It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

6

share:

This will eventually catch people off guard.

If you have a "subsidy" for your health plan, you might not be able to "keep" all of it or you might "Owe" more money because the "subsidy" might be too much.

This is according to the "government" according to a Washington Post article.

The problem seems to be with the software (that may not even exist yet) that determines your "subsidy" by cross referencing IRS data that has your income.

This was exposed some time ago, and I think the "government" is using some kind of estimate and "honor" system and sending the subsidies to insurance companies until somebody can actually figure this boondoggle out.

Now they are even asking people to mail in pay stubs !!

Be very careful and double-check everything involving the money and the insurance company you are dealing with.

I can foresee some major financial difficulties for people.

I wonder why this has been such a problem ? Seems easy enough to solve, unless it's part of master plan.

Sorry excuse for a system that is supposed to help people isn't it.

Federal health-care subsidies may be too high or too low for more than 1 million Americans

Mr. Obama's Constitution:

If you have a "subsidy" for your health plan, you might not be able to "keep" all of it or you might "Owe" more money because the "subsidy" might be too much.

This is according to the "government" according to a Washington Post article.

The problem seems to be with the software (that may not even exist yet) that determines your "subsidy" by cross referencing IRS data that has your income.

This was exposed some time ago, and I think the "government" is using some kind of estimate and "honor" system and sending the subsidies to insurance companies until somebody can actually figure this boondoggle out.

Now they are even asking people to mail in pay stubs !!

Be very careful and double-check everything involving the money and the insurance company you are dealing with.

I can foresee some major financial difficulties for people.

I wonder why this has been such a problem ? Seems easy enough to solve, unless it's part of master plan.

Sorry excuse for a system that is supposed to help people isn't it.

The government may be paying incorrect subsidies to more than 1 million Americans for their health plans in the new federal insurance marketplace and has been unable so far to fix the errors, according to internal documents and three people familiar with the situation.

The problem means that potentially hundreds of thousands of people are receiving bigger subsidies than they deserve. They are part of a large group of Americans who listed incomes on their insurance applications that differ significantly — either too low or too high — from those on file with the Internal Revenue Service, documents show.

Federal health-care subsidies may be too high or too low for more than 1 million Americans

Mr. Obama's Constitution:

a reply to: xuenchen

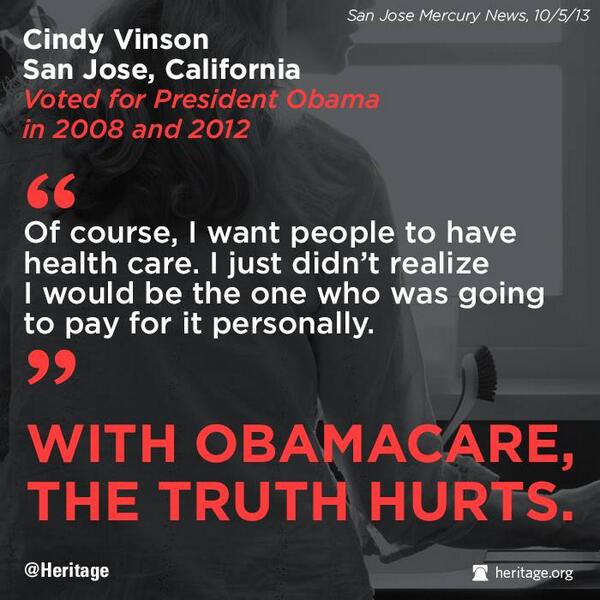

Some people may not know just how serious falsely reporting their income could be.

Yes, they may have got'en a better deal on Obamacare Premiums.

But when it's discovered by the all knowing I R S that the Stammer's Been Scammed!

I'm sure your going to be paying Interest on those fines.

