property. Heck . . . you know what makes it even easier to buy property . . . Stop wasting your money on frivolous items if you really want to buy a home (meaning: if it's that important to you) and don't buy a home until you can pay for it with cash.

That's exactly what the foreigners are doing, especially here in Arizona. Most of them, despite the other post talking about foreign investors are from India and Central Europe, in AZ. Although, Canadians are always big buyers in AZ. They use them as rentals until retirement.

We can look at you post as a negative and blame any and all regulation; however, that seems to be glossing over the fact that the very reason for the housing collapse was a government supported program to reduce regulation and "get everybody home". It started with Clinton and GB ran with it.

As for the "American Dream":

The American Dream is a national ethos of the United States, a set of ideals in which freedom includes the opportunity for prosperity and success, and an upward social mobility achieved through hard work. In the definition of the American Dream by James Truslow Adams in 1931, "life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement" regardless of social class or circumstances of birth.[1]

The idea of the American Dream is rooted in the United States Declaration of Independence which proclaims that "all men are created equal" and that they are "endowed by their Creator with certain inalienable Rights" including "Life, Liberty and the pursuit of Happiness."[2]

I don't know about you . . . or anyone else, but I see nothing about home or property ownership being part of the "American Dream".

a reply to: schuyler

SOOOOO many good points in your post. As a 24 year old I have up to this point been extremely lucky. Last year at this time we were renting a 3BR 1Bath home with a basement for only 700 a month, located directly across from the local middle school (good neighborhood), now, as I have lost my job (was making 24 an hour with full benefits) and my gf only making 10 an hour we are probably going to have to move soon. We are already going without internet/cable(I'm currently using her phone as a hotspot as our only connection), no car insurance, no cell phone for me(she is still on her parents plan), and still only barely scraping by. I've already dried up my 401k (had 30k saved in less than 5 years, but only got about 17k after fees), and now have taken the last bit I had saved up in the form of a roth ira just to keep the power on.

As you can see, things are quickly going down the drain, and a year ago, I was set. Just goes to show you how horrible things are currently. I have plenty of skills, but without a degree and lots of experience no-one wants to hire you, and the fast food restaurants around here already fill their labor pool with underage workers from the local high school to get around paying minimum wage, so there are not even those jobs around here. Things are rough..

SOOOOO many good points in your post. As a 24 year old I have up to this point been extremely lucky. Last year at this time we were renting a 3BR 1Bath home with a basement for only 700 a month, located directly across from the local middle school (good neighborhood), now, as I have lost my job (was making 24 an hour with full benefits) and my gf only making 10 an hour we are probably going to have to move soon. We are already going without internet/cable(I'm currently using her phone as a hotspot as our only connection), no car insurance, no cell phone for me(she is still on her parents plan), and still only barely scraping by. I've already dried up my 401k (had 30k saved in less than 5 years, but only got about 17k after fees), and now have taken the last bit I had saved up in the form of a roth ira just to keep the power on.

As you can see, things are quickly going down the drain, and a year ago, I was set. Just goes to show you how horrible things are currently. I have plenty of skills, but without a degree and lots of experience no-one wants to hire you, and the fast food restaurants around here already fill their labor pool with underage workers from the local high school to get around paying minimum wage, so there are not even those jobs around here. Things are rough..

new topics

-

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 18 minutes ago -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 2 hours ago -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 4 hours ago -

Bobiverse

Fantasy & Science Fiction: 7 hours ago -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 7 hours ago -

Former Labour minister Frank Field dies aged 81

People: 9 hours ago -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 11 hours ago

top topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections: 16 hours ago, 19 flags -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest: 7 hours ago, 8 flags -

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs: 11 hours ago, 7 flags -

Former Labour minister Frank Field dies aged 81

People: 9 hours ago, 4 flags -

Bobiverse

Fantasy & Science Fiction: 7 hours ago, 3 flags -

Ode to Artemis

General Chit Chat: 16 hours ago, 3 flags -

This is our Story

General Entertainment: 13 hours ago, 3 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 18 minutes ago, 2 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 4 hours ago, 1 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 2 hours ago, 0 flags

active topics

-

President BIDEN Vows to Make Americans Pay More Federal Taxes in 2025 - Political Suicide.

2024 Elections • 87 • : FlyersFan -

Thousands Of Young Ukrainian Men Trying To Flee The Country To Avoid Conscription And The War

Other Current Events • 134 • : Consvoli -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest • 1 • : chiefsmom -

I Guess Cloud Seeding Works

Fragile Earth • 40 • : BrucellaOrchitis -

"We're All Hamas" Heard at Columbia University Protests

Social Issues and Civil Unrest • 277 • : Xtrozero -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology • 2 • : Springbok -

Bobiverse

Fantasy & Science Fiction • 2 • : Springbok -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 18 • : watchitburn -

Florida man's trip overseas ends in shock over $143,000 T-Mobile phone bill

Social Issues and Civil Unrest • 13 • : Consvoli -

British TV Presenter Refuses To Use Guest's Preferred Pronouns

Education and Media • 137 • : Annee