From Your Source

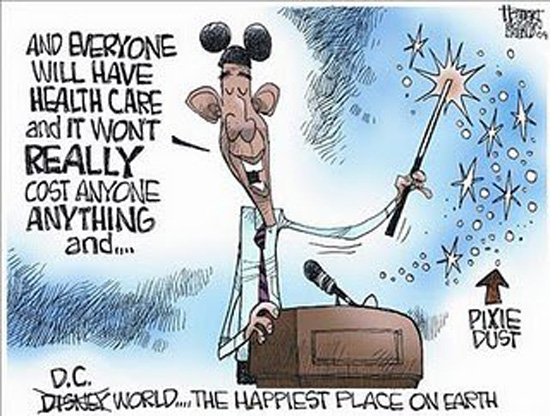

Some of You still believe this A$$hole and his lies.

Some people may not know just how serious falsely reporting their income could be.

Yes, they may have got'en a better deal on Obamacare Premiums.

But when it's discovered by the all knowing I R S that the Stammer's Been Scammed!

I'm sure your going to be paying Interest on those fines.

From their vantage point, consumer advocates have also been concerned about the possibility of inaccurate income information. They worry that some consumers who have innocently overstated their incomes should be getting higher subsidies — and perhaps better insurance — than they are receiving, while those who accidentally understated their income may get a nasty surprise during tax season next year when the IRS demands that they return any subsidy money they have improperly collected.

“The longer it takes and the more months . . . go by, the more serious the consequences of any error that may have occurred,” said Judy Solomon, vice president for health policy at the Center on Budget and Policy Priorities, which has been pressing its concern with administration officials.

“I have this sick feeling that there are these people out there who have made unintentional errors, and in a few years will be subject to massive tax bills,” said Jessica Waltman, senior vice president for government affairs at the National Association of Health Underwriters, a lobbying group for health insurance brokers.

From Your Source

Some of You still believe this A$$hole and his lies.

edit on 17-5-2014 by guohua because: (no reason given)

Some people filed, had a change in status (pay increase, employer offers insurance, changed employers, etc) and may (or may not) now be in trouble

with the IRS since they "falsified" their conditions at the time of application.

I am just going to be blunt in hopes that whatever federal agents that might read this and can pass it on. There are lots of people in America that would have zero qualms about going to DC and shooting the place up if their tax refund is stolen from them over this stupid law. It will not be an organized rebellion of armed forces clashing with the armed force set in their path. It will be random ordinary looking people that are pissed off and will shoot at anything in a suit and tie thinking it is a politician. Think of it as the clashes with moonshiners and the revenuers except they will come to DC rather than sitting back and reacting in a defensive posture.

Sadly that means innocent professionals will be targeted by these angry people and many innocent common people will be subjected by law enforcement to problems because they looked or acted suspicious.

I am just going to be blunt in hopes that whatever federal agents that might read this and can pass it on. There are lots of people in America that would have zero qualms about going to DC and shooting the place up if their tax refund is stolen from them over this stupid law. It will not be an organized rebellion of armed forces clashing with the armed force set in their path. It will be random ordinary looking people that are pissed off and will shoot at anything in a suit and tie thinking it is a politician. Think of it as the clashes with moonshiners and the revenuers except they will come to DC rather than sitting back and reacting in a defensive posture.

Sadly that means innocent professionals will be targeted by these angry people and many innocent common people will be subjected by law enforcement to problems because they looked or acted suspicious.

originally posted by: BrianFlanders

originally posted by: guohua

a reply to: xuenchen

Some people may not know just how serious falsely reporting their income could be.

Some people may not know that you shouldn't have to buy health insurance out of fear of being punished if you don't.

Your statement is Soooo, Very True and then you have these people to Contend with too!

The Young and Dumb!

Hours cut to 30 hours a week, a believing they'd have Free Healthcare because they Voted For You Know Who!

I've been gone for the last week due to medical treatments but I just want to say that Obamacare just very likely saved my damn life. I had been

uninsured for 13 years due to preexisting conditions, which basically created a scenario where I could not even remotely afford to get treatment for

any of the issues threatening my brain. Trust me, I tried last year and had to shell out $1000 for just an appointment and blood tests as someone

who had become fully disabled.

The legislative changes created by Obamacare opened the door so that not only could I be accepted under the newly broadened criteria for those disabled who had fallen through the cracks but that I would actually be covered by any form of insurance. Previously, I had lost my insurance due to a preexisting condition and "made too much" to be covered by other alternatives. That changed with Obamacare and I've spent the last 10 years watching myself erode away to the point where I could no longer write.

That's changing. Rapidly. I'm going to live. You all have no idea how happy I am today to find that I can do things that I couldn't do just a week ago. Complain all you want but my children and I are ecstatic today and have hope that I'm actually going to get even better.

The legislative changes created by Obamacare opened the door so that not only could I be accepted under the newly broadened criteria for those disabled who had fallen through the cracks but that I would actually be covered by any form of insurance. Previously, I had lost my insurance due to a preexisting condition and "made too much" to be covered by other alternatives. That changed with Obamacare and I've spent the last 10 years watching myself erode away to the point where I could no longer write.

That's changing. Rapidly. I'm going to live. You all have no idea how happy I am today to find that I can do things that I couldn't do just a week ago. Complain all you want but my children and I are ecstatic today and have hope that I'm actually going to get even better.

a reply to: WhiteAlice

I am truly happy you can get medical treatment.....but don't you have a big deductible to satisfy?

Many middle class people...like me...have a huge deductible before insurance pays for anything.

And, now we have to worry about subsidies being wrong.

Although, I thought I read they can only take your refunds...that there is no tax/penalty to be paid

I am truly happy you can get medical treatment.....but don't you have a big deductible to satisfy?

Many middle class people...like me...have a huge deductible before insurance pays for anything.

And, now we have to worry about subsidies being wrong.

Although, I thought I read they can only take your refunds...that there is no tax/penalty to be paid

edit on Sun May 18 2014 by DontTreadOnMe because: (no reason given)

a reply to: WhiteAlice

I am so very, very Happy for you.

You have to be One of the few. I have the same question though, did you have a big deductible?

I am so very, very Happy for you.

You have to be One of the few. I have the same question though, did you have a big deductible?

a reply to: DontTreadOnMe

No, actually. One of the things that the ACA did was broaden the acceptance sphere of Medicaid and people with disabilities. My mistake was, a long time ago, not applying for any kind of disability benefit immediately following my insurance loss. However, I thought that I would be insured through new employment and ended up moving to the Navajo reservation where employment preferences towards Navajo are legislative. Volunteer work didn't provide benefits. That created a medical record gap that made obtaining any kind of disability related health insurance unfeasible. The changes in the ACA, however, allowed me to be accepted not only by Medicaid but by my state's disability plan as well. As I stated in my above post, I'd tried to obtain that in 2008 and was denied. Basically, I was disabled and fell through the cracks.

I have basically spent the last year and a half losing my vision along with a host of other serious problems, with the thought that I could die being very present in the back of my mind. That's a tough way to exist especially when you have two children who absolutely depend on your existence (terrible family so if I'm gone, they really are being thrown to the wolves). I thought I was being overly dramatic but I wasn't. I had an infection in my jawline that was impacting my neurological function to the extent of causing facial droop, right side tremor and diplopia and have significant damage in my neck due to a fall relating to balance and perception issues--probably from that infection. Much of the former is repairing now on its own with the source of the infection eliminated. Still need an MRI so not sure what they're going to do about my neck but it's looking like traction at the least or surgery.

My deductible so far has been nothing. Not a penny. That might make people mad but let's look at it this way. If I remain fully disabled, I will have to start drawing SSDI fully. No joke as I'll eventually lose the function of my arms. Getting treated and repaired, on the other hand, is going to make it so that I will be able to go back to work and become a tax payer again, hopefully within the next 6 mos to year depending on what remains to be done and that MRI. I have two degrees, an insane work ethic (150%) and a ton of experience. If any get mad at my having no deductible because my body got broken, which would you prefer? That I slowly rot in my home sucking away at our country's tax revenues or in a coffin with two practically orphaned children or that I become a viable taxpaying citizen again?

I'm personally very happy to be looking forward to the latter and thanks. I have hope again.

No, actually. One of the things that the ACA did was broaden the acceptance sphere of Medicaid and people with disabilities. My mistake was, a long time ago, not applying for any kind of disability benefit immediately following my insurance loss. However, I thought that I would be insured through new employment and ended up moving to the Navajo reservation where employment preferences towards Navajo are legislative. Volunteer work didn't provide benefits. That created a medical record gap that made obtaining any kind of disability related health insurance unfeasible. The changes in the ACA, however, allowed me to be accepted not only by Medicaid but by my state's disability plan as well. As I stated in my above post, I'd tried to obtain that in 2008 and was denied. Basically, I was disabled and fell through the cracks.

I have basically spent the last year and a half losing my vision along with a host of other serious problems, with the thought that I could die being very present in the back of my mind. That's a tough way to exist especially when you have two children who absolutely depend on your existence (terrible family so if I'm gone, they really are being thrown to the wolves). I thought I was being overly dramatic but I wasn't. I had an infection in my jawline that was impacting my neurological function to the extent of causing facial droop, right side tremor and diplopia and have significant damage in my neck due to a fall relating to balance and perception issues--probably from that infection. Much of the former is repairing now on its own with the source of the infection eliminated. Still need an MRI so not sure what they're going to do about my neck but it's looking like traction at the least or surgery.

My deductible so far has been nothing. Not a penny. That might make people mad but let's look at it this way. If I remain fully disabled, I will have to start drawing SSDI fully. No joke as I'll eventually lose the function of my arms. Getting treated and repaired, on the other hand, is going to make it so that I will be able to go back to work and become a tax payer again, hopefully within the next 6 mos to year depending on what remains to be done and that MRI. I have two degrees, an insane work ethic (150%) and a ton of experience. If any get mad at my having no deductible because my body got broken, which would you prefer? That I slowly rot in my home sucking away at our country's tax revenues or in a coffin with two practically orphaned children or that I become a viable taxpaying citizen again?

I'm personally very happy to be looking forward to the latter and thanks. I have hope again.

edit on 22/5/14 by WhiteAlice because: (no

reason given)

new topics

-

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 4 hours ago -

1980s Arcade

General Chit Chat: 6 hours ago -

Deadpool and Wolverine

Movies: 7 hours ago -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 8 hours ago -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 9 hours ago -

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 11 hours ago

top topics

-

Lawsuit Seeks to ‘Ban the Jab’ in Florida

Diseases and Pandemics: 11 hours ago, 20 flags -

Starburst galaxy M82 - Webb Vs Hubble

Space Exploration: 13 hours ago, 13 flags -

The Superstition of Full Moons Filling Hospitals Turns Out To Be True!

Medical Issues & Conspiracies: 15 hours ago, 8 flags -

CIA botched its handling of sexual assault allegations, House intel report says

Breaking Alternative News: 9 hours ago, 8 flags -

15 Unhealthiest Sodas On The Market

Health & Wellness: 14 hours ago, 6 flags -

whistleblower Captain Bill Uhouse on the Kingman UFO recovery

Aliens and UFOs: 4 hours ago, 6 flags -

Teenager makes chess history becoming the youngest challenger for the world championship crown

Other Current Events: 8 hours ago, 3 flags -

Deadpool and Wolverine

Movies: 7 hours ago, 3 flags -

1980s Arcade

General Chit Chat: 6 hours ago, 3 flags

active topics

-

Definitive 9.11 Pentagon EVIDENCE.

9/11 Conspiracies • 420 • : Lazy88 -

1980s Arcade

General Chit Chat • 8 • : F2d5thCavv2 -

What is a dream

The Gray Area • 27 • : wrayth -

Europe declares war on Russia?

World War Three • 61 • : F2d5thCavv2 -

The Acronym Game .. Pt.3

General Chit Chat • 7741 • : F2d5thCavv2 -

Russia Ukraine Update Thread - part 3

World War Three • 5713 • : F2d5thCavv2 -

IDF Intel Chief Resigns Over Hamas attack

Middle East Issues • 32 • : Terpene -

15 Unhealthiest Sodas On The Market

Health & Wellness • 32 • : VariedcodeSole -

Fast Moving Disc Shaped UFO Captured on Camera During Flight from Florida to New York City

Aliens and UFOs • 18 • : inflaymes69 -

They Killed Dr. Who for Good

Rant • 61 • : Cymru

6